444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The GCC housing market represents one of the most dynamic and rapidly evolving real estate sectors in the Middle East, encompassing residential properties across the United Arab Emirates, Saudi Arabia, Qatar, Kuwait, Bahrain, and Oman. This market has experienced significant transformation over the past decade, driven by economic diversification initiatives, population growth, and substantial infrastructure investments. Market dynamics indicate robust growth potential, with the sector benefiting from government-led housing initiatives and increasing foreign investment participation.

Regional development across GCC countries has accelerated housing demand, particularly in urban centers where expatriate populations and young nationals seek modern residential solutions. The market demonstrates strong resilience despite global economic fluctuations, supported by strategic government policies promoting homeownership and sustainable urban development. Housing supply has expanded considerably, with developers focusing on affordable housing segments while maintaining luxury property offerings for high-net-worth individuals.

Investment flows into the GCC housing sector have intensified, with international real estate firms establishing significant regional presence. The market benefits from favorable regulatory frameworks, including foreign ownership laws and long-term residency programs that enhance property investment attractiveness. Growth projections suggest continued expansion at a compound annual growth rate of 6.2% through the forecast period, driven by demographic trends and economic diversification strategies.

The GCC housing market refers to the comprehensive residential real estate ecosystem encompassing property development, sales, rentals, and related services across the six Gulf Cooperation Council member states. This market includes various housing types from affordable apartments to luxury villas, serving diverse demographic segments including nationals, expatriates, and investors seeking residential properties for personal use or investment purposes.

Market scope extends beyond traditional property transactions to include mortgage financing, property management, real estate technology solutions, and construction services. The housing market operates within regulatory frameworks established by individual GCC governments, each promoting sustainable development while addressing local housing needs. Stakeholder participation involves government entities, private developers, financial institutions, and international investors collaborating to meet growing residential demand.

Economic significance of the GCC housing market extends to job creation, GDP contribution, and urban development acceleration. The sector serves as a key indicator of economic health and consumer confidence across the region, influencing related industries including construction materials, home furnishing, and professional services.

Strategic analysis reveals the GCC housing market positioned for sustained growth, supported by demographic expansion and government-led affordable housing initiatives. The market demonstrates increasing sophistication with technology integration, sustainable building practices, and diversified financing options enhancing accessibility for various income segments. Regional variations exist, with the UAE and Saudi Arabia leading market activity while smaller GCC states focus on targeted development projects.

Key performance indicators show positive trends across multiple metrics, including construction permits, property registrations, and mortgage approvals. The market benefits from 65% expatriate population in certain GCC countries, creating consistent rental demand alongside growing homeownership aspirations among nationals. Investment attraction has increased significantly, with foreign direct investment in real estate reaching new highs across several GCC markets.

Market maturation is evident through improved regulatory frameworks, enhanced transparency, and professional service standards alignment with international best practices. The sector increasingly focuses on sustainability, with green building certifications and energy-efficient designs becoming standard requirements rather than premium features.

Demographic drivers fundamentally shape GCC housing market dynamics, with young populations and urbanization trends creating sustained residential demand. The market exhibits strong correlation between economic diversification efforts and housing development, particularly in non-oil sectors that attract skilled professionals requiring quality residential options.

Population growth serves as the primary catalyst for GCC housing market expansion, with natural increase and continued expatriate influx creating consistent residential demand. Government economic diversification strategies attract international businesses and skilled professionals, generating housing requirements across various price segments. Urbanization acceleration concentrates population in major cities, intensifying demand for modern housing solutions with integrated amenities and connectivity.

Government initiatives significantly influence market dynamics through national housing programs, land allocation policies, and homeownership promotion campaigns. These programs often include subsidized financing, reduced down payment requirements, and streamlined approval processes for eligible citizens. Regulatory improvements enhance market transparency and investor confidence, including property registration systems and dispute resolution mechanisms.

Economic stability across GCC countries provides favorable conditions for long-term property investment and development projects. Low interest rate environments and competitive mortgage products improve housing affordability for middle-income segments. Infrastructure development including transportation networks, utilities, and social facilities increases property attractiveness and values in emerging residential areas.

Cultural shifts toward homeownership among younger generations drive market demand, supported by changing lifestyle preferences and family formation patterns. The growing preference for modern amenities, community facilities, and sustainable living environments influences developer strategies and project designs.

Economic volatility related to oil price fluctuations creates uncertainty in GCC housing markets, affecting both consumer confidence and government spending on housing initiatives. During economic downturns, expatriate populations may decline, reducing rental demand and impacting property values in certain segments. Construction cost inflation challenges project viability and affordability, particularly for affordable housing developments targeting middle-income buyers.

Regulatory complexity across different GCC jurisdictions creates challenges for regional developers and investors seeking to operate across multiple markets. Varying foreign ownership laws, building codes, and approval processes require specialized local knowledge and extended project timelines. Market oversupply in certain luxury segments has led to price corrections and extended sales periods in some locations.

Financing constraints affect some market segments, particularly first-time buyers who may struggle with down payment requirements or income verification processes. Limited mortgage product diversity and conservative lending practices can restrict market accessibility for certain demographic groups. Skills shortages in construction and real estate services create project delays and cost increases, impacting overall market efficiency.

Environmental challenges including extreme climate conditions increase construction and maintenance costs while requiring specialized building techniques and materials. Water scarcity and energy costs influence long-term property operating expenses and sustainability considerations.

Affordable housing development presents significant opportunities across GCC markets, with government support and growing middle-class populations creating substantial demand for reasonably priced residential options. Public-private partnerships enable innovative financing structures and development models that address housing accessibility while maintaining commercial viability. Technology integration offers opportunities for PropTech companies and traditional developers to enhance customer experience and operational efficiency.

Sustainable development creates opportunities for green building specialists, renewable energy integrators, and sustainable materials suppliers as environmental consciousness increases among consumers and regulators. Senior housing represents an emerging opportunity as GCC populations age and require specialized residential facilities with healthcare integration and accessibility features.

Tourism-related housing including vacation rentals and hospitality-residential hybrids benefit from growing regional tourism and business travel. Student housing opportunities expand alongside higher education sector growth and international university establishment in GCC countries. Co-living concepts appeal to young professionals and expatriates seeking flexible, community-oriented housing solutions.

Real estate services including property management, maintenance, and financial services present growth opportunities as the market matures and property ownership increases. Cross-border investment facilitation services help international investors navigate regulatory requirements and market entry strategies.

Supply and demand balance varies significantly across GCC housing markets, with some experiencing oversupply in luxury segments while facing shortages in affordable housing categories. Market cycles demonstrate increasing correlation with global economic conditions and regional geopolitical stability, requiring adaptive strategies from market participants. Price dynamics reflect local economic conditions, with markets showing annual price appreciation of 4.8% in key urban areas.

Competitive landscape evolution shows increasing participation from international developers alongside established regional players, creating innovation pressure and service quality improvements. Customer preferences shift toward integrated communities with comprehensive amenities, influencing project design and marketing strategies. Financing evolution includes expanded Islamic banking products and alternative financing mechanisms improving market accessibility.

Regulatory dynamics continue evolving with enhanced transparency requirements, foreign ownership liberalization, and sustainability mandates shaping market operations. Technology adoption accelerates across all market segments, from virtual property tours to blockchain-based property transactions and smart home integration. Market maturation indicators include improved professional standards, standardized practices, and increased institutional investment participation.

Regional integration efforts facilitate cross-border investment and development activities, while maintaining local market characteristics and regulatory requirements. Economic diversification success directly correlates with housing market performance, as new industries attract residents and create housing demand.

Comprehensive analysis of the GCC housing market employs multiple research methodologies to ensure accurate and reliable insights. Primary research includes extensive interviews with industry stakeholders including developers, real estate agents, government officials, and financial institutions across all six GCC countries. Survey methodologies capture consumer preferences, buying behaviors, and market sentiment from diverse demographic segments.

Secondary research incorporates government statistical data, industry reports, and regulatory publications to establish market baselines and trend analysis. Data triangulation ensures accuracy by cross-referencing multiple sources and validating findings through expert consultations. Market modeling techniques project future trends based on historical patterns, demographic projections, and economic indicators.

Quantitative analysis examines transaction volumes, price trends, construction permits, and mortgage approvals to identify market patterns and growth trajectories. Qualitative assessment explores market sentiment, regulatory impacts, and emerging trends through expert interviews and focus group discussions. Regional comparison methodologies account for local market variations while identifying common trends across GCC countries.

Validation processes include peer review, stakeholder feedback, and continuous monitoring of market developments to ensure research relevance and accuracy. Technology utilization enhances data collection and analysis through digital surveys, automated data gathering, and advanced analytics platforms.

United Arab Emirates leads the GCC housing market with 28% regional market share, driven by Dubai and Abu Dhabi’s international appeal and diverse economic base. The UAE market demonstrates strong luxury segment performance alongside growing affordable housing initiatives. Foreign ownership laws and long-term residency programs attract international investors and residents, creating sustained demand across multiple property categories.

Saudi Arabia represents the largest potential market with 35% of regional population and ambitious Vision 2030 development goals including massive housing programs. The Kingdom’s housing market benefits from substantial government investment and private sector participation in affordable housing development. NEOM and other megaprojects create new residential opportunities while traditional markets in Riyadh and Jeddah continue expanding.

Qatar maintains a specialized market focused on high-quality residential developments serving its affluent population and international business community. World Cup legacy projects contribute to housing stock expansion while ongoing infrastructure development enhances property values. The market demonstrates strong rental yields of 6.5% in prime locations.

Kuwait shows steady market growth with government housing programs supporting citizen homeownership and private sector development addressing expatriate housing needs. Regulatory reforms improve market transparency and foreign investment participation. Bahrain offers an accessible market for regional investors with competitive property prices and established legal frameworks.

Oman focuses on sustainable development and tourism-related residential projects while maintaining affordable housing programs for nationals. The market benefits from stable economic conditions and strategic location advantages.

Market leadership in the GCC housing sector involves both regional champions and international developers bringing global expertise and capital resources. Competition intensity varies by market segment, with luxury developments facing significant competition while affordable housing segments offer more collaborative opportunities through government partnerships.

Competitive strategies increasingly focus on sustainability, technology integration, and customer experience enhancement. Market consolidation trends show larger developers acquiring smaller firms to expand geographic presence and development capabilities. International partnerships bring advanced construction techniques and global best practices to regional markets.

By Property Type: The GCC housing market segments into apartments, villas, townhouses, and specialized housing categories. Apartment developments dominate urban markets, offering various sizes from studio units to luxury penthouses. Villa communities appeal to families and high-net-worth individuals seeking privacy and space. Townhouse developments provide middle-ground options combining affordability with individual property ownership.

By Price Segment: Market segmentation includes luxury properties exceeding premium price points, mid-market housing serving professional families, and affordable housing targeting first-time buyers and middle-income groups. Luxury segment focuses on waterfront properties, golf communities, and ultra-high-end amenities. Affordable segment benefits from government support and innovative financing solutions.

By End User: Primary segments include owner-occupiers, investors, and expatriate renters. Owner-occupier demand drives long-term market stability while investor activity provides market liquidity and development capital. Expatriate rental market creates consistent income streams for property owners and developers.

By Location: Urban centers command premium pricing and high demand, while suburban developments offer value and family-oriented amenities. Waterfront properties maintain premium positioning across all GCC markets. Mixed-use developments integrate residential, commercial, and recreational facilities.

Luxury Housing Category demonstrates resilience despite economic fluctuations, supported by high-net-worth individuals and international investors seeking premium residential assets. This segment emphasizes unique architectural designs, exclusive amenities, and prime locations. Market performance shows luxury properties maintaining 15% price premium over comparable mid-market alternatives, driven by scarcity and exclusivity factors.

Mid-Market Housing represents the largest segment by volume, serving professional families and established expatriate communities. This category balances quality, amenities, and affordability while maintaining good connectivity to business districts and schools. Developer focus on this segment intensifies due to consistent demand and reasonable profit margins.

Affordable Housing gains momentum through government initiatives and private sector innovation in cost-effective construction methods. This segment addresses first-time buyer needs and supports homeownership goals among younger demographics. Financing innovation including reduced down payments and extended loan terms improves accessibility.

Student Housing emerges as a specialized category supporting educational sector expansion across GCC countries. Purpose-built student accommodation offers modern amenities and community features tailored to young adult preferences. Investment returns in this category show promising potential with occupancy rates exceeding 85% in established markets.

Senior Housing represents an emerging category as GCC populations age and require specialized residential facilities. This segment combines healthcare integration with residential comfort, creating new opportunities for specialized developers and operators.

Developers benefit from strong market fundamentals including population growth, government support, and improving regulatory frameworks. Revenue diversification opportunities exist across multiple property types and price segments, reducing market risk exposure. Technology adoption enhances operational efficiency and customer satisfaction while reducing development costs and timelines.

Investors gain access to stable rental income streams and capital appreciation potential in growing markets. Portfolio diversification across GCC countries provides geographic risk distribution while maintaining regional expertise advantages. Currency stability and government backing in several GCC countries offer investment security.

Financial institutions expand mortgage portfolios and related financial services as homeownership increases across the region. Islamic banking products serve large market segments while conventional financing options attract international residents. Risk management improves through diversified lending portfolios and enhanced regulatory oversight.

Government entities achieve social and economic objectives through successful housing programs that improve citizen welfare and economic stability. Tax revenue generation from property transactions and related economic activity supports public finances. Urban development goals advance through coordinated housing and infrastructure projects.

Service providers including real estate agents, property managers, and construction companies benefit from market expansion and increasing sophistication. Professional development opportunities arise as market standards align with international best practices.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability Integration transforms GCC housing markets as environmental consciousness increases among consumers and regulators mandate green building standards. LEED and BREEAM certifications become standard requirements rather than premium features, driving innovation in construction materials and energy systems. Solar integration and water conservation technologies gain widespread adoption, reducing long-term operating costs.

Smart Home Technology adoption accelerates across all market segments, with developers integrating IoT devices, automated systems, and connectivity infrastructure as standard features. Home automation appeals to tech-savvy residents while providing operational efficiency benefits for property managers. Digital integration extends to property management, maintenance scheduling, and community services.

Community-Centric Development emphasizes integrated lifestyle concepts combining residential, commercial, recreational, and educational facilities within master-planned communities. Walkability and public transportation connectivity become key selling points as urban planning philosophies evolve. Social infrastructure including parks, community centers, and healthcare facilities enhance property values and resident satisfaction.

Flexible Living Solutions respond to changing lifestyle preferences with co-living spaces, serviced apartments, and adaptable unit designs. Rental market evolution includes furnished options, flexible lease terms, and comprehensive service packages. Multigenerational housing designs accommodate extended family living arrangements common in GCC cultures.

Investment Democratization through real estate investment trusts, fractional ownership platforms, and crowdfunding mechanisms expands market participation beyond traditional high-net-worth investors. MarkWide Research indicates these trends show 25% annual growth in investor participation rates.

Regulatory Evolution across GCC countries includes enhanced foreign ownership rights, streamlined approval processes, and improved transparency requirements. Saudi Arabia’s recent reforms allowing full foreign ownership in certain areas represent significant market opening initiatives. Digital transformation of government services accelerates property registration and permit processes.

Mega Project Announcements including NEOM, Dubai 2040 Urban Master Plan, and Qatar National Vision 2030 create massive housing development opportunities. These projects integrate advanced technologies, sustainable design principles, and innovative urban planning concepts. Public-private partnerships facilitate large-scale development while sharing risks and expertise.

Financial Innovation includes new Islamic banking products, alternative financing mechanisms, and international banking partnerships expanding mortgage accessibility. Fintech integration streamlines loan applications, property valuations, and transaction processes. Cryptocurrency acceptance for property transactions emerges in select markets, attracting tech-savvy investors.

Construction Technology advancement includes 3D printing, modular construction, and advanced materials reducing costs and construction timelines. Robotics integration improves construction safety and efficiency while addressing skilled labor shortages. Building Information Modeling becomes standard practice for complex developments.

International Partnerships bring global expertise and capital to GCC housing markets through joint ventures, management agreements, and technology transfers. Cross-border investment flows increase as regulatory barriers decrease and market transparency improves.

Market Entry Strategies should prioritize local partnership development and regulatory compliance understanding before significant capital commitment. Due diligence processes must account for local market dynamics, cultural preferences, and regulatory requirements specific to each GCC country. Phased development approaches reduce risk exposure while building market knowledge and relationships.

Product Development recommendations emphasize sustainability features, technology integration, and community amenities that differentiate properties in competitive markets. Affordability innovation through construction efficiency and financing creativity expands addressable market segments. Design flexibility accommodating cultural preferences and family structures enhances market appeal.

Investment Timing considerations suggest favorable conditions for long-term commitments given demographic trends and government support initiatives. Market cycle awareness helps optimize entry and exit strategies while managing risk exposure. Currency hedging strategies protect against exchange rate fluctuations for international investors.

Technology Adoption should focus on customer experience enhancement and operational efficiency improvements rather than technology for its own sake. Digital marketing strategies must account for local preferences and regulatory requirements. Data analytics capabilities provide competitive advantages in market analysis and customer targeting.

Risk Management frameworks should address regulatory changes, economic volatility, and market oversupply risks through diversification and flexible strategies. MarkWide Research analysis suggests maintaining portfolio diversification across 60% residential and 40% commercial properties for optimal risk-adjusted returns.

Long-term growth prospects for the GCC housing market remain positive, supported by demographic trends, economic diversification success, and continued government commitment to housing sector development. Population projections indicate sustained growth across all GCC countries, with urbanization rates expected to reach 88% by 2030, creating consistent housing demand.

Technology integration will accelerate, with smart cities initiatives and digital infrastructure development enhancing property values and resident experiences. Artificial intelligence and machine learning applications will optimize property management, energy efficiency, and predictive maintenance. Virtual and augmented reality technologies will transform property marketing and sales processes.

Sustainability requirements will become mandatory rather than optional, driving innovation in construction materials, energy systems, and water management. Carbon neutrality goals across GCC countries will influence building codes and development standards. Circular economy principles will guide construction waste management and material recycling initiatives.

Market maturation will continue with improved professional standards, enhanced transparency, and increased institutional investment participation. Real estate investment trusts and other investment vehicles will expand market accessibility for smaller investors. Cross-border investment facilitation will increase as regulatory harmonization progresses.

Economic diversification success will reduce oil dependency and create more stable housing market conditions. Knowledge economy development will attract skilled professionals requiring quality housing options. Tourism sector growth will drive vacation rental and hospitality-residential hybrid developments. MWR projections suggest the market will maintain steady growth momentum of 5.8% annually through the next decade.

The GCC housing market stands positioned for continued growth and evolution, driven by fundamental demographic trends, supportive government policies, and ongoing economic diversification efforts across the region. Market dynamics demonstrate increasing sophistication with technology integration, sustainability focus, and enhanced regulatory frameworks creating favorable conditions for both developers and investors.

Strategic opportunities exist across multiple segments, from affordable housing addressing growing middle-class needs to luxury developments serving international investors and high-net-worth individuals. Innovation adoption in construction techniques, financing mechanisms, and property management services will differentiate successful market participants from traditional approaches.

Regional cooperation and regulatory harmonization efforts will facilitate cross-border investment and development activities while maintaining local market characteristics. Sustainability integration and smart technology adoption will become standard requirements rather than premium features, driving industry transformation and operational efficiency improvements.

Long-term success in the GCC housing market requires understanding of local preferences, regulatory compliance, and strategic partnerships with established regional players. Market participants who embrace innovation, prioritize sustainability, and maintain flexibility in their strategies will be best positioned to capitalize on the significant opportunities ahead in this dynamic and growing market.

What is GCC Housing?

GCC Housing refers to the residential real estate sector within the Gulf Cooperation Council countries, which includes various types of housing such as apartments, villas, and townhouses. This sector is influenced by factors like population growth, urbanization, and economic conditions in the region.

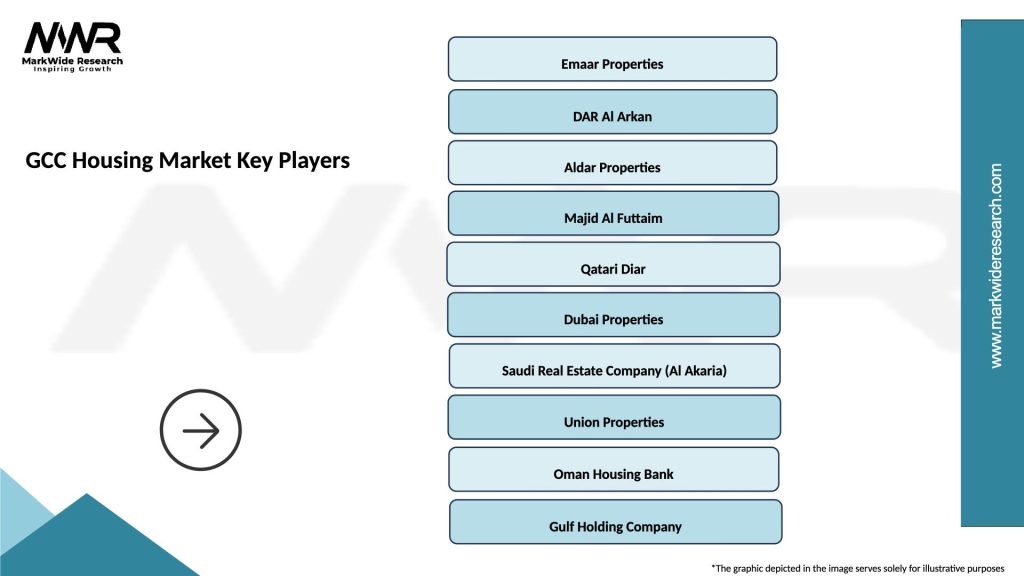

What are the key players in the GCC Housing Market?

Key players in the GCC Housing Market include Emaar Properties, Aldar Properties, and Damac Properties, which are known for their large-scale residential developments. These companies are actively involved in shaping the housing landscape through innovative projects and community developments, among others.

What are the main drivers of the GCC Housing Market?

The main drivers of the GCC Housing Market include increasing population and urbanization, rising disposable incomes, and government initiatives aimed at boosting home ownership. Additionally, the demand for affordable housing solutions is also contributing to market growth.

What challenges does the GCC Housing Market face?

The GCC Housing Market faces challenges such as fluctuating oil prices, which can impact economic stability, and regulatory hurdles that may affect property development. Additionally, there is a growing concern over housing affordability for lower-income residents.

What opportunities exist in the GCC Housing Market?

Opportunities in the GCC Housing Market include the development of smart homes and sustainable housing projects that cater to environmentally conscious consumers. There is also potential for growth in the rental market as expatriate populations continue to seek housing options.

What trends are shaping the GCC Housing Market?

Trends shaping the GCC Housing Market include a shift towards mixed-use developments that combine residential, commercial, and recreational spaces. Additionally, there is an increasing focus on luxury housing and smart technology integration in new residential projects.

GCC Housing Market

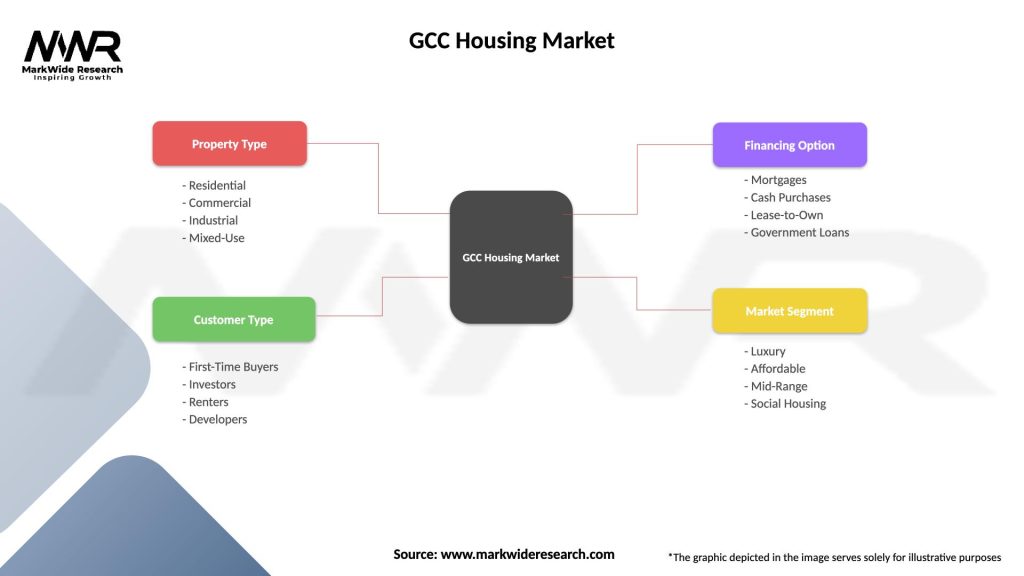

| Segmentation Details | Description |

|---|---|

| Property Type | Residential, Commercial, Industrial, Mixed-Use |

| Customer Type | First-Time Buyers, Investors, Renters, Developers |

| Financing Option | Mortgages, Cash Purchases, Lease-to-Own, Government Loans |

| Market Segment | Luxury, Affordable, Mid-Range, Social Housing |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the GCC Housing Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at