444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The North America vehicle logistics market represents a critical component of the automotive supply chain, encompassing the comprehensive management and transportation of vehicles from manufacturing facilities to end consumers. This dynamic sector has experienced remarkable transformation driven by evolving consumer preferences, technological advancements, and the growing emphasis on efficient supply chain management. The market demonstrates robust growth potential with an anticipated CAGR of 6.2% through the forecast period, reflecting the increasing complexity of automotive distribution networks.

Market dynamics indicate that the North American region, comprising the United States, Canada, and Mexico, serves as a pivotal hub for automotive manufacturing and distribution. The integration of advanced logistics technologies, including GPS tracking, fleet management systems, and automated loading equipment, has revolutionized traditional vehicle transportation methods. Digital transformation initiatives have enhanced operational efficiency by approximately 35% across major logistics providers, enabling real-time visibility and optimized route planning.

Regional distribution patterns show the United States commanding the largest market share at 78%, followed by Canada and Mexico contributing significantly to cross-border vehicle movements. The market encompasses various vehicle categories, including passenger cars, commercial vehicles, electric vehicles, and specialty automotive products, each requiring specialized handling and transportation protocols.

The North America vehicle logistics market refers to the comprehensive ecosystem of services, technologies, and infrastructure dedicated to the efficient movement, storage, and distribution of automotive vehicles across the North American continent. This specialized logistics sector encompasses inbound logistics from suppliers to manufacturing facilities, outbound distribution from production sites to dealerships, and aftermarket vehicle transportation services.

Vehicle logistics involves multiple interconnected processes including vehicle carrier transportation, rail transport, port operations, storage facilities, and last-mile delivery services. The market integrates traditional transportation methods with cutting-edge technologies such as Internet of Things (IoT) sensors, artificial intelligence-driven route optimization, and blockchain-based tracking systems to ensure seamless vehicle movement while maintaining quality and security standards.

Key components of this market include finished vehicle logistics, automotive parts distribution, reverse logistics for vehicle returns, and specialized services for electric and autonomous vehicles. The sector plays a crucial role in supporting the automotive industry’s just-in-time manufacturing principles while adapting to emerging trends such as direct-to-consumer delivery models and sustainable transportation practices.

Strategic analysis reveals that the North America vehicle logistics market is experiencing unprecedented growth driven by the automotive industry’s recovery and expansion. The market benefits from robust manufacturing activities, increasing vehicle sales, and the growing adoption of electric vehicles requiring specialized logistics solutions. Technology integration has emerged as a primary differentiator, with companies investing heavily in digital platforms to enhance operational efficiency and customer satisfaction.

Market leaders are focusing on capacity expansion, strategic partnerships, and sustainability initiatives to maintain competitive advantages. The adoption of alternative fuel vehicles in logistics fleets has increased by 28% over the past three years, reflecting the industry’s commitment to environmental responsibility. Cross-border trade facilitation through the United States-Mexico-Canada Agreement (USMCA) has strengthened regional integration and created new opportunities for logistics providers.

Investment trends indicate significant capital allocation toward infrastructure development, technology upgrades, and workforce training programs. The market demonstrates resilience against economic fluctuations while adapting to changing consumer behaviors, including the growing preference for online vehicle purchases and home delivery services.

Comprehensive analysis of the North America vehicle logistics market reveals several critical insights that shape industry dynamics and future growth trajectories:

Automotive industry growth serves as the primary catalyst driving the North America vehicle logistics market expansion. The recovering automotive sector, supported by pent-up consumer demand and favorable financing conditions, has generated increased vehicle production and distribution requirements. Manufacturing reshoring initiatives have brought automotive production closer to North American markets, creating new logistics corridors and distribution patterns.

E-commerce transformation has fundamentally altered vehicle purchasing behaviors, with online sales platforms requiring sophisticated logistics solutions to deliver vehicles directly to consumers. This shift has created demand for specialized last-mile delivery services, vehicle preparation facilities, and digital integration platforms. Consumer expectations for transparency and convenience have pushed logistics providers to invest in customer-facing technologies and service enhancements.

Electric vehicle proliferation represents a significant growth driver, requiring specialized handling, charging infrastructure, and trained personnel. The unique characteristics of electric vehicles, including battery safety protocols and charging requirements, have created new service categories within the logistics ecosystem. Government incentives and regulatory support for clean transportation have accelerated EV adoption, generating corresponding logistics demand.

Infrastructure investments in ports, rail networks, and highway systems have enhanced the capacity and efficiency of vehicle logistics operations. Public-private partnerships have facilitated the development of multimodal transportation hubs and specialized automotive terminals, improving overall network connectivity and reducing transportation costs.

Labor shortages represent a significant constraint affecting the North America vehicle logistics market, with skilled driver shortages and specialized technician availability limiting operational capacity. The aging workforce in the transportation sector, combined with challenging working conditions and regulatory requirements, has created persistent staffing challenges. Training costs for specialized vehicle handling and emerging technology systems add financial burden to logistics providers.

Regulatory complexity across different jurisdictions creates operational challenges, particularly for cross-border movements and specialized vehicle categories. Varying safety standards, environmental regulations, and documentation requirements increase compliance costs and operational complexity. Insurance costs for high-value vehicle transportation have risen significantly, impacting profit margins and service pricing.

Infrastructure limitations in certain regions constrain market growth, with aging transportation networks and capacity bottlenecks affecting service reliability. Port congestion, rail capacity constraints, and highway maintenance issues create operational inefficiencies and increased costs. Weather-related disruptions pose ongoing challenges, particularly for time-sensitive deliveries and seasonal demand fluctuations.

Technology integration costs and cybersecurity concerns present barriers for smaller logistics providers seeking to compete with larger, well-capitalized competitors. The rapid pace of technological change requires continuous investment in systems upgrades and staff training, straining financial resources for many companies.

Electric vehicle logistics presents the most significant growth opportunity, with specialized services for EV transportation, charging infrastructure integration, and battery handling protocols. The expanding EV market requires dedicated logistics solutions, creating opportunities for service differentiation and premium pricing. Autonomous vehicle preparation for future self-driving car distribution represents an emerging opportunity requiring specialized facilities and expertise.

Digital transformation initiatives offer opportunities for logistics providers to enhance operational efficiency and customer experience through advanced analytics, artificial intelligence, and blockchain technologies. Data monetization through insights and analytics services represents a new revenue stream for companies with comprehensive tracking and monitoring capabilities.

Sustainability services are gaining traction as automotive manufacturers and consumers prioritize environmental responsibility. Carbon-neutral logistics solutions, alternative fuel fleet operations, and circular economy initiatives create competitive advantages and align with corporate sustainability goals. Green certification programs enable premium pricing for environmentally conscious services.

Cross-border expansion opportunities exist through the strengthened USMCA framework, facilitating increased trade flows and integrated supply chain operations. Nearshoring trends in automotive manufacturing create new logistics corridors and distribution patterns, particularly between the United States and Mexico.

Supply chain evolution continues to reshape the North America vehicle logistics market, with manufacturers adopting more flexible and responsive distribution strategies. The shift from traditional push-based inventory models to demand-driven pull systems has increased the importance of real-time visibility and rapid response capabilities. Just-in-time principles require precise coordination between manufacturing schedules and logistics operations, creating opportunities for technology-enabled service providers.

Competitive dynamics are intensifying as traditional logistics companies compete with technology-focused startups and automotive manufacturers developing in-house capabilities. Strategic partnerships between logistics providers, technology companies, and automotive manufacturers are becoming increasingly common to leverage complementary strengths and share investment risks.

Customer expectations continue to evolve, with demands for greater transparency, faster delivery times, and enhanced service quality. The consumerization of vehicle purchasing through online platforms has raised expectations for logistics services to match the convenience and reliability of other e-commerce experiences. Service differentiation through value-added services such as vehicle preparation, customization, and white-glove delivery is becoming crucial for competitive positioning.

Regulatory evolution in areas such as autonomous vehicles, electric vehicle safety, and environmental standards is creating both challenges and opportunities for logistics providers. Companies that proactively adapt to regulatory changes and invest in compliance capabilities are positioned to capture market share as standards evolve.

Comprehensive research approach employed for analyzing the North America vehicle logistics market combines primary and secondary research methodologies to ensure accuracy and reliability of findings. Primary research includes extensive interviews with industry executives, logistics managers, automotive manufacturers, and technology providers to gather firsthand insights into market trends, challenges, and opportunities.

Secondary research encompasses analysis of industry reports, government publications, trade association data, and company financial statements to establish market baselines and validate primary research findings. Data triangulation techniques ensure consistency and reliability across multiple information sources, enhancing the credibility of market assessments.

Quantitative analysis utilizes statistical modeling and forecasting techniques to project market growth trends and segment performance. Qualitative assessment provides context and interpretation for quantitative findings, offering insights into underlying market dynamics and strategic implications for industry participants.

Market segmentation analysis examines various dimensions including service type, vehicle category, transportation mode, and geographic distribution to provide granular insights into market structure and growth patterns. Competitive intelligence gathering through public sources and industry networks provides comprehensive understanding of market positioning and strategic initiatives among key players.

United States dominance in the North America vehicle logistics market reflects the country’s position as the largest automotive market and manufacturing hub in the region. The U.S. market benefits from extensive transportation infrastructure, including major automotive ports in California, Texas, and the Southeast, comprehensive rail networks, and established logistics service providers. Regional distribution shows the Midwest maintaining its position as the automotive manufacturing heartland, while Southern states attract increasing investment in electric vehicle production facilities.

Canada’s market demonstrates steady growth driven by domestic automotive production and cross-border trade with the United States. The Canadian market shows particular strength in specialized logistics services for harsh weather conditions and remote area deliveries. Infrastructure investments in port facilities and rail connections enhance Canada’s role as a gateway for international automotive trade, particularly with Asian markets.

Mexico’s expanding role in North American automotive supply chains has generated significant logistics demand, with the country serving as both a manufacturing base and growing consumer market. Cross-border logistics between Mexico and the United States represent one of the fastest-growing segments, supported by improved trade facilitation under USMCA. Manufacturing clusters in states such as Guanajuato, Puebla, and Nuevo León have created concentrated logistics demand and specialized service offerings.

Regional integration continues to strengthen through infrastructure development projects, harmonized regulations, and trade facilitation initiatives. According to MarkWide Research analysis, cross-border vehicle movements have increased by 25% since USMCA implementation, demonstrating the benefits of enhanced regional cooperation.

Market leadership in the North America vehicle logistics sector is characterized by a mix of global logistics giants, specialized automotive transporters, and emerging technology-enabled service providers. The competitive environment emphasizes operational excellence, technology innovation, and customer service quality as key differentiators.

Competitive strategies focus on technology differentiation, geographic expansion, and value-added service development. Strategic acquisitions and partnerships enable companies to enhance capabilities, expand market reach, and access new technologies. Innovation investments in areas such as artificial intelligence, robotics, and sustainability initiatives create competitive advantages and support premium pricing strategies.

Service type segmentation reveals the diverse nature of the North America vehicle logistics market, with each category serving specific customer needs and operational requirements:

By Service Type:

By Transportation Mode:

By Vehicle Type:

Passenger vehicle logistics represents the largest market segment, driven by high-volume production and diverse distribution requirements. This category benefits from established transportation networks and standardized handling procedures, enabling efficient operations and competitive pricing. Technology integration in passenger vehicle logistics focuses on route optimization, real-time tracking, and customer communication systems.

Electric vehicle logistics emerges as the fastest-growing category, requiring specialized infrastructure, trained personnel, and safety protocols. Battery handling procedures and charging infrastructure integration create unique service requirements and opportunities for differentiation. The segment commands premium pricing due to specialized requirements and limited service provider availability.

Commercial vehicle logistics involves complex coordination due to vehicle size, weight restrictions, and specialized equipment requirements. Permit management and route planning for oversized vehicles create operational challenges and service opportunities. The segment demonstrates steady growth aligned with economic activity and infrastructure development projects.

Luxury vehicle logistics emphasizes security, quality preservation, and white-glove service delivery. Enclosed transportation and specialized handling procedures command premium pricing while requiring significant investment in equipment and training. Customer expectations for service excellence drive continuous improvement in this high-margin segment.

Automotive manufacturers benefit from specialized logistics services through reduced transportation costs, improved delivery reliability, and enhanced supply chain visibility. Outsourcing logistics enables manufacturers to focus on core competencies while accessing specialized expertise and infrastructure. Risk mitigation through professional logistics services reduces potential damage, delays, and compliance issues.

Dealerships and retailers gain from improved inventory management, faster vehicle availability, and enhanced customer satisfaction through reliable delivery services. Direct-to-consumer delivery options expand market reach and improve customer convenience, supporting sales growth and competitive positioning.

Logistics service providers benefit from stable, long-term contracts with automotive industry clients, providing predictable revenue streams and opportunities for operational optimization. Technology investments in vehicle logistics create competitive advantages and enable expansion into adjacent markets and service categories.

Consumers experience improved vehicle availability, faster delivery times, and enhanced purchasing convenience through professional logistics services. Quality assurance and damage prevention during transportation protect consumer investments and ensure satisfaction with vehicle purchases.

Government stakeholders benefit from efficient vehicle logistics through reduced traffic congestion, improved air quality through optimized transportation, and enhanced economic activity supporting employment and tax revenues.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digitalization acceleration represents the most significant trend reshaping the North America vehicle logistics market, with companies investing heavily in Internet of Things sensors, artificial intelligence, and blockchain technologies. Real-time visibility has become a standard customer expectation, driving adoption of comprehensive tracking and monitoring systems across all transportation modes.

Sustainability initiatives are gaining momentum as logistics providers respond to environmental concerns and corporate responsibility requirements. Alternative fuel adoption in logistics fleets, carbon offset programs, and circular economy principles are becoming competitive differentiators. Green logistics certification programs enable premium pricing and attract environmentally conscious customers.

Direct-to-consumer delivery models are transforming traditional distribution patterns, with logistics providers developing specialized capabilities for home delivery and customer interaction. Last-mile innovation includes mobile vehicle preparation units, appointment scheduling systems, and white-glove delivery services enhancing customer experience.

Autonomous vehicle preparation is emerging as logistics providers prepare for future self-driving car distribution requirements. Infrastructure adaptation and service model development for autonomous vehicles represent long-term strategic initiatives requiring significant planning and investment.

Cross-border integration continues strengthening through improved trade facilitation, harmonized regulations, and infrastructure development. USMCA benefits are materializing through reduced processing times and enhanced cooperation between North American logistics networks.

Technology partnerships between logistics providers and automotive manufacturers are accelerating innovation in vehicle transportation and handling. Collaborative platforms enable real-time information sharing, coordinated planning, and optimized resource utilization across supply chain partners.

Infrastructure investments in specialized automotive terminals, rail facilities, and port expansions are enhancing capacity and efficiency. Public-private partnerships facilitate development of multimodal transportation hubs and dedicated automotive logistics corridors.

Workforce development initiatives address skilled labor shortages through training programs, apprenticeships, and technology-assisted operations. Industry associations collaborate with educational institutions to develop specialized curricula and certification programs for vehicle logistics professionals.

Regulatory harmonization efforts across North American jurisdictions are reducing compliance complexity and facilitating cross-border operations. Digital documentation systems and automated customs processing improve efficiency and reduce administrative burden.

Sustainability commitments from major logistics providers include carbon neutrality targets, alternative fuel fleet conversion, and circular economy initiatives. Industry standards for environmental performance are emerging through collaborative efforts between logistics companies and automotive manufacturers.

Strategic recommendations for North America vehicle logistics market participants emphasize the importance of technology investment, sustainability initiatives, and service differentiation. MarkWide Research analysis suggests that companies prioritizing digital transformation and customer experience enhancement will achieve superior market positioning and financial performance.

Technology adoption should focus on integrated platforms providing end-to-end visibility, predictive analytics, and automated decision-making capabilities. Investment priorities include artificial intelligence for route optimization, IoT sensors for real-time monitoring, and blockchain for secure information sharing.

Partnership strategies with automotive manufacturers, technology providers, and complementary service companies can accelerate capability development and market expansion. Strategic alliances enable resource sharing, risk mitigation, and access to specialized expertise and infrastructure.

Workforce development initiatives should address current skill shortages while preparing for future technology requirements. Training programs combining traditional logistics skills with digital competencies will create competitive advantages and operational resilience.

Sustainability integration should encompass operational practices, fleet management, and customer service offerings. Environmental performance metrics and reporting capabilities will become increasingly important for customer retention and competitive positioning.

Market projections indicate continued robust growth for the North America vehicle logistics market, driven by automotive industry expansion, technology adoption, and evolving consumer preferences. Electric vehicle proliferation will create substantial opportunities for specialized logistics services, with market penetration expected to reach 40% by 2030.

Technology evolution will continue reshaping operational models, with artificial intelligence, robotics, and autonomous systems becoming integral to logistics operations. Digital integration across supply chain partners will enable unprecedented levels of coordination and optimization.

Sustainability requirements will intensify, with carbon neutrality becoming a standard expectation rather than a competitive differentiator. Regulatory support for clean transportation will accelerate adoption of alternative fuel logistics fleets and environmentally responsible practices.

Market consolidation may occur as smaller providers struggle to make necessary technology investments, while larger companies acquire specialized capabilities and geographic coverage. Strategic partnerships will become increasingly important for accessing complementary strengths and sharing investment risks.

Customer expectations will continue evolving toward greater convenience, transparency, and service quality. Direct-to-consumer delivery models will expand beyond luxury segments to mainstream vehicle categories, requiring significant operational adaptations and service innovations.

The North America vehicle logistics market stands at a pivotal juncture, characterized by robust growth prospects, technological transformation, and evolving customer expectations. The market’s resilience and adaptability have been demonstrated through successful navigation of recent challenges while positioning for future opportunities in electric vehicle logistics, digital transformation, and sustainability initiatives.

Strategic success in this dynamic market requires balanced investment in technology capabilities, operational excellence, and customer service innovation. Companies that effectively integrate digital solutions, develop specialized expertise, and build strategic partnerships will capture disproportionate value creation opportunities. Market leaders will distinguish themselves through comprehensive service offerings, superior execution capabilities, and proactive adaptation to industry evolution.

Future growth will be driven by the continued expansion of North American automotive markets, increasing complexity of supply chain requirements, and the emergence of new vehicle technologies requiring specialized logistics solutions. The market’s fundamental strengths, including established infrastructure, technological leadership, and regional integration, provide a solid foundation for sustained expansion and value creation across all stakeholder categories.

What is Vehicle Logistics?

Vehicle logistics refers to the process of managing the transportation, storage, and distribution of vehicles from manufacturers to dealerships and end consumers. This includes various activities such as inventory management, shipping, and handling of vehicles throughout the supply chain.

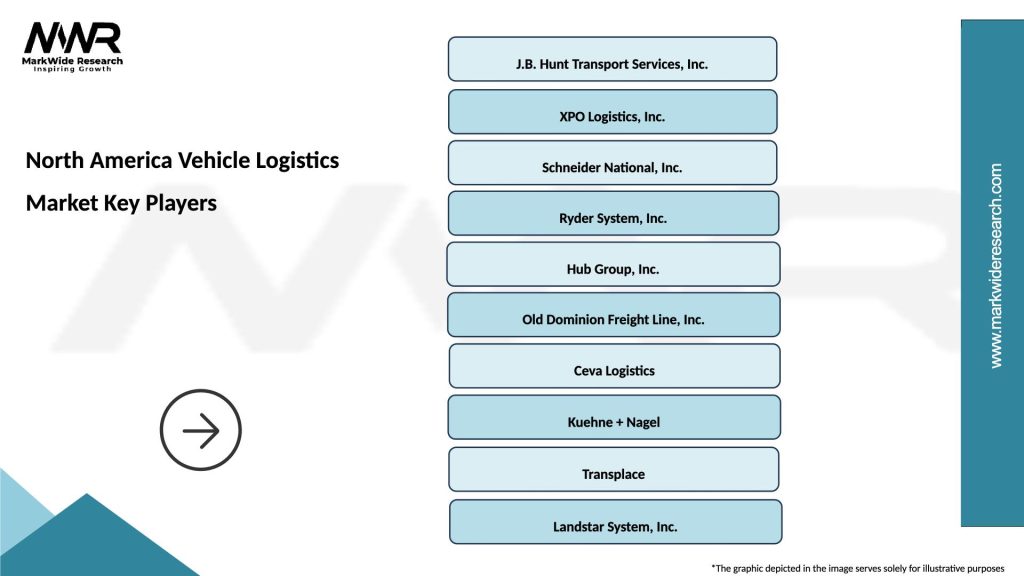

What are the key players in the North America Vehicle Logistics Market?

Key players in the North America Vehicle Logistics Market include companies like Penske Logistics, XPO Logistics, and J.B. Hunt Transport Services, among others. These companies provide comprehensive logistics solutions tailored to the automotive industry.

What are the main drivers of growth in the North America Vehicle Logistics Market?

The main drivers of growth in the North America Vehicle Logistics Market include the increasing demand for vehicles, advancements in logistics technology, and the expansion of e-commerce in the automotive sector. Additionally, the rise in consumer preferences for online vehicle purchases is influencing logistics strategies.

What challenges does the North America Vehicle Logistics Market face?

Challenges in the North America Vehicle Logistics Market include fluctuating fuel prices, supply chain disruptions, and regulatory compliance issues. These factors can impact the efficiency and cost-effectiveness of vehicle transportation and logistics operations.

What opportunities exist in the North America Vehicle Logistics Market?

Opportunities in the North America Vehicle Logistics Market include the adoption of electric vehicles, which requires new logistics strategies, and the integration of automation and AI in logistics operations. Additionally, the growth of shared mobility services presents new logistics challenges and opportunities.

What trends are shaping the North America Vehicle Logistics Market?

Trends shaping the North America Vehicle Logistics Market include the increasing use of digital platforms for logistics management, a focus on sustainability in transportation, and the rise of just-in-time delivery systems. These trends are driving innovation and efficiency in vehicle logistics operations.

North America Vehicle Logistics Market

| Segmentation Details | Description |

|---|---|

| Vehicle Type | Passenger Cars, Trucks, Buses, Motorcycles |

| Service Type | Transportation, Warehousing, Inventory Management, Freight Forwarding |

| End User | OEMs, Fleet Operators, Dealerships, Aftermarket Providers |

| Technology | Telematics, GPS Tracking, RFID, Autonomous Vehicles |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the North America Vehicle Logistics Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at