444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Middle East Africa turboprop aircraft market represents a dynamic and rapidly evolving segment of the regional aviation industry, characterized by increasing demand for efficient regional connectivity and specialized aviation applications. This market encompasses a diverse range of turboprop-powered aircraft serving commercial airlines, cargo operators, government agencies, and private aviation sectors across the Middle East and African regions.

Regional aviation dynamics in the Middle East and Africa have created unique opportunities for turboprop aircraft deployment, particularly in connecting remote locations, supporting oil and gas operations, and providing essential air services to underserved communities. The market demonstrates significant growth potential driven by expanding regional economies, infrastructure development projects, and the need for cost-effective aviation solutions in challenging operational environments.

Market characteristics include a strong preference for versatile aircraft capable of operating from short and unpaved runways, excellent fuel efficiency compared to jet aircraft for shorter routes, and robust performance in harsh climatic conditions typical of the region. The turboprop aircraft market in this region is experiencing growth at approximately 6.2% CAGR, reflecting increasing adoption across multiple aviation sectors.

Geographic distribution shows concentrated activity in key aviation hubs including the United Arab Emirates, Saudi Arabia, Qatar, South Africa, Nigeria, and Kenya, with emerging markets in Ethiopia, Ghana, and Morocco demonstrating substantial growth potential. The market benefits from supportive government policies promoting regional connectivity and aviation sector development.

The Middle East Africa turboprop aircraft market refers to the comprehensive ecosystem encompassing the manufacturing, sales, leasing, operation, and maintenance of turboprop-powered aircraft within the Middle East and African regions. This market includes various aircraft categories ranging from small single-engine turboprops to large twin-engine commercial aircraft designed for regional passenger and cargo transportation.

Turboprop aircraft are characterized by their propeller-driven propulsion systems powered by turbine engines, offering superior fuel efficiency and operational flexibility compared to jet aircraft for short to medium-haul routes. These aircraft typically feature excellent short takeoff and landing capabilities, making them ideal for operations in regions with limited airport infrastructure.

Market scope encompasses new aircraft sales, aircraft leasing arrangements, aftermarket services including maintenance and parts supply, pilot training programs, and ground support equipment. The market serves diverse applications including scheduled passenger services, charter operations, cargo transportation, medical evacuation, surveillance missions, and specialized industrial applications such as oil and gas support operations.

Strategic market positioning of the Middle East Africa turboprop aircraft market reflects a robust growth trajectory driven by expanding regional aviation requirements and increasing recognition of turboprop aircraft advantages for specific operational scenarios. The market demonstrates resilience and adaptability to regional economic conditions while maintaining steady expansion across key segments.

Key growth drivers include rising demand for regional connectivity, expansion of oil and gas exploration activities requiring specialized aviation support, growing tourism sectors in multiple countries, and government initiatives promoting aviation infrastructure development. The market benefits from approximately 78% operational cost advantage of turboprops over jets for routes under 500 nautical miles.

Market segmentation reveals strong performance across commercial aviation, cargo operations, and specialized applications, with commercial passenger services representing the largest segment by aircraft utilization. The aftermarket services segment demonstrates particularly strong growth potential, driven by an expanding installed base and increasing focus on operational efficiency.

Competitive landscape features established international manufacturers alongside emerging regional players, creating a dynamic market environment with diverse product offerings and service capabilities. Strategic partnerships between manufacturers and regional operators are becoming increasingly important for market success.

Market intelligence reveals several critical insights shaping the Middle East Africa turboprop aircraft market landscape:

According to MarkWide Research analysis, the market demonstrates particular strength in applications requiring operational flexibility and cost efficiency, with regional airlines showing increasing preference for modern turboprop aircraft over older jet aircraft for appropriate route structures.

Economic development across the Middle East and Africa regions creates substantial demand for improved transportation infrastructure, with turboprop aircraft serving as essential components of comprehensive connectivity solutions. Growing economies require efficient movement of people and goods, particularly between emerging business centers and established commercial hubs.

Resource sector expansion drives significant demand for specialized aviation services, with oil and gas exploration, mining operations, and renewable energy projects requiring reliable transportation to remote locations. Turboprop aircraft offer ideal solutions for personnel transport, equipment delivery, and emergency evacuation services in challenging operational environments.

Tourism industry growth creates opportunities for regional aviation services connecting tourist destinations with major airports and population centers. Many attractive destinations in both regions lack jet-capable airports, making turboprop aircraft essential for tourism accessibility and economic development.

Government initiatives promoting regional connectivity and aviation sector development provide policy support and financial incentives for turboprop aircraft operations. National aviation strategies increasingly recognize the importance of regional aircraft in achieving comprehensive transportation network coverage.

Operational cost advantages of turboprop aircraft become increasingly important as fuel costs and operational expenses impact airline profitability. Airlines report approximately 35% lower operating costs per seat-mile for turboprop aircraft compared to regional jets on routes under 400 nautical miles.

Infrastructure limitations in certain regions create operational challenges for turboprop aircraft, including inadequate ground support equipment, limited maintenance facilities, and insufficient fuel supply networks. These constraints can limit market expansion in otherwise promising territories.

Regulatory complexities across multiple jurisdictions create compliance challenges for operators seeking to establish regional services. Varying certification requirements, operational standards, and safety regulations can increase operational complexity and costs for multi-country operations.

Pilot availability represents a significant constraint, with shortages of qualified turboprop pilots limiting fleet expansion capabilities. Training requirements and career progression preferences often favor jet aircraft operations, creating recruitment challenges for turboprop operators.

Passenger perceptions sometimes favor jet aircraft over turboprop aircraft, particularly among business travelers who may perceive turboprops as less comfortable or prestigious. This perception can limit market development in certain premium segments despite superior operational economics.

Economic volatility in some regional markets creates uncertainty for aviation investments, with currency fluctuations and political instability potentially impacting long-term operational planning and fleet acquisition decisions.

Emerging market development presents substantial opportunities as previously underserved regions develop economic activity requiring aviation connectivity. Countries investing in infrastructure development and economic diversification create new demand for regional aviation services.

Cargo market expansion offers significant growth potential, with e-commerce growth and supply chain optimization driving demand for efficient cargo transportation solutions. Turboprop aircraft provide ideal platforms for time-sensitive cargo operations to secondary destinations.

Medical aviation services represent a growing opportunity segment, with increasing demand for air ambulance services, medical supply delivery, and healthcare accessibility improvement in remote areas. Specialized medical configurations of turboprop aircraft address critical healthcare transportation needs.

Technology integration opportunities include advanced avionics systems, improved fuel efficiency technologies, and enhanced passenger comfort features that can differentiate turboprop aircraft in competitive markets. Modern technology integration addresses traditional turboprop limitations while maintaining operational advantages.

Public-private partnerships create opportunities for innovative financing and operational models, enabling market expansion through risk-sharing arrangements and government support for essential air services. These partnerships can unlock previously uneconomical routes and destinations.

Supply chain dynamics in the Middle East Africa turboprop aircraft market reflect complex interactions between international manufacturers, regional distributors, and local service providers. The market demonstrates increasing localization of maintenance and support services, with regional MRO capabilities expanding to meet growing fleet requirements.

Competitive dynamics show intensifying competition among aircraft manufacturers seeking to establish market presence, with pricing strategies, financing options, and after-sales support becoming key differentiators. Regional preferences for specific aircraft types create opportunities for targeted market approaches.

Technology adoption patterns indicate rapid integration of modern avionics and safety systems, with operators prioritizing aircraft featuring advanced weather radar, terrain awareness systems, and automated flight management capabilities. These technology adoptions enhance operational safety and efficiency while meeting evolving regulatory requirements.

Financial dynamics reveal diverse funding mechanisms including traditional aircraft financing, operating leases, and innovative financing structures adapted to regional market conditions. Leasing penetration reaches approximately 42% of new aircraft deliveries, reflecting operator preferences for flexible fleet management approaches.

Operational dynamics demonstrate increasing focus on route optimization, fleet utilization improvement, and operational cost management. Airlines report achieving 85% average load factors on well-planned turboprop routes, indicating strong market demand when properly matched to aircraft capabilities.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable market intelligence for the Middle East Africa turboprop aircraft market. The research approach combines quantitative data analysis with qualitative insights from industry stakeholders across the aviation value chain.

Primary research includes structured interviews with airline executives, aircraft manufacturers, leasing companies, maintenance providers, and regulatory authorities. Survey methodologies capture operational data, market preferences, and strategic planning insights from key market participants.

Secondary research encompasses analysis of industry publications, regulatory filings, financial reports, and aviation databases to establish market baselines and trend identification. Historical data analysis provides context for market evolution and future projections.

Data validation processes ensure information accuracy through cross-referencing multiple sources, expert review panels, and statistical validation techniques. Market sizing methodologies employ bottom-up and top-down approaches to ensure comprehensive market coverage.

Regional analysis methodology accounts for diverse market conditions across Middle East and African countries, with country-specific research addressing local regulatory environments, economic conditions, and aviation infrastructure capabilities.

Middle East region demonstrates strong market leadership in turboprop aircraft adoption, with the United Arab Emirates, Saudi Arabia, and Qatar leading in fleet modernization and operational innovation. The region benefits from substantial government investment in aviation infrastructure and supportive regulatory environments promoting regional connectivity.

Gulf Cooperation Council countries show particular strength in specialized applications including oil and gas support operations, with approximately 28% of regional turboprop operations serving energy sector requirements. These markets demonstrate resilience and continued growth despite economic fluctuations.

North Africa presents significant growth opportunities, with Morocco, Egypt, and Algeria developing regional aviation capabilities to support tourism and economic development initiatives. Infrastructure investments and regulatory modernization create favorable conditions for market expansion.

Sub-Saharan Africa represents the largest growth potential segment, with countries including South Africa, Nigeria, Kenya, and Ethiopia leading market development. The region benefits from increasing economic integration and infrastructure development projects requiring enhanced transportation connectivity.

East Africa shows particularly strong growth momentum, with regional integration initiatives and economic development creating demand for efficient transportation solutions. Countries in this region demonstrate approximately 8.5% annual growth in turboprop aircraft utilization.

West Africa markets benefit from resource sector development and increasing regional trade, with Nigeria leading market development and Ghana, Senegal, and Ivory Coast showing emerging opportunities for turboprop aircraft operations.

Market leadership in the Middle East Africa turboprop aircraft market features a diverse competitive environment with established international manufacturers and emerging regional players competing across multiple market segments.

Competitive strategies focus on product differentiation, regional service support, financing flexibility, and operational cost optimization. Manufacturers increasingly emphasize local partnerships and regional service capabilities to enhance market competitiveness.

Market positioning varies by manufacturer, with some focusing on high-volume commercial applications while others target specialized or premium market segments. Service support capabilities and parts availability become increasingly important competitive factors.

By Aircraft Type:

By Application:

By End User:

Commercial aviation segment demonstrates the strongest growth momentum, with regional airlines increasingly recognizing turboprop aircraft advantages for appropriate route structures. This segment benefits from route optimization strategies and improved passenger acceptance of modern turboprop aircraft featuring enhanced comfort and safety systems.

Cargo operations category shows exceptional growth potential driven by e-commerce expansion and supply chain optimization requirements. Turboprop aircraft offer ideal solutions for time-sensitive cargo delivery to secondary destinations, with operators reporting 92% on-time performance rates for dedicated cargo services.

Business aviation segment reflects increasing demand for versatile aircraft capable of accessing smaller airports while providing jet-like performance and comfort. This category benefits from economic development creating demand for efficient business transportation solutions.

Government services category encompasses diverse applications including border patrol, maritime surveillance, medical evacuation, and emergency response operations. Government operators value turboprop aircraft reliability and operational flexibility for mission-critical applications.

Specialized applications segment includes aerial survey, pilot training, agricultural aviation, and industrial support operations. This category demonstrates steady growth driven by expanding economic activities requiring specialized aviation services.

Airlines and operators benefit from superior operational economics, with turboprop aircraft offering approximately 40% lower fuel consumption compared to regional jets on routes under 500 nautical miles. Enhanced operational flexibility enables service to destinations with limited infrastructure while maintaining competitive operating costs.

Passengers and communities gain access to improved connectivity and transportation options, with turboprop services enabling economic development and tourism growth in previously underserved regions. Modern turboprop aircraft provide comfortable and safe transportation with reduced environmental impact.

Manufacturers and suppliers benefit from expanding market opportunities and growing aftermarket services demand. The installed base growth creates sustained revenue streams through parts supply, maintenance services, and aircraft modifications.

Governments and regulators achieve policy objectives including regional development, economic integration, and transportation accessibility improvement. Turboprop aircraft operations support national aviation strategies while promoting economic growth in remote regions.

Financial institutions find attractive investment opportunities in turboprop aircraft financing and leasing, with strong residual values and diverse application markets providing risk mitigation and return optimization potential.

Strengths:

Weaknesses:

Opportunities:

Threats:

Technology modernization represents a dominant trend, with manufacturers integrating advanced avionics, improved engines, and enhanced safety systems to address traditional turboprop limitations while maintaining operational advantages. Modern glass cockpits and automated systems improve pilot workload and operational safety.

Sustainability focus drives development of more fuel-efficient engines and sustainable aviation fuel compatibility, with operators increasingly prioritizing environmental performance alongside economic benefits. Turboprop aircraft demonstrate inherent environmental advantages through lower fuel consumption and emissions.

Service integration trends show increasing emphasis on comprehensive support packages including maintenance, training, and operational support services. Manufacturers develop integrated service offerings to enhance customer relationships and create recurring revenue streams.

Fleet optimization strategies emphasize right-sizing aircraft to route requirements, with airlines achieving 15% improvement in operational efficiency through strategic turboprop deployment on appropriate routes. Data analytics and route optimization tools support these strategic decisions.

Regional partnerships become increasingly important, with manufacturers establishing local partnerships for sales, service, and support activities. These partnerships enhance market access and customer support capabilities while reducing operational costs.

Product innovations include next-generation turboprop aircraft featuring improved fuel efficiency, enhanced passenger comfort, and advanced safety systems. Manufacturers invest substantially in research and development to maintain competitive advantages and address evolving market requirements.

Market expansion initiatives see established operators entering new geographic markets and route networks, supported by improved aircraft capabilities and regulatory harmonization efforts. These expansions create new opportunities for turboprop aircraft deployment.

Infrastructure investments across the region improve airport capabilities and ground support facilities, enabling expanded turboprop operations and enhanced service reliability. Government and private sector investments support aviation sector development.

Regulatory developments include updated safety standards, environmental regulations, and operational requirements that influence aircraft selection and operational procedures. Industry stakeholders actively participate in regulatory development processes to ensure practical and effective standards.

Strategic partnerships between manufacturers, operators, and service providers create integrated solutions addressing comprehensive customer requirements. These partnerships enhance market competitiveness and customer satisfaction through coordinated service delivery.

MWR analysis recommends that industry participants focus on operational efficiency optimization and route network development to maximize turboprop aircraft advantages. Strategic route planning and fleet right-sizing initiatives can significantly improve operational performance and financial returns.

Market positioning strategies should emphasize turboprop aircraft unique advantages including operational flexibility, cost efficiency, and environmental benefits. Effective marketing and customer education can address perception challenges while highlighting operational advantages.

Technology investment priorities should focus on avionics modernization, fuel efficiency improvements, and passenger comfort enhancements to maintain competitive positioning against alternative aircraft types. Strategic technology partnerships can accelerate development while managing investment risks.

Service capability development represents a critical success factor, with regional maintenance and support capabilities becoming increasingly important for market competitiveness. Investment in local service infrastructure and personnel training supports long-term market development.

Partnership strategies should emphasize regional collaboration and local market expertise to enhance market access and operational effectiveness. Strategic partnerships can provide market knowledge, regulatory expertise, and operational support capabilities.

Long-term market prospects for the Middle East Africa turboprop aircraft market remain highly positive, supported by continued economic development, infrastructure investment, and recognition of turboprop aircraft operational advantages for regional connectivity applications.

Growth projections indicate sustained market expansion at approximately 6.8% CAGR over the next decade, driven by expanding regional economies, tourism development, and increasing demand for efficient transportation solutions. The cargo segment shows particularly strong growth potential with projected 9.2% annual growth rates.

Technology evolution will continue driving market development, with next-generation turboprop aircraft featuring enhanced performance, improved efficiency, and advanced capabilities addressing traditional market limitations while maintaining operational advantages.

Market maturation processes will create more sophisticated customer requirements and competitive dynamics, with service quality, operational reliability, and total cost of ownership becoming increasingly important selection criteria.

Regional integration initiatives will create new opportunities for turboprop aircraft operations, with improved regulatory harmonization and infrastructure development supporting expanded route networks and operational efficiency improvements.

The Middle East Africa turboprop aircraft market represents a dynamic and rapidly evolving sector with substantial growth potential driven by regional economic development, infrastructure investment, and increasing recognition of turboprop aircraft operational advantages. The market demonstrates resilience and adaptability while maintaining strong growth momentum across diverse application segments.

Strategic opportunities abound for industry participants who can effectively leverage turboprop aircraft unique capabilities including operational flexibility, cost efficiency, and infrastructure adaptability. Success requires comprehensive understanding of regional market dynamics, customer requirements, and competitive positioning strategies.

Future market development will be shaped by technology advancement, regulatory evolution, and changing customer expectations, with successful participants demonstrating ability to adapt and innovate while maintaining focus on operational excellence and customer satisfaction. The market outlook remains highly positive for stakeholders who can effectively navigate regional complexities while capitalizing on substantial growth opportunities.

What is Turboprop Aircraft?

Turboprop aircraft are a type of fixed-wing aircraft that use a gas turbine engine to drive a propeller. They are commonly used for regional flights, cargo transport, and in areas with shorter runways due to their ability to take off and land on less developed airstrips.

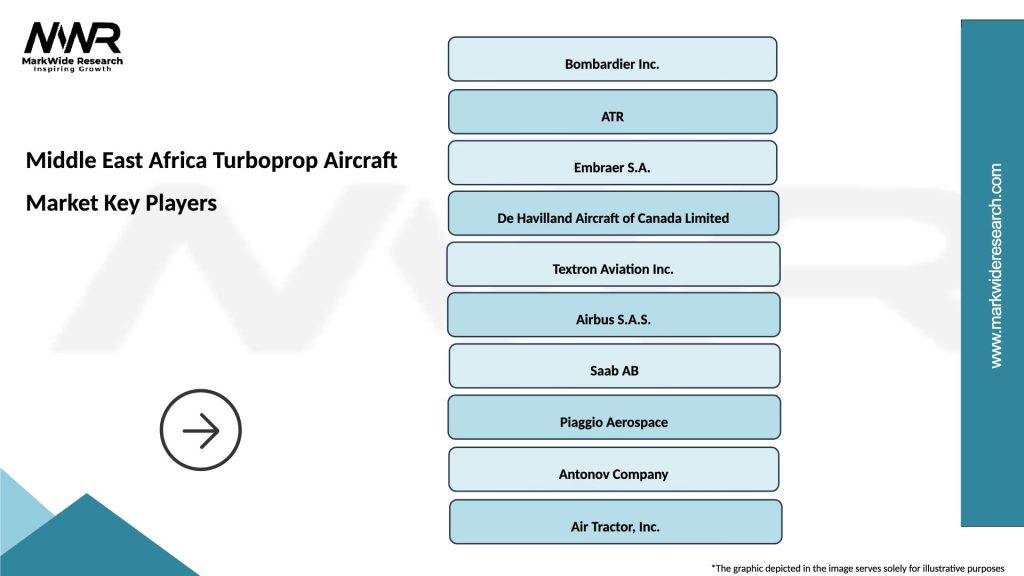

What are the key players in the Middle East Africa Turboprop Aircraft Market?

Key players in the Middle East Africa Turboprop Aircraft Market include Bombardier, ATR, and Embraer, which manufacture a range of turboprop models for various applications, including passenger transport and cargo services, among others.

What are the growth factors driving the Middle East Africa Turboprop Aircraft Market?

The growth of the Middle East Africa Turboprop Aircraft Market is driven by increasing demand for regional air travel, the expansion of air cargo services, and the need for cost-effective aircraft solutions in remote areas.

What challenges does the Middle East Africa Turboprop Aircraft Market face?

Challenges in the Middle East Africa Turboprop Aircraft Market include regulatory hurdles, competition from jet aircraft, and fluctuating fuel prices, which can impact operational costs and profitability.

What opportunities exist in the Middle East Africa Turboprop Aircraft Market?

Opportunities in the Middle East Africa Turboprop Aircraft Market include the potential for increased investment in regional aviation infrastructure, the rise of low-cost carriers, and advancements in aircraft technology that enhance fuel efficiency and reduce emissions.

What trends are shaping the Middle East Africa Turboprop Aircraft Market?

Trends in the Middle East Africa Turboprop Aircraft Market include a growing focus on sustainability, the introduction of more fuel-efficient turboprop models, and the integration of advanced avionics and safety features to improve operational efficiency.

Middle East Africa Turboprop Aircraft Market

| Segmentation Details | Description |

|---|---|

| Product Type | Regional, Utility, Cargo, Passenger |

| End User | Commercial Airlines, Charter Services, Government, Cargo Operators |

| Technology | Avionics, Propulsion, Navigation, Communication |

| Application | Air Ambulance, Surveillance, Agricultural, Tourism |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Middle East Africa Turboprop Aircraft Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at