444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The GCC home electronics market represents a dynamic and rapidly evolving sector that encompasses consumer electronics, smart home devices, kitchen appliances, and entertainment systems across the Gulf Cooperation Council region. Market dynamics indicate substantial growth driven by increasing disposable income, urbanization trends, and technological advancement adoption throughout the region. The market demonstrates remarkable resilience and expansion potential, with digital transformation initiatives and smart city developments creating unprecedented opportunities for home electronics manufacturers and retailers.

Regional characteristics show the GCC home electronics market benefiting from high consumer spending power, government infrastructure investments, and a tech-savvy population increasingly demanding advanced home automation solutions. The market encompasses diverse product categories including smart televisions, home appliances, gaming consoles, audio systems, and emerging Internet of Things (IoT) devices. Consumer preferences are shifting toward energy-efficient, connected devices that offer enhanced functionality and integration capabilities.

Growth trajectories indicate the market is expanding at a compound annual growth rate of 8.2%, driven by increasing adoption of smart home technologies and rising consumer awareness about energy-efficient appliances. The region’s strategic position as a technology hub and gateway between East and West continues to attract international electronics manufacturers seeking to establish regional presence and capitalize on growing consumer demand.

The GCC home electronics market refers to the comprehensive ecosystem of consumer electronic devices, appliances, and smart home technologies sold and utilized within the Gulf Cooperation Council countries, including Saudi Arabia, UAE, Kuwait, Qatar, Bahrain, and Oman. This market encompasses traditional home appliances, entertainment systems, and increasingly sophisticated smart home automation solutions designed to enhance residential living experiences.

Market scope includes various product categories ranging from basic household appliances like refrigerators, washing machines, and air conditioning systems to advanced smart home devices including voice-controlled assistants, automated lighting systems, security cameras, and integrated home management platforms. The definition extends to encompass both standalone electronic devices and interconnected smart home ecosystems that enable seamless device communication and centralized control.

Technological evolution within this market reflects the transition from traditional standalone appliances to connected, intelligent devices capable of learning user preferences, optimizing energy consumption, and providing enhanced convenience through automation. The market represents a convergence of consumer electronics, home automation, energy management, and digital lifestyle enhancement technologies tailored to meet the specific needs and preferences of GCC consumers.

Strategic analysis reveals the GCC home electronics market experiencing robust expansion driven by favorable economic conditions, government digitization initiatives, and evolving consumer lifestyle preferences. The market demonstrates strong growth momentum across all major product categories, with smart home technologies and energy-efficient appliances leading adoption trends. Regional governments are actively promoting smart city initiatives and sustainable living practices, creating additional demand for advanced home electronics solutions.

Key market drivers include rising disposable income levels, increasing urbanization rates reaching 85% across the region, and growing consumer awareness about energy efficiency and smart home benefits. The market benefits from strong retail infrastructure, expanding e-commerce platforms, and favorable import policies that facilitate product availability and competitive pricing. Consumer behavior patterns show increasing preference for premium, feature-rich products that offer connectivity, automation, and energy savings.

Competitive landscape features a mix of international brands, regional distributors, and emerging local players competing across various price segments and product categories. Market leaders are investing heavily in local partnerships, service networks, and customized product offerings to capture growing demand. Innovation focus centers on smart home integration, voice control capabilities, energy efficiency improvements, and mobile app connectivity that enhances user experience and device management.

Consumer preferences analysis reveals several critical insights shaping market development and product innovation strategies across the GCC region:

Economic prosperity across the GCC region serves as a fundamental driver for home electronics market expansion, with high per capita income levels enabling consumers to invest in premium appliances and smart home technologies. The region’s economic diversification efforts and continued infrastructure development create favorable conditions for sustained market growth. Government initiatives promoting smart city development and digital transformation directly support increased adoption of connected home devices and intelligent appliances.

Demographic trends significantly influence market dynamics, with a young, tech-savvy population driving demand for innovative electronics and smart home solutions. The region’s rapid urbanization and modern lifestyle adoption create natural demand for convenient, automated home management systems. Cultural shifts toward nuclear family structures and modern living arrangements increase individual household electronics consumption compared to traditional extended family setups.

Technological advancement and increasing internet penetration rates reaching 95% across major GCC cities enable widespread adoption of connected devices and smart home ecosystems. The proliferation of high-speed broadband infrastructure and 5G network deployment creates the necessary foundation for advanced home electronics functionality. Climate considerations unique to the region drive specific demand for efficient cooling systems, air purification devices, and energy management solutions designed for extreme weather conditions.

Economic volatility related to oil price fluctuations can impact consumer spending patterns and discretionary purchases of non-essential home electronics, creating periodic market uncertainty. While the region maintains overall economic stability, fluctuations in commodity prices can influence government spending and private sector investment levels. Import dependency for most electronics products creates vulnerability to global supply chain disruptions, currency fluctuations, and international trade policy changes.

Technical challenges include limited local technical expertise for advanced smart home system installation and maintenance, potentially slowing adoption of complex integrated solutions. The lack of standardized smart home protocols and compatibility issues between different device manufacturers can create consumer confusion and hesitation. Infrastructure limitations in some areas, particularly regarding reliable internet connectivity and power grid stability, may constrain the effectiveness of connected home devices.

Cultural considerations and privacy concerns related to smart home devices that collect personal data or monitor household activities may limit adoption among certain consumer segments. Traditional preferences for manual control and skepticism about automated systems can slow market penetration in specific demographics. Regulatory complexities surrounding data protection, device certification, and import regulations can create barriers for new product introductions and market entry strategies.

Smart city initiatives across the GCC region present substantial opportunities for home electronics manufacturers to develop integrated solutions that complement urban digitization efforts. Government investments in smart infrastructure create demand for compatible home devices that can interface with city-wide systems for energy management, security, and communication. Sustainability focus driven by Vision 2030 programs and environmental awareness creates opportunities for energy-efficient appliances and renewable energy integration solutions.

Emerging technologies including artificial intelligence, machine learning, and Internet of Things present opportunities for next-generation home electronics that offer predictive maintenance, personalized user experiences, and enhanced automation capabilities. The growing adoption of electric vehicles creates opportunities for home charging solutions and energy management systems. Health and wellness trends accelerated by recent global events create demand for air purification systems, water treatment devices, and health monitoring technologies.

Market expansion opportunities exist in underserved segments including affordable smart home solutions for middle-income households and specialized products for commercial residential developments. The growing expatriate population creates demand for diverse product offerings that cater to various cultural preferences and technical requirements. Service sector development presents opportunities for installation, maintenance, and smart home consultation services that complement product sales and enhance customer experience.

Supply chain evolution reflects the market’s adaptation to global disruptions and regional requirements, with manufacturers increasingly establishing local distribution centers and service facilities to ensure product availability and customer support. The dynamics show a shift toward regional sourcing strategies and partnerships with local retailers to enhance market responsiveness. Competitive intensity continues to increase as international brands compete for market share through aggressive pricing, product differentiation, and enhanced service offerings.

Consumer behavior patterns demonstrate increasing sophistication in product evaluation, with buyers conducting extensive online research before purchases and prioritizing features like energy efficiency, connectivity, and brand reputation. The market dynamics reflect growing influence of social media and online reviews on purchasing decisions. Seasonal fluctuations remain significant, with peak demand periods during summer months for cooling appliances and during major shopping festivals and holidays.

Technological convergence creates dynamic interactions between traditionally separate product categories, with smart home platforms integrating entertainment, security, climate control, and energy management functions. According to MarkWide Research analysis, this convergence is driving 35% of consumers to consider ecosystem compatibility when making individual device purchases. Regulatory evolution continues to shape market dynamics through energy efficiency standards, safety requirements, and data protection regulations that influence product development and marketing strategies.

Comprehensive market analysis employs a multi-faceted research approach combining primary and secondary data collection methods to ensure accurate and reliable market insights. The methodology incorporates quantitative analysis of market trends, consumer surveys, industry expert interviews, and detailed examination of competitive landscape dynamics. Primary research includes direct consumer surveys across all GCC countries, retailer interviews, and manufacturer consultations to gather firsthand market intelligence and validate secondary research findings.

Secondary research encompasses analysis of government statistics, industry reports, trade publications, and company financial statements to establish market baseline data and historical trends. The research methodology includes examination of import/export statistics, retail sales data, and consumer spending patterns to quantify market size and growth trajectories. Qualitative analysis incorporates expert opinions, industry stakeholder interviews, and market observation studies to understand underlying market dynamics and future development potential.

Data validation processes ensure research accuracy through cross-referencing multiple sources, statistical analysis verification, and expert review of findings and conclusions. The methodology includes regular market monitoring and trend analysis to maintain current and relevant insights. Regional segmentation analysis examines country-specific variations in consumer preferences, regulatory environments, and market development patterns to provide comprehensive regional market understanding.

Saudi Arabia represents the largest segment of the GCC home electronics market, accounting for approximately 42% of regional demand, driven by its substantial population, ongoing economic diversification efforts, and ambitious smart city development projects. The kingdom’s Vision 2030 initiative creates significant opportunities for smart home technologies and energy-efficient appliances. Consumer preferences in Saudi Arabia show strong demand for premium appliances, smart home security systems, and entertainment electronics that cater to large family households.

United Arab Emirates demonstrates the highest per capita consumption of home electronics, with Dubai and Abu Dhabi leading adoption of luxury and smart home technologies. The UAE’s position as a regional trade hub and its diverse expatriate population create demand for varied product offerings and international brands. Market characteristics include strong preference for cutting-edge technology, high-end appliances, and integrated smart home solutions that complement the country’s modern lifestyle and architectural trends.

Kuwait, Qatar, and Bahrain collectively represent significant market opportunities with high disposable income levels and growing interest in home automation technologies. These markets show particular strength in premium appliance segments and smart home security systems. Oman’s market demonstrates steady growth with increasing urbanization and government infrastructure investments creating demand for modern home electronics. Regional variations in climate, cultural preferences, and regulatory requirements influence product specifications and marketing strategies across different GCC countries.

Market leadership is distributed among several international electronics manufacturers and regional distributors, each competing through different strategies including product innovation, pricing, and service excellence. The competitive environment features both global technology giants and specialized regional players who understand local market requirements and consumer preferences.

By Product Category:

By Technology:

By Distribution Channel:

Major Appliances category demonstrates consistent demand driven by household formation, replacement cycles, and upgrading to energy-efficient models. Consumer preferences show increasing interest in larger capacity appliances suitable for extended families and smart features that enhance convenience. Innovation trends focus on energy efficiency improvements, smart connectivity integration, and designs adapted to local architectural and cultural requirements.

Climate Control Systems represent a critical market segment given the region’s extreme weather conditions and high cooling requirements. The category shows strong demand for energy-efficient air conditioning systems, air purification devices, and smart climate management solutions. Market dynamics include seasonal demand patterns, government energy efficiency incentives, and growing awareness of indoor air quality importance.

Smart Home Technologies emerge as the fastest-growing category with annual growth rates exceeding 15%, driven by increasing consumer interest in home automation, security, and energy management. The segment includes voice assistants, smart lighting systems, security cameras, and integrated home management platforms. Consumer adoption is accelerating as products become more user-friendly and affordable, with particular strength in security and convenience applications.

Entertainment Electronics continue to evolve with demand for larger screen televisions, high-definition audio systems, and gaming equipment. The category benefits from increasing leisure time, growing entertainment consumption, and demand for premium home entertainment experiences. Technology trends include 4K and 8K display adoption, streaming service integration, and immersive audio technologies that enhance home entertainment value.

Manufacturers benefit from the GCC market’s high purchasing power, growing demand for premium products, and relatively stable economic conditions that support sustained business growth. The region offers opportunities for product customization, brand building, and market expansion into emerging segments like smart home technologies. Strategic advantages include access to affluent consumer base, favorable import conditions, and growing government support for technology adoption and energy efficiency initiatives.

Retailers and Distributors gain from strong consumer demand, expanding product categories, and opportunities to develop specialized services including installation, maintenance, and smart home consultation. The market offers potential for both traditional retail and e-commerce growth, with consumers increasingly comfortable with online electronics purchases. Business opportunities include value-added services, extended warranties, and partnerships with smart home service providers.

Consumers benefit from wide product selection, competitive pricing due to market competition, and access to latest technologies and innovations. The market provides opportunities to enhance lifestyle quality through smart home automation, energy savings through efficient appliances, and improved home comfort and security. Value propositions include access to international brands, comprehensive warranty support, and growing availability of financing options for premium purchases.

Government and Society benefit from increased energy efficiency adoption, reduced environmental impact, and economic development through technology sector growth. Smart home technologies support smart city initiatives and contribute to overall digitization objectives. Societal benefits include job creation in retail and service sectors, technology skill development, and improved quality of life through modern home conveniences and automation.

Strengths:

Weaknesses:

Opportunities:

Threats:

Smart Home Integration represents the most significant trend transforming the GCC home electronics market, with consumers increasingly seeking connected devices that can be controlled remotely and integrated into comprehensive home automation systems. This trend encompasses voice-controlled appliances, smartphone app connectivity, and artificial intelligence features that learn user preferences and optimize device performance automatically.

Energy Efficiency Prioritization continues gaining momentum as consumers become more environmentally conscious and seek to reduce utility costs. The trend includes demand for Energy Star certified appliances, solar-powered devices, and smart energy management systems that optimize power consumption. Government initiatives supporting energy efficiency through rebates and incentives further accelerate this trend adoption.

Premium Product Preference reflects the region’s affluent consumer base increasingly choosing high-end appliances and electronics that offer superior quality, advanced features, and prestigious brand recognition. This trend supports market premiumization and creates opportunities for luxury electronics segments. Consumer behavior shows willingness to invest in products that offer long-term value, advanced technology, and enhanced lifestyle benefits.

Health and Wellness Focus drives demand for home electronics that contribute to healthier living environments, including air purification systems, water treatment devices, and appliances with antimicrobial features. The trend reflects increased health consciousness and desire for products that support family well-being and safety.

Strategic partnerships between international manufacturers and regional distributors are reshaping market dynamics, with companies establishing stronger local presence through joint ventures and exclusive distribution agreements. These partnerships enable better market understanding, customized product offerings, and enhanced customer service capabilities. Investment activities include establishment of regional service centers, training facilities, and demonstration showrooms that support market expansion efforts.

Product innovation continues accelerating with manufacturers introducing region-specific features including enhanced cooling capabilities, dust resistance, and cultural customization options. Recent developments include smart appliances with Arabic language support, prayer time notifications, and energy management features optimized for local utility structures. Technology advancement focuses on improving connectivity, user interface design, and integration capabilities that enhance overall user experience.

Retail evolution includes expansion of experiential showrooms, virtual reality product demonstrations, and augmented reality applications that help consumers visualize products in their homes. MWR data indicates that 78% of consumers prefer to experience smart home technologies before purchasing, driving retailers to invest in interactive demonstration facilities. E-commerce development includes improved delivery services, installation support, and virtual consultation capabilities that bridge online and offline shopping experiences.

Market entry strategies should prioritize understanding local consumer preferences, regulatory requirements, and cultural considerations that influence product acceptance and marketing effectiveness. Companies entering the GCC market should invest in local partnerships, service infrastructure, and customized product offerings that address specific regional needs. Success factors include strong brand building, comprehensive warranty support, and development of local technical expertise for installation and maintenance services.

Product development recommendations focus on energy efficiency improvements, smart connectivity integration, and features that address regional climate challenges and cultural preferences. Manufacturers should consider developing products specifically designed for GCC market conditions including enhanced cooling capabilities, dust resistance, and energy management features. Innovation priorities should include voice control in local languages, mobile app localization, and integration with regional smart city infrastructure initiatives.

Distribution strategy optimization should balance traditional retail presence with growing e-commerce opportunities, ensuring comprehensive market coverage and customer convenience. Companies should invest in omnichannel retail experiences that combine online convenience with physical product demonstration and service support. Service excellence becomes increasingly important as products become more sophisticated and consumers expect comprehensive support throughout product lifecycle.

Market trajectory indicates continued robust growth driven by sustained economic prosperity, government digitization initiatives, and evolving consumer lifestyle preferences toward smart home technologies and premium appliances. The outlook reflects increasing market sophistication with consumers demanding more integrated, intelligent, and energy-efficient home electronics solutions. Growth projections suggest the market will maintain strong momentum with particular strength in smart home and energy-efficient appliance segments.

Technology evolution will continue transforming the market through artificial intelligence integration, improved connectivity standards, and enhanced user interface design that makes smart home technologies more accessible and valuable to consumers. Future developments include predictive maintenance capabilities, personalized automation features, and seamless integration with smart city infrastructure. Innovation focus will emphasize sustainability, user experience enhancement, and cost optimization that makes advanced technologies accessible to broader consumer segments.

Market expansion opportunities include development of affordable smart home solutions, specialized products for commercial residential developments, and services that complement product sales including installation, maintenance, and consultation. According to MarkWide Research projections, the market will experience sustained growth rates above 7% annually over the next five years, driven by continued urbanization, rising disposable income, and increasing technology adoption. Regional development will benefit from ongoing infrastructure investments, smart city initiatives, and government policies supporting energy efficiency and digital transformation objectives.

The GCC home electronics market presents exceptional opportunities for sustained growth and development, supported by favorable economic conditions, government initiatives, and evolving consumer preferences toward smart, efficient, and premium home technologies. The market demonstrates remarkable resilience and expansion potential across all major product categories, with particular strength in smart home technologies and energy-efficient appliances that align with regional development objectives and consumer lifestyle aspirations.

Strategic success in this market requires understanding of local preferences, investment in service infrastructure, and commitment to product innovation that addresses specific regional requirements including climate adaptation, cultural sensitivity, and integration with emerging smart city initiatives. Companies that prioritize customer experience, energy efficiency, and smart connectivity will be best positioned to capitalize on the market’s substantial growth potential and evolving consumer demands for advanced home electronics solutions.

What is Home Electronics?

Home electronics refer to a range of electronic devices designed for personal use within a household. This includes products such as televisions, audio systems, smart home devices, and kitchen appliances that enhance convenience and entertainment.

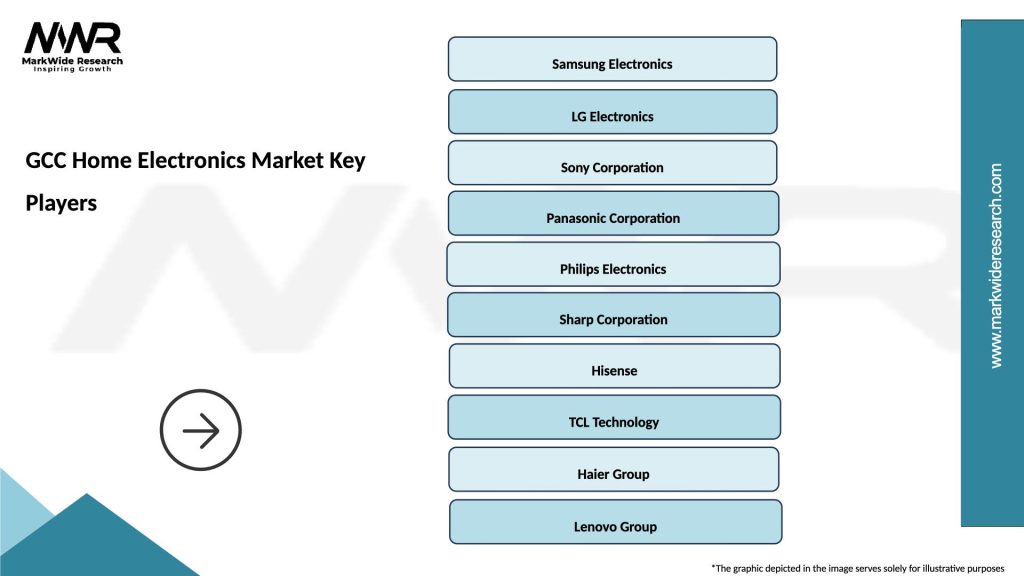

What are the key players in the GCC Home Electronics Market?

Key players in the GCC Home Electronics Market include Samsung, LG Electronics, Sony, and Panasonic, among others. These companies are known for their innovative products and strong market presence in the region.

What are the main drivers of the GCC Home Electronics Market?

The main drivers of the GCC Home Electronics Market include increasing disposable incomes, a growing demand for smart home technologies, and the rising trend of home entertainment systems. Additionally, urbanization and technological advancements play significant roles.

What challenges does the GCC Home Electronics Market face?

The GCC Home Electronics Market faces challenges such as intense competition, rapid technological changes, and fluctuating consumer preferences. Additionally, economic uncertainties can impact consumer spending on electronics.

What opportunities exist in the GCC Home Electronics Market?

Opportunities in the GCC Home Electronics Market include the expansion of e-commerce platforms, increasing demand for energy-efficient appliances, and the integration of artificial intelligence in home devices. These trends can lead to innovative product offerings and enhanced consumer experiences.

What trends are shaping the GCC Home Electronics Market?

Trends shaping the GCC Home Electronics Market include the rise of smart home devices, the popularity of streaming services influencing television sales, and a growing focus on sustainability in product design. These trends reflect changing consumer behaviors and technological advancements.

GCC Home Electronics Market

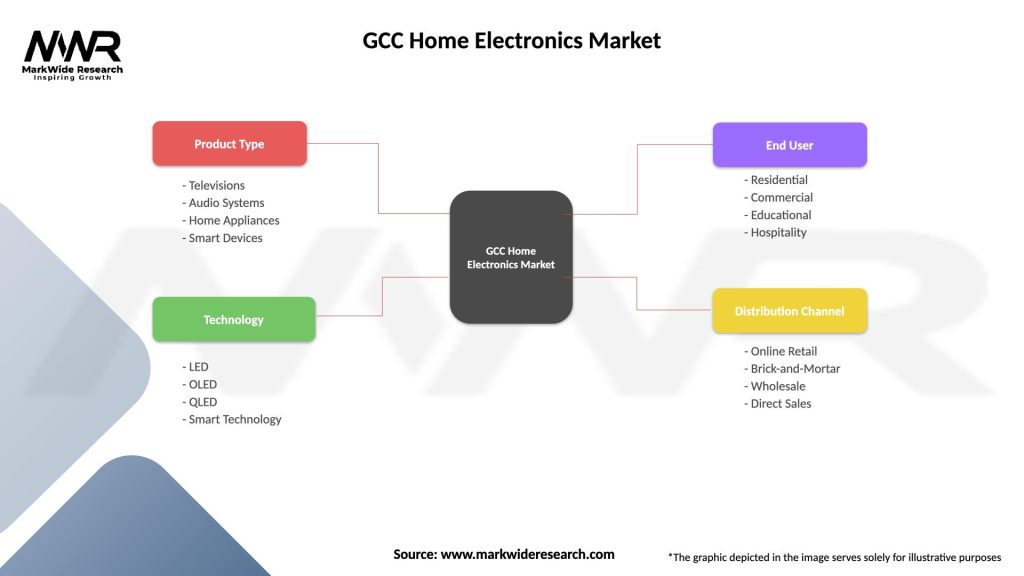

| Segmentation Details | Description |

|---|---|

| Product Type | Televisions, Audio Systems, Home Appliances, Smart Devices |

| Technology | LED, OLED, QLED, Smart Technology |

| End User | Residential, Commercial, Educational, Hospitality |

| Distribution Channel | Online Retail, Brick-and-Mortar, Wholesale, Direct Sales |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the GCC Home Electronics Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at