444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The APAC clean label ingredients market represents one of the fastest-growing segments in the Asia-Pacific food and beverage industry, driven by increasing consumer awareness about health and wellness. Clean label ingredients encompass natural, minimally processed components that consumers can easily recognize and understand, replacing artificial additives and synthetic compounds in food formulations. The region’s diverse culinary traditions, combined with rising disposable incomes and urbanization, create a unique landscape for clean label adoption across countries including China, India, Japan, Australia, and Southeast Asian nations.

Market dynamics in the APAC region show remarkable growth momentum, with the sector experiencing a compound annual growth rate (CAGR) of 8.2% as health-conscious consumers increasingly scrutinize ingredient lists. Food manufacturers across the region are responding to this demand by reformulating products with natural alternatives, organic components, and traditional ingredients that align with local preferences while meeting international clean label standards.

Regional variations play a significant role in market development, with developed markets like Japan and Australia leading in premium clean label adoption, while emerging economies such as India and Vietnam show rapid growth in mainstream clean label penetration. The market encompasses various ingredient categories including natural preservatives, organic flavors, plant-based proteins, natural colors, and functional ingredients derived from traditional Asian botanicals and herbs.

The APAC clean label ingredients market refers to the commercial ecosystem encompassing the production, distribution, and consumption of natural, minimally processed food ingredients across Asia-Pacific countries that meet consumer expectations for transparency, simplicity, and health benefits in food products.

Clean label ingredients are characterized by their recognizable names, minimal processing methods, and absence of artificial additives, synthetic preservatives, or chemical-sounding compounds. These ingredients enable food manufacturers to create products with shorter, more understandable ingredient lists that resonate with health-conscious consumers seeking authentic, wholesome food options.

Market scope includes various ingredient categories such as natural sweeteners, organic acids, plant-based emulsifiers, natural antimicrobials, botanical extracts, fermented ingredients, and traditional Asian ingredients like seaweed extracts, mushroom powders, and herbal concentrates. The definition extends beyond mere ingredient substitution to encompass sustainable sourcing practices, ethical production methods, and transparent supply chain management that align with consumer values and regulatory requirements across different APAC markets.

Strategic market positioning reveals the APAC clean label ingredients market as a transformative force reshaping the regional food industry landscape. Consumer behavior shifts toward health-conscious purchasing decisions drive unprecedented demand for transparent, natural ingredient solutions across diverse product categories including beverages, snacks, dairy alternatives, and processed foods.

Key market drivers include rising health awareness, increasing prevalence of lifestyle diseases, growing middle-class population, and enhanced food safety regulations across APAC countries. Market penetration rates show significant variation, with premium segments achieving 45% clean label adoption in developed markets while mainstream categories reach 23% penetration in emerging economies.

Competitive landscape features both multinational ingredient suppliers and regional specialty manufacturers leveraging local botanical resources and traditional processing methods. Innovation trends focus on functional ingredients that combine clean label attributes with health benefits, particularly in areas such as immune support, digestive health, and natural energy enhancement.

Future projections indicate sustained growth momentum driven by expanding e-commerce channels, increasing regulatory support for natural ingredients, and growing consumer willingness to pay premium prices for clean label products. Market expansion opportunities exist in untapped rural markets, emerging product categories, and cross-border trade facilitation within the APAC region.

Consumer preference analysis reveals distinct patterns across APAC markets, with the following critical insights shaping industry development:

Market intelligence from MarkWide Research indicates that ingredient functionality remains paramount, with manufacturers seeking clean label solutions that maintain product performance, shelf stability, and sensory attributes while meeting consumer expectations for naturalness and simplicity.

Health consciousness revolution across APAC countries represents the primary catalyst driving clean label ingredients adoption. Rising awareness about the connection between diet and health outcomes motivates consumers to seek products with recognizable, natural ingredients that support wellness goals and align with preventive healthcare approaches.

Regulatory environment improvements create favorable conditions for clean label market expansion. Government initiatives promoting food safety, natural ingredient usage, and transparent labeling practices encourage manufacturers to invest in clean label reformulations while providing consumers with greater confidence in product choices.

Economic prosperity in emerging APAC markets enables increased spending on premium food products. Growing middle class populations demonstrate higher purchasing power and willingness to invest in quality ingredients that offer perceived health benefits and align with aspirational lifestyle choices.

Urbanization trends contribute to market growth as city dwellers exhibit greater exposure to global food trends, health information, and clean label concepts. Urban consumers typically demonstrate higher education levels, increased health awareness, and greater access to premium food products featuring clean label ingredients.

Digital connectivity facilitates information sharing about ingredient benefits, health impacts, and product transparency. Social media platforms and health-focused online communities amplify clean label messaging, creating viral effects that accelerate consumer adoption and market penetration across diverse demographic segments.

Cost considerations present significant challenges for widespread clean label adoption across price-sensitive APAC markets. Natural ingredients typically command premium pricing compared to synthetic alternatives, creating barriers for manufacturers serving cost-conscious consumer segments and limiting market penetration in emerging economies.

Technical limitations of natural ingredients pose formulation challenges for food manufacturers. Performance gaps in areas such as shelf stability, color consistency, and flavor intensity require extensive research and development investments to achieve comparable functionality to conventional synthetic ingredients.

Supply chain complexities associated with natural ingredient sourcing create operational challenges. Seasonal availability, quality variations, and limited supplier networks for specialty botanical ingredients can disrupt production schedules and increase procurement costs for manufacturers.

Regulatory inconsistencies across different APAC countries create compliance challenges for regional manufacturers and international suppliers. Varying definitions of clean label standards, natural ingredient classifications, and labeling requirements complicate product development and market entry strategies.

Consumer education gaps limit market growth potential in certain regions and demographic segments. Limited awareness about clean label benefits, ingredient functionality, and health implications requires significant marketing investments to drive adoption and justify premium pricing strategies.

Emerging market penetration presents substantial growth opportunities as developing APAC countries experience rising incomes and increasing health awareness. Untapped markets in rural areas and secondary cities offer significant potential for clean label ingredient adoption as distribution networks expand and consumer education initiatives increase.

Innovation in functional ingredients creates opportunities for manufacturers to develop clean label solutions that deliver specific health benefits. Botanical extracts native to the APAC region, such as adaptogenic herbs and traditional medicinal plants, offer unique positioning opportunities in global clean label markets.

E-commerce expansion enables direct-to-consumer marketing of clean label products, bypassing traditional retail limitations and reaching health-conscious consumers willing to pay premium prices. Online platforms facilitate education about ingredient benefits and brand storytelling that resonates with clean label values.

Cross-border trade facilitation within APAC creates opportunities for ingredient suppliers to access larger markets and achieve economies of scale. Regional trade agreements and harmonized standards can reduce barriers for clean label ingredient distribution across multiple countries.

Partnership opportunities between ingredient suppliers and food manufacturers enable collaborative development of innovative clean label solutions. Strategic alliances can accelerate product development timelines, share research costs, and create competitive advantages in rapidly evolving market segments.

Supply and demand equilibrium in the APAC clean label ingredients market reflects complex interactions between consumer preferences, manufacturing capabilities, and regulatory frameworks. Demand growth consistently outpaces supply capacity for premium natural ingredients, creating pricing pressures and supply chain optimization opportunities.

Competitive intensity increases as both established multinational companies and emerging regional players compete for market share. Innovation cycles accelerate as companies invest in research and development to create differentiated clean label solutions that meet specific regional preferences and functional requirements.

Value chain evolution shows increasing integration between ingredient suppliers, food manufacturers, and retail partners to ensure quality, traceability, and consumer education. Vertical integration strategies enable better control over ingredient quality and supply chain transparency that consumers increasingly demand.

Technology adoption drives efficiency improvements in natural ingredient processing, extraction, and preservation methods. Advanced processing techniques enable manufacturers to maintain ingredient functionality while preserving natural characteristics and clean label positioning.

Market maturation patterns vary significantly across APAC countries, with developed markets showing sophisticated consumer preferences while emerging markets focus on basic clean label attributes. Regional adaptation strategies become critical for success across diverse market conditions and consumer expectations.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the APAC clean label ingredients market. Primary research includes extensive surveys of consumers, manufacturers, suppliers, and industry experts across key APAC countries to gather firsthand perspectives on market trends, challenges, and opportunities.

Secondary research incorporates analysis of industry reports, government publications, trade association data, and academic studies to provide comprehensive market context. Data triangulation methods validate findings across multiple sources to ensure accuracy and reliability of market insights and projections.

Quantitative analysis utilizes statistical modeling techniques to identify market patterns, growth trends, and correlation factors affecting clean label ingredient adoption. Market sizing methodologies employ bottom-up and top-down approaches to ensure comprehensive coverage of market segments and regional variations.

Qualitative research includes in-depth interviews with industry leaders, focus groups with target consumers, and expert panel discussions to understand underlying market dynamics and future development scenarios. Trend analysis incorporates social media monitoring and consumer behavior studies to identify emerging preferences and market shifts.

Regional expertise ensures cultural sensitivity and local market understanding across diverse APAC countries. Local research partners provide market-specific insights and validate findings against regional business practices and consumer behaviors.

China dominates the APAC clean label ingredients market with 35% regional market share, driven by massive population, growing health consciousness, and government support for food safety initiatives. Chinese consumers increasingly prefer traditional ingredients like goji berries, green tea extracts, and herbal compounds in clean label formulations.

Japan represents the most mature clean label market in APAC, with premium segments achieving 60% penetration rates. Japanese manufacturers lead in developing sophisticated clean label solutions that maintain traditional food culture while meeting modern health expectations, particularly in fermented ingredients and umami enhancers.

India shows remarkable growth potential with rapid urbanization driving 12% annual growth in clean label adoption. Indian market dynamics favor traditional Ayurvedic ingredients, spices, and plant-based proteins that align with cultural preferences and vegetarian dietary patterns prevalent across the country.

Australia and New Zealand demonstrate strong consumer willingness to pay premiums for clean label products, with organic ingredients achieving 40% market penetration. Regulatory frameworks in these markets support clean label development through clear labeling standards and organic certification programs.

Southeast Asian markets including Thailand, Malaysia, and Indonesia show emerging opportunities with growing middle-class populations driving 15% annual demand growth. Regional preferences favor tropical fruit extracts, coconut-derived ingredients, and traditional herbs in clean label applications.

Market leadership in the APAC clean label ingredients sector features a diverse mix of global corporations and specialized regional suppliers competing across different ingredient categories and market segments:

Regional competitors include numerous specialty suppliers focusing on traditional Asian ingredients, botanical extracts, and culturally relevant clean label solutions that leverage local sourcing advantages and market knowledge.

By Ingredient Type:

By Application:

By Source:

Natural Preservatives represent the fastest-growing clean label ingredient category, driven by consumer concerns about synthetic additives and regulatory pressure to reduce artificial preservatives. Plant-based antimicrobials derived from rosemary, green tea, and traditional Asian herbs show particular promise in extending shelf life while maintaining clean label positioning.

Natural Colors experience strong demand as manufacturers seek alternatives to synthetic dyes. Anthocyanins from berries, curcumin from turmeric, and spirulina-based blues and greens gain popularity across beverage and confectionery applications, despite challenges with color stability and intensity.

Natural Sweeteners benefit from growing diabetes awareness and sugar reduction initiatives across APAC countries. Stevia cultivation expands rapidly in China and Southeast Asia, while monk fruit and coconut-based sweeteners gain traction in premium product segments.

Functional Ingredients combine clean label attributes with health benefits, appealing to wellness-focused consumers. Plant proteins from sources like mung beans, rice, and traditional legumes address growing demand for meat alternatives and protein fortification in Asian diets.

Traditional Ingredients experience renaissance as manufacturers rediscover heritage components like fermented soy products, seaweed extracts, and mushroom powders that offer both clean label positioning and cultural authenticity in modern food applications.

Manufacturers benefit from clean label ingredient adoption through enhanced brand positioning, premium pricing opportunities, and improved consumer loyalty. Product differentiation becomes possible through unique natural ingredient combinations that create competitive advantages and support marketing claims about health and wellness benefits.

Suppliers gain access to growing market segments and establish long-term partnerships with manufacturers seeking reliable sources of quality natural ingredients. Value-added services including technical support, application development, and regulatory assistance create additional revenue streams and strengthen customer relationships.

Retailers experience increased consumer traffic and higher basket values as clean label products command premium prices and attract health-conscious shoppers. Private label opportunities enable retailers to develop exclusive clean label product lines that build customer loyalty and improve profit margins.

Consumers receive products with improved nutritional profiles, reduced synthetic additives, and greater transparency about ingredient sources and processing methods. Health benefits include reduced exposure to artificial chemicals and increased intake of beneficial plant compounds and traditional nutrients.

Regulatory Bodies achieve improved food safety outcomes and consumer protection through clearer labeling standards and reduced reliance on synthetic additives. Public health initiatives benefit from industry alignment with natural ingredient preferences and traditional dietary patterns.

Strengths:

Weaknesses:

Opportunities:

Threats:

Functional clean label ingredients emerge as the dominant trend, combining naturalness with specific health benefits. Adaptogenic herbs, immune-supporting botanicals, and gut health ingredients gain prominence as consumers seek products that address specific wellness concerns while maintaining clean label credentials.

Fermentation technology revolutionizes clean label ingredient production, enabling manufacturers to create natural flavors, preservatives, and functional compounds through traditional fermentation processes. Precision fermentation allows production of specific compounds without synthetic chemistry while maintaining natural positioning.

Transparency initiatives extend beyond ingredient lists to include sourcing practices, processing methods, and environmental impact. Blockchain technology enables complete supply chain traceability, allowing consumers to verify ingredient origins and production methods through digital platforms.

Personalized nutrition drives demand for customizable clean label ingredients that address individual health needs and dietary preferences. AI-powered formulation tools help manufacturers create targeted ingredient combinations for specific demographic groups and health conditions.

Sustainable sourcing becomes integral to clean label positioning as consumers increasingly consider environmental and social impacts. Regenerative agriculture practices and fair trade certification add value to natural ingredients while supporting long-term supply chain sustainability.

Strategic partnerships between ingredient suppliers and food manufacturers accelerate clean label innovation and market penetration. Collaborative research initiatives focus on developing region-specific solutions that combine traditional Asian ingredients with modern food technology capabilities.

Manufacturing capacity expansion occurs across APAC countries as companies invest in natural ingredient processing facilities. Extraction technology upgrades enable higher yields and improved quality from botanical sources while maintaining clean label positioning and cost competitiveness.

Regulatory harmonization efforts within APAC create more consistent standards for clean label ingredients across different countries. Mutual recognition agreements facilitate cross-border trade and reduce compliance costs for manufacturers serving multiple markets.

Investment in research and development increases as companies seek to overcome technical limitations of natural ingredients. University partnerships and government research grants support innovation in areas such as natural preservation, flavor enhancement, and functional ingredient development.

Acquisition activity intensifies as large corporations seek to expand clean label capabilities through strategic purchases of specialty ingredient companies and innovative startups. Vertical integration strategies enable better control over ingredient quality and supply chain transparency.

Market entry strategies should focus on regional adaptation and cultural sensitivity when introducing clean label ingredients across diverse APAC markets. Local partnerships with established distributors and food manufacturers can accelerate market penetration while providing valuable insights into consumer preferences and regulatory requirements.

Investment priorities should emphasize research and development capabilities that address technical limitations of natural ingredients. Processing technology improvements can help bridge performance gaps while maintaining clean label positioning and cost competitiveness in price-sensitive markets.

Supply chain optimization requires diversification of sourcing locations and development of long-term supplier relationships. Vertical integration opportunities in key ingredient categories can provide better quality control and supply security while supporting sustainability initiatives.

Consumer education initiatives should communicate the benefits of clean label ingredients through multiple channels including digital marketing, in-store demonstrations, and partnership with health professionals. Transparency tools such as QR codes and mobile apps can provide detailed ingredient information and build consumer trust.

Regulatory compliance strategies should anticipate evolving standards and invest in systems that ensure consistent quality and documentation across different markets. Proactive engagement with regulatory bodies can help shape favorable policies while ensuring compliance with emerging requirements.

Long-term growth prospects for the APAC clean label ingredients market remain highly positive, driven by sustained consumer health consciousness and continued economic development across the region. Market expansion is expected to accelerate as clean label concepts penetrate mainstream food categories and reach previously untapped consumer segments.

Technology advancement will continue to address current limitations of natural ingredients through improved processing methods, enhanced stability solutions, and innovative delivery systems. Biotechnology applications including precision fermentation and enzymatic processing will expand the range of available clean label ingredients while improving cost competitiveness.

Regional integration will strengthen as trade agreements and regulatory harmonization reduce barriers to ingredient distribution across APAC countries. Supply chain optimization will benefit from improved logistics infrastructure and digital tracking systems that enhance transparency and efficiency.

Innovation focus will shift toward multifunctional ingredients that combine clean label positioning with specific health benefits, convenience features, and sustainability attributes. Personalization trends will drive development of customizable ingredient solutions for different demographic groups and health conditions.

Market maturation in developed APAC countries will create opportunities for premium, specialized ingredients while emerging markets will drive volume growth in mainstream clean label categories. MarkWide Research projects continued strong performance with expanding applications and increasing consumer acceptance across all market segments.

The APAC clean label ingredients market represents a transformative opportunity for food industry stakeholders seeking to capitalize on evolving consumer preferences and health consciousness trends. Market dynamics favor continued expansion driven by rising incomes, urbanization, regulatory support, and increasing awareness of the connection between diet and health outcomes.

Success factors include strategic regional adaptation, investment in research and development capabilities, supply chain optimization, and effective consumer education initiatives. Companies that embrace clean label principles while addressing technical challenges and cost considerations will be best positioned to capture market opportunities and build sustainable competitive advantages.

Future growth will be supported by technological innovations that improve natural ingredient functionality, regulatory developments that favor transparency and natural ingredients, and continued consumer willingness to pay premium prices for products that align with health and wellness values. The APAC clean label ingredients market is poised for sustained expansion as it becomes an integral component of the region’s evolving food industry landscape.

What is Clean Label Ingredients?

Clean label ingredients refer to food components that are perceived as natural, simple, and free from artificial additives. These ingredients are often sourced from whole foods and are transparent in their origin and processing methods.

What are the key players in the APAC Clean Label Ingredients Market?

Key players in the APAC Clean Label Ingredients Market include companies like Ingredion Incorporated, DuPont de Nemours, Inc., and Kerry Group, which focus on providing natural and clean label solutions for food and beverage applications, among others.

What are the main drivers of the APAC Clean Label Ingredients Market?

The main drivers of the APAC Clean Label Ingredients Market include increasing consumer demand for transparency in food labeling, a growing preference for natural and organic products, and rising health consciousness among consumers.

What challenges does the APAC Clean Label Ingredients Market face?

Challenges in the APAC Clean Label Ingredients Market include the higher cost of clean label ingredients compared to conventional options, regulatory hurdles regarding labeling standards, and the need for extensive research and development to ensure product efficacy.

What opportunities exist in the APAC Clean Label Ingredients Market?

Opportunities in the APAC Clean Label Ingredients Market include the expansion of plant-based food products, innovations in clean label formulations, and the potential for growth in emerging markets as consumer awareness increases.

What trends are shaping the APAC Clean Label Ingredients Market?

Trends shaping the APAC Clean Label Ingredients Market include the rise of functional ingredients that offer health benefits, the increasing use of clean label ingredients in snacks and beverages, and a shift towards sustainable sourcing practices.

APAC Clean Label Ingredients Market

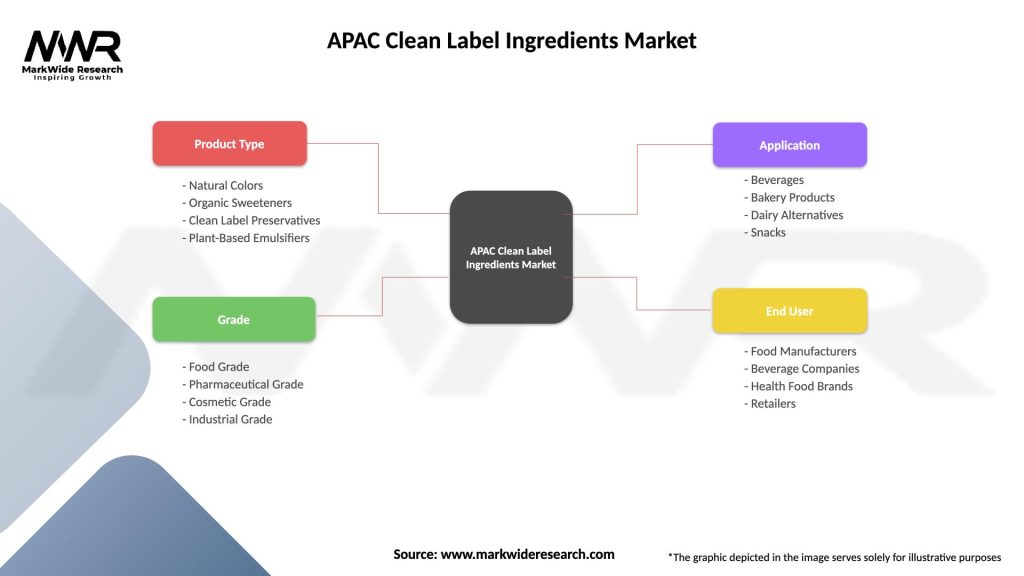

| Segmentation Details | Description |

|---|---|

| Product Type | Natural Colors, Organic Sweeteners, Clean Label Preservatives, Plant-Based Emulsifiers |

| Grade | Food Grade, Pharmaceutical Grade, Cosmetic Grade, Industrial Grade |

| Application | Beverages, Bakery Products, Dairy Alternatives, Snacks |

| End User | Food Manufacturers, Beverage Companies, Health Food Brands, Retailers |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the APAC Clean Label Ingredients Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at