444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2150

The Indian processed cashew market represents one of the most significant segments within the global nut processing industry, establishing India as a dominant force in cashew production and export. India’s cashew processing sector has evolved into a sophisticated industry that combines traditional expertise with modern technology to deliver premium quality cashew products to domestic and international markets. The market encompasses various processing stages including shelling, grading, roasting, and packaging of cashew nuts sourced primarily from coastal regions of India.

Market dynamics indicate robust growth driven by increasing health consciousness among consumers and rising demand for premium snack foods. The industry benefits from India’s favorable climatic conditions, skilled workforce, and established supply chain networks that connect rural cashew farmers with global markets. Processing facilities are concentrated in states like Kerala, Karnataka, Tamil Nadu, and Goa, where traditional cashew cultivation meets modern processing infrastructure.

Export performance remains a critical driver, with Indian processed cashews commanding premium prices in international markets due to their superior quality and consistent processing standards. The market demonstrates strong growth potential with expanding applications in confectionery, bakery, and ready-to-eat snack segments, supported by increasing consumer preference for healthy and nutritious food options.

The Indian processed cashew market refers to the comprehensive industry ecosystem involved in transforming raw cashew nuts into value-added products through various processing techniques including shelling, grading, roasting, flavoring, and packaging for domestic consumption and export purposes.

Processing operations encompass multiple stages beginning with procurement of raw cashew nuts from farmers and cooperatives, followed by steam cooking, shelling, peeling, grading based on size and quality parameters, and final packaging. The market includes both traditional hand-processing methods and mechanized processing facilities that ensure consistent quality and higher productivity levels.

Value addition activities extend beyond basic processing to include flavored cashews, cashew-based snack mixes, cashew butter, and specialty products catering to premium market segments. The industry supports millions of workers, particularly women in rural areas, providing sustainable livelihood opportunities while contributing significantly to India’s agricultural export earnings.

India’s processed cashew market demonstrates exceptional growth trajectory supported by strong domestic demand and robust export performance across global markets. The industry leverages India’s position as one of the world’s largest cashew producers and processors, with processing capacity concentrated in traditional cashew-growing regions that benefit from decades of accumulated expertise and infrastructure development.

Key growth drivers include increasing health awareness among consumers, rising disposable incomes, expanding retail distribution networks, and growing demand for premium snack foods in both domestic and international markets. The market benefits from government support through various schemes promoting cashew cultivation, processing infrastructure development, and export facilitation measures.

Technological advancement in processing equipment and techniques has enhanced productivity while maintaining the traditional quality standards that Indian cashews are renowned for globally. The industry shows strong resilience with diversified product portfolios, established supply chains, and increasing focus on sustainable processing practices that ensure long-term market viability.

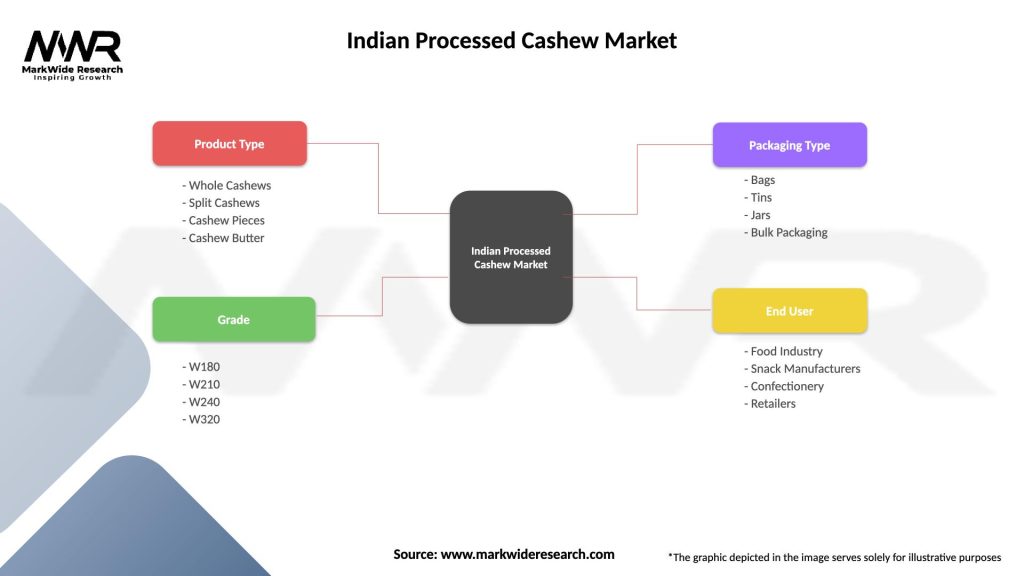

Market segmentation reveals diverse opportunities across product categories, processing methods, and distribution channels that collectively drive industry growth:

Health consciousness trends significantly propel market growth as consumers increasingly recognize cashews’ nutritional benefits including healthy fats, protein, vitamins, and minerals. The growing awareness of cashews as heart-healthy snacks and their role in weight management drives premium positioning in health food segments.

Export demand expansion from developed markets continues to fuel industry growth, with Indian processed cashews maintaining competitive advantages through superior quality, consistent supply, and competitive pricing. International market penetration benefits from India’s reputation for producing world-class cashew products that meet stringent quality standards.

Government support initiatives including subsidies for processing equipment, infrastructure development programs, and export promotion schemes create favorable business environment. Policy measures supporting cashew cultivation, processing technology upgradation, and market linkage development strengthen the entire value chain from farm to consumer.

Rising disposable incomes in domestic markets drive consumption of premium cashew products, while urbanization and changing lifestyle patterns increase demand for convenient, healthy snack options. Retail expansion through modern trade channels and e-commerce platforms enhances market accessibility and consumer reach.

Raw material price volatility poses significant challenges as cashew nut prices fluctuate based on seasonal factors, weather conditions, and global supply-demand dynamics. Price fluctuations impact processing margins and create uncertainty in long-term planning for processing units, particularly affecting small and medium-scale operators.

Labor dependency in traditional processing methods creates operational challenges including seasonal labor shortages, wage inflation, and skill development requirements. Processing efficiency remains constrained by heavy reliance on manual operations, limiting scalability and productivity improvements in many facilities.

Competition from mechanized processing in other countries threatens India’s traditional advantages, as automated processing technologies reduce labor costs and increase consistency. Technology adoption barriers including high capital requirements and technical expertise limitations hinder modernization efforts among smaller processors.

Quality control challenges arise from inconsistent raw material quality, storage issues, and varying processing standards across different facilities. Export compliance requirements including food safety standards, traceability systems, and certification processes create additional operational complexities and costs.

Value-added product development presents substantial growth opportunities through innovative cashew-based products including flavored varieties, organic options, and functional foods targeting health-conscious consumers. Product diversification into cashew milk, cashew cheese, and plant-based alternatives aligns with growing vegan and dairy-free market trends.

Technology integration offers potential for productivity enhancement through semi-automated processing equipment that maintains quality while improving efficiency. Processing innovation including improved shelling techniques, quality sorting systems, and packaging technologies can strengthen competitive positioning.

Emerging market expansion in Asia-Pacific, Latin America, and Africa provides new export destinations with growing middle-class populations and increasing demand for premium nut products. Market penetration strategies focusing on quality differentiation and brand building can capture higher value segments.

Sustainable processing practices including organic certification, fair trade compliance, and environmental sustainability initiatives create premium market positioning opportunities. Certification programs for quality, sustainability, and social responsibility can command price premiums and enhance market access.

Supply chain integration drives market evolution as processors establish direct relationships with cashew farmers through contract farming arrangements and cooperative models. Vertical integration strategies help ensure consistent raw material quality while providing farmers with assured markets and better price realization.

Seasonal processing patterns significantly influence market dynamics, with peak processing activities concentrated during harvest seasons creating capacity utilization challenges and working capital requirements. Storage infrastructure development becomes critical for managing seasonal variations and maintaining year-round processing operations.

Quality standardization efforts across the industry enhance market credibility and export competitiveness through adoption of international quality standards and certification programs. Processing standards evolution includes implementation of food safety protocols, traceability systems, and quality assurance measures.

Market consolidation trends emerge as larger processing companies acquire smaller facilities to achieve economies of scale and improve operational efficiency. Industry structure evolution balances between maintaining traditional processing expertise and adopting modern business practices for sustainable growth.

Primary research approach encompasses comprehensive field studies across major cashew processing regions including Kerala, Karnataka, Tamil Nadu, and Goa to gather firsthand insights from processors, exporters, and industry stakeholders. Data collection methods include structured interviews with processing unit owners, export companies, and government officials involved in cashew industry development.

Secondary research analysis incorporates extensive review of government statistics, export-import data, industry reports, and academic studies related to cashew processing and trade patterns. Information sources include Cashew Export Promotion Council data, Agricultural Marketing Division reports, and international trade statistics.

Market validation processes involve cross-referencing multiple data sources and conducting expert consultations with industry veterans and research institutions specializing in cashew cultivation and processing. Quality assurance measures ensure data accuracy through triangulation methods and peer review processes.

Analytical framework employs both quantitative and qualitative research techniques to provide comprehensive market insights covering production trends, processing capacity, export performance, and future growth projections based on current market dynamics and emerging opportunities.

Kerala dominates the Indian processed cashew market with approximately 45% of total processing capacity, leveraging its traditional expertise, established infrastructure, and proximity to major cashew growing areas. Kollam district serves as the cashew processing capital, hosting numerous large-scale processing units and export facilities that have developed over decades.

Karnataka emerges as a significant processing hub with 25% market share, particularly in the coastal districts of Dakshina Kannada and Uttara Kannada where cashew cultivation and processing activities are well-integrated. Processing facilities in Karnataka benefit from government support and modern infrastructure development initiatives.

Tamil Nadu contributes approximately 15% of processing capacity, with operations concentrated in southern districts where cashew cultivation is traditional. Processing units in Tamil Nadu focus on both domestic and export markets, with increasing emphasis on value-added products and quality enhancement.

Goa maintains its position with 10% market share despite its smaller size, leveraging high-quality processing standards and premium product positioning. Other states including Andhra Pradesh, Maharashtra, and Odisha collectively account for the remaining 5% of processing capacity, with growing potential for expansion based on local cashew cultivation development.

Market leadership is distributed among several established players who have built strong reputations for quality and reliability in both domestic and international markets:

Competitive strategies focus on quality differentiation, processing efficiency, supply chain optimization, and market diversification to maintain sustainable competitive advantages in increasingly competitive market conditions.

By Product Type:

By Processing Method:

By End Use:

Whole cashew category maintains market leadership due to premium positioning and higher profit margins, with W180 and W210 grades particularly sought after in international markets. Quality parameters including size uniformity, color consistency, and minimal breakage determine price premiums and market acceptance.

Cashew pieces segment demonstrates strong growth potential driven by increasing demand from food processing industries and cost-conscious consumers. Industrial applications in confectionery, bakery, and ready-to-eat products create stable demand for broken kernels and smaller pieces.

Flavored cashews category represents emerging opportunities with innovative product development including spiced, coated, and seasoned varieties targeting premium retail segments. Value addition through flavoring and packaging creates differentiation opportunities and higher margins for processors.

Organic cashews segment shows rapid growth as health-conscious consumers seek certified organic products, despite higher processing costs and certification requirements. Premium positioning of organic products commands significant price premiums in both domestic and export markets.

Farmers benefit from assured markets and better price realization through direct linkages with processing units and cooperative marketing arrangements. Income stability improves through contract farming agreements and premium payments for quality raw materials meeting processing specifications.

Processors gain from established supply chains, skilled workforce availability, and government support for infrastructure development and technology upgradation. Export opportunities provide access to premium international markets with higher profit margins and long-term business relationships.

Workers, particularly women, benefit from employment opportunities in processing units that provide stable income and skill development in rural areas. Social impact includes empowerment of women workers and community development through cashew processing activities.

Government stakeholders benefit from foreign exchange earnings, rural employment generation, and agricultural value addition that supports broader economic development objectives. Export revenues contribute significantly to India’s agricultural export performance and trade balance improvement.

Strengths:

Weaknesses:

Opportunities:

Threats:

Automation adoption accelerates as processors invest in semi-automated equipment to improve efficiency while maintaining quality standards. Technology integration focuses on selective mechanization of specific processing stages rather than complete automation to preserve traditional quality advantages.

Sustainable processing practices gain prominence with increasing focus on environmental responsibility, worker welfare, and social impact. Certification programs for organic, fair trade, and sustainable processing create market differentiation and premium positioning opportunities.

Direct marketing initiatives expand as processors develop their own brands and retail channels to capture higher value addition. E-commerce penetration enables direct-to-consumer sales and brand building activities that bypass traditional distribution channels.

Quality standardization efforts intensify with implementation of international food safety standards, traceability systems, and quality assurance protocols. Export compliance requirements drive adoption of modern quality control systems and documentation processes throughout the supply chain.

Government initiatives include launch of comprehensive cashew development programs focusing on cultivation expansion, processing infrastructure development, and export promotion activities. Policy support encompasses subsidies for processing equipment, technology upgradation, and market linkage development programs.

Technology partnerships emerge between Indian processors and international equipment manufacturers to develop customized processing solutions suitable for Indian conditions. Innovation focus includes development of semi-automated shelling machines and quality sorting systems that maintain traditional processing advantages.

Market expansion activities include participation in international food exhibitions, trade missions, and buyer-seller meets to promote Indian processed cashews in new markets. Brand development initiatives focus on creating awareness about quality and origin advantages of Indian cashews.

Research collaboration between processing companies, research institutions, and government agencies drives innovation in processing techniques, product development, and quality enhancement. MarkWide Research analysis indicates increasing investment in research and development activities across the cashew processing sector.

Strategic recommendations emphasize the need for balanced approach between maintaining traditional processing advantages and adopting selective mechanization for improved efficiency. Investment priorities should focus on semi-automated equipment that enhances productivity while preserving quality standards that Indian cashews are known for globally.

Market diversification strategies should explore emerging applications in plant-based food products, functional foods, and premium snack segments. Product development initiatives focusing on organic, flavored, and specialty cashew products can capture higher value segments and reduce dependence on commodity markets.

Supply chain optimization through direct farmer linkages, contract farming arrangements, and cooperative models can ensure consistent raw material quality and supply. Vertical integration strategies should be evaluated for their potential to improve margins and market control.

Export market expansion should focus on emerging economies with growing middle-class populations and increasing demand for premium nut products. Market penetration strategies should emphasize quality differentiation and brand building to command premium prices in competitive international markets.

Growth projections indicate continued expansion of the Indian processed cashew market driven by strong domestic demand and robust export performance. MarkWide Research forecasts suggest sustained growth momentum supported by increasing health consciousness, rising disposable incomes, and expanding retail distribution networks.

Technology evolution will likely focus on selective automation that preserves quality advantages while improving processing efficiency and reducing labor dependency. Innovation trends include development of customized processing equipment, quality enhancement technologies, and sustainable processing practices.

Market structure evolution may witness gradual consolidation as larger players acquire smaller processing units to achieve economies of scale and operational efficiency. Industry development will balance between maintaining traditional processing expertise and adopting modern business practices for sustainable growth.

Export opportunities are expected to expand with growing global demand for healthy snack foods and premium nut products. Market penetration in emerging economies and development of new product categories will drive long-term growth and market expansion opportunities.

The Indian processed cashew market stands as a testament to the successful combination of traditional expertise and modern market dynamics, creating a robust industry that serves both domestic and international markets effectively. The market’s strength lies in its established supply chains, skilled workforce, and reputation for producing high-quality cashew products that command premium prices globally.

Future success will depend on the industry’s ability to adapt to changing market conditions while preserving the traditional quality advantages that have made Indian cashews globally renowned. Strategic investments in selective mechanization, quality enhancement, and market diversification will be crucial for maintaining competitive positioning in an increasingly dynamic global marketplace.

Sustainable growth prospects remain strong, supported by favorable market trends, government support, and increasing global demand for healthy and premium food products. The industry’s continued evolution toward higher value addition, quality standardization, and market expansion positions it well for long-term success and contribution to India’s agricultural export performance.

What is Processed Cashew?

Processed cashew refers to cashew nuts that have been shelled, roasted, and packaged for consumption. This includes various forms such as whole nuts, pieces, and flavored varieties, catering to both snack and culinary uses.

What are the key players in the Indian Processed Cashew Market?

Key players in the Indian Processed Cashew Market include companies like Nutraj, Vishakha Cashew Company, and Kerala State Cashew Development Corporation. These companies are involved in processing, exporting, and distributing cashew products, among others.

What are the growth factors driving the Indian Processed Cashew Market?

The growth of the Indian Processed Cashew Market is driven by increasing health consciousness among consumers, rising demand for healthy snacks, and the expansion of the food processing industry. Additionally, the popularity of cashews in various cuisines contributes to market growth.

What challenges does the Indian Processed Cashew Market face?

The Indian Processed Cashew Market faces challenges such as fluctuating raw material prices, competition from other nuts, and labor shortages in processing units. These factors can impact production costs and supply chain stability.

What opportunities exist in the Indian Processed Cashew Market?

Opportunities in the Indian Processed Cashew Market include the potential for product diversification, such as organic and flavored cashews, and expanding export markets. Additionally, increasing online retailing presents new avenues for reaching consumers.

What trends are shaping the Indian Processed Cashew Market?

Trends in the Indian Processed Cashew Market include a growing preference for plant-based snacks, innovations in packaging for sustainability, and the rise of health-focused products. These trends reflect changing consumer preferences towards healthier and environmentally friendly options.

Indian Processed Cashew Market

| Segmentation Details | Description |

|---|---|

| Product Type | Whole Cashews, Split Cashews, Cashew Pieces, Cashew Butter |

| Grade | W180, W210, W240, W320 |

| Packaging Type | Bags, Tins, Jars, Bulk Packaging |

| End User | Food Industry, Snack Manufacturers, Confectionery, Retailers |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Indian Processed Cashew Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at