444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The Mobile Wallet Market is at the forefront of financial innovation, revolutionizing the way individuals and businesses conduct transactions. In this comprehensive analysis, we will delve into the meaning of this market, present an executive summary, discuss key market insights, examine market drivers, constraints, and opportunities, explore market dynamics, provide regional analysis, scrutinize the competitive landscape, offer segmentation insights, outline the benefits for industry participants and stakeholders, perform a SWOT analysis, highlight market trends, assess the Covid-19 impact, discuss key industry developments, offer analyst suggestions, present the future outlook, and conclude with a comprehensive summary of this transformative market.

Meaning

The Mobile Wallet Market refers to digital platforms that enable users to store payment information, make transactions, and conduct financial activities using their mobile devices. It represents a paradigm shift in the way we handle money and conduct financial transactions.

Executive Summary

The Mobile Wallet Market is shaping the future of finance by making payments more convenient, secure, and efficient. In this executive summary, we encapsulate key market insights, drivers, constraints, opportunities, and the dynamic nature characterizing this market. Key market insights highlight the diverse range of services offered by mobile wallets, from payment processing and digital ticketing to loyalty programs and financial management tools. Furthermore, collaborations between technology giants, financial institutions, and fintech startups are driving innovation and expanding the market’s reach.

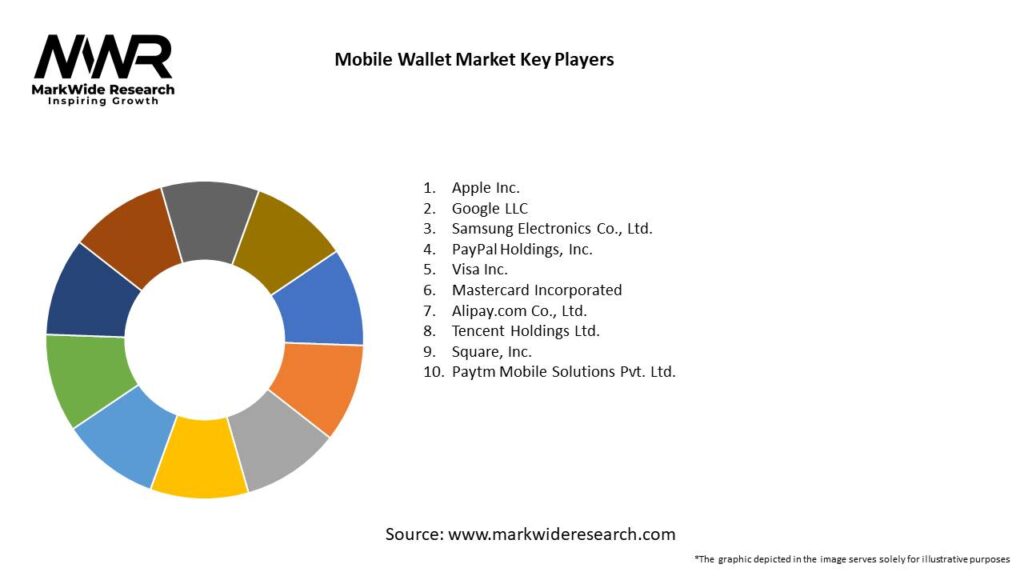

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

The Mobile Wallet Market is characterized by:

Market Drivers

Several factors drive the growth of the Mobile Wallet Market:

Market Constraints

Despite its potential, the Mobile Wallet Market faces challenges such as:

Market Opportunities

The Mobile Wallet Market offers numerous growth opportunities:

Market Dynamics

The Mobile Wallet Market is influenced by factors such as:

Regional Analysis

The Mobile Wallet Market exhibits regional variations influenced by consumer behavior, regulatory environments, and technology adoption. A comprehensive regional analysis offers insights into these nuances:

Competitive Landscape

Leading Companies in Mobile Wallet Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

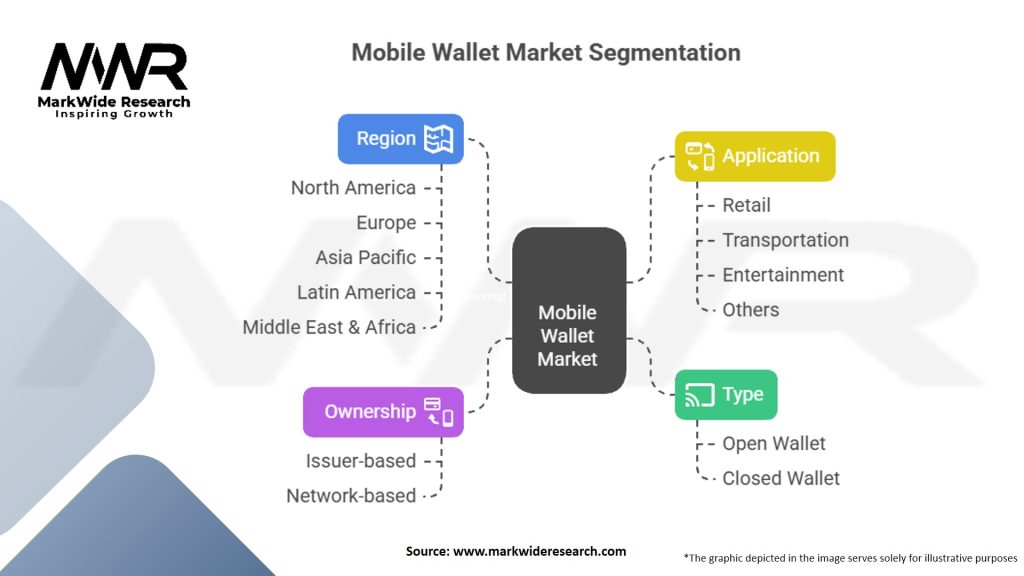

Segmentation

Segmentation of the market based on factors such as payment method, application, platform, and region provides a comprehensive understanding of market dynamics:

Benefits for Industry Participants and Stakeholders

The Mobile Wallet Market offers benefits to industry participants and stakeholders:

SWOT Analysis

A SWOT analysis offers a comprehensive view of the Mobile Wallet Market:

Market Key Trends

Several key trends influence the Mobile Wallet Market:

Covid-19 Impact

The Covid-19 pandemic significantly impacted the Mobile Wallet Market:

Key Industry Developments

Key industry developments provide insights into the evolution of the Mobile Wallet Market:

Analyst Suggestions

Analysts offer valuable suggestions for industry participants:

Future Outlook

The future of the Mobile Wallet Market promises a cashless society where financial transactions are seamless, secure, and universally accessible. Industry players must continue to innovate, prioritize security, and adapt to evolving consumer preferences to shape this future. With the increasing prevalence of smartphones and the growing preference for convenient, cashless transactions, the market has witnessed exponential expansion. The Mobile Wallet Market signifies a future where the wallet is no longer a physical object but a digital companion that simplifies and enriches our financial lives. It’s a future where payments are at our fingertips, where financial services are inclusive, and where convenience and security are paramount.

The future outlook for the Mobile Wallet Market is exceedingly optimistic, with opportunities for further technological integration, enhanced security measures, and the potential to reach underbanked populations. Industry stakeholders should continue to prioritize user experience, security, and interoperability to sustain growth and ensure widespread adoption. Ultimately, mobile wallets play a pivotal role in shaping the future of digital commerce, offering convenience, security, and efficiency to consumers worldwide.

Conclusion

In conclusion, the Mobile Wallet Market is not just a market; it’s a financial revolution that is reshaping the way we conduct transactions, manage money, and access financial services. It is the embodiment of convenience, security, and financial inclusion in the digital age. As the market continues to evolve, it becomes increasingly evident that mobile wallets are not just a payment method but a gateway to a world where financial transactions are effortless, data-driven, and accessible to all. The Mobile Wallet Market signifies a future where physical wallets are replaced by digital counterparts, where every smartphone is a financial hub, and where the way we pay reflects the advancements of the modern era.

The Mobile Wallet Market stands at the forefront of the digital revolution, reshaping the way individuals conduct financial transactions. This comprehensive analysis underscores the remarkable growth and transformative impact of mobile wallets on global commerce. With the increasing prevalence of smartphones and the growing preference for convenient, cashless transactions, the market has witnessed exponential expansion.

Mobile Wallet Market

| Segmentation Details | Description |

|---|---|

| Type | Open Wallet, Closed Wallet |

| Ownership | Issuer-based, Network-based |

| Application | Retail, Transportation, Entertainment, Others |

| Region | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in Mobile Wallet Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at