444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The MEA specialty food ingredients market represents a dynamic and rapidly evolving sector within the Middle East and Africa region, characterized by increasing consumer demand for premium food products and innovative culinary solutions. This market encompasses a diverse range of specialized ingredients including natural flavors, functional additives, preservatives, emulsifiers, and nutritional enhancers that cater to the region’s unique dietary preferences and cultural requirements.

Market growth in the MEA region is driven by urbanization, rising disposable incomes, and a growing awareness of health and wellness among consumers. The region’s strategic position as a trading hub between Europe, Asia, and Africa has facilitated the introduction of international food trends while maintaining strong connections to traditional Middle Eastern and African cuisines. Food manufacturers are increasingly incorporating specialty ingredients to meet evolving consumer expectations for taste, nutrition, and convenience.

Regional dynamics show significant variation across different countries, with the Gulf Cooperation Council (GCC) nations leading in terms of market sophistication and adoption of premium ingredients. The market demonstrates a robust growth trajectory of approximately 6.2% CAGR, reflecting the region’s economic diversification efforts and expanding food processing industry. Consumer preferences are shifting toward clean-label products, organic ingredients, and functional foods that offer health benefits beyond basic nutrition.

The MEA specialty food ingredients market refers to the commercial sector encompassing the production, distribution, and application of specialized food additives, functional ingredients, and premium components used in food and beverage manufacturing across the Middle East and Africa region. These ingredients serve specific purposes in food formulation, including enhancing flavor profiles, improving nutritional content, extending shelf life, and meeting regulatory requirements.

Specialty food ingredients differ from commodity ingredients through their unique properties, specialized applications, and higher value propositions. They include natural and artificial flavoring agents, texture modifiers, nutritional supplements, preservation systems, and processing aids that enable food manufacturers to create differentiated products. Market participants range from multinational ingredient suppliers to regional specialty producers who understand local taste preferences and cultural dietary requirements.

Industry scope encompasses various application sectors including bakery and confectionery, dairy and frozen desserts, beverages, processed foods, and nutraceuticals. The market serves both traditional food processing companies and emerging startups focused on innovative food solutions that cater to health-conscious consumers and specific dietary needs such as halal, kosher, and plant-based requirements.

Market performance in the MEA specialty food ingredients sector demonstrates strong momentum driven by demographic shifts, economic growth, and evolving consumer preferences. The region’s young population, increasing urbanization rates, and growing middle class are creating substantial opportunities for specialty ingredient suppliers and food manufacturers seeking to capitalize on emerging trends.

Key growth drivers include the expansion of organized retail, rising health consciousness, and increasing demand for convenience foods. The market benefits from approximately 68% urban population growth across major MEA countries, which correlates with higher consumption of processed and packaged foods requiring specialty ingredients. Investment flows into food processing infrastructure and technology adoption are accelerating market development.

Competitive landscape features a mix of international players and regional specialists, with companies focusing on product innovation, local partnerships, and supply chain optimization. Market challenges include regulatory complexity, raw material price volatility, and the need for halal certification across Muslim-majority markets. Despite these challenges, the sector maintains strong growth prospects supported by government initiatives promoting food security and industrial diversification.

Consumer behavior analysis reveals significant shifts toward premium and health-focused food products across the MEA region. MarkWide Research indicates that consumers are increasingly willing to pay premium prices for products containing natural and functional ingredients that offer perceived health benefits.

Demographic transformation across the MEA region serves as a primary catalyst for specialty food ingredients market growth. The region’s predominantly young population, with approximately 60% under age 30, demonstrates higher propensity for trying new food products and embracing international culinary trends. Urbanization trends are accelerating the adoption of processed and convenience foods that require specialty ingredients for flavor enhancement, preservation, and nutritional fortification.

Economic development in key markets including the UAE, Saudi Arabia, and South Africa is driving increased consumer spending on premium food products. Government initiatives promoting food security and local production capabilities are encouraging investment in food processing infrastructure, creating demand for specialized ingredients and technical expertise. Tourism growth in the region is exposing consumers to diverse culinary experiences, influencing local food preferences and ingredient demand.

Health consciousness is becoming increasingly prevalent among MEA consumers, particularly in urban areas where lifestyle-related health concerns are rising. Functional food trends are gaining traction as consumers seek products that offer specific health benefits such as immune support, digestive health, and energy enhancement. Regulatory support for food innovation and safety standards is creating a more favorable environment for specialty ingredient adoption and new product development.

Economic volatility in several MEA countries poses challenges for market growth, with currency fluctuations and political instability affecting consumer spending patterns and business investment decisions. Import dependency for many specialty ingredients creates vulnerability to supply chain disruptions and price volatility, particularly affecting smaller food manufacturers with limited negotiating power.

Regulatory complexity across different MEA countries creates barriers for ingredient suppliers seeking regional market expansion. Certification requirements vary significantly between countries, with some markets requiring extensive documentation and testing procedures that increase time-to-market and compliance costs. Infrastructure limitations in certain regions affect cold chain logistics and ingredient storage capabilities, limiting the types of specialty ingredients that can be effectively distributed.

Cultural resistance to certain ingredients or food technologies may limit market acceptance in traditional communities. Price sensitivity among lower-income consumer segments restricts the adoption of premium specialty ingredients, particularly in price-competitive food categories. Technical expertise gaps in some markets limit the effective utilization of advanced specialty ingredients, requiring additional investment in training and technical support services.

Plant-based ingredients represent a significant growth opportunity as consumers increasingly seek sustainable and health-conscious food options. The growing popularity of vegetarian and vegan diets, combined with environmental awareness, is driving demand for plant-derived proteins, natural colors, and functional ingredients. Innovation potential in developing region-specific plant-based ingredients using local agricultural resources presents opportunities for both ingredient suppliers and food manufacturers.

Functional beverages are experiencing rapid growth across the MEA region, creating opportunities for specialized ingredients including natural sweeteners, flavor enhancers, and nutritional additives. Sports nutrition and energy drink segments are particularly promising, driven by increasing fitness awareness and active lifestyle adoption among younger consumers. Traditional ingredient modernization offers opportunities to develop commercially viable versions of traditional Middle Eastern and African ingredients for broader market application.

E-commerce expansion is creating new distribution channels for specialty food products and ingredients, enabling smaller suppliers to reach broader markets and consumers to access premium products. Food service growth in the region, including restaurants, cafes, and catering services, is driving demand for professional-grade specialty ingredients. Export opportunities are emerging as MEA-based ingredient suppliers develop capabilities to serve international markets with unique regional ingredients and formulations.

Supply chain evolution in the MEA specialty food ingredients market is characterized by increasing localization efforts and strategic partnerships between international suppliers and regional distributors. Technology adoption is accelerating across the value chain, with companies investing in advanced processing equipment, quality control systems, and digital supply chain management tools to improve efficiency and product quality.

Consumer education initiatives are playing a crucial role in market development, as ingredient suppliers and food manufacturers work to increase awareness of specialty ingredients’ benefits and applications. Collaborative innovation between ingredient suppliers and food manufacturers is driving the development of customized solutions that meet specific regional taste preferences and regulatory requirements. Market consolidation trends are emerging as larger companies acquire specialized suppliers to expand their ingredient portfolios and regional capabilities.

Sustainability focus is becoming increasingly important, with approximately 45% of consumers expressing preference for environmentally responsible ingredient sourcing and production methods. Digital transformation is reshaping market dynamics through improved customer engagement, supply chain transparency, and data-driven product development processes. Quality standards are continuously evolving, with companies investing in advanced testing and certification capabilities to meet international food safety requirements.

Primary research for the MEA specialty food ingredients market analysis involved comprehensive interviews with industry executives, ingredient suppliers, food manufacturers, and regulatory officials across key markets including the UAE, Saudi Arabia, Egypt, and South Africa. Survey methodology included structured questionnaires administered to over 200 industry participants to gather quantitative data on market trends, growth drivers, and competitive dynamics.

Secondary research encompassed analysis of industry reports, government publications, trade association data, and company financial statements to validate primary research findings and provide comprehensive market context. Market sizing was conducted through bottom-up analysis of ingredient consumption patterns across different food and beverage categories, validated through top-down analysis of regional food processing industry data.

Data validation processes included cross-referencing multiple sources, conducting follow-up interviews with key informants, and applying statistical analysis to ensure data accuracy and reliability. Regional analysis methodology involved country-specific research to account for varying market conditions, regulatory environments, and consumer preferences across the MEA region. Trend analysis incorporated historical data spanning five years to identify growth patterns and project future market developments.

Gulf Cooperation Council countries represent the most developed segment of the MEA specialty food ingredients market, accounting for approximately 42% market share due to high disposable incomes, advanced retail infrastructure, and strong import capabilities. United Arab Emirates serves as a regional hub for ingredient distribution and food innovation, with Dubai and Abu Dhabi hosting major food processing facilities and international ingredient suppliers’ regional headquarters.

Saudi Arabia demonstrates the highest growth potential within the GCC, driven by Vision 2030 initiatives promoting food security and local manufacturing capabilities. Government investment in food processing infrastructure and support for local ingredient production is creating opportunities for both domestic and international suppliers. Consumer spending on premium food products continues to increase, supporting demand for specialty ingredients.

North African markets, particularly Egypt and Morocco, show strong growth in basic specialty ingredients while premium segments remain price-sensitive. South Africa leads the sub-Saharan African market with approximately 35% regional market share, benefiting from established food processing industry and sophisticated retail channels. Emerging markets including Nigeria and Kenya are experiencing rapid growth in urban areas, though infrastructure challenges limit market development in rural regions.

Market leadership in the MEA specialty food ingredients sector is characterized by a combination of global multinational companies and specialized regional players who understand local market dynamics and regulatory requirements. International players leverage their global R&D capabilities and extensive product portfolios to serve large food manufacturers, while regional specialists focus on niche applications and culturally specific ingredients.

By Product Type: The MEA specialty food ingredients market encompasses diverse product categories, each serving specific functional and nutritional requirements in food and beverage applications.

By Application: Market segmentation by end-use applications reveals varying growth patterns and ingredient requirements across different food categories.

Natural ingredients are experiencing the strongest growth across all categories, driven by consumer preference for clean-label products and perceived health benefits. Organic certification is becoming increasingly important, with approximately 28% of consumers actively seeking organic ingredient labels when making food purchasing decisions. Plant-based proteins are gaining significant traction, particularly in urban markets where health consciousness and environmental awareness are highest.

Flavor enhancement remains the dominant category, with Middle Eastern and North African traditional flavors experiencing renewed interest among younger consumers. Spice extracts and aromatic compounds derived from regional ingredients such as saffron, rose water, and various herbs are finding applications in both traditional and modern food products. Functional beverages represent the fastest-growing application category, with energy drinks and health-focused beverages driving demand for specialized ingredients.

Preservation technologies are evolving toward natural alternatives, with companies developing plant-based preservation systems that meet both consumer preferences and regulatory requirements. Texture modification ingredients are becoming more sophisticated, enabling food manufacturers to create products with improved mouthfeel and stability. Nutritional fortification is expanding beyond basic vitamins and minerals to include probiotics, omega-3 fatty acids, and other functional compounds that support specific health benefits.

Food manufacturers benefit from access to innovative specialty ingredients that enable product differentiation, improved nutritional profiles, and extended shelf life. Cost optimization opportunities arise through ingredient efficiency improvements and reduced waste in production processes. Market expansion becomes possible through ingredient solutions that meet diverse cultural and dietary requirements across the MEA region.

Ingredient suppliers gain access to growing markets with increasing sophistication and purchasing power. Partnership opportunities with local food manufacturers provide insights into regional preferences and enable customized product development. Technology transfer and knowledge sharing contribute to overall industry development and create long-term business relationships.

Consumers benefit from improved food quality, enhanced nutritional value, and greater product variety in the marketplace. Health outcomes improve through access to functional foods and beverages that support specific wellness goals. Cultural preservation is supported through modern applications of traditional ingredients and flavors. Economic development in the region creates employment opportunities and supports local agricultural sectors through ingredient sourcing initiatives.

Strengths:

Weaknesses:

Opportunities:

Threats:

Clean label movement is reshaping ingredient selection criteria across the MEA region, with consumers increasingly demanding transparency in food formulations and ingredient sourcing. MWR analysis indicates that approximately 52% of consumers actively read ingredient labels and prefer products with recognizable, natural components. Manufacturers are responding by reformulating products to eliminate artificial additives and replace them with natural alternatives.

Functional food innovation is accelerating as consumers seek products that offer health benefits beyond basic nutrition. Probiotic ingredients are experiencing particularly strong growth in dairy and beverage applications, while plant-based proteins are gaining acceptance across various food categories. Immune support ingredients have seen increased demand following global health concerns, driving innovation in vitamin C, zinc, and botanical extract applications.

Sustainability initiatives are becoming integral to ingredient sourcing and production strategies. Circular economy principles are being applied to reduce waste and improve resource efficiency in ingredient processing. Local sourcing trends are strengthening as companies seek to reduce environmental impact and support regional agricultural development. Packaging innovation is extending to ingredient preservation and delivery systems, improving product quality and reducing environmental impact.

Strategic partnerships between international ingredient suppliers and regional food manufacturers are accelerating market development and technology transfer. Investment flows into food processing infrastructure are creating new opportunities for specialty ingredient applications and market expansion. Regulatory harmonization efforts across GCC countries are simplifying market access and reducing compliance costs for ingredient suppliers.

Technology adoption is advancing rapidly, with companies implementing advanced processing techniques, quality control systems, and supply chain management tools. Research and development investments are increasing, focusing on region-specific ingredient solutions and applications that meet local taste preferences and cultural requirements. Certification programs for halal, organic, and sustainable ingredients are expanding to meet growing consumer and regulatory demands.

Market consolidation activities include acquisitions of regional specialists by international companies seeking to expand their MEA presence and ingredient portfolios. Innovation hubs are being established in key markets to support local product development and customer technical support. Digital transformation initiatives are improving customer engagement, supply chain transparency, and operational efficiency across the industry.

Market entry strategies should prioritize understanding local consumer preferences, regulatory requirements, and cultural sensitivities. Partnership development with established regional distributors and food manufacturers can accelerate market penetration and reduce entry risks. Investment priorities should focus on supply chain infrastructure, technical support capabilities, and regulatory compliance systems.

Product development should emphasize natural ingredients, functional benefits, and cultural relevance to maximize market acceptance. Quality assurance systems must meet international standards while accommodating regional certification requirements such as halal compliance. Pricing strategies should consider market segmentation and competitive positioning while maintaining profitability.

Innovation focus should target emerging trends including plant-based ingredients, functional foods, and sustainable sourcing practices. Technology adoption can provide competitive advantages through improved product quality, operational efficiency, and customer service capabilities. Market expansion should follow a phased approach, starting with established markets before entering emerging economies with different risk profiles.

Growth projections for the MEA specialty food ingredients market remain positive, with continued expansion expected across all major product categories and applications. Market maturation in developed regions will drive demand for more sophisticated and specialized ingredients, while emerging markets will experience growth in basic specialty ingredient adoption. MarkWide Research forecasts sustained growth momentum with increasing market sophistication and consumer awareness.

Technology advancement will continue to drive innovation in ingredient functionality, processing efficiency, and application versatility. Sustainability requirements will become increasingly important, influencing sourcing decisions, production methods, and packaging solutions. Regulatory evolution is expected to support market growth through improved standards harmonization and streamlined approval processes.

Consumer trends toward health, wellness, and premium products will sustain demand for functional and natural ingredients. Economic development across the region will support continued market expansion and increasing sophistication in ingredient applications. Export opportunities may emerge as regional suppliers develop capabilities to serve international markets with unique Middle Eastern and African ingredients and formulations.

The MEA specialty food ingredients market represents a dynamic and rapidly evolving sector with significant growth potential driven by demographic trends, economic development, and changing consumer preferences. Market opportunities are abundant across various product categories and applications, particularly in natural ingredients, functional foods, and culturally relevant formulations that meet regional taste preferences and dietary requirements.

Success factors for market participants include understanding local market dynamics, building strong regional partnerships, and investing in quality assurance and regulatory compliance capabilities. Innovation focus on clean-label products, functional benefits, and sustainable sourcing practices will be crucial for long-term competitive advantage. Strategic positioning should emphasize the unique value proposition of specialty ingredients in enabling product differentiation and meeting evolving consumer expectations.

Future growth will be supported by continued economic development, urbanization, and increasing health consciousness across the MEA region. Companies that successfully navigate regulatory complexity, build local capabilities, and develop culturally relevant products will be well-positioned to capitalize on the substantial opportunities in this expanding market. The MEA specialty food ingredients market offers compelling prospects for sustainable growth and innovation in the global food industry landscape.

What is Specialty Food Ingredients?

Specialty food ingredients refer to unique components used in food products to enhance flavor, texture, and nutritional value. These ingredients often cater to specific dietary needs and preferences, such as gluten-free, organic, or plant-based options.

What are the key players in the MEA Specialty Food Ingredients Market?

Key players in the MEA Specialty Food Ingredients Market include companies like DSM, Ingredion, and Kerry Group, which provide a range of specialty ingredients for various applications, including bakery, dairy, and beverages, among others.

What are the growth factors driving the MEA Specialty Food Ingredients Market?

The MEA Specialty Food Ingredients Market is driven by increasing consumer demand for healthier food options, the rise of plant-based diets, and innovations in food technology that enhance ingredient functionality and appeal.

What challenges does the MEA Specialty Food Ingredients Market face?

Challenges in the MEA Specialty Food Ingredients Market include regulatory hurdles related to food safety, the need for consistent quality in ingredient sourcing, and competition from conventional ingredients that may be more cost-effective.

What opportunities exist in the MEA Specialty Food Ingredients Market?

Opportunities in the MEA Specialty Food Ingredients Market include the growing trend of clean label products, increasing interest in functional foods, and the expansion of e-commerce platforms for specialty food ingredient distribution.

What trends are shaping the MEA Specialty Food Ingredients Market?

Trends in the MEA Specialty Food Ingredients Market include the rise of natural and organic ingredients, the incorporation of sustainable sourcing practices, and the development of innovative flavor profiles to meet diverse consumer preferences.

MEA Specialty Food Ingredients Market

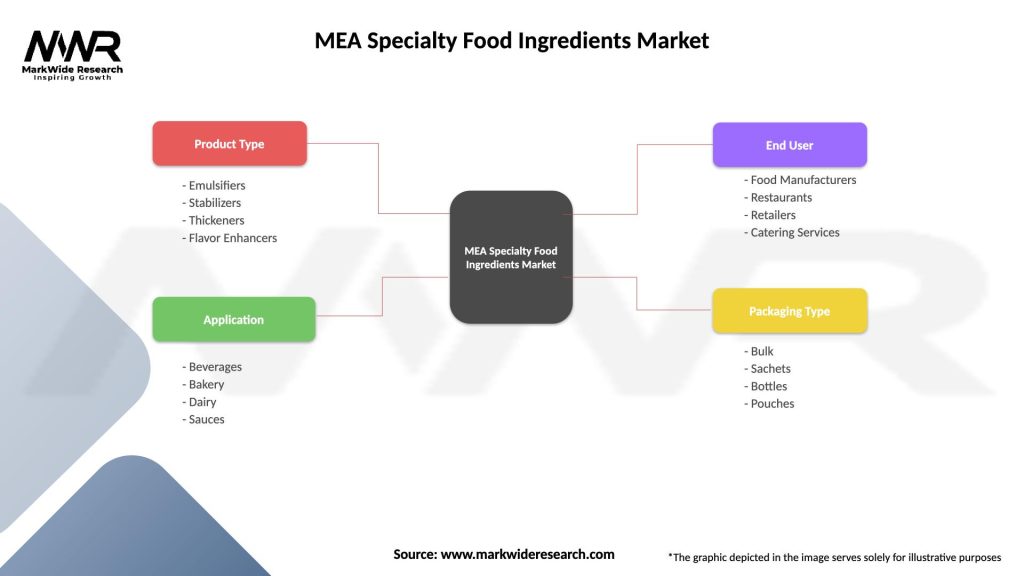

| Segmentation Details | Description |

|---|---|

| Product Type | Emulsifiers, Stabilizers, Thickeners, Flavor Enhancers |

| Application | Beverages, Bakery, Dairy, Sauces |

| End User | Food Manufacturers, Restaurants, Retailers, Catering Services |

| Packaging Type | Bulk, Sachets, Bottles, Pouches |

Please note: The segmentation can be entirely customized to align with our client’s needs.

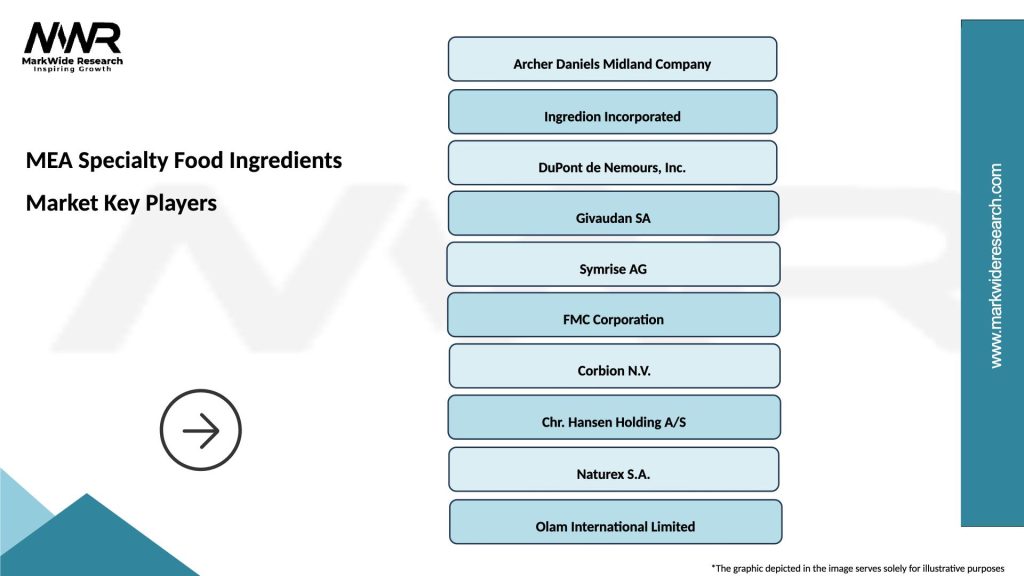

Leading companies in the MEA Specialty Food Ingredients Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at