444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The European sports drinks market represents a dynamic and rapidly evolving sector within the broader beverage industry, characterized by increasing consumer awareness of health and fitness. Market dynamics indicate substantial growth potential driven by rising participation in sports activities, growing health consciousness, and expanding distribution channels across European countries. The market encompasses a diverse range of products including isotonic drinks, energy drinks, protein beverages, and recovery formulations designed to enhance athletic performance and support active lifestyles.

Consumer preferences in Europe have shifted significantly toward functional beverages that offer specific health benefits beyond basic hydration. The market demonstrates robust growth with a projected CAGR of 6.2% over the forecast period, reflecting strong demand across both professional athletic segments and recreational fitness enthusiasts. Regional variations exist across European markets, with Western European countries showing mature market characteristics while Eastern European nations present emerging opportunities for market expansion.

Product innovation continues to drive market evolution, with manufacturers focusing on natural ingredients, reduced sugar formulations, and specialized nutritional profiles. The integration of advanced sports science research has led to more sophisticated product offerings that cater to specific athletic requirements and recovery needs. Distribution channels have expanded beyond traditional retail outlets to include online platforms, fitness centers, and specialized sports nutrition stores, enhancing market accessibility and consumer convenience.

The European sports drinks market refers to the comprehensive ecosystem of beverages specifically formulated to support athletic performance, enhance hydration, and facilitate recovery for active individuals across European countries. This market encompasses products designed with scientifically-backed formulations containing electrolytes, carbohydrates, proteins, vitamins, and minerals that address the physiological demands of physical exercise and sports participation.

Sports drinks are functionally distinct from regular beverages due to their specialized composition aimed at replacing fluids, electrolytes, and energy lost during physical activity. These products serve multiple purposes including pre-workout preparation, during-exercise hydration, and post-workout recovery support. The European market specifically reflects regional preferences, regulatory requirements, and cultural attitudes toward sports nutrition and active lifestyle choices.

Market segmentation includes various product categories such as isotonic drinks for electrolyte balance, hypotonic beverages for rapid hydration, hypertonic solutions for energy replenishment, and specialized recovery drinks containing proteins and amino acids. The definition encompasses both traditional sports drink formulations and innovative products incorporating natural ingredients, organic certifications, and functional additives that appeal to health-conscious European consumers.

Market performance in the European sports drinks sector demonstrates consistent growth momentum driven by increasing health awareness and expanding participation in fitness activities. The market benefits from strong demographic trends including rising disposable incomes, urbanization, and growing emphasis on preventive healthcare approaches. Consumer behavior patterns indicate a shift toward premium products with clean labels, natural ingredients, and scientifically-validated benefits.

Competitive dynamics feature established multinational brands competing alongside emerging local players who leverage regional preferences and innovative formulations. The market shows approximately 42% penetration rate among regular fitness participants, indicating substantial room for growth as sports participation continues expanding across European demographics. Distribution evolution has been particularly notable, with online sales channels growing at 18% annually and representing an increasingly important revenue stream.

Innovation trends focus on personalized nutrition solutions, sustainable packaging initiatives, and functional ingredients that address specific performance goals. The market demonstrates resilience against economic fluctuations due to the essential nature of hydration and nutrition for active lifestyles. Regulatory compliance across European Union markets has standardized product claims and labeling requirements, creating opportunities for brands that can effectively navigate complex regulatory landscapes while maintaining product efficacy and consumer appeal.

Consumer demographics reveal that the European sports drinks market serves a diverse audience spanning professional athletes, recreational fitness enthusiasts, and health-conscious individuals seeking functional beverage alternatives. The primary consumer base includes individuals aged 18-45 who maintain active lifestyles and prioritize performance optimization through nutrition.

Health consciousness represents the primary driver propelling European sports drinks market expansion, with consumers increasingly recognizing the importance of proper hydration and nutrition for optimal physical performance. This trend reflects broader societal shifts toward preventive healthcare approaches and active lifestyle adoption across diverse demographic segments.

Sports participation growth continues accelerating across European countries, driven by government initiatives promoting physical activity, increased leisure time availability, and growing awareness of exercise benefits for mental and physical wellbeing. The proliferation of fitness centers, recreational sports leagues, and community wellness programs creates expanding consumer bases for sports nutrition products.

Product innovation drives market growth through continuous development of specialized formulations addressing specific athletic needs, dietary preferences, and performance goals. Manufacturers invest heavily in research and development to create products featuring natural ingredients, reduced sugar content, enhanced bioavailability, and targeted nutritional profiles that appeal to sophisticated European consumers.

Distribution accessibility has improved significantly with expanded retail presence, online availability, and integration into fitness facilities and sports venues. This enhanced accessibility removes barriers to product trial and regular consumption while creating convenient purchasing opportunities aligned with consumer activity patterns and lifestyle preferences.

Regulatory complexity across European markets creates challenges for manufacturers seeking to launch products with consistent formulations and claims across multiple countries. Varying national regulations regarding ingredient approvals, health claims, and labeling requirements can increase compliance costs and limit product standardization opportunities.

Price sensitivity among certain consumer segments limits market penetration, particularly in price-conscious demographics and regions with lower disposable incomes. The premium pricing of specialized sports drinks compared to conventional beverages can restrict adoption rates and limit market expansion in cost-sensitive segments.

Competition intensity from both established beverage companies and emerging specialized brands creates pressure on profit margins and marketing investments. The market’s attractiveness has led to increased competitive activity, making differentiation and market share maintenance increasingly challenging for existing players.

Seasonal demand fluctuations create inventory management challenges and revenue variability that can impact business planning and profitability. The concentration of demand during warmer months and peak sports seasons requires careful supply chain management and marketing resource allocation to optimize performance throughout annual cycles.

Emerging markets within Eastern Europe present significant growth opportunities as economic development increases disposable incomes and sports participation rates. These markets offer potential for establishing strong brand positions before competitive intensity reaches levels seen in mature Western European markets.

Product diversification opportunities exist in developing specialized formulations for specific sports, demographic groups, and performance objectives. The growing understanding of sports nutrition science enables creation of targeted products addressing unique physiological requirements and consumer preferences across diverse athletic activities.

Digital transformation creates opportunities for direct consumer engagement, personalized product recommendations, and subscription-based delivery models that enhance customer loyalty and lifetime value. Advanced analytics and consumer data can inform product development and marketing strategies while improving customer experience and satisfaction.

Sustainability positioning offers competitive advantages as environmentally conscious consumers increasingly prioritize brands demonstrating commitment to sustainable practices. Opportunities exist in developing eco-friendly packaging, sustainable ingredient sourcing, and carbon-neutral production processes that align with European environmental values and regulations.

Supply chain evolution reflects changing consumer preferences and distribution channel requirements, with manufacturers adapting production and logistics capabilities to serve diverse market segments efficiently. The integration of advanced manufacturing technologies enables flexible production runs and customized formulations while maintaining cost competitiveness and quality standards.

Consumer behavior patterns demonstrate increasing sophistication in product selection, with buyers evaluating ingredients, nutritional profiles, and brand values before making purchasing decisions. This trend toward informed consumption creates opportunities for brands that can effectively communicate product benefits and differentiation while building trust through transparency and scientific validation.

Competitive positioning strategies increasingly focus on brand authenticity, scientific credibility, and consumer community building rather than traditional advertising approaches. Successful brands develop comprehensive ecosystems including educational content, fitness partnerships, and consumer engagement programs that create lasting relationships beyond transactional interactions.

Technology integration enables enhanced product development, consumer insights, and operational efficiency throughout the value chain. From advanced formulation techniques to digital marketing platforms and supply chain optimization, technology adoption drives competitive advantages and market responsiveness across all business functions.

Primary research methodologies employed in analyzing the European sports drinks market include comprehensive consumer surveys, industry expert interviews, and retail channel assessments across major European markets. These approaches provide direct insights into consumer preferences, purchasing behaviors, and market trends that inform strategic analysis and forecasting.

Secondary research incorporates analysis of industry reports, regulatory filings, company financial statements, and academic studies related to sports nutrition and beverage consumption patterns. This comprehensive data collection ensures robust market understanding and validates primary research findings through multiple information sources.

Market modeling techniques utilize statistical analysis, trend extrapolation, and scenario planning to develop accurate market projections and identify growth opportunities. Advanced analytical tools enable segmentation analysis, competitive benchmarking, and regional market comparisons that support strategic decision-making processes.

Data validation processes ensure research accuracy through cross-referencing multiple sources, expert review panels, and continuous monitoring of market developments. This rigorous approach maintains research credibility and provides reliable foundations for business planning and investment decisions across the European sports drinks market.

Western Europe represents the most mature segment of the European sports drinks market, with countries like Germany, France, and the United Kingdom demonstrating established consumer bases and sophisticated distribution networks. These markets show 65% market penetration among active adults and feature intense competition among premium brands focusing on innovation and brand differentiation.

Northern European countries including Sweden, Denmark, and Norway exhibit strong growth potential driven by high sports participation rates and health-conscious consumer attitudes. The region demonstrates approximately 28% annual growth in organic and natural sports drink categories, reflecting consumer preferences for clean-label products and sustainable brands.

Southern Europe markets such as Spain, Italy, and Portugal show seasonal demand patterns aligned with outdoor activity cycles and tourism influences. These markets benefit from strong sports cultures and growing fitness awareness, with 35% of consumers regularly purchasing sports drinks during peak activity seasons.

Eastern Europe presents emerging opportunities with countries like Poland, Czech Republic, and Hungary experiencing rapid economic development and increasing sports participation. According to MarkWide Research analysis, these markets demonstrate 15% annual growth rates as disposable incomes rise and fitness culture expands across urban populations.

Market leadership in the European sports drinks sector features a combination of established multinational beverage companies and specialized sports nutrition brands that compete across different market segments and price points. The competitive environment emphasizes innovation, brand building, and distribution excellence as key success factors.

By Product Type: The European sports drinks market segments into isotonic drinks for electrolyte replacement, hypotonic beverages for rapid hydration, hypertonic solutions for energy supplementation, and specialized recovery drinks containing proteins and amino acids. Each segment addresses specific physiological needs and consumer preferences across different athletic activities and performance objectives.

By Distribution Channel: Market segmentation includes supermarkets and hypermarkets representing the largest retail category, convenience stores providing accessibility, online platforms offering convenience and variety, fitness centers and gyms enabling targeted marketing, and specialty sports nutrition stores catering to serious athletes and fitness enthusiasts.

By Consumer Demographics: Segmentation encompasses professional athletes requiring specialized performance nutrition, recreational fitness enthusiasts seeking general hydration support, health-conscious consumers prioritizing functional beverages, and occasional users purchasing during specific activities or seasons.

By Geographic Regions: Market segmentation reflects distinct regional characteristics including Western Europe’s mature markets with premium positioning, Northern Europe’s health-focused consumers, Southern Europe’s seasonal demand patterns, and Eastern Europe’s emerging growth opportunities driven by economic development and lifestyle changes.

Isotonic Drinks: This category dominates the European sports drinks market with approximately 52% market share, offering balanced electrolyte replacement that matches human physiological needs. Products in this segment focus on rapid absorption and effective hydration during moderate to intense physical activity, appealing to both professional athletes and recreational fitness participants.

Energy Drinks: Representing a significant market segment, energy drinks combine caffeine, taurine, and B-vitamins to provide immediate energy boosts and mental alertness. This category shows strong growth among younger demographics and urban consumers seeking performance enhancement for both athletic and daily activities.

Protein Drinks: The fastest-growing segment focuses on post-workout recovery and muscle building support, featuring whey protein, casein, and plant-based alternatives. These products appeal to strength training enthusiasts and athletes requiring enhanced recovery nutrition for optimal performance maintenance.

Natural and Organic Options: Emerging category reflecting consumer preferences for clean-label products with natural ingredients, organic certifications, and minimal processing. This segment commands premium pricing and demonstrates strong growth potential as health consciousness continues expanding across European consumer bases.

Manufacturers benefit from expanding market opportunities driven by growing health awareness and sports participation across European demographics. The market offers potential for premium pricing through product innovation, brand differentiation, and specialized formulations that address specific consumer needs and performance objectives.

Retailers gain advantages through sports drinks category growth that drives foot traffic, increases basket sizes, and provides opportunities for cross-merchandising with complementary health and fitness products. The category’s strong margins and consistent demand patterns support profitable retail operations and customer loyalty development.

Consumers receive enhanced product options featuring improved formulations, better taste profiles, and specialized nutritional benefits that support active lifestyles and performance goals. Market competition drives continuous innovation and value improvement while expanding accessibility through diverse distribution channels.

Athletes and Fitness Enthusiasts benefit from scientifically-validated products that optimize hydration, enhance performance, and accelerate recovery processes. The market’s evolution provides increasingly sophisticated nutrition solutions tailored to specific sports, training regimens, and individual physiological requirements.

Strengths:

Weaknesses:

Opportunities:

Threats:

Clean Label Movement: European consumers increasingly demand sports drinks with natural ingredients, minimal processing, and transparent labeling that clearly communicates product composition and benefits. This trend drives reformulation efforts and premium positioning strategies across major brands seeking to align with health-conscious consumer preferences.

Personalized Nutrition: Growing interest in customized sports drinks tailored to individual physiological needs, training regimens, and performance goals. Advanced testing technologies and data analytics enable personalized product recommendations and specialized formulations that optimize individual athletic performance and recovery processes.

Sustainability Integration: Environmental consciousness drives demand for eco-friendly packaging, sustainable ingredient sourcing, and carbon-neutral production processes. Brands increasingly emphasize environmental responsibility as a core value proposition to appeal to environmentally aware European consumers and comply with evolving regulatory requirements.

Functional Ingredient Innovation: Integration of advanced functional ingredients including adaptogens, probiotics, nootropics, and plant-based compounds that provide benefits beyond traditional hydration and energy support. These innovations create product differentiation opportunities and appeal to consumers seeking comprehensive wellness solutions through sports nutrition.

Product Launch Activities: Major brands continue introducing innovative formulations featuring reduced sugar content, natural flavoring systems, and specialized nutritional profiles targeting specific athletic activities and consumer demographics. Recent launches emphasize clean ingredients and scientific validation of performance benefits.

Strategic Partnerships: Industry participants increasingly form partnerships with professional sports organizations, fitness influencers, and research institutions to enhance credibility and expand market reach. These collaborations provide authentic endorsements and scientific validation that support brand positioning and consumer trust development.

Manufacturing Investments: Companies invest in advanced production facilities and technologies that enable flexible manufacturing, quality enhancement, and cost optimization. These investments support product innovation capabilities while improving operational efficiency and market responsiveness across European operations.

Digital Marketing Evolution: Brands adopt sophisticated digital marketing strategies leveraging social media platforms, fitness applications, and data analytics to engage consumers and build communities around active lifestyles. MWR research indicates that digital marketing investments have increased by 25% annually as brands recognize the importance of direct consumer engagement and personalized communication strategies.

Innovation Focus: Industry participants should prioritize research and development investments in natural ingredients, functional additives, and personalized nutrition solutions that address evolving consumer preferences and scientific understanding of sports nutrition. Continuous innovation remains essential for maintaining competitive advantages and market leadership positions.

Market Expansion: Companies should consider strategic expansion into emerging Eastern European markets where economic development and lifestyle changes create significant growth opportunities. Early market entry can establish strong brand positions before competitive intensity reaches levels seen in mature Western European markets.

Sustainability Leadership: Brands should proactively address environmental concerns through sustainable packaging initiatives, responsible sourcing practices, and transparent communication about environmental impact. Sustainability leadership can create competitive advantages and appeal to environmentally conscious European consumers.

Digital Transformation: Organizations should invest in digital capabilities including e-commerce platforms, consumer data analytics, and personalized marketing technologies that enhance customer engagement and enable direct-to-consumer business models. Digital transformation supports market responsiveness and customer relationship development in increasingly competitive environments.

Market trajectory for the European sports drinks sector indicates continued growth driven by sustained health consciousness, expanding sports participation, and ongoing product innovation. The market is projected to maintain robust growth rates with increasing penetration across diverse demographic segments and geographic regions throughout the forecast period.

Technology integration will play an increasingly important role in product development, consumer engagement, and operational efficiency. Advanced formulation techniques, personalized nutrition platforms, and digital marketing capabilities will become essential competitive requirements for sustained market success and growth.

Regulatory evolution across European markets may influence product formulations, health claims, and marketing approaches as authorities balance consumer protection with industry innovation. Companies that proactively address regulatory requirements while maintaining product efficacy will be best positioned for long-term success.

Consumer sophistication will continue increasing as buyers become more knowledgeable about sports nutrition science and demand higher quality products with validated benefits. According to MarkWide Research projections, premium product segments are expected to grow at 8.5% annually as consumers prioritize quality and effectiveness over price considerations in their purchasing decisions.

The European sports drinks market represents a dynamic and promising sector characterized by strong growth fundamentals, continuous innovation, and expanding consumer acceptance across diverse demographic segments. Market drivers including increasing health consciousness, growing sports participation, and product innovation create sustainable growth opportunities for industry participants who can effectively navigate competitive challenges and regulatory requirements.

Strategic success in this market requires comprehensive approaches encompassing product innovation, brand building, distribution excellence, and consumer engagement. Companies that invest in research and development, embrace sustainability principles, and leverage digital technologies will be best positioned to capture growth opportunities and maintain competitive advantages in evolving market conditions.

Future prospects remain positive as demographic trends, lifestyle changes, and scientific advances continue supporting market expansion. The combination of established market foundations in Western Europe and emerging opportunities in Eastern European countries provides diverse growth pathways for both established players and new market entrants seeking to participate in this attractive and dynamic industry sector.

What is Sports Drinks?

Sports drinks are beverages designed to hydrate and replenish electrolytes lost during physical activity. They often contain carbohydrates, vitamins, and minerals to support athletic performance and recovery.

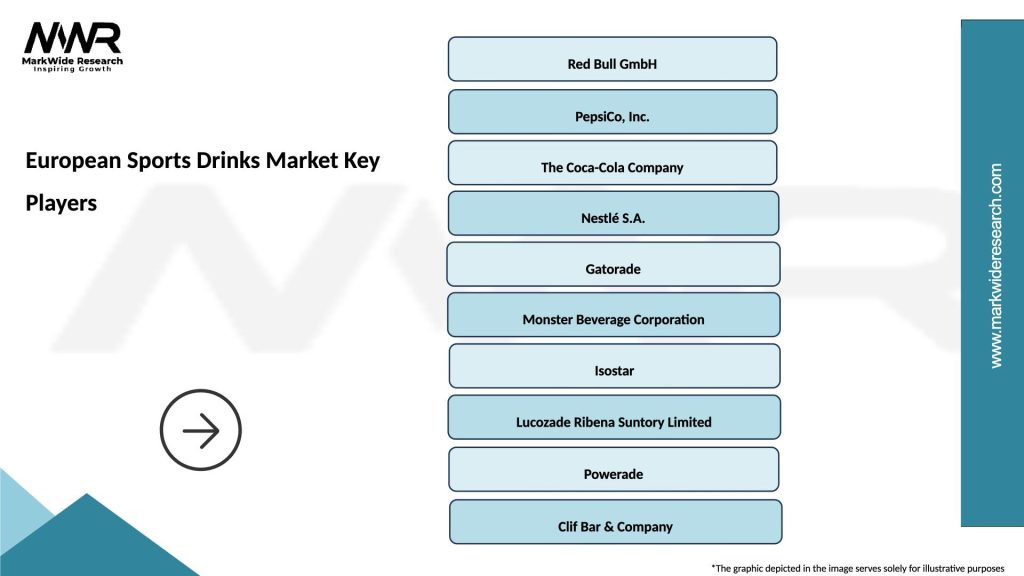

What are the key players in the European Sports Drinks Market?

Key players in the European Sports Drinks Market include brands like Gatorade, Powerade, and Lucozade, which offer a variety of products tailored for athletes and active consumers, among others.

What are the growth factors driving the European Sports Drinks Market?

The growth of the European Sports Drinks Market is driven by increasing health consciousness among consumers, rising participation in sports and fitness activities, and the demand for convenient hydration solutions.

What challenges does the European Sports Drinks Market face?

Challenges in the European Sports Drinks Market include intense competition among brands, regulatory scrutiny regarding health claims, and changing consumer preferences towards natural and low-sugar options.

What opportunities exist in the European Sports Drinks Market?

Opportunities in the European Sports Drinks Market include the development of innovative flavors and formulations, the rise of plant-based and organic products, and expanding distribution channels through e-commerce.

What trends are shaping the European Sports Drinks Market?

Trends in the European Sports Drinks Market include a growing focus on functional beverages that offer additional health benefits, the popularity of ready-to-drink formats, and an increasing emphasis on sustainability in packaging and sourcing.

European Sports Drinks Market

| Segmentation Details | Description |

|---|---|

| Product Type | Isotonic, Hypotonic, Hypertonic, Functional |

| End User | Athletes, Fitness Enthusiasts, Casual Consumers, Sports Teams |

| Distribution Channel | Supermarkets, Online Retail, Convenience Stores, Health Shops |

| Packaging Type | Bottles, Cans, Pouches, Tetra Packs |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the European Sports Drinks Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at