444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The North America wearable ambulatory monitoring devices market represents a rapidly expanding segment of the healthcare technology industry, driven by increasing demand for continuous patient monitoring and remote healthcare solutions. Wearable ambulatory monitoring devices have emerged as critical tools in modern healthcare delivery, enabling healthcare providers to track patient vital signs, detect anomalies, and provide timely interventions outside traditional clinical settings.

Market dynamics in North America are particularly favorable, with the region experiencing robust growth at a CAGR of 12.8% over the forecast period. The integration of advanced technologies such as artificial intelligence, machine learning, and Internet of Things (IoT) capabilities has significantly enhanced the functionality and accuracy of these devices. Healthcare providers across the United States and Canada are increasingly adopting wearable monitoring solutions to improve patient outcomes while reducing healthcare costs.

Technological advancement continues to drive market expansion, with manufacturers developing increasingly sophisticated devices capable of monitoring multiple physiological parameters simultaneously. The market encompasses various device types including cardiac monitors, glucose monitors, blood pressure monitors, and multi-parameter monitoring systems. Patient acceptance has improved dramatically, with adoption rates reaching 68% among chronic disease patients in major metropolitan areas.

The North America wearable ambulatory monitoring devices market refers to the commercial ecosystem encompassing the development, manufacturing, distribution, and deployment of portable medical devices designed for continuous patient monitoring outside traditional healthcare facilities. These devices enable real-time collection and transmission of physiological data, supporting remote patient management and early intervention strategies.

Ambulatory monitoring specifically denotes the capability to monitor patients while they maintain normal daily activities, providing healthcare professionals with comprehensive data about patient health status over extended periods. Wearable technology integration ensures patient comfort and compliance while delivering clinically accurate measurements that inform treatment decisions and care management protocols.

Market leadership in North America’s wearable ambulatory monitoring devices sector is characterized by intense innovation and strategic partnerships between technology companies and healthcare providers. The market demonstrates strong growth momentum, supported by favorable regulatory environments, increasing healthcare digitization, and growing emphasis on preventive care approaches.

Key market drivers include the aging population, rising prevalence of chronic diseases, and healthcare cost containment initiatives. Chronic disease management represents the largest application segment, accounting for 45% of total device deployments. The integration of telemedicine platforms and electronic health records has created comprehensive care ecosystems that maximize the value of continuous monitoring data.

Competitive landscape features established medical device manufacturers alongside emerging technology companies, creating a dynamic environment for innovation and market expansion. Strategic acquisitions and partnerships have accelerated product development cycles and market penetration strategies across diverse healthcare settings.

Market penetration analysis reveals significant opportunities for expansion across various healthcare segments and patient populations. The following key insights shape market development strategies:

Demographic trends represent the primary catalyst for market expansion, with North America’s aging population creating unprecedented demand for continuous health monitoring solutions. Chronic disease prevalence continues to rise, with conditions such as diabetes, cardiovascular disease, and respiratory disorders requiring ongoing monitoring and management.

Healthcare cost pressures drive adoption of ambulatory monitoring technologies as healthcare systems seek to reduce expensive hospital admissions and emergency department visits. Remote monitoring capabilities enable early intervention strategies that prevent costly medical complications and improve overall patient outcomes.

Technological advancement in sensor miniaturization, battery life, and wireless connectivity has made wearable devices more practical and user-friendly. Artificial intelligence integration enhances device capabilities by providing intelligent alerts, trend analysis, and predictive insights that support clinical decision-making processes.

Regulatory support from agencies such as the FDA has streamlined approval processes for digital health technologies, encouraging innovation and market entry. Reimbursement expansion by insurance providers has improved patient access to monitoring technologies, with coverage rates increasing by 35% over the past three years.

Implementation challenges continue to impact market growth, particularly regarding device interoperability and integration with existing healthcare information systems. Technical complexity associated with data management and analysis requires significant investment in IT infrastructure and staff training.

Privacy concerns related to health data collection and transmission create hesitation among some patient populations and healthcare providers. Regulatory compliance requirements, while supportive of innovation, also create complexity and costs for manufacturers seeking market approval.

Cost considerations remain significant for both healthcare providers and patients, particularly in value-based care environments where return on investment must be clearly demonstrated. Device reliability and accuracy concerns impact provider confidence, especially for critical monitoring applications requiring clinical-grade precision.

Market fragmentation across different device types and monitoring applications creates challenges for standardization and interoperability. User adoption barriers including technology literacy and device comfort continue to limit market penetration among certain demographic groups.

Emerging applications in mental health monitoring, medication adherence tracking, and rehabilitation management present significant growth opportunities for wearable ambulatory monitoring devices. Artificial intelligence integration enables development of sophisticated predictive analytics capabilities that can identify health risks before clinical symptoms appear.

Partnership opportunities between device manufacturers and healthcare providers create pathways for integrated care delivery models that maximize monitoring technology value. Telehealth expansion accelerated by recent healthcare delivery changes provides natural integration points for ambulatory monitoring solutions.

International expansion opportunities exist as regulatory frameworks in other regions evolve to support digital health technologies. Consumer market development beyond traditional healthcare settings offers potential for direct-pay and wellness-focused applications.

Technology convergence with smartphones, smart home devices, and other connected technologies creates opportunities for comprehensive health monitoring ecosystems. Data monetization through anonymized health insights and population health analytics represents emerging revenue streams for market participants.

Competitive dynamics in the North America wearable ambulatory monitoring devices market reflect a balance between established medical device companies and innovative technology startups. Market consolidation through strategic acquisitions has created larger, more capable organizations with comprehensive product portfolios and distribution networks.

Innovation cycles continue to accelerate, with new product introductions occurring at increasingly rapid intervals. Customer expectations for device functionality, accuracy, and user experience continue to rise, driving continuous improvement in product development strategies.

Supply chain dynamics have evolved to support rapid scaling of production capabilities while maintaining quality standards. Distribution channels have expanded beyond traditional medical device networks to include direct-to-consumer and retail pharmacy channels.

Pricing pressures from healthcare cost containment initiatives influence market dynamics, encouraging manufacturers to develop cost-effective solutions without compromising clinical effectiveness. Technology standardization efforts aim to improve interoperability and reduce implementation complexity for healthcare providers.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable market insights. Primary research includes extensive interviews with healthcare providers, device manufacturers, and industry experts to gather firsthand perspectives on market trends and challenges.

Secondary research incorporates analysis of industry reports, regulatory filings, clinical studies, and market data from authoritative sources. Quantitative analysis utilizes statistical modeling to project market trends and validate findings across different data sources.

Market segmentation analysis examines device types, application areas, end-user categories, and geographic regions to provide detailed market understanding. Competitive intelligence gathering includes analysis of company financial reports, product launches, and strategic initiatives.

Data validation processes ensure accuracy and reliability of market projections through cross-referencing multiple sources and expert review. MarkWide Research methodology incorporates both quantitative and qualitative research approaches to deliver comprehensive market intelligence.

United States dominance in the North American market reflects the country’s advanced healthcare infrastructure, favorable regulatory environment, and high healthcare spending levels. Market concentration in major metropolitan areas accounts for 78% of total device deployments, driven by healthcare system sophistication and patient demographics.

Canadian market development demonstrates strong growth potential, supported by universal healthcare coverage and increasing emphasis on preventive care approaches. Provincial variations in adoption rates reflect differences in healthcare system priorities and technology integration capabilities.

Regional healthcare networks play crucial roles in market development, with large integrated delivery systems driving standardization and scale adoption. Rural market penetration remains limited but represents significant opportunity for telemedicine-integrated monitoring solutions.

Cross-border collaboration between US and Canadian healthcare organizations facilitates knowledge sharing and best practice development. Regulatory harmonization efforts aim to streamline device approval processes and reduce market entry barriers for innovative technologies.

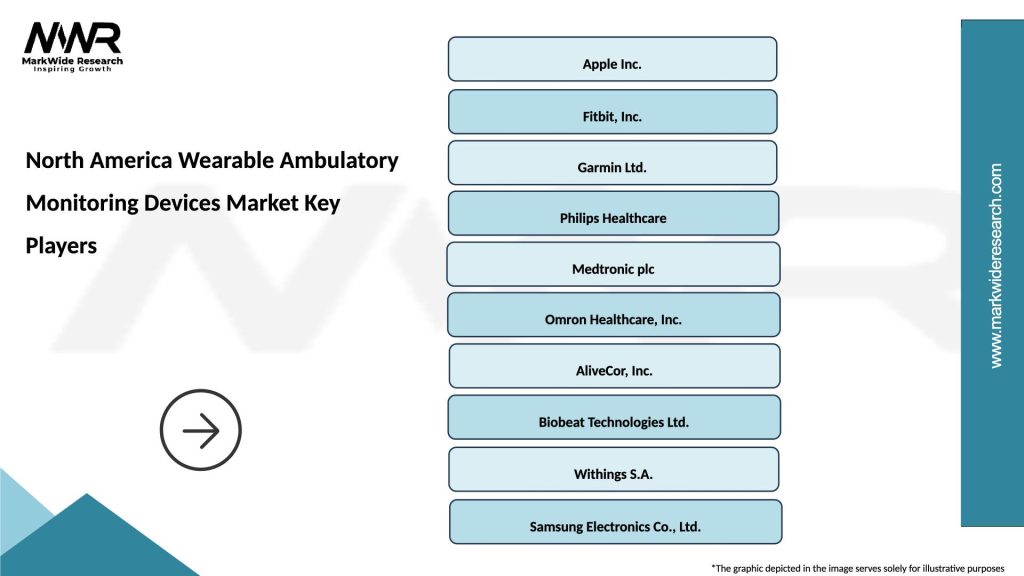

Market leadership is distributed among several key players, each bringing unique strengths and capabilities to the wearable ambulatory monitoring devices sector:

Competitive strategies focus on technological innovation, clinical evidence development, and strategic partnerships with healthcare providers. Market differentiation occurs through device accuracy, user experience, data analytics capabilities, and integration with existing healthcare workflows.

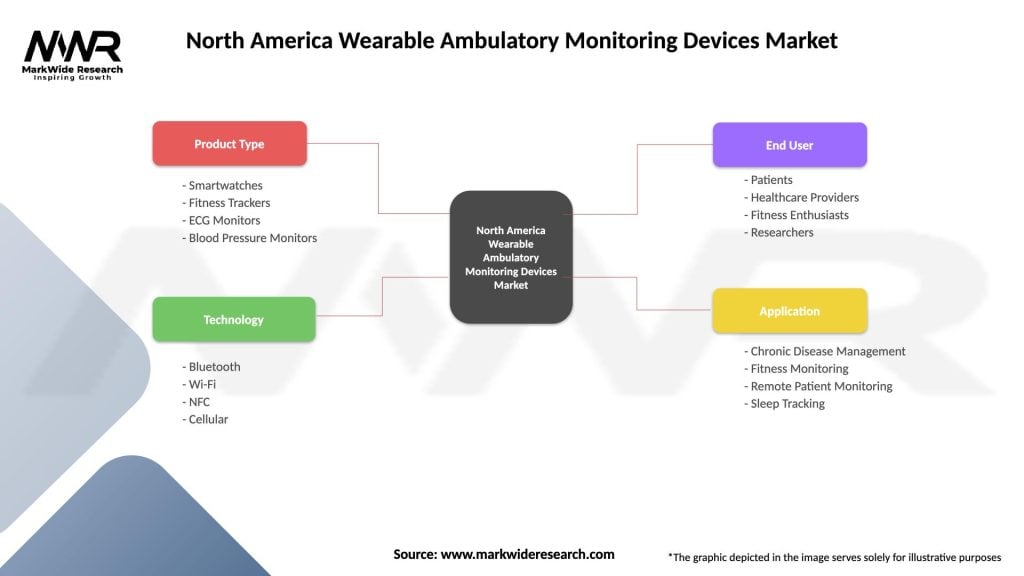

Device type segmentation reveals diverse market opportunities across multiple monitoring applications and patient populations:

By Device Type:

By Application:

By End User:

Cardiac monitoring devices represent the largest market segment, driven by high prevalence of cardiovascular disease and proven clinical benefits of continuous monitoring. Arrhythmia detection capabilities have improved significantly, with modern devices achieving 94% accuracy in identifying clinically significant events.

Glucose monitoring systems demonstrate strong growth momentum, supported by increasing diabetes prevalence and patient preference for continuous monitoring over traditional finger-stick testing. Integration capabilities with insulin delivery systems create comprehensive diabetes management solutions.

Multi-parameter monitoring represents an emerging category with significant growth potential, offering comprehensive health tracking capabilities that appeal to both healthcare providers and patients. Data integration across multiple physiological parameters enables more sophisticated health insights and predictive analytics.

Respiratory monitoring applications have gained prominence, particularly for sleep disorder diagnosis and chronic obstructive pulmonary disease management. Remote monitoring capabilities reduce the need for expensive sleep laboratory studies while maintaining diagnostic accuracy.

Healthcare providers benefit from improved patient outcomes, reduced readmission rates, and enhanced care coordination capabilities through continuous monitoring data. Clinical decision support features enable more informed treatment decisions and timely interventions.

Patients experience improved quality of life through reduced hospital visits, better disease management, and increased independence in managing their health conditions. Early detection capabilities provide peace of mind and enable proactive health management approaches.

Healthcare systems achieve cost savings through reduced emergency interventions, optimized resource utilization, and improved care efficiency. Population health management capabilities enable better understanding of community health trends and needs.

Device manufacturers benefit from expanding market opportunities, recurring revenue models through service contracts, and valuable health data insights. Innovation partnerships with healthcare providers accelerate product development and market validation processes.

Insurance providers realize cost savings through reduced claims for preventable complications and emergency interventions. Risk stratification capabilities enable more accurate underwriting and personalized coverage options.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence integration represents the most significant trend shaping the wearable ambulatory monitoring devices market, with AI-powered analytics enabling predictive health insights and personalized treatment recommendations. Machine learning algorithms continuously improve monitoring accuracy and reduce false alarms.

Miniaturization trends continue to drive device development, with manufacturers creating increasingly compact and comfortable monitoring solutions. Battery life improvements extend monitoring duration and reduce maintenance requirements for both patients and healthcare providers.

Interoperability focus has intensified as healthcare systems seek seamless integration between monitoring devices and electronic health records. Standardization initiatives aim to improve data sharing and reduce implementation complexity across different healthcare settings.

Consumer-grade monitoring capabilities are expanding beyond traditional medical applications to include wellness and fitness tracking. Direct-to-consumer sales channels are growing, with retail pharmacies and online platforms increasing market accessibility.

Subscription service models are emerging as manufacturers seek recurring revenue streams and enhanced customer relationships. Data analytics services provide additional value through population health insights and clinical research applications.

Regulatory milestone achievements include FDA breakthrough device designations for innovative monitoring technologies, accelerating market entry for promising solutions. Clinical study results continue to validate the effectiveness of ambulatory monitoring in improving patient outcomes and reducing healthcare costs.

Strategic partnerships between device manufacturers and healthcare systems have accelerated adoption and integration of monitoring technologies. Technology acquisitions by major medical device companies have consolidated market capabilities and expanded product portfolios.

Reimbursement expansion by Medicare and private insurance providers has improved patient access to monitoring technologies. Coverage decisions increasingly recognize the cost-effectiveness of remote monitoring compared to traditional care delivery methods.

International expansion efforts by North American companies have created global market opportunities and knowledge sharing. Research collaborations between academic institutions and industry partners continue to drive innovation and clinical validation.

MarkWide Research analysis indicates that recent industry developments have significantly strengthened the market foundation for sustained growth and innovation in ambulatory monitoring technologies.

Investment priorities should focus on artificial intelligence capabilities, user experience improvements, and interoperability solutions that address current market limitations. Technology development efforts should emphasize clinical accuracy, device reliability, and seamless integration with existing healthcare workflows.

Market entry strategies should consider partnerships with established healthcare providers and technology companies to accelerate adoption and reduce implementation barriers. Regulatory preparation remains critical for companies seeking to introduce innovative monitoring solutions to the market.

Customer education initiatives should address privacy concerns and demonstrate clear value propositions for both healthcare providers and patients. Training programs for healthcare staff can improve implementation success and maximize technology benefits.

Geographic expansion opportunities exist in underserved markets and rural areas where telemedicine integration can provide significant value. Vertical integration strategies may help companies control quality and reduce costs across the value chain.

Data strategy development should focus on creating valuable insights while maintaining patient privacy and regulatory compliance. Partnership opportunities with health systems and payers can create sustainable business models and improve market access.

Market trajectory indicates continued strong growth driven by technological advancement, demographic trends, and healthcare delivery transformation. Innovation acceleration is expected to continue, with breakthrough technologies emerging in areas such as non-invasive monitoring and predictive analytics.

Adoption rates are projected to increase significantly, with penetration reaching 85% among target patient populations by the end of the forecast period. Geographic expansion will extend market reach to previously underserved areas through telemedicine integration and mobile health initiatives.

Technology convergence with other digital health solutions will create comprehensive care ecosystems that maximize patient value and clinical outcomes. Artificial intelligence capabilities will become standard features, enabling sophisticated health prediction and personalized treatment recommendations.

Regulatory evolution is expected to continue supporting innovation while ensuring patient safety and data security. Reimbursement expansion will improve market accessibility and accelerate adoption across diverse healthcare settings.

MWR projections suggest that the market will experience sustained growth momentum, driven by continuous innovation and expanding applications across the healthcare continuum. Market maturation will bring increased standardization and improved interoperability, reducing implementation barriers for healthcare providers.

North America’s wearable ambulatory monitoring devices market represents a dynamic and rapidly evolving sector with significant growth potential driven by demographic trends, technological advancement, and healthcare delivery transformation. Market fundamentals remain strong, supported by proven clinical benefits, expanding reimbursement coverage, and continuous innovation in device capabilities.

Competitive landscape dynamics favor companies that can successfully integrate advanced technologies with user-friendly designs and comprehensive healthcare system integration. Future success will depend on addressing current market challenges including interoperability, cost-effectiveness, and user adoption while capitalizing on emerging opportunities in artificial intelligence and predictive analytics.

Strategic positioning for market participants should focus on developing comprehensive solutions that address the full spectrum of ambulatory monitoring needs while maintaining clinical accuracy and regulatory compliance. Long-term market outlook remains highly positive, with sustained growth expected across all major market segments and geographic regions throughout the forecast period.

What is Wearable Ambulatory Monitoring Devices?

Wearable Ambulatory Monitoring Devices are portable health monitoring tools that allow for continuous tracking of vital signs and health metrics. These devices are commonly used in healthcare settings to monitor patients’ conditions remotely and can include features like heart rate monitoring, blood pressure tracking, and activity logging.

What are the key players in the North America Wearable Ambulatory Monitoring Devices Market?

Key players in the North America Wearable Ambulatory Monitoring Devices Market include companies like Fitbit, Apple, and Garmin, which offer a range of health monitoring solutions. Other notable companies include Philips and Medtronic, among others.

What are the growth factors driving the North America Wearable Ambulatory Monitoring Devices Market?

The growth of the North America Wearable Ambulatory Monitoring Devices Market is driven by increasing health awareness, the rise in chronic diseases, and advancements in technology. Additionally, the demand for remote patient monitoring solutions is propelling market expansion.

What challenges does the North America Wearable Ambulatory Monitoring Devices Market face?

Challenges in the North America Wearable Ambulatory Monitoring Devices Market include data privacy concerns, regulatory hurdles, and the need for interoperability among devices. These factors can hinder widespread adoption and integration into healthcare systems.

What opportunities exist in the North America Wearable Ambulatory Monitoring Devices Market?

Opportunities in the North America Wearable Ambulatory Monitoring Devices Market include the development of advanced analytics for health data, integration with telehealth services, and the potential for personalized medicine. These trends can enhance patient care and improve health outcomes.

What trends are shaping the North America Wearable Ambulatory Monitoring Devices Market?

Trends in the North America Wearable Ambulatory Monitoring Devices Market include the increasing use of artificial intelligence for health monitoring, the rise of fitness-focused wearables, and the growing emphasis on preventive healthcare. These innovations are transforming how health data is collected and utilized.

North America Wearable Ambulatory Monitoring Devices Market

| Segmentation Details | Description |

|---|---|

| Product Type | Smartwatches, Fitness Trackers, ECG Monitors, Blood Pressure Monitors |

| Technology | Bluetooth, Wi-Fi, NFC, Cellular |

| End User | Patients, Healthcare Providers, Fitness Enthusiasts, Researchers |

| Application | Chronic Disease Management, Fitness Monitoring, Remote Patient Monitoring, Sleep Tracking |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the North America Wearable Ambulatory Monitoring Devices Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at