444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Europe retail market represents one of the world’s most sophisticated and diverse commercial landscapes, encompassing traditional brick-and-mortar establishments, e-commerce platforms, and innovative omnichannel retail experiences. This dynamic sector spans across multiple countries with varying consumer preferences, regulatory frameworks, and economic conditions, creating a complex yet lucrative environment for retailers and stakeholders.

Market dynamics in European retail are characterized by rapid digital transformation, sustainability initiatives, and evolving consumer behaviors that have been accelerated by recent global events. The region’s retail ecosystem includes everything from luxury boutiques in Paris and Milan to discount chains across Eastern Europe, demonstrating remarkable diversity in retail formats and consumer segments.

Growth trajectories across the European retail landscape show significant variation by country and sector, with e-commerce penetration reaching 15.8% of total retail sales and continuing to expand rapidly. The integration of digital technologies, artificial intelligence, and data analytics has become crucial for retailers seeking to maintain competitive advantage in this evolving marketplace.

Regional variations play a significant role in shaping retail strategies, with Western European markets showing mature retail infrastructures while Eastern European countries present substantial growth opportunities. The sector’s resilience and adaptability have been tested through various economic challenges, demonstrating the fundamental strength of European consumer markets.

The Europe retail market refers to the comprehensive ecosystem of businesses engaged in selling goods and services directly to consumers across European countries, encompassing both physical and digital retail channels. This market includes department stores, specialty retailers, supermarkets, hypermarkets, convenience stores, e-commerce platforms, and emerging retail formats that serve diverse consumer needs.

Retail operations within this market span multiple sectors including fashion and apparel, food and beverages, electronics, home improvement, health and beauty, and automotive retail. The European retail landscape is characterized by its regulatory complexity, with each country maintaining distinct consumer protection laws, taxation systems, and business regulations that retailers must navigate.

Digital transformation has fundamentally redefined the meaning of retail in Europe, with traditional boundaries between online and offline shopping becoming increasingly blurred. Modern European retail encompasses omnichannel experiences, mobile commerce, social commerce, and innovative technologies such as augmented reality and artificial intelligence-powered personalization.

Strategic positioning within the European retail market requires understanding of diverse consumer preferences, regulatory environments, and competitive landscapes across multiple countries. The market demonstrates strong fundamentals with consistent consumer spending patterns, though growth rates vary significantly between regions and retail categories.

Key performance indicators show that European retail continues evolving toward sustainability-focused business models, with 73% of consumers indicating willingness to pay premium prices for environmentally responsible products. This shift represents both opportunity and challenge for retailers adapting their operations and supply chains.

Technology adoption across European retail has accelerated dramatically, with mobile commerce representing 42% of all e-commerce transactions in major markets. Retailers investing in digital infrastructure, data analytics, and customer experience technologies are positioning themselves for sustained competitive advantage.

Market consolidation trends indicate increasing importance of scale and operational efficiency, while simultaneously creating opportunities for niche players and innovative retail concepts. The balance between large-scale operations and personalized customer experiences continues shaping strategic decisions across the sector.

Consumer behavior patterns across European retail markets reveal several critical insights that shape strategic planning and operational decisions:

Digital transformation initiatives serve as primary catalysts driving European retail market evolution. The integration of advanced technologies including artificial intelligence, machine learning, and Internet of Things devices enables retailers to optimize operations, enhance customer experiences, and develop data-driven strategies that improve competitive positioning.

Consumer lifestyle changes significantly influence retail market dynamics, with urbanization trends, changing work patterns, and demographic shifts creating new shopping behaviors and preferences. The growing emphasis on convenience, personalization, and time-saving solutions drives demand for innovative retail formats and service offerings.

Sustainability imperatives increasingly drive retail market development as consumers, regulators, and investors prioritize environmental responsibility. Retailers implementing circular economy principles, reducing carbon footprints, and offering sustainable product alternatives gain competitive advantages while meeting evolving stakeholder expectations.

Economic recovery patterns following global disruptions create opportunities for retail market expansion, particularly in sectors benefiting from pent-up consumer demand and changing spending patterns. Government stimulus measures and supportive monetary policies contribute to consumer confidence and spending capacity across European markets.

Cross-border commerce growth facilitated by improved logistics networks, payment systems, and regulatory harmonization enables retailers to expand market reach and access new customer segments. The development of pan-European retail strategies becomes increasingly viable and attractive for ambitious retailers.

Regulatory complexity across European countries creates significant challenges for retailers seeking to expand operations or implement standardized business models. Varying taxation systems, labor laws, consumer protection regulations, and data privacy requirements increase operational costs and complexity for multi-country retail operations.

Economic uncertainties including inflation pressures, currency fluctuations, and geopolitical tensions impact consumer spending patterns and retail profitability. These factors create challenges for inventory management, pricing strategies, and long-term business planning across European retail markets.

Supply chain disruptions continue affecting retail operations through increased costs, delivery delays, and inventory management challenges. Global supply chain vulnerabilities exposed during recent crises require retailers to develop more resilient and flexible sourcing strategies, often at higher operational costs.

Intense competition from both traditional retailers and new market entrants creates pressure on profit margins and requires continuous investment in differentiation strategies. The rise of direct-to-consumer brands and platform-based retailers intensifies competitive dynamics across multiple retail categories.

Labor market constraints including skills shortages, wage inflation, and changing work preferences impact retail operations, particularly in customer service, logistics, and technology roles. These challenges require retailers to invest in employee development, automation technologies, and innovative workforce management strategies.

Emerging market segments present substantial growth opportunities for European retailers willing to innovate and adapt their business models. The development of new retail categories, niche markets, and specialized services creates avenues for differentiation and market expansion beyond traditional retail boundaries.

Technology integration opportunities enable retailers to enhance operational efficiency, improve customer experiences, and develop new revenue streams. Investment in artificial intelligence, augmented reality, blockchain technology, and advanced analytics creates competitive advantages and operational improvements.

Sustainability-focused retail models represent growing market opportunities as consumers increasingly prioritize environmental responsibility. Retailers developing circular economy initiatives, sustainable product lines, and carbon-neutral operations can capture market share while meeting evolving consumer expectations.

Cross-border expansion potential within European markets offers growth opportunities for successful retailers seeking to leverage their expertise and brand recognition across multiple countries. Improved logistics infrastructure and digital payment systems facilitate international retail expansion strategies.

Partnership and collaboration opportunities with technology providers, logistics companies, and complementary businesses enable retailers to enhance capabilities while sharing risks and costs. Strategic alliances can accelerate innovation adoption and market penetration across European retail markets.

Competitive forces within European retail markets create dynamic environments where traditional retail models compete with innovative digital-native brands and international market entrants. This competition drives continuous innovation in customer experience, operational efficiency, and business model development across the sector.

Consumer empowerment through digital technologies and information access shifts power dynamics between retailers and customers. Modern consumers expect transparency, personalization, and value, requiring retailers to adapt strategies and operations to meet these elevated expectations while maintaining profitability.

Technology disruption continues reshaping retail market dynamics through automation, artificial intelligence, and data analytics capabilities. According to MarkWide Research analysis, retailers implementing advanced technology solutions achieve 23% improvement in operational efficiency compared to traditional approaches.

Supply chain evolution toward more resilient, sustainable, and efficient models influences retail market dynamics. The development of local sourcing strategies, automated fulfillment centers, and last-mile delivery innovations creates new competitive advantages and operational requirements.

Regulatory developments including data protection laws, sustainability requirements, and consumer protection measures continue shaping retail market dynamics. Retailers must balance compliance requirements with business objectives while maintaining competitive positioning in evolving regulatory environments.

Primary research approaches utilized in analyzing European retail markets include comprehensive surveys of industry participants, in-depth interviews with retail executives, and consumer behavior studies across multiple European countries. These methodologies provide direct insights into market trends, challenges, and opportunities from key stakeholders.

Secondary research components encompass analysis of industry reports, government statistics, financial statements, and regulatory documents from relevant European authorities. This approach ensures comprehensive coverage of market data, regulatory developments, and economic factors influencing retail market dynamics.

Data validation processes involve cross-referencing multiple sources, conducting expert interviews, and applying statistical analysis techniques to ensure accuracy and reliability of market insights. The methodology includes regular updates to reflect changing market conditions and emerging trends.

Market segmentation analysis employs both quantitative and qualitative research methods to identify distinct retail categories, consumer segments, and regional variations. This approach enables detailed understanding of market structure and growth opportunities across different retail sectors and geographic markets.

Trend analysis methodologies combine historical data analysis with forward-looking projections based on identified market drivers, technological developments, and consumer behavior patterns. These approaches provide insights into likely market evolution and strategic implications for retail industry participants.

Western European markets including Germany, France, United Kingdom, and Italy represent mature retail landscapes with sophisticated consumer bases and established retail infrastructures. These markets demonstrate stable growth rates with emphasis on premium products, sustainability, and omnichannel retail experiences.

Northern European countries such as Sweden, Denmark, and Norway lead in digital retail adoption and sustainability initiatives, with 89% of consumers regularly using digital payment methods and mobile shopping applications. These markets serve as testing grounds for innovative retail technologies and sustainable business models.

Eastern European markets including Poland, Czech Republic, and Hungary present significant growth opportunities with expanding middle-class populations and increasing consumer spending power. Retail penetration in these markets continues growing, with modern retail formats gaining market share from traditional retail channels.

Southern European markets encompassing Spain, Portugal, and Greece show recovery trends with tourism-dependent retail sectors benefiting from increased travel and consumer confidence. These markets demonstrate growing e-commerce adoption rates and interest in international retail brands.

Cross-regional trends indicate convergence in consumer preferences for sustainability, digital integration, and personalized shopping experiences, while maintaining distinct cultural and economic characteristics that influence local retail strategies and market approaches.

Market leadership in European retail is distributed among various categories of companies, from traditional department store chains to innovative e-commerce platforms and specialized retailers. The competitive environment encourages continuous innovation and strategic differentiation across multiple retail segments.

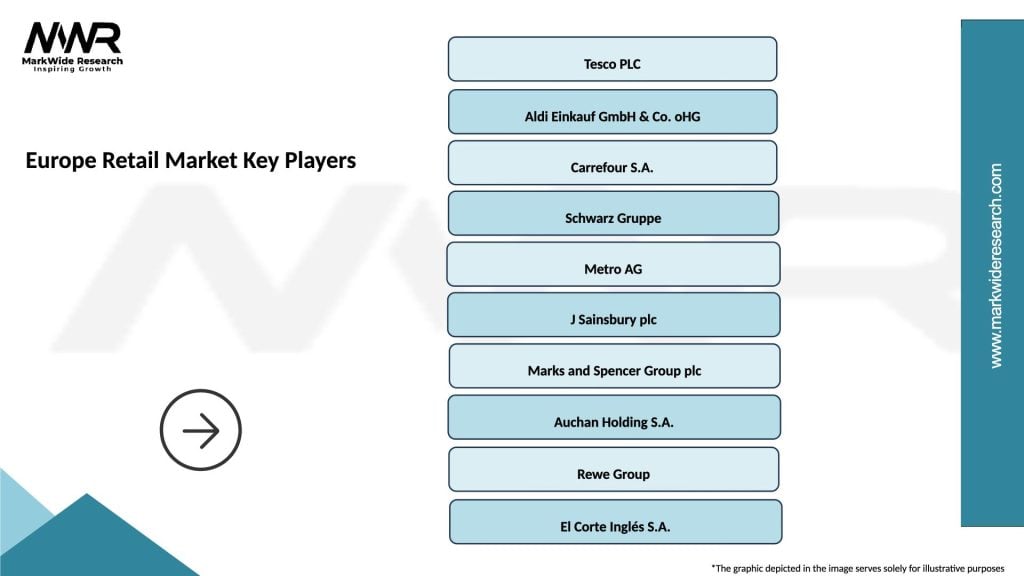

Key market participants include established European retailers, international retail chains, and emerging digital-native brands:

Competitive strategies focus on digital transformation, sustainability initiatives, customer experience enhancement, and operational efficiency improvements. Successful retailers demonstrate ability to adapt to changing market conditions while maintaining brand identity and customer loyalty.

By Retail Format:

By Product Category:

By Geography:

Fashion and Apparel Retail demonstrates strong performance across European markets with increasing focus on sustainability, ethical sourcing, and circular economy principles. Fast fashion retailers face growing pressure to adopt more sustainable practices while maintaining competitive pricing and trend responsiveness.

Food and Beverage Retail shows resilience and consistent growth with consumers prioritizing quality, convenience, and health-conscious options. The sector benefits from growing interest in organic products, local sourcing, and specialty food categories that command premium pricing.

Electronics Retail experiences rapid evolution driven by technological advancement and changing consumer preferences for smart devices, gaming equipment, and home automation systems. Retailers in this category must balance inventory management with rapid product lifecycle changes.

Home and Garden Retail benefits from increased consumer investment in home improvement and outdoor living spaces. The category shows strong growth in DIY products, sustainable materials, and smart home technologies that enhance living experiences.

Health and Beauty Retail demonstrates consistent growth with consumers increasingly focused on personal wellness, natural products, and personalized beauty solutions. The category benefits from aging populations and growing awareness of health and wellness importance.

Automotive Retail undergoes significant transformation with electric vehicle adoption, changing mobility preferences, and evolving consumer relationships with vehicle ownership. Traditional automotive retailers adapt business models to include services, subscriptions, and alternative mobility solutions.

Retailers operating in European markets benefit from access to affluent consumer bases, sophisticated retail infrastructure, and supportive regulatory environments that protect intellectual property and ensure fair competition. The diversity of European markets enables retailers to test different strategies and scale successful approaches across multiple countries.

Suppliers and Manufacturers gain access to large, stable markets with predictable demand patterns and established distribution networks. European retail markets provide opportunities for premium positioning, brand building, and long-term partnership development with major retail chains.

Technology Providers benefit from European retailers’ willingness to invest in innovative solutions, data analytics, and customer experience technologies. The region’s focus on digital transformation creates substantial opportunities for companies offering retail technology solutions and services.

Logistics and Supply Chain Companies capitalize on growing e-commerce volumes, cross-border trade, and demand for efficient, sustainable delivery solutions. European retail markets drive innovation in last-mile delivery, warehouse automation, and supply chain optimization.

Real Estate Investors benefit from stable retail property markets, particularly in prime locations and modern retail formats. The evolution toward omnichannel retail creates opportunities in logistics real estate, urban fulfillment centers, and experiential retail spaces.

Financial Services Providers gain opportunities through growing demand for payment solutions, consumer credit, and retail financing options. The expansion of digital payments and alternative payment methods creates new revenue streams and partnership opportunities.

Strengths:

Weaknesses:

Opportunities:

Threats:

Omnichannel Integration continues accelerating across European retail markets as consumers expect seamless experiences across digital and physical touchpoints. Retailers invest heavily in technology infrastructure, inventory management systems, and customer data platforms to deliver consistent brand experiences regardless of shopping channel.

Sustainability Transformation becomes central to retail strategy with consumers increasingly prioritizing environmental responsibility in purchasing decisions. Retailers implement circular economy principles, reduce packaging waste, and develop sustainable product lines to meet evolving consumer expectations and regulatory requirements.

Personalization Technologies enable retailers to deliver customized shopping experiences through artificial intelligence, machine learning, and advanced data analytics. MWR research indicates that personalized retail experiences generate 31% higher customer satisfaction rates compared to generic approaches.

Local and Artisanal Products gain popularity as consumers seek authentic, unique products that support local communities and small businesses. This trend creates opportunities for retailers to differentiate through curated selections and partnerships with local producers and artisans.

Social Commerce Growth transforms how consumers discover and purchase products, with social media platforms becoming important retail channels. Retailers develop social commerce strategies that leverage influencer partnerships, user-generated content, and social media advertising to reach target audiences.

Subscription and Service Models expand beyond traditional product sales to include recurring revenue streams and value-added services. Retailers explore subscription boxes, membership programs, and service offerings that enhance customer relationships and improve revenue predictability.

Digital Payment Innovation accelerates across European retail markets with contactless payments, mobile wallets, and buy-now-pay-later options becoming standard customer expectations. Retailers invest in payment technology infrastructure to support diverse payment preferences and enhance checkout experiences.

Warehouse Automation implementation increases as retailers seek to improve fulfillment efficiency and reduce labor costs. Advanced robotics, automated sorting systems, and artificial intelligence-powered inventory management enable faster order processing and improved accuracy in retail operations.

Sustainable Packaging Solutions development responds to consumer environmental concerns and regulatory pressures. Retailers collaborate with suppliers to reduce packaging waste, implement recyclable materials, and develop innovative packaging solutions that maintain product protection while minimizing environmental impact.

Augmented Reality Integration enhances customer experiences through virtual try-on capabilities, product visualization, and interactive shopping experiences. Retailers in fashion, furniture, and beauty categories particularly benefit from AR technologies that help customers make confident purchasing decisions.

Voice Commerce Adoption grows as smart speakers and voice assistants become more prevalent in European households. Retailers develop voice-enabled shopping capabilities and optimize product information for voice search to capture this emerging commerce channel.

Micro-Fulfillment Centers deployment enables retailers to bring inventory closer to customers, reducing delivery times and costs while improving customer satisfaction. These smaller, automated fulfillment facilities support last-mile delivery optimization and omnichannel inventory management.

Investment Prioritization should focus on digital transformation initiatives that enhance customer experience and operational efficiency. Retailers should allocate resources toward omnichannel integration, data analytics capabilities, and customer relationship management systems that provide competitive advantages in evolving market conditions.

Market Entry Strategies for new retailers should emphasize understanding local consumer preferences, regulatory requirements, and competitive dynamics in target European countries. Successful market entry requires careful analysis of cultural nuances, pricing strategies, and distribution channel preferences specific to each market.

Sustainability Integration should become core to business strategy rather than peripheral initiative. Retailers should develop comprehensive sustainability programs that encompass supply chain management, product development, operations, and customer engagement to meet growing environmental expectations.

Technology Adoption should balance innovation with practical implementation, focusing on technologies that directly improve customer experience or operational efficiency. Retailers should prioritize technology investments that provide measurable returns and align with long-term strategic objectives.

Partnership Development with technology providers, logistics companies, and complementary businesses can accelerate capability development while sharing risks and costs. Strategic partnerships enable retailers to access specialized expertise and resources without significant capital investment.

Customer Data Strategy should prioritize privacy compliance while maximizing insights for personalization and business optimization. Retailers must balance data utilization with consumer privacy expectations and regulatory requirements across European markets.

Market evolution in European retail will continue toward more integrated, sustainable, and technology-enabled business models that prioritize customer experience and operational efficiency. The sector’s growth trajectory indicates sustained expansion driven by digital transformation, changing consumer preferences, and innovative retail concepts.

Technology integration will accelerate across all retail categories, with artificial intelligence, machine learning, and automation becoming standard operational components rather than competitive differentiators. Retailers investing early in technology infrastructure will maintain advantages as these capabilities become market requirements.

Sustainability requirements will intensify through both consumer demand and regulatory mandates, requiring retailers to fundamentally restructure operations, supply chains, and product offerings. Companies demonstrating genuine commitment to environmental responsibility will capture increasing market share from traditional retailers.

Cross-border commerce will expand as logistics infrastructure improves and regulatory barriers decrease, enabling successful retailers to scale operations across multiple European countries more efficiently. This trend will favor retailers with strong digital capabilities and adaptable business models.

Consumer expectations will continue evolving toward more personalized, convenient, and value-driven shopping experiences that seamlessly integrate digital and physical touchpoints. Retailers meeting these expectations while maintaining operational efficiency will achieve sustainable competitive advantages in European markets.

The European retail market represents a dynamic and sophisticated commercial environment that continues evolving through digital transformation, sustainability initiatives, and changing consumer behaviors. This comprehensive analysis reveals a sector characterized by both significant opportunities and complex challenges that require strategic thinking and operational excellence.

Market fundamentals remain strong across European retail sectors, supported by affluent consumer bases, advanced infrastructure, and regulatory frameworks that encourage innovation while protecting consumer interests. The diversity of European markets provides retailers with opportunities to test strategies, scale successful approaches, and build resilient business models.

Future success in European retail markets will depend on retailers’ ability to balance traditional retail excellence with innovative technologies, sustainable practices, and evolving consumer expectations. Companies that successfully integrate omnichannel capabilities, sustainability initiatives, and personalized customer experiences will capture disproportionate market share and achieve sustainable growth in this competitive landscape.

What is Europe Retail?

Europe Retail refers to the sector involved in the sale of goods and services to consumers in Europe. This includes various formats such as supermarkets, department stores, online retail, and specialty shops.

What are the key players in the Europe Retail Market?

Key players in the Europe Retail Market include companies like Tesco, Aldi, and Carrefour, which operate large retail chains across multiple countries. Additionally, e-commerce giants like Amazon also play a significant role in shaping the retail landscape, among others.

What are the main drivers of growth in the Europe Retail Market?

The main drivers of growth in the Europe Retail Market include the increasing adoption of e-commerce, changing consumer preferences towards convenience, and the rise of mobile shopping. Additionally, innovations in supply chain management and logistics are enhancing retail efficiency.

What challenges does the Europe Retail Market face?

The Europe Retail Market faces challenges such as intense competition, changing regulations, and the impact of economic fluctuations on consumer spending. Additionally, the shift towards sustainable practices is pushing retailers to adapt their operations.

What opportunities exist in the Europe Retail Market?

Opportunities in the Europe Retail Market include the expansion of online shopping platforms, the integration of technology in retail experiences, and the growing demand for sustainable and ethically sourced products. Retailers can leverage these trends to attract new customers.

What trends are shaping the Europe Retail Market?

Trends shaping the Europe Retail Market include the rise of omnichannel retailing, personalization of shopping experiences, and the increasing importance of sustainability in consumer choices. Retailers are also focusing on enhancing customer engagement through digital platforms.

Europe Retail Market

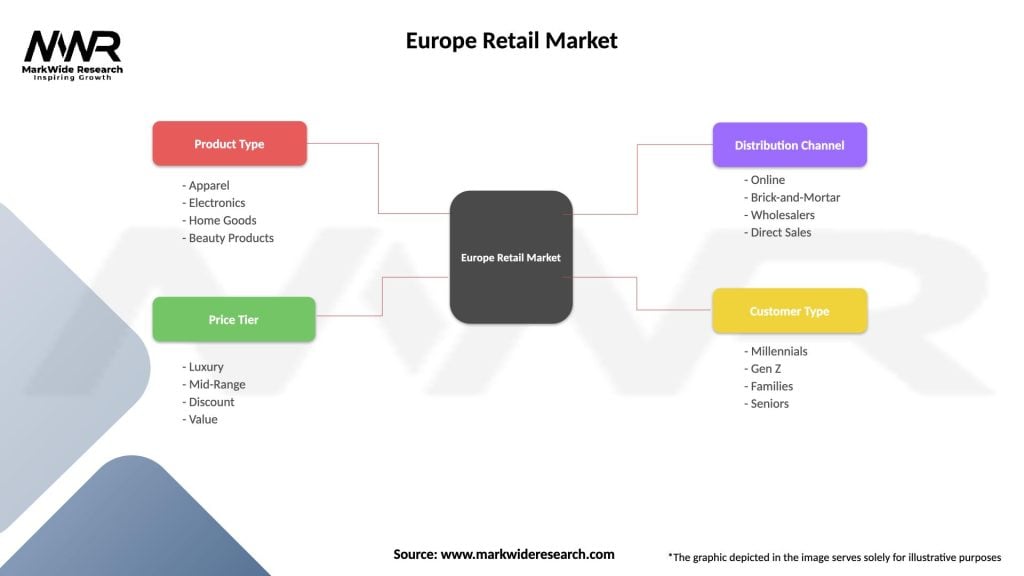

| Segmentation Details | Description |

|---|---|

| Product Type | Apparel, Electronics, Home Goods, Beauty Products |

| Price Tier | Luxury, Mid-Range, Discount, Value |

| Distribution Channel | Online, Brick-and-Mortar, Wholesalers, Direct Sales |

| Customer Type | Millennials, Gen Z, Families, Seniors |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Europe Retail Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at