444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2150

The Smart Grid in India market represents a transformative shift in the country’s electrical infrastructure, driven by the urgent need for efficient power distribution and renewable energy integration. India’s smart grid initiatives are experiencing unprecedented growth as the nation grapples with increasing energy demands, grid modernization requirements, and sustainability goals. The market encompasses advanced metering infrastructure, distribution automation, demand response systems, and grid analytics solutions that collectively enhance power system reliability and efficiency.

Government initiatives such as the National Smart Grid Mission and various state-level programs are accelerating adoption across urban and rural areas. The market is witnessing a compound annual growth rate of 18.5%, reflecting the substantial investment in grid modernization projects. Key drivers include the integration of renewable energy sources, reduction of transmission and distribution losses, and the need for real-time monitoring capabilities.

Technological advancement in areas such as Internet of Things (IoT), artificial intelligence, and advanced analytics is reshaping India’s power sector landscape. The market spans multiple segments including smart meters, grid automation systems, energy management platforms, and cybersecurity solutions specifically designed for critical infrastructure protection.

The Smart Grid in India market refers to the comprehensive ecosystem of intelligent electrical grid technologies, infrastructure, and services designed to modernize India’s power distribution network through digital communication, automation, and advanced monitoring capabilities. This market encompasses the deployment of smart meters, grid sensors, communication networks, data analytics platforms, and control systems that enable bidirectional power flow, real-time monitoring, and automated response to grid conditions.

Smart grid technology transforms traditional electrical grids into intelligent networks capable of integrating renewable energy sources, managing demand fluctuations, and providing consumers with detailed energy consumption insights. The market includes hardware components such as advanced metering infrastructure, software solutions for grid management, and services related to system integration, maintenance, and cybersecurity.

India’s smart grid market is positioned for exceptional growth as the country undertakes one of the world’s largest grid modernization initiatives. The market is characterized by substantial government backing, increasing private sector participation, and growing consumer awareness about energy efficiency. Key market segments include advanced metering infrastructure, which currently holds approximately 45% market share, followed by distribution automation and demand response systems.

Regional deployment is expanding rapidly across major metropolitan areas and tier-2 cities, with pilot projects demonstrating significant improvements in grid reliability and energy efficiency. The market benefits from favorable regulatory frameworks, including net metering policies and renewable energy mandates that drive smart grid adoption. Technology integration challenges and high initial investment costs remain primary considerations for market participants.

Competitive dynamics feature a mix of international technology providers, domestic equipment manufacturers, and system integrators working collaboratively on large-scale deployment projects. The market is expected to witness continued expansion driven by urbanization, industrial growth, and India’s commitment to achieving carbon neutrality goals.

Strategic market insights reveal several critical trends shaping the Smart Grid in India market landscape:

Primary market drivers propelling the Smart Grid in India market include the urgent need for grid modernization to address increasing power demand and reduce transmission losses. Government initiatives such as the National Smart Grid Mission, which aims to deploy smart grids across the country, provide substantial momentum through policy support and funding mechanisms.

Renewable energy integration requirements serve as a critical driver, as India pursues ambitious clean energy targets requiring intelligent grid management capabilities. The country’s commitment to installing renewable energy capacity necessitates advanced grid infrastructure capable of managing variable power generation and bidirectional energy flows.

Urbanization trends and smart city development initiatives create demand for sophisticated energy management systems that can handle complex urban power requirements. Industrial growth and the expansion of manufacturing sectors drive the need for reliable, efficient power distribution systems with real-time monitoring capabilities.

Consumer awareness about energy efficiency and cost savings motivates adoption of smart metering and demand response programs. Technological advancement in areas such as IoT, artificial intelligence, and communication technologies makes smart grid deployment more feasible and cost-effective than traditional alternatives.

Significant market restraints include the substantial capital investment requirements for comprehensive smart grid deployment, which can strain utility budgets and require complex financing arrangements. Technical challenges related to integrating legacy infrastructure with modern smart grid components create implementation complexities and potential compatibility issues.

Cybersecurity concerns represent a major restraint as utilities must invest heavily in protective technologies and protocols to secure critical infrastructure against potential threats. Skilled workforce shortages in areas such as grid automation, data analytics, and cybersecurity limit the pace of deployment and ongoing system management.

Regulatory complexities across different states and jurisdictions can create deployment challenges and require extensive coordination between multiple stakeholders. Consumer resistance to new technologies, particularly in rural areas, may slow adoption rates and require extensive education and engagement programs.

Interoperability issues between different technology platforms and vendors can complicate system integration and limit flexibility in technology selection. Grid stability concerns during transition periods may require careful planning and phased implementation approaches to maintain reliable power supply.

Substantial market opportunities exist in the development of indigenous smart grid technologies and solutions tailored specifically for Indian market conditions. Technology localization initiatives present opportunities for domestic manufacturers to develop cost-effective solutions while reducing import dependency and creating local employment.

Rural electrification programs offer significant opportunities for innovative smart grid deployment models that can extend advanced grid benefits to remote and underserved areas. Microgrid development for industrial complexes, commercial establishments, and residential communities creates new market segments with substantial growth potential.

Energy storage integration opportunities are expanding as battery technology costs decline and grid-scale storage becomes more economically viable. Electric vehicle infrastructure development creates demand for smart charging solutions and vehicle-to-grid technologies that can enhance grid flexibility and efficiency.

Data analytics services and artificial intelligence applications for grid optimization present high-value opportunities for technology companies and service providers. Public-private partnerships offer collaborative opportunities for risk sharing and accelerated deployment of smart grid infrastructure across multiple regions.

Market dynamics in the Smart Grid in India sector are characterized by rapid technological evolution and increasing government support for grid modernization initiatives. Competitive pressures are intensifying as both international and domestic players vie for market share in this expanding sector, leading to innovation and cost optimization efforts.

Regulatory environment continues to evolve with new policies and standards being developed to support smart grid deployment while ensuring grid security and consumer protection. Technology convergence between telecommunications, information technology, and power systems is creating new possibilities for integrated solutions and services.

Investment patterns show increasing private sector participation alongside government funding, with utilities exploring innovative financing models to accelerate deployment. Consumer behavior is shifting toward greater energy awareness and demand for transparency in energy consumption and billing, driving adoption of smart metering solutions.

Supply chain dynamics are evolving with emphasis on local manufacturing and technology transfer agreements to support domestic industry development. Skill development initiatives are expanding to address workforce requirements for smart grid deployment and maintenance, creating new career opportunities in the energy sector.

Comprehensive research methodology employed for analyzing the Smart Grid in India market combines primary and secondary research approaches to ensure accuracy and depth of market insights. Primary research includes extensive interviews with utility executives, technology providers, government officials, and industry experts to gather firsthand perspectives on market trends and challenges.

Secondary research encompasses analysis of government reports, regulatory documents, industry publications, and company financial statements to establish market baseline data and validate primary research findings. Data triangulation methods are employed to cross-verify information from multiple sources and ensure reliability of market assessments.

Market modeling techniques incorporate statistical analysis, trend extrapolation, and scenario planning to develop accurate market projections and identify key growth drivers. Regional analysis methodology includes state-wise assessment of smart grid initiatives, regulatory frameworks, and deployment progress to provide granular market insights.

Technology assessment involves evaluation of emerging technologies, patent analysis, and innovation tracking to identify future market opportunities and competitive dynamics. Stakeholder mapping and value chain analysis provide comprehensive understanding of market structure and participant relationships.

Regional market distribution across India shows significant variation in smart grid adoption and deployment progress, with metropolitan areas and progressive states leading implementation efforts. Northern regions including Delhi, Punjab, and Haryana account for approximately 28% of smart grid deployments, driven by high power demand and supportive state policies.

Western India represents the largest market segment with 35% market share, led by Maharashtra, Gujarat, and Rajasthan, which have implemented comprehensive smart grid programs and renewable energy integration initiatives. Southern states including Karnataka, Tamil Nadu, and Andhra Pradesh contribute 25% of market activity, focusing on technology innovation and pilot project development.

Eastern regions show growing momentum with 12% market participation, as states like West Bengal and Odisha initiate smart grid modernization programs. Rural deployment initiatives are expanding across all regions, with particular emphasis on integrating renewable energy sources and improving grid reliability in remote areas.

State-level variations in regulatory frameworks, utility structures, and funding mechanisms create diverse market conditions requiring tailored deployment strategies. Urban-rural divide influences technology selection and implementation approaches, with cities focusing on advanced automation while rural areas emphasize basic smart metering and reliability improvements.

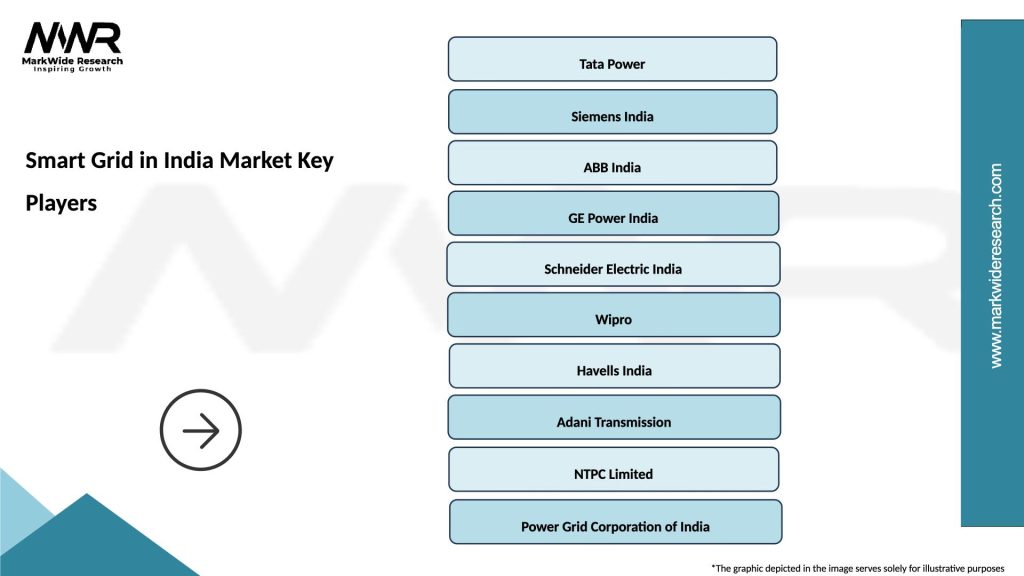

Competitive landscape in the Smart Grid in India market features a diverse mix of international technology leaders, domestic equipment manufacturers, and specialized service providers competing across multiple market segments:

Market competition is intensifying as companies develop India-specific solutions and establish local manufacturing capabilities to meet growing demand and government localization requirements.

Market segmentation of the Smart Grid in India market reveals distinct categories based on technology, application, and end-user requirements:

By Technology:

By Application:

Advanced Metering Infrastructure represents the largest market category, driven by government mandates for smart meter deployment and utility requirements for accurate billing and consumption monitoring. AMI systems are experiencing rapid adoption with deployment rates increasing by 22% annually across major urban centers and industrial areas.

Distribution automation category shows strong growth potential as utilities prioritize grid reliability and operational efficiency improvements. Automated switching systems and fault detection technologies are becoming essential components of modern grid infrastructure, particularly in areas prone to power outages and grid instability.

Demand response systems are gaining traction as utilities seek to manage peak demand and integrate variable renewable energy sources. Consumer engagement platforms and automated load control systems are showing 15% adoption growth among commercial and industrial customers seeking energy cost optimization.

Grid analytics and artificial intelligence applications represent high-growth categories as utilities recognize the value of data-driven grid management and predictive maintenance capabilities. Energy storage integration is emerging as a critical category for grid stability and renewable energy optimization, with deployment rates accelerating in renewable-rich regions.

Utility companies benefit from smart grid deployment through improved operational efficiency, reduced transmission and distribution losses, and enhanced grid reliability. Operational cost savings of up to 20% are achievable through automated systems and predictive maintenance capabilities that minimize outages and optimize resource utilization.

Consumers gain access to real-time energy consumption data, enabling informed decisions about energy usage and cost management. Energy savings of 10-15% are typical for residential customers using smart grid technologies and demand response programs effectively.

Technology providers benefit from expanding market opportunities, long-term service contracts, and the potential for innovation in emerging areas such as grid analytics and cybersecurity. Government stakeholders achieve policy objectives related to energy security, environmental sustainability, and economic development through smart grid initiatives.

Industrial customers benefit from improved power quality, reduced downtime, and opportunities for energy cost optimization through demand management programs. Environmental benefits include reduced carbon emissions through improved grid efficiency and enhanced renewable energy integration capabilities.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence integration is emerging as a dominant trend, with utilities implementing AI-powered grid management systems for predictive maintenance, load forecasting, and automated response to grid conditions. Machine learning algorithms are being deployed to optimize energy distribution and identify potential equipment failures before they occur.

Blockchain technology adoption is gaining momentum for peer-to-peer energy trading, renewable energy certificate management, and secure data sharing between grid participants. Cybersecurity enhancement remains a critical trend as utilities invest in advanced threat detection and response systems to protect critical infrastructure.

Edge computing deployment is accelerating to enable real-time data processing and decision-making at the grid edge, reducing latency and improving system responsiveness. 5G connectivity is being explored for high-speed, low-latency communication between grid components and control systems.

Microgrids and distributed energy resources are becoming increasingly important as communities and businesses seek energy independence and resilience. Electric vehicle integration is driving development of smart charging infrastructure and vehicle-to-grid technologies that can provide grid services and energy storage capabilities.

Recent industry developments highlight the accelerating pace of smart grid deployment across India, with several major utilities announcing comprehensive modernization programs. MarkWide Research analysis indicates that state electricity boards are increasingly partnering with technology providers to implement large-scale AMI deployments and distribution automation projects.

Technology partnerships between international companies and domestic manufacturers are expanding, with focus on knowledge transfer and local production capabilities. Pilot projects in smart cities are demonstrating the effectiveness of integrated smart grid solutions and providing valuable insights for broader deployment.

Regulatory developments include new standards for smart grid interoperability, cybersecurity requirements, and consumer data protection measures. Funding initiatives from international development organizations and green finance institutions are supporting smart grid projects with environmental and social benefits.

Innovation centers and research facilities are being established to develop India-specific smart grid technologies and solutions. Skill development programs are expanding to address workforce requirements for smart grid deployment and operation, with universities and technical institutes offering specialized training programs.

Strategic recommendations for market participants include focusing on technology localization and developing India-specific solutions that address unique market conditions and requirements. Utilities should prioritize phased deployment approaches that balance investment requirements with operational benefits and risk management considerations.

Technology providers should establish local manufacturing capabilities and partnerships with domestic companies to meet government localization requirements and reduce costs. Investment in cybersecurity capabilities and expertise is essential given the critical nature of grid infrastructure and increasing threat landscape.

Collaboration between stakeholders including utilities, technology providers, regulators, and consumers is crucial for successful smart grid deployment and adoption. Focus on consumer education and engagement programs can accelerate adoption and maximize benefits from smart grid investments.

Rural market opportunities should be explored through innovative deployment models and financing mechanisms that make smart grid technologies accessible to underserved areas. Data analytics capabilities should be developed to extract maximum value from smart grid investments and enable continuous optimization of grid operations.

Future market prospects for the Smart Grid in India market remain exceptionally positive, with continued government support, increasing private sector investment, and growing consumer awareness driving sustained growth. MWR projections indicate that smart grid deployment will accelerate significantly over the next decade, with penetration rates expected to reach 60% in urban areas and 35% in rural regions by 2030.

Technology evolution will continue to drive market expansion, with artificial intelligence, machine learning, and advanced analytics becoming standard components of smart grid systems. Integration capabilities with renewable energy sources, energy storage systems, and electric vehicle infrastructure will become increasingly sophisticated and widespread.

Market consolidation may occur as smaller players partner with larger companies or are acquired to create comprehensive solution providers. International collaboration and technology transfer will continue to play important roles in market development, particularly in areas requiring specialized expertise.

Regulatory framework evolution will support market growth through standardization, interoperability requirements, and consumer protection measures. Investment levels are expected to remain robust as utilities recognize the long-term benefits of smart grid modernization for operational efficiency and customer service improvement.

The Smart Grid in India market represents one of the most significant infrastructure transformation opportunities in the global energy sector, driven by the country’s massive power system modernization requirements and ambitious sustainability goals. Market fundamentals remain strong with government policy support, increasing investment levels, and growing recognition of smart grid benefits among utilities and consumers.

Technology advancement and cost reduction trends are making smart grid deployment increasingly viable and attractive for utilities seeking operational efficiency improvements and enhanced customer service capabilities. Competitive dynamics are fostering innovation and driving development of India-specific solutions that address unique market requirements and conditions.

Future growth prospects are supported by multiple converging trends including urbanization, renewable energy expansion, electric vehicle adoption, and digital transformation initiatives across the power sector. Success factors for market participants include technology localization, strategic partnerships, cybersecurity expertise, and comprehensive understanding of India’s diverse regional market conditions. The Smart Grid in India market is positioned to play a crucial role in the country’s energy transition and economic development objectives over the coming decades.

What is Smart Grid in India?

Smart Grid in India refers to the modernization of the electrical grid to enhance efficiency, reliability, and sustainability. It incorporates advanced technologies such as smart meters, automated control systems, and renewable energy integration to optimize electricity distribution and consumption.

What are the key companies in the Smart Grid in India Market?

Key companies in the Smart Grid in India Market include Tata Power, Siemens, and ABB, which are involved in various aspects of smart grid technology, including infrastructure development and smart meter solutions, among others.

What are the drivers of growth in the Smart Grid in India Market?

The growth of the Smart Grid in India Market is driven by increasing energy demand, the need for efficient energy management, and government initiatives promoting renewable energy sources. Additionally, advancements in communication technologies are facilitating the deployment of smart grid solutions.

What challenges does the Smart Grid in India Market face?

The Smart Grid in India Market faces challenges such as high initial investment costs, regulatory hurdles, and the need for skilled workforce. Additionally, integrating diverse energy sources and ensuring cybersecurity are significant concerns.

What opportunities exist in the Smart Grid in India Market?

Opportunities in the Smart Grid in India Market include the expansion of renewable energy projects, the implementation of energy storage solutions, and the development of smart cities. These initiatives can enhance energy efficiency and reduce carbon emissions.

What trends are shaping the Smart Grid in India Market?

Trends shaping the Smart Grid in India Market include the increasing adoption of Internet of Things (IoT) technologies, the rise of decentralized energy systems, and the focus on data analytics for grid management. These trends are enhancing operational efficiency and consumer engagement.

Smart Grid in India Market

| Segmentation Details | Description |

|---|---|

| Technology | Advanced Metering Infrastructure, Demand Response, Distribution Management System, Energy Management System |

| End User | Utilities, Commercial Buildings, Industrial Facilities, Residential Users |

| Application | Load Forecasting, Grid Monitoring, Renewable Integration, Outage Management |

| Solution | Smart Meters, SCADA Systems, Communication Networks, Data Analytics |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Smart Grid in India Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at