444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The GCC secure logistics market represents a rapidly expanding sector within the Gulf Cooperation Council region, encompassing specialized transportation and storage services for high-value, sensitive, and regulated goods. Secure logistics operations in the GCC have experienced remarkable growth, driven by increasing demand for cash management, precious metals transportation, pharmaceutical distribution, and high-value electronics handling across the six member nations.

Regional dynamics indicate that the GCC secure logistics market is witnessing unprecedented expansion, with growth rates reaching 8.5% CAGR over recent years. The market encompasses comprehensive security solutions including armored vehicle transportation, secure warehousing, cash-in-transit services, and specialized handling of valuable commodities. Saudi Arabia and the United Arab Emirates collectively account for approximately 72% of regional market share, reflecting their economic prominence and infrastructure development.

Market participants range from international security logistics providers to regional specialists, all focusing on meeting stringent security requirements while maintaining operational efficiency. The integration of advanced technologies such as GPS tracking, biometric access controls, and real-time monitoring systems has become standard practice, enhancing service reliability and customer confidence throughout the region.

The GCC secure logistics market refers to the specialized segment of supply chain management that provides enhanced security measures for the transportation, storage, and handling of high-value, sensitive, or regulated goods across the Gulf Cooperation Council countries, including comprehensive risk management and protection services.

Secure logistics services encompass multiple specialized functions designed to protect valuable cargo throughout the supply chain. These services include armored transportation for cash and precious metals, temperature-controlled pharmaceutical logistics, secure warehousing facilities, and specialized handling procedures for high-value electronics and luxury goods. Service providers implement multi-layered security protocols, including trained personnel, advanced vehicle specifications, secure facility designs, and comprehensive insurance coverage.

Regional characteristics of the GCC secure logistics market reflect the unique economic landscape of the Gulf states, where substantial oil revenues, growing financial sectors, and increasing retail sophistication drive demand for specialized security services. The market serves diverse industries including banking, jewelry, pharmaceuticals, electronics, and government sectors, each requiring tailored security solutions that comply with local regulations and international standards.

Market expansion in the GCC secure logistics sector demonstrates robust growth momentum, supported by economic diversification initiatives and increasing security awareness across multiple industries. The regional market benefits from substantial infrastructure investments, regulatory framework development, and growing demand for specialized logistics services that ensure cargo protection and regulatory compliance.

Key growth drivers include expanding banking networks requiring cash-in-transit services, growing pharmaceutical imports necessitating cold chain security, increasing luxury goods consumption, and rising e-commerce activities demanding secure last-mile delivery solutions. Technology adoption rates have reached 85% penetration for GPS tracking systems and 67% implementation of biometric security measures among leading service providers.

Competitive dynamics reveal a market characterized by both international players and regional specialists, with service differentiation focusing on technology integration, regulatory compliance, and specialized industry expertise. Market consolidation trends indicate increasing partnerships between global logistics companies and local security specialists to enhance service capabilities and regional market penetration.

Future prospects remain highly favorable, with anticipated growth driven by continued economic diversification, increasing regulatory requirements, and expanding demand for specialized security services across emerging sectors including renewable energy, technology, and healthcare industries throughout the GCC region.

Strategic insights reveal several critical factors shaping the GCC secure logistics market landscape:

Market maturation indicators suggest increasing sophistication in service offerings, with providers developing specialized solutions for emerging sectors while maintaining traditional strengths in cash management and precious metals transportation. Customer expectations continue evolving toward integrated solutions that combine physical security with digital tracking and real-time visibility capabilities.

Economic diversification initiatives across GCC countries serve as primary market drivers, creating increased demand for secure logistics services as governments and private sectors invest in new industries requiring specialized transportation and storage solutions. Vision 2030 programs in Saudi Arabia and similar development strategies throughout the region emphasize economic transformation, directly benefiting secure logistics providers.

Banking sector expansion continues driving substantial demand for cash-in-transit services, with increasing ATM networks, retail banking growth, and electronic payment infrastructure requiring secure cash management solutions. Financial institutions increasingly outsource security logistics to specialized providers, creating stable revenue streams and long-term contractual relationships within the market.

Pharmaceutical industry growth represents another significant driver, as GCC countries expand healthcare infrastructure and increase medical imports requiring temperature-controlled secure transportation. Regulatory compliance requirements for pharmaceutical logistics create barriers to entry while ensuring sustained demand for certified service providers capable of maintaining cold chain integrity.

Luxury goods consumption and high-value electronics imports drive demand for specialized secure transportation services, particularly in UAE and Qatar where affluent consumer bases require reliable protection for expensive purchases. E-commerce growth further amplifies this demand as online retailers seek secure delivery solutions for high-value items.

Government security initiatives and increasing awareness of supply chain vulnerabilities encourage organizations to invest in professional secure logistics services rather than managing security internally, creating market expansion opportunities for specialized providers throughout the region.

High operational costs associated with secure logistics services present significant market restraints, as specialized equipment, trained personnel, insurance coverage, and compliance requirements create substantial overhead expenses that limit market accessibility for smaller businesses and price-sensitive customers.

Regulatory complexity across different GCC countries creates operational challenges for service providers, as varying licensing requirements, security standards, and cross-border procedures increase compliance costs and limit operational flexibility. Bureaucratic processes can delay service implementation and increase administrative burdens for both providers and customers.

Skilled personnel shortage represents a persistent constraint, as secure logistics operations require specialized training, security clearances, and ongoing certification maintenance. Labor market competition for qualified security professionals increases recruitment and retention costs, particularly affecting smaller regional providers.

Technology investment requirements create barriers for new market entrants and smaller operators, as customers increasingly demand advanced tracking, monitoring, and security systems that require substantial capital investments and ongoing maintenance expenses.

Economic volatility related to oil price fluctuations can impact customer spending on non-essential secure logistics services, particularly affecting luxury goods transportation and discretionary security services during periods of reduced economic activity throughout the region.

Digital transformation initiatives across GCC countries create substantial opportunities for secure logistics providers to develop integrated technology solutions combining physical security with digital tracking, blockchain verification, and IoT monitoring capabilities. Smart city projects throughout the region require sophisticated secure logistics support for technology infrastructure deployment and maintenance.

Healthcare sector expansion presents significant growth opportunities, particularly in pharmaceutical cold chain logistics, medical equipment transportation, and specialized handling of sensitive healthcare products. Medical tourism growth in UAE and Saudi Arabia creates additional demand for secure transportation of medical supplies and equipment.

Renewable energy projects across the GCC region require secure logistics services for transporting high-value solar panels, wind turbine components, and specialized equipment. Green energy initiatives create new market segments requiring customized security solutions for emerging technology sectors.

Cross-border e-commerce expansion offers opportunities for secure logistics providers to develop regional networks supporting online retail growth. Last-mile delivery services for high-value items represent an emerging opportunity as consumer expectations for secure delivery options continue increasing.

Financial technology sector growth creates opportunities for specialized secure logistics services supporting cryptocurrency operations, digital payment infrastructure, and fintech company requirements. Blockchain integration possibilities offer potential for developing next-generation secure logistics solutions with enhanced transparency and verification capabilities.

Competitive intensity within the GCC secure logistics market continues increasing as international players expand regional presence while local providers enhance service capabilities. Market dynamics reflect ongoing consolidation trends, with larger providers acquiring specialized companies to expand service portfolios and geographic coverage.

Customer expectations are evolving toward comprehensive solutions that integrate multiple security services, real-time tracking capabilities, and regulatory compliance support. Service differentiation increasingly focuses on technology integration, with providers investing in advanced monitoring systems and digital platforms to enhance customer experience and operational efficiency.

Pricing dynamics demonstrate market maturation, with competitive pressures encouraging efficiency improvements while maintaining service quality standards. Value-based pricing models are becoming more prevalent as customers recognize the cost benefits of outsourcing security logistics compared to internal management.

Partnership strategies are reshaping market dynamics, with secure logistics providers forming alliances with technology companies, insurance providers, and regional logistics networks to enhance service capabilities. Strategic collaborations enable smaller providers to compete effectively while offering customers access to broader service networks and specialized expertise.

Regulatory evolution continues influencing market dynamics, with governments implementing enhanced security standards and compliance requirements that favor established providers with proven track records and comprehensive certification portfolios.

Comprehensive analysis of the GCC secure logistics market employs multiple research methodologies to ensure accurate market assessment and reliable insights. Primary research includes structured interviews with industry executives, service providers, and key customers across all six GCC countries to gather firsthand market intelligence and validate market trends.

Secondary research encompasses analysis of industry reports, government publications, regulatory documents, and company financial statements to establish market baselines and identify growth patterns. Data triangulation methods ensure information accuracy by cross-referencing multiple sources and validating findings through independent verification processes.

Market sizing methodologies utilize bottom-up approaches analyzing individual market segments, service categories, and regional contributions to develop comprehensive market assessments. Statistical analysis techniques identify correlation patterns, growth trends, and market relationships that inform strategic insights and future projections.

Expert consultation with industry specialists, regulatory authorities, and technology providers ensures research findings reflect current market realities and emerging trends. MarkWide Research analytical frameworks provide structured approaches to market evaluation, competitive assessment, and opportunity identification throughout the research process.

Quality assurance protocols include peer review processes, data validation procedures, and accuracy verification methods to ensure research reliability and maintain analytical standards throughout the market assessment process.

Saudi Arabia dominates the GCC secure logistics market with approximately 42% regional market share, driven by the kingdom’s large economy, extensive banking network, and major infrastructure development projects. Vision 2030 initiatives continue creating new opportunities for secure logistics providers supporting economic diversification efforts and mega-project development.

United Arab Emirates represents the second-largest market with 30% market share, benefiting from Dubai’s position as a regional trade hub and Abu Dhabi’s growing financial sector. Free trade zones and international business centers create substantial demand for secure logistics services supporting high-value goods movement and storage.

Qatar maintains 12% market share with strong growth potential driven by ongoing infrastructure development, World Cup legacy projects, and expanding financial services sector. National Vision 2030 emphasizes economic diversification, creating opportunities for specialized secure logistics services across emerging industries.

Kuwait accounts for 8% market share, with growth driven by banking sector expansion and increasing retail sophistication. Government modernization initiatives create demand for secure logistics services supporting technology infrastructure and administrative system upgrades.

Bahrain holds 5% market share but demonstrates strong growth potential as a regional financial center requiring specialized secure logistics services for banking operations and cross-border financial transactions. Economic diversification efforts create new opportunities across multiple sectors.

Oman represents 3% market share with emerging opportunities driven by tourism development, port expansion, and increasing international trade activities requiring secure logistics support for various industries and government operations.

Market leadership in the GCC secure logistics sector features a mix of international security companies and regional specialists, each offering distinct advantages in terms of global expertise, local market knowledge, and specialized service capabilities.

Competitive strategies focus on technology differentiation, regulatory compliance excellence, and specialized industry expertise. Market positioning varies from comprehensive service providers offering integrated solutions to specialized companies focusing on specific market segments or geographic regions.

Innovation leadership drives competitive advantage, with leading providers investing in advanced tracking systems, biometric security measures, and digital platform development to enhance service quality and customer experience throughout the region.

Service type segmentation reveals distinct market categories with varying growth patterns and customer requirements:

End-user segmentation demonstrates diverse market applications:

Cash-in-Transit Services represent the most mature and established category within the GCC secure logistics market, benefiting from stable demand patterns and long-term contractual relationships with banking institutions. Service evolution includes integration of smart safes, real-time tracking, and automated cash processing systems that enhance operational efficiency and security standards.

Pharmaceutical Logistics demonstrates the highest growth potential, driven by increasing healthcare investments and regulatory requirements for temperature-controlled transportation. Cold chain capabilities require specialized equipment and trained personnel, creating competitive advantages for providers with comprehensive pharmaceutical logistics expertise.

High-Value Electronics transportation shows strong growth correlation with technology sector expansion and e-commerce development throughout the region. Handling requirements include anti-static packaging, climate control, and specialized security measures that differentiate this category from standard secure logistics services.

Precious Metals Transportation maintains steady demand patterns tied to regional gold trading activities and jewelry market dynamics. Security protocols for this category require the highest level of protection measures and insurance coverage, supporting premium pricing structures.

Document Security Services are evolving toward digital integration while maintaining physical transportation requirements for legal documents and sensitive materials. Compliance requirements drive demand for certified providers capable of meeting strict regulatory standards.

Service providers benefit from stable revenue streams through long-term contracts, particularly in cash-in-transit services where banking relationships provide predictable income sources. Market expansion opportunities across multiple GCC countries enable geographic diversification and risk mitigation strategies.

Technology vendors gain access to growing markets for security equipment, tracking systems, and monitoring solutions as secure logistics providers invest in advanced capabilities. Innovation partnerships create opportunities for developing specialized solutions tailored to regional market requirements.

Insurance companies benefit from increasing demand for comprehensive coverage policies supporting secure logistics operations. Risk assessment expertise becomes valuable as providers seek competitive insurance solutions that balance coverage requirements with cost considerations.

End-user customers achieve cost savings through outsourcing security logistics compared to internal management, while gaining access to specialized expertise and advanced security technologies. Risk mitigation benefits include professional liability coverage and regulatory compliance support.

Government stakeholders benefit from enhanced security infrastructure supporting economic development and regulatory compliance objectives. Tax revenue generation from growing secure logistics sector contributes to economic diversification goals throughout the region.

Financial institutions achieve operational efficiency improvements and risk reduction through professional secure logistics partnerships, enabling focus on core banking activities while maintaining security standards.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital integration represents the most significant trend shaping the GCC secure logistics market, with providers investing in IoT sensors, blockchain verification, and real-time tracking systems to enhance service transparency and customer confidence. Technology adoption rates continue accelerating as customers demand greater visibility into secure logistics operations.

Sustainability initiatives are gaining prominence as secure logistics providers adopt environmentally friendly vehicles and optimize routing systems to reduce carbon footprints. Green logistics practices become competitive differentiators while supporting regional environmental objectives and corporate responsibility goals.

Service integration trends show providers expanding beyond traditional transportation services to offer comprehensive supply chain security solutions including warehousing, inventory management, and last-mile delivery capabilities. One-stop solutions appeal to customers seeking simplified vendor relationships and integrated service delivery.

Cross-border expansion accelerates as providers develop regional networks supporting intra-GCC trade growth and international commerce. Network integration creates opportunities for seamless service delivery across multiple countries while maintaining consistent security standards.

Regulatory harmonization efforts across GCC countries create opportunities for standardized service offerings and simplified compliance procedures. Regional cooperation initiatives support market integration and reduce operational complexity for service providers.

Strategic partnerships between international secure logistics providers and regional companies continue reshaping market dynamics, with recent alliances focusing on technology sharing, geographic expansion, and service capability enhancement. Joint ventures enable market entry for international players while providing local partners access to global expertise and resources.

Technology investments by leading providers include deployment of artificial intelligence for route optimization, biometric security systems for personnel access control, and blockchain platforms for cargo verification. Innovation initiatives demonstrate industry commitment to maintaining competitive advantages through technological advancement.

Regulatory developments across GCC countries include enhanced licensing requirements, updated security standards, and improved cross-border procedures that support market professionalization. Government initiatives promote industry growth while ensuring service quality and security compliance.

Market consolidation activities include acquisitions of specialized providers by larger companies seeking to expand service portfolios and geographic coverage. Industry restructuring creates opportunities for improved operational efficiency and enhanced customer service capabilities.

Infrastructure projects throughout the region include development of secure logistics hubs, specialized warehousing facilities, and integrated transportation networks that support market growth and service enhancement opportunities.

Market positioning strategies should focus on developing specialized expertise in high-growth segments such as pharmaceutical logistics and e-commerce security services. MarkWide Research analysis indicates that providers with diversified service portfolios demonstrate greater resilience during economic fluctuations and achieve superior growth performance.

Technology investment priorities should emphasize customer-facing platforms that provide real-time visibility and digital interaction capabilities. Competitive differentiation increasingly depends on technological sophistication and service integration rather than traditional security measures alone.

Geographic expansion strategies should consider partnerships with local providers to navigate regulatory requirements and cultural considerations effectively. Regional network development creates opportunities for cross-border service offerings while maintaining compliance with local regulations.

Customer relationship management should focus on developing long-term partnerships through value-added services and consultative approaches. Service customization capabilities become essential for meeting diverse customer requirements across different industries and market segments.

Regulatory compliance investments should anticipate future requirements and maintain proactive approaches to certification and standard development. Industry leadership in compliance creates competitive advantages and supports premium pricing strategies.

Market growth prospects remain highly favorable for the GCC secure logistics sector, with anticipated expansion driven by economic diversification initiatives, increasing security awareness, and growing demand for specialized services across emerging industries. Long-term projections suggest sustained growth rates of 7-9% annually over the next five years.

Technology evolution will continue reshaping service delivery models, with artificial intelligence, autonomous vehicles, and blockchain integration creating new possibilities for operational efficiency and security enhancement. Digital transformation initiatives across GCC countries support technology adoption and create favorable conditions for innovative service development.

Market maturation trends indicate increasing sophistication in customer requirements and service offerings, with providers developing specialized solutions for niche markets while maintaining core competencies in traditional segments. Service evolution toward integrated logistics solutions creates opportunities for market expansion and customer relationship deepening.

Regional integration efforts will likely accelerate, creating opportunities for seamless cross-border services and standardized operational procedures. MWR forecasts indicate that successful providers will be those capable of adapting to evolving customer needs while maintaining operational excellence and security standards.

Investment opportunities remain attractive for both existing market participants and new entrants with specialized capabilities or innovative technology solutions. Market dynamics favor providers with strong financial resources, technological capabilities, and strategic vision for long-term growth and development.

The GCC secure logistics market presents compelling opportunities for growth and development, supported by robust economic fundamentals, increasing security awareness, and expanding demand across multiple industry sectors. Market dynamics favor providers capable of combining traditional security expertise with innovative technology solutions and comprehensive service offerings.

Strategic success in this market requires understanding of regional nuances, regulatory requirements, and customer expectations while maintaining operational excellence and security standards. Technology integration and service diversification represent key differentiators for achieving competitive advantage and sustainable growth.

Future prospects remain highly positive, with continued economic diversification, infrastructure development, and regulatory evolution creating favorable conditions for market expansion. Industry participants who invest in technology, develop specialized capabilities, and build strong customer relationships are well-positioned to capitalize on emerging opportunities and achieve long-term success in the dynamic GCC secure logistics market.

What is Secure Logistics?

Secure logistics refers to the processes and systems involved in the safe and efficient transportation, storage, and handling of goods, particularly those that are sensitive or high-value. This includes measures to prevent theft, damage, and loss during transit and storage.

What are the key players in the GCC Secure Logistics Market?

Key players in the GCC Secure Logistics Market include Agility Logistics, DHL Supply Chain, and GAC Group, among others. These companies provide a range of secure logistics services tailored to various industries such as pharmaceuticals, electronics, and high-value goods.

What are the main drivers of growth in the GCC Secure Logistics Market?

The main drivers of growth in the GCC Secure Logistics Market include the increasing demand for secure transportation of high-value goods, the rise in e-commerce activities, and the need for compliance with stringent regulations in sectors like pharmaceuticals and defense.

What challenges does the GCC Secure Logistics Market face?

Challenges in the GCC Secure Logistics Market include the high costs associated with implementing advanced security technologies, the complexity of regulatory compliance, and the risk of cyber threats targeting logistics operations.

What opportunities exist in the GCC Secure Logistics Market?

Opportunities in the GCC Secure Logistics Market include the expansion of e-commerce, which requires secure logistics solutions, and the increasing focus on supply chain transparency and traceability, particularly in industries like food and pharmaceuticals.

What trends are shaping the GCC Secure Logistics Market?

Trends shaping the GCC Secure Logistics Market include the adoption of advanced technologies such as IoT and blockchain for enhanced security and tracking, as well as a growing emphasis on sustainability practices within logistics operations.

GCC Secure Logistics Market

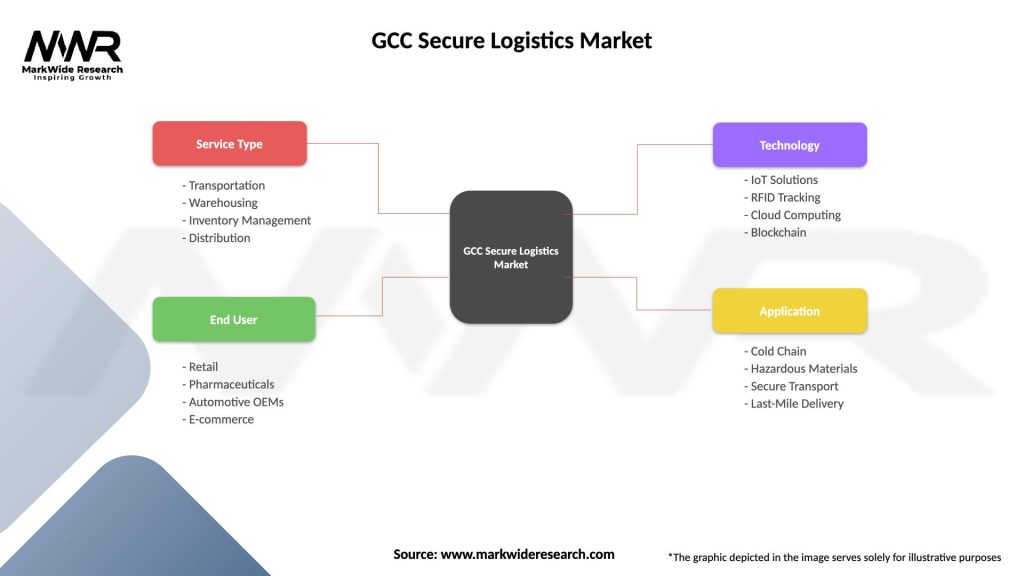

| Segmentation Details | Description |

|---|---|

| Service Type | Transportation, Warehousing, Inventory Management, Distribution |

| End User | Retail, Pharmaceuticals, Automotive OEMs, E-commerce |

| Technology | IoT Solutions, RFID Tracking, Cloud Computing, Blockchain |

| Application | Cold Chain, Hazardous Materials, Secure Transport, Last-Mile Delivery |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the GCC Secure Logistics Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at