444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2150

The India kitchen furniture market represents a dynamic and rapidly evolving sector within the country’s broader furniture industry. Kitchen furniture encompasses a comprehensive range of products including modular kitchen cabinets, countertops, storage solutions, kitchen islands, and specialized furniture designed for culinary spaces. The market has experienced substantial transformation driven by changing lifestyle preferences, urbanization trends, and increasing disposable income among Indian consumers.

Market dynamics indicate robust growth potential, with the sector expanding at a significant CAGR of 8.2% over recent years. This growth trajectory reflects the increasing adoption of modular kitchen concepts, rising awareness about space optimization, and growing preference for aesthetically appealing kitchen designs. Urban households particularly demonstrate strong demand for contemporary kitchen furniture solutions that combine functionality with modern aesthetics.

Consumer preferences have shifted dramatically toward customized and space-efficient kitchen furniture solutions. The market benefits from increasing nuclear family structures, changing cooking habits, and the influence of international design trends. Modular kitchen systems now account for approximately 45% of the total kitchen furniture market, indicating a clear preference for organized and efficient kitchen spaces among Indian consumers.

The India kitchen furniture market refers to the comprehensive ecosystem of furniture products, services, and solutions specifically designed for kitchen spaces across residential and commercial segments in India. This market encompasses traditional wooden cabinets, modern modular kitchen systems, countertops, storage solutions, kitchen islands, dining furniture, and specialized accessories that enhance kitchen functionality and aesthetics.

Kitchen furniture in the Indian context includes both ready-made and customized solutions that cater to diverse cultural cooking practices, space constraints, and design preferences. The market covers various price segments from budget-friendly options to premium luxury kitchen installations, serving different socioeconomic demographics across urban and rural areas.

Market participants include manufacturers, retailers, interior designers, carpenters, and service providers who collectively contribute to the design, production, distribution, and installation of kitchen furniture solutions. The market also encompasses related services such as kitchen planning, installation, maintenance, and after-sales support that ensure comprehensive customer satisfaction.

India’s kitchen furniture market demonstrates exceptional growth momentum driven by urbanization, changing lifestyle patterns, and increasing consumer awareness about kitchen aesthetics and functionality. The market has evolved from traditional carpenter-made furniture to sophisticated modular systems that offer superior space utilization and contemporary designs.

Key market drivers include rising disposable income, nuclear family growth, apartment living trends, and exposure to international kitchen design concepts through digital media and home improvement shows. The market benefits from increasing female workforce participation of 24%, leading to demand for time-saving and efficient kitchen solutions.

Regional distribution shows strong concentration in metropolitan cities and tier-1 urban centers, with North India accounting for 35% of market demand, followed by West India at 28% and South India at 25%. The market exhibits significant potential for expansion in tier-2 and tier-3 cities as urbanization accelerates and consumer awareness increases.

Technology integration has become increasingly important, with smart kitchen furniture solutions gaining traction among tech-savvy consumers. The market also shows growing preference for sustainable and eco-friendly materials, reflecting increased environmental consciousness among Indian consumers.

Market segmentation reveals distinct patterns in consumer preferences and purchasing behavior across different demographic groups and geographic regions. The following insights provide comprehensive understanding of market dynamics:

Urbanization trends serve as the primary catalyst for kitchen furniture market growth in India. Rapid urban development, increasing apartment living, and space constraints in metropolitan areas drive demand for efficient and space-optimized kitchen solutions. Urban population growth creates sustained demand for modern kitchen furniture that maximizes functionality within limited spaces.

Lifestyle transformation among Indian consumers significantly influences kitchen furniture preferences. Changing cooking habits, increased dining out culture, and preference for convenience foods modify kitchen usage patterns, creating demand for contemporary furniture designs. Nuclear family structures require different kitchen configurations compared to traditional joint family setups, driving market evolution.

Income growth across middle-class households enables increased spending on home improvement and kitchen upgrades. Rising disposable income allows consumers to invest in quality kitchen furniture that offers long-term value and enhanced aesthetics. Home ownership trends and property investments further stimulate kitchen furniture demand as homeowners seek to enhance property value through modern kitchen installations.

Digital influence through social media, home improvement shows, and online design platforms exposes consumers to international kitchen design trends and innovative furniture solutions. Design awareness has increased significantly, with consumers seeking Pinterest-worthy kitchen spaces that combine functionality with visual appeal.

High initial investment requirements for quality kitchen furniture installations present significant barriers for price-sensitive consumers. Premium modular kitchen systems and customized solutions often require substantial upfront costs that may deter budget-conscious buyers, limiting market penetration in lower-income segments.

Installation complexity and dependency on skilled labor create operational challenges for both manufacturers and consumers. Technical expertise requirements for proper installation, plumbing integration, and electrical work can complicate the purchase process and increase overall project costs and timelines.

Space limitations in Indian homes, particularly in urban areas, restrict kitchen furniture options and customization possibilities. Structural constraints in older buildings and apartments may limit renovation possibilities, affecting market potential for comprehensive kitchen furniture solutions.

Maintenance requirements and durability concerns, especially in Indian cooking environments with high heat, humidity, and intensive usage patterns, may discourage some consumers from investing in expensive kitchen furniture solutions. After-sales service availability and quality variations across different regions also impact consumer confidence and purchase decisions.

Tier-2 and tier-3 city expansion presents substantial growth opportunities as urbanization accelerates beyond metropolitan areas. Emerging urban centers demonstrate increasing purchasing power and design consciousness, creating untapped market potential for kitchen furniture manufacturers and retailers seeking geographic expansion.

Affordable housing initiatives and government-supported residential projects create volume opportunities for kitchen furniture suppliers. Mass housing developments require standardized yet attractive kitchen solutions that balance cost-effectiveness with modern aesthetics, opening new market segments for manufacturers.

Technology integration opportunities include smart kitchen furniture with IoT connectivity, automated storage solutions, and app-controlled features that appeal to tech-savvy consumers. Innovation potential exists in developing furniture solutions that incorporate modern technology while maintaining affordability and cultural relevance.

Sustainable materials and eco-friendly manufacturing processes present opportunities to capture environmentally conscious consumers. Green furniture solutions using recycled materials, low-emission finishes, and sustainable production methods can differentiate brands and command premium pricing in the market.

Supply chain evolution has transformed the kitchen furniture market landscape, with manufacturers investing in direct-to-consumer channels and reducing intermediary dependencies. Vertical integration strategies enable better quality control, cost management, and customer experience delivery, creating competitive advantages for established players.

Consumer behavior shifts toward online research and digital engagement have modified traditional sales processes. Omnichannel approaches combining online visualization tools, virtual consultations, and physical showroom experiences have become essential for market success and customer acquisition.

Competition intensity has increased significantly with both domestic and international players vying for market share. Market consolidation trends favor organized players with strong brand recognition, comprehensive service capabilities, and extensive distribution networks over traditional unorganized sector participants.

Innovation cycles have accelerated, with manufacturers continuously introducing new designs, materials, and features to maintain market relevance. Product differentiation through unique value propositions, superior quality, and comprehensive service offerings has become crucial for sustainable competitive positioning.

Primary research methodologies employed comprehensive consumer surveys, industry expert interviews, and manufacturer consultations to gather firsthand market insights. Data collection involved structured questionnaires administered across multiple geographic regions and demographic segments to ensure representative market understanding.

Secondary research incorporated analysis of industry reports, government statistics, trade publications, and company financial statements to validate primary findings and establish market baselines. Information sources included furniture industry associations, interior design organizations, and retail trade bodies providing sector-specific insights.

Market sizing utilized bottom-up and top-down approaches, analyzing production data, import-export statistics, and retail sales information to establish accurate market parameters. Forecasting models incorporated economic indicators, demographic trends, and historical growth patterns to project future market trajectories.

Quality assurance processes included data triangulation, expert validation, and cross-verification of findings across multiple sources to ensure research accuracy and reliability. Analytical frameworks employed statistical modeling and trend analysis to derive meaningful insights and actionable recommendations for market participants.

North India dominates the kitchen furniture market with 35% market share, driven by high urbanization rates in Delhi NCR, Punjab, and Haryana. Consumer preferences in this region favor spacious kitchen designs with emphasis on storage solutions and traditional cooking requirements. The region benefits from strong manufacturing presence and established distribution networks.

West India accounts for 28% of market demand, with Maharashtra and Gujarat leading consumption patterns. Mumbai and Pune demonstrate sophisticated design preferences and willingness to invest in premium kitchen furniture solutions. The region shows strong adoption of modular kitchen concepts and international design influences.

South India represents 25% market share with Karnataka, Tamil Nadu, and Andhra Pradesh showing robust growth. Bangalore and Chennai exhibit high demand for contemporary kitchen furniture driven by IT sector growth and cosmopolitan lifestyle preferences. The region demonstrates strong preference for functionality and space optimization.

East India contributes 12% to market revenue, with West Bengal leading regional demand. Kolkata market shows gradual shift toward modern kitchen furniture, though traditional preferences remain strong. The region presents significant growth potential as economic development accelerates and consumer awareness increases.

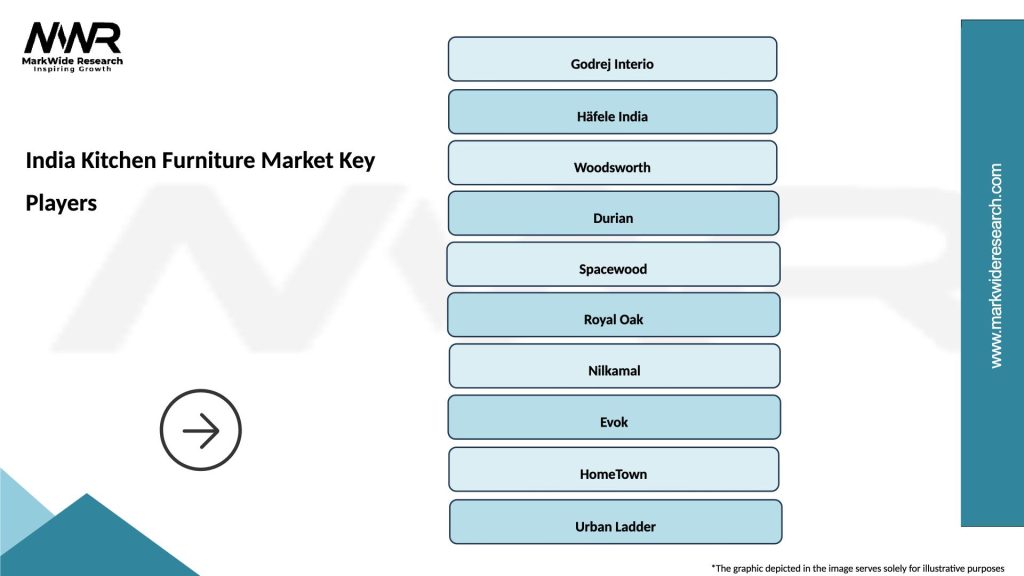

Market leadership is distributed among several key players who have established strong brand recognition and comprehensive service capabilities. The competitive environment features both domestic manufacturers and international brands competing across different market segments.

Competitive strategies focus on product innovation, service excellence, and customer experience differentiation. Market players invest heavily in showroom expansion, digital marketing, and technology integration to capture market share and enhance customer engagement.

By Product Type:

By Material:

By Price Range:

Modular Kitchen Systems represent the fastest-growing category with exceptional consumer adoption rates. Design flexibility and standardized components enable efficient manufacturing and installation while offering customization possibilities. This category benefits from changing lifestyle preferences and space optimization requirements in urban homes.

Storage Solutions demonstrate consistent demand across all market segments as Indian cooking practices require extensive storage for utensils, appliances, and ingredients. Innovative storage designs incorporating pull-out drawers, corner solutions, and vertical storage maximize space utilization in compact kitchens.

Countertop Solutions have evolved beyond basic functionality to become design focal points in modern kitchens. Material innovation includes granite, quartz, and engineered surfaces that combine durability with aesthetic appeal. This category shows strong correlation with overall kitchen renovation projects.

Kitchen Islands represent an emerging category gaining popularity in spacious homes and apartments. Multifunctional designs serve as cooking prep areas, dining spaces, and storage solutions, appealing to consumers seeking versatile kitchen furniture options that enhance both functionality and social interaction.

Manufacturers benefit from expanding market opportunities driven by urbanization and lifestyle changes. Production scalability enables cost optimization while meeting diverse consumer requirements across different market segments. The growing market provides sustainable revenue growth potential and opportunities for product innovation and differentiation.

Retailers and Distributors gain from increasing consumer awareness and willingness to invest in quality kitchen furniture. Service integration opportunities including design consultation, installation, and maintenance create additional revenue streams and enhance customer relationships. The market expansion supports network growth and geographic diversification strategies.

Consumers benefit from improved product quality, design variety, and competitive pricing resulting from market competition. Enhanced functionality and space optimization solutions address practical kitchen requirements while aesthetic improvements enhance home value and living experience. Access to financing options and comprehensive services simplifies the purchase and installation process.

Real Estate Developers leverage modern kitchen furniture installations to enhance property appeal and market value. Standardized solutions enable cost-effective bulk procurement while offering attractive amenities to potential buyers. Kitchen furniture quality significantly influences property differentiation in competitive real estate markets.

Strengths:

Weaknesses:

Opportunities:

Threats:

Smart Kitchen Integration emerges as a dominant trend with consumers seeking furniture solutions that accommodate modern appliances and technology. IoT-enabled features including automated storage systems, app-controlled lighting, and smart organization solutions appeal to tech-savvy consumers seeking convenience and efficiency in kitchen operations.

Sustainable Manufacturing practices gain prominence as environmental consciousness increases among consumers and manufacturers. Eco-friendly materials, low-emission finishes, and recyclable components become important differentiators in premium market segments. Manufacturers invest in green production processes to meet evolving consumer expectations and regulatory requirements.

Customization Demand intensifies as consumers seek personalized solutions that reflect individual preferences and space requirements. Modular flexibility enables manufacturers to offer customized configurations while maintaining production efficiency. Advanced design software and visualization tools facilitate customer engagement and decision-making processes.

Online-to-Offline Integration becomes essential as consumers research online but prefer physical experience before purchase. Omnichannel strategies combining digital marketing, virtual consultations, and showroom experiences create comprehensive customer journeys that enhance satisfaction and conversion rates.

Technology Partnerships between furniture manufacturers and technology companies accelerate smart kitchen solution development. Collaborative innovation enables integration of advanced features while maintaining cost-effectiveness and market accessibility. These partnerships drive product differentiation and create new market categories.

Manufacturing Automation investments improve production efficiency and quality consistency while reducing labor dependencies. Advanced machinery and robotics enable precise manufacturing and faster delivery times, enhancing competitive positioning and customer satisfaction levels.

Retail Network Expansion accelerates as manufacturers and retailers invest in showroom presence across tier-2 and tier-3 cities. Geographic diversification strategies capture emerging market opportunities and reduce dependency on metropolitan markets for revenue growth.

Sustainability Initiatives gain momentum with manufacturers adopting environmentally responsible practices throughout the value chain. Green certifications and sustainable material sourcing become important marketing differentiators and regulatory compliance requirements in the evolving market landscape.

MarkWide Research recommends that market participants focus on tier-2 city expansion strategies to capitalize on emerging urbanization trends and untapped consumer demand. Investment priorities should emphasize showroom development, local partnership building, and culturally relevant product offerings that resonate with regional preferences and requirements.

Technology integration represents a critical success factor for sustainable competitive advantage. Digital transformation initiatives should encompass customer engagement tools, design visualization platforms, and smart product features that enhance value propositions and differentiate offerings in increasingly competitive markets.

Service excellence becomes paramount as consumers prioritize comprehensive solutions over standalone products. Investment recommendations include installation capability development, after-sales service enhancement, and customer support infrastructure that ensures positive ownership experiences and generates referral business.

Sustainability positioning offers significant opportunities for premium market capture and brand differentiation. Strategic focus on eco-friendly materials, responsible manufacturing processes, and environmental certifications can command higher margins while appealing to conscious consumers and meeting regulatory expectations.

Market expansion is projected to continue at a robust pace driven by sustained urbanization, income growth, and lifestyle evolution across Indian consumer segments. Growth projections indicate continued 8-10% annual expansion over the next five years, with tier-2 and tier-3 cities contributing increasingly significant portions of market demand and revenue generation.

Technology integration will accelerate with smart kitchen solutions becoming mainstream rather than niche offerings. Innovation trends suggest widespread adoption of IoT-enabled furniture, automated storage systems, and app-controlled features that enhance convenience and efficiency for modern Indian households.

Market consolidation is expected to favor organized players with strong brand recognition, comprehensive service capabilities, and extensive distribution networks. MWR analysis indicates that market share concentration among top players will increase to 75% within five years, driven by consumer preference for reliable brands and comprehensive solutions.

Sustainability requirements will become mandatory rather than optional as environmental regulations strengthen and consumer awareness increases. Future market leaders will be those who successfully integrate sustainable practices while maintaining affordability and functionality that meets diverse Indian consumer requirements and preferences.

The India kitchen furniture market presents exceptional growth opportunities driven by fundamental demographic and lifestyle changes across the country. Urbanization trends, rising disposable income, and evolving consumer preferences create a favorable environment for sustained market expansion and innovation.

Market dynamics favor organized players who can deliver comprehensive solutions combining quality products, professional services, and customer-centric experiences. Success factors include geographic expansion into emerging cities, technology integration, sustainability positioning, and service excellence that differentiates offerings in competitive markets.

Future growth will be driven by continued urbanization, lifestyle evolution, and increasing consumer sophistication regarding kitchen design and functionality. Market participants who invest in innovation, service capabilities, and sustainable practices while maintaining affordability will capture the greatest share of this expanding market opportunity in India’s evolving furniture landscape.

What is Kitchen Furniture?

Kitchen furniture refers to the various types of furniture designed specifically for kitchen use, including cabinets, tables, chairs, and storage solutions that enhance functionality and aesthetics in the cooking space.

What are the key players in the India Kitchen Furniture Market?

Key players in the India Kitchen Furniture Market include Godrej Interio, Sleek, and Hettich, which offer a range of innovative and stylish kitchen solutions to meet diverse consumer needs, among others.

What are the growth factors driving the India Kitchen Furniture Market?

The growth of the India Kitchen Furniture Market is driven by increasing urbanization, rising disposable incomes, and a growing trend towards modular and customized kitchen solutions that cater to modern lifestyles.

What challenges does the India Kitchen Furniture Market face?

The India Kitchen Furniture Market faces challenges such as fluctuating raw material prices, intense competition among manufacturers, and changing consumer preferences that require constant innovation.

What opportunities exist in the India Kitchen Furniture Market?

Opportunities in the India Kitchen Furniture Market include the rising demand for eco-friendly materials, the growth of online retail channels, and the increasing popularity of smart kitchen solutions that integrate technology.

What trends are shaping the India Kitchen Furniture Market?

Trends shaping the India Kitchen Furniture Market include the shift towards minimalistic designs, the incorporation of sustainable materials, and the growing interest in multifunctional furniture that maximizes space efficiency.

India Kitchen Furniture Market

| Segmentation Details | Description |

|---|---|

| Product Type | Cabinets, Tables, Chairs, Shelves |

| Material | Wood, Metal, Glass, Plastic |

| Style | Modern, Traditional, Rustic, Contemporary |

| End User | Residential, Commercial, Hospitality, Others |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the India Kitchen Furniture Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at