444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The edible flakes market is a thriving sector within the food industry, offering a variety of versatile and convenient food products. Edible flakes are thin, flat pieces of food that are typically made from cereals, grains, fruits, or vegetables. They are widely consumed as breakfast cereals, snack toppings, and ingredient additives in various culinary applications. The market for edible flakes has witnessed steady growth due to the increasing demand for healthy and convenient food options.

Meaning

Edible flakes are popular food products that are created by processing and flattening various ingredients such as cereals, grains, fruits, or vegetables. The process involves cooking, drying, and flaking the ingredients to create thin, flat pieces that can be consumed as is or incorporated into different dishes. Edible flakes offer a convenient and nutritious option for consumers seeking quick and easy meals or snacks.

Executive Summary

The edible flakes market has experienced significant growth in recent years, driven by the rising demand for healthy and convenient food products. Edible flakes provide a versatile and nutritious option for consumers, offering a wide range of flavors, textures, and nutritional profiles. The market is characterized by the presence of both established players and emerging companies, each offering unique product offerings to cater to diverse consumer preferences.

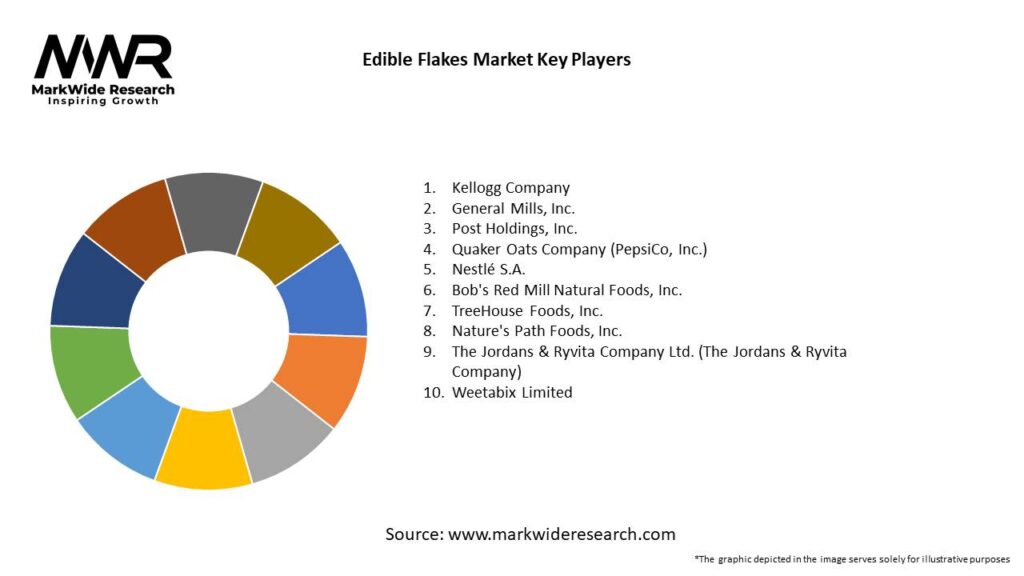

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

The global edible flakes market is growing at a CAGR of approximately 6–8%, led by cereal and vegetable flakes.

Clean-label, non-GMO, and gluten-free flakes are outperforming conventional variants in developed markets.

Online retail channels are gaining share as consumers seek bulk and specialty flakes for home cooking and meal kits.

Value-added flakes fortified with protein, fiber, vitamins, or probiotics are emerging to address health and wellness demands.

Seasonal and regional flavors (e.g., pumpkin spice oatmeal flakes) drive consumer trial and repeat purchases.

Market Drivers

Convenience and Time Savings: Busy lifestyles and the rise of instant breakfast and snack options propel demand for quick-prep flakes.

Health and Nutrition Trends: Consumers seek whole-grain, high-fiber flakes and vegetable or fruit-based variants to support balanced diets.

Innovation in Flake Processing: Advanced drying, flaking, and fortification technologies improve texture, flavor retention, and nutrient preservation.

Growth of Meal Kits and Ready Meals: Foodservice and retail meal-kit services incorporate flakes to simplify cooking and enhance nutritional profiles.

Expansion of E-commerce: Online platforms offer specialty flakes (ancient grains, superfood blends) to niche health-focused audiences.

Market Restraints

Raw Material Price Volatility: Fluctuating prices for grains, potatoes, and fresh produce can affect production costs and margins.

Supply Chain Disruptions: Seasonal harvest variations and logistics challenges may lead to periodic shortages or quality inconsistencies.

Consumer Perception of Processing: Some consumers associate highly processed flakes with lower nutritional value, dampening demand for certain products.

Storage and Shelf-Life Limitations: Although flakes are shelf-stable, improper storage can lead to moisture uptake and product spoilage.

Competitive Snack Alternatives: Growth in fresh-cut fruits, smoothies, and energy bars competes for consumer share in the convenience segment.

Market Opportunities

Plant-Based and Protein-Enriched Flakes: Fortification with pulses or pea protein to meet rising plant-protein demand.

Exotic and Superfood Blends: Incorporation of quinoa, amaranth, millet, or chia flakes to appeal to health enthusiasts.

Clean-Label Certifications: Organic, non-GMO, and allergen-free certifications to differentiate products in premium segments.

Customization and Private Label: Retailers offering bespoke flake blends under private-label programs for consumer loyalty.

Functional Ingredient Integration: Addition of probiotics, prebiotics, or adaptogens to target digestive health and stress management.

Market Dynamics

Premiumization: Consumers are willing to pay more for flakes with specialty ingredients, single-origin grains, and artisanal processing claims.

Sustainability Focus: Producers emphasize eco-friendly processing and upcycling by-products (e.g., vegetable pulp to flakes).

Collaborations: Partnerships between equipment manufacturers and flake producers drive innovation in drying and flaking machinery.

Regulatory Scrutiny: Food safety standards and labeling regulations influence product formulation and marketing.

Regional Taste Profiles: Tailoring flake flavors—such as curry-spiced potato flakes in Asia—boosts local market acceptance.

Regional Analysis

North America: Mature market dominated by breakfast cereals and snack flakes; growth in gluten-free and organic segments.

Europe: Strong demand for whole-grain cereal flakes and vegetable-fortified variants; regulations encourage clean labeling.

Asia Pacific: Rapid expansion driven by urbanization and rising disposable incomes; rice and multigrain flakes gain popularity.

Latin America: Emerging market with traditional potato and cassava flakes; economic growth supports premium snack adoption.

Middle East & Africa: Nascent but growing, with opportunities in fortified cereal flakes to address nutritional deficiencies.

Competitive LandscapeSegmentation

Leading companies in the Edible Flakes Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Category-wise Insights

Cereal Flakes: Oat, wheat, and corn flakes remain staples; innovation focuses on whole-grain and high-fiber variants.

Potato Flakes: Widely used in mashed products and snack formulations; demand for low-fat and gluten-free options is rising.

Vegetable Flakes: Spinach, carrot, and beetroot flakes used in soups, sauces, and baked goods for color, flavor, and nutrition.

Fruit Flakes: Apple, banana, and mixed-berry flakes added to granolas and yogurts; freeze-dried methods drive premium pricing.

Key Benefits for Industry Participants and Stakeholders

Reduced Preparation Time: Flakes offer instant or rapid rehydration, improving kitchen efficiency.

Extended Shelf Life: Dehydration and flaking processes prolong usability, reducing food waste.

Nutrient Retention: Gentle processing preserves vitamins, minerals, and natural flavors.

Product Versatility: Flakes can be used across breakfast cereals, snacks, bakery, and prepared meals.

Supply Chain Flexibility: Lightweight flakes lower transportation costs and simplify storage logistics.

SWOT Analysis

Strengths:

Broad applicability across food categories.

Growing consumer acceptance of convenient, healthy ingredients.

Weaknesses:

Perceived processing may deter health-conscious buyers.

Quality variability due to raw material differences.

Opportunities:

Development of plant-based protein flakes.

Expansion into meal-replacement and functional food segments.

Threats:

Substitute products like fresh-cut produce and snack bars.

Climatic risks affecting raw material harvests.

Market Key Trends

Multigrain Blends: Combining oats, amaranth, and quinoa flakes to boost nutritional profiles.

Savory Flakes: Potato and vegetable flakes used in seasoning blends and snack coatings.

Clean Labeling: Minimal ingredient lists and transparent sourcing to build consumer trust.

Meal-Kit Integration: Direct inclusion of flakes in subscription meal-kits for convenience.

Collaborative Innovation: Co-development programs between flake producers and CPG brands for bespoke formulations.

Covid-19 Impact

The pandemic spurred at-home cooking and bulk pantry stocking, boosting edible flakes sales across retail channels. Consumers turned to versatile, shelf-stable flakes for breakfasts, soups, and meal extensions, while supply chain disruptions prompted investments in local sourcing and inventory buffers.

Key Industry Developments

Launch of Protein-Fortified Oat Flakes: Leading cereal brands introduced pea-protein oats targeting fitness enthusiasts.

Innovative Vegetable Flake Lines: Ingredient suppliers rolled out dehydrated superfood blends for clean-label processors.

E-commerce Partnerships: Flake manufacturers collaborated with online grocers to offer customizable bulk-buy bundles.

Sustainability Initiatives: Companies adopted upcycling of fruit pulp into value-added flakes.

Analyst Suggestions

Emphasize Clean-Label Claims: Highlight simple ingredient lists and non-GMO sourcing to attract health-focused consumers.

Invest in R&D for Functional Flakes: Develop prebiotic, probiotic, or antioxidant-enriched flakes to meet wellness trends.

Expand Direct-to-Consumer Channels: Leverage e-commerce platforms and subscription models for niche and bulk offerings.

Forge Co-Branding Partnerships: Collaborate with popular meal-kit and nutrition brands to broaden usage occasions.

Future Outlook

The Edible Flakes market is expected to maintain a healthy growth trajectory, with innovation in functional, plant-based, and clean-label flakes driving premiumization. As consumer demand for convenience and nutrition persists, flakes will continue to expand into new applications—from protein-packed breakfasts to savory snack formulations—solidifying their position as a cornerstone ingredient in modern food systems.

Conclusion

Edible flakes offer a compelling blend of convenience, nutrition, and versatility that aligns with contemporary consumer preferences and industry trends. Companies that prioritize clean-label transparency, functional innovations, and strategic channel expansion will lead the market, delivering both value and health benefits to a global audience seeking quick, nutritious meal and snack solutions.

What are Edible Flakes?

Edible flakes are thin, flat pieces of food that are often used as toppings or ingredients in various dishes. They can be made from a variety of materials, including grains, fruits, and vegetables, and are popular in snacks, cereals, and culinary applications.

What are the key players in the Edible Flakes Market?

Key players in the Edible Flakes Market include companies like Kellogg’s, Quaker Oats, and General Mills, which produce a range of edible flakes for breakfast cereals and snacks. These companies focus on innovation and quality to meet consumer demands, among others.

What are the growth factors driving the Edible Flakes Market?

The Edible Flakes Market is driven by increasing consumer demand for convenient and healthy snack options. Additionally, the rise in plant-based diets and the popularity of gluten-free products are contributing to market growth.

What challenges does the Edible Flakes Market face?

The Edible Flakes Market faces challenges such as fluctuating raw material prices and competition from alternative snack options. Additionally, maintaining product quality and meeting regulatory standards can pose difficulties for manufacturers.

What opportunities exist in the Edible Flakes Market?

There are significant opportunities in the Edible Flakes Market, particularly in the development of innovative flavors and health-focused products. The growing trend of clean label products and organic ingredients also presents avenues for expansion.

What trends are shaping the Edible Flakes Market?

Current trends in the Edible Flakes Market include the increasing popularity of functional foods that offer health benefits, such as added vitamins and minerals. Additionally, sustainability practices in sourcing and packaging are becoming more important to consumers.

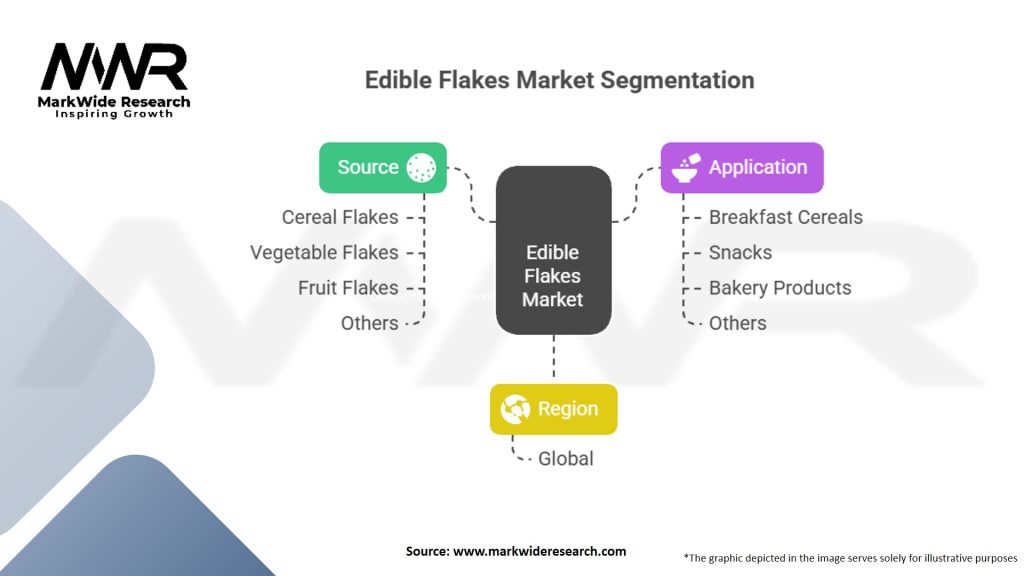

| Segmentation Details | Description |

|---|---|

| Product Type | Cereal Flakes, Potato Flakes, Corn Flakes, Vegetable Flakes, Fruit Flakes, Seaweed Flakes |

| Form | Dried, Freeze-Dried, Dehydrated, Instant, Toasted |

| Application | Breakfast Cereals, Snacks & Confectionery, Bakery Products, Soups & Sauces, Ready-to-Eat Meals, Pet Food |

| Distribution Channel | Supermarkets & Hypermarkets, Convenience Stores, Online Retail, Specialty Food Stores, Foodservice Operators |

Please note: The segmentation can be customized in line with the client’s objectives and requirements.

Leading companies in the Edible Flakes Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at