444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Asia-Pacific BFSI biometrics market represents one of the most dynamic and rapidly evolving sectors in the global financial technology landscape. This comprehensive market encompasses the deployment of advanced biometric authentication technologies across banking, financial services, and insurance institutions throughout the Asia-Pacific region. Market dynamics indicate unprecedented growth driven by increasing digital transformation initiatives, regulatory compliance requirements, and rising cybersecurity concerns across financial institutions.

Regional adoption of biometric technologies in BFSI applications has accelerated significantly, with countries like China, India, Japan, and South Korea leading the implementation of innovative authentication solutions. The market demonstrates robust expansion with a projected compound annual growth rate (CAGR) of 18.2% through the forecast period, reflecting the critical importance of secure authentication mechanisms in modern financial services.

Technology integration spans multiple biometric modalities including fingerprint recognition, facial recognition, iris scanning, voice authentication, and palm vein recognition. Financial institutions across the region are increasingly adopting multi-modal biometric systems to enhance security protocols while improving customer experience and operational efficiency.

The Asia-Pacific BFSI biometrics market refers to the comprehensive ecosystem of biometric authentication technologies specifically designed and deployed within banking, financial services, and insurance sectors across Asia-Pacific countries. This market encompasses hardware, software, and service components that enable secure identity verification and access control through unique biological characteristics.

Biometric authentication in BFSI applications involves the measurement and analysis of distinctive physical or behavioral traits to verify individual identity. These systems replace or supplement traditional authentication methods like passwords, PINs, and security tokens with more secure and user-friendly biological identifiers that cannot be easily replicated or stolen.

Market scope includes various deployment models ranging from branch-based authentication systems to mobile banking applications, ATM security enhancements, and enterprise-wide identity management solutions. The technology serves multiple functions including customer authentication, employee access control, transaction authorization, and fraud prevention across diverse financial service environments.

Strategic analysis reveals that the Asia-Pacific BFSI biometrics market is experiencing transformational growth driven by digital banking evolution, regulatory mandates, and increasing cyber threats. Financial institutions are prioritizing biometric solutions to address security vulnerabilities while meeting customer expectations for seamless, secure authentication experiences.

Key market drivers include government initiatives promoting digital financial inclusion, rising smartphone penetration enabling mobile biometric applications, and increasing awareness of identity theft risks. The market benefits from technological advancements in artificial intelligence, machine learning, and sensor technologies that enhance biometric accuracy and reduce false acceptance rates by over 85% compared to traditional systems.

Competitive landscape features established technology providers alongside emerging regional players developing specialized solutions for local market requirements. Major financial institutions are forming strategic partnerships with biometric technology vendors to accelerate deployment and customize solutions for specific operational needs.

Regional variations demonstrate diverse adoption patterns, with developed markets focusing on advanced multi-modal systems while emerging economies prioritize cost-effective single-modality solutions. The market shows strong potential for continued expansion as regulatory frameworks evolve and technology costs decrease.

Market intelligence reveals several critical insights shaping the Asia-Pacific BFSI biometrics landscape:

Digital transformation initiatives across Asia-Pacific financial institutions serve as the primary catalyst for biometric technology adoption. Banks and financial service providers are modernizing their infrastructure to meet evolving customer expectations while maintaining robust security standards. This transformation includes comprehensive digitization of customer touchpoints, from mobile banking applications to automated teller machines.

Regulatory compliance requirements significantly influence market growth, with governments across the region implementing stringent identity verification mandates. Financial authorities are establishing frameworks that require enhanced customer authentication mechanisms, particularly for high-value transactions and account access. These regulations create mandatory adoption scenarios that drive consistent market demand.

Cybersecurity concerns continue escalating as financial institutions face increasingly sophisticated cyber threats. Traditional authentication methods prove inadequate against advanced attack vectors, necessitating more secure biometric alternatives. The rise in data breaches and identity theft incidents compels financial organizations to invest in biometric solutions that provide inherent security advantages.

Customer experience enhancement represents another crucial driver, as financial institutions seek to balance security with convenience. Biometric authentication eliminates the need for customers to remember complex passwords or carry physical tokens, creating seamless user experiences that improve satisfaction and engagement rates.

Implementation costs present significant challenges for smaller financial institutions and emerging market players. The initial investment required for comprehensive biometric systems, including hardware, software, and integration services, can be substantial. These costs are particularly challenging for community banks and regional financial service providers with limited technology budgets.

Privacy concerns and cultural resistance in certain Asia-Pacific markets create adoption barriers. Some customer segments express reluctance to provide biometric data due to privacy considerations or cultural beliefs about personal information sharing. These concerns require careful management through education and transparent data handling policies.

Technical complexity associated with biometric system integration poses operational challenges. Legacy banking systems often require significant modifications to accommodate biometric authentication capabilities, creating implementation delays and additional costs. The complexity increases when institutions attempt to integrate multiple biometric modalities or upgrade existing systems.

Regulatory variations across different countries create compliance challenges for multinational financial institutions. Varying privacy laws, data protection requirements, and biometric data handling regulations complicate standardized deployment strategies and increase operational complexity.

Emerging market expansion presents substantial growth opportunities as developing economies in the Asia-Pacific region accelerate financial inclusion initiatives. Countries with large unbanked populations are implementing biometric-enabled financial services to extend banking access to rural and underserved communities. These markets offer significant potential for scalable biometric solutions.

Artificial intelligence integration creates opportunities for next-generation biometric systems with enhanced accuracy and functionality. AI-powered biometric solutions can adapt to changing user characteristics, detect spoofing attempts more effectively, and provide predictive analytics for fraud prevention. This technological evolution opens new market segments and premium pricing opportunities.

Internet of Things (IoT) connectivity enables innovative biometric applications across diverse financial service touchpoints. Connected devices can incorporate biometric authentication capabilities, creating seamless security experiences across multiple channels and platforms. This connectivity expansion multiplies potential deployment scenarios and market opportunities.

Partnership opportunities with fintech companies and technology startups provide established financial institutions with access to innovative biometric solutions. These collaborations can accelerate time-to-market for new services while sharing development costs and risks among multiple stakeholders.

Technological advancement continues reshaping the competitive landscape as biometric accuracy and reliability improve significantly. Modern systems demonstrate false acceptance rates below 0.001% while maintaining user-friendly interfaces that encourage adoption. These improvements address historical concerns about biometric reliability and create confidence among financial institution decision-makers.

Competitive intensity increases as established technology vendors compete with emerging regional players offering specialized solutions. This competition drives innovation while reducing costs, benefiting financial institutions seeking cost-effective biometric implementations. Market dynamics favor vendors that can demonstrate proven reliability, regulatory compliance, and local support capabilities.

Customer expectations evolve rapidly as users become accustomed to biometric authentication through consumer devices and applications. Financial institutions must meet these elevated expectations while maintaining security standards that exceed consumer-grade implementations. This dynamic creates pressure for continuous improvement and feature enhancement.

Integration complexity varies significantly based on existing infrastructure and institutional requirements. Organizations with modern core banking systems can implement biometric solutions more efficiently, while those with legacy systems face greater challenges and costs. These dynamics influence vendor selection and implementation strategies across different market segments.

Comprehensive market analysis employs multiple research methodologies to ensure accuracy and reliability of findings. Primary research includes extensive interviews with financial institution executives, technology vendors, regulatory officials, and industry experts across major Asia-Pacific markets. These interviews provide qualitative insights into market trends, challenges, and opportunities.

Secondary research incorporates analysis of industry reports, regulatory documents, financial statements, and technology specifications from leading biometric solution providers. This research foundation ensures comprehensive coverage of market dynamics and competitive positioning across different segments and geographic regions.

Data validation processes include cross-referencing multiple sources, conducting follow-up interviews, and analyzing market data consistency across different time periods. Statistical analysis techniques ensure that quantitative findings accurately represent market conditions and trends.

Market modeling utilizes advanced analytical frameworks to project future growth scenarios and identify key success factors. These models incorporate economic indicators, regulatory changes, technology adoption patterns, and competitive dynamics to provide reliable forecasts and strategic insights.

China dominates the Asia-Pacific BFSI biometrics market with approximately 35% market share, driven by massive digital payment adoption and government support for financial technology innovation. Chinese financial institutions lead in mobile biometric implementations, particularly facial recognition systems integrated with popular payment platforms. The regulatory environment strongly supports biometric adoption while maintaining strict data protection requirements.

India represents the fastest-growing regional market, benefiting from the world’s largest biometric identity program and increasing financial inclusion initiatives. Indian banks are rapidly deploying fingerprint and iris recognition systems to serve rural populations and comply with regulatory mandates. The market demonstrates strong growth potential with expanding smartphone penetration and digital banking adoption.

Japan maintains technological leadership in advanced biometric solutions, with financial institutions implementing sophisticated multi-modal systems for enhanced security. Japanese banks prioritize palm vein recognition and facial authentication technologies, reflecting cultural preferences for contactless interactions. The market emphasizes premium solutions with exceptional accuracy and reliability.

South Korea showcases high adoption rates across both traditional banking and emerging fintech applications. Korean financial institutions integrate biometric authentication with comprehensive digital banking platforms, creating seamless user experiences. The market benefits from advanced telecommunications infrastructure and high smartphone penetration rates.

Southeast Asian markets demonstrate diverse adoption patterns, with Singapore and Malaysia leading in regulatory framework development while Indonesia, Thailand, and Vietnam show rapid growth potential. These markets prioritize cost-effective solutions that can scale across large populations with varying technology literacy levels.

Market leadership features a diverse ecosystem of global technology providers, regional specialists, and emerging innovators competing across different solution categories and geographic markets. The competitive environment emphasizes technological differentiation, regulatory compliance, and local market expertise.

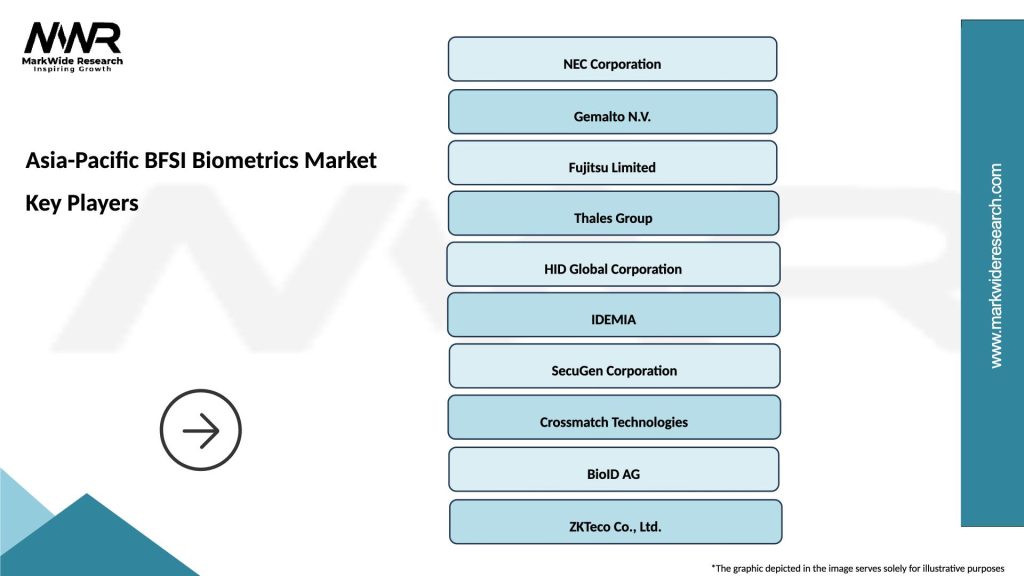

Key market participants include:

Competitive strategies focus on technological innovation, strategic partnerships with financial institutions, and development of region-specific solutions that address local regulatory requirements and cultural preferences.

Technology segmentation reveals diverse biometric modalities serving different applications and market requirements:

Application segmentation encompasses various use cases across financial institution operations:

Deployment model segmentation reflects different implementation approaches:

By Technology: Fingerprint recognition maintains market leadership with approximately 42% adoption rate across Asia-Pacific financial institutions, driven by smartphone integration and user familiarity. Facial recognition demonstrates the fastest growth trajectory, benefiting from AI advancements and contactless interaction preferences accelerated by pandemic-related hygiene concerns.

By Application: Customer authentication applications dominate market demand, representing the primary use case for biometric implementations across retail banking, mobile banking, and digital payment platforms. Employee access control applications show steady growth as financial institutions enhance internal security measures and comply with regulatory requirements for privileged access management.

By Institution Size: Large banks and financial institutions lead adoption with comprehensive multi-modal biometric deployments, while smaller institutions focus on cost-effective single-modality solutions. Credit unions and community banks increasingly adopt cloud-based biometric services to access advanced authentication capabilities without significant infrastructure investments.

By Geography: Developed markets emphasize advanced biometric technologies with premium features and exceptional accuracy, while emerging markets prioritize cost-effective solutions that can scale across large populations. Regional preferences vary significantly, with contactless biometrics gaining preference in hygiene-conscious markets and traditional fingerprint systems maintaining popularity in cost-sensitive segments.

Financial institutions realize multiple strategic advantages through biometric authentication implementations:

Technology vendors benefit from expanding market opportunities and strategic partnerships:

End customers experience improved service quality and security:

Strengths:

Weaknesses:

Opportunities:

Threats:

Contactless authentication emerges as a dominant trend, accelerated by hygiene concerns and user preference for touchless interactions. Financial institutions are prioritizing facial recognition and voice authentication technologies that eliminate physical contact requirements while maintaining security standards. This trend particularly influences ATM deployments and branch banking applications.

Multi-modal biometric systems gain traction as institutions seek enhanced accuracy and security through combined authentication methods. These systems typically integrate two or more biometric modalities to create layered security approaches that significantly reduce false acceptance rates while providing backup authentication options.

Artificial intelligence integration transforms biometric capabilities through machine learning algorithms that improve accuracy over time and detect sophisticated spoofing attempts. AI-powered systems can adapt to changing user characteristics and environmental conditions while providing predictive analytics for fraud prevention.

Mobile-first deployment strategies reflect the shift toward smartphone-based banking services and digital payment platforms. Financial institutions prioritize biometric solutions that integrate seamlessly with mobile applications and leverage device-native authentication capabilities.

Behavioral biometrics emerge as a complementary technology that analyzes user interaction patterns, typing rhythms, and device usage behaviors to provide continuous authentication throughout banking sessions. This approach enhances security without requiring explicit user actions.

Cloud-based biometric services expand accessibility for smaller financial institutions and fintech companies that lack resources for comprehensive on-premises implementations. These services offer scalability, cost-effectiveness, and access to advanced capabilities through subscription models.

Regulatory framework evolution across Asia-Pacific countries establishes clearer guidelines for biometric data handling, privacy protection, and cross-border data transfers. These developments provide greater certainty for financial institutions planning biometric implementations while ensuring customer protection.

Strategic partnerships between traditional banks and technology companies accelerate biometric solution development and deployment. Major financial institutions are forming alliances with biometric vendors to co-develop specialized solutions that address specific market requirements and regulatory compliance needs.

Technology standardization initiatives promote interoperability and reduce implementation complexity across different biometric systems and vendors. Industry associations and regulatory bodies collaborate to establish common standards that facilitate broader adoption and system integration.

Investment acceleration in biometric research and development reflects growing market confidence and competitive pressures. Technology vendors are increasing R&D spending to develop next-generation solutions with enhanced capabilities and reduced costs.

Pilot program expansion demonstrates successful biometric implementations across diverse financial service applications. These programs provide proof-of-concept validation and best practice development that supports broader market adoption.

Acquisition activity increases as established technology companies acquire specialized biometric firms to expand capabilities and market presence. This consolidation trend creates more comprehensive solution providers while accelerating technology development.

MarkWide Research analysis suggests that financial institutions should prioritize biometric strategies that align with long-term digital transformation objectives while addressing immediate security and compliance requirements. Organizations should evaluate multi-modal approaches that provide flexibility and enhanced security without overwhelming users with complex authentication processes.

Implementation planning should emphasize phased deployment approaches that allow institutions to validate technology performance and user acceptance before full-scale rollouts. Pilot programs in controlled environments can identify potential challenges and optimization opportunities while building internal expertise and confidence.

Vendor selection criteria should balance technological capabilities with local market expertise, regulatory compliance support, and long-term partnership potential. Financial institutions should prioritize vendors that demonstrate proven track records in similar deployments and offer comprehensive support services.

Customer education initiatives are essential for successful biometric adoption, particularly in markets where privacy concerns or cultural resistance may affect acceptance rates. Transparent communication about data protection measures and user benefits can significantly improve adoption outcomes.

Integration strategies should consider existing infrastructure capabilities and future technology roadmaps to ensure biometric implementations complement rather than complicate operational environments. Institutions should plan for scalability and interoperability from initial deployment phases.

Market evolution indicates continued strong growth with expanding applications across traditional banking, digital payments, and emerging financial services. The integration of biometric authentication into comprehensive digital identity frameworks will create new opportunities for enhanced customer experiences and operational efficiency.

Technology advancement will focus on improving accuracy, reducing costs, and expanding compatibility across diverse device types and operating environments. Next-generation biometric systems will incorporate advanced AI capabilities that provide adaptive authentication and predictive security analytics.

Regulatory development will continue shaping market dynamics through evolving privacy requirements, data protection standards, and cross-border compliance frameworks. Financial institutions must maintain flexibility to adapt to changing regulatory environments while preserving system functionality and user experience.

Market expansion into underserved segments and geographic regions will drive growth as technology costs decrease and implementation complexity reduces. Emerging markets present significant opportunities for scalable biometric solutions that support financial inclusion initiatives.

Competitive landscape will likely experience continued consolidation as technology vendors seek to expand capabilities and market presence through strategic acquisitions and partnerships. This consolidation may create more comprehensive solution providers while potentially reducing vendor choice for financial institutions.

Innovation acceleration will introduce new biometric modalities and hybrid authentication approaches that combine multiple verification methods for enhanced security and user convenience. These developments will expand application possibilities and market opportunities across diverse financial service environments.

The Asia-Pacific BFSI biometrics market represents a transformational opportunity for financial institutions seeking to enhance security, improve customer experience, and maintain competitive advantage in an increasingly digital financial services landscape. Market dynamics demonstrate strong growth potential driven by regulatory support, technological advancement, and evolving customer expectations for secure, convenient authentication experiences.

Strategic implementation of biometric solutions requires careful consideration of technology selection, deployment approaches, and change management strategies that address both institutional requirements and customer preferences. Success depends on balancing security enhancement with user convenience while maintaining compliance with evolving regulatory frameworks across diverse Asia-Pacific markets.

Future success will favor organizations that adopt comprehensive biometric strategies aligned with long-term digital transformation objectives. Financial institutions that invest in scalable, interoperable biometric solutions while maintaining focus on customer education and experience optimization will realize the greatest benefits from this rapidly evolving market opportunity.

What is BFSI Biometrics?

BFSI Biometrics refers to the use of biometric technologies in the Banking, Financial Services, and Insurance sectors to enhance security and streamline customer identification processes. This includes fingerprint recognition, facial recognition, and iris scanning, among other technologies.

What are the key players in the Asia-Pacific BFSI Biometrics Market?

Key players in the Asia-Pacific BFSI Biometrics Market include NEC Corporation, Gemalto, and HID Global, which provide various biometric solutions tailored for financial institutions and insurance companies, among others.

What are the growth factors driving the Asia-Pacific BFSI Biometrics Market?

The growth of the Asia-Pacific BFSI Biometrics Market is driven by increasing security concerns, the rise in digital banking, and the need for enhanced customer verification processes. Additionally, regulatory compliance and the demand for seamless user experiences are significant factors.

What challenges does the Asia-Pacific BFSI Biometrics Market face?

Challenges in the Asia-Pacific BFSI Biometrics Market include privacy concerns regarding data security, the high cost of implementation, and the need for continuous technological advancements. These factors can hinder widespread adoption among smaller financial institutions.

What opportunities exist in the Asia-Pacific BFSI Biometrics Market?

Opportunities in the Asia-Pacific BFSI Biometrics Market include the integration of AI and machine learning for improved accuracy, the expansion of mobile banking applications, and the potential for partnerships between tech companies and financial institutions to enhance service offerings.

What trends are shaping the Asia-Pacific BFSI Biometrics Market?

Trends in the Asia-Pacific BFSI Biometrics Market include the increasing adoption of multi-factor authentication, advancements in biometric technology such as voice recognition, and a growing focus on user-friendly interfaces to improve customer experience.

Asia-Pacific BFSI Biometrics Market

| Segmentation Details | Description |

|---|---|

| Product Type | Fingerprint Scanners, Facial Recognition Systems, Iris Recognition Devices, Voice Recognition Solutions |

| Technology | Artificial Intelligence, Machine Learning, Cloud Computing, Blockchain |

| End User | Banking Institutions, Insurance Companies, Financial Services, Investment Firms |

| Deployment | On-Premises, Cloud-Based, Hybrid, Mobile |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Asia-Pacific BFSI Biometrics Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at