444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Europe electric vehicle battery materials market represents a critical component of the continent’s transition toward sustainable transportation and energy independence. This dynamic sector encompasses the production, processing, and supply of essential raw materials including lithium, cobalt, nickel, graphite, and rare earth elements that form the backbone of modern electric vehicle battery systems. European manufacturers are experiencing unprecedented demand as automotive giants accelerate their electrification strategies, with the region witnessing a 12.5% annual growth rate in battery material consumption.

Market dynamics are being shaped by stringent environmental regulations, substantial government incentives, and the European Union’s ambitious carbon neutrality goals by 2050. The sector benefits from robust investments in local mining operations, recycling facilities, and advanced processing technologies. Supply chain resilience has become a paramount concern, driving European companies to establish strategic partnerships and develop domestic sourcing capabilities to reduce dependence on traditional suppliers.

Regional leadership in battery technology innovation positions Europe as a formidable competitor in the global electric vehicle ecosystem. Countries like Germany, France, and Sweden are leading the charge with significant investments in gigafactory construction and research facilities. The market demonstrates strong potential for sustained expansion, supported by increasing consumer acceptance of electric vehicles and corporate commitments to fleet electrification.

The Europe electric vehicle battery materials market refers to the comprehensive ecosystem of raw materials, processed components, and specialized chemicals required for manufacturing lithium-ion batteries used in electric vehicles across European territories. This market encompasses the entire value chain from mineral extraction and processing to the production of battery-grade materials that meet stringent automotive industry standards.

Key components within this market include lithium compounds for electrolytes, high-purity nickel for cathode materials, synthetic and natural graphite for anodes, cobalt for enhanced battery stability, and various additives that optimize battery performance. The market also includes emerging materials such as silicon nanowires, solid-state electrolytes, and next-generation cathode chemistries that promise improved energy density and safety characteristics.

Market participants range from mining companies and chemical processors to specialized battery material manufacturers and recycling facilities. The sector operates within a complex regulatory framework that emphasizes environmental sustainability, ethical sourcing practices, and circular economy principles, making it distinct from traditional commodity markets.

Europe’s electric vehicle battery materials market stands at the forefront of a transformative period in automotive history, driven by accelerating electric vehicle adoption and supportive policy frameworks. The market demonstrates remarkable resilience and growth potential, with European companies investing heavily in domestic production capabilities and innovative recycling technologies to create a sustainable supply chain ecosystem.

Strategic initiatives across the region focus on reducing import dependencies while establishing Europe as a global leader in battery technology and materials processing. Major automotive manufacturers including Volkswagen, BMW, and Stellantis are securing long-term supply agreements and investing in vertical integration strategies to ensure reliable access to critical materials.

Government support through the European Battery Alliance and various national programs provides substantial funding for research, development, and commercial-scale production facilities. The market benefits from a 15.8% increase in public and private investment commitments, reflecting strong confidence in the sector’s long-term prospects and strategic importance to European economic competitiveness.

Innovation leadership in battery chemistry and materials science positions European companies to capture significant value in the global supply chain. The focus on sustainable practices and circular economy principles creates competitive advantages that align with evolving consumer preferences and regulatory requirements.

Market intelligence reveals several critical insights that define the current landscape and future trajectory of Europe’s electric vehicle battery materials sector:

Regulatory mandates serve as the primary catalyst driving explosive growth in Europe’s electric vehicle battery materials market. The European Union’s comprehensive climate legislation, including the European Green Deal and Fit for 55 package, establishes binding targets for carbon emission reductions that necessitate rapid transportation electrification. National governments complement these frameworks with substantial incentives, tax benefits, and infrastructure investments that accelerate electric vehicle adoption rates.

Automotive industry transformation represents another fundamental driver as traditional manufacturers pivot toward electric mobility. Companies like Mercedes-Benz, Volvo, and Jaguar Land Rover have announced comprehensive electrification strategies with aggressive timelines for phasing out internal combustion engines. This industrial shift creates unprecedented demand for battery materials and drives long-term supply agreements that provide market stability.

Technological advancement in battery chemistry and manufacturing processes continues to improve performance characteristics while reducing costs. Innovations in lithium iron phosphate chemistries, solid-state electrolytes, and silicon-based anodes enhance energy density, charging speeds, and safety profiles. Research institutions across Europe collaborate with industry partners to accelerate commercialization of breakthrough technologies.

Energy security concerns motivate European policymakers to establish domestic supply chains for critical materials. Recent geopolitical tensions highlight vulnerabilities in traditional sourcing patterns, prompting investments in local mining operations, processing facilities, and strategic material reserves. Supply chain resilience becomes a competitive advantage that justifies premium pricing for domestically produced materials.

Raw material scarcity poses significant challenges to sustained market growth, particularly for lithium, cobalt, and high-grade nickel deposits within European territories. Geological limitations require continued reliance on imports from regions with political instability or conflicting strategic interests. Limited domestic mining capacity constrains supply chain localization efforts and maintains exposure to price volatility in global commodity markets.

Environmental concerns surrounding mining operations and chemical processing create regulatory hurdles and community opposition that delay project development. Permitting processes for new facilities often extend beyond five years, limiting the industry’s ability to respond quickly to demand surges. Strict environmental standards, while necessary for sustainability, increase operational costs and complexity for material producers.

Technical complexity in battery material processing requires specialized expertise and sophisticated equipment that may not be readily available across all European markets. Quality control standards for automotive applications demand consistent material properties and rigorous testing protocols that increase production costs and time-to-market for new suppliers.

Capital intensity of establishing processing facilities and recycling operations creates barriers to entry for smaller companies and limits market competition. Financial requirements for scaling production to commercially viable levels often exceed the resources of innovative startups, potentially slowing technology adoption and market diversification.

Circular economy development presents substantial opportunities for companies that can establish efficient recycling and material recovery systems. End-of-life battery volumes are projected to increase exponentially as first-generation electric vehicles reach replacement cycles, creating valuable feedstock for secondary material production. Advanced recycling technologies can recover materials at purities comparable to virgin sources while reducing environmental impact.

Next-generation battery technologies offer opportunities for European companies to establish leadership positions in emerging market segments. Solid-state batteries, lithium-metal anodes, and advanced cathode chemistries require new materials and processing techniques that favor companies with strong research capabilities and manufacturing flexibility.

Strategic partnerships with automotive manufacturers create opportunities for long-term supply agreements and joint development programs. Vertical integration initiatives by car companies seek reliable material suppliers who can meet quality standards and delivery schedules while supporting innovation objectives.

Export potential to other regions experiencing electric vehicle growth provides opportunities for European material producers to leverage their technological advantages and quality reputation. Global market expansion can justify investments in larger-scale production facilities and advanced processing technologies.

Supply and demand dynamics in Europe’s electric vehicle battery materials market reflect the complex interplay between rapidly growing consumption and constrained production capacity. Demand acceleration outpaces supply expansion in most material categories, creating favorable pricing conditions for established producers while attracting new market entrants seeking to capitalize on growth opportunities.

Price volatility remains a characteristic feature of commodity-based materials, influenced by factors including mining disruptions, geopolitical tensions, and speculative trading activities. Long-term contracts between material suppliers and battery manufacturers help stabilize pricing and provide predictable revenue streams that support capacity expansion investments.

Technology evolution continuously reshapes material requirements as battery chemistries advance and performance standards improve. Material specifications become increasingly sophisticated, demanding higher purity levels, specific particle sizes, and enhanced performance characteristics that challenge traditional production methods.

Competitive intensity increases as global players establish European operations while domestic companies expand their capabilities. Market consolidation through mergers and acquisitions creates larger, more integrated companies capable of serving major automotive customers and investing in advanced technologies.

Comprehensive market analysis employs multiple research methodologies to ensure accuracy and reliability of findings. Primary research includes extensive interviews with industry executives, technical experts, and key stakeholders across the battery materials value chain. Survey data from material suppliers, battery manufacturers, and automotive companies provides quantitative insights into market trends and future projections.

Secondary research incorporates analysis of industry reports, company financial statements, patent filings, and regulatory documents to validate primary findings and identify emerging trends. Database analysis of trade statistics, production data, and investment announcements provides quantitative foundation for market sizing and growth projections.

Expert consultation with leading researchers, industry analysts, and technology specialists ensures comprehensive coverage of technical developments and market dynamics. Peer review processes validate research findings and methodological approaches to maintain analytical rigor and objectivity.

Continuous monitoring of market developments, regulatory changes, and technological breakthroughs ensures research remains current and relevant. MarkWide Research maintains ongoing dialogue with industry participants to track evolving market conditions and emerging opportunities.

Germany dominates the European electric vehicle battery materials market, accounting for approximately 32% of regional consumption due to its strong automotive manufacturing base and aggressive electrification policies. German companies including BASF, Evonik, and Wacker Chemie lead in specialty chemical production and advanced material development. The country’s substantial investments in gigafactory construction and research facilities reinforce its market leadership position.

France represents the second-largest market with significant government support for domestic battery production and material processing capabilities. French initiatives focus on establishing complete supply chains from mining to recycling, with companies like Eramet and Orano developing lithium extraction and processing facilities. Strategic partnerships with automotive manufacturers strengthen the country’s competitive position.

Nordic countries including Sweden, Norway, and Finland leverage their abundant renewable energy resources and mining expertise to establish competitive advantages in energy-intensive material processing. Swedish companies like Northvolt integrate battery manufacturing with material production to create vertically integrated supply chains. The region’s focus on sustainability aligns with evolving market preferences.

Eastern European countries including Poland, Czech Republic, and Hungary attract investments through competitive labor costs and strategic locations within automotive supply chains. Manufacturing expansion in these markets supports regional material demand while providing cost-effective production alternatives for multinational companies.

Market leadership in Europe’s electric vehicle battery materials sector is distributed among established chemical companies, specialized material producers, and emerging technology companies. The competitive landscape reflects diverse strategic approaches ranging from vertical integration to focused specialization in specific material categories.

By Material Type: The market segments into distinct categories based on specific battery components and their functional roles within energy storage systems.

By Application: Market segmentation reflects diverse end-use applications with varying performance requirements and volume demands.

Lithium compounds represent the fastest-growing category within the European battery materials market, driven by expanding battery production capacity and evolving chemistry requirements. Lithium carbonate and lithium hydroxide demand increases as manufacturers optimize cathode formulations for improved energy density and thermal stability. European companies invest in domestic lithium extraction from brines and hard rock deposits to reduce import dependencies.

Nickel materials experience strong demand growth as high-energy-density battery chemistries gain market acceptance. Battery-grade nickel sulfate commands premium pricing due to stringent purity requirements and limited production capacity. European refiners upgrade their facilities to produce battery-grade materials while implementing sustainable production practices.

Graphite materials face supply chain challenges as synthetic graphite production requires significant energy inputs and specialized manufacturing capabilities. Natural graphite sources within Europe remain limited, driving investments in synthetic production facilities and alternative anode materials including silicon composites.

Cobalt materials encounter sustainability concerns and price volatility that motivate battery manufacturers to reduce cobalt content in cathode formulations. Ethical sourcing requirements drive European companies to establish transparent supply chains and invest in cobalt recycling technologies.

Material suppliers benefit from long-term demand visibility and premium pricing for high-quality products that meet automotive industry standards. Supply agreements with battery manufacturers provide revenue stability and support capacity expansion investments. European suppliers gain competitive advantages through proximity to major automotive markets and alignment with sustainability requirements.

Battery manufacturers achieve supply chain security and quality assurance through partnerships with European material suppliers. Reduced transportation costs and shorter lead times improve operational efficiency and responsiveness to market demands. Local sourcing supports sustainability goals and reduces carbon footprint of battery production.

Automotive companies secure reliable access to critical materials while supporting their electrification strategies and sustainability commitments. Vertical integration opportunities through material supplier partnerships provide greater control over supply chains and cost structures. European sourcing reduces geopolitical risks and supports regional economic development.

Government stakeholders achieve strategic objectives including industrial competitiveness, energy security, and environmental protection. Domestic supply chains create high-value employment opportunities and support technology leadership in critical industries. Tax revenues and economic multiplier effects benefit regional development initiatives.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability integration emerges as the dominant trend reshaping Europe’s electric vehicle battery materials market. Circular economy principles drive investments in recycling technologies, sustainable mining practices, and life-cycle assessment methodologies. Companies increasingly emphasize environmental stewardship and social responsibility in their operations and supply chain management.

Supply chain localization accelerates as European companies seek to reduce dependencies on distant suppliers and enhance supply security. Regional partnerships between mining companies, processors, and manufacturers create integrated value chains that improve efficiency and responsiveness. Government support for domestic capacity development reinforces this trend.

Technology advancement in battery chemistry and materials science continues to drive market evolution. Solid-state batteries, silicon anodes, and high-nickel cathodes require new materials and processing techniques. European research institutions and companies collaborate to commercialize breakthrough technologies and maintain competitive advantages.

Digital transformation enhances supply chain visibility, quality control, and operational efficiency throughout the materials value chain. Blockchain technology enables traceability and ethical sourcing verification while artificial intelligence optimizes production processes and predictive maintenance.

Strategic investments in European battery material production capacity reach unprecedented levels as companies respond to growing demand and policy support. Northvolt’s expansion includes integrated material production capabilities while BASF constructs new cathode material facilities across multiple European locations. These investments demonstrate industry confidence in long-term market prospects.

Recycling infrastructure development accelerates with new facilities designed to process end-of-life batteries and manufacturing waste. Umicore and Johnson Matthey expand their recycling capabilities while startups develop innovative recovery technologies. MarkWide Research indicates that recycling capacity could meet 25% of European material demand by 2030.

Research collaborations between industry and academia advance next-generation battery technologies and sustainable production methods. European Battery Alliance initiatives coordinate research efforts and facilitate technology transfer. Public funding supports pre-commercial development and demonstration projects.

Regulatory developments including the EU Battery Regulation establish comprehensive requirements for sustainability, recycling, and supply chain transparency. Due diligence obligations require companies to verify ethical sourcing practices and environmental compliance throughout their supply chains.

Market participants should prioritize supply chain diversification and vertical integration strategies to mitigate risks and capture value across the materials value chain. Strategic partnerships with automotive manufacturers provide demand visibility and support capacity planning decisions. Companies should invest in advanced recycling technologies to create sustainable competitive advantages.

Technology investment in next-generation materials and processing techniques remains critical for maintaining market leadership. Research and development spending should focus on improving material performance, reducing costs, and enhancing sustainability. Collaboration with research institutions accelerates innovation and reduces development risks.

Regulatory compliance requires proactive engagement with evolving requirements and industry standards. Sustainability reporting and supply chain transparency become competitive necessities rather than optional initiatives. Companies should implement comprehensive environmental and social governance programs.

Geographic expansion within Europe and globally can diversify market exposure and capture growth opportunities in emerging markets. Export strategies should leverage European quality and sustainability advantages while adapting to local market requirements and competitive conditions.

Long-term prospects for Europe’s electric vehicle battery materials market remain exceptionally positive, supported by accelerating electric vehicle adoption, supportive policy frameworks, and technological advancement. Market expansion is projected to continue at robust rates as automotive electrification reaches mainstream adoption and energy storage applications proliferate.

Technology evolution will reshape material requirements and create opportunities for innovative companies that can adapt to changing specifications. Solid-state batteries and advanced chemistries may require entirely new material categories while improving performance and safety characteristics. European companies are well-positioned to lead these technological transitions.

Sustainability imperatives will increasingly influence material selection, sourcing decisions, and production methods. Circular economy principles become standard practice as recycling technologies mature and regulatory requirements expand. Companies that embrace sustainability early will gain competitive advantages in future markets.

Supply chain evolution toward greater regional integration and resilience will continue as geopolitical considerations and sustainability requirements drive localization efforts. European self-sufficiency in critical materials becomes a strategic objective supported by government policies and industry investments. MWR analysis suggests that domestic sourcing could reach 60% of European demand by 2035 through continued capacity expansion and recycling development.

Europe’s electric vehicle battery materials market represents a transformative opportunity that combines environmental sustainability with economic competitiveness and technological leadership. The sector demonstrates remarkable growth potential driven by accelerating electric vehicle adoption, supportive regulatory frameworks, and substantial investments in domestic production capabilities.

Strategic positioning of European companies across the battery materials value chain creates competitive advantages through proximity to major automotive markets, advanced technology capabilities, and alignment with sustainability requirements. The focus on circular economy principles and supply chain localization addresses key market challenges while creating new opportunities for innovation and growth.

Future success will depend on continued investment in technology development, capacity expansion, and sustainable production practices. Companies that can navigate the complex regulatory environment while delivering high-quality materials at competitive costs will capture the greatest value from this dynamic market. The transition to electric mobility represents not just an environmental imperative but a significant economic opportunity for European industry participants and stakeholders.

What is Electric Vehicle Battery Materials?

Electric Vehicle Battery Materials refer to the various components and substances used in the production of batteries for electric vehicles, including lithium, cobalt, nickel, and graphite, among others.

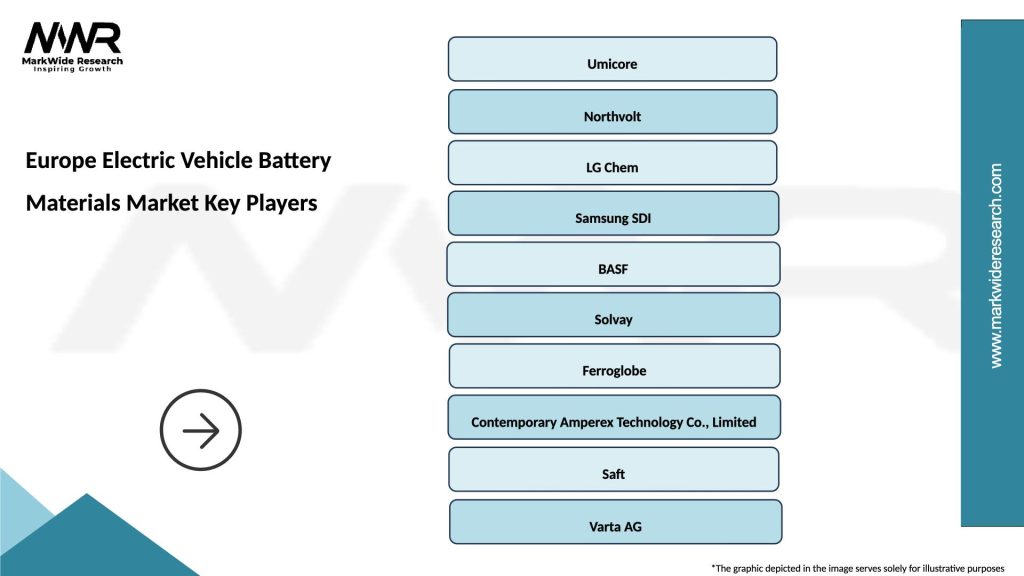

What are the key players in the Europe Electric Vehicle Battery Materials Market?

Key players in the Europe Electric Vehicle Battery Materials Market include companies like BASF, Umicore, and Northvolt, which are involved in the production and supply of essential battery materials, among others.

What are the main drivers of the Europe Electric Vehicle Battery Materials Market?

The main drivers of the Europe Electric Vehicle Battery Materials Market include the increasing demand for electric vehicles, advancements in battery technology, and government initiatives promoting sustainable transportation.

What challenges does the Europe Electric Vehicle Battery Materials Market face?

Challenges in the Europe Electric Vehicle Battery Materials Market include supply chain disruptions, fluctuating raw material prices, and environmental concerns related to mining and production processes.

What opportunities exist in the Europe Electric Vehicle Battery Materials Market?

Opportunities in the Europe Electric Vehicle Battery Materials Market include the development of new recycling technologies, the rise of solid-state batteries, and increasing investments in renewable energy sources.

What trends are shaping the Europe Electric Vehicle Battery Materials Market?

Trends shaping the Europe Electric Vehicle Battery Materials Market include the shift towards sustainable sourcing of materials, innovations in battery chemistry, and the growing emphasis on circular economy practices.

Europe Electric Vehicle Battery Materials Market

| Segmentation Details | Description |

|---|---|

| Product Type | Lithium-ion, Nickel Manganese Cobalt, Solid State, Lead Acid |

| Grade | High Purity, Industrial Grade, Battery Grade, Technical Grade |

| End User | OEMs, Tier-1 Suppliers, Aftermarket Providers, Vehicle Assemblers |

| Application | Passenger Vehicles, Commercial Vehicles, Two-Wheelers, Energy Storage Systems |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Europe Electric Vehicle Battery Materials Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at