444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The North America plastic film packaging market represents a dynamic and rapidly evolving sector that serves as the backbone of modern packaging solutions across diverse industries. This comprehensive market encompasses flexible packaging materials manufactured from various polymer resins, including polyethylene, polypropylene, polyester, and specialty films designed for specific applications. Market dynamics indicate robust growth driven by increasing consumer demand for convenient, lightweight, and cost-effective packaging solutions that extend product shelf life while maintaining quality and freshness.

Regional distribution across North America shows the United States commanding approximately 78% market share, followed by Canada and Mexico contributing significantly to overall market expansion. The market demonstrates remarkable resilience and adaptability, with manufacturers continuously innovating to meet evolving consumer preferences and stringent regulatory requirements. Growth projections suggest the market will experience a compound annual growth rate of 4.2% over the forecast period, driven by technological advancements and increasing adoption across food and beverage, pharmaceutical, and consumer goods sectors.

Industry transformation is evident through the integration of sustainable materials, advanced barrier properties, and smart packaging technologies that enhance product protection and consumer engagement. The market’s strategic importance extends beyond traditional packaging applications, encompassing emerging segments such as e-commerce packaging, medical device protection, and specialty industrial applications that require customized film solutions.

The North America plastic film packaging market refers to the comprehensive ecosystem of flexible packaging materials manufactured from synthetic polymer resins and designed to protect, preserve, and present products across multiple industry verticals. This market encompasses the production, distribution, and application of thin plastic films that serve as primary, secondary, or tertiary packaging solutions for consumer and industrial products.

Core components of this market include various film types such as stretch films, shrink films, barrier films, and specialty films engineered with specific properties including moisture resistance, oxygen barrier capabilities, puncture resistance, and heat sealability. The market definition extends to encompass both commodity films used for general packaging applications and high-performance films designed for specialized requirements in pharmaceutical, medical, and food safety applications.

Market scope includes manufacturing processes ranging from blown film extrusion to cast film production, along with converting operations that transform base films into finished packaging products. The definition also encompasses value-added services such as printing, lamination, coating, and customization that enhance film functionality and brand presentation capabilities.

Strategic analysis reveals the North America plastic film packaging market as a cornerstone of the regional packaging industry, characterized by steady growth, technological innovation, and increasing sustainability focus. The market demonstrates exceptional resilience across economic cycles, supported by essential applications in food preservation, pharmaceutical protection, and consumer goods packaging that maintain consistent demand regardless of market conditions.

Key growth drivers include the expanding e-commerce sector, which has increased demand for protective packaging films by approximately 35% over recent years, and the growing preference for convenient, portion-controlled packaging formats among consumers. The market benefits from continuous technological advancement in film manufacturing processes, enabling the production of thinner, stronger, and more functional films that reduce material usage while enhancing performance characteristics.

Competitive landscape features a mix of large multinational corporations and specialized regional players, with market leaders focusing on innovation, sustainability, and strategic partnerships to maintain competitive advantages. The market’s future trajectory appears positive, supported by increasing adoption of flexible packaging solutions that offer superior product protection, extended shelf life, and reduced transportation costs compared to rigid packaging alternatives.

Sustainability initiatives are reshaping market dynamics, with manufacturers investing heavily in recyclable films, bio-based materials, and circular economy solutions that address environmental concerns while maintaining packaging performance standards required by end-users across various industry segments.

Market intelligence reveals several critical insights that define the current state and future direction of the North America plastic film packaging market. These insights provide stakeholders with essential understanding of market dynamics, competitive positioning, and strategic opportunities that influence business decisions and investment priorities.

Primary growth catalysts propelling the North America plastic film packaging market forward encompass a diverse range of economic, technological, and consumer-driven factors that create sustained demand for flexible packaging solutions. These drivers represent fundamental market forces that influence long-term growth trajectories and strategic planning initiatives across the industry.

Consumer lifestyle changes constitute a major driving force, with increasing preference for convenient, portable, and ready-to-consume products that require sophisticated packaging solutions. The growing trend toward smaller household sizes and single-person households has increased demand for portion-controlled packaging formats that utilize specialized films designed to maintain product freshness and quality over extended periods.

E-commerce expansion continues to drive significant demand for protective packaging films, with online retail growth creating new requirements for films that provide superior puncture resistance, moisture protection, and tamper evidence during shipping and handling processes. This trend has resulted in increased adoption of multi-layer films and specialty barrier materials designed specifically for e-commerce applications.

Food safety regulations and consumer awareness regarding product quality and safety are driving adoption of advanced barrier films that prevent contamination, extend shelf life, and maintain nutritional value. These regulatory requirements create consistent demand for high-performance films that meet stringent food contact standards and provide superior protection against oxygen, moisture, and other environmental factors.

Technological advancement in film manufacturing processes enables production of thinner, stronger, and more functional films that reduce material costs while improving performance characteristics, creating competitive advantages for manufacturers and cost savings for end-users across various application segments.

Significant challenges facing the North America plastic film packaging market include environmental concerns, regulatory pressures, and raw material price volatility that create operational complexities and strategic planning difficulties for industry participants. These restraints require careful management and innovative solutions to maintain market growth momentum.

Environmental regulations and growing consumer awareness regarding plastic waste are creating pressure for sustainable packaging alternatives, potentially limiting growth in traditional plastic film segments. Regulatory initiatives targeting single-use plastics and packaging waste reduction are forcing manufacturers to invest heavily in recyclable and biodegradable film technologies, increasing production costs and complexity.

Raw material price volatility represents a persistent challenge, with petroleum-based resin prices subject to fluctuations based on crude oil markets, supply chain disruptions, and geopolitical factors. These price variations impact manufacturing costs and profit margins, requiring sophisticated supply chain management and pricing strategies to maintain competitive positioning.

Competition from alternative packaging materials including paper-based solutions, metal containers, and glass packaging creates market share pressure in certain application segments. These alternatives often benefit from perceived environmental advantages and consumer preference for sustainable packaging options, particularly in premium product categories.

Technical limitations in recycling infrastructure and consumer education regarding proper disposal methods limit the effectiveness of sustainability initiatives, creating ongoing challenges for manufacturers seeking to address environmental concerns while maintaining packaging performance standards required by end-users.

Emerging opportunities within the North America plastic film packaging market present significant potential for growth, innovation, and market expansion across diverse application segments and geographic regions. These opportunities reflect evolving consumer preferences, technological capabilities, and regulatory frameworks that create new avenues for business development and competitive differentiation.

Sustainable packaging solutions represent the most significant growth opportunity, with increasing demand for recyclable, compostable, and bio-based films creating new market segments and premium pricing opportunities. Manufacturers investing in sustainable technologies and circular economy solutions are positioned to capture growing market share as environmental consciousness continues to influence purchasing decisions.

Smart packaging technologies offer substantial growth potential through integration of intelligent features such as freshness indicators, temperature monitoring, and interactive consumer engagement capabilities. These advanced packaging solutions command premium pricing while providing enhanced value propositions for brand owners seeking to differentiate their products in competitive markets.

Healthcare and pharmaceutical applications present expanding opportunities driven by aging populations, increasing healthcare spending, and growing demand for sterile packaging solutions that ensure product safety and efficacy. This segment requires specialized films with superior barrier properties and regulatory compliance capabilities.

E-commerce packaging continues to create new opportunities for protective films designed specifically for shipping and handling applications, with growth potential enhanced by increasing online retail penetration and consumer expectations for damage-free delivery experiences.

Complex interactions between supply and demand factors, technological developments, and regulatory influences create dynamic market conditions that require continuous monitoring and strategic adaptation by industry participants. These dynamics shape competitive landscapes, pricing strategies, and investment priorities across the North America plastic film packaging market.

Supply chain integration is becoming increasingly important as manufacturers seek to optimize production efficiency and reduce costs through vertical integration and strategic partnerships. This trend is driving consolidation within the industry as companies pursue economies of scale and enhanced market positioning through expanded capabilities and geographic reach.

Innovation cycles are accelerating as manufacturers invest in research and development to create differentiated products that meet evolving customer requirements for performance, sustainability, and cost-effectiveness. According to MarkWide Research analysis, companies allocating more than 5% of revenue to R&D activities demonstrate superior market performance and customer retention rates.

Customer relationship management is evolving toward collaborative partnerships that involve joint product development, supply chain optimization, and sustainability initiatives. These relationships create competitive advantages through enhanced customer loyalty and reduced market volatility, while enabling manufacturers to better understand and respond to changing market requirements.

Regulatory compliance continues to influence market dynamics through evolving standards for food safety, environmental impact, and product performance that require ongoing investment in manufacturing capabilities and quality assurance systems.

Comprehensive research approach employed for analyzing the North America plastic film packaging market incorporates multiple data sources, analytical techniques, and validation methods to ensure accuracy, reliability, and actionable insights for industry stakeholders. The methodology combines quantitative analysis with qualitative assessment to provide holistic market understanding.

Primary research activities include extensive interviews with industry executives, manufacturing professionals, and end-user representatives across key market segments. These interviews provide insights into market trends, competitive dynamics, and future growth prospects that complement quantitative data analysis and market modeling activities.

Secondary research encompasses analysis of industry publications, regulatory filings, company annual reports, and trade association data to establish market baselines and identify emerging trends. This research foundation supports quantitative analysis and provides context for primary research findings and market projections.

Data validation processes include cross-referencing multiple sources, statistical analysis of data consistency, and expert review of findings to ensure research accuracy and reliability. Market projections undergo sensitivity analysis to account for various scenarios and potential market disruptions that could influence future growth trajectories.

Analytical frameworks incorporate industry-standard methodologies for market sizing, competitive analysis, and trend identification, ensuring research outputs meet professional standards and provide actionable insights for strategic decision-making processes.

Geographic distribution across North America reveals distinct market characteristics, growth patterns, and competitive dynamics that influence regional strategies and investment priorities for plastic film packaging manufacturers. Regional analysis provides essential insights for market entry, expansion planning, and resource allocation decisions.

United States market dominates the regional landscape, accounting for approximately 78% of total market share and serving as the primary innovation hub for new product development and technology advancement. The U.S. market benefits from diverse industrial base, advanced manufacturing capabilities, and sophisticated supply chain infrastructure that supports both domestic consumption and export activities.

Canadian market represents approximately 15% of regional market share and demonstrates strong growth potential driven by expanding food processing industry, growing e-commerce sector, and increasing focus on sustainable packaging solutions. The Canadian market is characterized by stringent environmental regulations that drive innovation in recyclable and biodegradable film technologies.

Mexican market contributes approximately 7% of regional market share but shows the highest growth rate potential, supported by expanding manufacturing sector, increasing foreign investment, and growing consumer goods production. The Mexican market benefits from cost-competitive manufacturing capabilities and strategic location for serving both North American and Latin American markets.

Cross-border trade patterns reveal significant integration across the region, with manufacturers leveraging USMCA trade agreements to optimize production locations and supply chain efficiency while serving diverse customer requirements across national boundaries.

Market structure within the North America plastic film packaging sector reflects a combination of large multinational corporations, specialized regional players, and emerging technology companies that create diverse competitive dynamics and strategic opportunities. The competitive environment continues to evolve through consolidation, innovation, and strategic partnerships.

Competitive strategies focus on innovation, sustainability, and customer partnership development, with leading companies investing heavily in research and development to create differentiated products that command premium pricing and enhance customer loyalty.

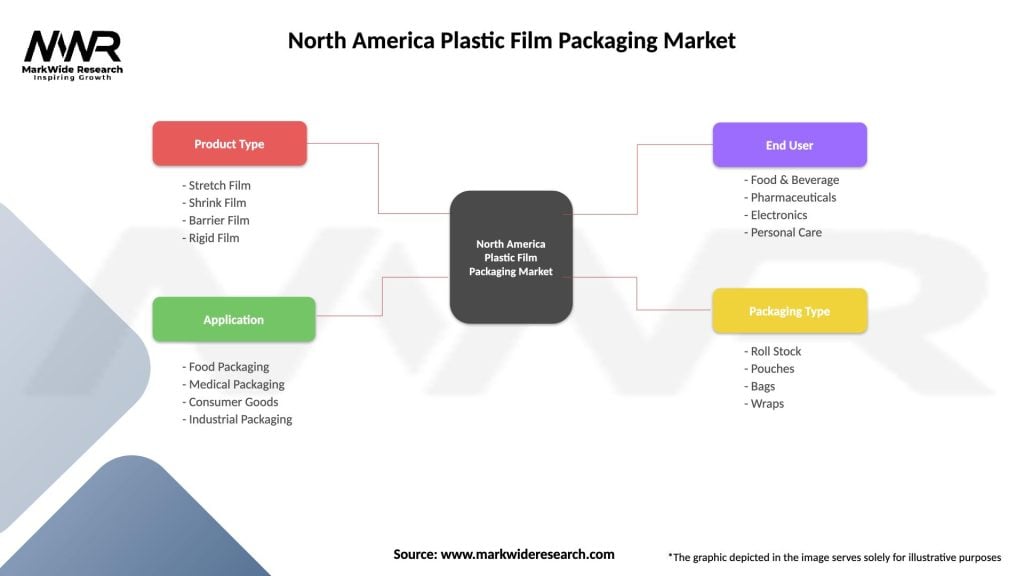

Market segmentation analysis reveals diverse application areas, material types, and end-user industries that create distinct market dynamics and growth opportunities within the North America plastic film packaging market. Understanding these segments enables targeted strategies and optimized resource allocation for maximum market impact.

By Material Type:

By Application:

By End-User Industry:

Detailed analysis of key market categories reveals specific trends, growth drivers, and competitive dynamics that influence strategic planning and investment decisions within the North America plastic film packaging market. These insights provide actionable intelligence for category-specific market approaches.

Food packaging films represent the largest market category, driven by increasing demand for convenient, shelf-stable products that maintain freshness and quality throughout distribution channels. This category benefits from continuous innovation in barrier technologies, with manufacturers developing films that provide enhanced oxygen and moisture protection while reducing material thickness and environmental impact.

Industrial packaging films demonstrate strong growth potential, supported by expanding manufacturing activities and increasing focus on supply chain efficiency. This category includes stretch films, shrink films, and protective wrapping materials that provide superior load stability and damage protection during transportation and storage operations.

Healthcare packaging films represent a high-value category characterized by stringent regulatory requirements and specialized performance characteristics. Growth in this category is driven by aging populations, increasing healthcare spending, and growing demand for sterile packaging solutions that ensure product safety and efficacy throughout shelf life.

Sustainable packaging films constitute an emerging category with significant growth potential, as manufacturers develop recyclable, compostable, and bio-based alternatives to traditional plastic films. This category addresses environmental concerns while maintaining packaging performance standards required by end-users across various application segments.

Strategic advantages available to industry participants and stakeholders within the North America plastic film packaging market encompass operational efficiencies, competitive positioning opportunities, and value creation potential that enhance business performance and market success. These benefits reflect the market’s fundamental strengths and growth prospects.

Manufacturers benefit from diverse market opportunities, technological advancement potential, and growing demand across multiple end-user segments that provide revenue stability and growth prospects. The market’s essential nature ensures consistent demand regardless of economic conditions, while innovation opportunities enable premium pricing and competitive differentiation strategies.

End-users gain access to advanced packaging solutions that enhance product protection, extend shelf life, and reduce total packaging costs compared to alternative materials. MWR analysis indicates that companies utilizing optimized film packaging solutions achieve average cost savings of 12-18% compared to rigid packaging alternatives while improving product presentation and consumer appeal.

Investors find attractive opportunities in a market characterized by steady growth, technological innovation, and increasing sustainability focus that creates long-term value creation potential. The market’s defensive characteristics provide stability during economic downturns while growth drivers ensure expansion opportunities during favorable economic conditions.

Supply chain partners benefit from collaborative relationships that optimize logistics efficiency, reduce transportation costs, and enhance customer service capabilities through improved packaging performance and reliability. These partnerships create competitive advantages and market differentiation opportunities for all participants.

Comprehensive assessment of strengths, weaknesses, opportunities, and threats provides strategic insights for navigating the North America plastic film packaging market landscape and developing effective competitive strategies that leverage market advantages while addressing potential challenges.

Strengths:

Weaknesses:

Opportunities:

Threats:

Transformative trends shaping the North America plastic film packaging market reflect evolving consumer preferences, technological capabilities, and regulatory frameworks that influence strategic planning and investment priorities across the industry. These trends provide insights into future market direction and competitive dynamics.

Sustainability integration represents the most significant trend, with manufacturers investing heavily in recyclable films, bio-based materials, and circular economy solutions that address environmental concerns while maintaining packaging performance. This trend is driving innovation in material science and manufacturing processes, with companies achieving recycled content levels of 30-50% in certain film applications.

Smart packaging adoption is accelerating through integration of intelligent features such as freshness indicators, temperature monitoring, and QR codes that enhance consumer engagement and provide supply chain visibility. These technologies create premium pricing opportunities while delivering enhanced value propositions for brand owners seeking product differentiation.

E-commerce optimization continues to drive demand for specialized films designed for shipping and handling applications, with manufacturers developing solutions that provide superior puncture resistance, moisture protection, and tamper evidence while minimizing packaging waste and transportation costs.

Lightweighting initiatives focus on reducing film thickness while maintaining or improving performance characteristics, enabling material cost savings and environmental impact reduction. Advanced manufacturing technologies allow production of films that are 20-30% thinner than previous generations while providing equivalent or superior barrier properties.

Customization capabilities are expanding through digital printing technologies and flexible manufacturing systems that enable small-batch production and personalized packaging solutions for niche market segments and premium product applications.

Recent developments within the North America plastic film packaging market demonstrate the industry’s dynamic nature and continuous evolution through technological advancement, strategic partnerships, and market expansion initiatives that shape competitive landscapes and growth trajectories.

Technology investments are accelerating as manufacturers upgrade production capabilities to meet growing demand for high-performance and sustainable packaging solutions. Major companies are investing in advanced extrusion technologies, multi-layer film capabilities, and recycling infrastructure that enhance product quality while reducing environmental impact.

Strategic acquisitions and partnerships are reshaping market structure as companies seek to expand geographic reach, enhance technology capabilities, and access new customer segments. These transactions reflect industry consolidation trends and the importance of scale in achieving competitive advantages in cost, innovation, and market coverage.

Regulatory compliance initiatives are driving investment in sustainable materials and manufacturing processes as companies prepare for evolving environmental regulations and consumer expectations regarding packaging sustainability. These initiatives include development of compostable films, enhanced recycling programs, and circular economy partnerships.

Market expansion activities include new facility construction, capacity additions, and geographic expansion initiatives that position companies to serve growing demand while optimizing supply chain efficiency and customer service capabilities across North American markets.

Innovation partnerships with technology companies, research institutions, and end-users are accelerating development of next-generation packaging solutions that incorporate smart features, enhanced barrier properties, and sustainable materials that meet evolving market requirements.

Strategic recommendations for industry participants focus on positioning for long-term success through innovation, sustainability leadership, and market diversification that address current challenges while capitalizing on emerging opportunities within the North America plastic film packaging market.

Innovation investment should prioritize sustainable materials development, smart packaging technologies, and manufacturing process optimization that create competitive advantages while addressing environmental concerns. Companies should allocate significant resources to research and development activities that support next-generation product development and market differentiation strategies.

Sustainability leadership requires comprehensive strategies that encompass recyclable materials, circular economy partnerships, and transparent environmental reporting that demonstrate commitment to responsible business practices. Companies should establish measurable sustainability goals and invest in technologies that support achievement of these objectives while maintaining packaging performance standards.

Market diversification across end-user segments, geographic regions, and application areas reduces risk while capturing growth opportunities in emerging market segments. Companies should evaluate expansion opportunities in healthcare packaging, e-commerce applications, and specialty films that offer premium pricing and growth potential.

Supply chain optimization through vertical integration, strategic partnerships, and regional manufacturing capabilities enhances competitiveness while reducing costs and improving customer service. Companies should evaluate opportunities to optimize production locations and supply chain efficiency while maintaining quality standards and regulatory compliance.

Customer partnership development creates competitive advantages through collaborative innovation, customized solutions, and long-term relationships that provide market stability and growth opportunities. Companies should invest in customer relationship management capabilities that support joint product development and supply chain optimization initiatives.

Long-term prospects for the North America plastic film packaging market remain positive, supported by fundamental growth drivers, technological advancement opportunities, and increasing market penetration across diverse application segments. The market’s future trajectory reflects evolving consumer preferences, regulatory frameworks, and competitive dynamics that create both challenges and opportunities.

Growth projections indicate sustained market expansion driven by e-commerce growth, food safety requirements, and increasing demand for convenient packaging solutions. MarkWide Research forecasts suggest the market will maintain a compound annual growth rate of 4.2% over the next five years, with sustainability-focused segments demonstrating higher growth rates as environmental consciousness continues to influence purchasing decisions.

Technology evolution will continue to drive market transformation through advanced materials, smart packaging features, and manufacturing process improvements that enhance product performance while reducing environmental impact. Innovation in bio-based materials, recyclable films, and intelligent packaging solutions will create new market segments and premium pricing opportunities.

Regulatory landscape evolution will influence market dynamics through environmental standards, food safety requirements, and sustainability mandates that require ongoing investment in compliance capabilities and sustainable technologies. Companies that proactively address regulatory trends will achieve competitive advantages and market leadership positions.

Market consolidation is expected to continue as companies seek scale advantages, technology capabilities, and market access through strategic acquisitions and partnerships. This consolidation will create stronger industry players with enhanced innovation capabilities and global market reach while maintaining competitive dynamics that benefit end-users.

Sustainability transformation will accelerate as companies develop circular economy solutions, recyclable materials, and waste reduction technologies that address environmental concerns while maintaining packaging performance standards required by diverse end-user applications across the North American market.

Comprehensive analysis of the North America plastic film packaging market reveals a dynamic and resilient industry positioned for continued growth despite environmental challenges and regulatory pressures. The market’s fundamental strengths, including essential applications, technological capabilities, and diverse end-user base, provide stability while innovation opportunities create pathways for premium growth and competitive differentiation.

Strategic success in this market requires balanced approaches that address sustainability concerns while maintaining packaging performance standards and cost competitiveness. Companies that invest in innovation, develop sustainable solutions, and build strong customer partnerships will achieve market leadership positions and long-term value creation in this evolving industry landscape.

Future opportunities are substantial for industry participants who embrace sustainability leadership, technology innovation, and market diversification strategies that position them to capitalize on emerging trends while addressing current market challenges. The North America plastic film packaging market’s evolution toward sustainable, intelligent, and high-performance solutions creates significant potential for companies committed to innovation and environmental responsibility.

What is Plastic Film Packaging?

Plastic film packaging refers to the use of thin plastic sheets to package products, providing protection, preservation, and convenience. It is widely used in various industries, including food, pharmaceuticals, and consumer goods.

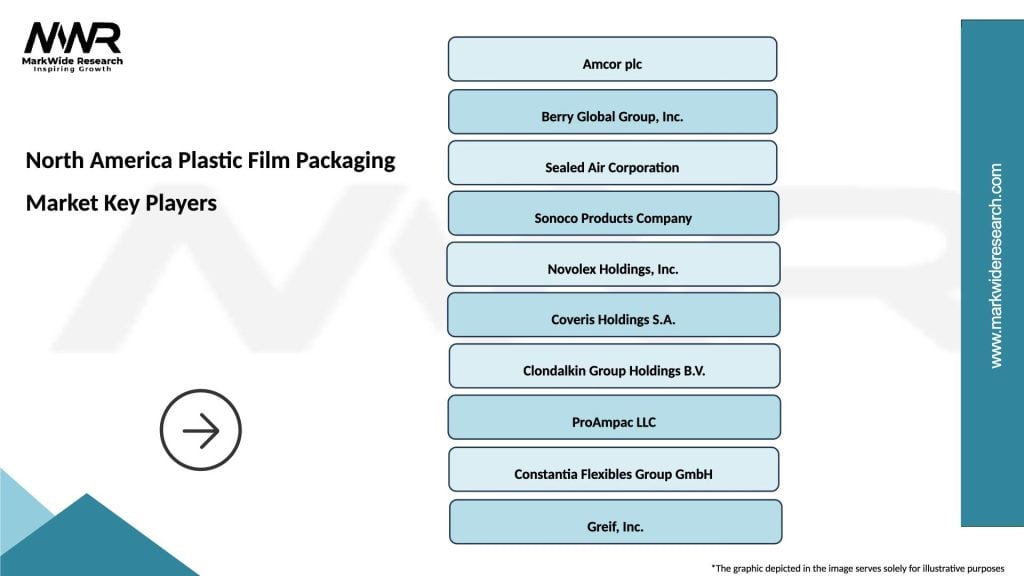

What are the key players in the North America Plastic Film Packaging Market?

Key players in the North America Plastic Film Packaging Market include Amcor plc, Sealed Air Corporation, and Berry Global, among others. These companies are known for their innovative packaging solutions and extensive product offerings.

What are the main drivers of the North America Plastic Film Packaging Market?

The main drivers of the North America Plastic Film Packaging Market include the growing demand for convenient packaging solutions, the rise in e-commerce, and the increasing focus on food safety and shelf life extension.

What challenges does the North America Plastic Film Packaging Market face?

The North America Plastic Film Packaging Market faces challenges such as environmental concerns regarding plastic waste, regulatory pressures for sustainable packaging, and competition from alternative materials like biodegradable films.

What opportunities exist in the North America Plastic Film Packaging Market?

Opportunities in the North America Plastic Film Packaging Market include the development of eco-friendly packaging solutions, advancements in technology for enhanced barrier properties, and the growing trend of personalized packaging.

What trends are shaping the North America Plastic Film Packaging Market?

Trends shaping the North America Plastic Film Packaging Market include the increasing adoption of smart packaging technologies, the shift towards sustainable materials, and the demand for lightweight and flexible packaging solutions.

North America Plastic Film Packaging Market

| Segmentation Details | Description |

|---|---|

| Product Type | Stretch Film, Shrink Film, Barrier Film, Rigid Film |

| Application | Food Packaging, Medical Packaging, Consumer Goods, Industrial Packaging |

| End User | Food & Beverage, Pharmaceuticals, Electronics, Personal Care |

| Packaging Type | Roll Stock, Pouches, Bags, Wraps |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the North America Plastic Film Packaging Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at