444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Asia-Pacific pouch packaging market represents one of the most dynamic and rapidly evolving segments within the global packaging industry. This region has emerged as a powerhouse for flexible packaging solutions, driven by robust economic growth, changing consumer preferences, and increasing demand for convenient packaging formats across diverse industries. Pouch packaging has gained significant traction due to its versatility, cost-effectiveness, and superior barrier properties that extend product shelf life while reducing material usage.

Market dynamics in the Asia-Pacific region are characterized by strong growth momentum, with the sector experiencing a compound annual growth rate (CAGR) of 6.8% over the forecast period. This growth trajectory is supported by expanding food and beverage industries, rising disposable incomes, and increasing urbanization across key markets including China, India, Japan, South Korea, and Southeast Asian nations. The region’s manufacturing capabilities and technological advancements have positioned it as a global hub for pouch packaging innovation.

Consumer behavior shifts toward convenience foods, on-the-go consumption, and sustainable packaging solutions have created substantial opportunities for pouch packaging manufacturers. The format’s ability to provide excellent product protection while offering enhanced shelf appeal and reduced transportation costs has made it increasingly popular among brand owners and retailers throughout the Asia-Pacific region.

The Asia-Pacific pouch packaging market refers to the comprehensive ecosystem of flexible packaging solutions designed in pouch formats across the Asia-Pacific geographical region. This market encompasses various pouch types including stand-up pouches, flat pouches, spouted pouches, and retort pouches used for packaging food products, beverages, personal care items, pharmaceuticals, and industrial applications.

Pouch packaging represents a sophisticated form of flexible packaging that combines multiple material layers to create barrier properties tailored to specific product requirements. These packaging solutions utilize advanced materials such as polyethylene, polypropylene, polyester, aluminum foil, and specialized barrier films to ensure product integrity, extend shelf life, and provide consumer convenience features like resealable closures and easy-open mechanisms.

The market encompasses the entire value chain from raw material suppliers and film manufacturers to pouch converters, filling equipment providers, and end-user industries. Regional characteristics include diverse consumer preferences, varying regulatory requirements, and distinct market maturity levels across different Asia-Pacific countries, creating a complex but opportunity-rich landscape for industry participants.

Strategic positioning within the Asia-Pacific pouch packaging market reveals a landscape characterized by robust growth opportunities, technological innovation, and evolving consumer demands. The market benefits from strong fundamentals including rapid urbanization, growing middle-class populations, and increasing adoption of modern retail formats across the region. Key growth drivers include the expanding food processing industry, rising demand for convenience packaging, and growing awareness of sustainable packaging solutions.

Market penetration rates vary significantly across different Asia-Pacific countries, with developed markets like Japan and South Korea showing higher adoption rates of 78% for premium pouch packaging solutions, while emerging markets present substantial growth potential. The food and beverage segment dominates market demand, accounting for approximately 65% of total pouch packaging consumption in the region.

Competitive dynamics are intensifying as both regional and international players expand their presence through strategic investments, technological upgrades, and capacity expansions. Innovation focus areas include sustainable materials, enhanced barrier properties, smart packaging features, and cost-effective manufacturing processes that cater to price-sensitive market segments while maintaining quality standards.

Market intelligence reveals several critical insights that shape the Asia-Pacific pouch packaging landscape:

Regional variations in consumer preferences and regulatory requirements create diverse market opportunities across different Asia-Pacific countries, with each market presenting unique growth potential and competitive dynamics.

Primary growth drivers propelling the Asia-Pacific pouch packaging market include several interconnected factors that create sustained demand momentum. Economic development across the region has led to rising disposable incomes and changing lifestyle patterns, with consumers increasingly seeking convenient, portable packaging solutions that align with busy urban lifestyles.

Food industry expansion represents a fundamental driver, as processed food consumption continues growing throughout Asia-Pacific markets. The region’s diverse culinary traditions and increasing adoption of international food products create demand for specialized pouch packaging solutions that preserve product quality while accommodating various food types and preparation methods.

Retail modernization across emerging Asia-Pacific markets drives demand for attractive, shelf-stable packaging formats. Modern retail environments favor packaging solutions that maximize shelf space utilization while providing strong visual impact and product protection. E-commerce growth further amplifies demand for durable, lightweight packaging that withstands shipping stresses while maintaining product integrity.

Sustainability concerns increasingly influence packaging decisions, with pouch formats offering material efficiency advantages over traditional rigid packaging. The ability to reduce packaging waste while maintaining product protection appeals to environmentally conscious consumers and regulatory authorities throughout the region.

Market challenges facing the Asia-Pacific pouch packaging industry include several factors that may limit growth potential or create operational difficulties. Raw material price volatility represents a significant concern, as petroleum-based packaging materials experience price fluctuations that impact manufacturing costs and profit margins for pouch packaging producers.

Technical limitations in certain pouch applications restrict market expansion in specific product categories. Some products require rigid packaging for structural support or extended shelf life, limiting pouch packaging adoption. Consumer perception challenges in traditional markets may resist transitioning from established packaging formats to newer pouch solutions.

Infrastructure constraints in developing Asia-Pacific markets can limit market penetration, particularly in rural areas where cold chain facilities and modern retail infrastructure remain underdeveloped. Regulatory complexities across different countries create compliance challenges for manufacturers seeking regional market expansion.

Competition from alternative packaging formats, including rigid containers and traditional flexible packaging, creates pricing pressure and market share challenges. Investment requirements for advanced pouch manufacturing equipment may limit entry opportunities for smaller regional players, potentially constraining market competition and innovation.

Emerging opportunities within the Asia-Pacific pouch packaging market present substantial growth potential across multiple dimensions. Sustainable packaging innovation offers significant opportunities as consumers and regulatory authorities increasingly prioritize environmental considerations. Development of biodegradable, compostable, and recyclable pouch materials addresses growing sustainability demands while opening new market segments.

Smart packaging integration represents a frontier opportunity, incorporating technologies such as freshness indicators, temperature monitoring, and QR codes for enhanced consumer engagement and supply chain visibility. These innovations can command premium pricing while providing added value to brand owners and consumers.

Market expansion into underserved product categories offers growth potential, particularly in pharmaceuticals, personal care, and industrial applications where pouch packaging adoption remains limited. Rural market penetration in developing Asia-Pacific countries presents opportunities as infrastructure development and income levels improve.

Export opportunities leverage Asia-Pacific manufacturing capabilities to serve global markets, particularly as international brands seek cost-effective, high-quality packaging solutions. Customization services for specific regional preferences and product requirements can create competitive advantages and customer loyalty.

Market dynamics in the Asia-Pacific pouch packaging sector reflect complex interactions between supply-side capabilities, demand-side preferences, and external environmental factors. Supply chain integration has become increasingly sophisticated, with manufacturers developing closer relationships with raw material suppliers and end-user customers to optimize efficiency and responsiveness.

Technology adoption rates vary significantly across the region, with advanced markets embracing cutting-edge printing, lamination, and converting technologies while emerging markets focus on cost-effective, proven solutions. This creates a technology gradient that influences competitive positioning and market opportunities for different player categories.

Consumer behavior evolution drives continuous adaptation in product offerings, with increasing demand for convenience features, portion control, and premium aesthetics. Regulatory harmonization efforts across ASEAN countries are gradually reducing compliance complexities, though significant variations remain between major markets like China, India, and Japan.

Investment flows into the sector remain robust, with both domestic and international companies expanding manufacturing capacity and technological capabilities. Market consolidation trends are emerging as larger players acquire regional specialists to expand geographic coverage and technical capabilities, while maintaining local market knowledge and customer relationships.

Comprehensive research methodology employed for analyzing the Asia-Pacific pouch packaging market incorporates multiple data collection and analysis techniques to ensure accuracy and reliability. Primary research activities include extensive interviews with industry executives, manufacturing specialists, technology providers, and end-user companies across key Asia-Pacific markets to gather firsthand insights on market trends, challenges, and opportunities.

Secondary research encompasses analysis of industry publications, company annual reports, government statistics, trade association data, and regulatory documents to establish market context and validate primary findings. Quantitative analysis utilizes statistical modeling techniques to project market trends and segment performance based on historical data and identified growth drivers.

Market segmentation analysis examines demand patterns across different product categories, end-use industries, and geographic regions to identify specific growth opportunities and competitive dynamics. Technology assessment evaluates emerging innovations and their potential market impact through expert consultations and patent analysis.

Validation processes include cross-referencing multiple data sources, conducting follow-up interviews with key stakeholders, and applying sensitivity analysis to test assumption validity. Regional expertise ensures accurate interpretation of local market conditions, cultural factors, and regulatory environments that influence pouch packaging adoption and growth patterns.

China dominates the Asia-Pacific pouch packaging market, representing approximately 42% of regional consumption due to its massive manufacturing base, large population, and rapidly expanding food processing industry. Chinese market characteristics include strong domestic demand, significant export manufacturing, and increasing focus on premium packaging solutions as consumer preferences evolve toward higher-quality products.

India presents substantial growth opportunities with its expanding middle class, urbanization trends, and developing retail infrastructure. The Indian market shows annual growth rates of 8.2%, driven by increasing processed food consumption and modern packaging adoption. Regulatory support for food safety and packaging standards further accelerates market development.

Japan and South Korea represent mature markets with sophisticated consumer preferences and advanced packaging technologies. These markets emphasize premium quality, innovative features, and sustainable packaging solutions. Technology leadership in these countries influences regional innovation trends and sets quality benchmarks for emerging markets.

Southeast Asian markets including Thailand, Vietnam, Indonesia, and Malaysia show robust growth potential driven by economic development, population growth, and increasing foreign investment in food processing industries. ASEAN integration facilitates regional trade and standardization efforts, creating opportunities for market expansion and efficiency improvements.

Market competition in the Asia-Pacific pouch packaging sector involves diverse player categories ranging from large multinational corporations to specialized regional manufacturers. Leading companies have established strong market positions through technological innovation, manufacturing scale, and comprehensive product portfolios.

Regional players maintain competitive advantages through local market knowledge, cost-effective operations, and specialized product offerings tailored to specific customer requirements and cultural preferences.

Market segmentation analysis reveals distinct patterns across multiple dimensions that influence demand characteristics and growth opportunities. By material type, the market encompasses various substrate combinations including plastic films, aluminum foil, and paper-based materials, each offering specific performance characteristics for different applications.

By pouch type:

By end-use industry:

Food packaging applications dominate the Asia-Pacific pouch packaging market, with snack foods representing the largest individual category. Consumer preferences for convenient, portable snacking options drive continuous innovation in pouch designs, barrier properties, and opening mechanisms. Premium positioning opportunities exist in organic, health-focused, and artisanal food products that command higher margins.

Beverage pouches show strong growth potential, particularly for products targeting younger consumers and on-the-go consumption occasions. Spouted pouches for fruit juices, energy drinks, and functional beverages benefit from superior convenience and portion control compared to traditional packaging formats.

Personal care applications present opportunities for premium packaging solutions that enhance brand image and consumer experience. Refill pouches for shampoos, lotions, and cosmetic products address sustainability concerns while reducing packaging costs. Travel-sized pouches cater to increasing mobility and convenience requirements.

Pharmaceutical pouches require specialized barrier properties and regulatory compliance, creating opportunities for technically advanced manufacturers. Unit-dose packaging and child-resistant features represent growing requirements in this segment, particularly for over-the-counter medications and nutritional supplements.

Manufacturers benefit from pouch packaging’s material efficiency, which reduces raw material costs while maintaining product protection performance. Production flexibility allows rapid changeovers between different product formats and sizes, enabling efficient response to market demand variations and seasonal fluctuations.

Brand owners gain significant advantages through enhanced shelf appeal, superior graphics capabilities, and differentiation opportunities that pouch packaging provides. Marketing effectiveness improves through larger printable surfaces and innovative structural designs that attract consumer attention and communicate brand messages effectively.

Retailers appreciate pouch packaging’s space efficiency, which maximizes shelf utilization and reduces storage requirements. Inventory management becomes more efficient due to standardized dimensions and stacking capabilities, while reduced package weight lowers transportation and handling costs.

Consumers enjoy convenience features including resealable closures, easy-open mechanisms, and portion control benefits. Product freshness is maintained through advanced barrier properties, while lightweight packaging reduces environmental impact and disposal concerns.

Supply chain participants benefit from reduced transportation costs, improved damage resistance, and enhanced logistics efficiency that pouch packaging provides throughout the distribution network.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability transformation represents the most significant trend shaping the Asia-Pacific pouch packaging market, with manufacturers investing heavily in recyclable materials, biodegradable alternatives, and circular economy solutions. Consumer awareness of environmental issues drives demand for eco-friendly packaging options, creating opportunities for innovative material technologies and design approaches.

Smart packaging integration is gaining momentum as brands seek enhanced consumer engagement and supply chain visibility. Digital printing technologies enable variable data printing, personalization, and limited edition packaging that creates marketing advantages and consumer excitement.

Premiumization trends across food and beverage categories drive demand for high-quality packaging solutions with superior aesthetics and functional performance. Artisanal and craft products particularly benefit from premium pouch packaging that communicates quality and authenticity to discerning consumers.

E-commerce optimization influences packaging design as online retail growth requires durable, lightweight solutions that protect products during shipping while minimizing packaging waste. Subscription box services and direct-to-consumer brands increasingly favor pouch packaging for its efficiency and brand communication capabilities.

Technology advancement continues driving industry evolution, with recent developments including improved barrier coating technologies, advanced printing capabilities, and innovative closure systems. Digital printing adoption enables shorter run lengths, faster time-to-market, and enhanced customization capabilities that benefit both manufacturers and brand owners.

Capacity expansion across the Asia-Pacific region reflects strong market confidence, with major manufacturers investing in new production facilities and equipment upgrades. Automation implementation improves manufacturing efficiency, quality consistency, and cost competitiveness while addressing labor shortage challenges in developed markets.

Sustainability initiatives include development of mono-material structures that improve recyclability, bio-based materials that reduce environmental impact, and lightweighting technologies that minimize material usage. Circular economy partnerships between packaging manufacturers, brand owners, and recycling companies create comprehensive sustainability solutions.

Market consolidation activities include strategic acquisitions, joint ventures, and technology licensing agreements that strengthen competitive positions and expand geographic coverage. Vertical integration trends see companies expanding into adjacent value chain segments to improve margins and customer relationships.

Strategic recommendations for Asia-Pacific pouch packaging market participants emphasize the importance of sustainability leadership, technological innovation, and market diversification. MarkWide Research analysis suggests that companies should prioritize development of recyclable and biodegradable packaging solutions to address growing environmental concerns and regulatory requirements.

Investment priorities should focus on advanced manufacturing technologies that improve efficiency, quality, and customization capabilities. Digital printing systems and automated converting equipment offer competitive advantages through enhanced flexibility and reduced operational costs.

Market expansion strategies should target underserved geographic regions and application segments where pouch packaging adoption remains limited. Partnership approaches with local distributors and end-user companies can accelerate market penetration while reducing investment risks.

Innovation focus areas should include smart packaging technologies, premium aesthetic solutions, and functional enhancements that create differentiation and value-added positioning. Customer collaboration in product development ensures solutions meet specific market requirements and performance expectations.

Supply chain optimization through vertical integration or strategic partnerships can improve cost competitiveness and customer service levels while ensuring reliable raw material access and quality control throughout the manufacturing process.

Long-term prospects for the Asia-Pacific pouch packaging market remain highly positive, supported by fundamental growth drivers including economic development, urbanization, and changing consumer lifestyles. Market expansion is expected to continue at a robust pace of 6.5% annually over the next decade, with emerging markets contributing disproportionately to growth momentum.

Technology evolution will drive continuous improvement in packaging performance, sustainability, and cost-effectiveness. Material innovations including bio-based polymers, improved barrier coatings, and smart packaging features will create new market opportunities and competitive advantages for early adopters.

Regulatory environment evolution toward stricter environmental standards will accelerate adoption of sustainable packaging solutions while potentially creating compliance challenges for traditional materials and processes. MWR projections indicate that sustainable packaging alternatives could capture 35% market share within the next five years.

Market maturation in developed Asia-Pacific countries will shift competition toward premium segments and value-added services, while emerging markets continue offering volume growth opportunities. Regional integration through trade agreements and standardization efforts will facilitate market expansion and operational efficiency improvements.

Consumer behavior evolution toward convenience, sustainability, and premium experiences will continue driving innovation and market development, creating opportunities for companies that successfully anticipate and respond to changing preferences and requirements.

The Asia-Pacific pouch packaging market represents a dynamic and rapidly growing sector with substantial opportunities for industry participants who can navigate its complexities and capitalize on emerging trends. Strong fundamentals including economic growth, urbanization, and changing consumer preferences provide a solid foundation for sustained market expansion across the region.

Success factors in this competitive landscape include technological innovation, sustainability leadership, operational efficiency, and deep understanding of local market requirements. Companies that invest in advanced manufacturing capabilities, develop eco-friendly solutions, and build strong customer relationships are well-positioned to capture market share and achieve profitable growth.

Future market development will be shaped by sustainability requirements, technological advancement, and evolving consumer expectations. The industry’s ability to address environmental concerns while maintaining performance and cost competitiveness will determine long-term success and market acceptance.

Strategic positioning for the future requires balanced investment in innovation, capacity expansion, and market development activities that align with regional growth patterns and customer needs. The Asia-Pacific pouch packaging market offers compelling opportunities for companies prepared to embrace change, invest in capabilities, and execute effective market strategies that deliver value to all stakeholders throughout the packaging value chain.

What is Pouch Packaging?

Pouch packaging refers to flexible packaging solutions that are made from various materials, typically used for food, beverages, and consumer goods. These pouches are designed to be lightweight, portable, and often resealable, making them popular among manufacturers and consumers alike.

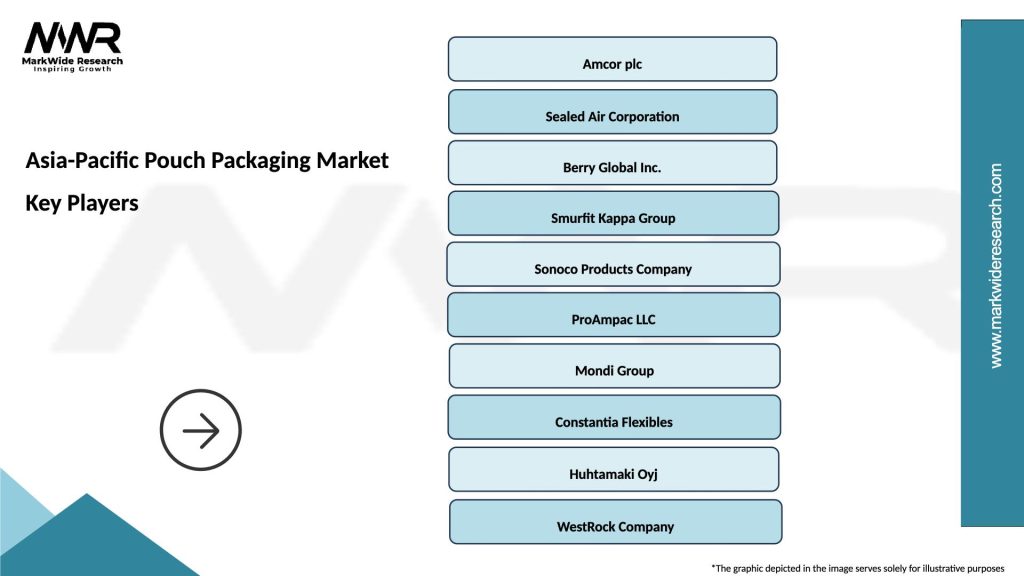

What are the key players in the Asia-Pacific Pouch Packaging Market?

Key players in the Asia-Pacific pouch packaging market include Amcor, Sealed Air Corporation, and Mondi Group, which are known for their innovative packaging solutions and extensive product offerings. These companies focus on sustainability and technological advancements to meet consumer demands, among others.

What are the main drivers of the Asia-Pacific Pouch Packaging Market?

The main drivers of the Asia-Pacific pouch packaging market include the growing demand for convenient packaging solutions, the rise in e-commerce, and increasing consumer preference for lightweight and portable products. Additionally, the trend towards sustainable packaging is also influencing market growth.

What challenges does the Asia-Pacific Pouch Packaging Market face?

Challenges in the Asia-Pacific pouch packaging market include stringent regulations regarding packaging materials and waste management, as well as competition from alternative packaging solutions. Additionally, fluctuating raw material prices can impact production costs.

What opportunities exist in the Asia-Pacific Pouch Packaging Market?

Opportunities in the Asia-Pacific pouch packaging market include the increasing demand for eco-friendly packaging solutions and the expansion of the food and beverage industry. Innovations in materials and technology also present avenues for growth and differentiation.

What trends are shaping the Asia-Pacific Pouch Packaging Market?

Trends shaping the Asia-Pacific pouch packaging market include the rise of smart packaging technologies, the shift towards sustainable materials, and the growing popularity of stand-up pouches. These trends reflect changing consumer preferences and advancements in packaging technology.

Asia-Pacific Pouch Packaging Market

| Segmentation Details | Description |

|---|---|

| Product Type | Stand-Up Pouches, Flat Pouches, Zipper Pouches, Vacuum Pouches |

| Material | Plastic, Paper, Aluminum, Composites |

| End User | Food & Beverage, Personal Care, Pharmaceuticals, Household Products |

| Packaging Type | Flexible Packaging, Rigid Packaging, Resealable Packaging, Eco-Friendly Packaging |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Asia-Pacific Pouch Packaging Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at