444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Asia-Pacific data center physical security market represents one of the fastest-growing segments in the global cybersecurity and infrastructure protection landscape. As digital transformation accelerates across the region, organizations are increasingly recognizing the critical importance of safeguarding their physical data center assets against unauthorized access, theft, and environmental threats. The market encompasses a comprehensive range of security solutions including access control systems, video surveillance, perimeter security, environmental monitoring, and fire suppression systems.

Regional growth dynamics indicate that the Asia-Pacific market is experiencing robust expansion, driven by the proliferation of cloud computing services, increasing data generation, and stringent regulatory compliance requirements. Countries such as China, Japan, India, Australia, and Singapore are leading the charge in data center investments, creating substantial demand for advanced physical security solutions. The market is projected to grow at a compound annual growth rate (CAGR) of 12.3% through the forecast period, significantly outpacing global averages.

Technology adoption patterns across the region show a strong preference for integrated security platforms that combine multiple protection layers. Organizations are increasingly investing in biometric access controls, AI-powered video analytics, and IoT-enabled environmental monitoring systems to create comprehensive security ecosystems. The growing emphasis on edge computing and 5G infrastructure deployment is further amplifying the need for distributed data center security solutions.

The Asia-Pacific data center physical security market refers to the comprehensive ecosystem of hardware, software, and services designed to protect data center facilities from physical threats, unauthorized access, and environmental hazards across the Asia-Pacific region. This market encompasses all security measures that safeguard the physical infrastructure housing critical IT equipment, servers, and networking components that support digital operations for businesses, government entities, and service providers.

Physical security solutions in this context include access control systems that manage entry and exit points, video surveillance networks that monitor facility activities, perimeter security measures that protect facility boundaries, environmental monitoring systems that track temperature and humidity levels, and fire suppression systems that prevent and mitigate fire-related damages. These solutions work in tandem to create multiple layers of protection around valuable data center assets.

Market scope extends beyond traditional security hardware to include advanced technologies such as artificial intelligence, machine learning, biometric authentication, and cloud-based security management platforms. The integration of these technologies enables data center operators to implement proactive threat detection, automated response protocols, and centralized security management across multiple facilities throughout the Asia-Pacific region.

Market dynamics in the Asia-Pacific data center physical security sector reflect a rapidly evolving landscape characterized by increasing digitalization, regulatory pressures, and sophisticated threat vectors. The region’s position as a global technology hub and manufacturing center has created unprecedented demand for secure data storage and processing facilities, driving substantial investments in physical security infrastructure.

Key growth drivers include the exponential increase in data generation, estimated at 35% annually across major Asia-Pacific markets, coupled with stringent data protection regulations and compliance requirements. Organizations are allocating approximately 8-12% of their total data center budgets to physical security measures, reflecting the critical importance of protecting valuable digital assets and maintaining operational continuity.

Technology trends show a clear shift toward intelligent, automated security systems that leverage artificial intelligence and machine learning capabilities. Cloud-based security management platforms are gaining traction, with adoption rates increasing by 28% year-over-year as organizations seek centralized control over distributed data center environments. The integration of IoT sensors and edge computing technologies is enabling real-time threat detection and response capabilities.

Competitive landscape features a mix of global security technology leaders and regional specialists, with companies focusing on developing integrated solutions that address the unique requirements of Asia-Pacific data center operators. Strategic partnerships between security vendors and data center service providers are becoming increasingly common, facilitating the deployment of comprehensive security ecosystems.

Market segmentation analysis reveals distinct patterns in technology adoption and investment priorities across different Asia-Pacific countries. The following key insights highlight the most significant trends shaping the regional data center physical security landscape:

Digital transformation initiatives across Asia-Pacific organizations are creating unprecedented demand for secure data center facilities. As businesses migrate critical operations to digital platforms, the need for robust physical security measures becomes paramount. Cloud adoption rates exceeding 65% in major markets are driving substantial investments in data center infrastructure and associated security systems.

Regulatory compliance requirements represent a significant market driver, with governments across the region implementing stringent data protection and privacy regulations. Countries such as Singapore, Australia, and Japan have established comprehensive frameworks that mandate specific physical security measures for data center operations. These regulations are compelling organizations to invest in advanced security technologies to ensure compliance and avoid substantial penalties.

Cybersecurity threat evolution is pushing organizations to adopt holistic security approaches that combine physical and digital protection measures. The recognition that physical breaches can compromise digital security is driving integrated security investments. Recent studies indicate that 23% of data breaches involve some form of physical security compromise, highlighting the critical importance of comprehensive protection strategies.

Edge computing proliferation is creating new security challenges as data processing moves closer to end users. The deployment of distributed data center infrastructure requires scalable security solutions that can protect multiple smaller facilities. This trend is driving demand for centralized security management platforms and standardized security protocols across distributed environments.

Economic growth and urbanization throughout the Asia-Pacific region are fueling increased data generation and digital service consumption. Rapid urban development and growing middle-class populations are creating substantial demand for digital services, requiring expanded data center capacity and enhanced security measures to protect critical infrastructure investments.

High implementation costs represent a significant barrier to market growth, particularly for small and medium-sized enterprises seeking to establish or upgrade data center facilities. Advanced physical security systems require substantial capital investments, with comprehensive solutions often representing 15-20% of total facility costs. This financial burden can delay or limit security implementations, especially in price-sensitive markets.

Technical complexity challenges associated with integrating multiple security systems create implementation hurdles for many organizations. The need to coordinate access control, surveillance, environmental monitoring, and fire suppression systems requires specialized expertise that may not be readily available in all markets. Integration complexity can lead to extended deployment timelines and increased project costs.

Skills shortage concerns across the region limit the effective deployment and management of advanced security systems. The rapid pace of technology evolution requires continuous training and skill development, creating ongoing challenges for organizations seeking to maintain optimal security operations. This shortage is particularly acute in emerging markets where technical expertise may be limited.

Legacy system compatibility issues constrain upgrade opportunities for existing data center facilities. Many older facilities operate with legacy security systems that may not integrate seamlessly with modern solutions. The cost and complexity of replacing entire security infrastructures can deter organizations from implementing comprehensive upgrades.

Regulatory variations across different Asia-Pacific countries create compliance challenges for multinational organizations operating distributed data center networks. Varying security standards and requirements necessitate customized approaches for different markets, increasing complexity and costs for regional deployments.

Artificial intelligence integration presents substantial opportunities for enhancing data center physical security capabilities. AI-powered analytics can transform traditional security systems into proactive threat detection platforms, enabling predictive security measures and automated response protocols. The integration of machine learning algorithms with existing security infrastructure offers significant value propositions for data center operators.

5G network deployment across the Asia-Pacific region is creating new opportunities for advanced security solutions. The ultra-low latency and high bandwidth capabilities of 5G networks enable real-time security monitoring and response systems. Edge data centers supporting 5G infrastructure require specialized security solutions, creating new market segments for security vendors.

Sustainability initiatives are driving demand for energy-efficient security systems that align with environmental goals. Green data center certifications increasingly include physical security considerations, creating opportunities for vendors offering sustainable security solutions. Energy-efficient surveillance systems and environmentally friendly fire suppression agents represent growing market segments.

Managed security services are gaining traction as organizations seek to outsource complex security operations to specialized providers. The growing acceptance of security-as-a-service models creates opportunities for service providers to offer comprehensive physical security management solutions. This trend is particularly strong among smaller organizations lacking internal security expertise.

Cross-border data center expansion by multinational corporations creates opportunities for standardized security solutions that can be deployed across multiple countries. Organizations seeking consistent security standards across distributed facilities represent a growing market for integrated security platforms and centralized management solutions.

Supply chain considerations significantly impact the Asia-Pacific data center physical security market, with regional manufacturing capabilities influencing product availability and pricing. The concentration of technology manufacturing in countries such as China, South Korea, and Taiwan creates both opportunities and challenges for security solution deployment across the region.

Technology convergence trends are reshaping market dynamics as traditional security boundaries blur with IT infrastructure. The integration of physical security systems with network infrastructure and cloud platforms is creating new solution categories and changing vendor relationships. This convergence is driving collaboration between security specialists and IT infrastructure providers.

Customer expectations evolution reflects increasing sophistication in security requirements and solution evaluation criteria. Data center operators are demanding integrated platforms that provide comprehensive visibility and control across all security domains. User experience considerations are becoming increasingly important in solution selection processes.

Competitive intensity continues to increase as global security vendors expand their Asia-Pacific presence while regional players develop specialized solutions for local markets. This competition is driving innovation and price optimization, benefiting end users through improved solution capabilities and value propositions.

Partnership ecosystem development is becoming crucial for market success, with vendors forming strategic alliances to deliver comprehensive solutions. Collaborations between security technology providers, system integrators, and data center operators are creating new go-to-market strategies and solution delivery models.

Primary research activities conducted for this market analysis included comprehensive interviews with data center operators, security solution vendors, system integrators, and industry experts across major Asia-Pacific markets. These interviews provided valuable insights into current market conditions, technology adoption patterns, and future growth projections.

Secondary research sources encompassed industry reports, government publications, regulatory documents, and company financial statements to establish market baselines and validate primary research findings. Analysis of patent filings and technology announcements provided insights into innovation trends and competitive positioning.

Market sizing methodology employed bottom-up and top-down approaches to establish accurate market dimensions and growth projections. Regional analysis considered country-specific factors including economic conditions, regulatory environments, and technology adoption rates to ensure accurate market representation.

Data validation processes included cross-referencing multiple sources and conducting follow-up interviews to confirm key findings. Statistical analysis techniques were applied to identify significant trends and correlations within the collected data sets.

Forecast modeling incorporated historical growth patterns, current market conditions, and anticipated future developments to project market evolution through the forecast period. Scenario analysis considered various growth trajectories based on different market conditions and external factors.

China dominates the Asia-Pacific data center physical security market, representing approximately 38% of regional market share driven by massive digital infrastructure investments and government initiatives supporting digital economy development. The country’s focus on data sovereignty and cybersecurity regulations is creating substantial demand for advanced physical security solutions across both enterprise and government data centers.

Japan maintains a strong market position with 22% regional market share, characterized by high technology adoption rates and stringent security standards. Japanese organizations prioritize comprehensive security solutions that integrate seamlessly with existing IT infrastructure. The country’s focus on disaster preparedness and business continuity drives significant investments in environmental monitoring and fire suppression systems.

India represents the fastest-growing market segment with 18% current market share and projected growth rates exceeding regional averages. The country’s rapid digitalization initiatives and expanding IT services sector are driving substantial data center investments. Government programs promoting digital infrastructure development are creating favorable conditions for security solution deployments.

Australia and Singapore collectively account for 15% of market share, with both countries serving as regional hubs for multinational data center operations. Stringent regulatory requirements and high security standards in these markets drive demand for premium security solutions. The concentration of financial services and government operations creates consistent demand for advanced security technologies.

South Korea, Thailand, and other emerging markets represent the remaining 7% market share but show strong growth potential driven by increasing digitalization and foreign investment in data center infrastructure. These markets are experiencing rapid adoption of cloud services and digital transformation initiatives, creating new opportunities for security solution providers.

Market leadership in the Asia-Pacific data center physical security sector is characterized by a diverse ecosystem of global technology leaders and specialized regional providers. The competitive landscape reflects the complex requirements of data center security and the need for integrated solution approaches.

Strategic positioning among market leaders focuses on developing integrated platforms that combine multiple security domains under unified management interfaces. Companies are investing heavily in artificial intelligence and machine learning capabilities to differentiate their offerings and provide advanced threat detection capabilities.

By Solution Type: The market segments into distinct solution categories, each addressing specific security requirements and operational challenges within data center environments.

By Deployment Model: Organizations choose between different deployment approaches based on operational requirements and resource availability.

By End User: Different customer segments demonstrate varying security requirements and investment patterns.

Access Control Systems represent the largest market segment, driven by the fundamental requirement to manage and monitor facility access. Biometric authentication technologies are gaining significant traction, with fingerprint and facial recognition systems showing 35% adoption growth annually. Multi-factor authentication approaches combining physical tokens, biometric verification, and PIN codes are becoming standard for high-security environments.

Video Surveillance Solutions are experiencing rapid evolution through artificial intelligence integration. AI-powered video analytics enable automated threat detection, behavioral analysis, and predictive security capabilities. The shift from analog to IP-based systems continues, with 78% of new installations utilizing network-connected cameras that integrate with broader security management platforms.

Environmental Monitoring Systems are becoming increasingly sophisticated as data centers focus on operational efficiency and equipment protection. IoT-enabled sensors provide real-time monitoring of temperature, humidity, air quality, and power conditions. These systems help prevent equipment failures and optimize energy consumption while maintaining security oversight of environmental conditions.

Fire Detection and Suppression technologies are advancing toward more environmentally friendly and equipment-safe solutions. Clean agent fire suppression systems are replacing traditional water-based approaches in 85% of new data center installations. Advanced detection systems utilizing multi-sensor technologies provide early warning capabilities and reduce false alarm incidents.

Integrated Security Platforms are gaining prominence as organizations seek unified management approaches for complex security environments. These platforms combine access control, video surveillance, environmental monitoring, and incident management under single interfaces, improving operational efficiency and response capabilities.

Data Center Operators benefit from comprehensive physical security solutions through enhanced asset protection, regulatory compliance assurance, and operational efficiency improvements. Advanced security systems reduce the risk of costly security incidents while providing detailed audit trails for compliance reporting. Integrated platforms streamline security management and reduce operational overhead.

Enterprise Customers gain confidence in data center service providers through visible security investments and transparent security practices. Robust physical security measures protect valuable digital assets and ensure business continuity. Compliance with industry standards and regulations reduces legal and financial risks associated with data protection requirements.

Security Solution Vendors access expanding market opportunities driven by increasing digitalization and security awareness. The growing complexity of data center environments creates demand for specialized solutions and ongoing support services. Long-term customer relationships develop through comprehensive security partnerships and managed service arrangements.

System Integrators benefit from increasing demand for complex security implementations requiring specialized expertise. The integration of multiple security domains creates opportunities for value-added services and ongoing support contracts. Partnerships with security vendors enable comprehensive solution delivery capabilities.

Government Entities achieve improved critical infrastructure protection through enhanced data center security standards. Robust physical security measures support national cybersecurity objectives and protect sensitive government data. Compliance with international security standards facilitates cross-border data sharing and cooperation.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial Intelligence Integration is transforming data center physical security through advanced analytics and automated response capabilities. AI-powered systems can analyze video feeds, detect anomalous behavior, and trigger appropriate responses without human intervention. Machine learning algorithms continuously improve threat detection accuracy and reduce false alarm rates.

Cloud-Based Security Management is gaining momentum as organizations seek centralized control over distributed data center environments. Cloud platforms enable real-time monitoring, remote management, and scalable security operations across multiple facilities. This trend is particularly strong among organizations operating geographically distributed data center networks.

IoT Sensor Integration is expanding security monitoring capabilities beyond traditional domains. Connected sensors provide comprehensive environmental monitoring, equipment status tracking, and facility condition assessment. The integration of IoT devices with security platforms creates holistic facility management solutions.

Biometric Authentication Advancement continues to evolve with more sophisticated and user-friendly technologies. Facial recognition, iris scanning, and behavioral biometrics are becoming more accurate and widely accepted. Multi-modal biometric systems combining multiple authentication factors provide enhanced security while improving user experience.

Mobile Security Applications are enabling remote monitoring and management capabilities for security personnel. Smartphone and tablet applications provide real-time alerts, video streaming, and system control functions. Mobile integration enhances response capabilities and enables flexible security operations.

Sustainability Considerations are influencing security solution selection as organizations prioritize environmental responsibility. Energy-efficient surveillance systems, environmentally friendly fire suppression agents, and sustainable manufacturing practices are becoming important evaluation criteria.

Strategic partnerships between security vendors and data center operators are creating comprehensive solution ecosystems. Recent collaborations focus on developing integrated platforms that combine physical security with IT infrastructure management. These partnerships enable more effective security implementations and ongoing support services.

Technology acquisitions continue to reshape the competitive landscape as companies seek to expand their solution portfolios and market reach. Recent acquisitions have focused on AI analytics capabilities, cloud-based management platforms, and specialized sensor technologies. These consolidation activities are creating more comprehensive solution providers.

Regulatory developments across Asia-Pacific countries are establishing new security standards and compliance requirements for data center operations. Recent regulations in Singapore, Australia, and Japan have introduced specific physical security mandates that are driving solution upgrades and implementations.

Innovation investments in research and development are accelerating the introduction of next-generation security technologies. Companies are investing heavily in AI development, quantum-resistant security measures, and advanced sensor technologies. These investments are creating competitive advantages and new market opportunities.

Market expansion initiatives by global security vendors are increasing competition and solution availability across emerging Asia-Pacific markets. Recent expansions into India, Thailand, and Vietnam are providing local organizations with access to advanced security technologies and support services.

Investment prioritization should focus on integrated security platforms that provide comprehensive coverage across multiple security domains. Organizations should evaluate solutions based on scalability, integration capabilities, and long-term support availability rather than focusing solely on initial costs. MarkWide Research analysis indicates that integrated approaches provide 25-30% better ROI compared to point solutions.

Technology selection should emphasize future-ready solutions that can adapt to evolving security requirements and integrate with emerging technologies. Organizations should prioritize vendors with strong AI capabilities, cloud integration options, and open platform architectures that support third-party integrations.

Implementation strategies should include comprehensive planning phases that address integration challenges, staff training requirements, and ongoing maintenance needs. Phased deployment approaches can help manage complexity and costs while ensuring successful system implementation and adoption.

Vendor evaluation should consider not only technology capabilities but also local support availability, regulatory compliance expertise, and long-term viability. Organizations should seek vendors with strong Asia-Pacific presence and demonstrated experience in regional data center deployments.

Budget planning should account for ongoing operational costs including software licensing, maintenance services, and staff training in addition to initial implementation expenses. Organizations should also consider the total cost of ownership over the system lifecycle when making investment decisions.

Market growth trajectory indicates continued expansion driven by increasing digitalization, regulatory requirements, and evolving security threats. The Asia-Pacific region is expected to maintain its position as the fastest-growing market globally, with projected growth rates exceeding 12% annually through the forecast period.

Technology evolution will continue to focus on artificial intelligence integration, cloud-based management, and IoT connectivity. Future security systems will become increasingly autonomous, requiring minimal human intervention while providing comprehensive threat detection and response capabilities. MWR projections suggest that AI-powered security systems will represent 65% of new deployments by the end of the forecast period.

Market consolidation is expected to continue as vendors seek to create comprehensive solution portfolios through acquisitions and partnerships. This consolidation will benefit customers through more integrated solutions and simplified vendor relationships while potentially reducing competitive pricing pressure.

Regulatory landscape will likely become more stringent as governments recognize the critical importance of data center security for national economic and security interests. New regulations may mandate specific security standards and regular compliance auditing, creating additional market demand for advanced security solutions.

Emerging technologies such as quantum computing, 6G networks, and advanced edge computing will create new security challenges and opportunities. Security vendors will need to develop solutions that address these emerging requirements while maintaining compatibility with existing infrastructure investments.

The Asia-Pacific data center physical security market represents a dynamic and rapidly expanding sector driven by increasing digitalization, regulatory requirements, and evolving security threats. The region’s position as a global technology hub and the accelerating adoption of cloud services, edge computing, and 5G infrastructure are creating substantial opportunities for security solution providers and system integrators.

Market fundamentals remain strong, with consistent demand growth across all major Asia-Pacific countries and expanding adoption of advanced security technologies. The integration of artificial intelligence, IoT connectivity, and cloud-based management platforms is transforming traditional security approaches and creating new value propositions for data center operators.

Competitive dynamics continue to evolve as global vendors expand their regional presence while local providers develop specialized solutions for specific market requirements. The trend toward integrated security platforms and managed service offerings is reshaping vendor relationships and creating new business models that benefit both providers and customers.

Future prospects indicate sustained growth opportunities driven by continued digital transformation, infrastructure investments, and regulatory developments. Organizations that invest in comprehensive, future-ready security solutions will be best positioned to protect their critical assets while maintaining operational efficiency and regulatory compliance in an increasingly complex threat environment.

What is Data Center Physical Security?

Data Center Physical Security refers to the measures and protocols implemented to protect data centers from physical threats such as unauthorized access, natural disasters, and vandalism. This includes surveillance systems, access controls, and environmental monitoring.

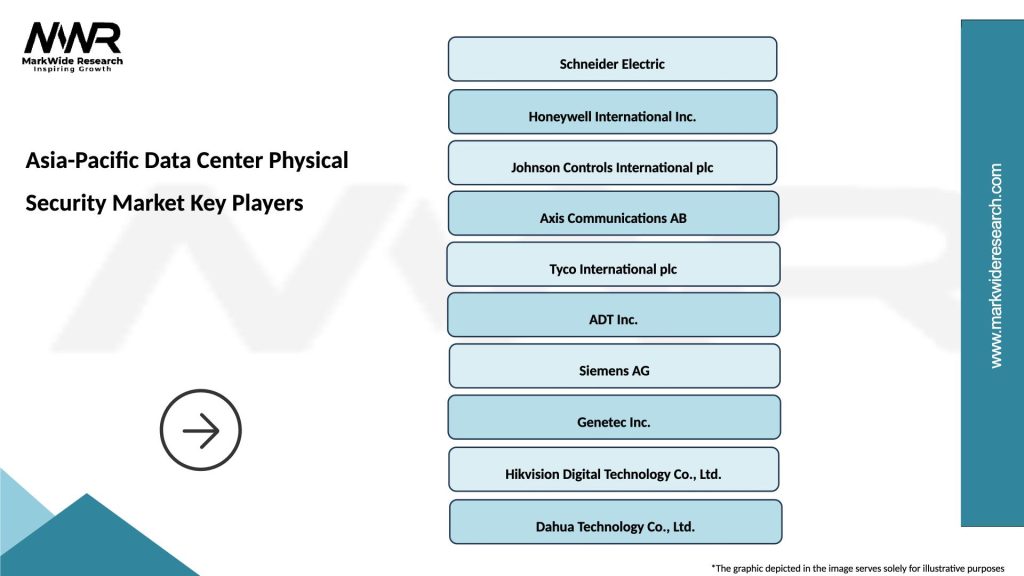

What are the key players in the Asia-Pacific Data Center Physical Security Market?

Key players in the Asia-Pacific Data Center Physical Security Market include companies like Cisco Systems, Honeywell International, and Johnson Controls, which provide various security solutions and technologies for data centers, among others.

What are the main drivers of the Asia-Pacific Data Center Physical Security Market?

The main drivers of the Asia-Pacific Data Center Physical Security Market include the increasing frequency of cyber threats, the growing need for data protection, and the expansion of cloud computing services. These factors are pushing organizations to invest in robust physical security measures.

What challenges does the Asia-Pacific Data Center Physical Security Market face?

Challenges in the Asia-Pacific Data Center Physical Security Market include the high costs associated with implementing advanced security technologies and the complexity of integrating various security systems. Additionally, the rapid evolution of threats requires continuous updates and training.

What opportunities exist in the Asia-Pacific Data Center Physical Security Market?

Opportunities in the Asia-Pacific Data Center Physical Security Market include the rising demand for smart security solutions and the integration of AI and IoT technologies. These advancements can enhance monitoring capabilities and improve response times to security incidents.

What trends are shaping the Asia-Pacific Data Center Physical Security Market?

Trends shaping the Asia-Pacific Data Center Physical Security Market include the adoption of biometric access controls, the use of advanced surveillance technologies like AI-driven analytics, and a focus on compliance with data protection regulations. These trends are driving innovation and investment in security solutions.

Asia-Pacific Data Center Physical Security Market

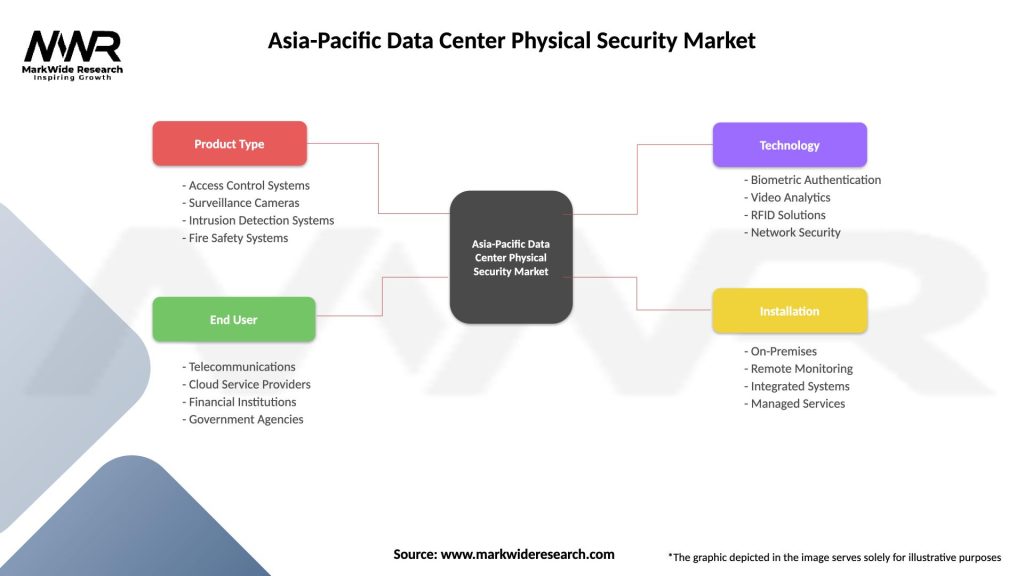

| Segmentation Details | Description |

|---|---|

| Product Type | Access Control Systems, Surveillance Cameras, Intrusion Detection Systems, Fire Safety Systems |

| End User | Telecommunications, Cloud Service Providers, Financial Institutions, Government Agencies |

| Technology | Biometric Authentication, Video Analytics, RFID Solutions, Network Security |

| Installation | On-Premises, Remote Monitoring, Integrated Systems, Managed Services |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Asia-Pacific Data Center Physical Security Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at