444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Europe data center storage market represents a dynamic and rapidly evolving sector that forms the backbone of the region’s digital infrastructure. As organizations across Europe accelerate their digital transformation initiatives, the demand for robust, scalable, and efficient data center storage solutions continues to surge. The market encompasses a comprehensive range of storage technologies, including traditional hard disk drives, solid-state drives, hybrid storage systems, and emerging technologies like storage-class memory.

Market dynamics indicate that the European data center storage landscape is experiencing unprecedented growth, driven by the exponential increase in data generation, cloud adoption, and regulatory compliance requirements. The market is characterized by intense competition among established players and innovative startups, all vying to capture market share in this lucrative sector. With data generation growing at approximately 25% annually across European enterprises, storage infrastructure has become a critical investment priority.

Regional variations within Europe showcase distinct patterns, with Western European countries leading in terms of adoption rates and infrastructure maturity, while Eastern European markets present significant growth opportunities. The market’s evolution is closely tied to broader technological trends, including artificial intelligence, machine learning, and the Internet of Things, all of which generate massive volumes of data requiring sophisticated storage solutions.

The Europe data center storage market refers to the comprehensive ecosystem of storage technologies, solutions, and services deployed within data centers across European countries to store, manage, and retrieve digital information efficiently. This market encompasses hardware components such as storage arrays, disk drives, and memory systems, as well as software solutions for data management, backup, and recovery.

Storage infrastructure in European data centers serves multiple critical functions, including primary data storage for active applications, secondary storage for backup and archival purposes, and specialized storage for high-performance computing workloads. The market includes both traditional on-premises storage solutions and cloud-based storage services, reflecting the hybrid nature of modern data center architectures.

Key components of the market include enterprise storage arrays, network-attached storage systems, storage area networks, and software-defined storage platforms. These solutions must comply with stringent European data protection regulations, including GDPR, while delivering the performance, reliability, and scalability required by modern digital businesses.

Strategic analysis reveals that the Europe data center storage market is positioned for sustained growth, driven by fundamental shifts in how organizations generate, process, and store data. The market’s trajectory is influenced by several converging factors, including regulatory compliance requirements, digital transformation initiatives, and the increasing adoption of cloud-native technologies.

Technology evolution within the market is accelerating, with solid-state drives gaining significant traction due to their superior performance characteristics. Flash storage adoption has reached approximately 40% penetration in enterprise environments, reflecting the growing demand for high-speed data access and processing capabilities. This shift toward faster storage technologies is reshaping the competitive landscape and driving innovation across the sector.

Market segmentation analysis indicates that enterprise customers represent the largest segment, followed by cloud service providers and telecommunications companies. The rise of edge computing is creating new opportunities for distributed storage solutions, while sustainability concerns are driving demand for energy-efficient storage technologies. According to MarkWide Research analysis, the market is experiencing robust growth across all major segments, with particular strength in hybrid cloud storage solutions.

Fundamental market insights reveal several critical trends shaping the Europe data center storage landscape:

Primary growth drivers propelling the Europe data center storage market include the exponential increase in data generation across industries. Organizations are producing data at unprecedented rates, with enterprise data volumes growing at approximately 35% annually, creating substantial demand for scalable storage infrastructure.

Digital transformation initiatives represent another significant driver, as European businesses modernize their IT infrastructure to remain competitive in the digital economy. This transformation often involves migrating from legacy storage systems to modern, software-defined storage platforms that offer greater flexibility and efficiency. The adoption of cloud-first strategies is accelerating this transition, with organizations seeking storage solutions that seamlessly integrate with public cloud services.

Regulatory compliance requirements continue to drive storage infrastructure investments, particularly in sectors such as financial services, healthcare, and telecommunications. European data protection regulations mandate specific data handling and storage practices, requiring organizations to invest in compliant storage solutions. Additionally, the growing importance of data analytics and artificial intelligence applications is driving demand for high-performance storage systems capable of supporting intensive computational workloads.

Emerging technologies such as 5G networks, Internet of Things devices, and autonomous systems are generating new categories of data that require specialized storage solutions. These technologies demand low-latency, high-throughput storage systems that can process and store data in real-time, creating opportunities for innovative storage vendors.

Significant challenges facing the Europe data center storage market include the high capital costs associated with implementing advanced storage infrastructure. Many organizations, particularly small and medium-sized enterprises, face budget constraints that limit their ability to invest in cutting-edge storage technologies. The complexity of modern storage systems also presents implementation challenges, requiring specialized expertise that may not be readily available.

Technical limitations of existing infrastructure can impede market growth, as many organizations operate legacy systems that are difficult to integrate with modern storage solutions. The process of migrating data from legacy systems to new storage platforms can be complex, time-consuming, and risky, leading some organizations to delay necessary upgrades.

Regulatory uncertainty in some European markets creates hesitation among potential buyers, particularly regarding data residency requirements and cross-border data transfer regulations. Organizations must navigate complex compliance landscapes while ensuring their storage solutions meet current and future regulatory requirements.

Skills shortages in the European technology sector pose additional challenges, as organizations struggle to find qualified professionals capable of designing, implementing, and managing sophisticated storage systems. This talent gap can slow adoption rates and increase implementation costs, particularly for organizations without established IT teams.

Emerging opportunities in the Europe data center storage market are substantial, particularly in the area of edge computing applications. As organizations deploy more distributed computing architectures, the demand for edge storage solutions is expected to grow significantly. This trend creates opportunities for storage vendors to develop specialized products optimized for edge environments.

Sustainability initiatives present another major opportunity, as European organizations increasingly prioritize environmental responsibility. Storage vendors that can demonstrate significant energy efficiency improvements and reduced carbon footprints are well-positioned to capture market share. The European Union’s Green Deal and related sustainability regulations are expected to drive demand for eco-friendly storage solutions.

Artificial intelligence integration offers significant growth potential, as organizations seek storage systems that can leverage AI for predictive maintenance, automated optimization, and intelligent data management. Storage solutions that incorporate machine learning capabilities to optimize performance and reduce operational costs are likely to see strong demand.

Vertical market specialization represents an opportunity for storage vendors to develop industry-specific solutions tailored to the unique requirements of sectors such as healthcare, financial services, and manufacturing. These specialized solutions can command premium pricing while addressing specific compliance and performance requirements.

Complex market dynamics characterize the Europe data center storage landscape, with multiple forces simultaneously shaping market evolution. The interplay between technological advancement, regulatory requirements, and economic factors creates a dynamic environment where successful vendors must demonstrate agility and innovation.

Competitive pressures are intensifying as traditional storage vendors face challenges from cloud service providers and software-defined storage specialists. This competition is driving innovation and forcing vendors to differentiate their offerings through superior performance, enhanced features, or specialized capabilities. The market is witnessing increased consolidation as larger players acquire innovative startups to expand their technology portfolios.

Customer expectations are evolving rapidly, with organizations demanding storage solutions that deliver cloud-like flexibility and scalability while maintaining enterprise-grade performance and security. This shift is driving the adoption of consumption-based pricing models and as-a-service delivery options, fundamentally changing how storage solutions are purchased and deployed.

Technology convergence is blurring traditional market boundaries, with storage, compute, and networking technologies becoming increasingly integrated. Hyper-converged infrastructure solutions that combine these elements are gaining traction, particularly among organizations seeking simplified management and reduced complexity. This convergence is creating new competitive dynamics and partnership opportunities within the market.

Comprehensive research methodology employed for analyzing the Europe data center storage market incorporates multiple data collection and analysis techniques to ensure accuracy and reliability. Primary research involves extensive interviews with industry executives, technology leaders, and end-users across various European markets to gather firsthand insights into market trends, challenges, and opportunities.

Secondary research encompasses analysis of industry reports, financial statements, regulatory filings, and technology documentation from leading storage vendors and market participants. This approach provides quantitative data on market performance, competitive positioning, and technology adoption rates across different segments and geographic regions.

Market modeling techniques utilize statistical analysis and forecasting methodologies to project market trends and growth patterns. These models incorporate various factors including economic indicators, technology adoption curves, and regulatory impact assessments to provide comprehensive market projections.

Validation processes ensure data accuracy through cross-referencing multiple sources and conducting follow-up interviews with industry experts. The research methodology emphasizes transparency and objectivity, with clear documentation of data sources and analytical assumptions to support the reliability of market insights and projections.

Western European markets dominate the regional landscape, with Germany, the United Kingdom, and France representing the largest segments by adoption and infrastructure investment. These markets benefit from mature IT ecosystems, substantial enterprise spending, and advanced regulatory frameworks that drive storage infrastructure investments. Germany leads with approximately 28% market share, driven by its strong manufacturing sector and robust data protection requirements.

Nordic countries demonstrate exceptional growth in sustainable storage solutions, with organizations prioritizing energy-efficient technologies and renewable energy integration. These markets are characterized by high technology adoption rates and strong government support for digital infrastructure development. The region’s focus on sustainability is driving innovation in green storage technologies.

Southern European markets, including Italy and Spain, are experiencing accelerated growth as organizations modernize their IT infrastructure and comply with European data protection regulations. These markets present significant opportunities for storage vendors, particularly in sectors such as telecommunications, financial services, and government.

Eastern European markets represent the fastest-growing segment, with countries such as Poland, Czech Republic, and Hungary investing heavily in digital infrastructure. These markets benefit from favorable economic conditions, EU funding for technology projects, and growing demand from multinational corporations establishing regional operations. The region’s growth rate exceeds 15% annually, making it an attractive target for storage vendors seeking expansion opportunities.

Market leadership in the Europe data center storage sector is characterized by intense competition among established technology giants and innovative specialists. The competitive landscape features both global vendors with comprehensive product portfolios and regional players focusing on specific market segments or technologies.

Competitive strategies focus on technology innovation, strategic partnerships, and vertical market specialization. Leading vendors are investing heavily in artificial intelligence, machine learning, and automation capabilities to differentiate their storage solutions and provide superior value to customers.

Technology segmentation reveals distinct market categories based on storage technologies and deployment models:

By Storage Type:

By Deployment Model:

By End-User Industry:

Enterprise storage arrays represent the largest category within the European market, driven by organizations’ need for high-performance, reliable storage systems capable of supporting mission-critical applications. This category is experiencing steady growth as enterprises modernize their storage infrastructure and adopt software-defined storage capabilities.

Flash storage solutions are experiencing the fastest growth, with adoption rates increasing by approximately 45% annually as organizations prioritize performance over cost considerations. The declining cost of flash memory and improving endurance characteristics are making SSD-based storage systems more attractive for a broader range of applications.

Hyper-converged infrastructure solutions are gaining significant traction, particularly among mid-market organizations seeking simplified storage management and reduced infrastructure complexity. This category combines storage, compute, and networking in integrated appliances that can be deployed and managed more easily than traditional storage systems.

Cloud storage services continue to grow rapidly as European organizations embrace hybrid cloud strategies. This category benefits from the flexibility and scalability of cloud-based storage while addressing data residency and compliance requirements specific to European markets. MWR data indicates that cloud storage adoption has reached 60% penetration among European enterprises.

Backup and recovery solutions remain critical components of the storage market, with organizations investing in modern data protection technologies that can handle growing data volumes and meet stringent recovery time objectives. This category is evolving to incorporate cloud-based backup services and AI-driven recovery optimization.

Storage vendors benefit from the expanding European market through increased revenue opportunities and the ability to showcase innovative technologies to sophisticated customers. The region’s emphasis on data protection and compliance creates demand for advanced storage features, allowing vendors to differentiate their offerings and command premium pricing.

End-user organizations gain access to cutting-edge storage technologies that improve operational efficiency, reduce costs, and enable new business capabilities. Modern storage solutions provide the foundation for digital transformation initiatives, supporting everything from real-time analytics to artificial intelligence applications.

System integrators and partners benefit from the complexity of modern storage deployments, which require specialized expertise for design, implementation, and ongoing management. The evolving storage landscape creates opportunities for partners to develop new service offerings and expand their customer relationships.

Cloud service providers leverage advanced storage technologies to differentiate their offerings and provide superior performance to customers. The integration of innovative storage solutions enables cloud providers to support demanding workloads and compete effectively in the European market.

Technology investors find attractive opportunities in the storage sector, particularly in companies developing next-generation technologies such as storage-class memory, AI-driven management, and sustainable storage solutions. The market’s growth trajectory and innovation potential make it an appealing investment target.

Strengths:

Weaknesses:

Opportunities:

Threats:

Software-defined storage adoption is accelerating across European organizations as they seek greater flexibility and control over their storage infrastructure. This trend enables organizations to abstract storage management from underlying hardware, providing greater agility and simplified operations. The shift toward software-defined architectures is fundamentally changing how storage is deployed and managed.

Artificial intelligence integration is becoming increasingly prevalent in storage systems, with vendors incorporating machine learning algorithms for predictive maintenance, performance optimization, and automated data management. These AI-driven capabilities help organizations reduce operational costs while improving storage system reliability and performance.

Sustainability initiatives are driving demand for energy-efficient storage technologies, with organizations seeking solutions that reduce power consumption and carbon footprint. European companies are increasingly evaluating storage solutions based on their environmental impact, creating opportunities for vendors offering green storage technologies.

Edge storage deployment is expanding rapidly as organizations implement distributed computing architectures to support IoT applications, autonomous systems, and real-time analytics. This trend requires storage solutions optimized for edge environments, including compact form factors, low power consumption, and remote management capabilities.

As-a-service delivery models are gaining traction as organizations seek to reduce capital expenditures and simplify storage procurement. Storage-as-a-service offerings provide consumption-based pricing and simplified management, making advanced storage technologies accessible to a broader range of organizations.

Technology partnerships between storage vendors and cloud service providers are reshaping the competitive landscape, enabling integrated solutions that span on-premises and cloud environments. These partnerships facilitate hybrid cloud deployments and provide customers with seamless data mobility across different storage platforms.

Acquisition activity continues to consolidate the storage market, with larger vendors acquiring specialized companies to expand their technology portfolios and market reach. Recent acquisitions have focused on AI-driven storage management, edge computing solutions, and sustainable storage technologies.

Regulatory developments in European data protection are influencing storage architecture decisions, with organizations investing in solutions that ensure compliance with evolving requirements. The implementation of new regulations creates both challenges and opportunities for storage vendors.

Research and development investments are accelerating as vendors compete to develop next-generation storage technologies. Focus areas include storage-class memory, quantum storage systems, and DNA-based storage for long-term archival applications.

Sustainability certifications are becoming increasingly important as European organizations prioritize environmental responsibility. Storage vendors are investing in green technologies and obtaining environmental certifications to meet customer requirements and regulatory expectations.

Strategic recommendations for storage vendors include focusing on hybrid cloud integration capabilities that enable seamless data movement between on-premises and cloud environments. Organizations increasingly demand storage solutions that provide flexibility in deployment models while maintaining consistent management and security policies.

Investment priorities should emphasize artificial intelligence and machine learning capabilities that can differentiate storage offerings in competitive markets. Vendors that successfully integrate AI-driven optimization and predictive maintenance features will be better positioned to capture market share and command premium pricing.

Partnership strategies should focus on developing relationships with cloud service providers, system integrators, and vertical market specialists. These partnerships can expand market reach and provide access to specialized expertise required for complex storage deployments.

Geographic expansion opportunities exist in Eastern European markets, where rapid economic growth and digital transformation initiatives are driving storage infrastructure investments. Vendors should consider establishing local presence and partnerships to capitalize on these growth opportunities.

Sustainability initiatives should be integrated into product development and marketing strategies, as European customers increasingly prioritize environmental considerations in purchasing decisions. Vendors that can demonstrate significant energy efficiency improvements and reduced environmental impact will have competitive advantages.

Long-term projections for the Europe data center storage market indicate sustained growth driven by fundamental technology trends and evolving business requirements. The market is expected to maintain robust growth rates exceeding 12% annually over the next five years, supported by continued digital transformation initiatives and increasing data generation across industries.

Technology evolution will continue to reshape the market, with emerging technologies such as storage-class memory and quantum storage systems beginning to impact commercial deployments. These advanced technologies will enable new applications and use cases while providing superior performance characteristics compared to current solutions.

Market consolidation is expected to continue as larger vendors acquire innovative companies and smaller players struggle to compete with comprehensive product portfolios. This consolidation will likely result in a more concentrated market with fewer but stronger competitors offering integrated solutions.

Regulatory developments will continue to influence market dynamics, with new data protection requirements and sustainability regulations creating both challenges and opportunities for storage vendors. Companies that proactively address regulatory requirements will be better positioned for long-term success.

Customer expectations will continue to evolve, with organizations demanding storage solutions that provide cloud-like flexibility, AI-driven optimization, and comprehensive security features. According to MarkWide Research projections, these evolving requirements will drive continued innovation and investment in the European storage market.

The Europe data center storage market represents a dynamic and rapidly evolving sector positioned for sustained growth and innovation. The convergence of digital transformation initiatives, regulatory requirements, and emerging technologies creates a compelling environment for storage vendors and end-user organizations alike.

Market fundamentals remain strong, with robust demand drivers including exponential data growth, cloud adoption, and the need for regulatory compliance. The market’s maturity and sophistication provide opportunities for advanced storage technologies while creating challenges that require innovative solutions and strategic partnerships.

Future success in the European storage market will depend on vendors’ ability to deliver integrated solutions that address evolving customer requirements for performance, flexibility, sustainability, and compliance. Organizations that can effectively navigate the complex regulatory landscape while providing superior technology solutions will be best positioned to capitalize on the market’s growth potential and establish lasting competitive advantages in this critical technology sector.

What is Data Center Storage?

Data Center Storage refers to the systems and technologies used to store, manage, and retrieve data in data centers. This includes various storage solutions such as hard disk drives, solid-state drives, and cloud storage services that support enterprise applications and data management needs.

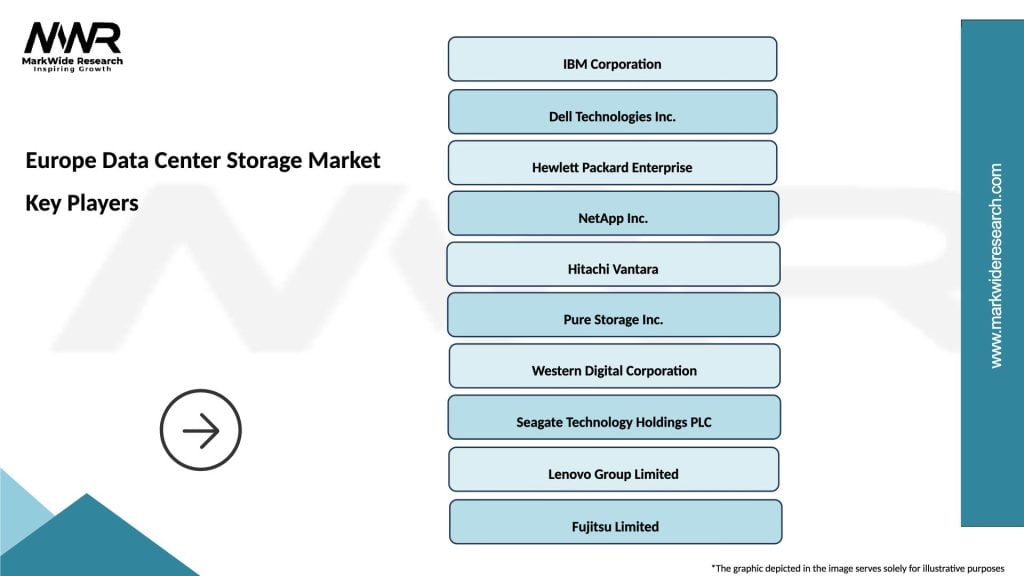

What are the key players in the Europe Data Center Storage Market?

Key players in the Europe Data Center Storage Market include Dell Technologies, Hewlett Packard Enterprise, IBM, and NetApp, among others. These companies provide a range of storage solutions tailored for data centers, focusing on performance, scalability, and security.

What are the main drivers of the Europe Data Center Storage Market?

The main drivers of the Europe Data Center Storage Market include the increasing demand for data storage due to the growth of cloud computing, the rise in big data analytics, and the need for enhanced data security. Additionally, the expansion of IoT devices contributes to the growing volume of data that needs to be stored.

What challenges does the Europe Data Center Storage Market face?

The Europe Data Center Storage Market faces challenges such as the high costs associated with advanced storage technologies and the complexity of data management. Additionally, concerns regarding data privacy and compliance with regulations can hinder market growth.

What opportunities exist in the Europe Data Center Storage Market?

Opportunities in the Europe Data Center Storage Market include the increasing adoption of hybrid cloud solutions and advancements in storage technologies like NVMe and AI-driven storage management. These trends can enhance efficiency and reduce costs for businesses.

What trends are shaping the Europe Data Center Storage Market?

Trends shaping the Europe Data Center Storage Market include the shift towards software-defined storage, the integration of artificial intelligence for data management, and the growing emphasis on sustainability in storage solutions. These trends are driving innovation and efficiency in data center operations.

Europe Data Center Storage Market

| Segmentation Details | Description |

|---|---|

| Product Type | Direct Attached Storage, Network Attached Storage, Storage Area Network, Cloud Storage |

| Technology | Flash Storage, Hard Disk Drive, Hybrid Storage, Object Storage |

| End User | Telecommunications, BFSI, Government, Healthcare |

| Deployment | On-Premises, Off-Premises, Hybrid, Multi-Cloud |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Europe Data Center Storage Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at