444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Europe flow battery market represents a rapidly evolving segment within the continent’s energy storage landscape, driven by ambitious renewable energy targets and increasing grid stability requirements. Flow batteries have emerged as a critical technology for large-scale energy storage applications, offering unique advantages in terms of scalability, longevity, and safety compared to conventional battery technologies. The European market is experiencing robust growth, with adoption rates increasing by approximately 12.5% annually across various applications including grid-scale storage, renewable energy integration, and industrial backup power systems.

Market dynamics in Europe are particularly influenced by the region’s commitment to achieving carbon neutrality by 2050, creating substantial demand for reliable energy storage solutions. Countries such as Germany, the United Kingdom, France, and the Netherlands are leading the adoption of flow battery technology, with Germany accounting for approximately 35% of the regional market share. The technology’s ability to provide long-duration energy storage makes it particularly attractive for balancing intermittent renewable energy sources like wind and solar power.

Technological advancements in vanadium redox flow batteries (VRFB) and emerging chemistries are driving market expansion, with efficiency improvements reaching 85-90% in modern systems. The European flow battery ecosystem encompasses a diverse range of stakeholders, from established energy companies to innovative startups, all contributing to the technology’s rapid commercialization and deployment across the continent.

The Europe flow battery market refers to the commercial ecosystem encompassing the development, manufacturing, deployment, and maintenance of flow battery energy storage systems across European countries. Flow batteries are electrochemical energy storage devices that store electrical energy in liquid electrolytes contained in external tanks, allowing for independent scaling of power and energy capacity.

Unlike conventional batteries, flow batteries separate energy storage from power generation components, enabling longer discharge durations and enhanced operational flexibility. The European market specifically focuses on applications ranging from utility-scale grid storage to commercial and industrial energy management, with particular emphasis on supporting renewable energy integration and grid stabilization initiatives across the continent.

Key characteristics of the European flow battery market include strong regulatory support through various national and EU-level policies, significant research and development investments, and growing commercial deployment driven by the region’s energy transition goals. The market encompasses various flow battery chemistries, with vanadium redox flow batteries currently dominating commercial applications due to their proven performance and reliability.

The European flow battery market is positioned at the forefront of the global energy storage revolution, benefiting from supportive regulatory frameworks and substantial investments in renewable energy infrastructure. Market growth is primarily driven by increasing demand for long-duration energy storage solutions, with flow batteries offering unique advantages in terms of cycle life, safety, and scalability that align perfectly with European energy transition objectives.

Key market drivers include the rapid expansion of renewable energy capacity, which has grown by approximately 15% annually across Europe, creating substantial demand for grid balancing solutions. The technology’s ability to provide storage durations ranging from 4 to 12 hours makes it particularly suitable for managing the variability of wind and solar power generation, addressing one of the most significant challenges in the European energy system.

Competitive landscape features a mix of established industrial players and emerging technology companies, with significant activity in countries that have implemented favorable energy storage policies. The market is characterized by increasing project scale, with utility-scale installations becoming more common and demonstrating the commercial viability of flow battery technology for large-scale energy storage applications.

Future prospects remain highly positive, supported by continued policy support, technological improvements, and declining costs. The European Green Deal and national energy strategies across the continent provide a strong foundation for sustained market growth, with flow batteries expected to play an increasingly important role in achieving Europe’s ambitious climate and energy objectives.

Strategic market insights reveal several critical factors shaping the European flow battery landscape. The following key insights provide a comprehensive understanding of market dynamics and opportunities:

Market intelligence indicates that the European flow battery sector is transitioning from demonstration projects to commercial-scale deployments, with project sizes increasing significantly and operational performance meeting or exceeding expectations. This transition is supported by improving economics and growing confidence in the technology’s long-term reliability and performance characteristics.

Primary market drivers for the European flow battery market stem from the continent’s ambitious energy transition goals and the inherent characteristics of flow battery technology that address specific market needs. Renewable energy integration represents the most significant driver, as European countries continue to increase their renewable energy capacity to meet climate commitments and reduce dependence on fossil fuel imports.

Grid stability requirements are becoming increasingly critical as the proportion of variable renewable energy sources grows. Flow batteries provide essential grid services including frequency regulation, voltage support, and load balancing, with their ability to respond rapidly to grid signals making them particularly valuable for maintaining system stability. The technology’s long cycle life and minimal degradation over time align well with the long-term planning horizons of utility operators.

Policy and regulatory support continues to drive market growth through various mechanisms including feed-in tariffs, capacity markets, and direct subsidies for energy storage projects. The European Union’s Clean Energy Package and national energy strategies provide clear signals about the importance of energy storage in achieving climate objectives, creating confidence for investors and project developers.

Economic factors including declining technology costs and improving performance metrics are making flow batteries increasingly competitive with alternative storage solutions. The ability to decouple power and energy components allows for optimized system design and cost-effective scaling, particularly for applications requiring long discharge durations where flow batteries demonstrate clear economic advantages over lithium-ion alternatives.

Market restraints affecting the European flow battery sector include several technical, economic, and regulatory challenges that continue to limit broader adoption despite the technology’s advantages. High initial capital costs remain a significant barrier, particularly for smaller-scale applications where the economies of scale that benefit flow battery technology are less pronounced.

Technical complexity associated with flow battery systems requires specialized expertise for design, installation, and maintenance, creating potential barriers for widespread adoption. The need for auxiliary systems including pumps, sensors, and control systems adds complexity compared to simpler battery technologies, potentially limiting adoption in applications where simplicity is prioritized.

Limited awareness among potential end-users about flow battery capabilities and benefits continues to constrain market growth. Many decision-makers remain more familiar with conventional battery technologies, requiring additional education and demonstration efforts to build confidence in flow battery solutions.

Supply chain constraints for key materials, particularly vanadium for VRFB systems, can create cost volatility and availability concerns. While alternative chemistries are being developed to address these constraints, the current market remains somewhat dependent on vanadium supply chains that can be subject to price fluctuations and geopolitical considerations.

Regulatory uncertainty in some European markets regarding energy storage compensation mechanisms and grid connection requirements can create project development challenges. While many countries have established clear frameworks, ongoing regulatory evolution requires careful navigation and can delay project timelines.

Significant market opportunities exist across multiple segments of the European flow battery market, driven by evolving energy system needs and technological advancements. Utility-scale storage represents the largest opportunity, with increasing recognition of flow batteries’ suitability for long-duration storage applications that support renewable energy integration and grid stability.

Industrial applications offer substantial growth potential, particularly in energy-intensive industries seeking to optimize energy costs and improve power quality. Flow batteries’ ability to provide both backup power and energy arbitrage services makes them attractive for industrial facilities with significant energy requirements and operational continuity needs.

Microgrid applications present emerging opportunities as communities and commercial facilities seek greater energy independence and resilience. Flow batteries’ scalability and long cycle life make them well-suited for microgrid applications where reliable, long-duration storage is essential for maintaining power supply during grid outages or peak demand periods.

Emerging chemistries beyond vanadium redox systems offer opportunities for cost reduction and performance improvement. Research into organic flow batteries, zinc-bromine systems, and other alternative chemistries could expand the addressable market by reducing costs and improving performance characteristics for specific applications.

Service and maintenance opportunities are growing as the installed base of flow battery systems expands. Specialized service providers and remote monitoring capabilities represent additional revenue streams and market opportunities for companies operating in the flow battery ecosystem.

Market dynamics in the European flow battery sector are characterized by rapid evolution driven by technological advancement, policy support, and changing energy system requirements. Competitive dynamics are intensifying as more players enter the market, leading to innovation acceleration and cost reduction efforts across the value chain.

Technology evolution continues to improve flow battery performance and economics, with efficiency gains of approximately 5-8% achieved in recent system generations. Advanced control systems, improved electrolyte formulations, and enhanced stack designs are contributing to better performance and lower operational costs, making flow batteries more competitive across a broader range of applications.

Market consolidation trends are emerging as smaller technology developers partner with or are acquired by larger industrial players seeking to expand their energy storage portfolios. This consolidation is accelerating technology commercialization and providing access to the capital and market channels necessary for large-scale deployment.

Customer dynamics are shifting as utilities and industrial customers become more sophisticated in their understanding of energy storage technologies and applications. Increasingly, customers are seeking integrated solutions that combine hardware, software, and services, creating opportunities for companies that can provide comprehensive flow battery solutions.

Supply chain dynamics are evolving to support market growth, with efforts to establish European manufacturing capabilities and reduce dependence on imported components. Local supply chain development is being supported by policy initiatives and investment programs aimed at building strategic autonomy in critical energy technologies.

Comprehensive research methodology employed for analyzing the European flow battery market incorporates multiple data sources and analytical approaches to ensure accuracy and completeness. Primary research includes extensive interviews with industry stakeholders including technology providers, system integrators, utilities, and end-users to gather firsthand insights about market trends, challenges, and opportunities.

Secondary research encompasses analysis of industry reports, academic publications, patent filings, and regulatory documents to understand technological developments and policy impacts. Market data is collected from multiple sources including industry associations, government agencies, and commercial databases to ensure comprehensive coverage of market activities and trends.

Quantitative analysis methods include statistical modeling and trend analysis to identify growth patterns and forecast future market developments. Data validation processes ensure accuracy and reliability of market estimates and projections, with cross-referencing across multiple sources to verify key findings and assumptions.

Qualitative analysis incorporates expert opinions and industry insights to provide context and interpretation for quantitative findings. This approach helps identify emerging trends and market dynamics that may not be fully captured in historical data but are important for understanding future market evolution.

Geographic analysis examines market conditions and opportunities across different European countries, considering variations in policy frameworks, energy system characteristics, and market maturity levels. This regional perspective provides insights into market development patterns and identifies key growth markets within Europe.

Regional market analysis reveals significant variations in flow battery adoption and market development across European countries, with Germany leading the market with approximately 35% market share due to its aggressive renewable energy policies and substantial energy storage incentives. German utilities and industrial customers have been early adopters of flow battery technology, supported by favorable regulatory frameworks and strong government support for energy storage deployment.

The United Kingdom represents the second-largest market, accounting for approximately 22% of European flow battery installations. The UK’s capacity market mechanism and grid balancing requirements have created strong demand for long-duration storage solutions, with flow batteries well-positioned to provide essential grid services. Brexit has created some uncertainty, but domestic policy support remains strong.

France and the Netherlands together account for approximately 25% of the regional market, with both countries implementing supportive policies for energy storage and renewable energy integration. France’s nuclear-heavy energy system creates unique opportunities for flow batteries in providing flexibility services, while the Netherlands’ focus on offshore wind development drives demand for grid balancing solutions.

Nordic countries including Sweden, Norway, and Denmark are emerging as important markets, leveraging their abundant renewable energy resources and advanced grid infrastructure. These countries are particularly interested in flow batteries for seasonal energy storage and grid export applications, taking advantage of their strong renewable energy positions.

Southern European countries including Spain, Italy, and Portugal are showing increasing interest in flow battery technology, driven by high solar energy potential and grid stability challenges. These markets are expected to grow rapidly as renewable energy deployment accelerates and grid infrastructure investments increase.

The competitive landscape of the European flow battery market features a diverse mix of established industrial companies, specialized technology providers, and emerging startups, each contributing unique capabilities and market approaches. Market leadership is distributed among several key players with different technological focuses and geographic strengths.

Competitive strategies vary significantly across market participants, with some companies focusing on technology innovation and cost reduction while others emphasize system integration and customer service capabilities. Vertical integration strategies are becoming more common as companies seek to control key components of the value chain and improve cost competitiveness.

Partnership strategies are prevalent throughout the industry, with technology providers collaborating with utilities, system integrators, and research institutions to accelerate market development and deployment. These partnerships often combine complementary capabilities and help share the risks associated with large-scale project development and technology commercialization.

Market segmentation of the European flow battery market reveals distinct categories based on technology type, application, end-user, and capacity range. By technology type, vanadium redox flow batteries currently dominate the market due to their proven performance and commercial availability, though alternative chemistries are gaining attention for specific applications.

By application, the market segments into several key categories:

By end-user, the market includes utilities, industrial customers, commercial facilities, and residential consumers, with utilities representing the largest segment due to their focus on grid-scale applications. Industrial customers are growing rapidly as awareness of flow battery benefits for energy management and power quality applications increases.

By capacity range, systems are typically categorized as small-scale (under 1 MWh), medium-scale (1-10 MWh), and large-scale (over 10 MWh), with large-scale systems representing the majority of market activity due to the economics of flow battery technology favoring larger installations.

Geographic segmentation reflects varying market maturity levels across European countries, with Western European markets generally more developed than Eastern European markets, though growth opportunities exist across all regions as energy transition policies are implemented.

Technology category insights reveal that vanadium redox flow batteries (VRFB) continue to dominate commercial deployments, accounting for approximately 80% of installed capacity in Europe. VRFB systems benefit from proven performance, long cycle life, and established supply chains, making them the preferred choice for large-scale utility applications where reliability and longevity are paramount.

Alternative chemistry categories are gaining traction for specific applications, with zinc-bromine and organic flow batteries showing promise for cost-sensitive applications. These emerging technologies offer potential advantages in terms of material costs and environmental impact, though they generally require additional development to match the proven performance of vanadium systems.

Application category analysis shows that grid-scale storage applications drive the majority of market activity, benefiting from supportive utility procurement practices and regulatory frameworks that value long-duration storage capabilities. Commercial and industrial applications are growing rapidly as businesses seek to optimize energy costs and improve power quality through advanced energy management systems.

Capacity category trends indicate increasing project sizes as the technology matures and economies of scale become more important. Large-scale installations (over 10 MWh) are becoming more common and demonstrating improved cost competitiveness compared to smaller systems, driving market development toward utility-scale applications.

Service category opportunities are expanding as the installed base grows, with increasing demand for specialized maintenance, monitoring, and optimization services. These service categories represent additional revenue opportunities and help ensure optimal system performance throughout the operational lifetime of flow battery installations.

Industry participants in the European flow battery market benefit from multiple value propositions that support business growth and market development. Technology providers benefit from growing market demand driven by energy transition policies and increasing recognition of flow battery advantages for specific applications.

Utilities gain significant benefits from flow battery deployment including improved grid stability, enhanced renewable energy integration capabilities, and access to new revenue streams through grid services provision. The long cycle life and minimal degradation characteristics of flow batteries align well with utility asset management practices and long-term planning horizons.

Industrial and commercial customers benefit from reduced energy costs through peak shaving and energy arbitrage, improved power quality and reliability, and enhanced energy independence. Flow batteries’ ability to provide both energy storage and backup power functions offers comprehensive energy management solutions for facilities with critical power requirements.

Investors and project developers benefit from supportive policy frameworks, improving technology economics, and growing market acceptance that reduce project risks and improve returns. The predictable performance characteristics of flow batteries support project financing and long-term investment strategies.

Research institutions and universities benefit from increased funding opportunities and industry collaboration as flow battery technology continues to evolve. The ongoing need for performance improvements and cost reductions creates sustained demand for research and development activities.

Supply chain participants benefit from growing demand for components and materials, creating opportunities for local manufacturing and service provision. The development of European supply chains reduces import dependence and supports local economic development in the clean energy sector.

Strengths:

Weaknesses:

Opportunities:

Threats:

Key market trends shaping the European flow battery landscape reflect broader energy system transformation and technological evolution. Increasing project scale represents a dominant trend, with utility-scale installations becoming larger and more common as the technology demonstrates commercial viability and cost competitiveness for long-duration storage applications.

Technology diversification is emerging as companies explore alternative chemistries beyond vanadium redox systems. Organic flow batteries, zinc-bromine systems, and other emerging technologies are attracting investment and development efforts aimed at reducing costs and improving performance for specific market segments.

Integration with renewable energy projects is becoming standard practice, with flow batteries increasingly deployed as part of comprehensive renewable energy developments. This co-location strategy improves project economics and provides enhanced grid services compared to standalone renewable or storage projects.

Digitalization and smart grid integration trends are driving demand for advanced control systems and grid-interactive capabilities. Flow batteries are being equipped with sophisticated monitoring and control systems that enable participation in multiple grid service markets and optimize performance based on real-time grid conditions.

Circular economy principles are gaining importance, with increasing focus on electrolyte recycling and sustainable material sourcing. Companies are developing closed-loop systems for electrolyte management and exploring bio-based materials to improve environmental sustainability.

Service-oriented business models are emerging as companies shift from pure equipment sales to comprehensive service offerings including financing, operation, and maintenance. These models reduce customer risks and provide predictable revenue streams for flow battery providers.

Recent industry developments demonstrate accelerating momentum in the European flow battery market, with significant project announcements, technology breakthroughs, and strategic partnerships driving market evolution. Major project deployments across multiple European countries are proving the commercial viability of flow battery technology and building confidence among utilities and investors.

Technology partnerships between flow battery companies and major industrial players are accelerating commercialization efforts and providing access to broader markets and distribution channels. These partnerships often combine complementary capabilities and help address the scale requirements for large utility projects.

Research breakthroughs in electrolyte chemistry and system design are improving performance and reducing costs, with several companies reporting significant efficiency gains and cost reductions in recent system generations. MarkWide Research analysis indicates that these technological improvements are critical for expanding market adoption beyond early adopter segments.

Manufacturing capacity expansion across Europe is supporting market growth and reducing dependence on imported systems. Several companies have announced plans for European manufacturing facilities, supported by government incentives and growing local demand for flow battery systems.

Regulatory developments including updated grid codes and energy storage compensation mechanisms are creating more favorable conditions for flow battery deployment. These regulatory improvements address previous barriers and provide clearer pathways for project development and grid connection.

Financial market developments including specialized financing products for energy storage projects are improving project economics and reducing development risks. Green bonds and other sustainable finance instruments are increasingly available for flow battery projects, supporting market growth.

Strategic recommendations for market participants focus on leveraging current market conditions and positioning for future growth opportunities. Technology companies should prioritize cost reduction efforts and performance improvements to enhance competitiveness against alternative storage technologies, while maintaining focus on applications where flow batteries offer clear advantages.

Market development strategies should emphasize education and demonstration projects to build awareness and confidence among potential customers. Successful case studies and performance data from existing installations provide powerful tools for market development and customer acquisition efforts.

Partnership strategies are essential for companies seeking to scale operations and access new markets. Strategic alliances with utilities, system integrators, and industrial customers can provide market access and reduce business development costs while sharing risks associated with large project deployments.

Geographic expansion strategies should consider varying market conditions across European countries, with focus on markets offering supportive policies and strong renewable energy development. Early entry into emerging markets can provide competitive advantages as these markets develop.

Service capabilities development represents an important opportunity for creating additional value and building long-term customer relationships. Companies should invest in remote monitoring, predictive maintenance, and optimization services that enhance system performance and customer satisfaction.

Supply chain strategies should address material cost volatility and availability concerns through diversification and vertical integration where appropriate. Local sourcing and manufacturing capabilities can provide cost and supply security advantages while supporting European industrial policy objectives.

Future market outlook for the European flow battery market remains highly positive, supported by continued policy momentum, technological advancement, and growing recognition of the technology’s unique value proposition for long-duration energy storage applications. Market growth is expected to accelerate as costs continue to decline and performance improves, with flow batteries becoming increasingly competitive across a broader range of applications.

Technology evolution will continue to drive market expansion, with efficiency improvements of 10-15% expected over the next five years through advances in stack design, electrolyte chemistry, and system optimization. These improvements will enhance the economic competitiveness of flow batteries and expand their addressable market significantly.

Policy support is expected to remain strong as European countries implement their national energy and climate plans, with energy storage playing an increasingly important role in achieving renewable energy and emissions reduction targets. The European Green Deal provides a long-term framework supporting continued investment in energy storage technologies.

Market maturation will bring improved standardization, reduced costs, and enhanced performance reliability, making flow batteries more attractive to mainstream utility and industrial customers. MWR projections indicate that the technology will transition from niche applications to mainstream adoption as these market maturation processes continue.

Application expansion is expected as flow batteries demonstrate success in initial deployments and customers become more familiar with their capabilities. New applications in sectors such as data centers, telecommunications, and transportation infrastructure represent significant growth opportunities for the technology.

International expansion from European bases will provide additional growth opportunities as companies leverage European experience and technology development to access global markets. European flow battery companies are well-positioned to compete internationally based on their technological capabilities and market experience.

The European flow battery market represents a dynamic and rapidly evolving sector within the broader energy storage landscape, characterized by strong growth potential, technological innovation, and supportive policy frameworks. The market’s development is intrinsically linked to Europe’s energy transition objectives and the growing need for flexible, long-duration energy storage solutions that can support renewable energy integration and grid stability.

Market fundamentals remain strong, with flow battery technology offering unique advantages in terms of cycle life, safety, and scalability that align well with European energy system requirements. While challenges related to costs and market awareness persist, ongoing technological improvements and successful project deployments are addressing these barriers and building market confidence.

Strategic positioning of flow batteries within the European energy storage market is strengthening as utilities and industrial customers recognize the technology’s value proposition for specific applications. The ability to provide long-duration storage with minimal degradation makes flow batteries particularly attractive for applications where conventional battery technologies face limitations.

Future prospects for the European flow battery market are highly favorable, supported by continued policy support, technological advancement, and growing market acceptance. As the technology continues to mature and costs decline, flow batteries are expected to play an increasingly important role in Europe’s energy system transformation, contributing significantly to the continent’s renewable energy and climate objectives while creating substantial opportunities for industry participants and stakeholders across the value chain.

What is Flow Battery?

Flow batteries are a type of rechargeable battery where energy is stored in liquid electrolytes contained in external tanks. They are known for their scalability, long cycle life, and ability to provide large amounts of energy over extended periods, making them suitable for various applications including renewable energy integration and grid storage.

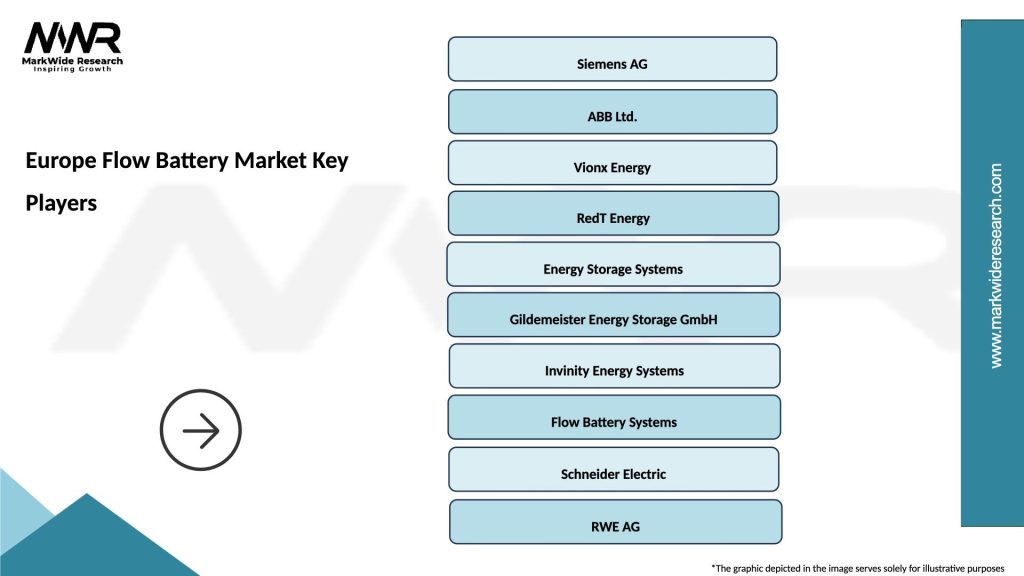

What are the key players in the Europe Flow Battery Market?

Key players in the Europe Flow Battery Market include companies such as Vanadis Power, RedT Energy, and Invinity Energy Systems, which are actively involved in the development and deployment of flow battery technologies for energy storage solutions, among others.

What are the growth factors driving the Europe Flow Battery Market?

The Europe Flow Battery Market is driven by the increasing demand for renewable energy sources, the need for grid stability, and advancements in battery technology. Additionally, government incentives for energy storage solutions and the growing focus on reducing carbon emissions are contributing to market growth.

What challenges does the Europe Flow Battery Market face?

The Europe Flow Battery Market faces challenges such as high initial investment costs and competition from other energy storage technologies like lithium-ion batteries. Additionally, the limited awareness and understanding of flow battery technology among potential users can hinder market adoption.

What opportunities exist in the Europe Flow Battery Market?

Opportunities in the Europe Flow Battery Market include the increasing integration of renewable energy sources, such as wind and solar, which require efficient energy storage solutions. Furthermore, the growing interest in electric vehicles and smart grid technologies presents additional avenues for flow battery applications.

What trends are shaping the Europe Flow Battery Market?

Trends shaping the Europe Flow Battery Market include the development of hybrid systems that combine flow batteries with other energy storage technologies, as well as innovations in electrolyte formulations to enhance performance. Additionally, there is a rising focus on sustainability and recycling of battery materials within the industry.

Europe Flow Battery Market

| Segmentation Details | Description |

|---|---|

| Type | Redox Flow, Zinc-Bromine, Vanadium, All-Vanadium |

| Application | Grid Storage, Renewable Integration, Backup Power, Frequency Regulation |

| End User | Utilities, Commercial, Industrial, Residential |

| Technology | Electrolyte Management, Energy Management, Control Systems, Monitoring Solutions |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Europe Flow Battery Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at