444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Europe medical waste management market represents a critical component of the continent’s healthcare infrastructure, encompassing comprehensive solutions for the safe collection, treatment, and disposal of medical waste generated by healthcare facilities. Medical waste management in Europe has evolved into a sophisticated industry driven by stringent regulatory frameworks, environmental consciousness, and the growing volume of healthcare services across the region.

Healthcare facilities across Europe generate substantial amounts of medical waste daily, including infectious materials, pathological waste, pharmaceutical residues, and sharps. The market encompasses various treatment technologies such as autoclaving, incineration, chemical treatment, and emerging microwave treatment methods. With healthcare expenditure consistently rising and the aging population driving increased medical services, the demand for efficient medical waste management solutions continues to expand at a steady growth rate of 5.2% CAGR.

Regulatory compliance remains the primary driver shaping market dynamics, with the European Union’s Waste Framework Directive and individual country regulations establishing strict guidelines for medical waste handling. The market serves diverse end-users including hospitals, clinics, diagnostic laboratories, pharmaceutical companies, and research institutions, each requiring specialized waste management protocols tailored to their specific waste streams.

The Europe medical waste management market refers to the comprehensive ecosystem of services, technologies, and infrastructure dedicated to the safe handling, treatment, and disposal of medical waste generated across European healthcare facilities. This market encompasses the entire waste management lifecycle from point-of-generation collection to final disposal, ensuring compliance with stringent European environmental and health regulations.

Medical waste management involves specialized processes designed to neutralize potentially infectious, toxic, or hazardous materials while minimizing environmental impact. The market includes various stakeholders such as waste management service providers, technology manufacturers, regulatory bodies, and healthcare institutions working collaboratively to maintain public health safety and environmental protection standards throughout the waste management process.

Market dynamics in the Europe medical waste management sector reflect a mature industry experiencing steady growth driven by regulatory compliance requirements and expanding healthcare services. The market demonstrates strong resilience with consistent demand patterns influenced by demographic trends, healthcare infrastructure development, and evolving treatment technologies.

Key market segments include infectious waste, pathological waste, pharmaceutical waste, and sharps, with infectious waste representing the largest category due to its prevalence across all healthcare settings. Treatment technologies show diversification trends, with traditional incineration methods maintaining significant market share while alternative technologies like autoclaving and microwave treatment gain adoption rates of approximately 28% annually.

Geographic distribution reveals Western European countries leading market development, with Germany, France, and the United Kingdom representing major market contributors. Eastern European markets demonstrate accelerated growth potential as healthcare infrastructure modernization initiatives drive increased demand for professional medical waste management services.

Industry consolidation trends indicate ongoing merger and acquisition activities as major service providers expand geographic coverage and service capabilities. The market benefits from stable regulatory frameworks while adapting to emerging challenges such as pharmaceutical waste management and specialized treatment requirements for new medical technologies.

Strategic market insights reveal several critical factors shaping the Europe medical waste management landscape:

Regulatory framework enforcement serves as the primary market driver, with European Union directives and national regulations mandating proper medical waste management practices. The Waste Framework Directive establishes comprehensive guidelines requiring healthcare facilities to implement professional waste management systems, creating consistent demand for specialized services across all European markets.

Healthcare sector expansion continues driving market growth as aging populations increase medical service utilization rates. The demographic transition across Europe results in higher healthcare facility utilization, generating increased medical waste volumes requiring professional management services. Healthcare expenditure growth of approximately 3.8% annually correlates directly with expanded waste management service requirements.

Environmental consciousness among healthcare institutions promotes adoption of sustainable waste management practices. Hospitals and clinics increasingly prioritize environmentally responsible waste treatment methods, driving demand for advanced technologies that minimize environmental impact while maintaining safety standards. This trend supports market growth for innovative treatment solutions and comprehensive service offerings.

Infection control awareness heightened by recent global health events emphasizes the critical importance of proper medical waste management. Healthcare facilities recognize medical waste management as an essential component of comprehensive infection prevention strategies, supporting consistent investment in professional waste management services and advanced treatment technologies.

High operational costs associated with medical waste management services create budget pressures for healthcare facilities, particularly smaller clinics and diagnostic centers. The specialized nature of medical waste treatment requires significant infrastructure investment and ongoing operational expenses, potentially limiting market expansion among cost-sensitive healthcare providers.

Complex regulatory compliance requirements across different European countries create operational challenges for waste management service providers. Varying national regulations and documentation requirements increase administrative burdens and compliance costs, potentially restricting market entry for smaller service providers and limiting cross-border service expansion.

Technology implementation barriers include high capital investment requirements for advanced treatment systems and the need for specialized technical expertise. Healthcare facilities may face challenges adopting new waste management technologies due to budget constraints, space limitations, or lack of technical resources, potentially slowing market adoption of innovative solutions.

Transportation restrictions and logistics challenges affect efficient waste collection and treatment operations. Regulatory requirements for specialized transportation, geographic distances between healthcare facilities and treatment centers, and urban access restrictions can increase operational complexity and costs for waste management service providers.

Eastern European expansion presents significant growth opportunities as healthcare infrastructure modernization drives increased demand for professional medical waste management services. Countries implementing EU healthcare standards create new market opportunities for established service providers seeking geographic expansion and revenue diversification.

Technology innovation opportunities include development of more efficient, environmentally sustainable treatment methods and digital waste tracking systems. Advanced technologies such as plasma gasification, advanced autoclaving, and IoT-enabled tracking systems offer competitive advantages and premium service positioning for forward-thinking market participants.

Pharmaceutical waste specialization represents a growing market segment as pharmaceutical manufacturing and research activities expand across Europe. Specialized handling requirements for pharmaceutical waste, including controlled substances and cytotoxic materials, create opportunities for service providers developing expertise in these high-value waste streams.

Service integration expansion allows waste management companies to offer comprehensive healthcare support services beyond traditional waste management. Opportunities include infection control consulting, regulatory compliance support, and sustainability reporting services that add value for healthcare facility clients while increasing revenue per customer.

Supply and demand dynamics in the Europe medical waste management market demonstrate stable equilibrium with consistent growth patterns. Healthcare facility expansion and increased medical service utilization create steady demand growth, while service provider capacity expansion and technology improvements enhance supply capabilities. This balance supports sustainable market development with capacity utilization rates averaging 78% across major treatment facilities.

Competitive dynamics reflect a moderately consolidated market with several major service providers maintaining significant market positions alongside numerous regional specialists. Competition focuses on service quality, regulatory compliance expertise, geographic coverage, and cost efficiency rather than price competition alone. Market concentration shows the top five providers controlling approximately 42% market share, leaving substantial opportunities for regional and specialized service providers.

Technology adoption dynamics indicate gradual transition toward more sustainable and efficient treatment methods. While traditional incineration maintains significant market presence, alternative technologies gain adoption as healthcare facilities prioritize environmental sustainability and operational efficiency. Innovation cycles typically span 5-7 years, allowing established technologies to maintain market relevance while new solutions gradually gain acceptance.

Regulatory dynamics provide market stability through consistent enforcement of medical waste management requirements while occasionally introducing new compliance challenges. Regulatory updates typically focus on environmental protection enhancements and improved waste tracking requirements, creating opportunities for service providers offering advanced compliance solutions and digital documentation systems.

Primary research methodology encompasses comprehensive data collection through structured interviews with healthcare facility waste management personnel, service provider executives, regulatory officials, and technology manufacturers. The research approach includes quantitative surveys measuring waste generation patterns, service satisfaction levels, and technology adoption preferences across diverse healthcare settings throughout Europe.

Secondary research analysis incorporates extensive review of regulatory documentation, industry reports, company financial statements, and academic research publications. Data sources include European Union regulatory databases, national healthcare statistics, industry association reports, and peer-reviewed research studies focusing on medical waste management practices and technology developments.

Market segmentation analysis utilizes both top-down and bottom-up approaches to validate market size estimates and growth projections. The methodology combines healthcare facility waste generation data with service provider capacity information to develop comprehensive market assessments across geographic regions, waste types, and treatment technologies.

Data validation processes include cross-referencing multiple data sources, conducting expert interviews for insight verification, and applying statistical analysis techniques to ensure research accuracy and reliability. MarkWide Research employs rigorous quality control measures throughout the research process to maintain high standards of data integrity and analytical precision.

Western Europe dominates the medical waste management market, with Germany, France, and the United Kingdom representing the largest individual markets. These countries benefit from mature healthcare systems, well-established regulatory frameworks, and comprehensive waste management infrastructure. Germany leads regional market development with approximately 23% market share, driven by stringent environmental regulations and advanced healthcare facilities.

Nordic countries demonstrate strong market development characterized by high environmental standards and advanced waste treatment technologies. Sweden, Norway, and Denmark prioritize sustainable waste management practices, creating demand for innovative treatment solutions and comprehensive service offerings. The region shows particular strength in waste-to-energy applications and circular economy principles integration.

Southern Europe markets including Italy, Spain, and France show steady growth supported by healthcare sector expansion and regulatory compliance improvements. These markets benefit from increasing healthcare infrastructure investment and growing awareness of proper medical waste management importance. Italy demonstrates particular growth in pharmaceutical waste management services due to its significant pharmaceutical manufacturing sector.

Eastern Europe presents the highest growth potential with countries like Poland, Czech Republic, and Hungary modernizing healthcare systems and implementing EU compliance standards. These markets show annual growth rates exceeding 8% as healthcare facilities upgrade waste management practices and invest in professional service providers. Infrastructure development and regulatory harmonization drive consistent market expansion across the region.

Market leadership is distributed among several major international and regional service providers, each offering specialized capabilities and geographic coverage. The competitive landscape reflects a mix of large multinational companies and focused regional specialists serving diverse healthcare facility requirements across Europe.

Competitive strategies focus on service quality differentiation, regulatory expertise, geographic expansion, and technology innovation. Leading providers invest in advanced treatment technologies, digital tracking systems, and comprehensive compliance support to maintain competitive advantages in this regulated market environment.

By Waste Type:

By Treatment Technology:

By End-User:

Infectious waste management represents the largest market category, driven by consistent generation across all healthcare settings and stringent regulatory requirements. This category benefits from standardized treatment protocols and established service provider capabilities, maintaining stable demand patterns with growth rates of 4.8% annually. Healthcare facilities prioritize reliable infectious waste management as a critical component of infection control programs.

Pharmaceutical waste management emerges as a high-growth category driven by expanding pharmaceutical manufacturing, increased medication usage, and specialized handling requirements. This segment commands premium pricing due to regulatory complexity and specialized treatment needs. Pharmaceutical waste shows particular growth in oncology medications and controlled substances requiring enhanced security and documentation protocols.

Sharps waste management maintains consistent demand driven by medical procedure volumes and safety requirements. This category benefits from specialized containment systems and established collection networks. The segment shows innovation in smart sharps containers with fill-level monitoring and automated collection scheduling, improving operational efficiency for healthcare facilities.

Pathological waste management requires specialized handling and treatment methods, creating opportunities for service providers with appropriate capabilities and regulatory approvals. This category emphasizes dignified disposal practices and comprehensive documentation, supporting premium service positioning for qualified providers.

Healthcare facilities benefit from professional medical waste management through reduced regulatory compliance risks, improved infection control, and operational efficiency gains. Outsourcing waste management allows healthcare providers to focus on core medical services while ensuring proper waste handling through expert service providers. Cost predictability through service contracts enables better budget planning and resource allocation.

Service providers benefit from stable, recurring revenue streams supported by regulatory requirements and consistent waste generation patterns. The market offers opportunities for geographic expansion, service diversification, and technology innovation. Long-term contracts with healthcare facilities provide revenue stability and support business growth planning.

Technology manufacturers benefit from ongoing demand for advanced treatment systems and digital tracking solutions. Innovation opportunities in sustainable treatment methods and operational efficiency improvements support premium product positioning and market expansion. Regulatory compliance requirements create consistent demand for certified treatment technologies.

Regulatory authorities benefit from professional waste management industry development through improved compliance rates, environmental protection, and public health safety. Industry expertise and infrastructure support regulatory objective achievement while reducing enforcement burdens through proactive compliance management.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation emerges as a dominant trend with healthcare facilities and service providers implementing advanced tracking systems, automated documentation, and real-time monitoring capabilities. IoT-enabled containers and blockchain-based tracking improve waste management transparency and regulatory compliance while reducing administrative burdens. Digital solutions show adoption rates of 34% annually among major healthcare facilities.

Sustainability initiatives drive increased adoption of environmentally friendly treatment technologies and waste reduction strategies. Healthcare facilities prioritize service providers offering carbon footprint reduction, waste-to-energy solutions, and circular economy approaches. This trend supports market growth for innovative treatment technologies and comprehensive sustainability reporting services.

Service consolidation trends show healthcare facilities preferring comprehensive waste management solutions from single service providers rather than managing multiple vendor relationships. This preference drives service provider expansion into adjacent services and geographic markets while supporting premium pricing for integrated service offerings.

Pharmaceutical waste specialization gains prominence as healthcare facilities generate increasing volumes of specialized pharmaceutical waste requiring expert handling. Oncology waste, controlled substances, and biosimilar medications create demand for specialized service capabilities and enhanced security protocols throughout the waste management process.

Regulatory harmonization efforts across European Union member states aim to standardize medical waste management requirements and improve cross-border service provision. Recent developments include updated waste classification systems and enhanced documentation requirements designed to improve waste tracking and environmental protection. These changes create opportunities for service providers with advanced compliance capabilities.

Technology partnerships between waste management companies and healthcare technology providers develop integrated solutions combining waste management with broader healthcare facility operations. MarkWide Research analysis indicates increasing collaboration between waste management providers and healthcare information systems companies to create comprehensive facility management platforms.

Merger and acquisition activity continues as major service providers expand geographic coverage and service capabilities through strategic acquisitions. Recent transactions focus on regional market expansion and specialized service capability acquisition, particularly in pharmaceutical waste management and advanced treatment technologies.

Infrastructure investment in advanced treatment facilities supports market capacity expansion and technology modernization. Major service providers invest in next-generation autoclaving systems, advanced incineration technologies, and alternative treatment methods to improve operational efficiency and environmental performance while meeting growing demand.

Service providers should prioritize technology investment and digital capability development to maintain competitive advantages in an increasingly sophisticated market environment. Digital transformation initiatives including IoT tracking, automated documentation, and predictive analytics offer opportunities for operational efficiency improvements and premium service positioning.

Geographic expansion strategies should focus on Eastern European markets where healthcare infrastructure modernization creates significant growth opportunities. Service providers should develop local partnerships and regulatory expertise to successfully enter these developing markets while maintaining service quality standards.

Healthcare facilities should evaluate comprehensive waste management partnerships that provide integrated services, regulatory compliance support, and sustainability reporting capabilities. Long-term service agreements with established providers offer cost predictability and operational efficiency benefits while ensuring regulatory compliance.

Technology manufacturers should focus on developing sustainable treatment solutions and digital integration capabilities that address healthcare facility priorities for environmental responsibility and operational efficiency. Innovation opportunities exist in waste reduction technologies, energy recovery systems, and automated handling solutions.

Market growth prospects remain positive supported by demographic trends, healthcare sector expansion, and regulatory compliance requirements. The aging European population drives increased healthcare service utilization, creating consistent growth in medical waste generation and management service demand. Long-term growth projections indicate sustained market expansion at annual rates of 5.1% through the next decade.

Technology evolution will continue driving market development through improved treatment efficiency, environmental sustainability, and operational automation. Advanced treatment technologies including plasma gasification, supercritical water oxidation, and enhanced autoclaving systems offer opportunities for service differentiation and premium positioning. MWR projects technology adoption rates accelerating as healthcare facilities prioritize sustainability and efficiency.

Regulatory development trends indicate continued emphasis on environmental protection, waste reduction, and improved tracking requirements. Future regulations may introduce enhanced pharmaceutical waste management requirements and expanded producer responsibility concepts, creating opportunities for specialized service providers with appropriate capabilities.

Market consolidation is expected to continue as service providers seek scale advantages and geographic expansion opportunities. However, specialized regional providers will maintain market positions through expertise in local regulations and customized service offerings. The market structure will likely evolve toward a mix of large integrated providers and focused specialists serving specific market segments or geographic regions.

The Europe medical waste management market represents a mature, stable industry with consistent growth prospects driven by regulatory requirements, demographic trends, and healthcare sector expansion. Market fundamentals remain strong with essential service characteristics providing recession resistance and predictable demand patterns supporting sustainable business development.

Technology innovation and sustainability initiatives create opportunities for market participants to differentiate services and capture premium positioning. Digital transformation trends and environmental consciousness among healthcare facilities support demand for advanced waste management solutions combining operational efficiency with environmental responsibility.

Geographic expansion opportunities in Eastern Europe and service diversification into specialized waste streams offer growth potential for established market participants. The market benefits from stable regulatory frameworks while adapting to evolving compliance requirements and environmental standards that support long-term industry development.

Future success in the Europe medical waste management market will depend on service providers’ ability to combine regulatory expertise, technology innovation, and operational efficiency while maintaining the highest safety and environmental standards. Healthcare facilities will increasingly value comprehensive partnerships with service providers offering integrated solutions, sustainability benefits, and reliable regulatory compliance support throughout their waste management requirements.

What is Medical Waste Management?

Medical Waste Management refers to the processes and practices involved in handling, treating, and disposing of waste generated from healthcare facilities, including hospitals, clinics, and laboratories. This waste can include hazardous materials, sharps, and infectious waste that require specialized management to ensure safety and compliance with regulations.

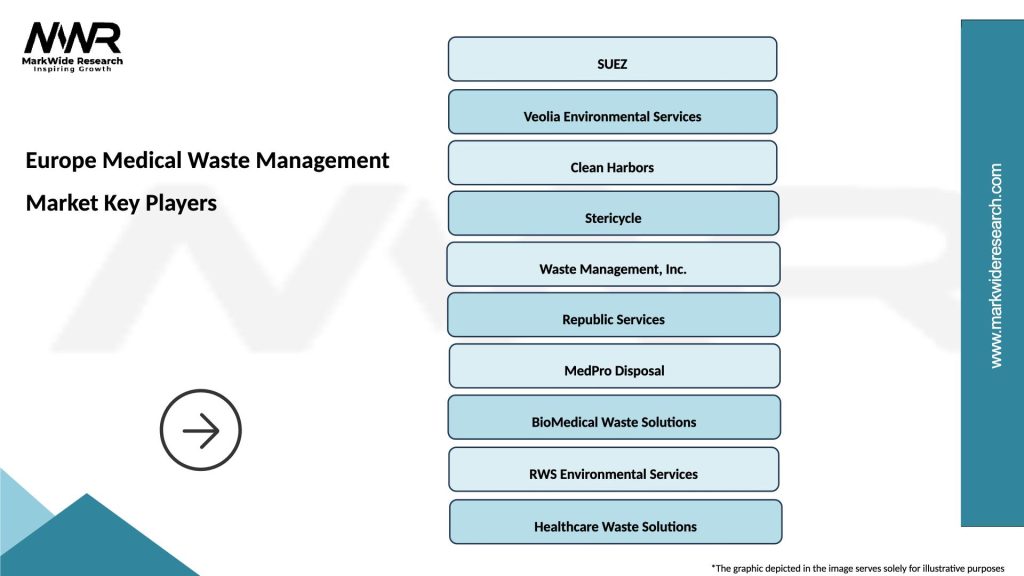

What are the key companies in the Europe Medical Waste Management Market?

Key companies in the Europe Medical Waste Management Market include Veolia Environmental Services, Stericycle, and SUEZ, which provide comprehensive waste management solutions tailored for healthcare facilities. These companies focus on safe disposal, recycling, and treatment of medical waste, among others.

What are the drivers of the Europe Medical Waste Management Market?

Drivers of the Europe Medical Waste Management Market include the increasing volume of medical waste generated due to rising healthcare activities and the growing awareness of environmental sustainability. Additionally, stringent regulations regarding waste disposal and the need for safe handling of hazardous materials are significant factors driving market growth.

What challenges does the Europe Medical Waste Management Market face?

The Europe Medical Waste Management Market faces challenges such as the high costs associated with waste treatment technologies and the lack of standardized regulations across different countries. Furthermore, the complexity of managing various types of medical waste can complicate compliance and operational efficiency.

What opportunities exist in the Europe Medical Waste Management Market?

Opportunities in the Europe Medical Waste Management Market include the development of advanced waste treatment technologies and the increasing adoption of sustainable practices among healthcare providers. Additionally, the growing emphasis on recycling and resource recovery from medical waste presents new avenues for innovation and investment.

What trends are shaping the Europe Medical Waste Management Market?

Trends shaping the Europe Medical Waste Management Market include the integration of digital technologies for tracking waste management processes and the rise of eco-friendly disposal methods. Moreover, there is a growing focus on public-private partnerships to enhance waste management infrastructure and efficiency.

Europe Medical Waste Management Market

| Segmentation Details | Description |

|---|---|

| Type | Hazardous Waste, Non-Hazardous Waste, Infectious Waste, Pharmaceutical Waste |

| Technology | Autoclaving, Incineration, Chemical Treatment, Microwave Treatment |

| End User | Hospitals, Clinics, Laboratories, Long-term Care Facilities |

| Service Type | Collection, Transportation, Treatment, Disposal |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Europe Medical Waste Management Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at