444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Europe Internal Combustion Engines Market represents a critical segment of the continent’s automotive and industrial machinery landscape, encompassing a diverse range of applications from passenger vehicles to heavy-duty industrial equipment. Despite the growing emphasis on electric mobility and sustainable transportation solutions, internal combustion engines continue to maintain a significant presence across European markets, driven by ongoing technological innovations and specific application requirements where alternative powertrains remain less viable.

Market dynamics in the European region reflect a complex interplay between traditional automotive manufacturing excellence and evolving regulatory frameworks aimed at reducing carbon emissions. The market encompasses various engine types, including gasoline, diesel, and alternative fuel engines, each serving distinct segments with varying growth trajectories. Technological advancement remains a key differentiator, with manufacturers investing heavily in efficiency improvements, emission reduction technologies, and hybrid integration capabilities.

Regional leadership in automotive engineering continues to position Europe as a global hub for internal combustion engine innovation, with countries like Germany, France, Italy, and the United Kingdom maintaining strong manufacturing bases. The market demonstrates resilience through adaptation, with engine manufacturers focusing on advanced combustion technologies, turbocharging solutions, and integration with electrification systems to meet stringent environmental standards while maintaining performance characteristics.

Growth projections indicate the market will experience a moderate decline of 2.1% annually through 2030, primarily due to the transition toward electric vehicles, while certain segments maintain stability through specialized applications and emerging market demands for efficient, clean-burning engine technologies.

The Europe Internal Combustion Engines Market refers to the comprehensive ecosystem encompassing the design, manufacturing, distribution, and servicing of engines that generate power through the combustion of fuel within enclosed cylinders, specifically within the European geographical and regulatory framework. This market includes engines for automotive applications, industrial machinery, marine vessels, power generation equipment, and specialized transportation vehicles.

Engine categories within this market span from small displacement motorcycle engines to large industrial powerplants, each engineered to meet specific performance, efficiency, and emission requirements. The market encompasses both original equipment manufacturer (OEM) production and aftermarket services, including maintenance, repair, and component replacement activities across the engine lifecycle.

Technological scope includes traditional spark-ignition gasoline engines, compression-ignition diesel engines, and advanced variants incorporating direct injection, variable valve timing, turbocharging, and hybrid-electric integration. The market also encompasses supporting systems such as fuel injection equipment, emission control technologies, and engine management systems that enhance performance and environmental compliance.

Market transformation characterizes the current state of Europe’s internal combustion engines sector, as traditional powertrains navigate the transition toward sustainable mobility while maintaining relevance in specific applications. The market demonstrates remarkable adaptability through technological innovation, regulatory compliance, and strategic positioning within the broader automotive ecosystem.

Key performance indicators reveal that while passenger vehicle applications face declining demand due to electrification trends, commercial vehicle and industrial applications maintain steady growth, with heavy-duty diesel engines showing particular resilience. The market benefits from Europe’s strong manufacturing base, advanced engineering capabilities, and established supply chain networks that support both domestic consumption and global export activities.

Competitive dynamics feature established automotive manufacturers alongside specialized engine producers, creating a diverse ecosystem that spans from high-volume production to niche applications. Innovation focus areas include fuel efficiency improvements of 15-20% through advanced combustion technologies, emission reduction systems achieving 90% cleaner outputs compared to previous generations, and integration capabilities with hybrid-electric powertrains.

Strategic positioning involves balancing immediate market demands with long-term sustainability goals, as manufacturers invest in cleaner combustion technologies while preparing for eventual market transitions. The market maintains significant economic importance through employment, export revenues, and technological leadership in global automotive markets.

Market segmentation reveals distinct growth patterns across different engine categories and applications, with commercial vehicles and industrial equipment showing greater stability compared to passenger car applications. The following key insights shape market understanding:

Commercial vehicle demand serves as a primary market driver, with logistics, construction, and transportation sectors requiring reliable, efficient powertrains capable of handling heavy loads and extended operating cycles. The growth of e-commerce and last-mile delivery services particularly supports demand for light commercial vehicle engines optimized for urban environments.

Industrial applications continue driving market growth through construction equipment, agricultural machinery, and power generation systems where internal combustion engines provide proven reliability and performance characteristics. The expansion of infrastructure projects across Europe creates sustained demand for construction equipment powered by advanced diesel engines.

Technological advancement drives market evolution through continuous improvements in fuel efficiency, emission reduction, and performance optimization. Manufacturers invest heavily in research and development to create engines that meet increasingly stringent environmental standards while maintaining competitive performance and cost characteristics.

Export opportunities provide significant growth potential as European engine manufacturers leverage their technological expertise and quality reputation to serve global markets. Emerging economies particularly value European engineering excellence in commercial and industrial applications where reliability and durability are paramount.

Regulatory compliance creates ongoing demand for engine upgrades and replacements as older vehicles and equipment must meet current emission standards. This regulatory-driven replacement cycle supports market stability even as new vehicle sales face challenges from electrification trends.

Electrification pressure represents the most significant market restraint, as government policies, consumer preferences, and corporate sustainability commitments increasingly favor electric powertrains over internal combustion engines. This transition particularly affects passenger vehicle applications where electric alternatives demonstrate comparable or superior performance characteristics.

Regulatory stringency creates substantial compliance costs and technical challenges as emission standards become increasingly demanding. The upcoming Euro VII standards require significant investment in advanced aftertreatment systems and engine optimization, potentially making some applications economically unviable.

Fuel cost volatility affects market attractiveness as fluctuating petroleum prices impact total cost of ownership calculations for commercial operators. High fuel costs can accelerate adoption of alternative powertrains or drive demand for more efficient engine technologies.

Investment uncertainty challenges manufacturers as they balance investments in internal combustion engine technology improvements against potential future obsolescence. This uncertainty can limit research and development spending and affect long-term competitiveness.

Supply chain disruptions impact production capabilities and cost structures, particularly for specialized components required for advanced emission control systems. Global supply chain challenges can affect delivery schedules and increase manufacturing costs.

Alternative fuel integration presents significant opportunities for market expansion through engines optimized for hydrogen, biofuels, and synthetic fuels. These technologies offer pathways to reduce carbon emissions while maintaining existing infrastructure and operational characteristics that favor internal combustion engines.

Hybrid system integration creates new market segments where internal combustion engines work in conjunction with electric motors to optimize efficiency and performance. This integration allows engines to operate in their most efficient ranges while electric systems handle low-speed and peak power demands.

Emerging market expansion offers growth opportunities as developing economies invest in infrastructure and transportation systems. European engine manufacturers can leverage their technological advantages to capture market share in regions where internal combustion engines remain the primary powertrain choice.

Specialized applications provide niche opportunities in marine, aerospace, and industrial sectors where electric alternatives face technical or economic limitations. These applications often require custom engineering solutions that command premium pricing and long-term service relationships.

Aftermarket services represent growing revenue opportunities as engine complexity increases and maintenance requirements become more sophisticated. Digital service platforms and predictive maintenance technologies can enhance service value propositions and customer relationships.

Competitive intensity characterizes the European internal combustion engines market as established manufacturers face pressure from multiple directions including electrification trends, regulatory requirements, and cost optimization demands. This intensity drives continuous innovation and efficiency improvements while challenging traditional business models.

Technology convergence creates dynamic market conditions as internal combustion engines increasingly integrate with electric systems, advanced materials, and digital control technologies. This convergence requires manufacturers to develop new competencies while maintaining excellence in traditional engine technologies.

Supply chain evolution reflects changing market dynamics as component suppliers adapt to new technologies and shifting demand patterns. MarkWide Research analysis indicates that supply chain resilience has become a critical competitive factor, with manufacturers investing in diversified sourcing strategies and regional production capabilities.

Customer expectations continue evolving toward higher efficiency, lower emissions, and enhanced reliability while maintaining cost competitiveness. These expectations drive product development priorities and influence market positioning strategies across different application segments.

Regulatory landscape creates dynamic market conditions through evolving emission standards, fuel quality requirements, and safety regulations. Manufacturers must anticipate regulatory changes and invest in compliance technologies while maintaining commercial viability.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable market insights. Primary research activities include extensive interviews with industry executives, technology specialists, and market participants across the European internal combustion engines value chain.

Data collection strategies encompass both quantitative and qualitative research approaches, including manufacturer surveys, customer interviews, and expert consultations. Secondary research involves analysis of industry publications, regulatory documents, and company financial reports to validate primary research findings.

Market modeling utilizes advanced analytical techniques to project market trends, segment growth patterns, and competitive dynamics. Statistical analysis and econometric modeling support quantitative projections while qualitative insights provide context for market interpretation.

Validation processes ensure research accuracy through triangulation of multiple data sources, expert review panels, and cross-verification of key findings. Industry feedback sessions provide additional validation and refinement of market analysis.

Continuous monitoring maintains research currency through ongoing market surveillance, regulatory tracking, and technology development monitoring. This approach ensures that market analysis reflects current conditions and emerging trends that may impact future market evolution.

Germany maintains its position as the largest European market for internal combustion engines, driven by its strong automotive manufacturing base and industrial equipment sector. The country’s 35% market share reflects the presence of major automotive manufacturers and their extensive supply chains, while ongoing investment in advanced engine technologies supports market leadership.

France demonstrates steady market performance with particular strength in diesel engine applications for commercial vehicles and industrial equipment. The country’s focus on efficient combustion technologies and alternative fuel integration positions it well for market evolution, maintaining approximately 18% regional market share.

Italy shows robust performance in specialized engine applications, particularly for agricultural equipment, marine vessels, and high-performance automotive applications. Italian manufacturers excel in niche markets requiring custom engineering solutions, contributing 15% of regional market activity.

United Kingdom maintains significant market presence despite Brexit-related challenges, with strength in premium automotive engines and industrial applications. The country’s focus on advanced materials and hybrid integration technologies supports continued market relevance with 12% market share.

Spain and Eastern Europe represent growing market segments driven by industrial development and commercial vehicle demand. These regions show particular strength in cost-competitive engine applications and emerging market export production, collectively accounting for 20% of regional market activity.

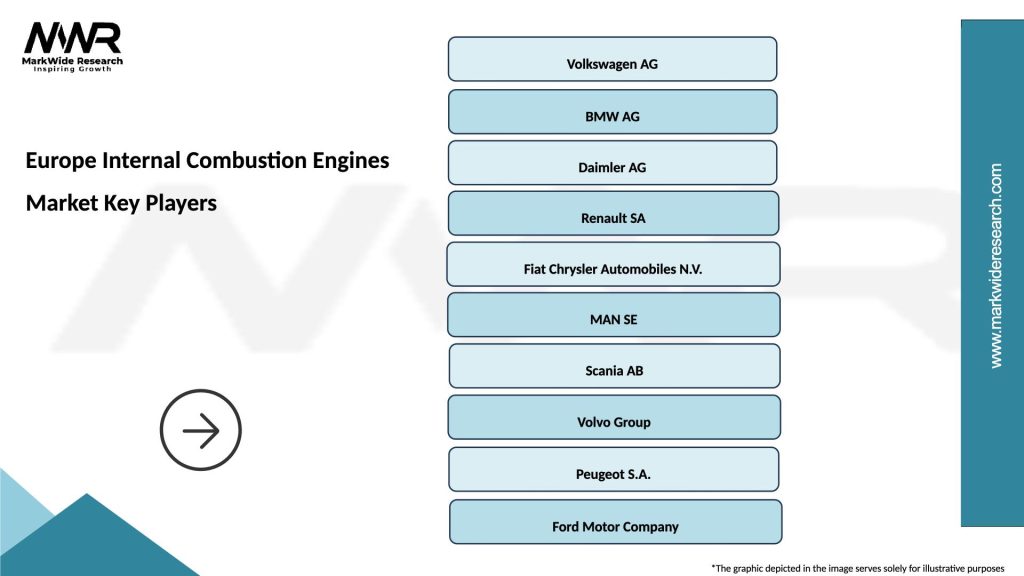

Market leadership in the European internal combustion engines sector features a diverse mix of automotive manufacturers, specialized engine producers, and component suppliers. The competitive landscape reflects both traditional automotive excellence and emerging technology capabilities:

By Engine Type: The market segments into distinct categories based on combustion technology and fuel systems. Gasoline engines serve primarily passenger vehicle and light commercial applications, while diesel engines dominate heavy-duty commercial and industrial segments. Alternative fuel engines represent emerging segments with growing market interest.

By Application: Market segmentation reflects diverse end-use applications including automotive (passenger cars, commercial vehicles), industrial (construction equipment, agricultural machinery), marine (commercial vessels, recreational boats), and power generation (standby generators, distributed power systems).

By Power Output: Engine categorization spans from small displacement engines under 1.0 liter for motorcycles and small equipment to large industrial engines exceeding 10 liters for heavy-duty applications. Each power category serves specific market needs with distinct performance and efficiency requirements.

By Technology: Advanced technology segments include turbocharged engines, direct injection systems, variable valve timing, and hybrid-integrated powertrains. These technologies command premium pricing while delivering enhanced performance and efficiency characteristics.

By End-User: Market segmentation includes original equipment manufacturers (OEMs), aftermarket service providers, fleet operators, and individual consumers. Each segment has distinct purchasing criteria, service requirements, and value propositions.

Passenger Vehicle Engines face the greatest transition pressure as electrification accelerates across European markets. However, hybrid integration creates opportunities for optimized internal combustion engines that work efficiently with electric systems. Gasoline engines increasingly adopt turbocharging and direct injection to improve efficiency while reducing displacement.

Commercial Vehicle Engines maintain strong market positions due to payload requirements, operating range needs, and infrastructure considerations that favor internal combustion powertrains. Diesel engines continue dominating heavy-duty applications while meeting increasingly stringent emission standards through advanced aftertreatment systems.

Industrial Engines demonstrate consistent growth across construction, agricultural, and power generation applications where reliability, durability, and fuel availability favor internal combustion solutions. These engines often operate in demanding environments requiring proven technology and extensive service support.

Marine Engines represent a specialized segment with unique requirements for saltwater operation, space constraints, and regulatory compliance. European manufacturers maintain strong positions in both commercial and recreational marine applications through advanced engineering and quality reputation.

High-Performance Engines serve niche markets including motorsports, luxury vehicles, and specialized equipment where performance characteristics outweigh efficiency or emission considerations. These applications often drive technology development that eventually benefits mainstream engine applications.

Manufacturers benefit from continued market demand in commercial and industrial segments while leveraging technological expertise to serve global markets. The transition period creates opportunities for companies that successfully balance traditional engine excellence with emerging technology integration.

Suppliers gain from increasing component complexity and technology content per engine, particularly in emission control systems, fuel injection equipment, and electronic control systems. Advanced manufacturing capabilities and innovation capacity become key competitive differentiators.

Service providers benefit from growing complexity and maintenance requirements as engines incorporate advanced technologies and emission control systems. Digital service platforms and predictive maintenance create new revenue opportunities and enhanced customer relationships.

Fleet operators benefit from improved fuel efficiency, reduced maintenance requirements, and enhanced reliability of modern internal combustion engines. Total cost of ownership improvements support business competitiveness while meeting operational requirements.

End users gain from continuous improvements in engine performance, efficiency, and environmental impact while maintaining familiar operating characteristics and infrastructure compatibility. Advanced engines deliver enhanced user experiences through improved refinement and reliability.

Strengths:

Weaknesses:

Opportunities:

Threats:

Efficiency optimization drives continuous improvement in fuel consumption and performance characteristics through advanced combustion technologies, turbocharging, and engine management systems. Manufacturers achieve efficiency improvements of 15-25% compared to previous generation engines while maintaining performance standards.

Emission reduction represents a critical trend as manufacturers invest heavily in aftertreatment systems, advanced combustion strategies, and alternative fuel compatibility. Modern engines achieve emission reductions exceeding 90% for key pollutants compared to earlier technology generations.

Digitalization transforms engine development, manufacturing, and service through advanced simulation, predictive maintenance, and connectivity features. Digital technologies enable optimized performance, reduced development time, and enhanced customer service capabilities.

Hybridization creates new market segments where internal combustion engines integrate with electric systems to optimize overall powertrain efficiency and performance. This trend particularly affects commercial vehicle applications where hybrid systems can improve fuel economy and reduce emissions.

Alternative fuel adaptation gains momentum as engines become compatible with hydrogen, biofuels, and synthetic fuels. MWR research indicates growing investment in fuel-flexible engine technologies that can operate on multiple fuel types while maintaining performance and efficiency standards.

Technology partnerships between traditional engine manufacturers and technology companies accelerate development of advanced combustion systems, digital control technologies, and alternative fuel capabilities. These collaborations combine automotive engineering expertise with cutting-edge technology development.

Manufacturing investments focus on flexible production systems capable of producing multiple engine variants while maintaining quality and efficiency standards. Advanced manufacturing technologies enable customization and rapid response to market demands.

Regulatory compliance drives significant product development as manufacturers prepare for Euro VII emission standards and other environmental regulations. These developments require substantial investment in research and development while maintaining commercial viability.

Market consolidation continues as companies seek scale advantages and technology synergies through mergers, acquisitions, and strategic partnerships. This consolidation affects competitive dynamics and market structure across different segments.

Service innovation transforms aftermarket operations through digital platforms, predictive maintenance, and enhanced customer support capabilities. These innovations create new revenue streams while improving customer satisfaction and loyalty.

Strategic positioning requires manufacturers to balance immediate market opportunities with long-term sustainability goals. Companies should focus on applications where internal combustion engines maintain competitive advantages while preparing for market transitions through technology diversification.

Investment priorities should emphasize efficiency improvements, emission reduction technologies, and alternative fuel compatibility to extend market relevance while meeting regulatory requirements. Selective investment in high-value segments can maintain profitability during market transitions.

Partnership strategies can accelerate technology development and market access through collaboration with electric vehicle manufacturers, fuel suppliers, and technology companies. Strategic alliances enable companies to participate in emerging market segments while leveraging existing capabilities.

Market diversification across geographic regions and application segments can reduce dependence on declining passenger vehicle markets while capturing growth opportunities in commercial and industrial applications. Global expansion strategies should focus on markets where internal combustion engines remain preferred.

Service enhancement through digital platforms and predictive maintenance can create competitive differentiation and recurring revenue streams. Investment in service capabilities supports customer relationships and provides stability during market transitions.

Market evolution will continue toward specialized applications and niche segments where internal combustion engines maintain competitive advantages over alternative powertrains. Commercial vehicles, industrial equipment, and marine applications are expected to sustain demand through the next decade while passenger vehicle applications face continued pressure from electrification.

Technology development will focus on alternative fuel compatibility, hybrid integration, and efficiency optimization to extend market relevance and meet environmental requirements. MarkWide Research projects that engines capable of operating on multiple fuel types will capture increasing market share of 30-40% by 2030.

Regional dynamics will shift as European manufacturers increasingly focus on export markets where internal combustion engines remain preferred while domestic markets transition toward electric alternatives. Emerging economies represent significant growth opportunities for European engine technology and manufacturing expertise.

Competitive landscape will continue consolidating as companies seek scale advantages and technology synergies. Successful companies will balance traditional engine excellence with emerging technology capabilities while maintaining cost competitiveness and regulatory compliance.

Innovation priorities will emphasize sustainability, efficiency, and performance optimization through advanced materials, combustion technologies, and system integration. The market will reward companies that successfully navigate the transition while maintaining technological leadership and customer satisfaction.

The Europe Internal Combustion Engines Market faces a complex transition period characterized by declining passenger vehicle applications offset by continued strength in commercial and industrial segments. While electrification trends create challenges for traditional engine applications, opportunities exist in specialized markets, alternative fuel integration, and hybrid system applications.

Market resilience depends on manufacturers’ ability to adapt their technologies and business models to evolving customer needs and regulatory requirements. Companies that successfully balance efficiency improvements, emission reduction, and cost competitiveness while exploring alternative fuel capabilities will maintain market relevance during the transition period.

Strategic success requires focus on high-value applications where internal combustion engines maintain competitive advantages while preparing for long-term market evolution. The combination of European engineering excellence, established manufacturing capabilities, and global market access provides a foundation for continued market participation despite changing industry dynamics.

Future prospects remain positive for companies that embrace innovation, pursue strategic partnerships, and maintain flexibility in their market approach. The Europe Internal Combustion Engines Market will continue evolving toward specialized applications and advanced technologies that deliver superior performance while meeting environmental and economic requirements in an increasingly competitive landscape.

What is Internal Combustion Engines?

Internal combustion engines are machines that convert fuel into mechanical energy through combustion. They are widely used in various applications, including automobiles, motorcycles, and industrial machinery.

What are the key players in the Europe Internal Combustion Engines Market?

Key players in the Europe Internal Combustion Engines Market include companies like Volkswagen AG, Daimler AG, and BMW AG, which are known for their significant contributions to engine technology and automotive manufacturing, among others.

What are the main drivers of the Europe Internal Combustion Engines Market?

The main drivers of the Europe Internal Combustion Engines Market include the increasing demand for personal and commercial vehicles, advancements in engine efficiency, and the need for reliable power sources in various industries.

What challenges does the Europe Internal Combustion Engines Market face?

The Europe Internal Combustion Engines Market faces challenges such as stringent emissions regulations, the rising popularity of electric vehicles, and the need for significant investment in research and development to improve engine technologies.

What opportunities exist in the Europe Internal Combustion Engines Market?

Opportunities in the Europe Internal Combustion Engines Market include the development of hybrid engines, innovations in fuel efficiency, and the potential for growth in emerging markets where internal combustion engines remain essential.

What trends are shaping the Europe Internal Combustion Engines Market?

Trends shaping the Europe Internal Combustion Engines Market include the integration of advanced technologies such as turbocharging, the shift towards cleaner fuels, and the ongoing research into alternative combustion methods to enhance performance and reduce emissions.

Europe Internal Combustion Engines Market

| Segmentation Details | Description |

|---|---|

| Product Type | Passenger Cars, Commercial Vehicles, Motorcycles, Heavy-Duty Trucks |

| Fuel Type | Petrol, Diesel, Biofuels, Natural Gas |

| End User | OEMs, Fleet Operators, Aftermarket Providers, Dealerships |

| Technology | Turbocharged, Hybrid, Direct Injection, Variable Valve Timing |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Europe Internal Combustion Engines Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at