444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Europe fabric shavers market represents a dynamic and evolving segment within the broader household appliances industry, characterized by increasing consumer awareness about garment care and sustainability. Fabric shavers, also known as lint removers or pill removers, have gained significant traction across European households as consumers seek effective solutions to extend the lifespan of their clothing and textiles. The market demonstrates robust growth potential, driven by rising disposable incomes, changing lifestyle patterns, and growing environmental consciousness among European consumers.

Market dynamics indicate that the European region shows particularly strong adoption rates, with 72% of households in major European countries now owning at least one fabric care appliance. The market encompasses various product categories, from handheld battery-operated devices to professional-grade electric models, catering to diverse consumer preferences and usage requirements. Innovation trends continue to shape the market landscape, with manufacturers introducing advanced features such as adjustable cutting heights, ergonomic designs, and enhanced safety mechanisms.

Regional distribution shows Western European countries leading in market penetration, while Eastern European markets demonstrate the highest growth rates at approximately 8.5% annually. The market benefits from strong retail infrastructure, including both traditional brick-and-mortar stores and rapidly expanding e-commerce platforms that facilitate product accessibility and consumer education.

The Europe fabric shavers market refers to the commercial ecosystem encompassing the manufacturing, distribution, and retail sale of fabric shaving devices specifically designed to remove pills, lint, and fuzz from clothing and textiles across European territories. Fabric shavers are specialized appliances that utilize rotating cutting blades or screens to gently remove unwanted fabric pills while preserving the integrity of the underlying textile structure.

Market scope includes various product types ranging from compact handheld units to larger desktop models, serving both residential and commercial applications. The market encompasses traditional retail channels, online marketplaces, and specialty stores that cater to fabric care needs. Consumer segments include households, professional garment care services, textile manufacturers, and fashion retailers who utilize these devices for product maintenance and quality control purposes.

Geographic coverage spans all major European Union countries, the United Kingdom, Norway, Switzerland, and other European Economic Area nations, each presenting unique market characteristics influenced by local consumer preferences, economic conditions, and retail landscapes. The market definition also includes aftermarket services, replacement parts, and complementary accessories that enhance the overall user experience.

Market performance across Europe demonstrates consistent upward trajectory, with the fabric shavers segment experiencing sustained growth driven by multiple convergent factors. Consumer behavior shifts toward sustainable fashion practices and garment longevity have created favorable conditions for market expansion, with 68% of European consumers now actively seeking products that help extend clothing lifespan.

Key market drivers include rising awareness about fast fashion environmental impacts, increasing quality of available products, and growing penetration of e-commerce platforms that facilitate product discovery and purchase decisions. The market benefits from strong brand presence of established manufacturers alongside emerging innovative companies that introduce novel features and competitive pricing strategies.

Competitive landscape features a mix of international brands and regional players, with product differentiation occurring primarily through technological innovation, design aesthetics, and price positioning. Market segmentation reveals distinct consumer preferences across different European regions, with Northern European countries showing preference for premium, durable models while Southern European markets demonstrate price sensitivity and feature-focused purchasing decisions.

Future prospects remain positive, supported by continued urbanization, rising disposable incomes, and increasing consumer education about proper garment care techniques. The market is expected to benefit from ongoing product innovations and expanding distribution networks across both traditional and digital retail channels.

Consumer adoption patterns reveal significant insights into European fabric shaver market dynamics, with distinct preferences emerging across different demographic segments and geographic regions. Primary users typically include quality-conscious consumers who invest in higher-end clothing and seek to maintain garment appearance and longevity through proper care techniques.

Market maturity levels vary significantly across European regions, with Western European countries showing higher penetration rates while Eastern European markets present substantial growth opportunities. Consumer education initiatives by manufacturers and retailers continue to drive market awareness and proper usage techniques.

Sustainability consciousness emerges as the primary driver propelling the Europe fabric shavers market forward, as consumers increasingly recognize the environmental benefits of extending garment lifecycles. Environmental awareness campaigns and media coverage about fast fashion impacts have significantly influenced consumer behavior, creating demand for products that support sustainable clothing care practices.

Economic factors contribute substantially to market growth, with rising costs of quality clothing motivating consumers to invest in maintenance tools that preserve garment value. Disposable income growth across European markets enables consumers to purchase specialized appliances for household use, while economic uncertainty simultaneously drives interest in cost-saving measures like garment preservation.

Technological advancements in fabric shaver design and functionality continue to attract new consumers and encourage upgrades among existing users. Product innovations include improved battery life, enhanced safety features, ergonomic designs, and specialized attachments for different fabric types, making devices more appealing and effective for diverse applications.

Urbanization trends across Europe create favorable conditions for fabric shaver adoption, as urban consumers typically own smaller wardrobes with higher-quality pieces that benefit from regular maintenance. Lifestyle changes associated with urban living, including increased professional attire requirements and social consciousness about appearance, drive demand for effective garment care solutions.

E-commerce expansion facilitates market growth by improving product accessibility, enabling price comparisons, and providing consumer education through reviews and demonstrations. Digital marketing efforts by manufacturers effectively reach target demographics and communicate product benefits, contributing to increased market awareness and adoption rates.

Consumer awareness limitations represent a significant restraint in the Europe fabric shavers market, as many potential users remain unfamiliar with product benefits or proper usage techniques. Education gaps result in underutilization of available products and missed opportunities for market expansion, particularly in regions where fabric care traditions rely on alternative methods.

Product quality concerns among consumers create hesitation in purchase decisions, especially regarding lower-priced models that may damage delicate fabrics or provide inconsistent results. Quality perception issues affect market growth when consumers experience disappointing performance from inferior products, leading to negative word-of-mouth and reduced category interest.

Competition from alternatives poses ongoing challenges, as traditional methods like fabric combs, razors, and professional cleaning services continue to serve consumer needs. Substitute products often appear more cost-effective or familiar to consumers, requiring significant marketing efforts to demonstrate fabric shaver advantages and justify purchase decisions.

Economic sensitivity in certain European markets affects discretionary spending on household appliances, with fabric shavers often considered non-essential purchases during economic downturns. Price competition pressures manufacturers to balance quality with affordability, potentially compromising product development or profit margins.

Seasonal demand fluctuations create challenges for manufacturers and retailers in inventory management and production planning. Market seasonality concentrates sales in specific periods, requiring careful resource allocation and marketing timing to optimize business performance throughout the year.

Emerging market segments present substantial opportunities for expansion within the Europe fabric shavers market, particularly in Eastern European countries where rising living standards and increased consumer spending create favorable conditions for market entry. Market penetration strategies targeting these regions could yield significant returns through localized product offerings and competitive pricing approaches.

Product innovation opportunities abound in areas such as smart technology integration, sustainable materials usage, and specialized applications for different fabric types. Technology advancement possibilities include app connectivity, automated settings adjustment, and enhanced user interfaces that appeal to tech-savvy European consumers seeking convenience and efficiency.

E-commerce expansion continues to offer growth opportunities as online retail penetration increases across European markets. Digital marketplace development enables manufacturers to reach previously inaccessible consumer segments while reducing distribution costs and improving profit margins through direct-to-consumer sales models.

Partnership opportunities with fashion retailers, dry cleaning services, and garment manufacturers could create new distribution channels and increase product visibility among target consumers. Strategic collaborations might include co-marketing initiatives, bundled product offerings, or integrated service packages that enhance value propositions for end users.

Sustainability positioning presents opportunities to align with growing environmental consciousness among European consumers. Green marketing strategies emphasizing product longevity, reduced waste generation, and sustainable manufacturing practices could differentiate brands and capture environmentally conscious market segments with premium pricing potential.

Supply chain dynamics within the Europe fabric shavers market reflect complex interactions between global manufacturing centers, regional distribution networks, and local retail channels. Manufacturing concentration in Asian markets creates dependencies that influence pricing, availability, and innovation cycles, while European assembly and customization operations add value and reduce logistics costs.

Competitive dynamics demonstrate ongoing market evolution as established brands compete with emerging players through innovation, pricing strategies, and marketing approaches. Market consolidation trends appear in certain segments while niche players continue to find success through specialized offerings and targeted consumer segments.

Consumer behavior dynamics show increasing sophistication in purchase decisions, with buyers conducting extensive research, comparing features, and seeking value optimization. Decision-making processes increasingly involve online research, peer recommendations, and sustainability considerations that influence brand selection and loyalty patterns.

Regulatory dynamics across European markets create both opportunities and challenges, with safety standards and environmental regulations shaping product development while potentially increasing compliance costs. Standardization efforts within the European Union facilitate market access while ensuring consumer protection and product quality consistency.

Technology dynamics continue to reshape market possibilities through improvements in battery technology, motor efficiency, and user interface design. Innovation cycles accelerate as manufacturers respond to consumer demands for enhanced performance, durability, and convenience features that justify premium pricing and drive replacement purchases.

Research approach for analyzing the Europe fabric shavers market employs comprehensive methodologies combining primary and secondary data sources to ensure accuracy and reliability of market insights. Data collection strategies include consumer surveys, industry interviews, retail analysis, and comprehensive review of market publications and trade statistics.

Primary research components encompass structured interviews with key industry stakeholders, including manufacturers, distributors, retailers, and end consumers across major European markets. Survey methodologies utilize both online and telephone approaches to gather consumer preference data, usage patterns, and purchase decision factors from representative demographic samples.

Secondary research elements involve analysis of industry reports, trade publications, government statistics, and company financial disclosures to establish market sizing, competitive positioning, and trend identification. Data validation processes ensure consistency and accuracy through cross-referencing multiple sources and expert verification of key findings.

Analytical frameworks applied include market segmentation analysis, competitive benchmarking, consumer behavior modeling, and trend forecasting using statistical methods and industry expertise. Geographic analysis covers all major European markets with specific attention to regional variations in consumer preferences, economic conditions, and market maturity levels.

Quality assurance measures include peer review processes, data triangulation techniques, and continuous monitoring of market developments to ensure research findings remain current and relevant. Methodology transparency enables stakeholders to understand research limitations and interpret findings within appropriate contexts for strategic decision-making purposes.

Western European markets demonstrate mature characteristics with high penetration rates and established consumer awareness of fabric shaver benefits. Germany leads regional market share at approximately 28% of total European volume, driven by strong consumer preference for quality household appliances and systematic garment care practices. France and United Kingdom follow as significant markets, each contributing substantial volumes through diverse retail channels and consumer segments.

Northern European countries including Sweden, Denmark, and Norway show premium market characteristics with consumers willing to invest in higher-priced, feature-rich models that offer superior performance and durability. Market penetration rates in these regions exceed 85% of target households, indicating mature market conditions with growth primarily driven by replacement purchases and product upgrades.

Southern European markets encompassing Italy, Spain, and Portugal demonstrate growing adoption rates with increasing consumer awareness about garment care benefits. Price sensitivity remains higher in these regions, with mid-range products capturing the largest market segments while premium categories show gradual growth as economic conditions improve.

Eastern European markets present the highest growth potential, with countries like Poland, Czech Republic, and Hungary experiencing rapid market expansion as living standards rise and consumer spending patterns evolve. Growth rates in these markets frequently exceed 12% annually, driven by increasing urbanization and exposure to Western European lifestyle trends.

Market distribution patterns vary significantly across regions, with Western European countries showing balanced online and offline sales channels while Eastern European markets demonstrate stronger online preference due to competitive pricing and product variety available through e-commerce platforms.

Market leadership in the Europe fabric shavers market is distributed among several key players who have established strong brand recognition and distribution networks across the region. Competitive positioning occurs primarily through product quality, innovation, pricing strategies, and marketing effectiveness, with companies pursuing different approaches to capture market share.

Competitive strategies include product differentiation through technological innovation, aggressive pricing for market share capture, and strategic partnerships with retail chains for improved distribution coverage. Brand positioning varies from mass market accessibility to premium quality focus, allowing companies to target different consumer segments effectively.

Innovation competition drives continuous product development in areas such as battery technology, ergonomic design, safety features, and specialized attachments for different fabric types. Marketing competition utilizes both traditional advertising and digital channels to build brand awareness and communicate product benefits to target consumers.

Product type segmentation reveals distinct market categories within the Europe fabric shavers market, each serving specific consumer needs and preferences. Handheld battery-operated models dominate market share due to convenience and portability advantages, while corded electric models serve consumers requiring consistent power and extended usage capabilities.

By Technology:

By Application:

By Price Range:

Handheld battery-operated category represents the largest market segment, capturing consumer preference through convenience, portability, and ease of use. Consumer adoption in this category benefits from improved battery technology, lightweight designs, and competitive pricing that makes products accessible to broad market segments. Innovation trends focus on extending battery life, reducing charging time, and incorporating ergonomic features that enhance user comfort during operation.

Corded electric models serve consumers requiring consistent power delivery and extended usage capabilities, particularly in professional applications and households with extensive fabric care needs. Market positioning emphasizes reliability, continuous operation capability, and superior performance for challenging fabric conditions. Growth potential remains steady as consumers recognize benefits of consistent power delivery for optimal results.

Premium category insights reveal growing consumer willingness to invest in higher-quality products that offer enhanced features, improved durability, and superior performance. Feature preferences include adjustable settings, multiple attachments, safety mechanisms, and aesthetic design elements that complement modern home environments. Brand loyalty runs higher in premium segments, with consumers showing greater satisfaction and repeat purchase behavior.

Professional-grade equipment demonstrates specialized market characteristics with emphasis on durability, performance consistency, and service support. Business customers prioritize total cost of ownership, including maintenance requirements, replacement part availability, and warranty coverage. Market growth correlates with expansion of professional garment care services and increased quality standards in retail environments.

Sustainable product category emerges as growing segment, with manufacturers introducing eco-friendly materials, energy-efficient designs, and recyclable components. Consumer interest in sustainable options continues to increase, particularly among younger demographics who prioritize environmental considerations in purchase decisions.

Manufacturers benefit from expanding market opportunities across diverse European regions, with growing consumer awareness creating favorable conditions for product innovation and market penetration. Revenue growth potential exists through premium product development, market expansion into underserved regions, and strategic partnerships with retail channels that enhance distribution coverage and brand visibility.

Retailers gain advantages through offering fabric shavers as complementary products that enhance customer satisfaction and increase average transaction values. Profit margins on fabric care products typically exceed those of basic household items, while customer loyalty benefits from providing solutions that extend garment lifecycles and demonstrate retailer commitment to customer value.

Consumers receive significant value through cost savings achieved by extending garment lifecycles, improved clothing appearance, and enhanced wardrobe management capabilities. Quality of life improvements include reduced clothing replacement frequency, better garment presentation, and alignment with sustainability values that many European consumers prioritize in lifestyle choices.

Distribution partners including wholesalers and logistics providers benefit from steady market growth and expanding product categories that create additional revenue streams. Market stability in fabric care products provides reliable business opportunities with predictable seasonal patterns and consistent consumer demand across diverse market segments.

Service providers such as repair technicians and customer support specialists find opportunities in growing installed base of fabric shavers requiring maintenance, replacement parts, and user education services. Business expansion potential exists through specialized service offerings that support product longevity and customer satisfaction.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability integration emerges as the dominant trend shaping the Europe fabric shavers market, with manufacturers increasingly incorporating eco-friendly materials, energy-efficient designs, and recyclable packaging. Consumer demand for sustainable products drives innovation in areas such as biodegradable components, reduced energy consumption, and longer product lifecycles that minimize environmental impact.

Smart technology adoption represents a growing trend as manufacturers explore opportunities to integrate connectivity features, automated settings, and user-friendly interfaces that appeal to tech-savvy European consumers. Innovation directions include smartphone app connectivity, automatic fabric type detection, and predictive maintenance features that enhance user experience and product longevity.

Design aesthetics evolution reflects changing consumer preferences for household appliances that complement modern home environments. Product design trends emphasize sleek profiles, premium materials, and color options that allow fabric shavers to serve as attractive accessories rather than purely functional tools hidden in storage.

Customization capabilities gain importance as consumers seek products that accommodate diverse fabric types and personal preferences. Feature development focuses on adjustable settings, interchangeable components, and specialized attachments that enable users to optimize performance for specific applications and fabric characteristics.

Direct-to-consumer sales growth transforms distribution strategies as manufacturers leverage e-commerce platforms to build direct relationships with customers, improve profit margins, and gather valuable consumer insights. Digital marketing evolution emphasizes content creation, influencer partnerships, and social media engagement to build brand awareness and drive online sales.

Product innovation acceleration characterizes recent industry developments, with manufacturers introducing advanced features such as improved battery technology, enhanced safety mechanisms, and ergonomic designs that address consumer feedback and market demands. Technology partnerships between fabric shaver manufacturers and component suppliers drive innovation in areas such as motor efficiency, blade durability, and user interface design.

Market expansion initiatives by leading brands focus on penetrating underserved European markets through localized product offerings, competitive pricing strategies, and targeted marketing campaigns. Distribution partnerships with major retail chains and e-commerce platforms facilitate market entry and improve product accessibility for consumers across diverse geographic regions.

Sustainability initiatives gain momentum as manufacturers respond to environmental concerns through eco-friendly product development, sustainable packaging solutions, and corporate responsibility programs. Industry collaboration on sustainability standards and best practices helps establish consistent approaches to environmental stewardship across the fabric care industry.

Digital transformation efforts reshape marketing and sales strategies, with companies investing in e-commerce capabilities, digital marketing expertise, and data analytics tools to better understand and serve customer needs. Customer engagement evolution includes social media presence, online education content, and direct communication channels that build brand loyalty and support customer satisfaction.

Quality improvement programs address consumer concerns about product reliability and effectiveness through enhanced testing procedures, improved manufacturing standards, and comprehensive warranty offerings. Customer service enhancement includes expanded support options, user education resources, and responsive problem resolution processes that build consumer confidence in fabric shaver products.

Market entry strategies for new participants should focus on identifying underserved consumer segments or geographic regions where established competitors have limited presence. MarkWide Research analysis suggests that Eastern European markets offer the most attractive opportunities for expansion, with growing consumer spending and increasing awareness of fabric care benefits creating favorable conditions for market entry.

Product development priorities should emphasize sustainability features, smart technology integration, and enhanced user experience elements that differentiate offerings in increasingly competitive markets. Innovation investment in areas such as battery technology, ergonomic design, and safety features can create competitive advantages and justify premium pricing strategies.

Distribution strategy optimization requires balanced approach between traditional retail channels and expanding e-commerce platforms, with particular attention to online marketplace presence and direct-to-consumer capabilities. Channel partnerships with specialty retailers and professional service providers can create additional revenue streams and improve market penetration.

Marketing approach recommendations include emphasis on sustainability benefits, cost-saving advantages, and quality-of-life improvements that resonate with European consumer values. Content marketing strategies should focus on education about proper fabric care techniques, product demonstrations, and customer success stories that build confidence and drive purchase decisions.

Competitive positioning should leverage unique product features, brand heritage, or specialized market focus to create differentiation in crowded marketplace. Value proposition development must clearly communicate benefits that justify purchase decisions and support customer loyalty in face of numerous alternative options.

Market growth prospects for the Europe fabric shavers market remain positive, supported by continued consumer awareness growth, expanding distribution channels, and ongoing product innovation that addresses evolving consumer needs. Long-term trends favor sustainable products, smart technology integration, and premium quality offerings that provide superior user experience and durability.

Technology evolution will likely drive next-generation product development, with opportunities for artificial intelligence integration, automated fabric detection, and predictive maintenance features that enhance convenience and effectiveness. Innovation cycles are expected to accelerate as manufacturers compete for market share through differentiated offerings and advanced capabilities.

Geographic expansion opportunities will continue to emerge, particularly in Eastern European markets where economic development and changing lifestyle patterns create favorable conditions for fabric care product adoption. Market penetration in these regions could drive significant growth over the next five to ten years, with potential for 15-20% annual growth rates in select markets.

Consumer behavior evolution toward sustainability and quality consciousness supports premium market segment growth, while price-sensitive segments will continue to demand value-oriented options. Demographic shifts including urbanization and changing household compositions will influence product design and marketing strategies to address diverse consumer needs.

Industry consolidation may occur as smaller players seek partnerships or acquisition opportunities with larger manufacturers who possess greater resources for innovation, marketing, and distribution. Market structure evolution could result in stronger competitive positions for leading brands while creating opportunities for specialized niche players who serve specific consumer segments effectively.

The Europe fabric shavers market demonstrates strong fundamentals and positive growth trajectory, driven by increasing consumer awareness about garment care, sustainability consciousness, and ongoing product innovation. Market dynamics favor continued expansion, particularly in Eastern European regions where rising living standards and evolving consumer preferences create substantial opportunities for market participants.

Competitive landscape evolution will likely reward companies that successfully balance innovation, quality, and value proposition while building strong distribution networks and brand recognition. Success factors include understanding regional consumer preferences, investing in sustainable product development, and leveraging digital marketing channels to reach target demographics effectively.

Future market development will be shaped by technological advancement, sustainability requirements, and changing consumer lifestyle patterns that influence fabric care needs and preferences. Strategic positioning around these trends will determine long-term success for manufacturers, retailers, and other industry participants seeking to capitalize on market opportunities.

Overall market outlook remains optimistic, with MarkWide Research projecting continued growth supported by favorable demographic trends, expanding distribution channels, and increasing consumer recognition of fabric shaver benefits. The market’s alignment with sustainability values and cost-conscious consumer behavior provides solid foundation for sustained expansion across European territories, making it an attractive segment for continued investment and development efforts.

What is Fabric Shavers?

Fabric shavers are devices designed to remove lint, fuzz, and pilling from fabrics, enhancing the appearance and longevity of clothing and upholstery. They are commonly used on garments, blankets, and furniture to maintain a clean look.

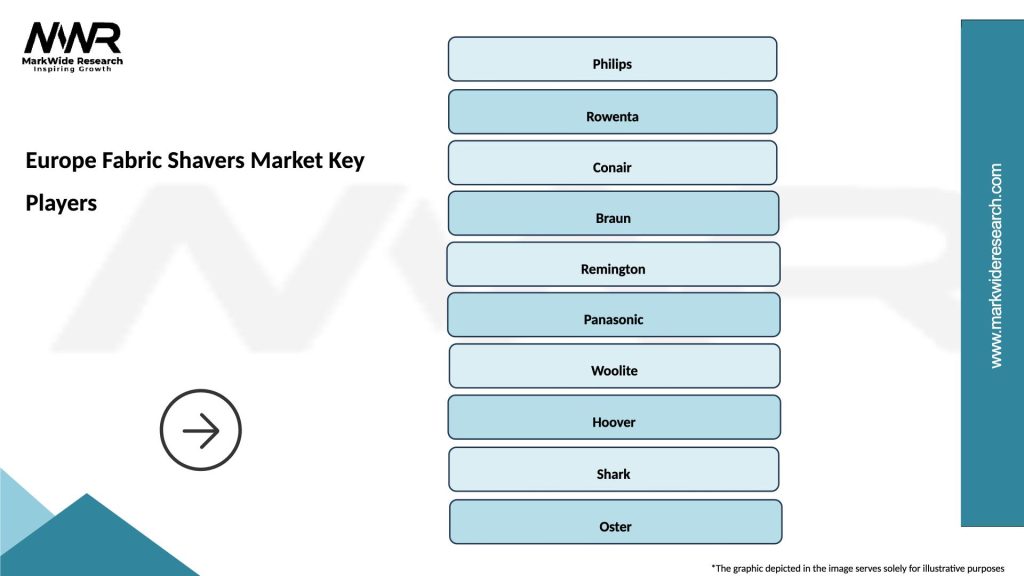

What are the key players in the Europe Fabric Shavers Market?

Key players in the Europe Fabric Shavers Market include Philips, Conair, and Rowenta, which are known for their innovative designs and effective performance. These companies focus on quality and user-friendly features to cater to consumer needs, among others.

What are the growth factors driving the Europe Fabric Shavers Market?

The Europe Fabric Shavers Market is driven by increasing consumer awareness about fabric care and the rising demand for maintaining clothing quality. Additionally, the growth of online retailing has made these products more accessible to consumers.

What challenges does the Europe Fabric Shavers Market face?

Challenges in the Europe Fabric Shavers Market include competition from alternative fabric care solutions and the potential for product quality inconsistency. Additionally, consumer preferences for sustainable products may impact traditional fabric shaver sales.

What opportunities exist in the Europe Fabric Shavers Market?

Opportunities in the Europe Fabric Shavers Market include the development of eco-friendly models and the integration of advanced technology, such as rechargeable batteries and ergonomic designs. These innovations can attract environmentally conscious consumers.

What trends are shaping the Europe Fabric Shavers Market?

Trends in the Europe Fabric Shavers Market include a growing preference for cordless models and multifunctional devices that combine fabric shaving with other cleaning features. Additionally, there is an increasing focus on stylish designs that appeal to modern consumers.

Europe Fabric Shavers Market

| Segmentation Details | Description |

|---|---|

| Product Type | Manual, Electric, Rechargeable, Corded |

| End User | Households, Retailers, Online Shoppers, Professionals |

| Technology | Rotary, Foil, Battery-Powered, Plug-In |

| Distribution Channel | Supermarkets, E-Commerce, Specialty Stores, Wholesale |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Europe Fabric Shavers Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at