444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Europe green buildings market represents a transformative sector driving sustainable construction practices across the continent. This dynamic market encompasses environmentally conscious building designs, energy-efficient technologies, and sustainable construction materials that significantly reduce environmental impact while enhancing occupant comfort and operational efficiency. European nations are leading global sustainability initiatives, with green building adoption accelerating at an impressive 8.2% CAGR across major markets including Germany, France, the United Kingdom, and Scandinavian countries.

Market dynamics indicate robust growth driven by stringent environmental regulations, increasing energy costs, and growing corporate sustainability commitments. The sector encompasses residential, commercial, and industrial green building projects, with commercial buildings representing approximately 45% market share due to corporate environmental responsibility initiatives. Technological innovations in smart building systems, renewable energy integration, and sustainable materials are reshaping construction methodologies across European markets.

Regional leadership varies significantly, with Germany and the Netherlands demonstrating 62% adoption rates in new construction projects, while emerging markets in Eastern Europe show accelerating growth patterns. The integration of IoT technologies, advanced building management systems, and renewable energy solutions creates comprehensive ecosystems that optimize energy consumption and reduce carbon footprints throughout building lifecycles.

The Europe green buildings market refers to the comprehensive ecosystem of environmentally sustainable construction practices, technologies, and materials designed to minimize environmental impact while maximizing energy efficiency and occupant well-being across European territories. This market encompasses building design, construction methodologies, operational systems, and lifecycle management approaches that prioritize environmental sustainability, resource conservation, and carbon footprint reduction.

Green building certification programs such as BREEAM, LEED, and DGNB provide standardized frameworks for evaluating environmental performance, energy efficiency, and sustainability metrics. These certification systems establish benchmarks for water conservation, waste reduction, indoor air quality, and renewable energy integration that guide construction professionals and property developers in implementing sustainable building practices.

Technological integration forms the foundation of modern green buildings, incorporating smart sensors, automated building management systems, and renewable energy technologies that optimize resource utilization. The market includes sustainable materials such as recycled content products, low-emission finishes, and locally sourced construction components that reduce transportation-related carbon emissions while supporting regional economies.

Market transformation across Europe’s green buildings sector reflects accelerating sustainability adoption driven by regulatory mandates, economic incentives, and environmental consciousness. The comprehensive market encompasses diverse building types, from residential developments to large-scale commercial complexes, each incorporating advanced technologies and sustainable design principles that deliver measurable environmental and economic benefits.

Key growth drivers include the European Union’s ambitious carbon neutrality targets, rising energy costs that make efficiency investments economically attractive, and increasing tenant demand for sustainable workspace environments. Corporate sustainability commitments are particularly influential, with 78% of major European corporations implementing green building requirements for their real estate portfolios, creating substantial market demand for certified sustainable properties.

Technology adoption patterns reveal significant investment in building automation systems, renewable energy integration, and smart building technologies that enable real-time monitoring and optimization of energy consumption. Regional variations demonstrate mature markets in Western Europe achieving 35% green building penetration rates, while Eastern European markets show rapid growth potential with increasing regulatory support and international investment flows.

Future prospects indicate continued expansion driven by evolving building codes, technological innovations, and growing recognition of green buildings’ role in addressing climate change challenges while delivering superior financial returns through reduced operational costs and enhanced property values.

Strategic market insights reveal fundamental shifts in European construction practices, with sustainability considerations becoming integral to project planning, financing, and execution phases. These insights demonstrate how green building adoption creates competitive advantages for developers, property owners, and occupants while contributing to broader environmental objectives.

Regulatory frameworks across European Union member states create powerful market drivers through mandatory energy efficiency standards, carbon emission reduction targets, and building performance requirements. The European Green Deal establishes comprehensive sustainability objectives that directly influence construction practices, requiring new buildings to achieve near-zero energy consumption while existing buildings undergo efficiency retrofits.

Economic incentives significantly accelerate green building adoption through tax credits, subsidies, and preferential financing terms that reduce implementation costs for developers and property owners. Energy cost escalation makes efficiency investments increasingly attractive, with green buildings typically achieving 25-40% energy savings compared to conventional structures, creating compelling financial justifications for sustainable construction approaches.

Corporate sustainability commitments drive substantial demand for green building spaces as multinational corporations implement environmental responsibility policies that require sustainable real estate portfolios. Tenant preferences increasingly favor green buildings due to improved indoor air quality, natural lighting optimization, and enhanced workplace environments that contribute to employee satisfaction and productivity.

Technological advancement reduces implementation barriers while improving green building performance through innovations in building automation, renewable energy systems, and sustainable materials that deliver superior functionality at competitive costs. Climate change awareness creates social pressure for sustainable construction practices, influencing consumer preferences, investor decisions, and regulatory policy development across European markets.

Implementation costs represent significant market restraints, particularly for smaller developers and property owners who face substantial upfront investments in green building technologies, sustainable materials, and certification processes. Capital requirements for advanced building systems, renewable energy installations, and high-performance materials can increase project costs by 15-25% compared to conventional construction, creating financial barriers for cost-sensitive developments.

Technical complexity challenges construction professionals who must integrate multiple sustainable technologies, coordinate specialized systems, and ensure optimal performance across interconnected building components. Skills shortages in green building design, installation, and maintenance limit market growth as the industry requires specialized expertise in emerging technologies and sustainable construction methodologies.

Regulatory inconsistencies across European markets create compliance challenges for developers operating in multiple countries, as varying building codes, certification requirements, and incentive programs complicate project planning and execution. Market fragmentation results from different national approaches to green building standards, making it difficult to achieve economies of scale in technology deployment and material procurement.

Performance verification concerns arise when green building systems fail to deliver projected energy savings or environmental benefits, potentially undermining market confidence and investor willingness to support sustainable construction projects. Maintenance requirements for sophisticated building systems may exceed traditional building management capabilities, requiring ongoing investment in specialized services and technical support.

Retrofit market potential presents enormous opportunities across Europe’s extensive existing building stock, with millions of structures requiring energy efficiency upgrades to meet evolving regulatory standards and operational cost reduction objectives. Building renovation projects offer substantial market expansion possibilities as property owners seek to improve asset values, reduce operational expenses, and comply with increasingly stringent environmental regulations.

Smart city initiatives across major European metropolitan areas create integrated opportunities for green building development within broader urban sustainability programs that combine transportation, energy, and building systems optimization. Digital transformation enables new service models including building performance monitoring, predictive maintenance, and energy optimization services that generate recurring revenue streams for green building technology providers.

Emerging markets in Eastern Europe demonstrate significant growth potential as economic development, EU integration, and international investment flows drive adoption of modern construction practices and green building technologies. Industrial applications represent underexplored opportunities for green building implementation in manufacturing facilities, logistics centers, and industrial complexes that can achieve substantial energy savings through sustainable design approaches.

Financial innovation creates new funding mechanisms including green bonds, sustainability-linked loans, and environmental impact investment vehicles that reduce capital barriers while attracting environmentally conscious investors to green building projects. Technology convergence between renewable energy, energy storage, and building automation systems enables comprehensive solutions that optimize performance while reducing implementation complexity and costs.

Supply chain evolution demonstrates significant transformation as traditional construction material suppliers adapt to sustainability requirements while new companies emerge specializing in eco-friendly building products and systems. Market consolidation occurs as larger construction companies acquire specialized green building expertise through strategic partnerships and acquisitions that enhance their sustainable construction capabilities.

Competitive dynamics shift toward differentiation based on environmental performance, certification achievements, and technology integration rather than traditional cost-focused competition. Innovation cycles accelerate as companies invest heavily in research and development to create next-generation green building technologies that deliver superior performance while reducing implementation costs and complexity.

Customer expectations evolve rapidly as building occupants become more sophisticated in evaluating environmental performance, indoor air quality, and sustainability features that influence their space selection decisions. Investment patterns show increasing allocation of capital toward green building projects as institutional investors recognize superior risk-adjusted returns and alignment with environmental, social, and governance investment criteria.

Regulatory evolution continues across European markets with increasingly stringent building codes, expanded certification requirements, and enhanced enforcement mechanisms that drive market adoption while creating compliance challenges for industry participants. Technology maturation reduces implementation risks while improving system reliability, creating more predictable project outcomes that encourage broader market adoption and investor confidence.

Comprehensive market analysis employs multiple research methodologies to ensure accurate representation of Europe’s green buildings market dynamics, growth patterns, and competitive landscape. Primary research includes extensive interviews with industry executives, construction professionals, technology providers, and regulatory officials across major European markets to gather firsthand insights into market trends and challenges.

Secondary research incorporates analysis of government publications, industry reports, certification body data, and academic studies that provide quantitative market data and qualitative insights into green building adoption patterns. Market surveys capture perspectives from building owners, developers, architects, and facility managers regarding green building implementation experiences, performance outcomes, and future investment intentions.

Data validation processes ensure research accuracy through cross-referencing multiple sources, statistical analysis of market trends, and expert review of findings by industry professionals with extensive green building experience. Regional analysis examines market conditions across major European countries, identifying local regulatory influences, economic factors, and cultural considerations that impact green building adoption rates.

Trend analysis evaluates historical market development patterns, current growth trajectories, and emerging factors that influence future market evolution, providing comprehensive understanding of market dynamics and growth potential. Technology assessment examines current and emerging green building technologies, evaluating their market impact, adoption barriers, and potential for widespread implementation across European markets.

Western European markets demonstrate mature green building adoption with Germany leading implementation through comprehensive regulatory frameworks and substantial government incentives that achieve 52% market penetration in new commercial construction. German market leadership results from early adoption of green building standards, robust certification programs, and strong corporate sustainability commitments that create consistent demand for environmentally responsible construction.

United Kingdom maintains significant market presence despite Brexit-related uncertainties, with London’s commercial real estate sector driving green building adoption through tenant demand and investor requirements for sustainable properties. French markets show accelerating growth driven by national energy transition policies and urban development programs that prioritize environmental sustainability in major metropolitan areas.

Nordic countries including Sweden, Denmark, and Norway achieve highest adoption rates globally, with comprehensive integration of renewable energy systems, advanced building automation, and sustainable materials that create exemplary green building implementations. Scandinavian leadership demonstrates how supportive regulatory environments, cultural sustainability values, and technological innovation combine to create thriving green building markets.

Eastern European markets represent significant growth opportunities as EU integration drives adoption of Western European building standards while economic development creates demand for modern, efficient construction. Poland and Czech Republic show particularly strong growth potential with expanding commercial sectors and increasing international investment in sustainable development projects that meet European environmental standards.

Market leadership encompasses diverse participants including construction companies, technology providers, material suppliers, and certification organizations that collectively shape Europe’s green buildings ecosystem. Competitive positioning increasingly depends on technological capabilities, sustainability expertise, and ability to deliver integrated solutions that address multiple aspects of green building implementation.

Strategic partnerships between construction companies and technology providers create comprehensive service offerings that address complete green building project lifecycles from design through operation and maintenance.

Market segmentation reveals distinct categories based on building types, technology applications, and certification levels that demonstrate varying growth patterns and market dynamics across Europe’s green buildings sector.

By Building Type:

By Technology:

By Certification Level:

Commercial building segment demonstrates strongest growth momentum driven by corporate real estate strategies that prioritize environmental performance and employee well-being. Office buildings increasingly incorporate advanced building automation systems, natural lighting optimization, and indoor air quality management that create productive work environments while reducing energy consumption and operational costs.

Residential green buildings show expanding adoption as homebuyers become more environmentally conscious and seek properties with lower utility costs and enhanced comfort features. Multi-family residential developments particularly benefit from economies of scale in implementing green building technologies, making sustainable features more affordable for individual units while achieving significant overall environmental impact.

Industrial applications focus primarily on energy efficiency and operational cost reduction, with manufacturing facilities implementing advanced HVAC systems, LED lighting, and building envelope improvements that deliver substantial energy savings. Warehouse and logistics facilities increasingly adopt green building practices to meet corporate sustainability requirements from major retailers and e-commerce companies.

Technology categories show varying adoption patterns, with building automation systems achieving rapid market penetration due to their ability to deliver immediate energy savings and operational improvements. Renewable energy integration grows steadily as system costs decline and government incentives make installations economically attractive for building owners seeking long-term energy cost stability.

Property developers gain competitive advantages through green building implementation, including faster lease-up rates, premium rental income, and enhanced property values that improve investment returns. Market differentiation becomes increasingly important as tenants and investors prioritize environmental performance in their real estate decisions, creating clear benefits for developers who embrace sustainable construction practices.

Building owners realize substantial operational cost savings through reduced energy consumption, lower maintenance requirements, and improved system efficiency that directly impact property profitability. Asset value enhancement occurs as green buildings command premium valuations and demonstrate superior investment performance compared to conventional properties in most European markets.

Occupants benefit from improved indoor environmental quality, including better air quality, natural lighting, and thermal comfort that enhance productivity, health, and overall satisfaction. Corporate tenants achieve sustainability reporting benefits and employee attraction advantages by occupying certified green buildings that align with environmental responsibility objectives.

Technology providers access expanding market opportunities as green building adoption accelerates, creating demand for innovative solutions in building automation, renewable energy, and sustainable materials. Service providers develop new revenue streams through building performance monitoring, energy management, and sustainability consulting services that support green building operation and optimization.

Society benefits through reduced environmental impact, improved urban air quality, and decreased carbon emissions that contribute to climate change mitigation objectives while creating healthier communities and more sustainable urban development patterns.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation emerges as a dominant trend with Internet of Things sensors, artificial intelligence, and machine learning technologies enabling predictive building management and real-time optimization of energy consumption. Smart building integration creates comprehensive systems that automatically adjust lighting, heating, and ventilation based on occupancy patterns and environmental conditions, achieving enhanced efficiency while improving occupant comfort.

Circular economy principles increasingly influence green building design and construction, with emphasis on material reuse, waste reduction, and end-of-life building component recovery. Sustainable material innovation includes development of bio-based construction materials, recycled content products, and locally sourced components that reduce transportation-related carbon emissions while supporting regional economies.

Net-zero energy buildings represent an emerging standard as technology costs decline and regulatory requirements become more stringent, with buildings designed to produce as much energy as they consume through renewable energy integration. Carbon neutrality becomes a key design objective as building owners seek to align with corporate sustainability commitments and regulatory requirements for carbon emission reduction.

Wellness-focused design gains prominence as building occupants increasingly value indoor environmental quality, natural lighting, and biophilic design elements that enhance mental health and productivity. Health and wellness certifications such as WELL Building Standard complement traditional green building certifications by addressing occupant health and well-being considerations in building design and operation.

Regulatory advancement across European markets includes implementation of the EU Taxonomy for Sustainable Activities, which establishes criteria for environmentally sustainable economic activities including green building construction and operation. Building Performance Standards become increasingly stringent with requirements for energy efficiency disclosure, carbon emission reporting, and mandatory efficiency upgrades for existing buildings.

Technology partnerships between construction companies and technology providers create integrated solutions that combine building design expertise with advanced automation systems and renewable energy technologies. Strategic alliances enable companies to offer comprehensive green building services while sharing development costs and technical risks associated with emerging technologies.

Certification program evolution includes development of new standards that address emerging technologies, climate resilience, and social sustainability considerations beyond traditional environmental performance metrics. Digital certification processes streamline assessment and verification procedures while providing real-time performance monitoring capabilities that enhance building operation and maintenance.

Investment trends show increasing allocation of capital toward green building projects as institutional investors recognize superior risk-adjusted returns and alignment with environmental, social, and governance investment criteria. Green financing mechanisms including sustainability-linked loans and green bonds provide favorable terms for qualifying green building projects, reducing capital costs and improving project economics.

Market participants should prioritize technology integration capabilities and sustainability expertise to capitalize on growing demand for comprehensive green building solutions. MarkWide Research analysis indicates that companies offering integrated services across design, construction, and operation phases achieve stronger market positioning and customer relationships compared to single-service providers.

Investment strategies should focus on retrofit market opportunities as existing building upgrades represent substantial market potential with favorable economics due to operational cost savings and regulatory compliance requirements. Geographic expansion into Eastern European markets offers significant growth potential as these regions experience economic development and increasing adoption of Western European building standards.

Technology development priorities should emphasize artificial intelligence and machine learning applications that enable predictive building management and autonomous optimization of building systems. Partnership strategies with technology companies can accelerate innovation while sharing development costs and technical risks associated with emerging green building technologies.

Regulatory compliance preparation becomes increasingly important as building codes evolve rapidly and enforcement mechanisms become more sophisticated. Certification strategy should consider multiple green building standards to address diverse market requirements and customer preferences across different European countries and market segments.

Long-term market prospects remain highly positive as European Union climate objectives, technological advancement, and economic benefits drive continued green building adoption across all market segments. Growth acceleration is expected as implementation costs decline, technology performance improves, and regulatory requirements become more stringent, creating compelling business cases for sustainable construction practices.

Technology evolution will enable more sophisticated building systems that integrate renewable energy, energy storage, and artificial intelligence to create autonomous buildings that optimize performance without human intervention. MWR projections indicate that smart building technologies will achieve widespread adoption within the next decade as costs decline and performance capabilities expand significantly.

Market expansion into emerging European markets will accelerate as economic development, EU integration, and international investment flows drive adoption of modern construction practices and green building technologies. Retrofit opportunities will become increasingly important as existing building stock requires efficiency upgrades to meet evolving regulatory standards and operational cost reduction objectives.

Industry transformation toward sustainability-focused business models will create new service opportunities in building performance monitoring, energy management, and sustainability consulting that generate recurring revenue streams. Competitive dynamics will increasingly favor companies with comprehensive sustainability expertise and integrated technology capabilities that address complete building lifecycles from design through operation and maintenance.

Europe’s green buildings market represents a transformative sector that combines environmental responsibility with compelling economic benefits, creating sustainable growth opportunities for industry participants across the construction value chain. The market demonstrates robust fundamentals driven by supportive regulatory frameworks, technological innovation, and increasing recognition of green buildings’ superior financial and environmental performance.

Strategic positioning in this dynamic market requires comprehensive understanding of regional variations, technology trends, and evolving customer requirements that shape demand patterns across different building types and market segments. Success factors include technology integration capabilities, sustainability expertise, and ability to deliver measurable performance outcomes that justify green building investments.

Future market evolution will be characterized by continued technology advancement, expanding retrofit opportunities, and growing integration of smart building systems that enable autonomous optimization of building performance. Market participants who invest in technology development, build sustainability expertise, and establish strategic partnerships will be best positioned to capitalize on the substantial growth opportunities in Europe’s green buildings market.

What is Green Buildings?

Green buildings refer to structures that are designed, constructed, and operated to minimize their environmental impact. They focus on energy efficiency, sustainable materials, and water conservation, contributing to a healthier environment and reduced carbon footprint.

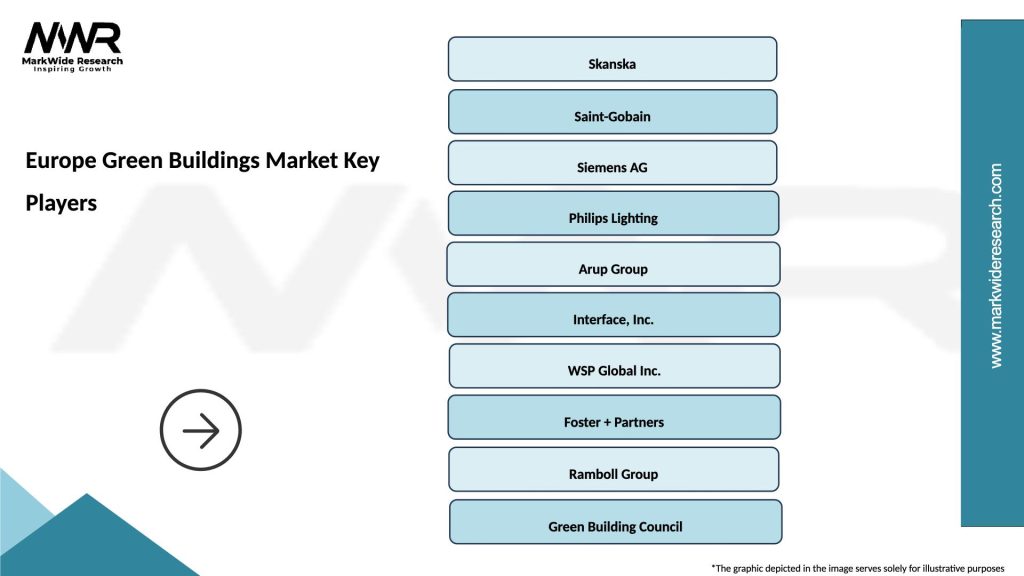

What are the key players in the Europe Green Buildings Market?

Key players in the Europe Green Buildings Market include companies like Skanska, Bouygues Construction, and Balfour Beatty, which are known for their commitment to sustainable building practices and innovative green technologies, among others.

What are the main drivers of the Europe Green Buildings Market?

The main drivers of the Europe Green Buildings Market include increasing government regulations promoting sustainability, rising consumer demand for energy-efficient buildings, and advancements in green building technologies that enhance performance and reduce costs.

What challenges does the Europe Green Buildings Market face?

The Europe Green Buildings Market faces challenges such as high initial construction costs, a lack of awareness among consumers about the benefits of green buildings, and the complexity of integrating sustainable practices into traditional building methods.

What opportunities exist in the Europe Green Buildings Market?

Opportunities in the Europe Green Buildings Market include the growing trend of retrofitting existing buildings to meet green standards, the expansion of smart building technologies, and increased investment in renewable energy sources for building operations.

What trends are shaping the Europe Green Buildings Market?

Trends shaping the Europe Green Buildings Market include the rise of biophilic design, the integration of smart technologies for energy management, and a focus on circular economy principles in construction practices.

Europe Green Buildings Market

| Segmentation Details | Description |

|---|---|

| Product Type | Insulation Materials, Windows, HVAC Systems, Lighting Solutions |

| End User | Commercial Buildings, Residential Properties, Educational Institutions, Healthcare Facilities |

| Technology | Smart Building Technologies, Renewable Energy Systems, Energy Management Systems, Building Automation |

| Application | New Construction, Renovation, Retrofitting, Maintenance |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Europe Green Buildings Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at