444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The North America solid waste management market represents a critical infrastructure sector that encompasses the collection, transportation, treatment, and disposal of municipal and industrial waste across the United States and Canada. This comprehensive market has experienced significant transformation driven by environmental regulations, technological innovations, and growing sustainability awareness among consumers and businesses. The sector demonstrates robust growth potential with increasing urbanization, population growth, and evolving waste generation patterns creating substantial demand for advanced waste management solutions.

Market dynamics indicate that the North American region leads global waste management innovation, with sophisticated recycling programs, waste-to-energy facilities, and smart collection technologies. The market encompasses various service segments including residential waste collection, commercial waste management, hazardous waste treatment, and specialized recycling services. Growth rates in the sector reflect a steady 4.2% CAGR driven by regulatory compliance requirements and corporate sustainability initiatives.

Regional distribution shows the United States commanding approximately 85% market share due to its larger population base and extensive industrial activities, while Canada represents a significant growth opportunity with increasing environmental consciousness and government support for sustainable waste management practices. The market continues to evolve with emerging technologies such as artificial intelligence, IoT-enabled collection systems, and advanced sorting technologies revolutionizing traditional waste management approaches.

The North America solid waste management market refers to the comprehensive ecosystem of services, technologies, and infrastructure dedicated to the systematic handling of solid waste materials generated by residential, commercial, and industrial sources across the United States and Canada. This market encompasses the entire waste lifecycle from initial collection and transportation through processing, treatment, recycling, and final disposal or energy recovery.

Solid waste management involves multiple interconnected processes including waste collection services, transfer station operations, material recovery facilities, composting operations, landfill management, and waste-to-energy conversion. The market serves diverse stakeholders including municipalities, private waste management companies, industrial manufacturers, commercial establishments, and residential communities, all requiring tailored solutions for their specific waste management needs.

Market participants range from large integrated waste management corporations operating across multiple states and provinces to specialized service providers focusing on specific waste streams or geographic regions. The sector plays a crucial role in environmental protection, resource conservation, and public health maintenance while supporting circular economy principles through advanced recycling and resource recovery technologies.

Market leadership in North America’s solid waste management sector reflects a mature industry undergoing significant technological transformation and regulatory evolution. The market demonstrates consistent growth driven by increasing waste generation rates, stricter environmental regulations, and growing corporate sustainability commitments. Key growth drivers include urbanization trends, e-commerce expansion generating packaging waste, and increasing adoption of circular economy principles across industries.

Technology integration represents a major market trend with companies investing heavily in smart collection systems, route optimization software, and automated sorting technologies. The sector benefits from strong regulatory support with government initiatives promoting waste diversion from landfills, encouraging recycling programs, and supporting renewable energy generation through waste-to-energy facilities.

Competitive dynamics feature both consolidation among major players and emergence of specialized service providers focusing on niche markets such as electronic waste recycling, organic waste processing, and hazardous material handling. The market shows resilient performance characteristics with essential service nature providing stability during economic fluctuations while offering growth opportunities through value-added services and technological innovations.

Strategic insights reveal several critical factors shaping the North American solid waste management landscape. The market demonstrates increasing sophistication in waste stream segregation and processing, with advanced material recovery facilities achieving recovery rates exceeding 75% for targeted recyclable materials. This efficiency improvement reflects significant technological investments and operational optimization efforts across the industry.

Primary growth drivers propelling the North American solid waste management market include increasing urbanization rates, population growth, and evolving consumption patterns that generate diverse waste streams requiring specialized handling. The rise of e-commerce has significantly impacted packaging waste volumes, creating opportunities for companies offering comprehensive commercial waste management solutions.

Environmental regulations serve as powerful market drivers, with federal, state, and provincial governments implementing stricter waste diversion requirements, landfill restrictions, and recycling mandates. These regulatory frameworks encourage investment in advanced processing technologies and create competitive advantages for companies offering innovative waste treatment solutions.

Corporate sustainability initiatives represent another significant driver as businesses across industries seek to reduce their environmental footprint and achieve zero-waste-to-landfill goals. This trend generates demand for specialized services including waste auditing, customized recycling programs, and comprehensive reporting on waste diversion metrics.

Technological advancement drives market growth through improved operational efficiency, enhanced service quality, and new revenue opportunities. Smart collection systems, automated sorting technologies, and waste-to-energy innovations enable companies to offer more competitive pricing while improving environmental outcomes.

Significant challenges facing the North American solid waste management market include high capital investment requirements for advanced processing facilities and collection equipment. The substantial upfront costs associated with waste-to-energy plants, material recovery facilities, and fleet modernization can limit market entry for smaller companies and constrain expansion plans for existing operators.

Regulatory complexity presents ongoing challenges as companies must navigate varying requirements across different jurisdictions, with federal, state, provincial, and local regulations creating compliance burdens. The evolving nature of environmental regulations requires continuous investment in monitoring systems, reporting capabilities, and operational modifications.

Market volatility in recyclable commodity prices affects revenue stability for companies with significant recycling operations. Fluctuating prices for materials such as paper, cardboard, metals, and plastics can impact profitability and complicate long-term planning for recycling-focused service providers.

Labor challenges including driver shortages, safety concerns, and increasing wage pressures affect operational costs and service delivery capabilities. The physically demanding nature of waste collection work and safety risks associated with handling various waste materials contribute to workforce recruitment and retention difficulties.

Emerging opportunities in the North American solid waste management market center around technological innovation and service diversification. The growing emphasis on circular economy principles creates opportunities for companies to develop advanced recycling capabilities, material recovery technologies, and waste-to-product conversion processes that generate additional revenue streams beyond traditional collection and disposal services.

Smart city initiatives across North American municipalities present significant opportunities for technology-enabled waste management solutions. IoT-powered collection systems, predictive analytics for route optimization, and integrated waste monitoring platforms align with municipal goals for operational efficiency and environmental sustainability.

Industrial waste management represents a high-growth opportunity segment as manufacturing companies seek specialized solutions for complex waste streams. The increasing focus on industrial sustainability and regulatory compliance creates demand for customized waste treatment, hazardous material handling, and comprehensive waste stream management services.

Organic waste processing offers substantial growth potential with increasing recognition of food waste environmental impact and growing demand for compost and biogas production. The development of anaerobic digestion facilities and advanced composting operations addresses both waste diversion goals and renewable energy generation objectives.

Dynamic market forces shaping the North American solid waste management sector reflect the interplay between regulatory requirements, technological capabilities, and evolving customer expectations. The market demonstrates increasing sophistication in waste stream analysis and processing optimization, with companies leveraging data analytics to improve operational efficiency and environmental outcomes.

Competitive pressures drive continuous innovation in service delivery models, pricing strategies, and technology adoption. Companies differentiate themselves through specialized capabilities, geographic coverage, customer service quality, and environmental performance metrics. The market shows consolidation trends with larger players acquiring regional operators to expand service territories and achieve operational synergies.

Customer demand evolution reflects growing environmental consciousness and corporate sustainability commitments. Businesses increasingly seek comprehensive waste management partners capable of providing detailed reporting, waste diversion services, and support for environmental certification programs. This trend creates opportunities for value-added services and premium pricing for companies offering advanced capabilities.

Technology integration continues accelerating with companies investing in digital platforms, automation technologies, and data analytics capabilities. These investments enable improved route optimization, predictive maintenance, customer communication, and operational monitoring, resulting in efficiency improvements exceeding 20% for leading operators.

Comprehensive research methodology employed for analyzing the North American solid waste management market incorporates multiple data sources and analytical approaches to ensure accuracy and reliability of market insights. The research framework combines quantitative analysis of market trends, regulatory impacts, and financial performance with qualitative assessment of industry dynamics, competitive positioning, and future growth prospects.

Primary research activities include extensive interviews with industry executives, municipal officials, regulatory authorities, and technology providers to gather firsthand insights on market conditions, challenges, and opportunities. These interviews provide valuable perspectives on operational trends, investment priorities, and strategic initiatives shaping the market landscape.

Secondary research encompasses analysis of government databases, industry reports, company financial statements, and regulatory filings to establish comprehensive market baseline data. This research includes examination of waste generation statistics, recycling rates, facility capacity data, and regulatory compliance metrics across different geographic regions and market segments.

Data validation processes ensure research accuracy through cross-referencing multiple sources, statistical analysis of trends, and expert review of findings. The methodology incorporates both historical analysis and forward-looking projections to provide comprehensive market understanding and reliable growth forecasts for stakeholders.

United States market dominates the North American solid waste management sector, representing approximately 85% of regional market activity due to its large population base, extensive industrial infrastructure, and mature waste management industry. The U.S. market demonstrates significant regional variations in regulatory requirements, waste generation patterns, and service delivery models across different states and metropolitan areas.

California and Texas represent the largest state markets, driven by substantial population centers, diverse industrial activities, and progressive environmental regulations. These states lead in waste-to-energy adoption, advanced recycling programs, and technology innovation, creating benchmark standards for industry best practices across the region.

Canadian market shows strong growth potential with increasing environmental consciousness, government support for sustainable waste management, and growing urban populations. Provincial regulations in Ontario, Quebec, and British Columbia drive investment in advanced processing facilities and comprehensive recycling programs, with waste diversion rates exceeding 60% in leading municipalities.

Regional cooperation between the United States and Canada facilitates technology sharing, regulatory harmonization, and cross-border waste management solutions. This collaboration supports industry development through shared research initiatives, joint environmental programs, and coordinated approaches to emerging waste management challenges such as electronic waste and plastic pollution.

Market leadership in the North American solid waste management sector features several major integrated companies alongside numerous regional and specialized service providers. The competitive landscape demonstrates ongoing consolidation trends as larger companies acquire regional operators to expand geographic coverage and achieve operational synergies.

Competitive differentiation occurs through service quality, geographic coverage, specialized capabilities, technology adoption, and environmental performance. Companies invest heavily in fleet modernization, facility upgrades, and digital platforms to maintain competitive advantages and meet evolving customer requirements.

Market segmentation in the North American solid waste management sector reflects diverse customer needs, waste stream characteristics, and service requirements across residential, commercial, and industrial sectors. Each segment demonstrates distinct growth patterns, pricing dynamics, and competitive factors that influence strategic positioning and investment priorities.

By Service Type:

By Waste Type:

By End User:

Residential waste management represents the largest market segment by volume, characterized by stable demand patterns, municipal contract relationships, and increasing focus on recycling and organic waste diversion. This segment benefits from predictable revenue streams and opportunities for service expansion through additional waste stream collection and processing services.

Commercial waste management demonstrates higher growth potential with diverse customer needs, premium pricing opportunities, and value-added service demand. Businesses increasingly seek comprehensive waste management solutions including waste auditing, sustainability reporting, and customized recycling programs that support corporate environmental goals.

Industrial waste management offers the highest margins and specialization opportunities, requiring technical expertise, regulatory compliance capabilities, and customized treatment solutions. This segment shows strong growth driven by manufacturing expansion, environmental regulations, and increasing focus on industrial sustainability and circular economy principles.

Hazardous waste management represents a specialized high-value segment with significant regulatory requirements, technical expertise needs, and limited competition. Companies operating in this segment benefit from premium pricing, long-term customer relationships, and substantial barriers to entry that protect market positions.

Industry participants in the North American solid waste management market benefit from multiple value creation opportunities including stable revenue streams from essential services, growth potential through market expansion and service diversification, and operational efficiency improvements through technology adoption and scale economies.

Municipal stakeholders gain access to professional waste management services that ensure regulatory compliance, environmental protection, and cost-effective operations. Partnerships with private waste management companies enable municipalities to focus on core governmental functions while ensuring reliable waste collection and processing services for residents and businesses.

Commercial customers benefit from comprehensive waste management solutions that support sustainability goals, reduce operational complexity, and provide detailed reporting for environmental compliance and corporate responsibility initiatives. Professional waste management services enable businesses to focus on core operations while ensuring proper waste handling and disposal.

Environmental benefits include improved waste diversion rates, reduced landfill dependence, increased recycling and resource recovery, and support for circular economy principles. Advanced waste management practices contribute to greenhouse gas reduction, resource conservation, and environmental protection across North American communities.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation represents a fundamental trend reshaping the North American solid waste management market, with companies investing heavily in IoT sensors, mobile applications, and cloud-based platforms to improve operational efficiency and customer service. These technologies enable real-time monitoring of collection routes, predictive maintenance of equipment, and enhanced communication with customers.

Sustainability integration drives market evolution as companies expand beyond traditional collection and disposal services to offer comprehensive environmental solutions. This trend includes development of circular economy services, carbon footprint reduction programs, and advanced recycling technologies that support corporate sustainability goals and regulatory requirements.

Automation advancement continues accelerating with implementation of automated collection systems, robotic sorting technologies, and AI-powered operational optimization. These innovations address labor challenges while improving safety, efficiency, and service quality across the waste management value chain.

Service diversification reflects industry maturation as companies seek growth opportunities through specialized services, geographic expansion, and vertical integration. This trend includes development of waste-to-energy capabilities, organic waste processing, and industrial services that command premium pricing and create competitive differentiation.

Recent industry developments demonstrate the dynamic nature of the North American solid waste management market, with significant investments in technology, facility upgrades, and service expansion initiatives. MarkWide Research analysis indicates that major companies are prioritizing digital transformation projects and sustainability-focused service offerings to maintain competitive advantages.

Merger and acquisition activity continues at elevated levels as companies seek to achieve scale economies, expand geographic coverage, and acquire specialized capabilities. Recent transactions focus on regional consolidation, technology acquisition, and vertical integration opportunities that strengthen market positions and operational capabilities.

Technology partnerships between waste management companies and technology providers accelerate innovation adoption and capability development. These collaborations focus on developing advanced sorting systems, route optimization software, and customer engagement platforms that improve operational efficiency and service quality.

Regulatory developments across federal, state, and provincial levels continue shaping market dynamics through new environmental requirements, waste diversion mandates, and extended producer responsibility programs. These regulatory changes create both challenges and opportunities for companies with appropriate capabilities and strategic positioning.

Strategic recommendations for North American solid waste management market participants emphasize the importance of technology adoption, service diversification, and operational excellence in maintaining competitive advantages. Companies should prioritize investments in digital platforms, automation technologies, and data analytics capabilities that improve efficiency and customer service while reducing operational costs.

Market expansion strategies should focus on geographic diversification, specialized service development, and strategic partnerships that create new revenue opportunities and competitive differentiation. Companies with strong operational capabilities should consider expansion into adjacent markets such as industrial services, environmental consulting, and resource recovery operations.

Operational optimization represents a critical success factor with companies needing to balance cost management, service quality, and environmental performance. Investment in fleet modernization, facility upgrades, and workforce development supports long-term competitiveness while addressing regulatory requirements and customer expectations.

Sustainability positioning becomes increasingly important as customers and regulators emphasize environmental performance and circular economy principles. Companies should develop comprehensive sustainability strategies that integrate waste diversion, resource recovery, and environmental reporting capabilities to meet evolving market demands.

Long-term market prospects for the North American solid waste management sector remain positive, supported by population growth, urbanization trends, and increasing environmental consciousness. MWR projections indicate continued market expansion driven by regulatory requirements, technology adoption, and growing demand for comprehensive waste management solutions across residential, commercial, and industrial sectors.

Technology evolution will continue transforming industry operations with advanced automation, artificial intelligence, and IoT integration becoming standard capabilities rather than competitive differentiators. Companies that successfully integrate these technologies while maintaining operational excellence will achieve sustainable competitive advantages and superior financial performance.

Regulatory trends point toward increasingly stringent environmental requirements, expanded recycling mandates, and greater emphasis on circular economy principles. These developments create opportunities for companies with advanced processing capabilities while potentially challenging operators with traditional disposal-focused business models.

Market consolidation is expected to continue with larger companies acquiring regional operators and specialized service providers to achieve scale economies and expand service capabilities. This trend will likely result in a more concentrated market structure while creating opportunities for niche players with specialized expertise and innovative service offerings. The sector shows potential for sustained growth rates of 4-5% annually over the next decade.

The North America solid waste management market represents a mature yet dynamic sector undergoing significant transformation driven by technological innovation, regulatory evolution, and changing customer expectations. The market demonstrates resilient growth characteristics supported by essential service demand, regulatory requirements, and increasing environmental consciousness across residential, commercial, and industrial sectors.

Key success factors for market participants include operational excellence, technology adoption, service diversification, and strategic positioning to capitalize on emerging opportunities in sustainability services, automation, and specialized waste processing. Companies that successfully balance cost management with service quality and environmental performance will achieve sustainable competitive advantages in this evolving market landscape.

Future market development will be shaped by continued consolidation, technology integration, and regulatory advancement, creating both challenges and opportunities for industry participants. The sector’s essential nature and growth potential make it an attractive market for investors and operators with appropriate capabilities and strategic vision to navigate the evolving competitive environment successfully.

What is Solid Waste Management?

Solid Waste Management refers to the collection, treatment, and disposal of solid waste materials. It encompasses various processes including recycling, composting, and landfill management to minimize environmental impact and promote sustainability.

What are the key players in the North America Solid Waste Management Market?

Key players in the North America Solid Waste Management Market include Waste Management, Inc., Republic Services, and Veolia North America, among others. These companies provide a range of services from waste collection to recycling and landfill operations.

What are the main drivers of the North America Solid Waste Management Market?

The main drivers of the North America Solid Waste Management Market include increasing urbanization, rising environmental awareness, and stringent regulations on waste disposal. These factors contribute to the growing demand for efficient waste management solutions.

What challenges does the North America Solid Waste Management Market face?

The North America Solid Waste Management Market faces challenges such as limited landfill space, high operational costs, and public opposition to waste management facilities. These issues can hinder the growth and efficiency of waste management operations.

What opportunities exist in the North America Solid Waste Management Market?

Opportunities in the North America Solid Waste Management Market include advancements in recycling technologies, the growth of the circular economy, and increased investment in waste-to-energy projects. These trends can enhance sustainability and resource recovery.

What trends are shaping the North America Solid Waste Management Market?

Trends shaping the North America Solid Waste Management Market include the adoption of smart waste management technologies, increased focus on zero waste initiatives, and the integration of sustainability practices in waste management strategies. These trends aim to improve efficiency and reduce environmental impact.

North America Solid Waste Management Market

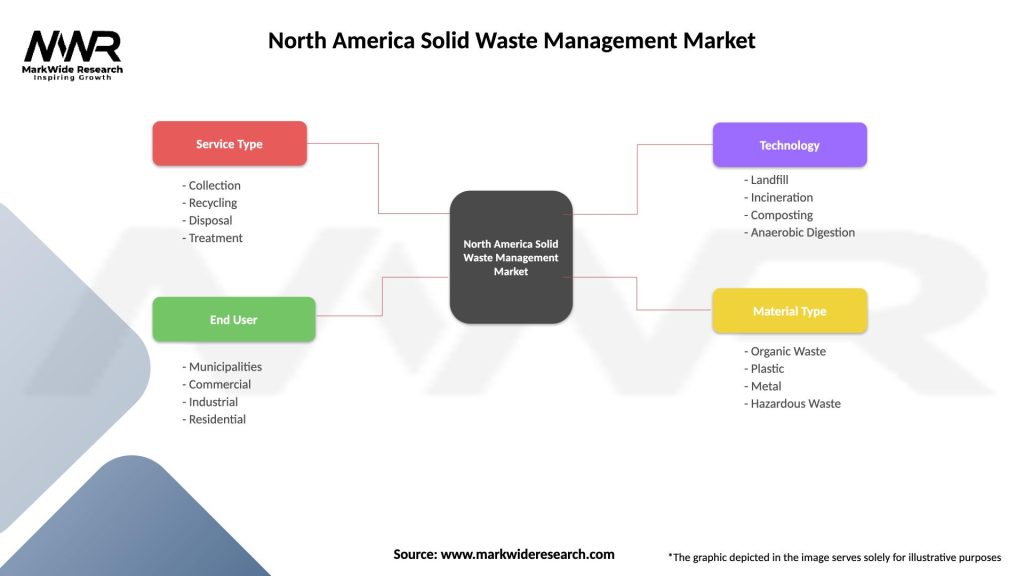

| Segmentation Details | Description |

|---|---|

| Service Type | Collection, Recycling, Disposal, Treatment |

| End User | Municipalities, Commercial, Industrial, Residential |

| Technology | Landfill, Incineration, Composting, Anaerobic Digestion |

| Material Type | Organic Waste, Plastic, Metal, Hazardous Waste |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the North America Solid Waste Management Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at