444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The North America built-in home appliances market represents a dynamic and rapidly evolving sector within the broader home improvement and construction industry. This market encompasses integrated appliances designed to seamlessly blend with kitchen cabinetry and home design aesthetics, including built-in refrigerators, dishwashers, ovens, cooktops, and microwave systems. Market growth has been particularly robust, driven by increasing consumer preference for streamlined kitchen designs and premium home features.

Regional dynamics show the United States commanding approximately 78% market share within North America, followed by Canada with significant contributions from urban centers like Toronto, Vancouver, and Montreal. The market has experienced consistent expansion, with growth rates averaging 6.2% annually over the past five years. Consumer behavior increasingly favors integrated appliance solutions that maximize space efficiency while maintaining high-performance standards.

Technology integration has become a defining characteristic of modern built-in appliances, with smart connectivity features and energy-efficient designs driving consumer adoption. The market benefits from strong residential construction activity, kitchen renovation projects, and growing disposable income among North American households. Premium positioning of built-in appliances continues to attract affluent consumers seeking luxury home features and enhanced property values.

The North America built-in home appliances market refers to the comprehensive ecosystem of integrated household appliances specifically designed for permanent installation within kitchen cabinetry and home infrastructure. These appliances are engineered to create seamless visual integration with surrounding cabinetry while delivering superior functionality and space optimization compared to traditional freestanding units.

Built-in appliances distinguish themselves through custom-fit dimensions, panel-ready designs, and advanced installation requirements that necessitate professional setup. The market encompasses various product categories including refrigeration systems, cooking appliances, dishwashers, wine storage units, and specialty appliances designed for luxury residential applications. Integration capabilities allow homeowners to achieve cohesive kitchen aesthetics while maximizing available space through efficient design solutions.

Market scope extends beyond individual appliance sales to include installation services, maintenance programs, and design consultation services. The sector serves diverse customer segments ranging from luxury home builders and renovation contractors to affluent homeowners seeking premium kitchen solutions. Value proposition centers on enhanced home aesthetics, improved functionality, and increased property values through sophisticated appliance integration.

Market performance in the North America built-in home appliances sector demonstrates robust growth trajectory supported by favorable demographic trends and increasing consumer investment in home improvement projects. The market benefits from strong demand drivers including rising household incomes, growing preference for luxury home features, and expanding residential construction activity across key metropolitan areas.

Competitive landscape features established premium appliance manufacturers competing on innovation, design aesthetics, and technological integration. Leading market participants focus on developing smart appliance solutions, energy-efficient technologies, and customizable design options to meet evolving consumer preferences. Market penetration rates show approximately 34% adoption among high-income households, indicating substantial growth potential in mainstream market segments.

Regional distribution shows concentrated demand in affluent suburban markets, urban luxury developments, and high-end residential communities. The market demonstrates seasonal patterns aligned with construction cycles and home renovation activities, with peak demand occurring during spring and summer months. Future projections indicate continued market expansion driven by demographic shifts, technological advancement, and evolving consumer lifestyle preferences.

Consumer preferences increasingly favor integrated appliance solutions that combine functionality with aesthetic appeal. Market research reveals growing demand for smart connectivity features, with wireless connectivity adoption reaching 42% among new built-in appliance installations. Energy efficiency remains a critical purchase factor, driving innovation in sustainable appliance technologies.

Residential construction activity serves as a primary market driver, with new home construction and major renovation projects creating sustained demand for built-in appliance solutions. The market benefits from strong housing market fundamentals, including low mortgage rates, demographic shifts toward homeownership, and increasing investment in home improvement projects. Construction spending on residential projects has increased by 8.4% annually, directly supporting appliance market growth.

Consumer lifestyle evolution drives demand for premium home features and integrated living solutions. Modern homeowners increasingly view kitchens as central gathering spaces requiring sophisticated appliance integration and enhanced functionality. Demographic trends show millennials entering peak home-buying years with preferences for modern, technology-enabled home features that support contemporary lifestyles.

Technology advancement creates new market opportunities through smart appliance capabilities, energy-efficient designs, and enhanced user interfaces. Internet of Things integration enables remote monitoring, predictive maintenance, and seamless connectivity with home automation systems. Innovation cycles drive regular product upgrades and replacement demand among technology-conscious consumers seeking latest appliance features.

Economic prosperity in North America supports discretionary spending on luxury home features and premium appliance solutions. Rising household incomes, particularly among high-income demographics, enable investment in built-in appliances that enhance home value and living experience. Wealth accumulation trends support sustained demand for premium home improvement products and services.

High initial costs represent a significant barrier to market expansion, with built-in appliances typically commanding premium pricing compared to freestanding alternatives. Installation complexity adds additional expenses through professional service requirements, custom cabinetry modifications, and potential electrical or plumbing upgrades. Total investment costs can exceed traditional appliance purchases by 150-200%, limiting market accessibility for price-sensitive consumers.

Installation complexity creates challenges for both consumers and contractors, requiring specialized knowledge, custom measurements, and coordination with other home improvement projects. Complex installation processes can extend project timelines, increase labor costs, and create potential compatibility issues with existing home infrastructure. Technical requirements may necessitate significant home modifications that discourage some potential customers.

Limited flexibility in appliance placement and future modifications constrains consumer options compared to freestanding appliances. Built-in installations create permanent commitments that complicate future kitchen renovations, appliance upgrades, or home modifications. Replacement challenges may require extensive cabinetry modifications and professional installation services that add complexity and cost to future appliance changes.

Economic sensitivity affects market demand during economic downturns when consumers defer discretionary home improvement spending. Built-in appliances represent luxury purchases that may be postponed during uncertain economic conditions, creating cyclical demand patterns aligned with broader economic cycles. Market volatility can impact both new construction activity and renovation project investments that drive appliance demand.

Smart home integration presents substantial growth opportunities as consumers increasingly adopt connected home technologies. Built-in appliances can serve as central components of comprehensive home automation systems, enabling advanced functionality, energy management, and user convenience features. Technology convergence creates opportunities for appliance manufacturers to develop integrated solutions that enhance overall home intelligence and user experience.

Sustainable design trends drive demand for energy-efficient appliances that reduce environmental impact while lowering operational costs. Growing environmental consciousness among consumers creates market opportunities for manufacturers developing eco-friendly appliance technologies and sustainable design solutions. Green building standards increasingly require energy-efficient appliances, expanding market opportunities in environmentally-focused construction projects.

Aging population demographics create opportunities for accessible design features and user-friendly appliance interfaces that accommodate diverse physical capabilities. Universal design principles can expand market reach while addressing specific needs of aging homeowners who prefer aging-in-place solutions. Accessibility features represent an underserved market segment with significant growth potential.

Emerging market segments include compact urban living solutions, multi-generational housing designs, and luxury rental properties seeking premium appliance features. Changing household compositions and living arrangements create new market niches requiring specialized appliance solutions and innovative design approaches. Market diversification opportunities extend beyond traditional single-family homes to include condominiums, townhomes, and luxury apartment developments.

Supply chain dynamics significantly influence market performance through component availability, manufacturing capacity, and distribution efficiency. Global supply chain disruptions have created periodic challenges for appliance manufacturers, affecting product availability and pricing strategies. Manufacturing resilience has become increasingly important as companies develop diversified supplier networks and flexible production capabilities.

Competitive intensity drives continuous innovation and product differentiation among leading market participants. Manufacturers compete on design aesthetics, technological features, energy efficiency, and customer service capabilities to maintain market position. Market consolidation trends show larger manufacturers acquiring specialized brands to expand product portfolios and market reach.

Regulatory environment shapes market development through energy efficiency standards, safety requirements, and environmental regulations. Evolving regulatory frameworks create both challenges and opportunities for manufacturers developing compliant appliance solutions. Compliance costs influence product development strategies and market entry decisions for both established and emerging market participants.

Consumer behavior evolution reflects changing lifestyle preferences, technology adoption patterns, and home design trends. Social media influence and home improvement television programming drive consumer awareness and demand for premium appliance features. Purchase decision factors increasingly emphasize design integration, smart features, and long-term value rather than initial purchase price alone.

Primary research encompasses comprehensive surveys of consumers, industry professionals, and market participants to gather firsthand insights into market trends, preferences, and growth drivers. MarkWide Research conducted extensive interviews with appliance manufacturers, distributors, contractors, and end-users to develop comprehensive market understanding and identify emerging opportunities.

Secondary research involves systematic analysis of industry publications, government statistics, trade association reports, and corporate financial disclosures to validate primary findings and establish market baselines. Data sources include construction industry reports, housing market statistics, and appliance industry publications that provide historical context and trend analysis.

Market modeling utilizes statistical analysis techniques to project future market trends based on historical performance, demographic shifts, and economic indicators. Quantitative analysis incorporates regression modeling, trend extrapolation, and scenario planning to develop robust market forecasts and identify potential growth trajectories.

Expert validation ensures research accuracy through consultation with industry experts, academic researchers, and market specialists who provide insights into market dynamics and validate research findings. Quality assurance processes include data triangulation, peer review, and methodology validation to maintain research integrity and reliability.

United States market dominates North American demand with strong performance across diverse geographic regions. California leads state-level demand with approximately 18% market share, driven by high-income demographics, active construction markets, and strong preference for luxury home features. Texas and Florida represent rapidly growing markets supported by population growth, new construction activity, and favorable economic conditions.

Northeast corridor including New York, New Jersey, and Connecticut demonstrates strong demand for premium built-in appliances driven by high property values, affluent demographics, and active renovation markets. Urban markets show particular strength in luxury condominium developments and high-end residential projects. Market penetration reaches 45% among luxury home segments in major metropolitan areas.

Canadian market shows concentrated demand in major urban centers including Toronto, Vancouver, and Montreal where high property values and affluent demographics support premium appliance adoption. Provincial variations reflect economic conditions, construction activity levels, and demographic characteristics that influence market development patterns.

Regional preferences vary based on climate conditions, architectural styles, and local design trends that influence appliance selection and installation approaches. Pacific Northwest emphasizes sustainable design features and energy efficiency, while Southern markets focus on cooling efficiency and humidity management capabilities. Market maturity levels differ across regions, creating diverse growth opportunities and competitive dynamics.

Market leadership is distributed among several established appliance manufacturers with strong brand recognition and comprehensive product portfolios. Competition focuses on design innovation, technological advancement, and customer service excellence to maintain market position and drive growth.

Competitive strategies emphasize product differentiation through design innovation, smart technology integration, and superior customer service. Market positioning varies from ultra-premium luxury brands to accessible premium options that target broader market segments. Distribution networks include specialized appliance dealers, home improvement retailers, and direct-to-consumer channels that serve diverse customer preferences.

Product segmentation encompasses diverse appliance categories designed for integrated installation and seamless kitchen design integration. Each segment demonstrates unique growth patterns, consumer preferences, and competitive dynamics that influence overall market development.

By Product Type:

By Technology:

Built-in refrigeration represents the largest market segment with strong demand for custom panel-ready designs that integrate seamlessly with cabinetry. Consumer preferences favor large capacity units with advanced temperature management, multiple cooling zones, and smart connectivity features. Innovation focus includes energy efficiency improvements, noise reduction technologies, and enhanced food preservation capabilities.

Cooking appliances demonstrate robust growth driven by consumer interest in culinary experiences and professional-grade performance. Induction cooktops show particularly strong adoption rates of 28% annually due to energy efficiency and precise temperature control capabilities. Wall oven combinations including convection, steam, and microwave functions provide versatile cooking solutions for modern kitchens.

Dishwasher integration focuses on quiet operation, energy efficiency, and flexible loading configurations that accommodate diverse dishware and cooking utensils. Third rack designs and adjustable tine systems enhance functionality while maintaining integrated aesthetics. Water efficiency improvements meet environmental standards while delivering superior cleaning performance.

Specialty appliances including wine storage, beverage centers, and warming drawers create opportunities for kitchen customization and luxury features. Wine storage solutions show growing demand among affluent consumers with dual-zone temperature control and humidity management capabilities. Market expansion includes compact appliances designed for smaller kitchen spaces and urban living environments.

Manufacturers benefit from premium pricing opportunities and strong brand differentiation potential in the built-in appliances market. Higher profit margins compared to standard appliances enable investment in research and development, advanced manufacturing technologies, and market expansion initiatives. Brand positioning in luxury market segments creates customer loyalty and reduces price-based competition pressures.

Distributors and retailers enjoy enhanced profitability through higher-value product sales and associated services including design consultation, installation coordination, and extended warranty programs. Service integration creates additional revenue streams while strengthening customer relationships and market differentiation. Specialized expertise requirements create barriers to entry that protect established distribution networks.

Installation professionals benefit from specialized service opportunities requiring advanced technical skills and certification programs. Premium service pricing reflects complexity and expertise requirements while creating sustainable business models for qualified contractors. Ongoing maintenance and service contracts provide recurring revenue opportunities and long-term customer relationships.

Homeowners gain enhanced property values, improved functionality, and superior aesthetics through built-in appliance installations. Energy efficiency benefits reduce operational costs while supporting environmental sustainability goals. Smart connectivity features enable convenient operation, remote monitoring, and integration with home automation systems that enhance daily living experiences.

Strengths:

Weaknesses:

Opportunities:

Threats:

Smart connectivity integration represents the most significant trend shaping market development, with manufacturers incorporating Internet of Things capabilities, voice control, and mobile app integration. Connected appliances enable remote monitoring, predictive maintenance, and energy management that enhance user convenience and operational efficiency. Artificial intelligence integration provides personalized recommendations and automated operation optimization.

Sustainable design emphasis drives innovation in energy-efficient technologies, eco-friendly materials, and reduced environmental impact throughout product lifecycles. Energy Star certification has become standard expectation rather than premium feature, with efficiency improvements averaging 15-20% compared to previous generation appliances. Water conservation features in dishwashers and refrigerators support environmental sustainability goals.

Customization capabilities expand through modular designs, interchangeable components, and flexible configuration options that accommodate diverse kitchen layouts and consumer preferences. Panel-ready designs allow seamless integration with existing cabinetry while maintaining appliance functionality and performance standards. Color and finish options expand beyond traditional stainless steel to include black stainless, custom colors, and textured surfaces.

Health and wellness features gain prominence through air purification systems, antimicrobial surfaces, and food preservation technologies that support healthy living goals. Steam cooking capabilities preserve nutrients while providing versatile cooking options for health-conscious consumers. Water filtration integration in refrigerators ensures clean drinking water and ice production.

Technology partnerships between appliance manufacturers and smart home platform providers create integrated solutions that enhance user experience and market differentiation. Voice assistant integration with Amazon Alexa, Google Assistant, and Apple HomeKit enables hands-free appliance control and smart home ecosystem integration. Platform compatibility ensures broad market appeal and future-proofing for technology-conscious consumers.

Manufacturing innovations include advanced materials, improved energy efficiency, and enhanced durability that extend product lifecycles while reducing environmental impact. Inverter technology in refrigerators and dishwashers provides variable speed operation that optimizes energy consumption and reduces noise levels. Sensor integration enables automatic operation adjustment based on load conditions and usage patterns.

Distribution channel evolution includes expanded online presence, virtual showrooms, and augmented reality tools that enhance customer experience and purchase decision-making. Direct-to-consumer sales growth enables manufacturers to maintain closer customer relationships while improving profit margins. Service integration creates comprehensive customer support throughout product lifecycles.

Regulatory developments include updated energy efficiency standards, safety requirements, and environmental regulations that shape product development priorities and market entry strategies. MWR analysis indicates increasing regulatory focus on sustainability and energy conservation that drives innovation investment and compliance costs across the industry.

Market participants should prioritize smart technology integration and connectivity features to meet evolving consumer expectations and maintain competitive differentiation. Investment priorities should focus on user interface development, mobile app functionality, and integration with popular smart home platforms that enhance customer value and market appeal.

Manufacturers should expand product portfolios to include diverse price points and feature combinations that address broader market segments while maintaining premium positioning. Modular design approaches can provide customization flexibility while achieving manufacturing efficiencies and cost optimization. Sustainability initiatives should encompass entire product lifecycles from manufacturing through disposal and recycling.

Distribution strategies should emphasize omnichannel approaches that combine traditional retail presence with enhanced digital capabilities and direct-to-consumer options. Service integration creates differentiation opportunities and recurring revenue streams that strengthen customer relationships and market position. Professional training programs for installation and service providers ensure quality customer experiences and market growth support.

Strategic partnerships with home builders, kitchen designers, and renovation contractors can expand market reach while providing integrated solutions that meet customer needs. Technology collaborations with smart home platform providers and software developers enhance product capabilities and market competitiveness. Supply chain diversification reduces risk while ensuring product availability and cost competitiveness.

Market growth prospects remain positive driven by favorable demographic trends, continued housing market strength, and increasing consumer investment in home improvement projects. Technology advancement will continue driving product innovation and market expansion as smart home adoption accelerates and consumer expectations evolve. Projected growth rates indicate sustained expansion at 6.8% annually over the next five years.

Emerging technologies including artificial intelligence, machine learning, and advanced sensor systems will create new functionality and user experience improvements that drive replacement demand and market expansion. Energy efficiency requirements will become increasingly stringent, driving innovation in sustainable appliance technologies and eco-friendly design approaches.

Market expansion opportunities include emerging demographic segments, alternative housing formats, and international market development that broaden customer base and growth potential. Urban living solutions and compact appliance designs address changing lifestyle preferences and housing market trends. Luxury rental markets represent underserved segments with significant growth potential.

Competitive dynamics will intensify as market maturity increases and new entrants seek market share through innovation and competitive pricing strategies. MarkWide Research projects continued market consolidation as larger manufacturers acquire specialized brands and technologies to strengthen market position and expand capabilities. Service integration will become increasingly important for market differentiation and customer retention in competitive market conditions.

The North America built-in home appliances market demonstrates strong growth potential supported by favorable demographic trends, increasing consumer preference for integrated home solutions, and continued innovation in smart appliance technologies. Market fundamentals remain robust with sustained demand from luxury housing segments, active renovation markets, and growing adoption of premium home features among affluent consumers.

Technology integration continues driving market evolution as manufacturers develop sophisticated connectivity features, energy-efficient designs, and enhanced user interfaces that meet evolving consumer expectations. Smart home adoption creates significant opportunities for appliance manufacturers to develop integrated solutions that enhance customer value and market differentiation. Sustainability trends support long-term market growth through environmental consciousness and regulatory requirements that drive innovation investment.

Competitive landscape remains dynamic with established premium brands maintaining market leadership while emerging technologies and changing consumer preferences create opportunities for innovation and market expansion. Distribution channel evolution and service integration provide additional growth avenues while strengthening customer relationships and market position. Future prospects indicate continued market expansion driven by demographic shifts, technology advancement, and evolving lifestyle preferences that support sustained demand for premium built-in appliance solutions throughout North America.

What is Built-In Home Appliances?

Built-In Home Appliances refer to kitchen and home devices that are integrated into the structure of a home, providing a seamless look and efficient use of space. These appliances include ovens, dishwashers, and refrigerators designed to fit within cabinetry.

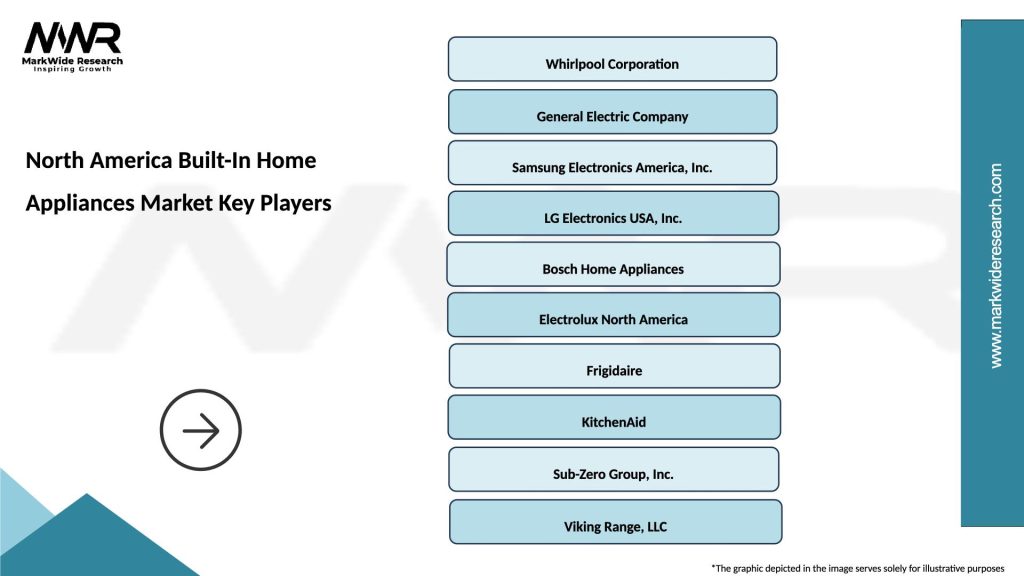

What are the key players in the North America Built-In Home Appliances Market?

Key players in the North America Built-In Home Appliances Market include Whirlpool Corporation, Bosch, GE Appliances, and Samsung, among others. These companies are known for their innovative designs and energy-efficient products.

What are the growth factors driving the North America Built-In Home Appliances Market?

The growth of the North America Built-In Home Appliances Market is driven by increasing consumer demand for modern kitchen designs, the rise in home renovations, and advancements in smart appliance technology. Additionally, the trend towards energy efficiency is influencing purchasing decisions.

What challenges does the North America Built-In Home Appliances Market face?

Challenges in the North America Built-In Home Appliances Market include high installation costs, competition from standalone appliances, and supply chain disruptions. These factors can impact consumer adoption and market growth.

What opportunities exist in the North America Built-In Home Appliances Market?

Opportunities in the North America Built-In Home Appliances Market include the growing trend of smart home integration, increasing demand for eco-friendly appliances, and the expansion of e-commerce platforms for appliance sales. These trends present avenues for innovation and market expansion.

What trends are shaping the North America Built-In Home Appliances Market?

Trends shaping the North America Built-In Home Appliances Market include the rise of smart appliances with IoT capabilities, a focus on sustainable materials, and the popularity of customizable kitchen solutions. These trends reflect changing consumer preferences and technological advancements.

North America Built-In Home Appliances Market

| Segmentation Details | Description |

|---|---|

| Product Type | Refrigerators, Ovens, Dishwashers, Washers |

| Technology | Smart Appliances, Energy-Efficient, IoT-Enabled, Traditional |

| End User | Residential, Commercial, Hospitality, Retail |

| Distribution Channel | Online Retail, Specialty Stores, Home Improvement, Direct Sales |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the North America Built-In Home Appliances Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at