444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2150

The India automotive LED lighting market represents a rapidly evolving segment within the country’s automotive industry, driven by technological advancement, regulatory mandates, and changing consumer preferences. LED technology has revolutionized automotive lighting systems, offering superior energy efficiency, longer lifespan, and enhanced design flexibility compared to traditional halogen and xenon lighting solutions. The market encompasses various applications including headlights, taillights, daytime running lights, interior lighting, and specialty automotive lighting systems.

Market dynamics in India are particularly influenced by the government’s push toward electric vehicles, stringent safety regulations, and the growing demand for premium automotive features. The adoption rate of LED lighting systems has accelerated significantly, with passenger vehicles leading the transformation while commercial vehicles gradually embrace this technology. Manufacturing capabilities within India have expanded substantially, with both domestic and international players establishing production facilities to serve the growing demand.

Growth projections indicate the market is expanding at a robust CAGR of 12.5%, driven by increasing vehicle production, rising consumer awareness about energy efficiency, and the automotive industry’s shift toward advanced lighting technologies. The market benefits from India’s position as a major automotive manufacturing hub, with significant investments in research and development fostering innovation in LED lighting solutions.

The India automotive LED lighting market refers to the comprehensive ecosystem encompassing the design, manufacturing, distribution, and integration of light-emitting diode technology in automotive applications across India’s transportation sector. This market includes all LED-based lighting components used in passenger cars, commercial vehicles, two-wheelers, and specialty automotive applications, ranging from essential safety lighting to advanced aesthetic and functional lighting systems.

LED technology in automotive applications represents a significant advancement over conventional lighting solutions, utilizing semiconductor materials to produce light through electroluminescence. These systems offer enhanced durability, reduced power consumption, improved visibility, and greater design flexibility, making them increasingly attractive to automotive manufacturers and consumers alike. The market encompasses both original equipment manufacturer (OEM) installations and aftermarket replacement solutions.

India’s automotive LED lighting market has emerged as a dynamic and rapidly growing segment, characterized by technological innovation, regulatory support, and evolving consumer preferences. The market benefits from India’s robust automotive manufacturing sector, which produces millions of vehicles annually and serves both domestic and international markets. LED adoption rates have increased dramatically, with premium and mid-segment vehicles leading the transition while entry-level vehicles gradually incorporate LED technology.

Key market drivers include government regulations mandating improved vehicle safety features, the automotive industry’s focus on energy efficiency, and consumer demand for advanced lighting aesthetics. The market has witnessed significant investments in manufacturing infrastructure, with major global LED manufacturers establishing production facilities in India to capitalize on the growing demand and cost advantages.

Competitive landscape features a mix of international technology leaders and emerging domestic players, creating a dynamic environment that fosters innovation and competitive pricing. The market’s growth trajectory is supported by India’s expanding middle class, increasing vehicle ownership rates, and the government’s push toward electric mobility, which inherently favors energy-efficient LED lighting systems.

Strategic insights reveal several critical factors shaping the India automotive LED lighting market’s evolution and future prospects:

Government regulations serve as a primary catalyst for LED lighting adoption in India’s automotive sector. The implementation of stricter safety standards, including mandatory daytime running lights and improved visibility requirements, has accelerated the transition from traditional lighting technologies to LED systems. Regulatory frameworks continue to evolve, with authorities emphasizing energy efficiency and environmental sustainability in automotive design.

Energy efficiency concerns drive significant market growth as automotive manufacturers seek to reduce overall vehicle power consumption. LED lighting systems consume approximately 75% less energy than traditional halogen lights while providing superior illumination quality. This efficiency advantage becomes particularly important in electric vehicles, where every watt of power consumption affects driving range and battery performance.

Consumer preferences increasingly favor vehicles with modern, aesthetically appealing lighting systems. LED technology enables innovative design possibilities, including dynamic turn signals, customizable ambient lighting, and distinctive daytime running light patterns that enhance vehicle appeal. The growing middle class in India demonstrates increasing willingness to pay premium prices for advanced lighting features.

Manufacturing cost optimization has made LED lighting more accessible across vehicle segments. Economies of scale, technological improvements, and local manufacturing initiatives have significantly reduced LED system costs, making them viable for mid-segment and even entry-level vehicles. This cost reduction trend continues to expand market accessibility.

High initial costs remain a significant barrier to widespread LED adoption, particularly in India’s price-sensitive automotive market. While LED systems offer long-term cost benefits through reduced energy consumption and longer lifespan, the upfront investment required can be substantial, especially for comprehensive lighting system upgrades. This cost factor particularly affects entry-level vehicle segments where price competition is intense.

Technical complexity associated with LED lighting systems presents challenges for manufacturers and service providers. LED systems require sophisticated electronic control units, thermal management solutions, and specialized manufacturing processes. This complexity can increase production costs and require additional technical expertise throughout the supply chain.

Heat management issues pose ongoing challenges for LED lighting system performance and longevity. Effective thermal management is crucial for maintaining LED efficiency and preventing premature failure, requiring additional components and design considerations that can increase system complexity and cost.

Market fragmentation creates challenges for standardization and quality control. The presence of numerous suppliers offering varying quality levels can lead to inconsistent performance and reliability issues, potentially affecting consumer confidence in LED lighting technology.

Electric vehicle expansion presents enormous opportunities for LED lighting market growth. As India accelerates its transition toward electric mobility, the inherent energy efficiency advantages of LED lighting systems become increasingly valuable. Electric vehicle manufacturers prioritize energy-efficient components to maximize driving range, creating natural demand for advanced LED lighting solutions.

Smart lighting integration offers significant growth potential through the incorporation of connectivity features, adaptive lighting systems, and integration with vehicle telematics. These advanced features can command premium pricing while providing enhanced functionality and user experience. The development of intelligent lighting systems that respond to driving conditions, weather, and traffic situations represents a major opportunity.

Aftermarket segment expansion provides substantial growth opportunities as existing vehicle owners seek to upgrade their lighting systems. The large installed base of vehicles with traditional lighting creates a significant replacement market, particularly as LED technology becomes more affordable and accessible.

Export market potential leverages India’s manufacturing capabilities to serve international markets. As global automotive manufacturers seek cost-effective LED lighting solutions, India’s growing manufacturing expertise and competitive cost structure position the country as an attractive sourcing destination for automotive LED components.

Supply chain evolution significantly impacts market dynamics as manufacturers work to establish robust, cost-effective supply networks for LED components. The development of local supplier ecosystems reduces dependence on imports while improving supply chain resilience and cost competitiveness. Strategic partnerships between international technology providers and domestic manufacturers are reshaping the competitive landscape.

Technology advancement continues to drive market evolution through improvements in LED efficiency, lifespan, and functionality. Emerging technologies such as organic LEDs (OLEDs), micro-LEDs, and smart lighting systems are creating new market segments and applications. These technological developments enable innovative lighting designs and enhanced vehicle differentiation.

Competitive intensity has increased as more players enter the market, driven by growth opportunities and technological advancement. This competition fosters innovation while putting pressure on pricing and profit margins. Market consolidation trends are emerging as companies seek to achieve economies of scale and strengthen their competitive positions.

Regulatory evolution continues to shape market dynamics through evolving safety standards, environmental regulations, and quality requirements. These regulatory changes create both opportunities and challenges for market participants, requiring ongoing investment in compliance and technology development.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the India automotive LED lighting market. Primary research involves extensive interviews with industry executives, automotive manufacturers, LED technology providers, and market participants across the value chain. These interviews provide firsthand insights into market trends, challenges, and opportunities.

Secondary research encompasses analysis of industry reports, government publications, regulatory documents, and company financial statements. This research provides quantitative data on market size, growth rates, and competitive positioning while offering historical context for market development trends.

Market modeling utilizes statistical analysis and forecasting techniques to project future market trends and growth patterns. These models incorporate various factors including economic indicators, regulatory changes, technological developments, and consumer behavior patterns to generate reliable market projections.

Validation processes ensure research accuracy through cross-referencing multiple data sources, expert review, and market participant feedback. This rigorous validation approach enhances the reliability and credibility of market insights and projections.

Western India dominates the automotive LED lighting market, accounting for approximately 45% of total market share, driven by the concentration of major automotive manufacturing hubs in Maharashtra and Gujarat. This region benefits from established automotive clusters, robust infrastructure, and proximity to major ports for component imports and finished goods exports. Manufacturing capabilities in this region continue to expand with significant investments from both domestic and international players.

Northern India represents the second-largest market segment with approximately 28% market share, centered around the National Capital Region and Haryana’s automotive corridor. This region benefits from strong government support, established automotive manufacturing presence, and growing consumer demand for premium vehicle features. The region’s strategic location provides excellent connectivity to both domestic and international markets.

Southern India accounts for roughly 20% of market share, with significant automotive manufacturing presence in Tamil Nadu and Karnataka. This region has emerged as a major hub for automotive component manufacturing and is attracting increasing investment in LED lighting technology. Research and development activities are particularly strong in this region, supported by the presence of major technology companies and educational institutions.

Eastern India represents a smaller but growing market segment with approximately 7% market share. While historically less developed in automotive manufacturing, this region is experiencing increased investment and development activity, particularly in commercial vehicle manufacturing and component production.

Market leadership is characterized by a diverse mix of international technology giants and emerging domestic players, creating a dynamic competitive environment that fosters innovation and competitive pricing strategies.

Competitive strategies focus on technological innovation, cost optimization, and strategic partnerships with automotive manufacturers. Companies are investing heavily in research and development to create differentiated products while building local manufacturing capabilities to serve the growing domestic market.

By Vehicle Type: The market segmentation reveals distinct patterns across different vehicle categories, with passenger vehicles leading adoption rates while commercial vehicles show increasing interest in LED technology.

By Application: Different lighting applications show varying adoption rates and growth patterns based on regulatory requirements and consumer preferences.

Premium Vehicle Segment leads LED adoption with comprehensive lighting systems that include adaptive headlights, dynamic turn signals, and sophisticated interior ambient lighting. This segment prioritizes advanced features and is willing to pay premium prices for cutting-edge LED technology. Luxury automotive brands use LED lighting as a key differentiator, incorporating unique design elements and advanced functionality.

Mid-Segment Vehicles represent the fastest-growing category for LED adoption, driven by improving cost-effectiveness and consumer demand for modern features. This segment typically adopts LED technology selectively, starting with headlights and daytime running lights before expanding to comprehensive LED lighting systems. Cost optimization remains crucial for this segment’s continued growth.

Entry-Level Segment shows increasing LED adoption, particularly for mandatory safety features such as daytime running lights. While comprehensive LED lighting systems remain limited in this segment due to cost constraints, selective adoption of LED technology is growing as costs continue to decline and regulations drive requirements.

Commercial Vehicle Category focuses primarily on durability, energy efficiency, and total cost of ownership benefits. LED adoption in this segment is driven by operational cost savings, reduced maintenance requirements, and improved safety performance. Fleet operators increasingly recognize the long-term value proposition of LED lighting systems.

Automotive Manufacturers benefit from LED technology through enhanced product differentiation, improved energy efficiency, and compliance with evolving safety regulations. LED lighting systems enable innovative design possibilities that help brands create distinctive visual identities while meeting stringent performance requirements. Manufacturing flexibility offered by LED technology allows for greater customization and model differentiation.

Component Suppliers gain access to a rapidly growing market with significant technological advancement opportunities. The shift toward LED technology creates demand for specialized components, electronic control systems, and advanced manufacturing capabilities. Value chain integration opportunities allow suppliers to expand their service offerings and strengthen customer relationships.

Consumers benefit from improved safety, enhanced vehicle aesthetics, and long-term cost savings through reduced energy consumption and maintenance requirements. LED lighting systems provide superior visibility, longer lifespan, and advanced features that enhance the overall driving experience. Energy efficiency becomes particularly valuable as fuel costs rise and environmental consciousness increases.

Government and Regulators achieve policy objectives related to vehicle safety, energy efficiency, and environmental protection through LED technology adoption. The technology supports broader goals of reducing energy consumption and improving road safety while fostering technological advancement in the automotive sector.

Strengths:

Weaknesses:

Opportunities:

Threats:

Smart Lighting Integration represents a major trend as automotive manufacturers incorporate connectivity features, adaptive lighting systems, and integration with vehicle telematics. These intelligent systems can adjust lighting patterns based on driving conditions, weather, and traffic situations, providing enhanced safety and user experience. Connected vehicle platforms enable remote lighting control and diagnostic capabilities.

Design Innovation continues to drive market evolution as LED technology enables increasingly sophisticated lighting designs. Dynamic turn signals, customizable ambient lighting, and distinctive daytime running light patterns help automotive brands create unique visual identities. Aesthetic differentiation becomes increasingly important in competitive automotive markets.

Cost Reduction Initiatives focus on making LED technology accessible across all vehicle segments through manufacturing optimization, economies of scale, and technological improvements. Local manufacturing expansion contributes to cost competitiveness while reducing supply chain risks and import dependencies.

Sustainability Focus drives adoption of LED technology as automotive manufacturers seek to reduce environmental impact through energy-efficient components. LED lighting systems support broader sustainability goals while providing operational benefits through reduced power consumption and longer lifespan.

Manufacturing Investments have accelerated significantly with major international LED manufacturers establishing production facilities in India to serve growing domestic demand and export opportunities. These investments bring advanced technology, create employment opportunities, and strengthen India’s position in the global automotive LED supply chain. Technology transfer initiatives are enhancing domestic capabilities and innovation potential.

Strategic Partnerships between international technology providers and domestic automotive manufacturers are reshaping the competitive landscape. These collaborations combine global technology expertise with local market knowledge and manufacturing capabilities, creating synergies that benefit all stakeholders. Joint ventures and licensing agreements are becoming increasingly common.

Regulatory Evolution continues with government authorities implementing stricter safety standards and energy efficiency requirements that favor LED technology adoption. Recent regulatory changes mandate daytime running lights and improved visibility standards, directly driving LED market growth. Policy support for electric vehicles further accelerates LED adoption.

Technology Advancement includes development of next-generation LED technologies such as micro-LEDs, OLEDs, and smart lighting systems. According to MarkWide Research analysis, these technological developments are creating new market segments and applications while improving performance and reducing costs of existing LED solutions.

Market Entry Strategies should focus on building strong local partnerships and establishing manufacturing capabilities to serve the cost-sensitive Indian market effectively. Companies entering this market need to balance technology advancement with cost optimization to succeed across different vehicle segments. Localization initiatives are crucial for long-term competitiveness and market penetration.

Investment Priorities should emphasize research and development capabilities, manufacturing infrastructure, and supply chain optimization. Companies need to invest in advanced manufacturing technologies and quality control systems to meet evolving market requirements. Technology development investments should focus on smart lighting systems and integration capabilities.

Partnership Development with automotive manufacturers, component suppliers, and technology providers can accelerate market penetration and capability building. Strategic alliances enable companies to leverage complementary strengths while sharing risks and investments. Collaboration opportunities exist throughout the value chain from raw materials to finished products.

Market Positioning strategies should differentiate based on technology leadership, cost competitiveness, or specialized applications depending on target segments. Companies need to clearly communicate value propositions while building brand recognition in the competitive market environment. Customer education initiatives can help accelerate adoption and market development.

Growth Trajectory indicates continued strong expansion for the India automotive LED lighting market, driven by increasing vehicle production, regulatory support, and technological advancement. MWR projections suggest the market will maintain robust growth rates as LED technology becomes standard across all vehicle segments. The transition from traditional lighting to LED systems is expected to accelerate significantly over the next five years.

Technology Evolution will focus on smart lighting systems, improved energy efficiency, and enhanced design flexibility. Emerging technologies such as adaptive lighting, connectivity features, and integration with autonomous vehicle systems will create new market opportunities. Innovation cycles are expected to accelerate as competition intensifies and consumer expectations evolve.

Market Maturation will bring increased standardization, improved quality control, and greater cost optimization across the supply chain. As the market develops, consolidation trends may emerge while specialized niche players find opportunities in specific applications or technologies. Competitive dynamics will continue to evolve as the market matures and new players enter.

Electric Vehicle Impact will significantly influence market development as India accelerates its transition toward electric mobility. The inherent energy efficiency advantages of LED lighting make it the natural choice for electric vehicles, creating substantial growth opportunities. Synergistic effects between electric vehicle adoption and LED lighting demand will drive market expansion.

India’s automotive LED lighting market stands at a pivotal juncture, characterized by robust growth potential, technological innovation, and evolving market dynamics. The convergence of regulatory support, consumer demand, and technological advancement creates a favorable environment for sustained market expansion. LED technology adoption has moved beyond premium vehicles to encompass mid-segment and entry-level categories, indicating broad-based market development.

Strategic opportunities abound for market participants willing to invest in technology development, manufacturing capabilities, and market development initiatives. The transition toward electric vehicles, smart lighting systems, and connected automotive technologies will create new growth avenues while reinforcing the fundamental value proposition of LED lighting systems. Market participants who successfully navigate the balance between innovation and cost optimization will be best positioned for long-term success.

Future success in this dynamic market will require continuous adaptation to evolving consumer preferences, regulatory requirements, and technological possibilities. As MarkWide Research analysis indicates, companies that invest in local capabilities, strategic partnerships, and technology advancement while maintaining focus on cost competitiveness will capture the greatest share of this expanding market opportunity. The India automotive LED lighting market represents a compelling growth story with significant potential for value creation across the entire ecosystem.

What is Automotive LED Lighting?

Automotive LED Lighting refers to the use of light-emitting diodes in vehicles for various lighting applications, including headlights, taillights, and interior lighting. This technology is known for its energy efficiency, longevity, and brightness compared to traditional lighting solutions.

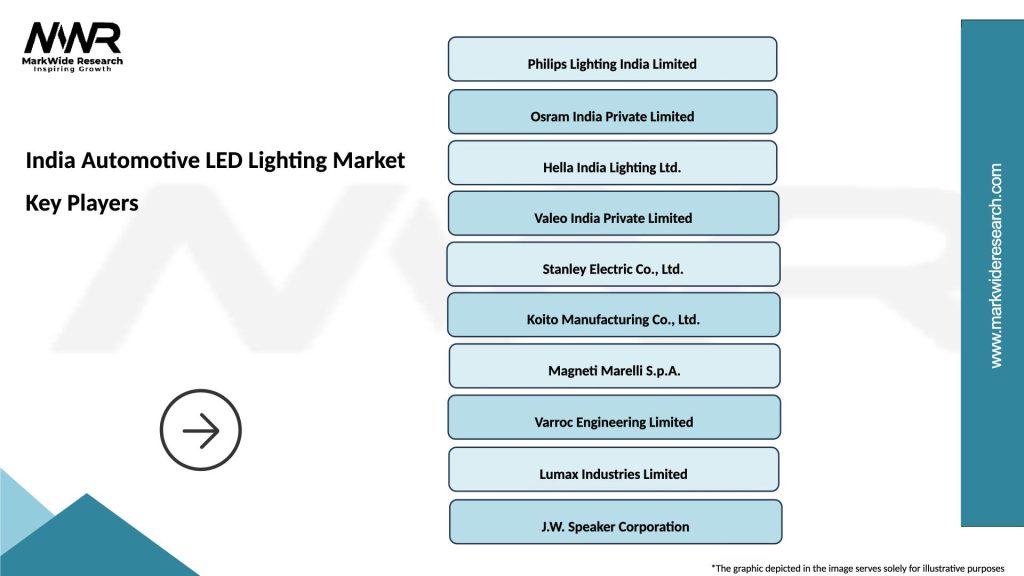

What are the key companies in the India Automotive LED Lighting Market?

Key companies in the India Automotive LED Lighting Market include Philips, Osram, and Hella, which are known for their innovative lighting solutions and extensive product ranges in the automotive sector, among others.

What are the drivers of growth in the India Automotive LED Lighting Market?

The growth of the India Automotive LED Lighting Market is driven by increasing vehicle production, rising consumer demand for energy-efficient lighting solutions, and advancements in automotive technology. Additionally, government regulations promoting energy efficiency are also contributing to market expansion.

What challenges does the India Automotive LED Lighting Market face?

The India Automotive LED Lighting Market faces challenges such as high initial costs of LED technology compared to traditional lighting, the need for specialized manufacturing processes, and competition from alternative lighting technologies. These factors can hinder widespread adoption in the automotive industry.

What opportunities exist in the India Automotive LED Lighting Market?

Opportunities in the India Automotive LED Lighting Market include the growing trend of electric vehicles, which often utilize LED lighting for efficiency, and the increasing focus on smart lighting solutions that enhance vehicle safety and aesthetics. Additionally, expanding aftermarket services present further growth potential.

What trends are shaping the India Automotive LED Lighting Market?

Trends in the India Automotive LED Lighting Market include the integration of smart technologies, such as adaptive lighting systems that adjust based on driving conditions, and the development of customizable lighting options for consumers. Furthermore, sustainability initiatives are pushing manufacturers to adopt eco-friendly practices in production.

India Automotive LED Lighting Market

| Segmentation Details | Description |

|---|---|

| Product Type | Headlights, Taillights, Fog Lights, Interior Lights |

| Technology | Halogen, Xenon, LED, Laser |

| End User | OEMs, Aftermarket Providers, Vehicle Assemblers, Tier-1 Suppliers |

| Application | Passenger Vehicles, Commercial Vehicles, Two-Wheelers, Electric Vehicles |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the India Automotive LED Lighting Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at