444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Asia Pacific automotive LED lighting market represents one of the most dynamic and rapidly evolving segments within the global automotive industry. This region has emerged as a powerhouse for automotive manufacturing and innovation, driving substantial demand for advanced lighting technologies. LED lighting systems have revolutionized vehicle illumination by offering superior energy efficiency, enhanced durability, and improved safety features compared to traditional halogen and xenon alternatives.

Market dynamics in the Asia Pacific region are particularly compelling due to the presence of major automotive manufacturing hubs in countries such as China, Japan, South Korea, India, and Thailand. The region accounts for approximately 65% of global automotive production, creating an enormous demand base for LED lighting components. Technological advancement and increasing consumer awareness about energy-efficient solutions have accelerated the adoption of LED lighting across various vehicle segments.

Growth trajectories indicate that the market is experiencing robust expansion, with projections showing a compound annual growth rate of 8.2% through 2030. This growth is primarily driven by stringent government regulations regarding vehicle safety, rising disposable incomes, and the increasing penetration of electric vehicles throughout the region. Premium vehicle segments are leading the adoption curve, while mass-market vehicles are rapidly incorporating LED technology as standard equipment.

The Asia Pacific automotive LED lighting market refers to the comprehensive ecosystem encompassing the design, manufacturing, distribution, and integration of light-emitting diode technology in vehicles across the Asia Pacific region. This market includes various lighting applications such as headlights, taillights, interior lighting, daytime running lights, and specialized automotive illumination systems.

LED technology in automotive applications represents a significant advancement over conventional lighting solutions, offering enhanced brightness, longer operational life, reduced power consumption, and superior design flexibility. The market encompasses both original equipment manufacturer (OEM) installations and aftermarket replacements, serving diverse vehicle categories from passenger cars to commercial vehicles and motorcycles.

Regional significance extends beyond mere component supply, as Asia Pacific serves as both a major production center and consumption market for automotive LED lighting. The market includes sophisticated supply chains connecting semiconductor manufacturers, LED component producers, automotive lighting system integrators, and vehicle manufacturers across multiple countries within the region.

Strategic positioning of the Asia Pacific automotive LED lighting market reflects the region’s dominance in global automotive manufacturing and its rapid adoption of advanced lighting technologies. The market demonstrates exceptional growth potential driven by multiple converging factors including regulatory mandates, technological innovations, and evolving consumer preferences toward energy-efficient vehicle components.

Key market drivers include the accelerating shift toward electric vehicles, which benefit significantly from LED lighting’s lower power consumption, and increasingly stringent safety regulations that mandate advanced lighting systems. The region’s automotive manufacturers are investing heavily in LED technology integration, with 75% of new vehicle models now incorporating LED lighting as either standard or optional equipment.

Competitive landscape features a mix of established global lighting manufacturers and emerging regional players, creating a dynamic environment for innovation and market expansion. Major automotive manufacturers in the region are increasingly partnering with LED lighting specialists to develop customized solutions that meet specific market requirements while maintaining cost competitiveness.

Future outlook suggests continued robust growth as the market benefits from ongoing technological advancements, expanding electric vehicle adoption, and increasing consumer awareness of LED lighting benefits. The integration of smart lighting systems and adaptive lighting technologies represents significant opportunities for market expansion and value creation.

Market penetration analysis reveals several critical insights that shape the Asia Pacific automotive LED lighting landscape:

Regulatory frameworks across Asia Pacific countries have become increasingly stringent regarding vehicle safety standards, creating mandatory requirements for advanced lighting systems. Governments in major markets including China, India, and ASEAN countries have implemented regulations that favor LED technology adoption due to its superior performance characteristics and energy efficiency benefits.

Electric vehicle proliferation serves as a primary catalyst for LED lighting adoption, as these vehicles require energy-efficient components to maximize battery range and performance. The region’s aggressive electric vehicle adoption targets, with several countries planning to phase out internal combustion engines, create substantial demand for LED lighting systems that complement electric powertrains.

Consumer preferences have evolved significantly toward vehicles offering advanced technology features and superior aesthetics. LED lighting provides both functional benefits and enhanced visual appeal, making it an attractive feature for consumers seeking modern, technologically advanced vehicles. The growing middle class in emerging markets particularly values these premium features.

Manufacturing cost reductions have made LED lighting increasingly accessible across vehicle segments. Economies of scale achieved through high-volume production in Asia Pacific manufacturing centers have driven down component costs, enabling broader market penetration beyond premium vehicle categories.

Technological advancement continues to drive market growth through the development of more efficient, durable, and feature-rich LED lighting solutions. Innovations in smart lighting, adaptive systems, and integrated connectivity features create new value propositions that attract both manufacturers and consumers.

Initial implementation costs remain a significant barrier for widespread LED adoption, particularly in price-sensitive market segments. While manufacturing costs have decreased, the initial investment required for LED lighting systems still exceeds traditional alternatives, creating challenges for budget-conscious consumers and manufacturers targeting entry-level vehicle segments.

Technical complexity associated with LED lighting systems requires specialized knowledge and infrastructure for proper installation, maintenance, and repair. This complexity can create barriers for smaller automotive service providers and may increase long-term ownership costs for consumers, particularly in markets with limited technical expertise.

Heat management challenges present ongoing technical obstacles for LED lighting implementation, especially in high-performance applications. Effective thermal management systems add complexity and cost to LED lighting solutions, potentially limiting adoption in certain vehicle categories or operating environments.

Supply chain dependencies create vulnerabilities for manufacturers relying on specialized LED components and materials. Disruptions in semiconductor supply chains, as experienced during recent global events, can significantly impact production schedules and market growth trajectories.

Standardization gaps across different countries within the Asia Pacific region create compliance challenges for manufacturers seeking to serve multiple markets. Varying regulatory requirements and technical standards can increase development costs and complicate market entry strategies.

Smart lighting integration represents a transformative opportunity as vehicles become increasingly connected and autonomous. The development of adaptive lighting systems that respond to driving conditions, traffic patterns, and environmental factors creates significant value-added opportunities for LED lighting manufacturers and automotive integrators.

Aftermarket expansion offers substantial growth potential as existing vehicle owners seek to upgrade their lighting systems. The large installed base of vehicles with traditional lighting creates a substantial retrofit market, particularly in countries with extended vehicle lifecycles and active modification cultures.

Commercial vehicle adoption presents significant untapped potential, as fleet operators increasingly recognize the operational benefits of LED lighting including reduced maintenance costs, improved safety, and enhanced fuel efficiency. The growing logistics and transportation sectors across Asia Pacific create substantial demand opportunities.

Emerging market penetration in countries such as Vietnam, Indonesia, and Bangladesh offers growth opportunities as these markets develop their automotive industries and consumer purchasing power increases. Early market entry in these regions can establish competitive advantages for LED lighting providers.

Technology convergence with other automotive systems including sensors, cameras, and communication modules creates opportunities for integrated solutions that provide enhanced functionality beyond basic illumination. These convergence opportunities can command premium pricing and create differentiated market positions.

Competitive intensity within the Asia Pacific automotive LED lighting market has increased significantly as both established global players and emerging regional manufacturers compete for market share. This competition drives continuous innovation, cost optimization, and service enhancement, ultimately benefiting end consumers through improved products and competitive pricing.

Supply chain evolution reflects the region’s strategic importance in global automotive manufacturing. Local component sourcing has increased by approximately 30% over recent years, reducing dependency on distant suppliers and improving supply chain resilience. This localization trend creates opportunities for regional suppliers while potentially challenging established global supply networks.

Technology transfer and knowledge sharing between developed and emerging markets within the region accelerate overall market development. Joint ventures, licensing agreements, and technology partnerships facilitate rapid capability building in emerging markets while providing established players with access to cost-effective manufacturing resources.

Investment patterns show increasing focus on research and development capabilities within the region. Major automotive manufacturers and lighting specialists are establishing regional R&D centers to develop solutions specifically tailored to Asia Pacific market requirements and preferences.

Market consolidation trends indicate ongoing merger and acquisition activity as companies seek to achieve scale economies and expand their technological capabilities. This consolidation creates both opportunities and challenges for market participants, potentially reshaping competitive dynamics over the medium term.

Comprehensive market analysis employed multiple research methodologies to ensure accurate and reliable insights into the Asia Pacific automotive LED lighting market. Primary research included extensive interviews with industry executives, automotive manufacturers, LED lighting specialists, and key stakeholders across major markets within the region.

Secondary research encompassed detailed analysis of industry reports, government publications, regulatory documents, and financial statements from publicly traded companies. This research provided historical context, market sizing information, and trend analysis essential for understanding market dynamics and future projections.

Data validation processes included cross-referencing multiple sources, conducting expert interviews for verification, and applying statistical analysis techniques to ensure data accuracy and reliability. Regional market experts provided local insights and cultural context essential for accurate market interpretation.

Quantitative analysis utilized advanced statistical modeling techniques to project market growth rates, segment performance, and regional variations. These models incorporated multiple variables including economic indicators, regulatory changes, and technological advancement rates to provide robust forecasting capabilities.

Qualitative assessment captured market nuances, competitive dynamics, and strategic implications that quantitative analysis alone cannot reveal. Expert opinions, industry observations, and strategic analysis provided depth and context to numerical findings, ensuring comprehensive market understanding.

China dominates the Asia Pacific automotive LED lighting market, accounting for approximately 45% of regional demand due to its massive automotive production capacity and rapidly growing domestic market. The country’s aggressive electric vehicle policies and substantial manufacturing infrastructure create favorable conditions for LED lighting adoption across all vehicle segments.

Japan maintains technological leadership in LED lighting innovation, contributing advanced manufacturing techniques and high-quality components to the regional market. Japanese manufacturers focus on premium applications and cutting-edge technologies, commanding 25% market share despite smaller production volumes compared to China.

South Korea represents a significant growth market with strong domestic automotive manufacturers increasingly adopting LED technology. The country’s emphasis on technology innovation and premium vehicle positioning drives above-average LED adoption rates, particularly in the luxury and electric vehicle segments.

India shows substantial growth potential as the automotive market expands and regulatory requirements become more stringent. While current LED penetration remains relatively low, government safety mandates and increasing consumer awareness are driving rapid adoption growth of approximately 12% annually.

ASEAN countries collectively represent an emerging opportunity as automotive production and consumption increase. Thailand, Indonesia, and Vietnam are experiencing growing demand for LED lighting as their automotive industries develop and consumer preferences evolve toward more advanced vehicle features.

Australia and New Zealand demonstrate high LED adoption rates due to stringent safety regulations and consumer preferences for advanced vehicle technologies. These markets serve as early adopters for new LED lighting innovations and premium applications.

Market leadership in the Asia Pacific automotive LED lighting sector is characterized by a diverse mix of global technology leaders and regional manufacturing specialists. The competitive environment fosters continuous innovation and cost optimization while serving diverse market segments with varying requirements and price sensitivities.

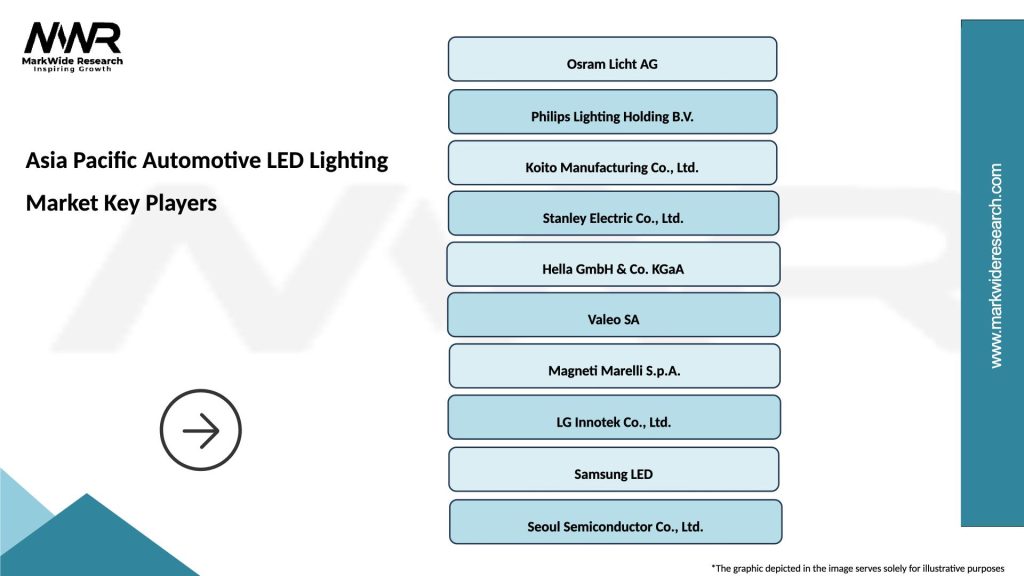

Key market participants include:

Strategic positioning varies among competitors, with some focusing on technological innovation and premium applications while others emphasize cost competitiveness and volume production. This diversity creates a dynamic competitive environment that serves different market segments effectively.

Partnership strategies are increasingly important as automotive manufacturers seek integrated lighting solutions that complement their vehicle designs and performance requirements. Long-term supply agreements and joint development programs characterize many successful competitive relationships in the market.

By Application:

By Vehicle Type:

By Technology:

Premium vehicle segment demonstrates the highest LED adoption rates, with luxury manufacturers using advanced lighting as a key differentiation factor. These applications often incorporate cutting-edge technologies such as adaptive lighting, matrix LED systems, and integrated smart features that command premium pricing and enhance brand positioning.

Mass market vehicles are experiencing rapid LED adoption as manufacturing costs decrease and regulatory requirements increase. Standard LED applications in this segment focus on reliability, cost-effectiveness, and compliance with safety regulations while providing improved performance compared to traditional lighting.

Electric vehicle category shows exceptional LED adoption rates due to the technology’s energy efficiency benefits. MarkWide Research analysis indicates that electric vehicles demonstrate 85% LED lighting adoption compared to conventional vehicles, reflecting the importance of energy conservation in electric powertrains.

Commercial vehicle applications increasingly recognize the operational benefits of LED lighting including reduced maintenance costs, improved safety, and enhanced visibility. Fleet operators particularly value the longer operational life and lower power consumption of LED systems, which translate to measurable cost savings over vehicle lifecycles.

Aftermarket segment represents significant growth potential as vehicle owners seek to upgrade existing lighting systems. This category benefits from increasing consumer awareness of LED benefits and the availability of retrofit solutions for older vehicles.

Automotive manufacturers benefit from LED lighting adoption through enhanced product differentiation, improved safety ratings, and reduced warranty costs. LED systems’ longer operational life and superior reliability reduce service requirements and enhance customer satisfaction, while advanced lighting features provide competitive advantages in increasingly crowded markets.

LED lighting suppliers gain access to a large and growing market with opportunities for long-term partnerships with automotive manufacturers. The automotive sector provides stable demand volumes and opportunities for technology development that can be leveraged across other applications and markets.

Consumers enjoy multiple benefits including improved visibility and safety, reduced energy consumption, longer component life, and enhanced vehicle aesthetics. LED lighting systems provide superior performance in various weather conditions and driving scenarios while requiring less maintenance than traditional alternatives.

Fleet operators realize significant operational advantages through reduced maintenance costs, improved fuel efficiency, and enhanced safety performance. The longer operational life of LED systems reduces vehicle downtime and maintenance expenses, while improved visibility contributes to accident reduction and insurance cost savings.

Regulatory authorities benefit from LED adoption through improved road safety statistics and reduced environmental impact. LED lighting’s superior performance characteristics support traffic safety objectives while lower energy consumption contributes to environmental sustainability goals.

Supply chain participants including component manufacturers, distributors, and service providers benefit from growing market demand and opportunities for specialization in LED-related products and services. The technology’s complexity creates opportunities for value-added services and specialized expertise.

Strengths:

Weaknesses:

Opportunities:

Threats:

Adaptive lighting systems are gaining significant traction as automotive manufacturers seek to differentiate their products through advanced technology features. These systems automatically adjust beam patterns, intensity, and direction based on driving conditions, traffic patterns, and environmental factors, providing enhanced safety and user experience.

Smart connectivity integration represents a transformative trend as LED lighting systems become connected components within broader vehicle networks. Integration with vehicle sensors, navigation systems, and external communication networks enables features such as predictive lighting adjustment and coordinated traffic management.

Design customization has become increasingly important as consumers seek personalized vehicle experiences. LED technology’s flexibility enables unique lighting signatures, customizable interior ambiance, and brand-specific design elements that enhance vehicle differentiation and emotional appeal.

Energy efficiency optimization continues to drive LED technology development, particularly as electric vehicles become more prevalent. Advanced LED systems now achieve efficiency improvements of 20-25% compared to earlier generations while providing enhanced functionality and reliability.

Manufacturing localization trends reflect the region’s strategic importance and supply chain resilience requirements. Major LED lighting manufacturers are establishing regional production facilities to serve local markets more effectively while reducing supply chain risks and transportation costs.

Sustainability focus is influencing LED lighting development through emphasis on recyclable materials, reduced environmental impact, and longer product lifecycles. These sustainability considerations align with broader automotive industry trends toward environmental responsibility and circular economy principles.

Strategic partnerships between automotive manufacturers and LED lighting specialists have intensified as companies seek to develop integrated solutions that meet specific market requirements. These collaborations often involve joint research and development programs, long-term supply agreements, and technology sharing arrangements.

Manufacturing capacity expansion across the region reflects growing market confidence and demand projections. Major LED lighting manufacturers have announced significant investments in new production facilities, particularly in China, India, and Southeast Asian countries, to serve growing regional demand.

Technology breakthroughs in LED efficiency, durability, and functionality continue to drive market evolution. Recent developments include improved thermal management systems, enhanced color rendering capabilities, and integration with advanced driver assistance systems.

Regulatory developments across Asia Pacific countries have established more stringent safety requirements and energy efficiency standards that favor LED lighting adoption. These regulations often include specific performance criteria and testing requirements that drive technology advancement and market standardization.

Investment activity in LED lighting technology companies has increased significantly as investors recognize the sector’s growth potential. Venture capital, private equity, and strategic investments are funding innovation and capacity expansion across the regional market.

Market consolidation through mergers and acquisitions has reshaped the competitive landscape as companies seek to achieve scale economies and expand their technological capabilities. These transactions often combine complementary strengths in technology, manufacturing, and market access.

Strategic positioning recommendations emphasize the importance of balancing cost competitiveness with technology innovation to serve diverse regional market requirements. Companies should develop portfolio strategies that address both premium and mass-market segments while maintaining technological differentiation.

Investment priorities should focus on manufacturing capacity expansion in key growth markets, particularly in emerging economies where automotive production is increasing rapidly. MWR analysis suggests that early market entry in developing countries can establish competitive advantages and customer relationships.

Technology development efforts should prioritize smart lighting integration, adaptive systems, and energy efficiency improvements that align with broader automotive industry trends. Companies should invest in capabilities that support electric vehicle requirements and autonomous driving applications.

Partnership strategies are essential for success in the fragmented and diverse Asia Pacific market. Strategic alliances with automotive manufacturers, technology partners, and regional distributors can provide market access, technical expertise, and scale advantages necessary for competitive success.

Supply chain optimization should emphasize regional sourcing and manufacturing to reduce costs, improve delivery times, and enhance supply chain resilience. Companies should develop flexible supply chain strategies that can adapt to changing market conditions and regulatory requirements.

Market entry strategies for emerging markets should consider local partnerships, gradual capacity building, and adaptation to local market requirements. Understanding cultural preferences, regulatory environments, and competitive dynamics is essential for successful market penetration.

Growth projections for the Asia Pacific automotive LED lighting market remain highly positive, with continued expansion expected across all major market segments. The convergence of regulatory requirements, technology advancement, and consumer preferences creates favorable conditions for sustained market growth over the next decade.

Technology evolution will likely focus on smart lighting systems that integrate with vehicle connectivity platforms and autonomous driving technologies. Advanced features such as communication-enabled lighting, predictive adjustment systems, and integrated sensor capabilities represent significant opportunities for market expansion and value creation.

Electric vehicle integration will continue to drive LED adoption as energy efficiency becomes increasingly critical for electric powertrain performance. The region’s aggressive electric vehicle adoption targets suggest that LED lighting will become standard equipment across most vehicle segments within the next five to seven years.

Market maturation in developed countries within the region will shift focus toward premium applications and advanced features, while emerging markets will drive volume growth through basic LED adoption. This dual dynamic creates opportunities for companies with diverse product portfolios and market strategies.

Regulatory evolution is expected to continue favoring LED technology through increasingly stringent safety and efficiency requirements. Government policies supporting electric vehicles and environmental sustainability will further accelerate LED adoption across the automotive sector.

Competitive dynamics will likely intensify as market growth attracts new entrants and drives consolidation among existing players. Success will depend on companies’ ability to balance cost competitiveness with technology innovation while building strong customer relationships and supply chain capabilities.

The Asia Pacific automotive LED lighting market represents a compelling growth opportunity characterized by strong fundamentals, favorable regulatory trends, and technological advancement. The region’s dominance in global automotive manufacturing, combined with rapidly evolving consumer preferences and regulatory requirements, creates an ideal environment for LED lighting adoption across all vehicle segments.

Market dynamics indicate continued robust growth driven by electric vehicle proliferation, smart technology integration, and expanding automotive production in emerging markets. The convergence of these trends with ongoing cost reductions and technology improvements suggests that LED lighting will become the dominant automotive lighting technology throughout the region within the current decade.

Strategic success in this market will require companies to balance innovation with cost competitiveness while building strong partnerships and regional capabilities. The diverse nature of Asia Pacific markets demands flexible strategies that can adapt to varying regulatory environments, consumer preferences, and competitive dynamics across different countries and market segments.

Future prospects remain highly positive as the Asia Pacific automotive LED lighting market continues to benefit from supportive regulatory frameworks, technological advancement, and growing consumer awareness of LED benefits. Companies that can effectively navigate the region’s complexity while delivering innovative, cost-effective solutions are well-positioned to capture significant value from this dynamic and rapidly expanding market opportunity.

What is Automotive LED Lighting?

Automotive LED Lighting refers to the use of light-emitting diodes (LEDs) in vehicles for various lighting applications, including headlights, taillights, and interior lighting. This technology is known for its energy efficiency, longevity, and ability to produce bright, high-quality light.

What are the key players in the Asia Pacific Automotive LED Lighting Market?

Key players in the Asia Pacific Automotive LED Lighting Market include Osram, Philips, and Cree, which are known for their innovative lighting solutions and extensive product ranges. These companies focus on enhancing vehicle safety and aesthetics through advanced LED technologies, among others.

What are the growth factors driving the Asia Pacific Automotive LED Lighting Market?

The growth of the Asia Pacific Automotive LED Lighting Market is driven by increasing vehicle production, rising consumer demand for energy-efficient lighting solutions, and advancements in automotive technology. Additionally, the shift towards electric vehicles is further propelling the adoption of LED lighting.

What challenges does the Asia Pacific Automotive LED Lighting Market face?

Challenges in the Asia Pacific Automotive LED Lighting Market include high initial costs of LED technology compared to traditional lighting, competition from alternative lighting solutions, and regulatory hurdles related to automotive safety standards. These factors can hinder market growth and adoption.

What opportunities exist in the Asia Pacific Automotive LED Lighting Market?

Opportunities in the Asia Pacific Automotive LED Lighting Market include the growing trend of smart lighting systems in vehicles, increasing investments in automotive R&D, and the rising popularity of connected cars. These trends are expected to create new avenues for innovation and market expansion.

What trends are shaping the Asia Pacific Automotive LED Lighting Market?

Trends shaping the Asia Pacific Automotive LED Lighting Market include the integration of adaptive lighting systems, the use of customizable LED designs, and the focus on sustainability through eco-friendly materials. These innovations are enhancing the functionality and appeal of automotive lighting solutions.

Asia Pacific Automotive LED Lighting Market

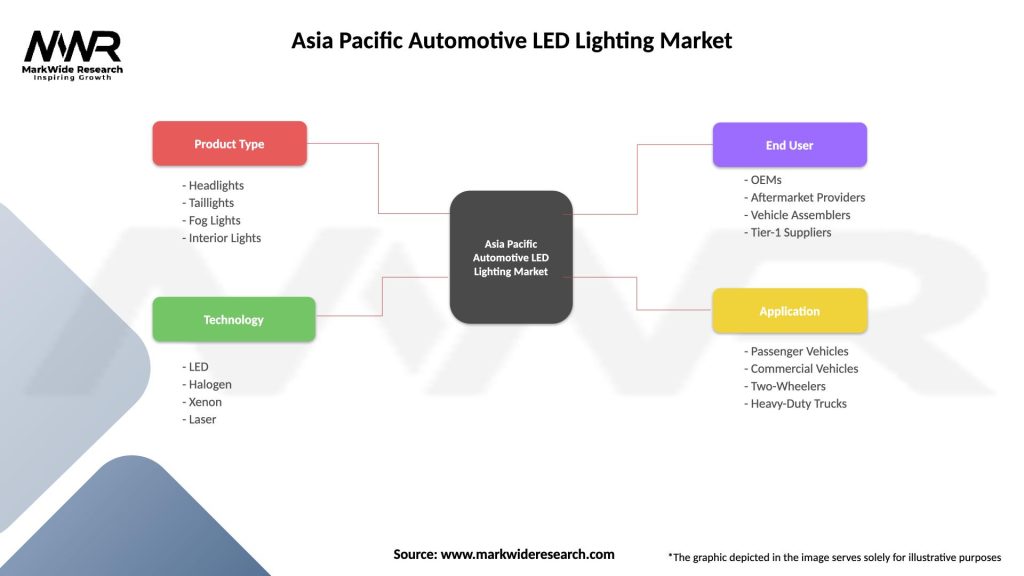

| Segmentation Details | Description |

|---|---|

| Product Type | Headlights, Taillights, Fog Lights, Interior Lights |

| Technology | LED, Halogen, Xenon, Laser |

| End User | OEMs, Aftermarket Providers, Vehicle Assemblers, Tier-1 Suppliers |

| Application | Passenger Vehicles, Commercial Vehicles, Two-Wheelers, Heavy-Duty Trucks |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Asia Pacific Automotive LED Lighting Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at