444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The North America compressor oil market represents a critical segment within the industrial lubricants industry, serving as the backbone for efficient compressor operations across diverse sectors. Market dynamics indicate robust growth driven by expanding manufacturing activities, increasing demand for compressed air systems, and technological advancements in compressor technologies. The region’s industrial infrastructure continues to evolve, with compressor oil playing an essential role in maintaining operational efficiency and equipment longevity.

Industrial expansion across North America has significantly influenced the compressor oil landscape, with manufacturing facilities, automotive plants, and energy production sites driving substantial demand. The market demonstrates steady growth patterns with a projected compound annual growth rate of 4.2% CAGR through the forecast period. Technological innovations in synthetic and semi-synthetic formulations have enhanced performance characteristics, extending maintenance intervals and improving overall system reliability.

Regional distribution shows the United States commanding approximately 78% market share, followed by Canada with 18% market presence, while Mexico contributes the remaining 4% market participation. End-user industries including manufacturing, automotive, oil and gas, and food processing continue to drive demand for high-performance compressor oils that meet stringent operational requirements and environmental standards.

The North America compressor oil market refers to the comprehensive ecosystem encompassing the production, distribution, and consumption of specialized lubricants designed for air compressors, gas compressors, and refrigeration compressors across the United States, Canada, and Mexico. Compressor oils serve as essential fluids that provide lubrication, cooling, and sealing functions within compressor systems, ensuring optimal performance and preventing premature equipment failure.

Market scope includes various oil types such as mineral-based, synthetic, and semi-synthetic formulations, each engineered to meet specific operational requirements and environmental conditions. Application diversity spans across industrial manufacturing, automotive production, energy generation, food processing, and commercial refrigeration systems. The market encompasses both original equipment manufacturer specifications and aftermarket replacement oils, catering to diverse customer needs and operational preferences.

Geographic coverage extends throughout North America, with distribution networks serving urban industrial centers, rural manufacturing facilities, and remote energy production sites. Market participants include global oil companies, specialty lubricant manufacturers, regional distributors, and end-user industries that rely on consistent compressor oil supply for uninterrupted operations.

Market performance in the North America compressor oil sector demonstrates resilient growth patterns supported by industrial expansion, technological advancement, and increasing emphasis on equipment efficiency. Key growth drivers include rising manufacturing activities, expanding energy production, and growing adoption of advanced compressor technologies requiring specialized lubricants. The market benefits from strong industrial base and continuous investment in manufacturing infrastructure across the region.

Competitive landscape features established global players alongside regional specialists, creating dynamic market conditions that foster innovation and customer-focused solutions. Product development trends emphasize extended drain intervals, enhanced thermal stability, and improved environmental compatibility. Synthetic oil adoption continues to gain momentum, representing approximately 35% market penetration due to superior performance characteristics and longer service life.

Regional dynamics show varying growth patterns, with the United States leading market development through robust industrial activities and technological innovation. Market challenges include raw material price volatility, environmental regulations, and increasing competition from alternative technologies. Future prospects remain positive, supported by ongoing industrial modernization, energy sector expansion, and growing emphasis on operational efficiency across end-user industries.

Market intelligence reveals several critical insights shaping the North America compressor oil landscape. Primary insights demonstrate the market’s strong correlation with industrial production cycles and manufacturing output levels:

Industrial expansion serves as the primary catalyst driving North America compressor oil market growth. Manufacturing renaissance across the region has created substantial demand for compressed air systems and associated lubricants. Automotive production continues to be a significant driver, with vehicle manufacturing facilities requiring reliable compressor systems for painting, assembly, and quality control processes.

Energy sector growth contributes significantly to market expansion, particularly in oil and gas production, renewable energy generation, and power plant operations. Natural gas processing facilities require specialized compressor oils for gas compression and transportation systems. Shale gas development has created additional demand for high-performance lubricants capable of operating under extreme conditions and extended service intervals.

Technological advancement in compressor design drives demand for specialized lubricants with enhanced performance characteristics. Equipment efficiency requirements push manufacturers toward synthetic and semi-synthetic formulations offering superior thermal stability and extended drain intervals. Maintenance cost reduction initiatives encourage adoption of premium oils that minimize downtime and extend equipment life, creating value propositions that justify higher initial costs through reduced total cost of ownership.

Raw material volatility presents significant challenges for compressor oil manufacturers, with base oil prices fluctuating based on crude oil markets and refinery capacity utilization. Cost pressures from volatile feedstock pricing impact profit margins and pricing strategies, particularly affecting smaller regional players with limited purchasing power. Supply chain disruptions occasionally affect product availability and delivery schedules, creating operational challenges for end users requiring consistent lubricant supply.

Environmental regulations impose increasing compliance costs and formulation constraints on compressor oil manufacturers. Emission standards require development of low-emission formulations, while waste disposal regulations increase operational costs for end users. Regulatory complexity varies across different states and provinces, creating compliance challenges for manufacturers serving multiple jurisdictions within North America.

Competition from alternatives includes oil-free compressor technologies and extended-life synthetic lubricants that reduce replacement frequency. Technology substitution in certain applications threatens traditional compressor oil demand, particularly in industries prioritizing environmental sustainability. Economic cyclicality affects industrial production levels, creating demand volatility that challenges inventory management and production planning for market participants.

Synthetic oil adoption presents substantial growth opportunities as end users increasingly recognize the value proposition of extended drain intervals and superior performance. Premium product segments offer higher margins and stronger customer relationships through technical service and support. Industrial modernization creates opportunities for specialized formulations designed for advanced compressor technologies and demanding operational conditions.

Emerging applications in renewable energy, data centers, and advanced manufacturing provide new market segments with specific performance requirements. Wind energy installations require specialized lubricants for turbine compressor systems, while data center cooling systems create demand for high-efficiency compressor oils. 3D printing and additive manufacturing facilities represent emerging opportunities for compressed air systems and associated lubricants.

Service integration opportunities allow manufacturers to expand beyond product sales into comprehensive lubrication management programs. Condition monitoring services combined with premium products create recurring revenue streams and stronger customer relationships. Digital solutions including IoT-enabled monitoring and predictive maintenance services represent value-added opportunities that differentiate market participants and justify premium pricing.

Supply-demand balance in the North America compressor oil market reflects broader industrial activity patterns and seasonal variations in manufacturing output. Demand fluctuations correlate with industrial production cycles, with peak periods typically occurring during spring and summer months when manufacturing activities intensify. Inventory management becomes critical for distributors and end users to ensure adequate supply during high-demand periods while minimizing carrying costs during slower periods.

Competitive dynamics feature intense rivalry among established players seeking to maintain market share while new entrants attempt to gain foothold through innovative products or competitive pricing. Product differentiation increasingly focuses on performance characteristics, service support, and total cost of ownership rather than price alone. Customer loyalty tends to be strong due to the critical nature of compressor operations and the risks associated with lubricant failure.

Technology evolution continues to reshape market dynamics as compressor manufacturers develop more efficient systems requiring specialized lubricants. Performance standards become increasingly stringent, driving demand for premium formulations and creating barriers to entry for lower-quality products. Market consolidation trends see larger players acquiring regional specialists to expand geographic coverage and technical capabilities, while maintaining local market knowledge and customer relationships.

Comprehensive analysis of the North America compressor oil market employs multiple research methodologies to ensure accuracy and reliability of findings. Primary research includes extensive interviews with industry participants, including manufacturers, distributors, and end users across various sectors. Secondary research encompasses analysis of industry publications, regulatory filings, and market intelligence from established sources.

Data collection methods include structured surveys of market participants, in-depth interviews with industry experts, and analysis of publicly available information from company reports and industry associations. Market sizing utilizes bottom-up and top-down approaches to validate findings and ensure consistency across different analytical frameworks. Trend analysis examines historical patterns and forward-looking indicators to identify emerging opportunities and potential challenges.

Validation processes include cross-referencing multiple data sources, expert review panels, and statistical analysis to ensure data accuracy and reliability. Regional analysis incorporates local market knowledge and cultural factors that influence purchasing decisions and market dynamics. Forecasting models utilize econometric analysis and scenario planning to project future market conditions under various economic and technological scenarios.

United States dominates the North America compressor oil market with approximately 78% market share, driven by extensive manufacturing infrastructure and diverse industrial base. Regional distribution shows concentration in the Great Lakes manufacturing corridor, Texas energy complex, and California industrial centers. Market characteristics include strong demand for premium products, emphasis on environmental compliance, and adoption of advanced maintenance practices.

Canada represents approximately 18% market participation, with demand concentrated in Ontario manufacturing regions, Alberta energy sector, and British Columbia industrial areas. Market dynamics reflect strong emphasis on cold-weather performance, extended service intervals, and environmental sustainability. Resource industries including mining, forestry, and energy production drive significant compressor oil demand with specific performance requirements for harsh operating conditions.

Mexico contributes 4% market presence with growing industrial base and expanding manufacturing sector. Market growth benefits from foreign direct investment, automotive production expansion, and energy sector development. Regional characteristics include price sensitivity, growing quality awareness, and increasing adoption of international standards. Distribution challenges include geographic dispersion and varying infrastructure quality across different regions.

Market leadership in the North America compressor oil sector features established global players with strong brand recognition and comprehensive product portfolios. Competitive positioning emphasizes technical expertise, product quality, and customer service capabilities. Key market participants include:

Competitive strategies include product innovation, technical service enhancement, and strategic partnerships with equipment manufacturers. Market differentiation increasingly focuses on total cost of ownership, environmental performance, and integrated service offerings rather than price competition alone.

Product segmentation in the North America compressor oil market reflects diverse application requirements and performance specifications. Primary categories include mineral-based oils, semi-synthetic formulations, and full synthetic products, each serving specific market segments with distinct value propositions.

By Oil Type:

By Application:

By End-User Industry:

Synthetic oil category demonstrates the strongest growth trajectory with approximately 8.5% annual growth rate, driven by increasing recognition of total cost of ownership benefits and superior performance characteristics. Market adoption accelerates in demanding applications where extended drain intervals and enhanced performance justify premium pricing. Technology advancement continues to improve synthetic formulations, expanding their applicability across diverse operating conditions.

Rotary screw compressor applications represent the largest market segment, accounting for approximately 55% application share due to widespread adoption in industrial and commercial settings. Performance requirements emphasize thermal stability, oxidation resistance, and extended service intervals. Market trends show increasing preference for synthetic and semi-synthetic formulations in this segment.

Manufacturing sector continues to drive substantial demand with diverse applications across automotive, aerospace, electronics, and general manufacturing industries. Quality requirements vary significantly based on specific applications, with automotive and aerospace sectors demanding premium formulations meeting stringent OEM specifications. Market dynamics reflect ongoing industrial modernization and increasing emphasis on operational efficiency.

Regional preferences show varying adoption patterns, with northern regions favoring cold-weather formulations while southern areas emphasize high-temperature performance. Seasonal variations affect demand patterns, with peak consumption typically occurring during spring and summer manufacturing seasons. Distribution strategies adapt to regional characteristics and customer preferences across different geographic markets.

Manufacturers benefit from growing market demand driven by industrial expansion and increasing emphasis on equipment efficiency. Revenue opportunities expand through premium product development, technical service offerings, and integrated lubrication management programs. Market positioning advantages accrue to companies investing in research and development, customer technical support, and sustainable product formulations.

Distributors gain value through comprehensive product portfolios, technical expertise, and strong supplier relationships. Service differentiation opportunities include inventory management, technical support, and condition monitoring services. Market expansion potential exists in emerging applications and underserved geographic regions requiring specialized distribution capabilities.

End users benefit from improved equipment reliability, extended maintenance intervals, and reduced total cost of ownership through premium compressor oil adoption. Operational advantages include minimized downtime, enhanced equipment performance, and improved energy efficiency. Cost benefits emerge from extended drain intervals, reduced maintenance requirements, and improved equipment longevity.

Equipment manufacturers gain competitive advantages through partnerships with lubricant suppliers, enabling optimized system performance and enhanced customer value propositions. Technical collaboration leads to improved equipment designs and specialized lubricant formulations meeting specific application requirements. Market opportunities expand through integrated offerings combining equipment and lubrication solutions.

Strengths:

Weaknesses:

Opportunities:

Threats:

Synthetic oil migration represents the most significant trend shaping the North America compressor oil market, with adoption rates increasing approximately 12% annually as end users recognize total cost of ownership benefits. Performance advantages including extended drain intervals, superior thermal stability, and enhanced equipment protection drive this transition despite higher initial costs. Technology advancement continues to improve synthetic formulations while reducing cost premiums.

Digitalization integration transforms traditional lubrication management through IoT-enabled monitoring systems and predictive maintenance capabilities. Smart lubrication solutions provide real-time performance data, enabling optimized maintenance schedules and preventing unexpected failures. Data analytics help end users maximize equipment uptime and minimize maintenance costs through condition-based maintenance practices.

Environmental sustainability increasingly influences product development and purchasing decisions across the market. Bio-based formulations gain traction in environmentally sensitive applications, while recyclable packaging and carbon footprint reduction become important selection criteria. Regulatory compliance drives development of low-emission formulations and environmentally responsible disposal practices.

Service model evolution sees manufacturers expanding beyond product sales into comprehensive lubrication management programs. Integrated offerings combine products, technical support, condition monitoring, and maintenance services to create value-added solutions. Customer relationships deepen through technical partnerships and collaborative problem-solving approaches that address specific operational challenges.

Product innovation continues to drive market evolution with manufacturers introducing advanced formulations designed for specific applications and operating conditions. Recent developments include ultra-long drain interval oils, extreme temperature formulations, and food-grade products meeting stringent safety requirements. Technology partnerships between lubricant manufacturers and equipment producers result in optimized system performance and enhanced customer value propositions.

Capacity expansion projects across North America reflect growing market confidence and demand projections. Manufacturing investments focus on synthetic oil production capabilities and specialized formulation facilities. Distribution enhancements include regional warehouse expansions and direct delivery capabilities to serve growing customer bases more effectively.

Acquisition activity shapes competitive landscape as larger players seek to expand geographic coverage and technical capabilities through strategic acquisitions. Market consolidation trends create opportunities for enhanced service offerings and improved operational efficiency. Partnership agreements between manufacturers and distributors strengthen market coverage and customer service capabilities.

Regulatory developments influence product formulations and market dynamics through environmental standards and safety requirements. Industry collaboration with regulatory agencies helps shape reasonable standards that protect environmental interests while maintaining operational effectiveness. Compliance initiatives drive investment in cleaner formulations and sustainable manufacturing practices across the industry.

MarkWide Research analysis indicates several strategic recommendations for market participants seeking to optimize their position in the North America compressor oil market. Product portfolio optimization should emphasize synthetic and semi-synthetic formulations to capture growing demand for premium products. Investment priorities should focus on research and development capabilities, technical service enhancement, and digital solution development.

Market expansion opportunities exist in emerging applications including renewable energy, data centers, and advanced manufacturing sectors. Geographic diversification within North America can help balance regional economic variations and seasonal demand patterns. Customer relationship management should emphasize technical partnerships and value-added services that differentiate offerings beyond price competition.

Technology investment in condition monitoring, predictive maintenance, and digital solutions creates competitive advantages and recurring revenue opportunities. Sustainability initiatives including bio-based formulations and environmental responsibility programs align with market trends and customer preferences. Supply chain optimization should focus on raw material security, inventory management, and distribution efficiency to maintain competitive positioning.

Strategic partnerships with equipment manufacturers, distributors, and technology providers can enhance market reach and technical capabilities. Talent development in technical sales, application engineering, and digital technologies supports long-term competitive positioning. Market intelligence systems should monitor emerging trends, competitive activities, and regulatory developments to enable proactive strategic responses.

Market prospects for the North America compressor oil sector remain positive, supported by ongoing industrial modernization, energy sector expansion, and increasing emphasis on operational efficiency. Growth projections indicate continued expansion at approximately 4.2% CAGR through the forecast period, driven by synthetic oil adoption and emerging application development. Technology advancement will continue to enhance product performance while creating new market opportunities.

Industry evolution toward integrated service offerings and digital solutions will reshape competitive dynamics and customer relationships. MWR projections suggest that companies successfully combining products with technical services and digital capabilities will capture disproportionate market share and profitability. Sustainability focus will increasingly influence product development and purchasing decisions across all market segments.

Regional dynamics will reflect broader economic trends, with the United States maintaining market leadership while Canada and Mexico contribute growing demand. Application diversification will reduce dependence on traditional industrial sectors while creating opportunities in emerging technologies and industries. Competitive landscape will continue evolving through consolidation, partnerships, and new market entrants bringing innovative solutions.

Long-term outlook remains favorable despite potential challenges from alternative technologies and economic cyclicality. Market resilience stems from the essential nature of compressor systems across diverse industries and the critical role of proper lubrication in equipment reliability. Innovation opportunities in formulation technology, service delivery, and digital integration will drive continued market development and value creation for industry participants.

North America compressor oil market demonstrates robust fundamentals supported by strong industrial infrastructure, technological advancement, and growing recognition of premium product benefits. Market dynamics reflect the essential nature of compressor lubrication across diverse industries while highlighting opportunities for innovation and service enhancement. Growth trajectory remains positive despite challenges from raw material volatility and economic cyclicality.

Strategic positioning for market success requires emphasis on synthetic formulations, technical service capabilities, and integrated solution offerings. Competitive advantages increasingly derive from total cost of ownership value propositions rather than price competition alone. Future opportunities exist in emerging applications, digital solutions, and sustainability-focused formulations that align with evolving market requirements and customer preferences.

Industry participants who successfully adapt to changing market dynamics through innovation, service enhancement, and strategic partnerships will capture disproportionate growth opportunities. Market evolution toward premium products and integrated services creates sustainable competitive advantages for companies investing in technical capabilities and customer relationships. The North America compressor oil market continues to offer attractive opportunities for growth and value creation across the industrial lubricants sector.

What is Compressor Oil?

Compressor oil is a lubricant specifically designed for use in compressors, helping to reduce friction, wear, and heat generation. It plays a crucial role in maintaining the efficiency and longevity of compressor systems across various applications, including refrigeration, air conditioning, and industrial processes.

What are the key players in the North America Compressor Oil Market?

Key players in the North America Compressor Oil Market include ExxonMobil, Chevron, and Shell, which offer a range of compressor oils tailored for different applications. These companies focus on innovation and quality to meet the diverse needs of industries such as automotive, manufacturing, and HVAC, among others.

What are the growth factors driving the North America Compressor Oil Market?

The North America Compressor Oil Market is driven by the increasing demand for energy-efficient systems and the growth of the HVAC industry. Additionally, advancements in compressor technology and rising industrial activities contribute to the market’s expansion.

What challenges does the North America Compressor Oil Market face?

The North America Compressor Oil Market faces challenges such as stringent environmental regulations and the high cost of synthetic oils. These factors can limit market growth and affect the adoption of new technologies in compressor lubrication.

What opportunities exist in the North America Compressor Oil Market?

Opportunities in the North America Compressor Oil Market include the development of bio-based lubricants and the increasing adoption of smart compressor systems. These innovations can enhance performance and sustainability in various applications, including refrigeration and industrial processes.

What trends are shaping the North America Compressor Oil Market?

Trends in the North America Compressor Oil Market include a shift towards synthetic and environmentally friendly oils, as well as the integration of IoT technologies in compressor systems. These trends aim to improve efficiency, reduce emissions, and enhance overall system performance.

North America Compressor Oil Market

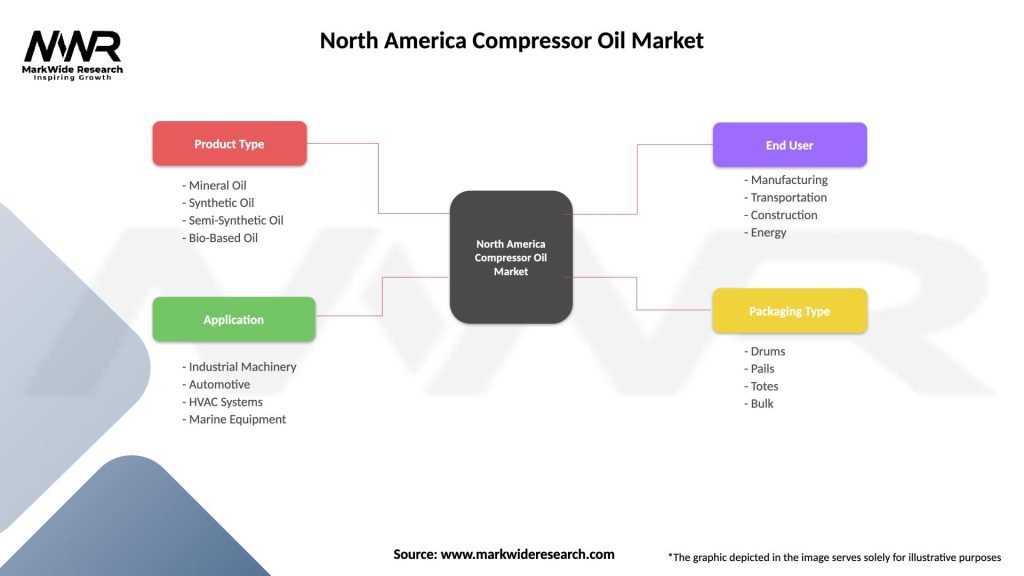

| Segmentation Details | Description |

|---|---|

| Product Type | Mineral Oil, Synthetic Oil, Semi-Synthetic Oil, Bio-Based Oil |

| Application | Industrial Machinery, Automotive, HVAC Systems, Marine Equipment |

| End User | Manufacturing, Transportation, Construction, Energy |

| Packaging Type | Drums, Pails, Totes, Bulk |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the North America Compressor Oil Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at