444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The North America satellite bus market represents a critical component of the region’s expanding space technology sector, encompassing the structural and functional backbone that supports satellite payloads across various orbital missions. Satellite bus systems provide essential services including power generation, thermal control, attitude determination, propulsion, and communication capabilities that enable satellites to operate effectively in space environments.

Market dynamics indicate robust growth driven by increasing demand for satellite-based services across telecommunications, earth observation, navigation, and defense applications. The region benefits from established aerospace infrastructure, advanced manufacturing capabilities, and significant government investment in space programs. Commercial space ventures are experiencing unprecedented expansion, with private companies launching constellation projects requiring hundreds of standardized satellite platforms.

Technological advancement continues reshaping the landscape, with manufacturers developing more efficient, cost-effective, and versatile bus architectures. The market demonstrates strong growth momentum, expanding at approximately 8.5% CAGR as demand intensifies for both traditional geostationary satellites and emerging low Earth orbit constellations. Integration capabilities between bus systems and diverse payload configurations remain crucial for market competitiveness.

Regional leadership in satellite manufacturing stems from decades of aerospace expertise, substantial research and development investments, and collaborative partnerships between government agencies, prime contractors, and specialized component suppliers. The market encompasses various satellite classes from small CubeSats to large geostationary platforms, each requiring tailored bus solutions.

The North America satellite bus market refers to the comprehensive ecosystem of companies, technologies, and services involved in designing, manufacturing, and supplying satellite platform systems that provide fundamental spacecraft functions independent of mission-specific payloads. Satellite bus platforms serve as the foundational infrastructure enabling satellites to maintain orbital position, generate power, regulate temperature, communicate with ground stations, and support payload operations throughout their operational lifetime.

Bus architecture encompasses multiple interconnected subsystems including structural frameworks, power generation and distribution systems, thermal management solutions, attitude and orbit control mechanisms, propulsion systems, and command and data handling capabilities. These integrated platforms must operate reliably in harsh space environments while providing standardized interfaces for various payload configurations.

Market scope includes both custom-designed bus solutions for specialized missions and standardized platforms optimized for constellation deployments. The sector serves diverse applications spanning commercial telecommunications, government defense programs, scientific research missions, earth observation services, and navigation system support.

North America’s satellite bus market demonstrates exceptional growth potential driven by expanding commercial space activities, government modernization programs, and increasing demand for satellite-enabled services. The region maintains technological leadership through continuous innovation in bus design, manufacturing processes, and system integration capabilities.

Key market drivers include the proliferation of satellite constellations, growing demand for broadband connectivity, enhanced earth observation requirements, and modernization of defense communication systems. Commercial operators are deploying large-scale constellation projects requiring standardized, cost-effective bus platforms capable of supporting diverse mission profiles.

Competitive landscape features established aerospace primes alongside emerging commercial space companies developing innovative bus architectures. Market participants focus on reducing manufacturing costs, improving system reliability, and enhancing platform versatility to address evolving customer requirements across multiple market segments.

Technology trends emphasize modular design approaches, electric propulsion integration, advanced materials utilization, and autonomous system capabilities. The market benefits from approximately 75% regional market share in global satellite bus manufacturing, reflecting strong industrial capabilities and established supply chain networks.

Strategic market analysis reveals several critical insights shaping the North America satellite bus landscape:

Market positioning reflects strong competitive advantages in advanced technology development, manufacturing scale, and established customer relationships across government and commercial sectors.

Primary growth drivers propelling the North America satellite bus market encompass multiple interconnected factors spanning technological advancement, market demand expansion, and strategic industry developments.

Satellite constellation deployment represents the most significant market driver, with multiple operators planning and implementing large-scale constellation projects requiring hundreds or thousands of standardized satellite platforms. These projects demand cost-effective, reliable bus solutions capable of supporting diverse payload configurations while maintaining consistent performance standards.

Commercial space sector growth continues accelerating as private companies expand satellite-based service offerings across telecommunications, earth observation, and data analytics markets. Investment capital flowing into commercial space ventures enables innovative bus development programs focused on reducing costs and improving operational efficiency.

Government modernization programs drive demand for advanced satellite bus technologies supporting defense communications, intelligence gathering, and scientific research missions. Space Force establishment and related defense initiatives emphasize the importance of resilient, capable satellite infrastructure requiring sophisticated bus platforms.

Broadband connectivity demand fuels satellite internet constellation development, requiring specialized bus architectures optimized for low Earth orbit operations. Digital transformation across industries increases reliance on satellite-enabled services, creating sustained demand for supporting infrastructure.

Technological advancement in subsystem components enables more capable, efficient bus designs that attract customers seeking enhanced performance and reduced operational costs. Manufacturing innovation reduces production timelines and costs, making satellite deployment more economically viable for diverse applications.

Market growth constraints present challenges that satellite bus manufacturers must navigate while pursuing expansion opportunities in the North America market.

High development costs associated with satellite bus design and qualification represent significant barriers for new market entrants and limit the pace of innovation for established players. Capital requirements for advanced manufacturing facilities and testing infrastructure create substantial financial commitments that may constrain smaller companies’ market participation.

Regulatory complexity surrounding satellite operations, spectrum allocation, and orbital debris mitigation creates compliance challenges that increase development timelines and costs. Export control restrictions limit international market opportunities and complicate supply chain management for companies seeking global expansion.

Technical risk factors inherent in space operations create potential liability concerns that may limit customer adoption of newer bus technologies. Mission failure consequences drive conservative decision-making processes that favor proven platforms over innovative alternatives, potentially slowing market adoption of advanced solutions.

Supply chain dependencies on specialized components and materials create vulnerability to disruptions that may impact production schedules and cost structures. Skilled workforce limitations in aerospace engineering and manufacturing specialties constrain industry capacity for rapid expansion.

Market saturation risks in certain satellite applications may limit long-term growth potential, particularly as constellation deployment phases complete and replacement cycles extend operational timelines.

Emerging opportunities within the North America satellite bus market present significant potential for growth and innovation across multiple strategic dimensions.

Small satellite market expansion creates opportunities for specialized bus platforms optimized for CubeSat and microsatellite applications. Standardization initiatives enable economies of scale that reduce per-unit costs while maintaining performance standards suitable for diverse mission requirements.

Electric propulsion integration opportunities allow bus manufacturers to develop more efficient platforms capable of extended operational lifetimes and enhanced maneuverability. Advanced materials adoption enables lighter, more durable bus structures that improve launch economics and operational performance.

Artificial intelligence integration presents opportunities for autonomous satellite operations that reduce ground control requirements and enhance system responsiveness. Edge computing capabilities embedded within bus architectures enable on-orbit data processing that reduces communication bandwidth requirements.

International market expansion opportunities exist for North American manufacturers seeking to leverage technological advantages in global markets. Public-private partnerships create collaborative opportunities that combine government resources with commercial innovation capabilities.

Servicing and logistics markets emerging around satellite constellation operations create demand for specialized bus platforms supporting orbital maintenance, refueling, and debris removal missions. Interplanetary exploration programs require advanced bus technologies capable of supporting deep space missions, representing high-value market opportunities.

Complex market dynamics shape the competitive landscape and strategic positioning within the North America satellite bus sector, reflecting interactions between technological evolution, customer requirements, and industry structure changes.

Competitive intensity increases as traditional aerospace contractors face competition from commercial space companies developing innovative bus solutions. Market consolidation trends create larger, more capable organizations while potentially reducing competitive diversity in certain market segments.

Customer behavior evolution reflects changing priorities emphasizing cost-effectiveness, rapid deployment capabilities, and operational flexibility over traditional performance maximization approaches. Procurement strategies increasingly favor commercial solutions that demonstrate proven reliability and cost advantages.

Technology convergence between terrestrial and space-based systems creates opportunities for cross-industry collaboration and component standardization. Manufacturing automation adoption enables higher production volumes and improved quality consistency while reducing labor dependencies.

Supply chain dynamics emphasize regional sourcing strategies that enhance security and reduce lead times for critical components. Vertical integration trends among major manufacturers aim to control key technologies and reduce external dependencies.

Investment patterns show increasing private capital allocation toward commercial space ventures, enabling rapid innovation cycles and market expansion. Government policy support through procurement preferences and research funding maintains industry competitiveness and technological leadership.

Comprehensive research methodology employed for analyzing the North America satellite bus market incorporates multiple data collection and analysis techniques to ensure accurate, reliable market insights.

Primary research activities include structured interviews with industry executives, technical specialists, and procurement decision-makers across government and commercial organizations. Survey methodologies capture quantitative data regarding market trends, technology preferences, and purchasing criteria from representative market participants.

Secondary research analysis encompasses review of industry publications, government reports, company financial statements, and technical documentation to validate primary findings and identify emerging trends. Patent analysis reveals innovation patterns and competitive positioning among key market participants.

Market modeling techniques utilize statistical analysis and forecasting methodologies to project market development scenarios based on identified drivers and constraints. Competitive intelligence gathering provides insights into strategic positioning, capability development, and market share dynamics.

Expert consultation with aerospace industry specialists, government officials, and academic researchers validates analytical findings and provides contextual interpretation of market developments. Data triangulation methods ensure consistency and reliability across multiple information sources.

Continuous monitoring of market developments, technology announcements, and competitive activities maintains current awareness of rapidly evolving market conditions and emerging opportunities.

Regional market distribution across North America reflects distinct competitive advantages, industrial capabilities, and market focus areas that shape overall sector development.

United States dominance accounts for approximately 85% regional market share, driven by established aerospace infrastructure, substantial government investment, and leading commercial space companies. California leadership in commercial space ventures concentrates significant bus development and manufacturing activities, while traditional aerospace centers in Colorado, Texas, and Florida maintain strong positions.

Canada’s contribution represents approximately 12% market share, focusing on specialized technologies including robotic systems, advanced materials, and satellite communication solutions. Canadian Space Agency programs and commercial partnerships with U.S. companies create collaborative opportunities that leverage complementary capabilities.

Mexico’s emerging role encompasses approximately 3% market share, primarily through manufacturing partnerships and component supply relationships with major North American satellite bus manufacturers. Aerospace cluster development in regions like Querétaro creates opportunities for expanded participation in satellite bus supply chains.

Cross-border collaboration strengthens regional competitiveness through integrated supply chains, shared technology development programs, and coordinated market strategies. USMCA trade agreement provisions support continued integration and collaboration across North American aerospace industries.

Regional advantages include proximity to major launch facilities, established supplier networks, skilled workforce availability, and supportive regulatory environments that facilitate satellite bus development and deployment activities.

Competitive dynamics within the North America satellite bus market feature established aerospace primes, emerging commercial space companies, and specialized technology providers competing across multiple market segments.

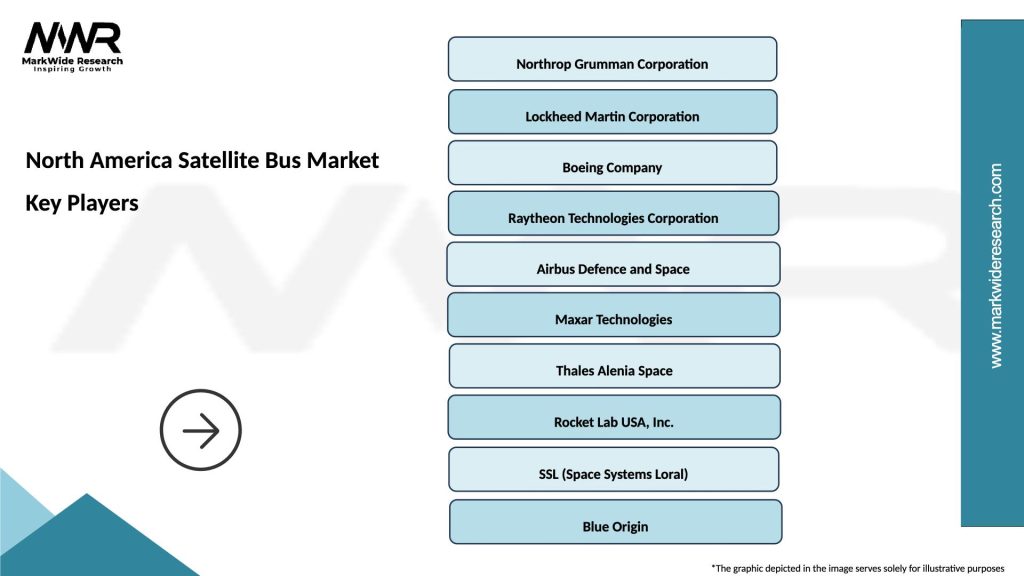

Leading market participants include:

Competitive strategies emphasize technology differentiation, cost reduction, manufacturing efficiency, and customer relationship development. Market positioning varies from full-service prime contractors to specialized component suppliers and innovative technology developers.

Strategic partnerships between established contractors and emerging companies create collaborative opportunities that combine proven capabilities with innovative approaches to address evolving market requirements.

Market segmentation analysis reveals distinct categories based on satellite size, orbit type, application focus, and customer segments that require tailored bus solutions.

By Satellite Size:

By Orbit Type:

By Application:

Small satellite bus segment demonstrates the highest growth rate at approximately 12% CAGR, driven by constellation deployment projects and commercial space venture expansion. Standardization efforts enable economies of scale that reduce per-unit costs while maintaining performance standards suitable for diverse applications.

LEO constellation platforms represent the fastest-growing orbit segment, with specialized bus architectures optimized for high-volume deployment and operational efficiency. Propulsion system integration becomes increasingly important for orbit maintenance and end-of-life disposal compliance.

Communication satellite applications maintain the largest market segment, though growth rates moderate as traditional geostationary markets mature. Broadband constellation projects create new opportunities for specialized LEO communication bus platforms.

Commercial customer segment shows approximately 60% market share and continues expanding as private companies develop satellite-based service offerings. Government applications maintain steady demand with emphasis on advanced capabilities and security requirements.

Modular bus architectures gain market acceptance by enabling customization while maintaining cost advantages through standardized subsystem components. Electric propulsion integration becomes standard for many applications, requiring bus design modifications to accommodate power and thermal requirements.

Manufacturing automation adoption enables higher production volumes and improved quality consistency, particularly important for constellation deployment projects requiring hundreds of identical platforms.

Industry participants across the North America satellite bus market ecosystem realize substantial benefits through strategic positioning and capability development.

Manufacturers benefit from:

Satellite operators gain:

Government stakeholders realize:

Strengths:

Weaknesses:

Opportunities:

Threats:

Transformative trends reshaping the North America satellite bus market reflect technological advancement, changing customer requirements, and evolving industry dynamics.

Standardization movement gains momentum as operators seek cost-effective solutions for large-scale constellation deployment. Modular architectures enable customization while maintaining economies of scale through standardized subsystem components and interfaces.

Electric propulsion adoption accelerates across multiple satellite classes, requiring bus design modifications to accommodate power generation, thermal management, and system integration requirements. Propulsion efficiency improvements enable extended operational lifetimes and enhanced maneuverability capabilities.

Artificial intelligence integration emerges as satellites require autonomous operation capabilities that reduce ground control dependencies and enhance system responsiveness. Machine learning algorithms embedded within bus systems enable predictive maintenance and operational optimization.

Manufacturing automation adoption increases production capacity and quality consistency while reducing labor dependencies. Additive manufacturing technologies enable complex component geometries and rapid prototyping capabilities that accelerate development cycles.

Sustainability focus drives development of bus systems optimized for end-of-life disposal and orbital debris mitigation. Green propulsion technologies reduce environmental impact while maintaining operational performance standards.

Software-defined architectures enable post-launch capability updates and mission flexibility through reconfigurable bus systems. Cybersecurity integration becomes essential as satellite systems face increasing security threats and attack vectors.

Recent industry developments demonstrate the dynamic nature of the North America satellite bus market and emerging trends shaping future growth directions.

Constellation deployment acceleration continues with multiple operators launching large-scale satellite networks requiring hundreds of standardized bus platforms. Manufacturing scale-up activities enable higher production volumes and reduced per-unit costs through automated assembly processes.

Technology partnerships between traditional aerospace contractors and commercial space companies create collaborative development programs that combine proven capabilities with innovative approaches. Vertical integration strategies among major manufacturers aim to control critical technologies and reduce supply chain dependencies.

Government program modernization drives demand for advanced satellite bus technologies supporting next-generation defense and civil space missions. Space Force initiatives emphasize resilient, capable satellite infrastructure requiring sophisticated bus platforms.

International collaboration expands through joint development programs and technology sharing agreements that leverage complementary capabilities across North American partners. Export opportunities grow as international customers seek advanced satellite bus technologies.

Investment activity increases as private capital flows into commercial space ventures developing innovative bus solutions and manufacturing capabilities. Acquisition strategies consolidate market participants and create larger, more capable organizations.

Regulatory developments address orbital debris mitigation, spectrum allocation, and space traffic management requirements that impact satellite bus design and operational requirements.

Strategic recommendations for North America satellite bus market participants focus on positioning for sustained growth and competitive advantage in an evolving industry landscape.

MarkWide Research analysis suggests that manufacturers should prioritize modular architecture development that enables standardization benefits while maintaining customization flexibility. Investment focus on automated manufacturing capabilities will prove essential for achieving cost competitiveness in high-volume constellation markets.

Technology integration strategies should emphasize electric propulsion, artificial intelligence, and software-defined architectures that enhance satellite capabilities and operational efficiency. Partnership development with emerging commercial space companies creates opportunities for collaborative innovation and market expansion.

Supply chain resilience requires diversification strategies that reduce dependencies on single-source components while maintaining quality and performance standards. Workforce development investments in aerospace engineering and manufacturing skills support long-term competitive positioning.

International market expansion opportunities should be pursued through strategic partnerships and technology licensing agreements that leverage North American technological advantages. Government relationship maintenance remains crucial for accessing defense and civil space program opportunities.

Sustainability initiatives should be integrated into bus design and manufacturing processes to address growing environmental concerns and regulatory requirements. Cybersecurity capabilities must be embedded throughout bus architectures to address emerging threat vectors.

Market positioning strategies should differentiate based on technology leadership, manufacturing scale, and customer service excellence rather than competing solely on price considerations.

Future market trajectory for the North America satellite bus sector indicates sustained growth driven by expanding commercial space activities, government modernization programs, and emerging application areas requiring advanced satellite capabilities.

Growth projections suggest continued expansion at approximately 8.2% CAGR through the next decade, with constellation deployment projects providing substantial near-term opportunities. Market maturation in traditional segments will be offset by emerging applications in areas such as space logistics, orbital manufacturing, and interplanetary exploration.

Technology evolution will emphasize autonomous systems, advanced materials, and integrated manufacturing approaches that reduce costs while enhancing performance capabilities. Electric propulsion becomes standard across most satellite classes, requiring corresponding bus architecture adaptations.

Commercial sector dominance continues expanding as private companies develop innovative business models and service offerings that require specialized satellite platforms. Government applications maintain steady demand with emphasis on advanced capabilities and security requirements.

International competitiveness remains strong through continued technology leadership and manufacturing excellence, though emerging competitors may challenge market position in cost-sensitive segments. MWR projections indicate that North American manufacturers will maintain approximately 70% global market share in high-performance satellite bus systems.

Regulatory environment evolution will address orbital debris mitigation, space traffic management, and cybersecurity requirements that impact satellite bus design and operational parameters. Sustainability considerations become increasingly important for market acceptance and regulatory compliance.

Investment patterns show continued private capital allocation toward commercial space ventures, enabling rapid innovation cycles and market expansion opportunities for satellite bus manufacturers.

North America’s satellite bus market represents a dynamic and rapidly evolving sector positioned for sustained growth through technological innovation, market expansion, and strategic industry developments. The region maintains strong competitive advantages through established aerospace infrastructure, advanced manufacturing capabilities, and substantial investment in research and development activities.

Market fundamentals remain robust, driven by expanding commercial space activities, government modernization programs, and increasing demand for satellite-enabled services across multiple application areas. Constellation deployment projects create substantial near-term opportunities while emerging applications in space logistics and interplanetary exploration provide long-term growth potential.

Technology trends emphasizing standardization, electric propulsion, artificial intelligence integration, and manufacturing automation will reshape competitive dynamics and operational approaches throughout the industry. Successful market participants will be those that effectively balance innovation investment with cost competitiveness while maintaining quality and reliability standards.

Strategic positioning requires focus on modular architectures, automated manufacturing capabilities, and collaborative partnerships that leverage complementary strengths across the industry ecosystem. Sustainability initiatives and cybersecurity capabilities become essential elements of competitive differentiation and market acceptance.

Future success in the North America satellite bus market will depend on organizations’ ability to adapt to evolving customer requirements, embrace technological advancement, and maintain operational excellence while pursuing sustainable growth strategies that create long-term value for stakeholders across the industry.

What is Satellite Bus?

A Satellite Bus is the structure and support system of a satellite, providing the necessary components for power, propulsion, thermal control, and communication. It serves as the foundation for various satellite payloads and is crucial for the satellite’s functionality in space.

What are the key players in the North America Satellite Bus Market?

Key players in the North America Satellite Bus Market include Boeing, Lockheed Martin, and Northrop Grumman, which are known for their advanced satellite technologies and manufacturing capabilities. These companies are involved in various satellite projects, including communication, Earth observation, and scientific missions, among others.

What are the growth factors driving the North America Satellite Bus Market?

The North America Satellite Bus Market is driven by increasing demand for satellite-based services, advancements in satellite technology, and the growing need for Earth observation and communication systems. Additionally, the rise of small satellite launches and the expansion of satellite constellations contribute to market growth.

What challenges does the North America Satellite Bus Market face?

Challenges in the North America Satellite Bus Market include high development costs, regulatory hurdles, and competition from emerging technologies such as small satellites and alternative communication methods. These factors can impact the pace of innovation and market entry for new players.

What opportunities exist in the North America Satellite Bus Market?

Opportunities in the North America Satellite Bus Market include the increasing demand for broadband connectivity, advancements in satellite miniaturization, and the potential for new applications in sectors like agriculture, disaster management, and environmental monitoring. These trends are likely to create new avenues for growth.

What trends are shaping the North America Satellite Bus Market?

Trends shaping the North America Satellite Bus Market include the shift towards small and medium-sized satellites, the integration of artificial intelligence for satellite operations, and the development of reusable launch systems. These innovations are expected to enhance satellite capabilities and reduce costs.

North America Satellite Bus Market

| Segmentation Details | Description |

|---|---|

| Product Type | Small Satellites, Medium Satellites, Large Satellites, CubeSats |

| Technology | Electric Propulsion, Chemical Propulsion, Hybrid Propulsion, Solar Power |

| End User | Government Agencies, Commercial Operators, Research Institutions, Defense |

| Deployment | Low Earth Orbit, Medium Earth Orbit, Geostationary Orbit, Polar Orbit |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the North America Satellite Bus Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at