444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Asia-Pacific satellite manufacturing market represents one of the most dynamic and rapidly evolving sectors in the global space industry. This region has emerged as a significant hub for satellite production, driven by increasing government investments in space programs, growing commercial satellite demand, and technological advancements in manufacturing capabilities. The market encompasses the design, development, and production of various satellite types including communication satellites, Earth observation satellites, navigation satellites, and scientific research satellites.

Regional governments across Asia-Pacific have demonstrated unprecedented commitment to space exploration and satellite technology development. Countries such as China, India, Japan, South Korea, and Australia have established robust space programs that fuel domestic satellite manufacturing capabilities. The market is experiencing substantial growth with projected expansion at a 12.5% CAGR through the forecast period, reflecting the region’s strategic focus on space technology independence and commercial satellite services.

Commercial satellite demand continues to surge across the region, driven by telecommunications expansion, broadband internet services, and Earth observation applications. The increasing adoption of small satellites and CubeSats has revolutionized the manufacturing landscape, enabling more cost-effective production methods and shorter development cycles. This trend has attracted numerous private companies and startups to enter the satellite manufacturing sector, creating a competitive and innovative market environment.

The Asia-Pacific satellite manufacturing market refers to the comprehensive ecosystem of companies, organizations, and facilities engaged in the design, development, assembly, testing, and production of artificial satellites within the Asia-Pacific region. This market encompasses all stages of satellite manufacturing from initial concept and design through final assembly and pre-launch testing.

Satellite manufacturing involves complex engineering processes that integrate advanced technologies including propulsion systems, communication equipment, power generation systems, attitude control mechanisms, and specialized payloads. The manufacturing process requires sophisticated clean room facilities, precision assembly techniques, and rigorous quality control measures to ensure satellites can withstand the harsh conditions of space and perform their intended functions reliably.

Market participants include government space agencies, established aerospace companies, emerging private manufacturers, component suppliers, and specialized service providers. The sector covers various satellite categories from large geostationary communication satellites weighing several tons to small CubeSats weighing just a few kilograms, each requiring different manufacturing approaches and capabilities.

Asia-Pacific’s satellite manufacturing sector has positioned itself as a critical component of the global space economy, demonstrating remarkable growth momentum and technological advancement. The region’s strategic investments in space infrastructure, combined with increasing commercial demand for satellite services, have created a thriving manufacturing ecosystem that serves both domestic and international markets.

Key market drivers include expanding telecommunications infrastructure needs, growing demand for Earth observation data, government space program initiatives, and the emergence of new space applications such as satellite-based internet services. The region accounts for approximately 35% of global satellite manufacturing capacity, with China and India leading in production volumes while Japan and South Korea excel in advanced technology development.

Manufacturing capabilities across the region have evolved significantly, with companies developing expertise in various satellite categories from traditional large satellites to innovative small satellite constellations. The market benefits from strong government support, increasing private sector participation, and growing international collaboration opportunities that enhance technological capabilities and market reach.

Future prospects remain highly positive, with emerging technologies such as artificial intelligence integration, advanced propulsion systems, and next-generation communication technologies driving continued innovation and market expansion throughout the forecast period.

Strategic market insights reveal several critical factors shaping the Asia-Pacific satellite manufacturing landscape:

Government space program investments serve as the primary catalyst for satellite manufacturing growth across Asia-Pacific. National space agencies in China, India, Japan, and other regional countries have allocated substantial budgets for satellite development programs, creating consistent demand for domestic manufacturing capabilities. These investments support both military and civilian satellite applications, driving technological advancement and production capacity expansion.

Commercial telecommunications demand continues to fuel satellite manufacturing growth as regional telecommunications companies expand coverage and capacity. The increasing need for high-speed internet services, particularly in remote and underserved areas, has created substantial demand for communication satellites. Mobile network operators are also investing in satellite-based services to complement terrestrial infrastructure and provide comprehensive coverage.

Earth observation applications represent a rapidly growing market segment driving satellite manufacturing demand. Applications including weather monitoring, agricultural assessment, disaster management, urban planning, and environmental monitoring require sophisticated Earth observation satellites. Government agencies and commercial organizations increasingly rely on satellite-based data for decision-making, creating sustained demand for specialized observation satellites.

Technological advancement opportunities in satellite miniaturization and cost reduction have opened new market segments and applications. The development of small satellites and CubeSats has democratized access to space, enabling universities, research institutions, and small companies to deploy satellites for various purposes. This trend has significantly expanded the addressable market for satellite manufacturers.

High capital investment requirements pose significant barriers to entry for new satellite manufacturing companies. Establishing satellite manufacturing facilities requires substantial investments in specialized equipment, clean room facilities, testing infrastructure, and skilled personnel. These capital requirements can limit market participation and slow the expansion of manufacturing capacity, particularly for smaller companies and startups.

Regulatory complexity across different Asia-Pacific countries creates challenges for manufacturers seeking to operate regionally. Varying export control regulations, licensing requirements, and technical standards can complicate cross-border operations and increase compliance costs. International Technology Transfer Regulations (ITAR) and other export control measures also restrict technology sharing and component sourcing options.

Technical complexity and risk associated with satellite manufacturing present ongoing challenges for market participants. Satellites must operate reliably in the harsh space environment for extended periods, requiring sophisticated design and manufacturing processes. Any technical failures can result in significant financial losses and damage to manufacturer reputations, creating pressure for extensive testing and quality assurance measures.

Supply chain dependencies for critical components and materials can create vulnerabilities for regional manufacturers. Many specialized satellite components are produced by a limited number of global suppliers, creating potential supply chain disruptions and cost fluctuations. Geopolitical tensions and trade restrictions can further complicate component sourcing and increase manufacturing costs.

Small satellite constellation deployment presents substantial growth opportunities for Asia-Pacific manufacturers. The increasing demand for satellite-based internet services, Earth observation data, and communication services is driving the development of large satellite constellations requiring hundreds or thousands of small satellites. This trend creates significant manufacturing volume opportunities and enables economies of scale.

International market expansion offers considerable growth potential for established regional manufacturers. As global demand for satellites continues to grow, Asia-Pacific companies can leverage their cost advantages and technical capabilities to compete for international contracts. Export opportunities in emerging markets and partnerships with global space agencies provide avenues for market expansion.

Advanced technology integration creates opportunities for manufacturers to develop next-generation satellite capabilities. Integration of artificial intelligence, advanced propulsion systems, software-defined satellites, and other emerging technologies can differentiate manufacturers and command premium pricing. These technological advances also enable new applications and market segments.

Public-private partnerships provide opportunities for manufacturers to participate in large-scale government space programs while sharing risks and costs. Collaborative arrangements between government agencies and private manufacturers can accelerate technology development, reduce individual company risks, and create sustainable business models for complex satellite programs.

Competitive dynamics within the Asia-Pacific satellite manufacturing market reflect a complex interplay between established aerospace companies, emerging private manufacturers, and government-backed entities. Traditional aerospace giants maintain advantages in large satellite production and complex mission requirements, while newer companies excel in small satellite manufacturing and innovative business models. This competitive environment drives continuous innovation and cost optimization efforts.

Technology evolution significantly impacts market dynamics as manufacturers adapt to changing customer requirements and emerging applications. The shift toward software-defined satellites, electric propulsion systems, and modular designs requires manufacturers to invest in new capabilities and production processes. Companies that successfully adapt to these technological changes gain competitive advantages and market share.

Customer demand patterns are evolving as satellite applications expand and new market segments emerge. Traditional government and military customers remain important, but commercial customers now represent a growing portion of demand. These commercial customers often have different requirements regarding cost, delivery schedules, and performance specifications, influencing manufacturing strategies and business models.

Supply chain dynamics play a crucial role in market competitiveness as manufacturers seek to optimize costs and reduce dependencies. Regional manufacturers are increasingly developing local supply chains and component manufacturing capabilities to improve cost competitiveness and reduce geopolitical risks. This trend toward supply chain localization creates opportunities for component suppliers and supports regional economic development.

Comprehensive market analysis for the Asia-Pacific satellite manufacturing market employs multiple research methodologies to ensure accuracy and completeness. Primary research involves direct engagement with industry participants including satellite manufacturers, component suppliers, government agencies, and end-users to gather firsthand insights on market conditions, trends, and future prospects.

Secondary research encompasses analysis of industry reports, government publications, company financial statements, technical papers, and trade association data. This approach provides historical context, market sizing information, and trend analysis that supports primary research findings. Academic research and patent analysis also contribute to understanding technological developments and innovation trends.

Expert interviews with industry leaders, government officials, and technical specialists provide qualitative insights that complement quantitative data. These discussions help identify emerging trends, assess market challenges, and evaluate future opportunities that may not be apparent from published sources alone.

Data validation processes ensure research accuracy through cross-referencing multiple sources, fact-checking with industry experts, and applying analytical frameworks to identify inconsistencies or gaps in available information. This rigorous approach enhances the reliability and credibility of market analysis and projections.

China dominates the Asia-Pacific satellite manufacturing landscape with the largest production capacity and most comprehensive manufacturing capabilities. Chinese manufacturers have achieved significant scale advantages and technological sophistication, producing satellites for both domestic and international markets. The country’s space program investments and commercial satellite demand support approximately 45% of regional manufacturing capacity.

India represents the second-largest satellite manufacturing market in the region, with strong capabilities in cost-effective satellite production and launch services. Indian manufacturers excel in small satellite production and have established a reputation for reliable, affordable satellite solutions. The country’s space program and commercial satellite services contribute approximately 25% of regional manufacturing activity.

Japan maintains technological leadership in advanced satellite systems and components, focusing on high-value, sophisticated satellite applications. Japanese manufacturers specialize in scientific satellites, advanced communication systems, and precision components that serve both domestic and international markets. Despite smaller production volumes, Japan contributes approximately 15% of regional manufacturing value.

South Korea has emerged as an important satellite manufacturing center with growing capabilities in communication satellites and small satellite systems. The country’s technology companies and government investments have created a competitive manufacturing sector that serves regional and international customers, representing approximately 10% of regional capacity.

Other regional markets including Australia, Singapore, and emerging space nations contribute the remaining manufacturing capacity while developing specialized capabilities and niche market positions.

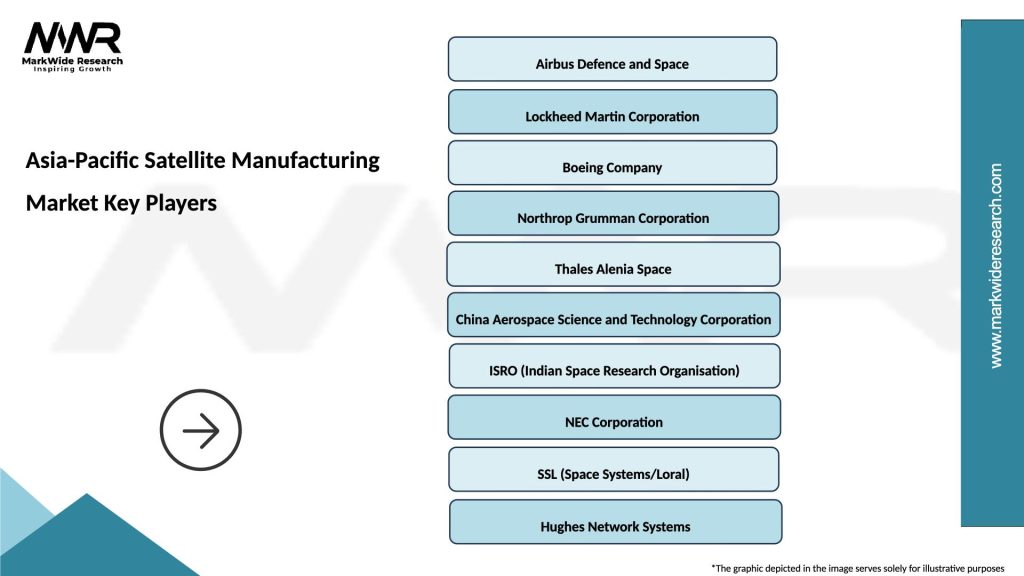

Major market participants in the Asia-Pacific satellite manufacturing sector include both established aerospace companies and emerging private manufacturers:

Competitive strategies focus on technological differentiation, cost optimization, and market expansion through international partnerships and export opportunities.

By Satellite Type:

By Satellite Size:

By End User:

Communication satellite manufacturing represents the largest market segment, driven by increasing demand for telecommunications services and satellite-based internet connectivity. Regional manufacturers have developed sophisticated capabilities in geostationary and low Earth orbit communication satellites, serving both domestic and international markets. The segment benefits from recurring replacement demand and expanding service requirements.

Earth observation satellite production has emerged as a rapidly growing segment with applications spanning weather monitoring, agricultural assessment, disaster management, and environmental monitoring. Manufacturers are developing specialized sensors and imaging capabilities to serve diverse customer requirements. The segment shows strong growth potential driven by increasing demand for satellite-based data and analytics.

Small satellite manufacturing has revolutionized the industry by enabling cost-effective access to space and shorter development cycles. Regional manufacturers have embraced this trend, developing production capabilities for small satellites and CubeSats that serve educational, research, and commercial applications. This segment demonstrates exceptional growth rates and attracts new market participants.

Navigation satellite production serves regional navigation systems and positioning services, with manufacturers developing capabilities to support domestic navigation infrastructure. While representing a smaller market segment, navigation satellites require specialized technologies and offer opportunities for technology development and export.

Manufacturers benefit from the growing Asia-Pacific satellite market through expanded business opportunities, technology development support, and access to diverse customer segments. The region’s competitive manufacturing costs and skilled workforce enable companies to achieve cost advantages while maintaining quality standards. Government support and investment programs provide financial backing and market stability for long-term business planning.

Government agencies gain access to domestic satellite manufacturing capabilities that support national security objectives, reduce dependency on foreign suppliers, and enable technology transfer and development. Regional manufacturing capabilities also support economic development goals and create high-skilled employment opportunities in advanced technology sectors.

Commercial customers benefit from competitive pricing, shorter delivery times, and customized solutions that address specific regional requirements. The proximity of manufacturers to regional markets enables better customer support and collaboration opportunities that enhance satellite system performance and reliability.

Technology suppliers and component manufacturers gain access to growing market opportunities as regional satellite production expands. The development of local supply chains creates business opportunities for specialized suppliers and supports technology transfer and capability development.

End users of satellite services benefit from improved service availability, competitive pricing, and enhanced capabilities as regional manufacturing capabilities expand and mature. Increased competition among manufacturers drives innovation and service improvements that benefit final customers.

Strengths:

Weaknesses:

Opportunities:

Threats:

Satellite miniaturization continues to reshape the manufacturing landscape as customers demand smaller, more cost-effective satellite solutions. This trend has enabled new applications and market segments while requiring manufacturers to develop new production capabilities and business models. The shift toward small satellites and CubeSats has democratized access to space and created opportunities for innovative manufacturers.

Software-defined satellites represent an emerging trend that enables greater flexibility and functionality through software updates and reconfiguration. This approach allows satellites to adapt to changing requirements during their operational life and provides opportunities for new service models and revenue streams. Manufacturers are investing in software capabilities and modular designs to support this trend.

Electric propulsion adoption is increasing as manufacturers seek to improve satellite efficiency and reduce launch costs. Electric propulsion systems enable satellites to reach their operational orbits more efficiently and extend their operational life, providing value to customers and competitive advantages for manufacturers who master this technology.

Artificial intelligence integration is beginning to transform satellite capabilities and operations, enabling autonomous decision-making, improved data processing, and enhanced system performance. Manufacturers are exploring AI applications in satellite design, manufacturing processes, and operational capabilities to create differentiated products and services.

Sustainable manufacturing practices are becoming increasingly important as environmental concerns and regulatory requirements drive demand for more sustainable satellite production and disposal methods. Manufacturers are investing in green technologies and circular economy approaches to address these requirements and market expectations.

Major capacity expansions across the region reflect growing market confidence and demand projections. Several leading manufacturers have announced significant investments in new production facilities and capability enhancements to serve expanding market opportunities. These investments demonstrate industry commitment to regional market development and technological advancement.

Strategic partnerships between regional manufacturers and international companies have accelerated technology transfer and market access opportunities. These collaborations enable regional companies to access advanced technologies while providing international partners with cost-effective manufacturing capabilities and regional market access.

Government policy initiatives supporting domestic satellite manufacturing have created favorable market conditions and investment incentives. New regulations, funding programs, and procurement policies have strengthened the competitive position of regional manufacturers and encouraged continued investment in capabilities and capacity.

Technology breakthrough announcements from regional manufacturers demonstrate growing technical capabilities and innovation potential. Recent developments in satellite design, manufacturing processes, and component technologies highlight the region’s emergence as a center for satellite technology innovation and development.

International contract awards to regional manufacturers validate their competitive capabilities and market acceptance. These successes demonstrate the growing recognition of Asia-Pacific manufacturers as reliable suppliers for critical satellite applications and international space programs.

MarkWide Research recommends that satellite manufacturers focus on developing specialized capabilities in high-growth market segments such as small satellites and Earth observation systems. Companies should invest in advanced manufacturing technologies and automation to maintain cost competitiveness while improving quality and production efficiency.

Strategic partnerships with international companies and technology providers can accelerate capability development and market access opportunities. Manufacturers should pursue collaborative arrangements that provide access to advanced technologies while leveraging regional cost advantages and market knowledge.

Supply chain development represents a critical success factor for long-term competitiveness. Companies should invest in local supplier development and component manufacturing capabilities to reduce dependencies and improve cost structures while supporting regional economic development objectives.

Technology investment priorities should focus on emerging areas such as software-defined satellites, artificial intelligence integration, and advanced propulsion systems. These technologies will likely determine competitive positioning in future market segments and provide opportunities for differentiation and premium pricing.

International market expansion strategies should leverage regional cost advantages and technical capabilities to compete for global contracts and partnerships. Companies should develop export capabilities and international business development resources to capitalize on growing global demand for satellite systems and services.

Long-term growth prospects for the Asia-Pacific satellite manufacturing market remain highly positive, supported by continued government investments, expanding commercial demand, and technological advancement opportunities. The market is expected to maintain robust growth rates throughout the forecast period as regional capabilities mature and international recognition increases.

Technology evolution will continue to drive market transformation as manufacturers adapt to changing customer requirements and emerging applications. The integration of artificial intelligence, advanced materials, and new propulsion technologies will create opportunities for innovation and differentiation while potentially disrupting traditional market segments.

Market consolidation may occur as smaller manufacturers seek partnerships or acquisition opportunities to achieve scale advantages and access advanced technologies. This trend could strengthen the competitive position of leading manufacturers while creating opportunities for strategic investors and technology companies.

International competitiveness of regional manufacturers is expected to continue improving as capabilities mature and cost advantages are maintained. Asia-Pacific manufacturers are likely to capture increasing shares of global satellite manufacturing demand, particularly in cost-sensitive market segments and high-volume applications.

Emerging applications such as satellite-based internet services, space manufacturing, and advanced Earth observation capabilities will create new market opportunities and drive continued investment in manufacturing capabilities. These applications may require new technologies and production approaches that favor innovative and agile manufacturers.

The Asia-Pacific satellite manufacturing market has established itself as a critical component of the global space economy, demonstrating remarkable growth momentum and technological sophistication. Regional manufacturers have successfully leveraged cost advantages, government support, and technical capabilities to compete effectively in both domestic and international markets while serving diverse customer requirements across multiple satellite applications.

Market fundamentals remain strong with continued government investments in space programs, expanding commercial satellite demand, and emerging applications driving sustained growth opportunities. The region’s manufacturers have demonstrated their ability to adapt to changing market conditions and technological requirements while maintaining competitive advantages in cost and quality.

Future success will depend on continued investment in advanced technologies, supply chain development, and international market expansion capabilities. Companies that successfully navigate these challenges while leveraging regional advantages are well-positioned to capture growing market opportunities and establish leadership positions in the global satellite manufacturing industry. The Asia-Pacific satellite manufacturing market is poised for continued expansion and technological advancement, supporting both regional economic development and global space industry growth.

What is Satellite Manufacturing?

Satellite manufacturing involves the design, assembly, and testing of satellites for various applications, including communication, Earth observation, and scientific research.

What are the key players in the Asia-Pacific Satellite Manufacturing Market?

Key players in the Asia-Pacific Satellite Manufacturing Market include Boeing, Lockheed Martin, and Airbus, among others.

What are the main drivers of growth in the Asia-Pacific Satellite Manufacturing Market?

The main drivers of growth in the Asia-Pacific Satellite Manufacturing Market include increasing demand for satellite-based communication services, advancements in satellite technology, and the rising need for Earth observation data.

What challenges does the Asia-Pacific Satellite Manufacturing Market face?

Challenges in the Asia-Pacific Satellite Manufacturing Market include high manufacturing costs, regulatory hurdles, and competition from emerging space economies.

What opportunities exist in the Asia-Pacific Satellite Manufacturing Market?

Opportunities in the Asia-Pacific Satellite Manufacturing Market include the growing demand for small satellites, advancements in satellite miniaturization, and increased investment in space exploration initiatives.

What trends are shaping the Asia-Pacific Satellite Manufacturing Market?

Trends shaping the Asia-Pacific Satellite Manufacturing Market include the rise of commercial satellite launches, the integration of artificial intelligence in satellite operations, and the development of mega-constellations for global internet coverage.

Asia-Pacific Satellite Manufacturing Market

| Segmentation Details | Description |

|---|---|

| Product Type | Communication Satellites, Earth Observation Satellites, Navigation Satellites, Scientific Satellites |

| Technology | Geostationary Orbit, Low Earth Orbit, Medium Earth Orbit, Hybrid Systems |

| End User | Government Agencies, Commercial Enterprises, Research Institutions, Defense Organizations |

| Application | Telecommunications, Weather Monitoring, Remote Sensing, Global Positioning |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Asia-Pacific Satellite Manufacturing Market

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at