444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Asia-Pacific satellite launch vehicle market represents one of the most dynamic and rapidly expanding segments in the global aerospace industry. This region has emerged as a significant player in space technology, driven by increasing government investments, growing commercial satellite deployment needs, and rising demand for earth observation and communication services. The market encompasses various types of launch vehicles, from small satellite launchers to heavy-lift rockets capable of deploying multiple payloads into different orbital configurations.

Regional dynamics indicate that countries like China, India, Japan, and South Korea are leading the charge in developing indigenous launch capabilities. The market is experiencing robust growth at a CAGR of approximately 8.2%, reflecting the region’s commitment to space exploration and satellite technology advancement. Commercial applications are driving significant demand, with telecommunications, navigation, and remote sensing satellites requiring reliable and cost-effective launch solutions.

Technological innovation continues to reshape the landscape, with reusable launch vehicles, advanced propulsion systems, and improved payload capacity becoming key differentiators. The region’s strategic focus on reducing launch costs while maintaining high reliability standards has attracted both domestic and international satellite operators, creating a competitive environment that benefits end users through improved services and reduced operational expenses.

The Asia-Pacific satellite launch vehicle market refers to the comprehensive ecosystem of rocket systems, launch services, and supporting infrastructure designed to deploy satellites and other payloads into various Earth orbits within the Asia-Pacific region. This market encompasses the entire value chain from launch vehicle manufacturing and testing to mission planning, launch operations, and post-launch support services.

Launch vehicles in this context include expendable launch vehicles, reusable rocket systems, small satellite launchers, medium-lift rockets, and heavy-lift launch systems. The market serves diverse customer segments including government space agencies, commercial satellite operators, telecommunications companies, defense organizations, and scientific research institutions requiring orbital deployment capabilities.

Geographic scope covers major space-faring nations including China, India, Japan, South Korea, Australia, and emerging players like Thailand, Malaysia, and Indonesia. Each country contributes unique capabilities, from advanced rocket technology and manufacturing expertise to launch site infrastructure and mission support services, creating a comprehensive regional ecosystem for satellite deployment.

Market momentum in the Asia-Pacific satellite launch vehicle sector continues to accelerate, driven by unprecedented demand for satellite-based services across telecommunications, navigation, earth observation, and defense applications. The region has established itself as a cost-effective alternative to traditional Western launch providers while maintaining competitive reliability and performance standards.

Key growth drivers include increasing government space budgets, rising commercial satellite constellation deployments, and growing demand for small satellite launch services. The market benefits from a 65% increase in regional satellite deployment requirements over the past five years, reflecting the expanding digital economy and connectivity needs across Asia-Pacific nations.

Competitive landscape features both established players with decades of launch experience and emerging companies developing innovative solutions for specific market segments. The region’s focus on developing indigenous launch capabilities has reduced dependence on foreign providers while creating opportunities for technology transfer and collaborative development programs.

Future prospects remain highly positive, with multiple countries expanding their launch capabilities and new market entrants developing specialized solutions for emerging applications like satellite internet constellations, earth observation networks, and space-based manufacturing platforms.

Strategic positioning within the global launch services market has strengthened significantly, with Asia-Pacific providers capturing an increasing share of international launch contracts. The region’s competitive advantages include cost-effective manufacturing, skilled technical workforce, and government support for space industry development.

Government initiatives across the region continue to provide substantial momentum for market growth. National space programs in China, India, Japan, and South Korea have allocated significant resources to developing indigenous launch capabilities, creating a foundation for commercial market expansion. These investments have resulted in advanced manufacturing facilities, skilled workforce development, and comprehensive testing infrastructure.

Commercial satellite demand represents the primary growth catalyst, with telecommunications companies, earth observation providers, and navigation service operators requiring reliable launch services. The proliferation of small satellite constellations has created new market segments requiring frequent, cost-effective launch opportunities that regional providers are well-positioned to serve.

Digital transformation across Asia-Pacific economies drives increasing demand for satellite-based connectivity, particularly in remote and underserved regions. This trend supports sustained growth in communication satellite deployments, creating consistent demand for launch services across various payload categories and orbital requirements.

Defense and security considerations motivate governments to develop independent launch capabilities, reducing reliance on foreign providers for critical national security satellites. This strategic imperative ensures continued government support and investment in domestic launch vehicle development programs.

Technical complexity and high development costs present significant barriers for new market entrants. Launch vehicle development requires substantial capital investment, advanced engineering expertise, and extensive testing programs that can span multiple years before achieving operational capability. These requirements limit the number of viable competitors and create challenges for smaller companies seeking market entry.

Regulatory frameworks vary significantly across different countries, creating compliance challenges for companies operating in multiple markets. Export control regulations, licensing requirements, and safety standards differ between nations, complicating international business development and technology transfer activities.

Insurance and liability considerations add complexity and cost to launch operations. The inherent risks associated with rocket launches require comprehensive insurance coverage, which can be expensive and sometimes difficult to obtain for newer providers without established track records of successful missions.

Competition from established global providers continues to pressure pricing and market share. Well-established Western launch companies with decades of operational experience and strong customer relationships present ongoing competitive challenges for regional providers seeking to expand their market presence.

Small satellite revolution creates unprecedented opportunities for specialized launch providers. The growing demand for frequent, dedicated small satellite launches has opened new market segments that traditional heavy-lift providers cannot serve cost-effectively. This trend favors agile regional companies developing purpose-built small satellite launch vehicles.

Emerging applications in space-based manufacturing, orbital debris removal, and space tourism represent future growth opportunities. These new market segments require innovative launch solutions and create potential for early movers to establish market leadership positions before competition intensifies.

International collaboration opportunities continue expanding as global satellite operators seek cost-effective launch alternatives. Regional providers can leverage competitive pricing and technical capabilities to win contracts from international customers, expanding their market reach beyond domestic boundaries.

Technology advancement in reusable launch systems presents opportunities to dramatically reduce launch costs while improving operational efficiency. Companies successfully developing reusable technology could gain significant competitive advantages and capture larger market shares across multiple customer segments.

Supply and demand dynamics continue evolving as satellite deployment requirements grow faster than available launch capacity in certain market segments. This imbalance creates opportunities for new providers while supporting pricing stability for existing operators. The market demonstrates strong elasticity, with demand responding positively to cost reductions and service improvements.

Competitive intensity varies significantly across different market segments. Heavy-lift launch services remain dominated by established players, while small satellite launch services show greater competition and innovation. This segmentation allows companies to focus on specific niches where they can develop competitive advantages and sustainable market positions.

Technology evolution drives continuous market transformation, with advances in propulsion systems, materials science, and manufacturing processes creating opportunities for performance improvements and cost reductions. Companies investing in research and development maintain advantages over competitors relying on legacy technologies.

Customer relationships play crucial roles in market success, with satellite operators preferring proven providers with strong track records. New entrants must demonstrate reliability through successful missions before gaining access to larger, more lucrative contracts from risk-averse customers.

Comprehensive analysis of the Asia-Pacific satellite launch vehicle market employs multiple research methodologies to ensure accuracy and completeness. Primary research includes interviews with industry executives, government officials, and technical experts across major space-faring nations in the region. These discussions provide insights into market trends, competitive dynamics, and future development plans.

Secondary research encompasses analysis of government publications, industry reports, technical papers, and financial statements from publicly traded companies. This information provides quantitative data on market performance, investment levels, and technological capabilities across different market segments and geographic regions.

Market modeling techniques incorporate historical performance data, announced development programs, and projected satellite deployment requirements to forecast future market growth. These models account for various scenarios including different levels of government support, technological advancement rates, and competitive dynamics.

Validation processes ensure research accuracy through cross-referencing multiple data sources, expert review panels, and sensitivity analysis of key assumptions. This rigorous approach provides confidence in market projections and strategic recommendations for industry participants and stakeholders.

China dominates the regional market with the most comprehensive launch vehicle portfolio and highest launch frequency. The country’s space program operates multiple launch sites and maintains diverse rocket families serving different payload requirements. Chinese providers have captured approximately 45% of regional market share through competitive pricing and reliable performance across various mission profiles.

India represents the second-largest market participant with strong capabilities in cost-effective satellite launches. The Indian Space Research Organisation has developed efficient launch vehicles particularly suited for small and medium satellites, attracting international customers seeking affordable launch solutions. India’s market share stands at approximately 25% of regional activity.

Japan maintains technological leadership in certain specialized areas, particularly precision orbit insertion and payload handling systems. Japanese launch providers focus on high-value missions requiring exceptional accuracy and reliability, serving both domestic and international customers with premium requirements.

South Korea has emerged as a significant player with ambitious development programs aimed at achieving independent launch capability. The country’s investment in indigenous rocket technology and launch infrastructure positions it for increased market participation in coming years.

Australia and other regional countries are developing niche capabilities, particularly in small satellite launch services and ground support systems. These emerging markets contribute to overall regional growth while creating opportunities for specialized service providers.

Market leadership is distributed among several key players, each with distinct competitive advantages and market positioning strategies. The competitive environment encourages innovation while maintaining focus on reliability and cost-effectiveness that customers demand.

Competitive strategies vary significantly, with established players leveraging operational experience and customer relationships while newer entrants focus on technological innovation and specialized market segments. This diversity creates a dynamic competitive environment benefiting customers through improved services and competitive pricing.

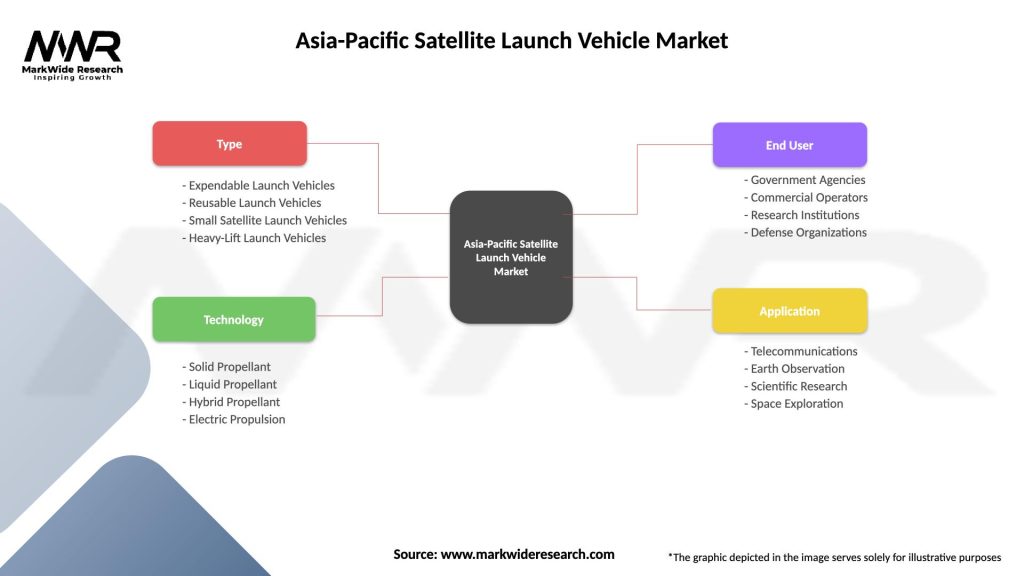

By Launch Vehicle Type: The market segments into small satellite launchers, medium-lift vehicles, and heavy-lift rockets, each serving distinct customer requirements and mission profiles. Small satellite launchers represent the fastest-growing segment, driven by constellation deployment demands and cost-sensitive customers seeking dedicated launch services.

By Payload Capacity: Market segmentation based on payload capacity reflects different customer needs and mission requirements. Light payload vehicles serve the growing small satellite market, while heavy-lift vehicles handle large communication satellites and complex multi-payload missions requiring precise orbital deployment.

By Application: Commercial applications dominate market activity, including telecommunications satellites, earth observation systems, and navigation services. Government and defense applications represent significant market segments with specific requirements for security, reliability, and indigenous launch capabilities.

By Orbit Type: Low Earth Orbit launches constitute the largest segment, driven by small satellite constellations and earth observation missions. Geostationary orbit launches serve traditional communication satellite markets, while specialized orbits support scientific and defense applications with unique requirements.

Small Satellite Launchers represent the most dynamic market category, experiencing rapid growth driven by constellation deployment requirements and cost-conscious customers. This segment benefits from technological innovations reducing launch costs while improving operational flexibility. Providers focusing on this category can achieve faster market entry and establish competitive positions before larger competitors respond.

Medium-Lift Vehicles serve the traditional satellite market with proven reliability and cost-effectiveness. This category maintains steady demand from established satellite operators requiring dependable launch services for valuable payloads. Competition focuses on operational efficiency, customer service, and pricing optimization rather than radical technological innovation.

Heavy-Lift Rockets address complex missions requiring large payload capacity or multiple satellite deployments. This premium market segment emphasizes reliability and technical capability over cost considerations, creating opportunities for providers with advanced engineering capabilities and extensive operational experience.

Specialized Launch Services include unique mission requirements such as polar orbits, sun-synchronous orbits, and interplanetary trajectories. These niche markets command premium pricing while requiring specialized technical capabilities and operational expertise that create barriers to entry for new competitors.

Satellite Operators benefit from increased launch options, competitive pricing, and improved service levels resulting from regional market development. The availability of multiple launch providers reduces scheduling constraints while providing backup options for mission-critical deployments. Cost reductions enable more frequent satellite replacements and constellation expansions supporting business growth.

Government Agencies gain strategic independence through indigenous launch capabilities while reducing costs for national space programs. Domestic launch providers support national security objectives while creating economic benefits through job creation and technology development. International competitiveness enhances diplomatic relationships and creates opportunities for space cooperation agreements.

Technology Companies access growing markets for satellite-based services supported by reliable, cost-effective launch capabilities. Reduced launch costs enable new business models and service offerings that were previously economically unfeasible. The expanding satellite infrastructure supports digital transformation initiatives across various industry sectors.

Investors find attractive opportunities in a growing market with strong fundamentals and government support. The space industry’s expansion creates multiple investment avenues from launch service providers to supporting infrastructure and technology companies. Long-term growth prospects support sustainable returns for patient capital providers.

Strengths:

Weaknesses:

Opportunities:

Threats:

Reusable Launch Technology is transforming cost structures and operational efficiency across the industry. Regional providers are investing heavily in developing reusable rocket systems that can significantly reduce launch costs while improving operational sustainability. This trend represents a fundamental shift in industry economics with long-term implications for competitive positioning.

Small Satellite Proliferation continues driving demand for frequent, cost-effective launch services. The trend toward smaller, more capable satellites deployed in large constellations requires launch providers to develop new service models emphasizing flexibility, rapid turnaround, and competitive pricing rather than traditional heavy-lift capabilities.

Commercial Space Growth is expanding beyond traditional satellite communications into new applications including earth observation, space manufacturing, and space tourism. These emerging markets create opportunities for innovative launch providers willing to develop specialized capabilities and service offerings tailored to unique customer requirements.

International Collaboration is increasing as space activities become more global and interconnected. Regional providers are forming partnerships with international companies, participating in global supply chains, and competing for contracts worldwide rather than focusing solely on domestic markets.

Technology Advancement continues at an accelerated pace with multiple breakthrough developments in propulsion systems, materials science, and manufacturing processes. Recent innovations include advanced composite materials reducing vehicle weight, improved engine efficiency increasing payload capacity, and automated manufacturing systems reducing production costs and improving quality consistency.

Infrastructure Expansion across the region includes new launch sites, upgraded ground support systems, and enhanced payload processing facilities. These investments improve operational capability while reducing costs through economies of scale and improved efficiency. MarkWide Research analysis indicates that infrastructure investment has increased by 40% over the past three years.

Regulatory Evolution is creating more favorable business environments for commercial space activities. Governments across the region are updating licensing procedures, streamlining approval processes, and creating regulatory frameworks that encourage private sector participation while maintaining safety and security standards.

Market Consolidation activities include strategic partnerships, joint ventures, and acquisition transactions as companies seek to achieve scale economies and expand capabilities. These developments are creating stronger, more capable organizations better positioned to compete in global markets while serving diverse customer requirements.

Strategic Focus should emphasize developing competitive advantages in specific market segments rather than attempting to compete across all categories. Companies should identify niche markets where they can establish leadership positions and build sustainable competitive moats through specialized capabilities, superior customer service, or unique technology offerings.

Technology Investment priorities should focus on areas with the greatest potential for competitive differentiation and cost reduction. Reusable launch technology, advanced manufacturing processes, and improved operational efficiency represent key areas where strategic investments can generate significant returns through improved market positioning and profitability.

International Expansion strategies should balance domestic market development with selective international opportunities. Companies should establish strong domestic positions before pursuing international growth, ensuring they have the operational capabilities and financial resources necessary to compete effectively in global markets.

Partnership Development can accelerate capability building while reducing development costs and risks. Strategic alliances with technology providers, customer relationships with satellite operators, and collaborative arrangements with government agencies can provide access to resources and markets that would be difficult to develop independently.

Market growth prospects remain highly positive, supported by increasing satellite deployment requirements, expanding commercial space applications, and continued government investment in space capabilities. MWR projections indicate the market will continue expanding at robust rates, with small satellite launch services showing particularly strong growth potential over the next decade.

Technology evolution will continue transforming industry economics and competitive dynamics. Successful development of reusable launch systems could dramatically reduce costs while improving operational efficiency, creating opportunities for market leaders to capture increased market share through superior value propositions for cost-conscious customers.

Competitive landscape changes will likely include market consolidation as smaller players seek scale economies through partnerships or acquisitions. This consolidation could create stronger regional competitors better positioned to challenge established global players while serving diverse customer requirements more effectively.

Geographic expansion of launch capabilities will continue as more countries develop indigenous space programs and commercial launch services. This trend will increase competition while creating new opportunities for technology transfer, collaborative development programs, and international business partnerships that benefit all market participants.

The Asia-Pacific satellite launch vehicle market represents one of the most dynamic and promising segments in the global aerospace industry. Strong government support, growing commercial demand, and competitive cost structures position regional providers for continued success in both domestic and international markets. The market’s evolution from primarily government-driven activities to commercially competitive services demonstrates the region’s technological capabilities and business acumen.

Key success factors include maintaining competitive pricing while improving reliability, developing specialized capabilities for emerging market segments, and building strong customer relationships based on superior service and operational excellence. Companies that successfully balance these requirements while investing in next-generation technologies will be best positioned to capture growth opportunities and establish sustainable competitive advantages.

Future prospects remain highly attractive, with multiple growth drivers supporting continued market expansion. The combination of increasing satellite deployment requirements, expanding commercial space applications, and ongoing technology advancement creates a favorable environment for both established players and new market entrants willing to invest in developing competitive capabilities and customer relationships.

What is Satellite Launch Vehicle?

A Satellite Launch Vehicle is a rocket used to transport satellites into orbit around the Earth. These vehicles are essential for deploying communication, weather, and scientific satellites, among others.

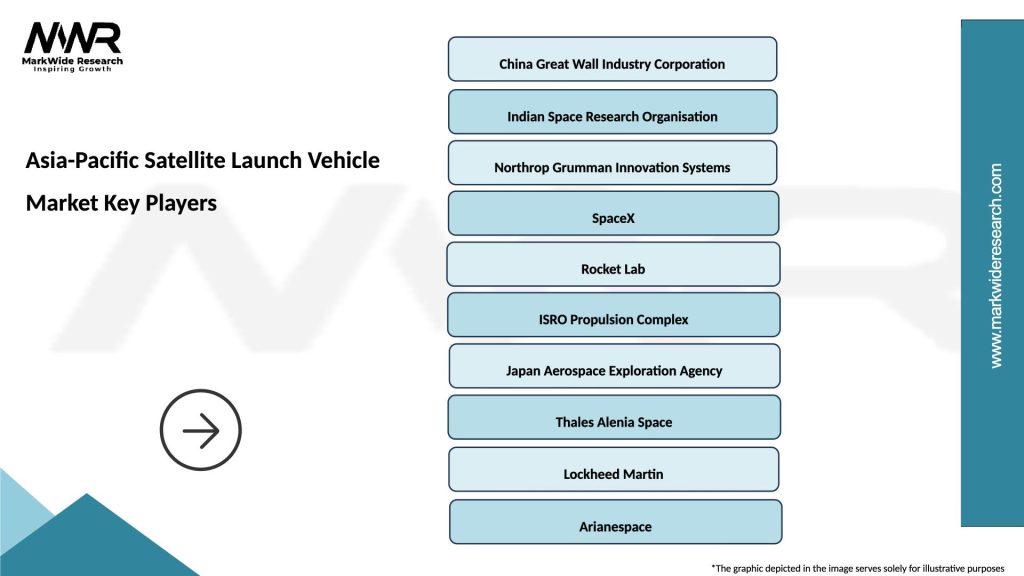

What are the key players in the Asia-Pacific Satellite Launch Vehicle Market?

Key players in the Asia-Pacific Satellite Launch Vehicle Market include SpaceX, ISRO, Arianespace, and Northrop Grumman, among others. These companies are involved in various aspects of satellite launch services and technology development.

What are the growth factors driving the Asia-Pacific Satellite Launch Vehicle Market?

The growth of the Asia-Pacific Satellite Launch Vehicle Market is driven by increasing demand for satellite-based services, advancements in launch technologies, and the rising number of small satellite missions. Additionally, government investments in space exploration contribute to market expansion.

What challenges does the Asia-Pacific Satellite Launch Vehicle Market face?

The Asia-Pacific Satellite Launch Vehicle Market faces challenges such as high launch costs, regulatory hurdles, and competition from emerging private players. These factors can impact the accessibility and affordability of launch services.

What opportunities exist in the Asia-Pacific Satellite Launch Vehicle Market?

Opportunities in the Asia-Pacific Satellite Launch Vehicle Market include the growing demand for satellite constellations, advancements in reusable launch systems, and partnerships between private companies and government agencies. These trends can enhance service offerings and reduce costs.

What trends are shaping the Asia-Pacific Satellite Launch Vehicle Market?

Trends shaping the Asia-Pacific Satellite Launch Vehicle Market include the rise of small satellite launches, increased collaboration between countries for joint missions, and the development of new propulsion technologies. These trends are expected to influence the future landscape of satellite launches.

Asia-Pacific Satellite Launch Vehicle Market

| Segmentation Details | Description |

|---|---|

| Type | Expendable Launch Vehicles, Reusable Launch Vehicles, Small Satellite Launch Vehicles, Heavy-Lift Launch Vehicles |

| Technology | Solid Propellant, Liquid Propellant, Hybrid Propellant, Electric Propulsion |

| End User | Government Agencies, Commercial Operators, Research Institutions, Defense Organizations |

| Application | Telecommunications, Earth Observation, Scientific Research, Space Exploration |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Asia-Pacific Satellite Launch Vehicle Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at