444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Europe single-use packaging market represents a dynamic and rapidly evolving sector within the broader packaging industry, characterized by significant transformation driven by sustainability concerns, regulatory changes, and shifting consumer preferences. This market encompasses a comprehensive range of disposable packaging solutions including food containers, beverage cups, takeaway packaging, medical packaging, and various consumer goods packaging formats designed for one-time use.

Market dynamics indicate substantial growth potential despite increasing environmental scrutiny, with the sector experiencing a 6.2% CAGR driven by the expanding food delivery sector, healthcare packaging requirements, and e-commerce growth. The market demonstrates remarkable resilience through innovation in sustainable materials, biodegradable alternatives, and circular economy initiatives that address environmental concerns while meeting practical packaging needs.

Regional variations across Europe reflect diverse regulatory landscapes, consumer behaviors, and economic conditions, with Western European markets leading in sustainable packaging adoption while Eastern European regions show strong growth in traditional single-use packaging segments. The market’s evolution reflects broader societal shifts toward convenience, hygiene consciousness, and environmental responsibility, creating complex dynamics that shape industry development patterns.

The Europe single-use packaging market refers to the comprehensive ecosystem of disposable packaging solutions designed for one-time use across various industries including food service, retail, healthcare, and consumer goods throughout European territories. This market encompasses traditional materials like plastics, paper, and aluminum alongside innovative sustainable alternatives such as biodegradable polymers, compostable materials, and recyclable composites.

Single-use packaging serves critical functions including product protection, contamination prevention, portion control, and convenience enhancement while addressing specific regulatory requirements and consumer expectations. The market includes diverse product categories from food containers and beverage packaging to medical device packaging and e-commerce shipping materials, each serving distinct functional and regulatory requirements.

Market scope extends beyond traditional packaging to include emerging categories such as smart packaging with integrated sensors, antimicrobial packaging for healthcare applications, and sustainable packaging solutions that align with circular economy principles. This comprehensive definition reflects the market’s evolution from simple disposable containers to sophisticated packaging systems that balance functionality, sustainability, and regulatory compliance.

Strategic analysis reveals the Europe single-use packaging market as a sector undergoing fundamental transformation, balancing traditional growth drivers with emerging sustainability imperatives. The market demonstrates robust expansion across multiple segments, with food service packaging representing the largest application area, followed by retail packaging and healthcare applications.

Key growth drivers include the expanding food delivery ecosystem, increased hygiene consciousness following global health concerns, and growing e-commerce penetration requiring protective packaging solutions. Simultaneously, regulatory pressures and consumer environmental awareness drive innovation in sustainable materials, with 43% of European consumers actively seeking environmentally responsible packaging options.

Market challenges center on balancing functionality requirements with environmental impact, managing cost implications of sustainable alternatives, and navigating complex regulatory landscapes across different European jurisdictions. The sector responds through technological innovation, material science advances, and collaborative approaches involving manufacturers, retailers, and waste management systems.

Future prospects indicate continued market expansion driven by urbanization, lifestyle changes, and digital commerce growth, while sustainability considerations reshape product development priorities and market positioning strategies. The market’s trajectory reflects broader European Union policy directions toward circular economy implementation and plastic waste reduction initiatives.

Market intelligence reveals several critical insights shaping the Europe single-use packaging landscape:

Primary growth catalysts propelling the Europe single-use packaging market include fundamental societal and economic shifts that create sustained demand for disposable packaging solutions. The food delivery revolution represents a major driver, with online food ordering platforms experiencing exponential growth and requiring specialized packaging that maintains food quality, temperature, and presentation during transportation.

Hygiene consciousness has intensified significantly, particularly in healthcare, food service, and retail environments where single-use packaging provides contamination prevention and safety assurance. This trend extends beyond traditional applications to include personal care products, pharmaceuticals, and consumer goods where hygiene considerations influence purchasing decisions and regulatory requirements.

Urbanization patterns across European cities drive demand for convenient packaging solutions that support busy lifestyles, on-the-go consumption, and space-efficient storage. Urban consumers increasingly rely on packaged foods, takeaway meals, and delivery services that require effective single-use packaging systems.

E-commerce expansion creates substantial packaging demand for product protection during shipping, with online retail growth requiring innovative packaging solutions that balance protection, cost efficiency, and environmental impact. The sector benefits from increasing consumer comfort with online purchasing and expanding product categories sold through digital channels.

Healthcare sector evolution drives specialized packaging requirements for medical devices, pharmaceuticals, and healthcare products, with aging European populations creating sustained demand for medical packaging solutions that ensure product integrity and patient safety.

Environmental regulations represent the most significant constraint facing the Europe single-use packaging market, with European Union directives targeting single-use plastic reduction and implementing extended producer responsibility frameworks. These regulations require substantial investment in alternative materials and packaging redesign while potentially limiting certain product categories.

Cost pressures from sustainable material alternatives create financial challenges for manufacturers and end-users, as biodegradable and compostable packaging options typically command premium pricing compared to traditional materials. This cost differential affects market adoption rates and competitive positioning across different market segments.

Consumer resistance to single-use packaging grows among environmentally conscious segments, with some consumers actively avoiding disposable packaging options in favor of reusable alternatives. This behavioral shift requires market participants to balance convenience benefits with environmental impact considerations.

Supply chain complexities associated with sustainable packaging materials include limited supplier networks, quality consistency challenges, and logistics complications that affect market scalability and reliability. These operational constraints can limit market growth and increase business risks for market participants.

Technical limitations of alternative materials sometimes compromise packaging functionality, including barrier properties, durability, and shelf life performance, creating challenges in applications requiring specific technical specifications or regulatory compliance standards.

Sustainable innovation presents the most significant opportunity within the Europe single-use packaging market, with growing demand for environmentally responsible packaging solutions creating space for companies developing biodegradable, compostable, and recyclable alternatives. This opportunity extends across all market segments and applications, driven by regulatory requirements and consumer preferences.

Smart packaging integration offers substantial growth potential through incorporating sensors, indicators, and digital connectivity features that enhance product functionality, safety monitoring, and consumer engagement. These technologies create value-added packaging solutions that command premium pricing and differentiate market offerings.

Circular economy participation enables market players to develop closed-loop packaging systems that address environmental concerns while creating new revenue streams through material recovery, recycling services, and sustainable packaging consulting. This approach aligns with European Union policy directions and corporate sustainability initiatives.

Healthcare market expansion provides growth opportunities in specialized medical packaging, pharmaceutical packaging, and healthcare product packaging driven by demographic trends, healthcare system evolution, and increasing medical device utilization across European markets.

Regional market development in Eastern European countries offers expansion opportunities as these markets develop modern retail infrastructure, food service sectors, and consumer packaging preferences that align with Western European consumption patterns.

Customization services create differentiation opportunities through offering tailored packaging solutions for specific applications, brands, or market segments, enabling premium pricing and stronger customer relationships in competitive market environments.

Competitive dynamics within the Europe single-use packaging market reflect intense competition balanced with collaborative innovation efforts addressing sustainability challenges. Market participants range from large multinational packaging companies to specialized sustainable packaging innovators, creating diverse competitive landscapes across different product segments and geographic regions.

Innovation cycles accelerate as companies invest heavily in research and development for sustainable materials, smart packaging technologies, and manufacturing process improvements. These innovation efforts focus on achieving 35% reduction in environmental impact while maintaining or improving packaging functionality and cost competitiveness.

Supply chain integration becomes increasingly important as companies seek to optimize material sourcing, manufacturing efficiency, and distribution networks while ensuring sustainable material availability and quality consistency. Vertical integration strategies and strategic partnerships help companies manage supply chain risks and capture value across the packaging lifecycle.

Regulatory adaptation requires continuous monitoring and response to evolving European Union directives, national regulations, and local ordinances affecting single-use packaging. Companies must balance compliance requirements with business objectives while anticipating future regulatory developments that may impact market opportunities.

Consumer engagement strategies evolve to address environmental concerns while communicating packaging benefits and proper disposal methods. Educational initiatives and transparency in environmental impact help companies maintain market position while addressing sustainability expectations.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the Europe single-use packaging market. Primary research includes extensive interviews with industry executives, packaging manufacturers, end-users, and regulatory officials across major European markets to gather firsthand insights into market trends, challenges, and opportunities.

Secondary research incorporates analysis of industry reports, regulatory documents, trade association publications, and company financial statements to establish market context and validate primary research findings. This approach ensures comprehensive coverage of market dynamics and competitive landscapes across different European regions and market segments.

Quantitative analysis utilizes statistical modeling and trend analysis to project market growth patterns, identify key performance indicators, and assess market segment potential. Data validation processes ensure accuracy and reliability of market projections and strategic recommendations.

Qualitative assessment includes expert opinion analysis, case study development, and scenario planning to understand market implications of regulatory changes, technological developments, and consumer behavior shifts. This methodology provides strategic context for quantitative findings and market projections.

Market segmentation analysis examines different product categories, application areas, and geographic regions to identify growth opportunities and competitive dynamics within specific market niches. This detailed segmentation enables targeted strategic recommendations and market entry strategies.

Western European markets lead in sustainable packaging adoption and regulatory compliance, with countries like Germany, France, and the Netherlands demonstrating advanced circular economy implementation and consumer environmental consciousness. These markets show 52% adoption rates for sustainable single-use packaging alternatives, driven by strong regulatory frameworks and consumer willingness to pay premiums for environmentally responsible products.

Nordic countries including Sweden, Denmark, and Norway represent the most advanced markets for sustainable packaging innovation, with government policies strongly supporting circular economy principles and companies investing heavily in biodegradable and compostable packaging solutions. These markets serve as testing grounds for innovative packaging technologies and sustainable business models.

Southern European markets including Italy, Spain, and Greece show strong growth in food service packaging driven by tourism, hospitality sectors, and expanding food delivery services. These markets balance traditional packaging preferences with increasing environmental awareness and regulatory compliance requirements.

Eastern European markets demonstrate rapid growth potential with expanding retail infrastructure, increasing consumer spending, and modernizing food service sectors. Countries like Poland, Czech Republic, and Hungary show 28% annual growth in single-use packaging consumption while beginning to implement sustainability initiatives aligned with European Union directives.

United Kingdom represents a unique market dynamic post-Brexit, with independent regulatory development while maintaining strong trade relationships with European Union markets. The UK market shows innovation in sustainable packaging while addressing specific regulatory requirements and market preferences.

Market leadership within the Europe single-use packaging sector includes established multinational companies alongside innovative sustainable packaging specialists. The competitive environment reflects diverse strategies ranging from traditional cost leadership to premium sustainable positioning and technological innovation focus.

Competitive strategies increasingly focus on sustainability leadership, technological innovation, and supply chain optimization to address market challenges while capturing growth opportunities in evolving market segments.

By Material Type:

By Application:

By End-User Industry:

Food service packaging represents the largest market segment, driven by expanding food delivery services, quick-service restaurant growth, and changing consumer dining habits. This category shows strong innovation in sustainable materials while maintaining functionality requirements for food safety, temperature retention, and presentation quality. Market penetration of sustainable alternatives reaches 41% in premium food service segments, indicating significant adoption potential across broader market categories.

Healthcare packaging demonstrates consistent growth driven by aging populations, increased medical device utilization, and stringent safety requirements. This segment commands premium pricing due to specialized functionality requirements including sterility maintenance, tamper evidence, and regulatory compliance. Innovation focuses on smart packaging features and sustainable materials that meet medical industry standards.

E-commerce packaging experiences rapid expansion as online retail continues growing across European markets. This category requires balancing product protection with environmental impact, leading to innovations in right-sized packaging, protective materials, and return logistics systems. The segment shows 67% growth in sustainable packaging adoption as companies address consumer environmental concerns and regulatory requirements.

Retail packaging evolves to address changing shopping patterns, including increased takeaway purchases, convenience store growth, and premium product positioning. This segment balances cost efficiency with sustainability requirements while maintaining brand differentiation and product protection functionality.

Beverage packaging faces significant regulatory pressure regarding single-use plastic cups and containers, driving innovation in alternative materials and reusable systems. The category shows strong growth in compostable and recyclable alternatives while maintaining functionality for different beverage types and service environments.

Manufacturers benefit from expanding market opportunities across multiple application segments, with particular growth potential in sustainable packaging solutions that command premium pricing and align with regulatory requirements. Innovation in materials and manufacturing processes creates competitive advantages and market differentiation opportunities.

End-users gain access to packaging solutions that balance functionality, cost efficiency, and environmental responsibility while meeting specific application requirements. Single-use packaging provides convenience, hygiene assurance, and operational efficiency benefits across food service, healthcare, and retail applications.

Consumers benefit from improved product safety, convenience, and increasingly sustainable packaging options that align with environmental values. Innovation in packaging design and materials enhances user experience while reducing environmental impact through improved recyclability and biodegradability.

Environmental stakeholders see progress toward circular economy goals through increased adoption of sustainable packaging materials, improved recycling systems, and reduced environmental impact from packaging waste. Industry collaboration supports broader sustainability objectives and regulatory compliance.

Regulatory bodies achieve policy objectives through industry compliance with environmental directives while maintaining economic growth and innovation within the packaging sector. Market development supports broader European Union sustainability goals and circular economy implementation.

Supply chain partners benefit from optimized packaging solutions that improve logistics efficiency, reduce transportation costs, and enhance product protection during distribution. Sustainable packaging initiatives create new business opportunities in recycling, waste management, and circular economy services.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability integration represents the dominant trend reshaping the Europe single-use packaging market, with companies investing heavily in biodegradable materials, compostable alternatives, and circular economy initiatives. This trend extends beyond material substitution to include packaging design optimization, lifecycle assessment integration, and supply chain sustainability improvements.

Smart packaging adoption accelerates across multiple market segments, incorporating sensors for freshness monitoring, temperature indicators for cold chain management, and digital connectivity for consumer engagement and supply chain tracking. These technologies create value-added packaging solutions that justify premium pricing while enhancing functionality.

Regulatory compliance evolution drives continuous adaptation to changing European Union directives, national regulations, and local ordinances affecting single-use packaging. Companies develop proactive compliance strategies and participate in regulatory development processes to influence policy directions and ensure market access.

Consumer education initiatives become increasingly important as companies address environmental concerns while communicating packaging benefits and proper disposal methods. Transparency in environmental impact and sustainability efforts helps maintain consumer acceptance and market positioning.

Supply chain optimization focuses on improving material sourcing, manufacturing efficiency, and distribution networks while ensuring sustainable material availability and quality consistency. Companies pursue vertical integration strategies and strategic partnerships to manage supply chain risks and capture value across the packaging lifecycle.

Customization services expand as companies offer tailored packaging solutions for specific applications, brands, or market segments. This trend enables premium pricing and stronger customer relationships while addressing diverse market requirements and differentiation needs.

Material innovation breakthroughs include development of advanced biodegradable polymers, plant-based packaging materials, and recyclable composite solutions that maintain traditional packaging functionality while reducing environmental impact. These innovations address key market constraints while creating competitive advantages for early adopters.

Manufacturing technology advancement enables more efficient production of sustainable packaging materials, reducing cost premiums and improving quality consistency. Investment in advanced manufacturing equipment and process optimization supports market scalability and competitive positioning.

Strategic partnerships between packaging manufacturers, material suppliers, and end-users accelerate sustainable packaging development and market adoption. Collaborative approaches enable risk sharing, technology development, and market education initiatives that benefit entire value chains.

Regulatory milestone achievements include successful implementation of European Union single-use plastic directives and development of extended producer responsibility frameworks. These regulatory developments create market structure changes while driving innovation and compliance investment.

Market consolidation activities include mergers and acquisitions focused on sustainable packaging capabilities, technology integration, and market expansion. Consolidation enables companies to achieve scale advantages while building comprehensive sustainable packaging portfolios.

Investment in recycling infrastructure supports circular economy development and addresses waste management challenges associated with single-use packaging. Public-private partnerships and industry initiatives improve recycling rates and create closed-loop packaging systems.

MarkWide Research recommends that market participants prioritize sustainable packaging innovation while maintaining functionality and cost competitiveness. Companies should invest in research and development for biodegradable and compostable materials while building supply chain capabilities for sustainable material sourcing and manufacturing.

Strategic positioning should emphasize environmental responsibility alongside traditional packaging benefits, with clear communication of sustainability efforts and environmental impact improvements. Companies must balance regulatory compliance with market opportunities while anticipating future regulatory developments that may affect market dynamics.

Technology integration offers significant differentiation opportunities through smart packaging features, digital connectivity, and enhanced functionality that justify premium pricing. Investment in technology capabilities should align with specific market segment requirements and customer value propositions.

Market expansion strategies should consider regional variations in regulatory requirements, consumer preferences, and competitive landscapes while building scalable business models that support growth across diverse European markets. Eastern European markets offer particular growth potential as these economies develop modern retail and food service infrastructure.

Partnership development with suppliers, customers, and technology providers can accelerate innovation, reduce development risks, and improve market access. Collaborative approaches enable companies to address complex sustainability challenges while building competitive advantages through shared expertise and resources.

Supply chain resilience requires diversified sourcing strategies, quality assurance systems, and contingency planning to manage material availability and cost volatility. Companies should build flexible supply chain capabilities that support both traditional and sustainable packaging requirements.

Market evolution toward sustainable packaging solutions will accelerate over the next decade, with biodegradable and compostable materials achieving 58% market penetration across key application segments. This transformation requires continued investment in material innovation, manufacturing capabilities, and supply chain development while maintaining packaging functionality and cost competitiveness.

Regulatory landscape development will continue shaping market opportunities and constraints, with European Union policies increasingly favoring circular economy principles and extended producer responsibility frameworks. Companies must maintain proactive regulatory compliance strategies while participating in policy development processes that affect market structure and competitive dynamics.

Technology integration will expand beyond smart packaging features to include artificial intelligence, Internet of Things connectivity, and advanced material science applications that create new value propositions and market differentiation opportunities. These technological developments support premium positioning while addressing evolving customer requirements.

Consumer behavior evolution will balance convenience requirements with environmental consciousness, creating market demand for packaging solutions that optimize both functionality and sustainability. Educational initiatives and transparency in environmental impact will become increasingly important for market acceptance and brand positioning.

MWR analysis indicates that successful market participants will be those who effectively balance traditional packaging benefits with sustainable innovation while building scalable business models that support growth across diverse European markets and application segments. The market’s future depends on industry collaboration, regulatory alignment, and continued innovation in sustainable packaging technologies.

The Europe single-use packaging market stands at a critical transformation point, balancing traditional growth drivers with emerging sustainability imperatives that reshape industry dynamics and competitive landscapes. Market participants face complex challenges requiring innovative solutions that address environmental concerns while maintaining packaging functionality, cost efficiency, and regulatory compliance across diverse European markets.

Sustainable innovation emerges as the primary differentiator for future market success, with companies investing heavily in biodegradable materials, compostable alternatives, and circular economy initiatives that align with regulatory requirements and consumer expectations. This transformation creates significant opportunities for companies that successfully navigate the transition from traditional packaging to environmentally responsible solutions.

Market growth prospects remain positive despite regulatory constraints, driven by expanding food delivery services, healthcare packaging requirements, e-commerce growth, and urbanization trends that support demand for convenient packaging solutions. The sector’s resilience reflects its ability to adapt to changing market conditions while addressing evolving customer needs and regulatory requirements.

Strategic success in the Europe single-use packaging market requires balanced approaches that combine innovation, sustainability, and operational excellence while building scalable business models that support growth across multiple market segments and geographic regions. Companies that effectively integrate these elements will be best positioned to capture market opportunities and achieve sustainable competitive advantages in this dynamic and evolving market landscape.

What is Single-use Packaging?

Single-use packaging refers to packaging materials that are designed to be used once and then discarded. This type of packaging is commonly found in food service, retail, and consumer goods, and includes items like plastic bags, food containers, and beverage cups.

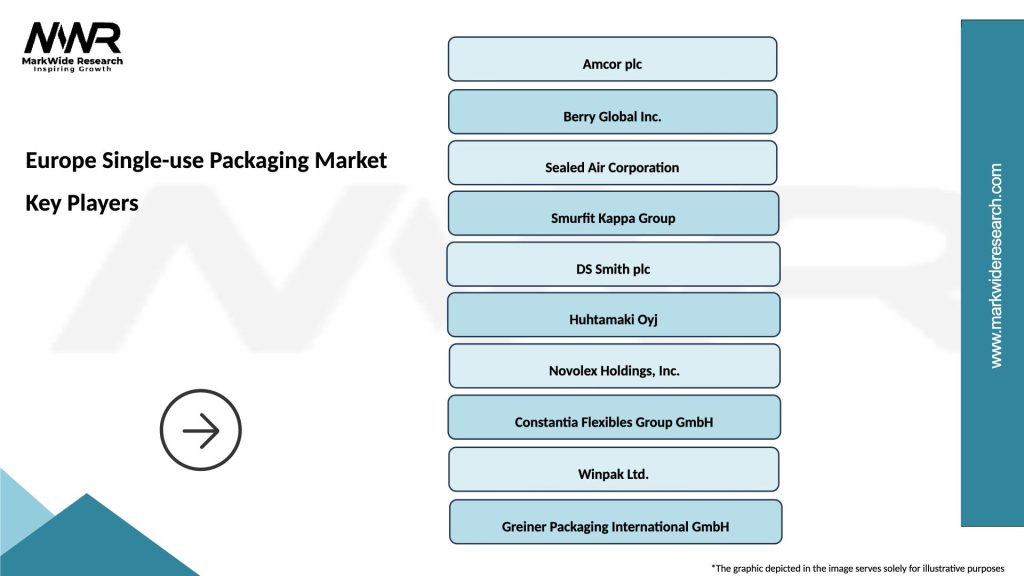

What are the key players in the Europe Single-use Packaging Market?

Key players in the Europe Single-use Packaging Market include companies like Amcor, Sealed Air Corporation, and Huhtamaki, which are known for their innovative packaging solutions and sustainability initiatives, among others.

What are the main drivers of the Europe Single-use Packaging Market?

The main drivers of the Europe Single-use Packaging Market include the growing demand for convenience in food and beverage services, increased online shopping leading to higher packaging needs, and a rise in consumer preference for ready-to-eat meals.

What challenges does the Europe Single-use Packaging Market face?

The Europe Single-use Packaging Market faces challenges such as increasing regulations on plastic use, growing environmental concerns among consumers, and the need for companies to adopt sustainable practices to reduce waste.

What opportunities exist in the Europe Single-use Packaging Market?

Opportunities in the Europe Single-use Packaging Market include the development of biodegradable and compostable packaging materials, innovations in recycling technologies, and the potential for growth in e-commerce packaging solutions.

What trends are shaping the Europe Single-use Packaging Market?

Trends shaping the Europe Single-use Packaging Market include a shift towards sustainable packaging solutions, increased use of digital printing for customization, and the adoption of smart packaging technologies that enhance user experience.

Europe Single-use Packaging Market

| Segmentation Details | Description |

|---|---|

| Product Type | Plastics, Paper, Biodegradable Materials, Glass |

| Packaging Type | Bags, Containers, Trays, Wraps |

| End User | Food & Beverage, Healthcare, Personal Care, Consumer Goods |

| Distribution Channel | Online Retail, Supermarkets, Convenience Stores, Wholesale |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Europe Single-use Packaging Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at