444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The North America bioplastics market represents a transformative segment within the broader plastics industry, driven by increasing environmental consciousness and regulatory pressures to reduce conventional plastic waste. This rapidly evolving market encompasses biodegradable and bio-based plastic materials derived from renewable resources such as corn starch, sugarcane, vegetable oils, and other organic materials. North American manufacturers are experiencing unprecedented demand for sustainable packaging solutions across multiple industries including food and beverage, consumer goods, automotive, and healthcare sectors.

Market dynamics indicate robust growth potential, with the region witnessing a compound annual growth rate (CAGR) of 12.5% over the forecast period. The United States dominates regional consumption, accounting for approximately 78% of total market share, while Canada and Mexico contribute significantly to the expanding bioplastics ecosystem. Consumer awareness regarding environmental sustainability has reached critical mass, compelling brands to adopt eco-friendly packaging alternatives that align with corporate social responsibility initiatives.

Technological advancements in bioplastic production have enhanced material properties, making them increasingly competitive with traditional petroleum-based plastics. The market benefits from substantial investments in research and development, with companies focusing on improving biodegradability rates, mechanical strength, and cost-effectiveness. Government initiatives supporting circular economy principles and plastic waste reduction have created favorable regulatory environments that accelerate bioplastics adoption across North America.

The North America bioplastics market refers to the commercial ecosystem encompassing the production, distribution, and consumption of plastic materials derived from renewable biological resources or designed to biodegrade naturally. These innovative materials serve as sustainable alternatives to conventional petroleum-based plastics, offering reduced environmental impact throughout their lifecycle from production to disposal.

Bioplastics encompass two primary categories: bio-based plastics manufactured from renewable feedstocks and biodegradable plastics engineered to decompose under specific environmental conditions. The market includes various polymer types such as polylactic acid (PLA), polyhydroxyalkanoates (PHA), starch-based plastics, and cellulose derivatives. Manufacturing processes utilize agricultural waste, plant-based materials, and microbial fermentation to create plastic polymers with properties comparable to traditional plastics.

Market participants include raw material suppliers, bioplastic manufacturers, converters, and end-use industries seeking sustainable packaging and product solutions. The ecosystem supports circular economy principles by reducing dependence on fossil fuels, minimizing carbon footprints, and addressing growing concerns about plastic pollution in marine and terrestrial environments.

The North America bioplastics market demonstrates exceptional growth momentum driven by convergence of environmental regulations, consumer preferences, and technological innovations. Market expansion reflects increasing adoption across diverse applications including flexible packaging, rigid containers, agricultural films, and disposable products. Key market drivers include stringent plastic waste regulations, corporate sustainability commitments, and growing consumer willingness to pay premium prices for environmentally responsible products.

Regional leadership in bioplastics development stems from robust research infrastructure, supportive government policies, and presence of major chemical companies investing heavily in sustainable technologies. The market benefits from established supply chains connecting agricultural feedstock producers with bioplastic manufacturers and end-use industries. Innovation focus centers on developing cost-competitive materials with enhanced performance characteristics suitable for demanding applications.

Competitive dynamics feature both established chemical giants and emerging biotechnology companies competing to capture market share through product differentiation and strategic partnerships. Market growth faces challenges including higher production costs compared to conventional plastics, limited processing infrastructure, and consumer education requirements. Future prospects remain highly positive, supported by increasing regulatory pressure on single-use plastics and growing corporate commitments to sustainable packaging solutions.

Strategic market insights reveal several critical factors shaping the North America bioplastics landscape. The following key observations provide comprehensive understanding of market dynamics and growth opportunities:

Environmental regulations serve as the primary catalyst driving North America bioplastics market expansion. Federal and state-level legislation targeting plastic waste reduction, including bans on single-use plastic bags, straws, and food containers, creates mandatory demand for biodegradable alternatives. Extended producer responsibility programs require manufacturers to manage packaging waste throughout its lifecycle, incentivizing adoption of compostable materials that reduce long-term environmental liability.

Corporate sustainability initiatives represent another significant growth driver as major brands commit to ambitious plastic reduction goals. Companies across food and beverage, consumer goods, and retail sectors are implementing comprehensive packaging strategies that prioritize renewable and biodegradable materials. Brand differentiation through environmental responsibility has become a competitive necessity, with consumers increasingly selecting products based on packaging sustainability credentials.

Technological advancement in bioplastic production continues reducing cost barriers while improving material performance. Innovations in enzyme technology, fermentation processes, and polymer chemistry are creating bioplastics with enhanced strength, flexibility, and barrier properties. Agricultural abundance in North America provides reliable access to renewable feedstocks including corn, sugarcane, and agricultural waste streams, supporting cost-effective production scaling.

Consumer awareness regarding plastic pollution impacts has reached unprecedented levels, driving purchasing decisions toward environmentally responsible alternatives. Educational campaigns highlighting marine plastic pollution and microplastic contamination have increased willingness to pay premium prices for sustainable packaging. Generational preferences particularly among younger demographics strongly favor brands demonstrating authentic environmental commitment through bioplastic adoption.

Cost competitiveness remains the most significant restraint limiting widespread bioplastics adoption across North America. Production costs for bio-based materials typically exceed conventional plastics by 20-50%, creating price sensitivity challenges particularly in cost-conscious market segments. Manufacturing scale limitations prevent bioplastic producers from achieving economies of scale comparable to established petrochemical facilities, maintaining cost disadvantages that impact market penetration rates.

Performance limitations in certain applications restrict bioplastic usage where specific mechanical, thermal, or barrier properties are required. Some biodegradable materials exhibit reduced shelf life, moisture sensitivity, or temperature constraints that limit their suitability for demanding packaging applications. Processing challenges require modifications to existing manufacturing equipment and processes, creating additional investment requirements for converters and brand owners.

Infrastructure gaps in waste management systems limit the environmental benefits of biodegradable plastics. Many regions lack adequate industrial composting facilities capable of processing bioplastic waste, leading to disposal in conventional landfills where biodegradation may not occur effectively. Consumer confusion regarding proper disposal methods for different bioplastic types creates contamination issues in recycling streams and composting systems.

Feedstock competition with food production creates ethical concerns and price volatility for agricultural-based bioplastics. Competing demands for corn, sugarcane, and other crops between food, fuel, and plastic applications can drive raw material costs higher while raising sustainability questions about land use priorities. Supply chain complexity involving multiple stakeholders from agriculture to end-use applications creates coordination challenges that can impact product availability and pricing stability.

Regulatory expansion presents substantial growth opportunities as additional jurisdictions implement plastic waste reduction legislation. Anticipated federal regulations targeting single-use plastics and packaging waste will create mandatory demand for bioplastic alternatives across broader market segments. Carbon pricing mechanisms and environmental taxes on conventional plastics will improve the relative cost competitiveness of bio-based materials, accelerating adoption rates.

Technology breakthroughs in next-generation bioplastics offer opportunities to address current performance and cost limitations. Advanced materials including marine-degradable plastics, high-temperature resistant bio-polymers, and enhanced barrier properties will expand addressable market applications. Biotechnology innovations utilizing synthetic biology and metabolic engineering promise to reduce production costs while improving material properties through precision fermentation processes.

Circular economy integration creates opportunities for bioplastic producers to develop closed-loop systems that capture additional value from waste streams. Partnerships with waste management companies and composting facilities can create revenue opportunities while ensuring proper end-of-life management. Agricultural waste utilization presents opportunities to develop cost-effective feedstocks while supporting rural economic development and reducing agricultural waste disposal costs.

Market expansion into emerging applications beyond traditional packaging offers significant growth potential. Opportunities in automotive components, electronics housings, construction materials, and medical devices represent high-value market segments with less price sensitivity. Export opportunities to international markets with strong environmental regulations can leverage North American production capabilities and technological expertise to capture global market share.

Supply-demand dynamics in the North America bioplastics market reflect rapidly evolving consumer preferences and regulatory requirements driving demand growth that often exceeds production capacity. Manufacturing capacity expansion requires significant capital investment and lead times, creating temporary supply constraints that support premium pricing. Demand volatility varies significantly across end-use applications, with food packaging showing consistent growth while other sectors experience cyclical patterns tied to economic conditions and regulatory implementation timelines.

Competitive intensity continues increasing as established chemical companies and innovative startups compete for market share through product differentiation and cost reduction strategies. Market leaders leverage economies of scale and integrated supply chains to maintain competitive advantages, while emerging players focus on specialized applications and novel materials. Strategic partnerships between bioplastic producers and major brands are reshaping competitive dynamics by creating exclusive supply relationships and co-development opportunities.

Price dynamics reflect complex interactions between feedstock costs, production scale, and market demand. Agricultural commodity price fluctuations directly impact bio-based plastic production costs, creating pricing volatility that challenges long-term supply agreements. Technology adoption rates vary significantly across industries, with early adopters in food service and consumer goods leading adoption while industrial applications lag due to performance requirements and cost sensitivity.

Innovation cycles in bioplastics development are accelerating as research investments yield breakthrough materials with enhanced properties. Patent activity and intellectual property development create competitive moats while driving continuous improvement in material performance and production efficiency. Market consolidation through mergers and acquisitions is reshaping the competitive landscape as companies seek to achieve scale advantages and vertical integration benefits.

Comprehensive market analysis employed multiple research methodologies to ensure accuracy and reliability of findings regarding the North America bioplastics market. Primary research included extensive interviews with industry executives, technology developers, regulatory officials, and end-use customers across the bioplastics value chain. Survey methodologies captured quantitative data on market size, growth rates, and competitive positioning from representative samples of market participants.

Secondary research incorporated analysis of industry reports, government statistics, patent filings, and financial disclosures from publicly traded companies operating in the bioplastics sector. Academic research publications and conference proceedings provided insights into emerging technologies and future market trends. Data triangulation techniques validated findings across multiple sources to ensure consistency and accuracy of market assessments.

Market modeling utilized econometric analysis to project future growth scenarios based on historical trends, regulatory developments, and technology adoption patterns. Sensitivity analysis examined the impact of key variables including feedstock costs, regulatory changes, and competitive dynamics on market growth projections. Expert validation sessions with industry specialists reviewed findings and provided feedback on market assumptions and growth forecasts.

Geographic analysis examined regional variations in market development across the United States, Canada, and Mexico, considering differences in regulatory environments, industrial infrastructure, and consumer preferences. Time-series analysis tracked market evolution over multiple years to identify sustainable growth trends versus temporary market fluctuations. Competitive intelligence gathering included analysis of company strategies, product launches, and investment activities to understand market dynamics and future direction.

United States dominance in the North America bioplastics market reflects the country’s advanced regulatory framework, robust research infrastructure, and large consumer market demanding sustainable alternatives. The U.S. accounts for approximately 78% of regional market share, driven by state-level plastic bag bans, corporate sustainability commitments, and strong venture capital investment in bioplastic technologies. California leadership in environmental regulations creates a significant market for biodegradable packaging, while the Midwest benefits from abundant agricultural feedstocks supporting cost-effective production.

Canada represents the second-largest regional market with approximately 15% market share, supported by federal single-use plastic bans and provincial environmental initiatives. Canadian companies focus on developing cold-climate compatible bioplastics and leveraging the country’s forestry resources for cellulose-based materials. Government support through research grants and tax incentives encourages bioplastic innovation and commercial development across multiple provinces.

Mexico contributes approximately 7% of regional market share but demonstrates the highest growth potential due to expanding manufacturing sector and increasing environmental awareness. The country’s strategic location provides access to both North American and Latin American markets while offering competitive manufacturing costs. Agricultural abundance in Mexico supports feedstock production for bioplastics while government initiatives promote sustainable manufacturing practices.

Regional integration through trade agreements facilitates cross-border movement of raw materials and finished bioplastic products, creating an integrated North American market. Supply chain optimization leverages each country’s comparative advantages, with the U.S. providing technology and market access, Canada contributing forestry resources, and Mexico offering cost-effective manufacturing capabilities. Regulatory harmonization efforts are reducing trade barriers and creating consistent standards for bioplastic products across the region.

Market leadership in the North America bioplastics sector features a diverse mix of established chemical companies, innovative biotechnology firms, and specialized material producers competing across different market segments and applications. The competitive environment continues evolving as traditional plastic manufacturers invest in bio-based alternatives while startup companies introduce breakthrough technologies.

Strategic positioning varies significantly among competitors, with some focusing on cost leadership through scale advantages while others pursue differentiation through specialized applications or superior performance characteristics. Vertical integration strategies are common, with companies seeking to control feedstock supply, production processes, and market access to maintain competitive advantages.

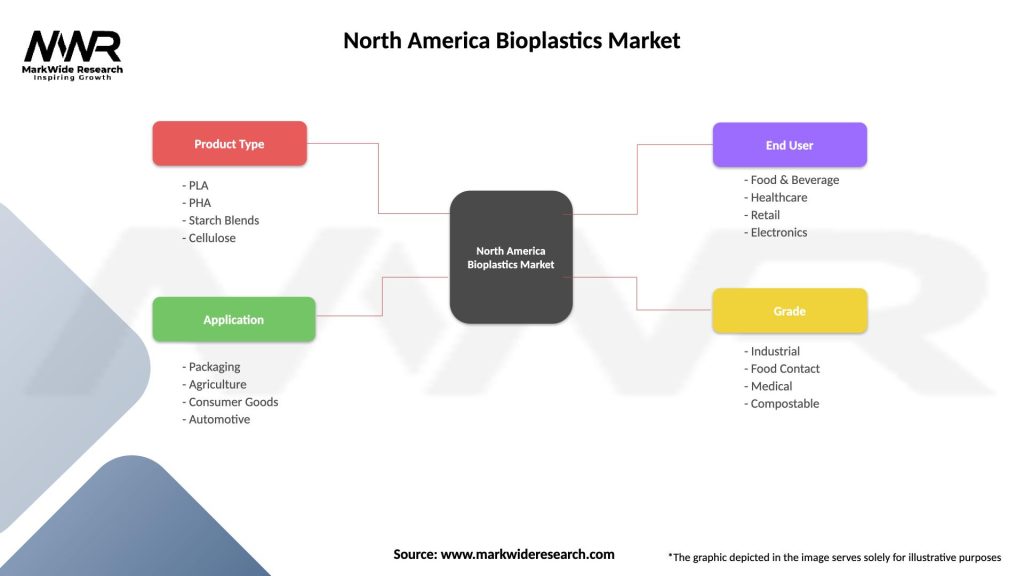

By Product Type: The North America bioplastics market segments into multiple polymer categories, each serving specific applications and performance requirements. Polylactic acid (PLA) represents the largest segment due to its versatility and established production infrastructure, while polyhydroxyalkanoates (PHA) show rapid growth in marine-degradable applications.

By Application: Market segmentation by end-use applications reveals diverse demand patterns across industries, with packaging applications dominating current consumption while emerging applications show strong growth potential.

Packaging applications continue dominating the North America bioplastics market, driven by consumer goods companies seeking sustainable alternatives to conventional plastic packaging. Food and beverage packaging represents the largest category within this segment, benefiting from direct consumer visibility and regulatory pressure on single-use plastics. Performance requirements for packaging applications focus on barrier properties, shelf life extension, and processing compatibility with existing manufacturing equipment.

Disposable products represent a high-growth category as food service establishments and events adopt compostable alternatives to traditional plastic utensils and containers. This category benefits from clear environmental messaging and regulatory support through plastic ban legislation. Cost sensitivity remains significant in this category, requiring continued innovation to achieve price parity with conventional alternatives.

Agricultural applications offer unique opportunities for bioplastics that can remain in soil after use, eliminating collection and disposal costs while providing soil conditioning benefits. Mulch films and crop protection products represent the primary applications within this category. Performance standards require materials that maintain integrity during growing seasons while biodegrading completely after harvest.

Industrial applications including automotive components and electronics housings represent emerging high-value categories with less price sensitivity but demanding performance requirements. These applications require bioplastics with enhanced mechanical properties, temperature resistance, and long-term durability. Market penetration in industrial categories remains limited but shows strong growth potential as material properties continue improving through technological advancement.

Brand owners benefit significantly from bioplastics adoption through enhanced sustainability credentials that resonate with environmentally conscious consumers. Companies implementing bioplastic packaging strategies report improved brand perception, increased customer loyalty, and competitive differentiation in crowded market segments. Risk mitigation benefits include reduced exposure to future plastic waste regulations and potential carbon pricing mechanisms that could impact conventional plastic costs.

Manufacturers and converters gain access to growing market segments while developing expertise in sustainable material processing that creates competitive advantages. Early adoption of bioplastic technologies positions companies to capture market share as demand accelerates. Innovation opportunities in bioplastic processing and application development can create intellectual property assets and technology licensing revenue streams.

Agricultural stakeholders benefit from new market opportunities for crop production and agricultural waste utilization that can provide additional revenue streams while supporting rural economic development. Bioplastic feedstock demand creates market diversification opportunities that reduce dependence on traditional commodity markets. Sustainability benefits include reduced agricultural waste disposal costs and improved land use efficiency through crop rotation and soil health improvements.

Investors and financial institutions gain exposure to high-growth sustainable technology markets with strong regulatory tailwinds and increasing consumer demand. Bioplastic investments align with environmental, social, and governance (ESG) criteria while offering potential for significant returns as markets mature. Portfolio diversification benefits include reduced exposure to fossil fuel price volatility and regulatory risks associated with conventional plastic production.

Strengths:

Weaknesses:

Opportunities:

Threats:

Circular economy integration represents the most significant trend shaping the North America bioplastics market, with companies developing closed-loop systems that capture value from waste streams while minimizing environmental impact. This trend includes partnerships between bioplastic producers and waste management companies to ensure proper end-of-life processing. Industrial symbiosis approaches connect agricultural waste producers with bioplastic manufacturers, creating efficient resource utilization and cost reduction opportunities.

Advanced material development focuses on creating next-generation bioplastics with enhanced performance characteristics that can compete directly with conventional plastics in demanding applications. Research emphasis includes marine-degradable materials, high-temperature resistant polymers, and improved barrier properties for food packaging. Biotechnology integration utilizing synthetic biology and metabolic engineering promises breakthrough materials with customized properties for specific applications.

Supply chain localization trends reflect efforts to reduce transportation costs and environmental impact while improving supply security through regional production networks. Companies are establishing distributed manufacturing facilities closer to both feedstock sources and end markets. Vertical integration strategies connect agricultural production with bioplastic manufacturing and end-use applications to capture additional value and ensure supply chain control.

Digital technology adoption includes blockchain systems for supply chain transparency, artificial intelligence for production optimization, and Internet of Things sensors for quality monitoring. These technologies improve operational efficiency while providing sustainability verification that supports premium pricing. Consumer engagement through digital platforms educates users about proper disposal methods and environmental benefits, supporting market growth through increased awareness and acceptance.

Major capacity expansions across North America reflect growing confidence in long-term market demand, with several companies announcing significant production facility investments. NatureWorks LLC completed expansion of its Nebraska facility, increasing PLA production capacity to meet growing packaging demand. Multiple biotechnology companies have secured funding for commercial-scale production facilities focused on next-generation bioplastic materials.

Strategic partnerships between bioplastic producers and major consumer brands are accelerating market adoption through guaranteed volume commitments and co-development programs. Recent agreements include multi-year supply contracts for food packaging applications and collaborative research initiatives for specialized material development. Acquisition activity has intensified as established chemical companies seek to acquire bioplastic technologies and market positions through strategic transactions.

Regulatory developments continue supporting market growth through expanded plastic waste legislation and extended producer responsibility programs. Several states have implemented comprehensive single-use plastic bans that create mandatory demand for biodegradable alternatives. Federal initiatives include research funding for sustainable material development and tax incentives for companies investing in bioplastic production capabilities.

Technology breakthroughs in fermentation processes and genetic engineering have improved production efficiency while reducing costs for bio-based materials. Recent innovations include engineered microorganisms that produce bioplastic precursors directly from agricultural waste streams. Patent activity remains robust, with companies securing intellectual property protection for novel materials and production processes that create competitive advantages.

Investment prioritization should focus on companies with integrated supply chains connecting feedstock production through end-use applications, as these businesses demonstrate better cost control and market positioning. MarkWide Research analysis indicates that vertically integrated players achieve 15-25% higher margins compared to companies dependent on external suppliers for raw materials or market access.

Technology evaluation requires careful assessment of intellectual property portfolios and production scalability potential when evaluating bioplastic investments. Companies with proprietary fermentation processes or novel material formulations offer stronger competitive positioning and growth potential. Market timing considerations suggest that early-stage investments in emerging applications may offer higher returns as these markets develop and mature.

Risk management strategies should address feedstock price volatility through diversified supply sources and long-term supply agreements that provide cost predictability. Companies should also invest in consumer education and proper disposal infrastructure to ensure environmental benefits are realized and regulatory support continues. Geographic diversification across North American markets can reduce regulatory and economic risks while capturing growth opportunities in different regional markets.

Partnership development with major brands and waste management companies creates sustainable competitive advantages while reducing market development costs. Strategic alliances should focus on long-term supply agreements and co-development programs that create mutual value and market barriers for competitors. Innovation investment in next-generation materials and production processes remains critical for maintaining competitive positioning as the market matures and competition intensifies.

Market trajectory for North America bioplastics remains strongly positive, supported by accelerating regulatory pressure on conventional plastics and growing corporate sustainability commitments. MWR projections indicate continued robust growth with the market expanding at a compound annual growth rate of 12.5% through the forecast period. Regulatory expansion into additional jurisdictions and applications will create new mandatory demand segments that support sustained growth momentum.

Technology evolution will address current cost and performance limitations through breakthrough innovations in production processes and material properties. Next-generation bioplastics with enhanced characteristics will expand addressable market opportunities into high-value industrial applications currently dominated by conventional materials. Production scaling and process optimization will improve cost competitiveness, potentially achieving price parity with traditional plastics in key market segments.

Infrastructure development including expanded composting facilities and specialized recycling systems will enhance the environmental value proposition of bioplastics while addressing current disposal challenges. Investment in waste management infrastructure will create additional revenue opportunities for bioplastic producers through waste processing services. Supply chain maturation will improve efficiency and reduce costs through optimized logistics and regional production networks.

Market expansion into emerging applications and geographic regions offers significant growth potential beyond traditional packaging markets. International export opportunities will leverage North American technological leadership and production capabilities to capture global market share. Consumer acceptance will continue increasing as environmental awareness grows and product performance improves, supporting premium pricing and market penetration across diverse applications.

The North America bioplastics market represents a transformative opportunity within the broader materials industry, driven by powerful convergence of environmental regulations, consumer preferences, and technological innovation. Market fundamentals remain exceptionally strong, supported by mandatory demand creation through plastic waste legislation and growing corporate sustainability commitments that prioritize renewable and biodegradable materials.

Growth prospects continue expanding as technology advancement addresses cost and performance limitations while new applications emerge across diverse industry sectors. The market benefits from North America’s abundant agricultural resources, advanced research infrastructure, and supportive regulatory environment that creates favorable conditions for sustained expansion. Competitive dynamics favor companies with integrated supply chains, proprietary technologies, and strategic partnerships that provide sustainable competitive advantages.

Investment opportunities remain compelling for stakeholders seeking exposure to high-growth sustainable technology markets with strong regulatory tailwinds and increasing consumer demand. Success factors include technology leadership, supply chain integration, and strategic positioning in emerging high-value applications. The North America bioplastics market is positioned to play a critical role in the transition toward a circular economy and sustainable materials future, offering significant value creation potential for industry participants and stakeholders committed to environmental responsibility and innovation excellence.

What is Bioplastics?

Bioplastics are materials derived from renewable biomass sources, such as plant starch, vegetable fats, and oils, or microbiota. They are designed to replace conventional plastics and can be biodegradable or non-biodegradable, depending on their composition and intended use.

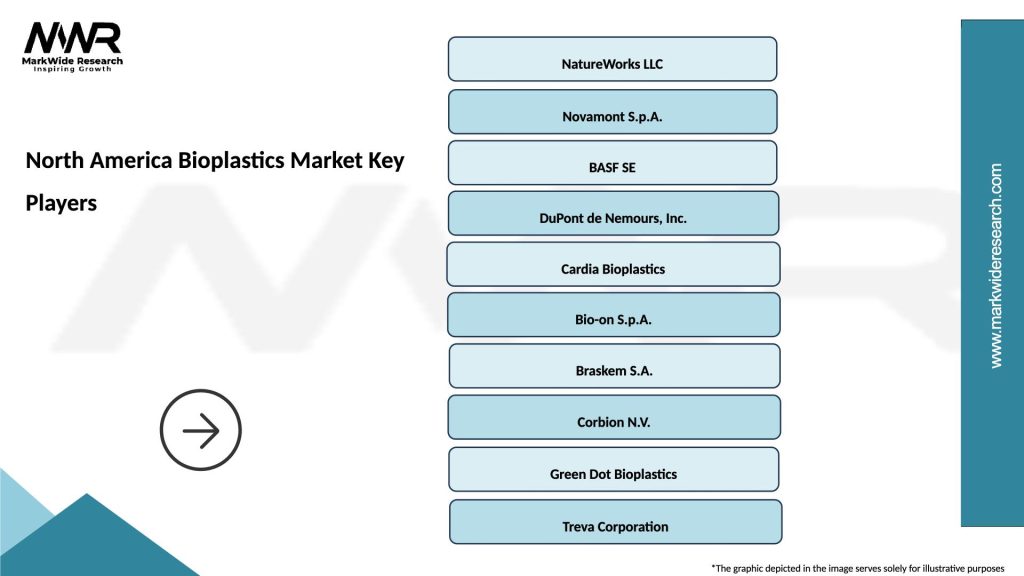

What are the key players in the North America Bioplastics Market?

Key players in the North America Bioplastics Market include companies like BASF, NatureWorks, and Novamont, which are known for their innovative bioplastic solutions. These companies focus on various applications, including packaging, automotive, and consumer goods, among others.

What are the growth factors driving the North America Bioplastics Market?

The North America Bioplastics Market is driven by increasing consumer demand for sustainable products, government regulations promoting eco-friendly materials, and advancements in bioplastic technology. Additionally, the rise in environmental awareness among consumers is pushing industries to adopt bioplastics.

What challenges does the North America Bioplastics Market face?

The North America Bioplastics Market faces challenges such as high production costs compared to conventional plastics and limited availability of raw materials. Additionally, there is a need for more comprehensive recycling systems to handle bioplastics effectively.

What opportunities exist in the North America Bioplastics Market?

Opportunities in the North America Bioplastics Market include the development of new bioplastic materials with enhanced properties and the expansion of applications in sectors like agriculture and food packaging. The growing trend towards circular economy practices also presents significant potential for bioplastics.

What trends are shaping the North America Bioplastics Market?

Trends shaping the North America Bioplastics Market include the increasing use of bioplastics in packaging solutions, innovations in material science leading to improved performance, and a shift towards more sustainable supply chains. Additionally, collaborations between companies and research institutions are fostering advancements in bioplastic technologies.

North America Bioplastics Market

| Segmentation Details | Description |

|---|---|

| Product Type | PLA, PHA, Starch Blends, Cellulose |

| Application | Packaging, Agriculture, Consumer Goods, Automotive |

| End User | Food & Beverage, Healthcare, Retail, Electronics |

| Grade | Industrial, Food Contact, Medical, Compostable |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the North America Bioplastics Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at