444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2150

The India dairy alternatives market represents one of the fastest-growing segments within the country’s food and beverage industry, driven by increasing health consciousness, lactose intolerance awareness, and environmental sustainability concerns. Plant-based milk alternatives have gained significant traction among Indian consumers, with products ranging from traditional options like coconut milk to modern innovations including almond, oat, and soy-based beverages. The market encompasses various product categories including plant-based milk, dairy-free yogurt, cheese alternatives, and ice cream substitutes.

Consumer adoption rates have accelerated dramatically, with urban markets leading the transformation toward dairy alternatives. The market is experiencing robust growth at a CAGR of 18.5%, reflecting the strong consumer shift toward healthier lifestyle choices. Millennial and Gen-Z consumers are particularly driving demand, with approximately 42% of urban consumers actively seeking dairy-free options for health and ethical reasons.

Regional distribution shows concentrated growth in metropolitan cities including Mumbai, Delhi, Bangalore, and Chennai, where awareness and availability of dairy alternatives are highest. The market spans multiple retail channels, from traditional grocery stores to modern e-commerce platforms, with online sales accounting for nearly 35% of total distribution. Product innovation continues to expand the market, with manufacturers introducing fortified alternatives that match or exceed the nutritional profile of conventional dairy products.

The India dairy alternatives market refers to the comprehensive ecosystem of plant-based and non-dairy products designed to replace traditional dairy items such as milk, yogurt, cheese, butter, and ice cream. These alternatives are primarily derived from plant sources including nuts, grains, legumes, and seeds, offering consumers lactose-free, vegan-friendly options that cater to various dietary preferences and restrictions.

Market scope encompasses both traditional Indian alternatives like coconut milk and modern Western-influenced products such as almond and oat milk. The definition includes ready-to-consume beverages, cooking ingredients, and processed dairy alternative products that serve as direct substitutes for conventional dairy items. Functional characteristics of these products aim to replicate the taste, texture, and nutritional benefits of dairy while addressing specific consumer needs including lactose intolerance, veganism, and health optimization.

Product categories within this market include liquid milk alternatives, powdered substitutes, fermented products like plant-based yogurt, solid alternatives such as vegan cheese and butter, and frozen desserts. The market also encompasses fortified versions that provide essential nutrients like calcium, vitamin D, and protein to match traditional dairy nutritional profiles.

Market dynamics in India’s dairy alternatives sector reflect a fundamental shift in consumer preferences toward healthier, more sustainable food choices. The industry has witnessed unprecedented growth driven by increasing awareness of lactose intolerance, rising disposable incomes, and growing environmental consciousness among Indian consumers. Product diversification has expanded beyond basic milk alternatives to include comprehensive dairy replacement ecosystems.

Key growth drivers include urbanization trends, with 68% of demand concentrated in tier-1 and tier-2 cities where health awareness is highest. The market benefits from strong demographic tailwinds, particularly among health-conscious millennials who represent the primary consumer base. Distribution expansion through both traditional retail and e-commerce channels has significantly improved product accessibility across urban markets.

Competitive landscape features a mix of international brands, domestic manufacturers, and emerging startups, creating a dynamic environment for innovation and market expansion. Investment activity has intensified, with venture capital and private equity firms recognizing the sector’s growth potential. Regulatory support and government initiatives promoting plant-based nutrition have created favorable conditions for market development.

Future prospects indicate continued robust expansion, with market penetration expected to deepen as product quality improves and prices become more competitive with traditional dairy products. Innovation focus on taste improvement, nutritional fortification, and local flavor preferences positions the market for sustained long-term growth.

Consumer behavior analysis reveals distinct patterns driving dairy alternatives adoption in India. Health considerations rank as the primary motivator, with digestive health concerns and lactose intolerance affecting a significant portion of the Indian population. Lifestyle changes associated with urbanization have created demand for convenient, nutritious alternatives that align with modern dietary preferences.

Market penetration varies significantly across demographic segments, with higher adoption rates among educated, urban consumers aged 25-40. Product preferences show strong demand for almond and oat-based alternatives, while traditional options like coconut milk maintain steady popularity in southern Indian markets.

Health awareness represents the most significant driver propelling India’s dairy alternatives market forward. Lactose intolerance prevalence affects a substantial portion of the Indian population, creating natural demand for dairy-free alternatives. Digestive health concerns and the association of dairy consumption with various health issues have motivated consumers to explore plant-based options that offer similar nutritional benefits without potential adverse effects.

Lifestyle transformation accompanying India’s rapid urbanization has created favorable conditions for dairy alternatives adoption. Working professionals and urban families increasingly prioritize convenience and health, making plant-based alternatives attractive options for busy lifestyles. Fitness culture and wellness trends have elevated the status of plant-based nutrition, with fitness enthusiasts and health-conscious consumers actively seeking dairy alternatives.

Environmental consciousness has emerged as a powerful driver, particularly among younger consumers who understand the environmental impact of traditional dairy farming. Sustainability concerns regarding water usage, greenhouse gas emissions, and land utilization associated with dairy production motivate environmentally conscious consumers to choose plant-based alternatives.

Product innovation continues to drive market expansion through improved taste, texture, and nutritional profiles. Fortification advances have addressed nutritional gaps, while flavor innovations have overcome taste barriers that previously limited adoption. Premium positioning of dairy alternatives as healthier, more sophisticated options appeals to aspirational consumers willing to pay premium prices for perceived health benefits.

Price sensitivity remains a significant restraint limiting widespread adoption of dairy alternatives in India’s price-conscious market. Cost premiums associated with plant-based alternatives compared to conventional dairy products create barriers for middle-income consumers, particularly in tier-2 and tier-3 cities where price considerations heavily influence purchasing decisions.

Taste preferences and cultural attachment to traditional dairy products present ongoing challenges for market expansion. Consumer skepticism regarding taste, texture, and cooking performance of dairy alternatives limits trial and repeat purchase rates. Traditional dietary habits deeply rooted in Indian culture create resistance to adopting new food categories, particularly among older demographic segments.

Limited awareness in rural and semi-urban markets restricts market penetration beyond metropolitan areas. Educational gaps regarding the benefits and applications of dairy alternatives limit consumer understanding and adoption. Distribution challenges in smaller cities and rural areas reduce product availability and market reach.

Nutritional concerns about protein content, vitamin availability, and overall nutritional adequacy of plant-based alternatives create hesitation among health-conscious consumers. Processing perceptions and concerns about artificial additives in some dairy alternatives may deter consumers seeking natural, minimally processed food options.

Rural market expansion presents substantial untapped opportunities as awareness and distribution networks develop in smaller cities and rural areas. Tier-2 and tier-3 cities represent significant growth potential as urbanization trends and rising disposable incomes create favorable conditions for dairy alternatives adoption. Educational initiatives and targeted marketing campaigns can accelerate awareness and trial in these emerging markets.

Product diversification opportunities exist across multiple categories including dairy-free desserts, plant-based cheese varieties, and functional beverages. Traditional Indian flavors and applications present opportunities for culturally adapted products that resonate with local taste preferences. Ayurvedic integration and traditional medicine positioning could create unique market positioning for certain dairy alternatives.

E-commerce expansion offers significant opportunities to reach consumers in markets with limited physical retail presence. Direct-to-consumer models and subscription services can build customer loyalty while providing convenient access to dairy alternatives. Digital marketing and social media engagement present cost-effective methods to build brand awareness and educate consumers.

Corporate partnerships with food service providers, restaurants, and cafes create opportunities for market expansion through foodservice channels. Private label development for major retailers offers opportunities for market penetration and cost optimization. Export potential to other South Asian markets leverages India’s manufacturing capabilities and cultural similarities.

Supply chain evolution in India’s dairy alternatives market reflects the sector’s rapid maturation and increasing sophistication. Raw material sourcing has become more strategic, with manufacturers establishing direct relationships with almond, oat, and coconut suppliers to ensure quality and cost control. Processing technology advancement has enabled local production of high-quality alternatives that compete effectively with imported products.

Competitive intensity has increased significantly as both international brands and domestic players recognize market potential. Brand differentiation strategies focus on taste, nutritional fortification, and cultural adaptation to Indian preferences. Pricing strategies have become more aggressive as manufacturers seek to achieve price parity with premium dairy products while maintaining profitability.

Consumer education efforts by manufacturers and retailers have accelerated market development through awareness campaigns, sampling programs, and nutritional education. Influencer partnerships and social media marketing have proven particularly effective in reaching target demographics and building brand credibility. Retail partnerships have expanded distribution reach and improved product visibility in key markets.

Regulatory environment continues to evolve, with food safety standards and labeling requirements becoming more defined for plant-based alternatives. Government initiatives promoting plant-based nutrition and sustainable agriculture create supportive conditions for market growth. Investment flows into the sector have accelerated, providing capital for expansion, innovation, and market development activities.

Primary research for analyzing India’s dairy alternatives market employed comprehensive consumer surveys, in-depth interviews with industry stakeholders, and focus group discussions across major metropolitan markets. Consumer behavior analysis included detailed questionnaires administered to over 2,500 respondents across different demographic segments, income levels, and geographic regions to understand purchasing patterns, preferences, and barriers to adoption.

Secondary research incorporated extensive analysis of industry reports, government publications, trade association data, and company financial statements to establish market trends and competitive dynamics. Market sizing methodologies combined top-down and bottom-up approaches, utilizing retail sales data, import/export statistics, and production capacity information from key manufacturers.

Expert interviews with industry leaders, retail executives, nutritionists, and food technology specialists provided qualitative insights into market trends, challenges, and future opportunities. Supply chain analysis included discussions with raw material suppliers, processors, distributors, and retailers to understand value chain dynamics and cost structures.

Data validation processes included cross-referencing multiple sources, triangulation of quantitative findings, and verification of key statistics through industry associations and regulatory bodies. Market forecasting utilized econometric modeling, trend analysis, and scenario planning to project future market development under various growth assumptions.

Western India leads the dairy alternatives market, with Maharashtra and Gujarat accounting for approximately 35% of national consumption. Mumbai metropolitan area represents the largest single market, driven by high disposable incomes, health consciousness, and diverse population with varying dietary preferences. Consumer sophistication in western markets has created demand for premium, imported alternatives alongside locally produced options.

Northern India markets, particularly Delhi NCR, demonstrate strong growth potential with 28% market share and rapidly increasing adoption rates. Urban centers in Punjab, Haryana, and Uttar Pradesh show growing awareness and trial of dairy alternatives, though price sensitivity remains a significant factor. Cultural acceptance varies across northern markets, with younger demographics showing higher adoption rates.

Southern India presents unique opportunities due to traditional consumption of coconut-based products and higher prevalence of lactose intolerance. Bangalore and Chennai lead adoption in the region, with tech-savvy populations driving demand for innovative alternatives. Traditional alternatives like coconut milk maintain strong market positions while modern alternatives gain traction among urban consumers.

Eastern India represents an emerging market with significant growth potential as awareness and distribution expand. Kolkata shows increasing interest in dairy alternatives, particularly among educated, health-conscious consumers. Market development in eastern regions requires targeted education and culturally appropriate product offerings to overcome traditional dietary preferences.

Market leadership in India’s dairy alternatives sector features a dynamic mix of international brands, established domestic players, and innovative startups competing across different product segments and price points. Brand positioning strategies vary from premium health-focused offerings to accessible mainstream alternatives targeting broader consumer segments.

Competitive strategies focus on product innovation, taste improvement, nutritional fortification, and cultural adaptation to Indian preferences. Distribution expansion and retail partnerships have become critical success factors, with leading brands investing heavily in supply chain development and market penetration initiatives.

Product-based segmentation reveals distinct market dynamics across different dairy alternative categories. Plant-based milk represents the largest segment, accounting for the majority of market volume and value. Yogurt alternatives show rapid growth as consumers seek probiotic benefits without dairy consumption. Cheese and butter alternatives remain niche segments with significant growth potential as product quality improves.

By Source:

By Distribution Channel:

Consumer segmentation identifies distinct groups with varying motivations, preferences, and purchasing behaviors, enabling targeted marketing and product development strategies.

Plant-based milk alternatives dominate the market with diverse options catering to different taste preferences and nutritional requirements. Almond milk leads the premium segment, offering superior taste and nutritional profile that appeals to health-conscious consumers. Oat milk has gained significant traction due to its creamy texture and environmental sustainability credentials, particularly among younger demographics.

Yogurt alternatives represent a high-growth category with significant innovation in probiotics, flavors, and textures. Coconut-based yogurts leverage traditional Indian preferences while providing modern convenience and health benefits. Cashew-based varieties offer premium positioning with superior taste and nutritional fortification.

Cheese alternatives remain a developing category with substantial growth potential as product quality and taste profiles improve. Cashew-based cheese shows promise in urban markets where consumers are willing to experiment with premium alternatives. Nutritional yeast-based products appeal to health-conscious consumers seeking umami flavors without dairy.

Ice cream alternatives have gained popularity as indulgent treats that align with health and dietary preferences. Coconut milk-based frozen desserts leverage traditional flavors while offering modern convenience. Cashew and almond-based premium ice creams target affluent consumers seeking guilt-free indulgence.

Manufacturers benefit from expanding market opportunities, premium pricing potential, and growing consumer acceptance of dairy alternatives. Product differentiation opportunities enable brands to establish unique market positions and build customer loyalty. Innovation capabilities in taste, texture, and nutritional fortification create competitive advantages and market leadership opportunities.

Retailers gain from higher margin products, increased foot traffic from health-conscious consumers, and enhanced brand positioning as health and wellness destinations. Category expansion provides opportunities to capture growing consumer segments and increase basket sizes. Private label development offers retailers opportunities to build exclusive product lines and improve profitability.

Consumers benefit from expanded choice, improved health outcomes, and alignment with personal values regarding sustainability and animal welfare. Nutritional advantages include reduced lactose-related digestive issues and access to fortified alternatives with enhanced vitamin and mineral content. Lifestyle alignment enables consumers to maintain dietary preferences while enjoying familiar food experiences.

Investors gain exposure to high-growth market segments with strong demographic tailwinds and increasing consumer acceptance. Market expansion potential across geographic regions and product categories provides multiple avenues for return generation. Sustainability trends align with ESG investment criteria and long-term value creation objectives.

Strengths:

Weaknesses:

Opportunities:

Threats:

Functional fortification has emerged as a dominant trend, with manufacturers enhancing dairy alternatives with proteins, vitamins, minerals, and probiotics to match or exceed traditional dairy nutritional profiles. Protein enrichment addresses consumer concerns about nutritional adequacy while vitamin D and calcium fortification ensures bone health benefits traditionally associated with dairy consumption.

Flavor localization represents a significant trend as brands adapt products to Indian taste preferences and culinary applications. Traditional spice integration and regional flavor profiles help overcome taste barriers and increase consumer acceptance. Chai-compatible formulations and cooking-specific alternatives cater to traditional Indian beverage and culinary practices.

Sustainability messaging has become increasingly important, with brands emphasizing environmental benefits, water conservation, and carbon footprint reduction compared to traditional dairy production. Packaging innovation using recyclable and biodegradable materials aligns with environmental consciousness trends among target consumers.

Premium positioning continues to evolve, with brands focusing on artisanal production methods, organic ingredients, and small-batch processing to justify price premiums. Craft alternatives and specialty formulations appeal to affluent consumers seeking unique, high-quality products that reflect personal values and lifestyle choices.

Manufacturing investments have accelerated significantly, with both domestic and international companies establishing production facilities in India to serve the growing market. Capacity expansion projects focus on key metropolitan markets while preparing for broader geographic expansion as demand develops.

Strategic partnerships between international brands and local distributors have facilitated market entry and expansion, leveraging local market knowledge and distribution networks. Technology transfer agreements enable domestic manufacturers to access advanced processing technologies and quality control systems.

Product launches have intensified, with companies introducing innovative formulations, flavors, and packaging formats to capture consumer attention and market share. Seasonal offerings and limited edition products create excitement and trial opportunities among target consumers.

Retail expansion initiatives have improved product availability across modern trade, traditional retail, and e-commerce channels. Category management partnerships with major retailers have enhanced shelf space allocation and promotional support for dairy alternatives.

Investment activity has surged, with venture capital firms, private equity investors, and strategic acquirers recognizing the sector’s growth potential. Funding rounds have enabled startups to scale operations, improve product quality, and expand market reach.

Market entry strategies should prioritize urban markets with high health consciousness and disposable income levels before expanding to tier-2 and tier-3 cities. MarkWide Research analysis indicates that focusing initial efforts on metropolitan areas provides the highest probability of success and fastest return on investment. Consumer education and sampling programs prove essential for overcoming taste barriers and building trial rates.

Product development should emphasize taste optimization, nutritional fortification, and cultural adaptation to Indian preferences and cooking applications. Local flavor profiles and traditional ingredient integration can significantly improve consumer acceptance and repeat purchase rates. Price optimization strategies should focus on achieving competitive positioning with premium dairy products rather than mass market alternatives.

Distribution strategy should leverage multi-channel approaches combining modern retail, e-commerce, and selective traditional retail partnerships. Digital marketing and social media engagement provide cost-effective methods to build brand awareness and educate consumers about product benefits. Influencer partnerships and health professional endorsements can enhance credibility and accelerate adoption.

Investment priorities should focus on supply chain development, quality improvement, and market expansion rather than aggressive price competition. Brand building and consumer education represent critical long-term investments that will determine market leadership positions as the category matures.

Market expansion is projected to accelerate significantly over the next five years, driven by increasing health awareness, improving product quality, and expanding distribution networks. Penetration rates are expected to grow from current levels to reach 15-20% of urban households by 2028, representing substantial market development potential.

Product innovation will continue to drive market growth through improved taste profiles, enhanced nutritional fortification, and culturally adapted formulations. Technology advancement in processing and preservation will enable better quality products at more competitive price points. MWR projections indicate that taste parity with traditional dairy products will be achieved across most categories within the next three years.

Geographic expansion will extend beyond current metropolitan focus areas to include tier-2 cities and eventually rural markets as awareness and distribution develop. Regional adaptation strategies will become increasingly important as brands seek to capture diverse consumer preferences across India’s varied cultural landscape.

Competitive dynamics will intensify as market potential attracts additional players and investment capital. Consolidation activity may emerge as successful brands seek to acquire complementary products or distribution capabilities. International expansion opportunities will develop as Indian manufacturers achieve scale and quality standards suitable for export markets.

The India dairy alternatives market represents a transformative opportunity within the country’s evolving food and beverage landscape, driven by powerful demographic, health, and lifestyle trends that support sustained long-term growth. Consumer adoption has reached a tipping point in urban markets, with increasing awareness, improved product quality, and expanding distribution creating favorable conditions for continued market expansion.

Market fundamentals remain strong, supported by rising health consciousness, increasing lactose intolerance awareness, and growing environmental sustainability concerns among Indian consumers. Product innovation continues to address historical barriers related to taste, texture, and nutritional adequacy, while cultural adaptation efforts enhance consumer acceptance across diverse market segments.

Investment opportunities abound for manufacturers, retailers, and investors willing to commit to long-term market development and consumer education. Success factors include focus on quality, taste optimization, strategic distribution, and effective consumer communication about health and environmental benefits. The India dairy alternatives market is positioned for robust growth, offering significant value creation potential for stakeholders committed to building this emerging category.

What is Dairy Alternatives?

Dairy alternatives refer to plant-based products that serve as substitutes for traditional dairy products. These include items like almond milk, soy yogurt, and coconut cheese, catering to consumers seeking lactose-free or vegan options.

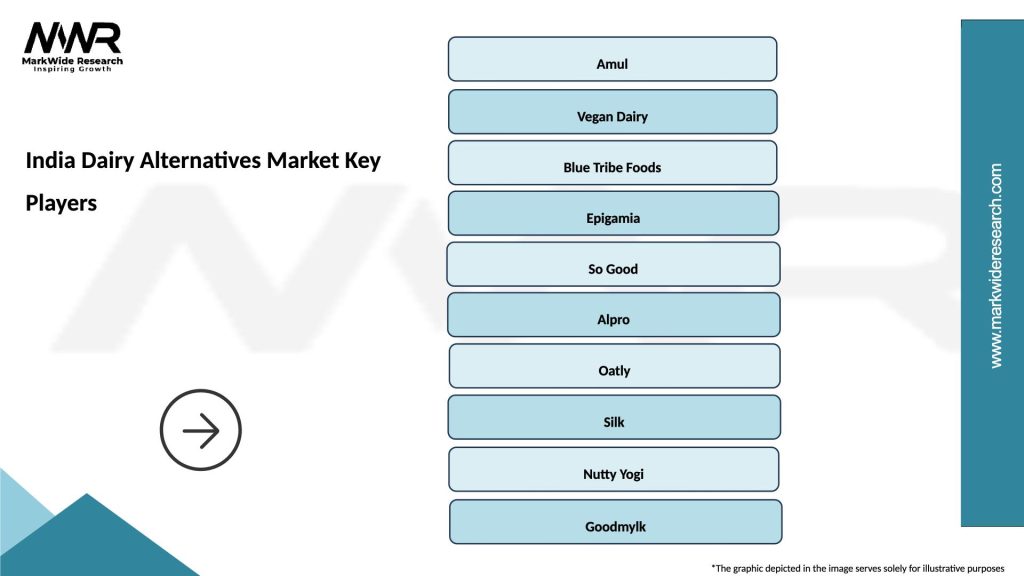

What are the key players in the India Dairy Alternatives Market?

Key players in the India Dairy Alternatives Market include companies like Epigamia, So Good, and Vezlay, which offer a range of dairy alternative products such as plant-based milk and yogurt, among others.

What are the growth factors driving the India Dairy Alternatives Market?

The India Dairy Alternatives Market is driven by increasing health consciousness among consumers, a rise in lactose intolerance, and the growing popularity of vegan diets. Additionally, the demand for sustainable and ethical food choices is contributing to market growth.

What challenges does the India Dairy Alternatives Market face?

Challenges in the India Dairy Alternatives Market include consumer skepticism regarding the taste and nutritional value of plant-based products. Additionally, competition from traditional dairy products and regulatory hurdles can hinder market expansion.

What opportunities exist in the India Dairy Alternatives Market?

The India Dairy Alternatives Market presents opportunities for innovation in product development, such as fortified dairy alternatives and new flavors. There is also potential for growth in e-commerce channels and increased awareness through marketing campaigns.

What trends are shaping the India Dairy Alternatives Market?

Trends in the India Dairy Alternatives Market include the rise of clean label products, increased investment in research and development, and a focus on sustainability. Consumers are also showing interest in functional foods that offer health benefits beyond basic nutrition.

India Dairy Alternatives Market

| Segmentation Details | Description |

|---|---|

| Product Type | Almond Milk, Soy Milk, Oat Milk, Coconut Milk |

| End User | Households, Cafes, Restaurants, Food Manufacturers |

| Distribution Channel | Online Retail, Supermarkets, Health Stores, Specialty Shops |

| Packaging Type | Cartons, Bottles, Pouches, Tetra Packs |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the India Dairy Alternatives Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at