444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The North America low voltage induction motors market represents a critical segment of the industrial automation and electrical machinery sector, experiencing robust growth driven by increasing industrial automation, energy efficiency mandates, and technological advancements. Low voltage induction motors, typically operating at voltages below 1,000V, serve as the backbone of numerous industrial applications across manufacturing, HVAC systems, water treatment facilities, and commercial buildings throughout the United States, Canada, and Mexico.

Market dynamics indicate substantial expansion opportunities, with the sector projected to grow at a compound annual growth rate (CAGR) of 6.2% over the forecast period. This growth trajectory reflects the region’s commitment to industrial modernization, energy efficiency improvements, and the adoption of smart manufacturing technologies. Manufacturing sectors across North America are increasingly prioritizing energy-efficient motor solutions to reduce operational costs and meet stringent environmental regulations.

Regional distribution shows the United States commanding approximately 75% market share, followed by Canada with 18%, and Mexico contributing 7% to the overall North American market. The dominance of advanced manufacturing industries, particularly in automotive, aerospace, food processing, and chemical sectors, continues to drive demand for reliable and efficient low voltage induction motor solutions across the region.

The North America low voltage induction motors market refers to the commercial ecosystem encompassing the design, manufacturing, distribution, and application of alternating current (AC) induction motors operating at voltages typically ranging from 200V to 690V across the United States, Canada, and Mexico. These motors utilize electromagnetic induction principles to convert electrical energy into mechanical energy, serving as fundamental components in industrial machinery, commercial equipment, and residential applications.

Low voltage induction motors are characterized by their robust construction, high reliability, and cost-effective operation, making them the preferred choice for applications requiring continuous operation and variable speed control. The market encompasses various motor types including squirrel cage motors, wound rotor motors, and specialized designs for specific industrial applications, all designed to meet North American electrical standards and efficiency requirements.

Strategic market positioning reveals the North America low voltage induction motors market as a mature yet evolving sector, driven by technological innovation and regulatory compliance requirements. The market demonstrates strong fundamentals supported by ongoing industrial expansion, infrastructure modernization, and the transition toward energy-efficient motor technologies. Key growth drivers include increasing adoption of variable frequency drives (VFDs), implementation of energy efficiency standards, and rising demand from emerging applications in renewable energy systems.

Competitive landscape analysis shows a consolidated market structure with established manufacturers maintaining significant market presence through continuous product innovation and strategic partnerships. The integration of Internet of Things (IoT) capabilities and smart monitoring systems represents a key differentiator, with manufacturers investing heavily in connected motor solutions to meet evolving customer demands for predictive maintenance and operational optimization.

Market segmentation reveals diverse application areas, with industrial manufacturing accounting for the largest share, followed by HVAC systems, water and wastewater treatment, and commercial applications. The trend toward premium efficiency motors continues to gain momentum, driven by utility rebate programs and corporate sustainability initiatives across North American industries.

Primary market insights highlight several critical factors shaping the North America low voltage induction motors landscape:

Industrial automation expansion serves as the primary catalyst for market growth, with North American manufacturers increasingly investing in automated production systems to enhance productivity and competitiveness. The integration of advanced motor control systems enables precise speed and torque control, supporting sophisticated manufacturing processes across automotive, aerospace, and electronics industries. Manufacturing efficiency improvements of up to 25% are achievable through strategic motor upgrades and automation implementations.

Energy efficiency regulations continue to drive market demand, with government mandates requiring higher efficiency standards for industrial motors. The implementation of NEMA Premium efficiency standards and utility incentive programs encourage businesses to upgrade aging motor systems, creating substantial replacement market opportunities. Energy cost reduction potential of 15-30% through motor efficiency improvements provides compelling economic justification for equipment upgrades.

Infrastructure modernization initiatives across water treatment facilities, commercial buildings, and industrial complexes generate consistent demand for reliable motor solutions. The aging industrial infrastructure in North America presents significant opportunities for motor replacement and system upgrades, particularly in sectors requiring continuous operation and high reliability standards.

High initial investment costs represent a significant barrier to market adoption, particularly for small and medium-sized enterprises considering motor system upgrades. The upfront capital requirements for premium efficiency motors and associated control systems can create budget constraints, despite long-term operational savings. Payback period concerns often delay investment decisions, especially in price-sensitive market segments.

Technical complexity challenges associated with motor selection, installation, and integration can deter potential customers lacking specialized technical expertise. The need for proper sizing, control system compatibility, and application-specific customization requires significant engineering support, potentially increasing project costs and implementation timelines.

Supply chain disruptions and raw material cost volatility impact market stability, with fluctuating prices for copper, steel, and rare earth materials affecting motor manufacturing costs. Global supply chain dependencies create potential risks for consistent product availability and pricing predictability, particularly affecting large-scale industrial projects with specific delivery requirements.

Smart manufacturing integration presents substantial growth opportunities as North American industries embrace Industry 4.0 technologies. The development of intelligent motor systems with embedded sensors, wireless connectivity, and predictive analytics capabilities addresses growing demand for operational optimization and maintenance efficiency. Connected motor solutions enable real-time performance monitoring and data-driven decision making, creating new revenue streams for manufacturers.

Renewable energy sector expansion offers emerging application opportunities for specialized low voltage induction motors in wind turbine systems, solar tracking mechanisms, and energy storage applications. The growing focus on sustainable energy solutions drives demand for motors designed to operate efficiently in renewable energy environments, requiring enhanced durability and performance characteristics.

Retrofit and replacement markets provide consistent growth opportunities as aging industrial infrastructure requires motor system upgrades. The large installed base of inefficient motors across North American industries represents a substantial addressable market for energy-efficient replacements and performance optimization solutions. Utility rebate programs and government incentives further support market expansion in this segment.

Technological evolution continues to reshape market dynamics, with manufacturers investing heavily in research and development to create more efficient, reliable, and intelligent motor solutions. The integration of advanced materials, improved magnetic designs, and sophisticated control algorithms enables significant performance enhancements while reducing environmental impact. Innovation cycles are accelerating as companies compete to deliver next-generation motor technologies.

Regulatory landscape changes influence market direction through evolving energy efficiency standards and environmental regulations. The implementation of stricter efficiency requirements drives continuous product improvement and creates market differentiation opportunities for manufacturers offering superior performance solutions. Compliance requirements often serve as market entry barriers while protecting established players with comprehensive product portfolios.

Customer behavior shifts toward total cost of ownership considerations rather than initial purchase price create opportunities for premium motor solutions. Lifecycle cost analysis increasingly influences purchasing decisions, with customers recognizing the value of energy-efficient motors, extended maintenance intervals, and enhanced reliability. This trend supports market premiumization and value-based selling approaches.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable market insights. Primary research activities include extensive interviews with industry executives, technical specialists, and end-users across various application segments. These interactions provide valuable insights into market trends, customer preferences, and emerging technology requirements that shape future market development.

Secondary research components encompass detailed analysis of industry publications, technical standards, regulatory documents, and company financial reports. The integration of multiple data sources enables comprehensive market validation and trend identification. MarkWide Research utilizes advanced analytical frameworks to process and interpret complex market data, ensuring robust conclusions and actionable insights.

Market modeling techniques incorporate statistical analysis, trend extrapolation, and scenario planning to develop accurate market forecasts. The methodology considers multiple variables including economic indicators, technological developments, regulatory changes, and competitive dynamics to create comprehensive market projections supporting strategic decision-making processes.

United States market leadership reflects the country’s advanced manufacturing base, stringent energy efficiency regulations, and substantial industrial infrastructure. The presence of major automotive, aerospace, and chemical manufacturing facilities drives consistent demand for high-performance motor solutions. Regional market share distribution shows the Midwest and Southeast regions commanding significant portions due to concentrated manufacturing activities.

Canadian market characteristics emphasize applications in natural resource extraction, pulp and paper manufacturing, and energy production sectors. The country’s focus on environmental sustainability and energy efficiency creates favorable conditions for premium motor adoption. Government incentive programs supporting industrial energy efficiency improvements contribute to steady market growth across key industrial provinces.

Mexican market expansion benefits from ongoing manufacturing sector growth, particularly in automotive assembly and electronics production. The country’s position as a manufacturing hub for North American markets drives demand for reliable and cost-effective motor solutions. Foreign direct investment in manufacturing facilities continues to support market development and technology adoption across various industrial sectors.

Market leadership structure features established global manufacturers with strong North American presence and comprehensive product portfolios. Key competitive factors include product reliability, energy efficiency performance, technical support capabilities, and distribution network coverage. The competitive environment emphasizes continuous innovation and customer service excellence to maintain market position.

Leading market participants include:

By Power Rating:

By Application:

By Efficiency Class:

Industrial manufacturing applications dominate market demand, accounting for approximately 45% of total market share. This segment emphasizes motor reliability, precise speed control, and integration with automated production systems. Manufacturing efficiency requirements drive adoption of premium efficiency motors paired with variable frequency drives to optimize energy consumption and process control.

HVAC applications represent a growing market segment, particularly in commercial and industrial buildings requiring sophisticated climate control systems. The emphasis on energy efficiency and quiet operation creates opportunities for specialized motor designs with enhanced performance characteristics. Building automation integration drives demand for motors with communication capabilities and smart control features.

Water and wastewater treatment applications require motors designed for harsh operating environments with high reliability and corrosion resistance. This segment values long-term durability and minimal maintenance requirements due to critical infrastructure applications. Regulatory compliance requirements for water quality and treatment efficiency support demand for high-performance motor solutions.

Manufacturers benefit from expanding market opportunities driven by industrial automation trends and energy efficiency mandates. The growing demand for smart motor solutions enables premium pricing and enhanced customer relationships through value-added services. Innovation investments in connected technologies and advanced materials create competitive differentiation and market leadership opportunities.

End-users realize significant operational advantages through improved energy efficiency, reduced maintenance costs, and enhanced process control capabilities. Total cost of ownership reductions of 20-35% are achievable through strategic motor upgrades and system optimization. Productivity improvements and reduced downtime contribute to enhanced competitiveness and profitability.

Service providers benefit from expanding aftermarket opportunities including motor maintenance, repair, and optimization services. The growing installed base of sophisticated motor systems creates consistent revenue streams through predictive maintenance contracts and performance optimization services. Technical expertise becomes increasingly valuable as motor systems become more complex and integrated.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digitalization and connectivity represent the most significant trend reshaping the low voltage induction motors market. Smart motor technologies incorporating IoT sensors, wireless communication, and cloud-based analytics enable predictive maintenance, energy optimization, and operational insights. This trend creates new business models focused on motor-as-a-service offerings and performance-based contracts.

Energy efficiency optimization continues driving market evolution, with manufacturers developing motors exceeding current efficiency standards. Advanced magnetic materials, improved winding designs, and optimized cooling systems enable significant performance improvements while reducing environmental impact. Utility partnership programs support market adoption through rebates and technical assistance.

Customization and application-specific solutions gain importance as industries require motors tailored to unique operating conditions and performance requirements. Modular design approaches enable cost-effective customization while maintaining manufacturing efficiency. Collaborative engineering between manufacturers and end-users drives innovation in specialized motor applications.

Recent technological breakthroughs include the development of permanent magnet-assisted induction motors offering superior efficiency and power density characteristics. Advanced control algorithms enable precise torque and speed control while minimizing energy consumption across variable load conditions. Material science innovations in magnetic steel and insulation systems contribute to enhanced motor performance and longevity.

Strategic partnerships between motor manufacturers and automation companies accelerate the development of integrated solutions combining motors, drives, and control systems. MarkWide Research analysis indicates increasing collaboration between traditional motor manufacturers and technology companies to develop smart motor solutions addressing Industry 4.0 requirements.

Manufacturing facility expansions across North America reflect growing market confidence and demand projections. Investment in automation and advanced manufacturing technologies enables improved product quality and cost competitiveness. Sustainability initiatives drive adoption of environmentally friendly manufacturing processes and recyclable motor designs.

Strategic recommendations for market participants emphasize the importance of investing in digital transformation and smart motor technologies. Innovation focus should prioritize connectivity, predictive maintenance capabilities, and energy optimization features to meet evolving customer requirements. Partnership strategies with automation and software companies can accelerate technology development and market penetration.

Market positioning strategies should emphasize total cost of ownership benefits rather than initial purchase price considerations. Value proposition development focusing on energy savings, reliability improvements, and operational optimization resonates with cost-conscious customers. Service capability expansion creates competitive differentiation and recurring revenue opportunities.

Geographic expansion opportunities exist in emerging industrial regions and renewable energy applications. Distribution network strengthening ensures market coverage and customer support capabilities. Technical expertise development through training and certification programs supports customer success and market credibility.

Long-term market prospects remain positive, supported by ongoing industrial automation trends, energy efficiency requirements, and technological advancement. Market growth projections indicate sustained expansion at a CAGR of 6.2% through the forecast period, driven by replacement demand and emerging applications. Technology evolution toward smart, connected motor solutions will define competitive success in future market conditions.

Emerging applications in electric vehicle charging infrastructure, data center cooling systems, and renewable energy installations create new growth opportunities beyond traditional industrial markets. Regulatory developments supporting energy efficiency and environmental sustainability will continue driving market demand for premium motor solutions.

Industry consolidation trends may accelerate as companies seek to achieve scale advantages and comprehensive technology portfolios. MWR projections suggest increasing importance of aftermarket services and digital solutions in overall business models. Sustainability focus will drive development of recyclable motor designs and environmentally friendly manufacturing processes, creating competitive advantages for forward-thinking manufacturers.

The North America low voltage induction motors market demonstrates robust fundamentals and promising growth prospects driven by industrial automation, energy efficiency mandates, and technological innovation. Market dynamics favor companies investing in smart motor technologies, comprehensive service capabilities, and customer-centric solutions addressing total cost of ownership considerations.

Strategic success factors include continuous innovation, strong distribution networks, technical expertise, and adaptability to evolving customer requirements. The integration of digital technologies and IoT capabilities represents a critical differentiator for future market leadership. Sustainability considerations and energy efficiency improvements will continue driving market evolution and creating opportunities for premium solutions.

Future market development will be characterized by increasing sophistication, connectivity, and application-specific customization. Companies positioning themselves at the forefront of these trends while maintaining focus on reliability and cost-effectiveness will be best positioned to capitalize on emerging opportunities in this dynamic and essential industrial market segment.

What is Low Voltage Induction Motors?

Low Voltage Induction Motors are electric motors that operate at low voltage levels, typically below a certain threshold, and are widely used in various applications such as industrial machinery, HVAC systems, and pumps.

What are the key players in the North America Low Voltage Induction Motors Market?

Key players in the North America Low Voltage Induction Motors Market include Siemens, ABB, and Schneider Electric, among others.

What are the main drivers of the North America Low Voltage Induction Motors Market?

The main drivers of the North America Low Voltage Induction Motors Market include the increasing demand for energy-efficient solutions, the growth of automation in industries, and the rising need for reliable power supply in various applications.

What challenges does the North America Low Voltage Induction Motors Market face?

Challenges in the North America Low Voltage Induction Motors Market include the high initial costs of advanced motor technologies, competition from alternative motor types, and regulatory compliance issues related to energy efficiency standards.

What opportunities exist in the North America Low Voltage Induction Motors Market?

Opportunities in the North America Low Voltage Induction Motors Market include the growing trend towards renewable energy integration, advancements in smart motor technologies, and increasing investments in infrastructure development.

What trends are shaping the North America Low Voltage Induction Motors Market?

Trends shaping the North America Low Voltage Induction Motors Market include the adoption of IoT-enabled motors for enhanced monitoring, the shift towards sustainable manufacturing practices, and the increasing focus on reducing operational costs through automation.

North America Low Voltage Induction Motors Market

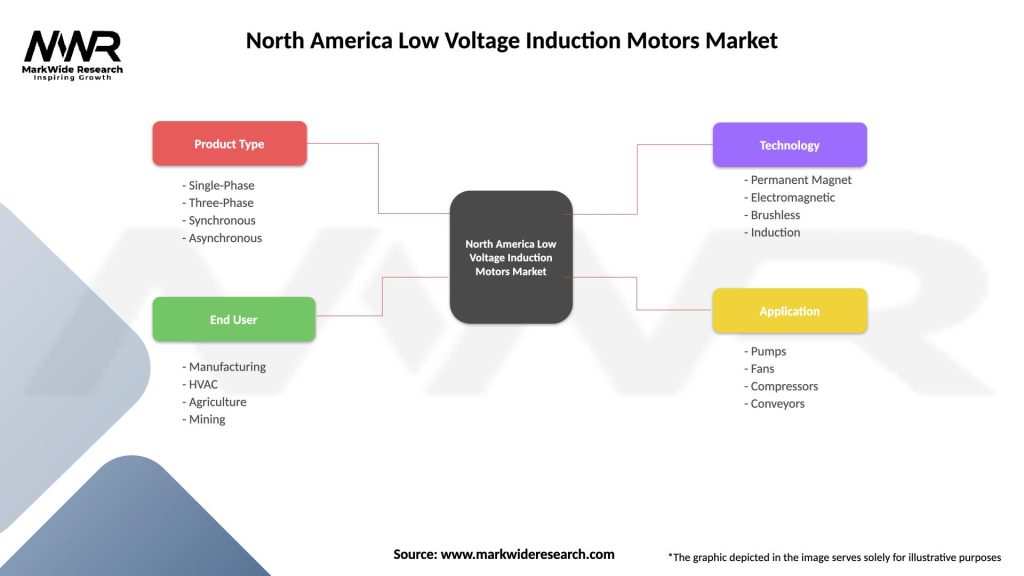

| Segmentation Details | Description |

|---|---|

| Product Type | Single-Phase, Three-Phase, Synchronous, Asynchronous |

| End User | Manufacturing, HVAC, Agriculture, Mining |

| Technology | Permanent Magnet, Electromagnetic, Brushless, Induction |

| Application | Pumps, Fans, Compressors, Conveyors |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the North America Low Voltage Induction Motors Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at