444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Asia Pacific integrated circuit market represents one of the most dynamic and rapidly evolving technological landscapes in the global semiconductor industry. This region has emerged as the epicenter of IC manufacturing, design, and innovation, driven by robust demand from consumer electronics, automotive, telecommunications, and industrial automation sectors. The market encompasses a comprehensive range of integrated circuits including microprocessors, memory chips, analog circuits, and specialized application-specific integrated circuits (ASICs).

Market dynamics in the Asia Pacific region are characterized by intense competition, technological advancement, and significant investment in research and development. Countries such as China, Japan, South Korea, Taiwan, and Singapore have established themselves as major players in the global IC ecosystem, contributing to approximately 75% of global semiconductor production capacity. The region’s strategic importance is further amplified by the presence of leading technology companies, advanced manufacturing facilities, and a skilled workforce dedicated to semiconductor innovation.

Growth trajectories indicate sustained expansion driven by emerging technologies such as artificial intelligence, 5G networks, Internet of Things (IoT), and autonomous vehicles. The market is experiencing unprecedented demand for high-performance computing chips, memory solutions, and power management ICs. Regional governments are implementing supportive policies and substantial investments to strengthen domestic semiconductor capabilities and reduce dependence on foreign technology suppliers.

The Asia Pacific integrated circuit market refers to the comprehensive ecosystem encompassing the design, manufacturing, testing, and distribution of semiconductor devices across the Asia Pacific region. An integrated circuit represents a semiconductor device containing multiple interconnected electronic components such as transistors, resistors, and capacitors fabricated on a single chip substrate, typically silicon.

This market definition includes various IC categories ranging from simple logic gates to complex system-on-chip (SoC) solutions that power modern electronic devices. The Asia Pacific region’s IC market specifically focuses on regional manufacturing capabilities, design centers, assembly and testing facilities, and the extensive supply chain network that supports global semiconductor demand. The market encompasses both domestic consumption and export-oriented production, making it a critical component of the global technology infrastructure.

Strategic positioning of the Asia Pacific integrated circuit market reflects its dominance in global semiconductor manufacturing and innovation. The region continues to attract significant foreign direct investment while simultaneously developing indigenous technological capabilities. Key market drivers include accelerating digital transformation, growing smartphone penetration, expanding automotive electronics, and increasing adoption of cloud computing infrastructure.

Competitive landscape features a mix of established multinational corporations and emerging regional players. Taiwan Semiconductor Manufacturing Company (TSMC), Samsung, SK Hynix, and numerous Chinese semiconductor companies are driving technological advancement and capacity expansion. The market benefits from government initiatives promoting semiconductor self-sufficiency, particularly in China, Japan, and South Korea.

Technology trends indicate a shift toward advanced node manufacturing, with increasing focus on 7nm, 5nm, and emerging 3nm process technologies. The market is experiencing robust growth in specialized ICs for artificial intelligence applications, with AI chip demand growing at approximately 28% annually. Memory segment continues to represent a significant portion of regional production, while logic and analog ICs are gaining momentum driven by automotive and industrial applications.

Fundamental market insights reveal the Asia Pacific region’s strategic importance in the global semiconductor value chain:

Primary growth drivers propelling the Asia Pacific integrated circuit market include accelerating digitalization across industries and increasing adoption of smart technologies. The proliferation of smartphones, tablets, and connected devices continues to generate substantial demand for various IC categories, particularly application processors, memory chips, and power management units.

Automotive electronics represents a rapidly expanding driver, with electric vehicles and advanced driver assistance systems requiring sophisticated semiconductor solutions. The automotive IC segment is experiencing growth rates of approximately 15% annually, driven by increasing electronic content per vehicle and the transition toward autonomous driving technologies.

5G network deployment across the region is creating significant demand for high-frequency ICs, baseband processors, and RF components. Telecommunications infrastructure upgrades and the rollout of 5G-enabled devices are driving substantial investment in specialized semiconductor solutions. Data center expansion and cloud computing growth are generating increased demand for server processors, memory modules, and networking ICs.

Industrial automation and Industry 4.0 initiatives are driving demand for microcontrollers, sensors, and power management ICs. The Internet of Things ecosystem expansion requires low-power, cost-effective IC solutions for various connected applications. Government initiatives promoting smart city development and digital infrastructure modernization are creating additional market opportunities.

Significant challenges facing the Asia Pacific integrated circuit market include supply chain vulnerabilities and geopolitical tensions affecting international trade relationships. Trade restrictions and export controls on advanced semiconductor technologies have created uncertainty and prompted companies to diversify their supply chains and manufacturing locations.

Capital intensity of semiconductor manufacturing presents substantial barriers to entry, with advanced fabrication facilities requiring investments exceeding several billion dollars. The rapid pace of technological advancement necessitates continuous capital expenditure for equipment upgrades and process development, creating financial pressure on market participants.

Talent shortage in specialized semiconductor engineering roles constrains industry growth, particularly in advanced process development and IC design. The complexity of modern semiconductor technologies requires highly skilled professionals, and competition for talent has intensified across the region.

Environmental regulations and sustainability requirements are increasing operational costs and complexity for semiconductor manufacturers. Water usage, chemical waste management, and energy consumption concerns require significant investment in environmental compliance and clean manufacturing technologies.

Emerging opportunities in the Asia Pacific integrated circuit market are driven by next-generation technologies and evolving consumer demands. Artificial intelligence and machine learning applications are creating substantial demand for specialized AI chips, neuromorphic processors, and high-performance computing solutions.

Edge computing proliferation presents opportunities for low-power, high-efficiency IC solutions that can process data locally rather than relying on cloud infrastructure. The growing emphasis on data privacy and real-time processing is driving demand for edge AI chips and specialized processors.

Quantum computing research and development initiatives across the region are creating opportunities for quantum IC technologies and supporting semiconductor solutions. While still in early stages, quantum computing represents a significant long-term opportunity for specialized semiconductor companies.

Sustainable technology trends are driving demand for energy-efficient ICs, power management solutions, and renewable energy system components. The transition toward electric vehicles and clean energy infrastructure creates opportunities for power semiconductors and battery management ICs. Healthcare technology advancement, particularly in medical devices and diagnostic equipment, is generating demand for specialized biomedical ICs and sensor solutions.

Dynamic market forces shaping the Asia Pacific integrated circuit landscape include rapid technological evolution and shifting competitive dynamics. The semiconductor industry operates on accelerated innovation cycles, with new process nodes and architectural improvements driving continuous market transformation.

Supply and demand dynamics are influenced by cyclical patterns in consumer electronics, seasonal variations in device launches, and inventory management strategies across the supply chain. The market experiences periodic capacity constraints and oversupply situations that impact pricing and profitability.

Technology migration toward advanced process nodes creates both opportunities and challenges for market participants. Companies must balance investment in cutting-edge technologies while maintaining profitability in mature product segments. The transition to smaller geometries enables higher performance and lower power consumption but requires substantial capital investment.

Ecosystem collaboration between IC designers, foundries, assembly and test providers, and equipment suppliers drives innovation and efficiency improvements. Strategic partnerships and joint development programs are becoming increasingly important for addressing complex technological challenges and market requirements. According to MarkWide Research analysis, collaborative innovation initiatives have increased by approximately 35% over the past three years.

Comprehensive research approach employed for analyzing the Asia Pacific integrated circuit market combines primary and secondary research methodologies to ensure accuracy and reliability of market insights. Primary research involves direct engagement with industry stakeholders including semiconductor manufacturers, design companies, equipment suppliers, and end-use customers.

Data collection methods include structured interviews with C-level executives, technical experts, and market analysts across major Asia Pacific countries. Survey methodologies capture quantitative data on market trends, technology adoption rates, and investment priorities from a representative sample of industry participants.

Secondary research encompasses analysis of company financial reports, government publications, industry association data, and technical literature. Patent analysis and technology roadmap evaluation provide insights into innovation trends and competitive positioning.

Market modeling techniques incorporate statistical analysis, trend extrapolation, and scenario planning to develop accurate market projections. Cross-validation of data sources ensures consistency and reliability of research findings. Regional analysis considers country-specific factors including government policies, economic conditions, and technological capabilities.

China dominates the Asia Pacific integrated circuit market with the largest domestic consumption and rapidly expanding manufacturing capabilities. The country accounts for approximately 45% of regional IC consumption and is investing heavily in domestic semiconductor production capacity. Government initiatives such as the National IC Industry Development Guidelines are driving substantial investment in foundry capacity, design capabilities, and advanced packaging technologies.

Taiwan maintains its position as a global leader in contract semiconductor manufacturing, with TSMC and other foundries providing advanced process technologies to global customers. The island’s semiconductor industry represents a significant portion of global production capacity and continues to lead in technology innovation.

South Korea excels in memory semiconductor production, with Samsung and SK Hynix dominating global DRAM and NAND flash markets. The country is also investing in logic IC capabilities and advanced packaging technologies to diversify its semiconductor portfolio.

Japan focuses on specialized semiconductor segments including automotive ICs, industrial semiconductors, and advanced materials. Japanese companies maintain strong positions in analog ICs, power semiconductors, and sensor technologies. Singapore and Malaysia serve as major assembly and testing hubs, providing critical backend manufacturing services to the global semiconductor industry.

Market leadership in the Asia Pacific integrated circuit sector is characterized by a diverse ecosystem of companies ranging from global technology giants to specialized regional players. The competitive landscape encompasses foundries, integrated device manufacturers, fabless design companies, and assembly and test service providers.

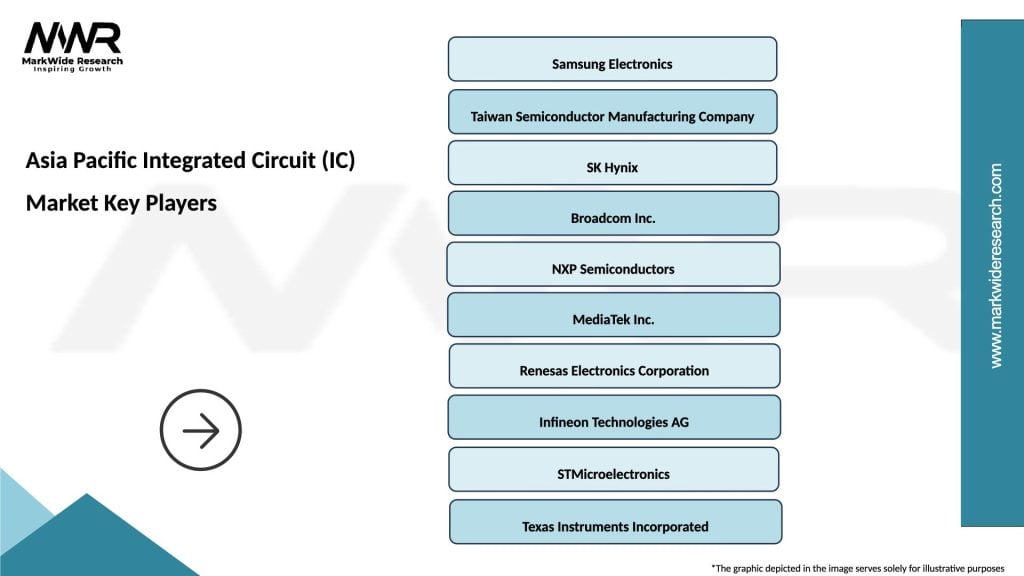

Leading companies shaping the competitive dynamics include:

Competitive strategies focus on technology differentiation, capacity expansion, and strategic partnerships to address evolving market requirements and maintain competitive advantages.

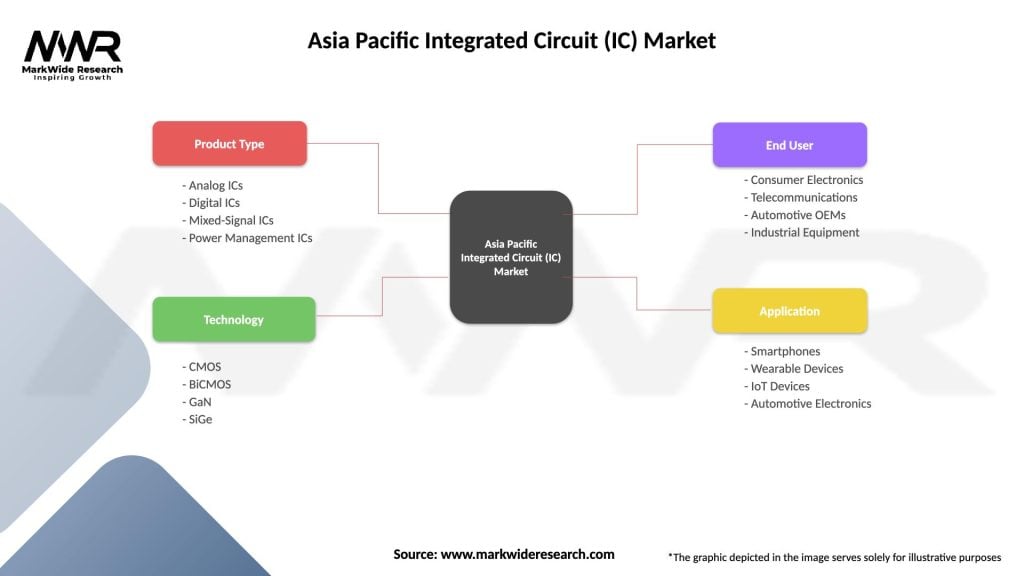

Market segmentation of the Asia Pacific integrated circuit market encompasses multiple dimensions including product type, application, technology node, and end-use industry. This comprehensive segmentation provides detailed insights into market dynamics and growth opportunities across different categories.

By Product Type:

By Application:

By Technology Node:

Logic IC segment represents the largest category within the Asia Pacific integrated circuit market, driven by continuous demand for application processors in smartphones and computing devices. Advanced logic ICs incorporating AI acceleration capabilities are experiencing particularly strong growth, with demand increasing by approximately 25% annually.

Memory IC category maintains significant market presence, with DRAM and NAND flash technologies serving diverse applications from mobile devices to data centers. The memory segment benefits from increasing data generation and storage requirements across various industries. Emerging memory technologies such as 3D NAND and next-generation DRAM architectures are driving innovation and capacity expansion.

Analog IC segment demonstrates steady growth driven by power management requirements in portable devices and automotive applications. The increasing complexity of electronic systems requires sophisticated analog solutions for power conversion, signal conditioning, and sensor interfaces. Power management ICs are experiencing particularly strong demand due to energy efficiency requirements.

Mixed-signal ICs are gaining prominence as system integration trends drive demand for chips combining analog and digital functionality. These solutions offer space and cost advantages while enabling new application possibilities in IoT devices and edge computing applications.

Semiconductor manufacturers benefit from the Asia Pacific market’s scale, manufacturing expertise, and cost advantages. The region’s established supply chain infrastructure enables efficient production and rapid time-to-market for new products. Access to skilled engineering talent and advanced manufacturing facilities supports innovation and competitive positioning.

Technology companies gain access to cutting-edge semiconductor solutions and manufacturing capabilities that enable product differentiation and performance advantages. The region’s foundry ecosystem provides flexible manufacturing options and advanced process technologies for various application requirements.

End-use industries benefit from reliable semiconductor supply, competitive pricing, and access to innovative IC solutions that enable new product capabilities. The automotive, telecommunications, and consumer electronics sectors particularly benefit from the region’s semiconductor expertise and manufacturing capacity.

Investors and stakeholders can capitalize on the region’s growth potential and technological advancement opportunities. The semiconductor industry’s strategic importance and government support create favorable conditions for long-term investment and partnership opportunities. Supply chain resilience and diversification benefits provide additional value for global technology companies.

Strengths:

Weaknesses:

Opportunities:

Threats:

Advanced packaging technologies are emerging as a critical trend, with companies investing in 3D packaging, system-in-package (SiP), and chiplet architectures to overcome traditional scaling limitations. These technologies enable higher performance and functionality while managing costs and power consumption.

Artificial intelligence integration is driving demand for specialized AI chips and neural processing units across various applications. Edge AI capabilities are becoming increasingly important, with AI chip adoption growing at approximately 30% annually in the region.

Sustainability initiatives are influencing semiconductor design and manufacturing processes, with companies focusing on energy-efficient ICs and environmentally responsible production methods. Green semiconductor technologies are gaining traction as environmental regulations become more stringent.

Automotive electrification is creating substantial demand for power semiconductors, battery management ICs, and electric vehicle-specific solutions. The automotive IC market is experiencing rapid transformation as vehicles become more electronic and connected.

5G and beyond wireless technologies are driving innovation in RF ICs, millimeter-wave components, and high-speed digital processing solutions. The deployment of 5G networks is creating new opportunities for specialized semiconductor solutions.

Major capacity expansion initiatives across the region include significant foundry investments in advanced process technologies. TSMC, Samsung, and other leading manufacturers are expanding production capacity to meet growing demand for cutting-edge semiconductors.

Strategic partnerships between regional companies and global technology leaders are accelerating innovation and market development. Collaborative research and development programs are addressing complex technological challenges and emerging application requirements.

Government initiatives such as China’s semiconductor development fund, Japan’s semiconductor strategy, and South Korea’s K-Semiconductor Belt project are driving substantial investment in domestic semiconductor capabilities.

Technology breakthroughs in areas such as extreme ultraviolet (EUV) lithography, advanced materials, and novel device architectures are enabling continued performance improvements and new application possibilities. MWR data indicates that technology development investments have increased by 40% over the past two years.

Merger and acquisition activities are reshaping the competitive landscape, with companies seeking to strengthen their technology portfolios and market positions through strategic transactions.

Strategic recommendations for market participants include diversifying technology portfolios to address multiple application segments and reduce dependence on single market categories. Companies should invest in emerging technologies such as AI chips, automotive semiconductors, and advanced packaging solutions to capture growth opportunities.

Supply chain resilience should be prioritized through geographic diversification and strategic partnerships with multiple suppliers. Companies should develop contingency plans for potential trade disruptions and invest in supply chain visibility and risk management capabilities.

Talent development initiatives are critical for maintaining competitive advantages in the rapidly evolving semiconductor industry. Companies should invest in training programs, university partnerships, and talent retention strategies to address skill shortages.

Sustainability integration should be incorporated into business strategies to address environmental regulations and customer requirements. Energy-efficient designs, sustainable manufacturing processes, and circular economy principles should guide product development and operations.

Innovation investment should focus on breakthrough technologies that can create new market opportunities and competitive differentiation. Research and development spending should target emerging applications and next-generation semiconductor architectures.

Long-term prospects for the Asia Pacific integrated circuit market remain highly positive, driven by continued digitalization, emerging technology adoption, and regional manufacturing advantages. The market is expected to maintain robust growth momentum with expanding applications across multiple industries.

Technology evolution will continue to drive market transformation, with advanced process nodes, novel materials, and innovative architectures enabling new performance levels and application possibilities. The transition toward more specialized and application-specific ICs will create opportunities for differentiation and value creation.

Regional integration and cooperation are expected to strengthen, with countries working together to build resilient supply chains and share technological expertise. Government support for semiconductor development will continue to drive investment and innovation across the region.

Market expansion into new application areas such as quantum computing, advanced robotics, and next-generation healthcare technologies will create additional growth opportunities. The convergence of multiple technologies will drive demand for increasingly sophisticated semiconductor solutions.

Sustainability focus will become increasingly important, with energy efficiency and environmental responsibility driving product development and manufacturing processes. The industry’s commitment to sustainable practices will influence competitive positioning and market success. According to MarkWide Research projections, sustainable semiconductor adoption is expected to grow at 22% annually over the next five years.

The Asia Pacific integrated circuit market stands at the forefront of global semiconductor innovation and manufacturing excellence. The region’s strategic advantages including advanced manufacturing capabilities, comprehensive supply chain infrastructure, and strong government support position it for continued leadership in the global semiconductor industry.

Market dynamics reflect the complex interplay of technological advancement, geopolitical considerations, and evolving application requirements. While challenges such as trade tensions and supply chain vulnerabilities exist, the fundamental growth drivers remain strong, supported by digitalization trends and emerging technology adoption.

Future success in this market will depend on companies’ ability to navigate technological transitions, invest in innovation, and build resilient business models that can adapt to changing market conditions. The region’s commitment to semiconductor development and technological leadership ensures its continued importance in the global technology ecosystem, making it an essential market for industry participants and stakeholders worldwide.

What is Integrated Circuit (IC)?

Integrated Circuits (ICs) are semiconductor devices that combine multiple electronic components into a single chip, enabling efficient processing and control in various applications such as computers, smartphones, and automotive systems.

What are the key players in the Asia Pacific Integrated Circuit (IC) Market?

Key players in the Asia Pacific Integrated Circuit (IC) Market include companies like Samsung Electronics, Taiwan Semiconductor Manufacturing Company (TSMC), Intel Corporation, and NXP Semiconductors, among others.

What are the growth factors driving the Asia Pacific Integrated Circuit (IC) Market?

The growth of the Asia Pacific Integrated Circuit (IC) Market is driven by the increasing demand for consumer electronics, advancements in automotive technology, and the rise of IoT applications that require efficient processing capabilities.

What challenges does the Asia Pacific Integrated Circuit (IC) Market face?

Challenges in the Asia Pacific Integrated Circuit (IC) Market include supply chain disruptions, rising material costs, and intense competition among manufacturers, which can impact profitability and innovation.

What opportunities exist in the Asia Pacific Integrated Circuit (IC) Market?

Opportunities in the Asia Pacific Integrated Circuit (IC) Market include the growing adoption of AI and machine learning technologies, the expansion of 5G networks, and increasing investments in smart city infrastructure.

What trends are shaping the Asia Pacific Integrated Circuit (IC) Market?

Trends in the Asia Pacific Integrated Circuit (IC) Market include the miniaturization of components, the shift towards more energy-efficient designs, and the integration of advanced technologies such as quantum computing and edge computing.

Asia Pacific Integrated Circuit (IC) Market

| Segmentation Details | Description |

|---|---|

| Product Type | Analog ICs, Digital ICs, Mixed-Signal ICs, Power Management ICs |

| Technology | CMOS, BiCMOS, GaN, SiGe |

| End User | Consumer Electronics, Telecommunications, Automotive OEMs, Industrial Equipment |

| Application | Smartphones, Wearable Devices, IoT Devices, Automotive Electronics |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Asia Pacific Integrated Circuit (IC) Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at