444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2150

The India insulin drug and delivery device market represents one of the most rapidly expanding healthcare segments in the country, driven by the escalating prevalence of diabetes and increasing awareness about advanced treatment options. India’s position as the diabetes capital of the world has created an unprecedented demand for innovative insulin therapies and sophisticated delivery mechanisms. The market encompasses a comprehensive range of insulin formulations, including rapid-acting, long-acting, and intermediate-acting variants, alongside cutting-edge delivery devices such as insulin pens, pumps, and smart injection systems.

Market dynamics indicate robust growth potential, with the sector experiencing a compound annual growth rate of 8.2% over the forecast period. This expansion is primarily attributed to the rising diabetic population, which currently affects over 77 million individuals across the country. Healthcare infrastructure improvements and government initiatives promoting diabetes management have significantly contributed to market accessibility and adoption rates.

Technological advancement in insulin delivery systems has revolutionized patient care, with smart insulin pens and continuous glucose monitoring integration becoming increasingly prevalent. The market demonstrates strong potential for both domestic and international pharmaceutical companies, with generic insulin manufacturers playing a crucial role in making treatments more affordable and accessible to diverse socioeconomic segments.

The India insulin drug and delivery device market refers to the comprehensive ecosystem encompassing the development, manufacturing, distribution, and utilization of insulin medications and associated delivery technologies specifically within the Indian healthcare landscape. This market includes various insulin types ranging from human insulin to advanced analog formulations, coupled with sophisticated delivery mechanisms designed to enhance patient compliance and therapeutic outcomes.

Market scope extends beyond traditional insulin vials and syringes to include innovative delivery systems such as prefilled insulin pens, insulin pumps, jet injectors, and emerging smart delivery devices equipped with digital connectivity features. The market serves both Type 1 and Type 2 diabetes patients, with particular emphasis on addressing the unique healthcare challenges and economic considerations prevalent in the Indian context.

Healthcare accessibility remains a central focus, with the market encompassing both premium international brands and cost-effective domestic alternatives. This dual approach ensures comprehensive coverage across urban and rural populations, addressing diverse economic capabilities while maintaining therapeutic efficacy standards.

India’s insulin market stands at a critical juncture, characterized by unprecedented growth opportunities and evolving patient needs. The market has witnessed significant transformation over the past decade, with insulin analog adoption rates increasing by 45% among urban diabetic populations. This shift reflects growing awareness about advanced diabetes management and improved healthcare accessibility across metropolitan and tier-2 cities.

Delivery device innovation has emerged as a key differentiator, with insulin pen usage demonstrating remarkable growth patterns. Patient preference studies indicate that 68% of insulin users prefer pen devices over traditional vial-and-syringe methods, primarily due to convenience, accuracy, and discretion factors. This preference shift has prompted manufacturers to focus extensively on developing user-friendly, cost-effective pen delivery systems.

Government initiatives supporting diabetes care have created favorable market conditions, with public healthcare programs increasingly incorporating modern insulin therapies. The market benefits from both domestic manufacturing capabilities and international collaborations, ensuring diverse product portfolios that cater to varying patient requirements and economic considerations.

Future prospects remain highly promising, with digital health integration and personalized medicine approaches expected to drive next-generation market growth. The convergence of insulin delivery technology with mobile health applications and continuous glucose monitoring systems represents significant opportunities for market expansion and improved patient outcomes.

Market segmentation analysis reveals distinct patterns in insulin consumption and delivery device preferences across different demographic groups. The following key insights provide comprehensive understanding of market dynamics:

Diabetes prevalence escalation serves as the primary catalyst driving market expansion, with India experiencing one of the world’s highest diabetes growth rates. The increasing incidence of lifestyle-related diabetes, particularly among younger demographics, has created sustained demand for insulin therapies. Urbanization patterns and changing dietary habits contribute significantly to this trend, with metropolitan areas witnessing accelerated diabetes onset rates.

Healthcare awareness campaigns have substantially improved diabetes recognition and treatment-seeking behavior among Indian populations. Government initiatives promoting early diabetes detection and management have resulted in increased insulin therapy initiation rates. Medical education programs targeting healthcare professionals have enhanced prescription patterns and patient counseling effectiveness.

Technological advancement in insulin delivery systems has revolutionized patient experience and compliance rates. The development of user-friendly insulin pens, smart delivery devices, and integrated glucose monitoring systems has made insulin therapy more accessible and manageable for diverse patient populations. Digital health integration enables better diabetes management through data tracking and personalized treatment adjustments.

Economic development and rising disposable incomes have improved healthcare affordability for middle-class populations. Insurance coverage expansion and government healthcare schemes have made insulin therapy more accessible to previously underserved segments. Healthcare infrastructure development in tier-2 and tier-3 cities has expanded market reach and improved treatment accessibility.

Cost barriers remain a significant challenge for widespread insulin adoption, particularly among lower-income populations. Despite generic alternatives, insulin therapy costs can represent substantial financial burden for families, especially those requiring multiple daily injections. Healthcare affordability concerns limit market penetration in rural and economically disadvantaged areas.

Healthcare infrastructure limitations in remote and rural regions restrict access to specialized diabetes care and insulin storage facilities. Inadequate cold chain management and limited healthcare professional availability create barriers to effective insulin therapy implementation. Geographic accessibility challenges prevent consistent treatment continuity for patients in underserved areas.

Patient education gaps regarding proper insulin administration and diabetes management continue to impact treatment outcomes. Many patients lack comprehensive understanding of insulin therapy requirements, leading to suboptimal adherence and potential complications. Cultural stigma associated with insulin injections sometimes delays treatment initiation and affects patient compliance.

Regulatory complexities and approval processes can slow the introduction of innovative insulin formulations and delivery devices. Quality control requirements and manufacturing standards, while necessary for patient safety, may increase production costs and market entry barriers for new players.

Rural market expansion presents enormous growth potential, with increasing healthcare awareness and improved infrastructure development creating new opportunities for insulin market penetration. Government initiatives focusing on rural healthcare delivery and telemedicine integration offer pathways for reaching previously inaccessible patient populations. Mobile health solutions can bridge geographic gaps and provide remote diabetes management support.

Biosimilar insulin development offers significant opportunities for cost-effective treatment options, potentially expanding market accessibility to price-sensitive segments. Domestic manufacturing capabilities for biosimilar insulin can reduce import dependence and improve supply chain reliability. Generic competition drives innovation while making treatments more affordable for broader populations.

Digital health integration represents a transformative opportunity, with smart insulin delivery devices and connected health platforms enabling personalized diabetes management. The convergence of insulin delivery technology with artificial intelligence and machine learning can optimize treatment protocols and improve patient outcomes. Data analytics applications offer insights for better diabetes management and treatment customization.

Public-private partnerships can accelerate market development through collaborative healthcare initiatives and improved distribution networks. Government healthcare programs increasingly recognize the importance of modern diabetes management, creating opportunities for innovative insulin therapy integration. Healthcare financing solutions can address affordability challenges while expanding market reach.

Supply chain evolution has significantly impacted market dynamics, with manufacturers investing heavily in cold chain infrastructure and distribution network optimization. The complexity of insulin storage and handling requirements has driven innovation in packaging and delivery systems. Logistics improvements have enhanced product availability and reduced wastage, contributing to better market efficiency.

Competitive landscape shifts reflect the entry of new players and the expansion of existing manufacturers into different market segments. International pharmaceutical companies continue to establish local manufacturing facilities, while domestic players strengthen their market positions through strategic partnerships and product portfolio diversification. Market consolidation trends indicate increasing collaboration between insulin manufacturers and delivery device companies.

Regulatory environment changes have influenced market dynamics through updated quality standards and approval processes. The Indian regulatory framework continues to evolve, balancing patient safety requirements with market accessibility needs. Policy initiatives supporting diabetes care have created favorable conditions for market growth and innovation.

Patient behavior patterns demonstrate increasing sophistication in treatment preferences and technology adoption. Younger diabetic patients show greater willingness to embrace advanced delivery devices and digital health solutions. Treatment adherence improvements through better patient education and support systems have positively impacted market dynamics and therapeutic outcomes.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable market insights. Primary research involves extensive interviews with healthcare professionals, diabetes specialists, patients, and industry stakeholders across different geographic regions. Survey methodologies capture patient preferences, treatment patterns, and market trends through structured questionnaires and focus group discussions.

Secondary research incorporates analysis of published medical literature, government healthcare statistics, pharmaceutical industry reports, and regulatory documentation. Database analysis includes examination of prescription patterns, hospital procurement data, and insurance claim information. Market intelligence gathering involves monitoring competitor activities, product launches, and strategic partnerships within the insulin market ecosystem.

Data validation processes ensure research accuracy through cross-referencing multiple sources and expert verification. Statistical analysis employs advanced modeling techniques to project market trends and growth patterns. Regional analysis considers demographic variations, healthcare infrastructure differences, and economic factors affecting market development across different Indian states and territories.

Industry expert consultations provide qualitative insights into market dynamics, regulatory changes, and future development prospects. Collaboration with medical professionals and diabetes care specialists offers clinical perspectives on treatment trends and patient needs. Continuous monitoring ensures research findings remain current and relevant to evolving market conditions.

Northern India demonstrates strong market presence, with states like Delhi, Punjab, and Haryana showing high insulin consumption rates. The region benefits from well-developed healthcare infrastructure and higher disposable incomes, contributing to premium insulin adoption rates of 52%. Urban centers in this region lead in advanced delivery device utilization and digital health integration.

Western India represents the largest market segment, with Maharashtra and Gujarat accounting for significant insulin consumption volumes. The region’s industrial development and healthcare infrastructure support robust market growth. Mumbai and Pune serve as major distribution hubs, with the western region contributing approximately 38% of total market share.

Southern India shows remarkable growth potential, with Karnataka, Tamil Nadu, and Andhra Pradesh experiencing rapid market expansion. The region’s IT industry growth has created awareness about advanced healthcare solutions, leading to increased adoption of smart insulin delivery systems. Bangalore and Chennai emerge as key markets for innovative diabetes management technologies.

Eastern India presents unique challenges and opportunities, with West Bengal and Odisha showing gradual market development. Healthcare accessibility improvements and government initiatives are driving insulin therapy adoption in this region. Rural market penetration remains a focus area, with traditional insulin formulations maintaining strong presence.

Market leadership is characterized by a mix of international pharmaceutical giants and emerging domestic players, each contributing unique strengths to the insulin market ecosystem. The competitive environment continues to evolve with new product launches and strategic partnerships.

Strategic partnerships between international and domestic companies have become increasingly common, enabling technology transfer and market access optimization. These collaborations facilitate the development of cost-effective insulin solutions while maintaining international quality standards.

By Insulin Type:

By Delivery Device:

By Patient Type:

Rapid-Acting Insulin Category demonstrates strong growth driven by increasing awareness about postprandial glucose control. This segment benefits from lifestyle changes and dietary patterns requiring flexible insulin dosing. Urban populations show higher adoption rates due to irregular meal timings and professional lifestyle demands. The category represents approximately 28% of total insulin consumption in metropolitan areas.

Long-Acting Insulin Category dominates the market due to its suitability for Type 2 diabetes management and once-daily dosing convenience. This segment has witnessed significant innovation with new analog formulations offering improved pharmacokinetic profiles. Patient compliance improvements through reduced injection frequency have driven category expansion.

Insulin Pen Delivery Category shows remarkable growth potential, with manufacturers focusing on user-friendly designs and cost optimization. The category benefits from improved patient acceptance and healthcare provider recommendations. Smart pen integration with mobile applications represents the next evolution in this category.

Biosimilar Insulin Category has emerged as a significant market segment, offering cost-effective alternatives to branded insulin products. Domestic manufacturers have successfully developed biosimilar formulations meeting international quality standards. Price advantages of 30-40% compared to originator products have driven rapid adoption in price-sensitive markets.

Healthcare Providers benefit from improved patient outcomes through advanced insulin formulations and delivery systems. Enhanced treatment options enable personalized diabetes management approaches, leading to better glycemic control and reduced complications. Clinical efficiency improvements through user-friendly delivery devices reduce consultation time and improve patient education effectiveness.

Patients experience significant quality of life improvements through convenient insulin delivery systems and flexible dosing options. Advanced formulations provide better glucose control with reduced hypoglycemia risk. Treatment adherence improvements through simplified administration methods contribute to better long-term health outcomes.

Pharmaceutical Companies benefit from expanding market opportunities and diversified product portfolios. The growing diabetic population ensures sustained demand for insulin products and delivery systems. Innovation opportunities in biosimilar development and digital health integration provide competitive advantages and market differentiation.

Healthcare Systems benefit from improved diabetes management outcomes and reduced long-term complications. Cost-effective insulin options help optimize healthcare budgets while maintaining treatment quality. Preventive care through better diabetes management reduces hospitalization rates and healthcare system burden.

Government Stakeholders benefit from improved public health outcomes and reduced diabetes-related healthcare costs. Domestic insulin manufacturing capabilities enhance healthcare security and reduce import dependence. Economic benefits through job creation and technology development support national healthcare objectives.

Strengths:

Weaknesses:

Opportunities:

Threats:

Smart Insulin Delivery Systems represent the most significant technological trend, with connected devices enabling real-time glucose monitoring and automated insulin dosing adjustments. These systems integrate with smartphone applications and cloud-based platforms for comprehensive diabetes management. Artificial intelligence integration provides predictive analytics and personalized treatment recommendations.

Biosimilar Insulin Adoption continues accelerating as healthcare systems seek cost-effective treatment alternatives. Domestic manufacturers are investing heavily in biosimilar development capabilities, creating competitive pressure on originator products. Quality improvements in biosimilar formulations have enhanced physician and patient confidence in these alternatives.

Personalized Medicine Approaches are gaining traction through pharmacogenomic testing and individualized treatment protocols. Healthcare providers increasingly recognize the importance of customized insulin therapy based on patient-specific factors. Precision dosing through advanced algorithms and continuous monitoring systems improves treatment outcomes.

Telemedicine Integration has accelerated diabetes care delivery, particularly in remote areas with limited healthcare access. Virtual consultations and remote monitoring capabilities enable continuous patient support and treatment adjustments. Digital therapeutics complement traditional insulin therapy through behavioral interventions and lifestyle management support.

Sustainability Focus is driving innovation in insulin packaging and delivery device design, with manufacturers developing environmentally friendly solutions. Recyclable pen devices and reduced packaging waste align with environmental consciousness trends. Green manufacturing processes are becoming important differentiators in market positioning.

Manufacturing Expansion initiatives by major pharmaceutical companies have strengthened domestic insulin production capabilities. Recent facility investments focus on advanced manufacturing technologies and increased production capacity. Biocon’s expansion of insulin manufacturing facilities represents significant industry development supporting market growth.

Strategic Partnerships between international and domestic companies have accelerated technology transfer and market access. These collaborations enable the development of innovative insulin formulations while maintaining cost competitiveness. Joint ventures facilitate knowledge sharing and resource optimization for market development.

Regulatory Approvals for new insulin formulations and delivery devices have expanded treatment options for Indian patients. Recent approvals include advanced insulin analogs and smart delivery systems previously unavailable in the domestic market. Fast-track approval processes for essential diabetes medications have improved market access timelines.

Digital Health Initiatives by healthcare providers and technology companies have created integrated diabetes management platforms. These developments include mobile applications for insulin dosing calculations and glucose monitoring integration. MarkWide Research indicates that digital health adoption in diabetes care has increased by 35% over the past two years.

Government Policy Changes supporting diabetes care have created favorable market conditions through improved insurance coverage and public healthcare program integration. Recent policy initiatives include insulin inclusion in essential medicine lists and price regulation frameworks. Healthcare accessibility improvements through government programs have expanded market reach to underserved populations.

Market Entry Strategies should focus on understanding regional healthcare dynamics and patient needs across different Indian markets. Companies entering the insulin market should prioritize local partnerships and distribution network development. Regulatory compliance and quality assurance capabilities are essential for successful market penetration and sustained growth.

Product Development Priorities should emphasize affordability without compromising quality, addressing the unique economic constraints of the Indian healthcare market. Innovation in delivery devices should focus on user-friendly designs suitable for diverse literacy levels and cultural preferences. Biosimilar development offers significant opportunities for companies with appropriate manufacturing capabilities.

Distribution Strategy Optimization requires comprehensive cold chain infrastructure and rural market penetration capabilities. Companies should invest in logistics networks that ensure product integrity while reaching remote healthcare facilities. Digital distribution platforms can complement traditional channels and improve market accessibility.

Patient Education Initiatives should be integral to market development strategies, addressing knowledge gaps about insulin therapy and diabetes management. Collaborative programs with healthcare providers can improve treatment adherence and patient outcomes. Community outreach programs can build brand awareness while supporting public health objectives.

Technology Integration should focus on practical solutions that address real patient needs rather than complex systems that may face adoption barriers. Smart delivery devices should prioritize simplicity and reliability over advanced features that may not be utilized. MWR analysis suggests that successful technology adoption requires comprehensive patient support and training programs.

Market expansion prospects remain highly favorable, with the Indian insulin market positioned for sustained growth over the next decade. Demographic trends, including population aging and lifestyle changes, will continue driving diabetes prevalence and insulin demand. Healthcare infrastructure development and improved accessibility will expand market reach to previously underserved populations.

Technology evolution will transform insulin delivery through artificial intelligence integration and personalized medicine approaches. Smart insulin systems with automated dosing capabilities represent the future of diabetes management. Continuous glucose monitoring integration with insulin delivery devices will enable closed-loop systems for optimal glucose control.

Regulatory environment is expected to become more supportive of innovation while maintaining safety standards. Streamlined approval processes for essential diabetes medications will accelerate market access for new products. Quality standards will continue evolving to ensure patient safety while promoting competitive market dynamics.

Market consolidation may occur as smaller players seek partnerships with established companies to compete effectively. Strategic alliances between insulin manufacturers and delivery device companies will create comprehensive diabetes management solutions. Vertical integration trends may emerge as companies seek to control entire value chains from manufacturing to patient delivery.

Affordability improvements through biosimilar competition and manufacturing efficiency gains will expand market accessibility. Government healthcare programs will increasingly incorporate modern insulin therapies, creating opportunities for volume growth. MarkWide Research projects that market penetration in rural areas will increase by 25% over the next five years through improved healthcare delivery systems.

India’s insulin drug and delivery device market represents a dynamic and rapidly evolving healthcare segment with enormous growth potential. The convergence of increasing diabetes prevalence, technological innovation, and improving healthcare infrastructure creates favorable conditions for sustained market expansion. Market participants who understand the unique challenges and opportunities within the Indian healthcare landscape will be best positioned for success.

Strategic focus on affordability, accessibility, and innovation will determine market leadership in this competitive environment. The successful integration of advanced insulin formulations with user-friendly delivery systems addresses critical patient needs while supporting healthcare provider objectives. Digital health integration and personalized medicine approaches represent the future direction of diabetes care in India.

Collaboration between stakeholders including pharmaceutical companies, healthcare providers, government agencies, and patient advocacy groups will be essential for addressing market challenges and maximizing opportunities. The development of comprehensive diabetes management ecosystems will benefit all participants while improving patient outcomes and quality of life for millions of diabetic individuals across India.

What is Insulin Drug And Delivery Device?

Insulin Drug And Delivery Device refers to the medications and tools used to manage diabetes by delivering insulin to patients. This includes various forms of insulin, such as rapid-acting and long-acting types, as well as delivery devices like syringes, pens, and pumps.

What are the key players in the India Insulin Drug And Delivery Device Market?

Key players in the India Insulin Drug And Delivery Device Market include companies like Novo Nordisk, Sanofi, and Eli Lilly, which are known for their innovative insulin formulations and delivery technologies, among others.

What are the growth factors driving the India Insulin Drug And Delivery Device Market?

The growth of the India Insulin Drug And Delivery Device Market is driven by the increasing prevalence of diabetes, rising awareness about diabetes management, and advancements in insulin delivery technologies, such as smart insulin pens and continuous glucose monitoring systems.

What challenges does the India Insulin Drug And Delivery Device Market face?

Challenges in the India Insulin Drug And Delivery Device Market include high costs of advanced delivery devices, regulatory hurdles for new products, and the need for better patient education on diabetes management.

What opportunities exist in the India Insulin Drug And Delivery Device Market?

Opportunities in the India Insulin Drug And Delivery Device Market include the development of biosimilar insulins, increasing investment in diabetes care technologies, and the potential for telemedicine solutions to enhance patient monitoring and adherence.

What trends are shaping the India Insulin Drug And Delivery Device Market?

Trends in the India Insulin Drug And Delivery Device Market include the rise of digital health solutions, integration of artificial intelligence in diabetes management, and a growing focus on personalized medicine to tailor insulin therapies to individual patient needs.

India Insulin Drug And Delivery Device Market

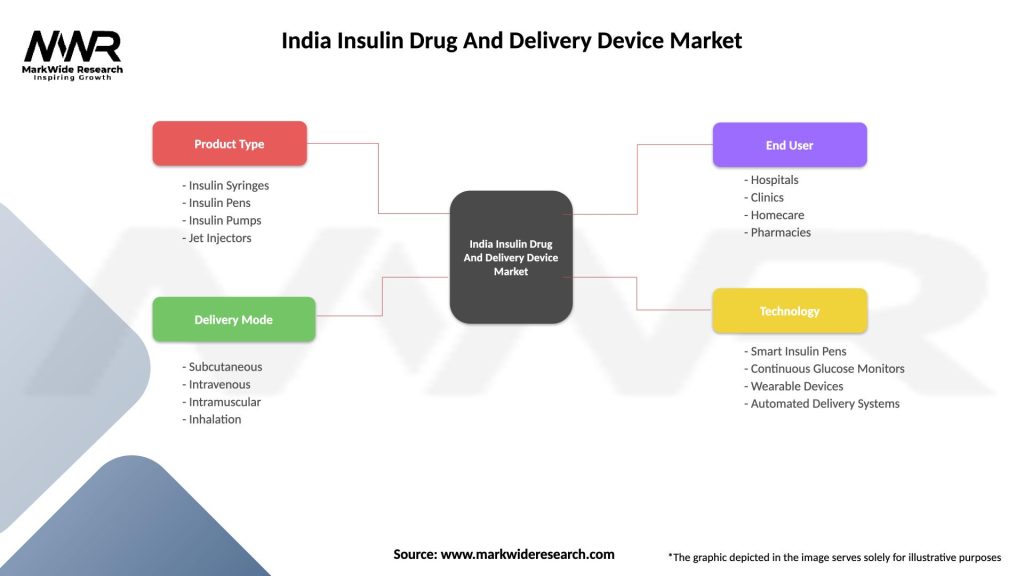

| Segmentation Details | Description |

|---|---|

| Product Type | Insulin Syringes, Insulin Pens, Insulin Pumps, Jet Injectors |

| Delivery Mode | Subcutaneous, Intravenous, Intramuscular, Inhalation |

| End User | Hospitals, Clinics, Homecare, Pharmacies |

| Technology | Smart Insulin Pens, Continuous Glucose Monitors, Wearable Devices, Automated Delivery Systems |

Please note: The segmentation can be entirely customized to align with our client’s needs.

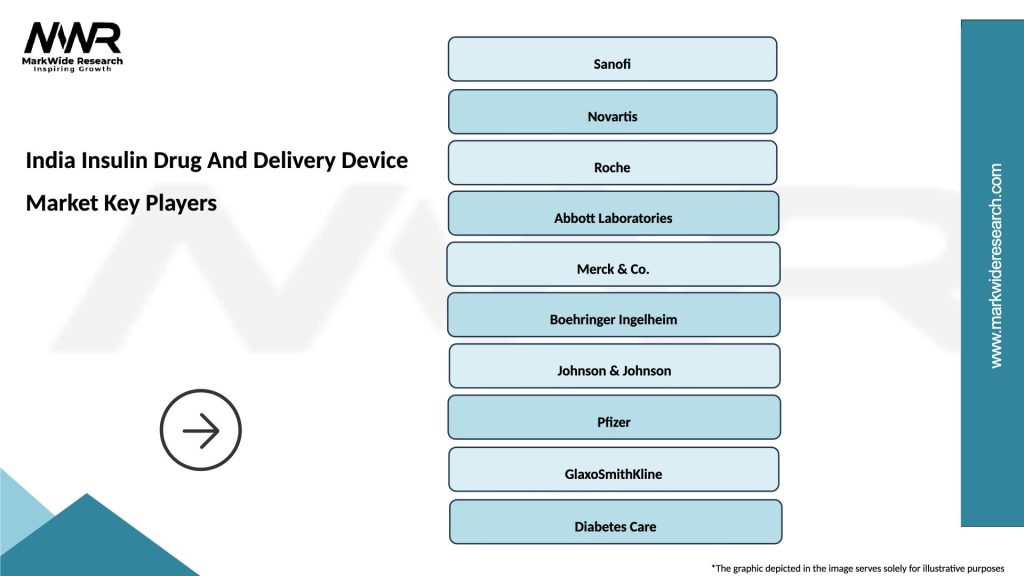

Leading companies in the India Insulin Drug And Delivery Device Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at