444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2150

The India security brokerage market represents one of the most dynamic and rapidly evolving financial services sectors in the country, experiencing unprecedented transformation driven by digital innovation, regulatory reforms, and changing investor preferences. This comprehensive market encompasses traditional full-service brokerages, discount brokerages, online trading platforms, and emerging fintech-enabled investment solutions that serve millions of retail and institutional investors across the nation.

Market dynamics indicate robust growth momentum, with the sector witnessing a compound annual growth rate (CAGR) of 12.5% over recent years, primarily fueled by increasing retail participation, technological advancement, and favorable regulatory environment. The proliferation of smartphone-based trading applications has democratized market access, enabling even small-town investors to participate in equity markets with unprecedented ease and affordability.

Digital transformation has emerged as the primary catalyst reshaping the competitive landscape, with traditional brokerages investing heavily in technology infrastructure while new-age discount brokers leverage artificial intelligence, machine learning, and data analytics to offer personalized investment solutions. The market has witnessed significant consolidation, with leading players expanding their service offerings beyond traditional brokerage to include wealth management, insurance, and comprehensive financial planning services.

Regulatory support from the Securities and Exchange Board of India (SEBI) has played a crucial role in market development, implementing investor-friendly policies, enhancing transparency, and promoting financial inclusion through various initiatives. The introduction of unified payment interfaces, real-time settlement systems, and simplified account opening procedures has significantly reduced barriers to market entry for retail investors.

The India security brokerage market refers to the comprehensive ecosystem of financial intermediaries, technology platforms, and service providers that facilitate the buying, selling, and trading of securities including equities, derivatives, commodities, currencies, and other financial instruments on behalf of retail and institutional clients across Indian stock exchanges.

This market encompasses various business models ranging from traditional full-service brokerages offering comprehensive investment advisory and wealth management services to discount brokerages focusing on low-cost execution, online trading platforms providing self-directed investment tools, and emerging robo-advisory services leveraging algorithmic investment strategies. The sector includes both domestic and international players operating under regulatory oversight of SEBI and other relevant authorities.

Key market participants include established financial institutions, independent brokerage houses, technology-driven startups, and hybrid models that combine traditional advisory services with digital innovation. The market serves diverse client segments from high-net-worth individuals seeking personalized wealth management to young retail investors preferring mobile-first trading experiences with minimal fees and charges.

The India security brokerage market stands at a pivotal juncture, characterized by intense competition, rapid technological advancement, and evolving customer expectations that are fundamentally reshaping the industry landscape. The sector has experienced remarkable growth in recent years, driven by increasing financial literacy, rising disposable incomes, and widespread adoption of digital trading platforms among younger demographics.

Market penetration has expanded significantly, with retail investor participation reaching approximately 8.5% of the total population, indicating substantial room for further growth compared to developed markets. The shift toward discount brokerage models has intensified price competition, compelling traditional players to innovate their service offerings and adopt technology-driven solutions to maintain market share.

Technological innovation continues to drive market evolution, with artificial intelligence, machine learning, and big data analytics enabling personalized investment recommendations, risk management tools, and enhanced customer experiences. The integration of social trading features, educational content, and gamification elements has attracted younger investors and increased overall market engagement levels.

Regulatory developments have created a more transparent and investor-friendly environment, with initiatives such as instant account opening, paperless transactions, and enhanced disclosure requirements strengthening market integrity and investor confidence. The market is expected to witness continued consolidation as smaller players struggle to compete with well-capitalized technology-focused brokerages.

Market transformation is being driven by several critical insights that highlight the changing dynamics of the India security brokerage landscape:

Several key factors are propelling the growth and evolution of the India security brokerage market, creating unprecedented opportunities for market participants and investors alike.

Digital transformation represents the most significant driver, with widespread smartphone adoption and improved internet connectivity enabling millions of Indians to access financial markets for the first time. The proliferation of user-friendly mobile applications has eliminated traditional barriers to market entry, allowing investors to trade securities with minimal technical knowledge or capital requirements.

Demographic dividend plays a crucial role, as India’s young population demonstrates increasing interest in wealth creation and financial independence. Rising disposable incomes, improved financial literacy, and changing investment preferences are driving sustained demand for brokerage services across urban and semi-urban markets.

Regulatory support from government and regulatory authorities has created a conducive environment for market growth through initiatives such as financial inclusion programs, tax incentives for equity investments, and simplified compliance procedures. The introduction of goods and services tax (GST) and other structural reforms have enhanced market transparency and operational efficiency.

Market infrastructure development including faster settlement cycles, improved clearing and settlement systems, and enhanced market surveillance mechanisms have increased investor confidence and reduced systemic risks. The integration of unified payment interfaces and digital payment systems has streamlined transaction processes and reduced operational costs.

Product innovation continues to drive market expansion, with brokerages introducing new investment products, advisory services, and technology-enabled solutions that cater to diverse investor needs and risk profiles. The emergence of thematic investing, systematic investment plans, and goal-based investment tools has attracted new investor segments.

Despite significant growth potential, the India security brokerage market faces several challenges and constraints that could impact future development and profitability.

Intense price competition has emerged as a primary concern, with discount brokerages offering zero-fee trading models that pressure traditional players to reduce fees and compress profit margins. This race to the bottom in pricing may compromise service quality and long-term sustainability for smaller market participants.

Regulatory compliance costs continue to increase as authorities implement stricter oversight measures, enhanced reporting requirements, and sophisticated risk management frameworks. These compliance burdens disproportionately affect smaller brokerages that lack the resources to invest in advanced technology and compliance infrastructure.

Technology infrastructure challenges including system outages, cybersecurity threats, and scalability issues can significantly impact customer experience and market confidence. The need for continuous technology upgrades and security enhancements requires substantial capital investment that may strain financial resources.

Market volatility and economic uncertainty can reduce trading volumes and investor activity, directly impacting brokerage revenues and profitability. Periods of market stress often lead to increased customer service demands and potential reputation risks for service providers.

Talent acquisition and retention challenges in technology and financial services sectors have increased operational costs and created competitive pressures for skilled professionals. The rapid pace of technological change requires continuous training and development investments to maintain competitive capabilities.

The India security brokerage market presents numerous growth opportunities that forward-thinking companies can leverage to expand their market presence and enhance profitability.

Tier-2 and Tier-3 city expansion represents a significant untapped opportunity, with improving internet infrastructure and rising income levels creating demand for accessible investment solutions. MarkWide Research analysis indicates that smaller cities show higher growth rates of 18-20% in new investor registrations compared to metropolitan areas.

Financial product diversification offers substantial revenue potential through cross-selling opportunities in mutual funds, insurance, personal loans, and wealth management services. Integrated financial platforms that provide comprehensive solutions can capture larger wallet share and improve customer lifetime value.

Institutional client services present opportunities for higher-margin business through sophisticated trading platforms, research services, and customized solutions for pension funds, insurance companies, and foreign institutional investors. The growing assets under management in the institutional segment create demand for specialized brokerage services.

Technology-enabled advisory services including robo-advisory, algorithmic trading, and artificial intelligence-powered investment recommendations can differentiate service offerings and attract tech-savvy investors. The integration of social trading features and community-based investment platforms can enhance user engagement and retention.

International market access through partnerships with global brokerages or direct international trading capabilities can attract high-net-worth individuals seeking portfolio diversification. The growing interest in global investment opportunities creates demand for comprehensive international trading solutions.

The interplay of various forces shapes the competitive landscape and growth trajectory of the India security brokerage market, creating both challenges and opportunities for market participants.

Competitive intensity has reached unprecedented levels as traditional full-service brokers compete with discount brokerages, fintech startups, and technology giants entering the financial services space. This competition drives innovation but also pressures profit margins and requires continuous investment in technology and customer acquisition.

Customer expectations continue to evolve, with investors demanding seamless digital experiences, personalized investment advice, transparent pricing, and comprehensive financial planning services. Meeting these expectations requires significant investment in technology infrastructure and human capital development.

Regulatory evolution creates both opportunities and challenges, with new rules potentially opening market access while imposing additional compliance costs and operational requirements. Successful market participants must maintain agility to adapt to changing regulatory landscapes while ensuring full compliance.

Technology disruption accelerates market transformation through artificial intelligence, blockchain technology, and advanced data analytics that enable new business models and service offerings. Companies that effectively leverage these technologies gain competitive advantages in customer acquisition and retention.

Market consolidation trends indicate that scale advantages become increasingly important for long-term success, with larger players better positioned to invest in technology, comply with regulations, and weather market volatility. Strategic partnerships and acquisitions may reshape the competitive landscape significantly.

This comprehensive analysis of the India security brokerage market employs a multi-faceted research approach combining primary and secondary research methodologies to ensure accuracy, reliability, and depth of insights.

Primary research activities included extensive interviews with industry executives, regulatory officials, technology providers, and market participants across different segments and geographic regions. These interactions provided firsthand insights into market trends, competitive dynamics, and future growth prospects from diverse stakeholder perspectives.

Secondary research encompassed analysis of regulatory filings, annual reports, industry publications, academic research, and government statistics to establish market baselines and validate primary research findings. This approach ensured comprehensive coverage of market segments and geographic regions.

Data triangulation methods were employed to cross-verify information from multiple sources and ensure research reliability. Quantitative analysis techniques including statistical modeling and trend analysis were applied to identify patterns and project future market developments.

Expert validation processes involved review and feedback from industry experts, regulatory specialists, and technology professionals to ensure accuracy and relevance of research findings. This collaborative approach enhanced the quality and credibility of market insights and projections.

The India security brokerage market exhibits distinct regional characteristics and growth patterns that reflect varying levels of economic development, financial literacy, and technology adoption across different states and territories.

Western India dominates market activity with approximately 35% market share, led by Maharashtra and Gujarat, which benefit from established financial centers, industrial presence, and high investor awareness. Mumbai’s status as the financial capital provides significant advantages in terms of infrastructure, talent availability, and institutional client presence.

Northern India represents nearly 28% of market activity, with Delhi NCR serving as a major hub for both retail and institutional investors. The region benefits from high disposable incomes, strong educational infrastructure, and growing awareness of investment opportunities among urban and semi-urban populations.

Southern India accounts for approximately 25% of market share, with Karnataka, Tamil Nadu, and Andhra Pradesh leading growth through technology adoption and increasing financial literacy. The region’s strong IT sector presence has created a tech-savvy investor base that readily adopts digital trading platforms.

Eastern India shows emerging potential with around 12% market participation, primarily concentrated in West Bengal and Odisha. While currently smaller in scale, the region demonstrates strong growth momentum driven by improving economic conditions and increasing awareness of investment opportunities.

Tier-2 and Tier-3 cities across all regions are experiencing rapid growth in investor participation, driven by improving internet connectivity, smartphone penetration, and targeted marketing efforts by brokerage firms. These markets represent significant future growth opportunities for market expansion.

The India security brokerage market features a diverse competitive landscape with established players, emerging fintech companies, and technology-driven startups competing across different market segments and customer categories.

Market competition intensifies as players differentiate through technology innovation, customer service quality, product offerings, and pricing strategies. The emergence of new business models and strategic partnerships continues to reshape competitive dynamics and market positioning.

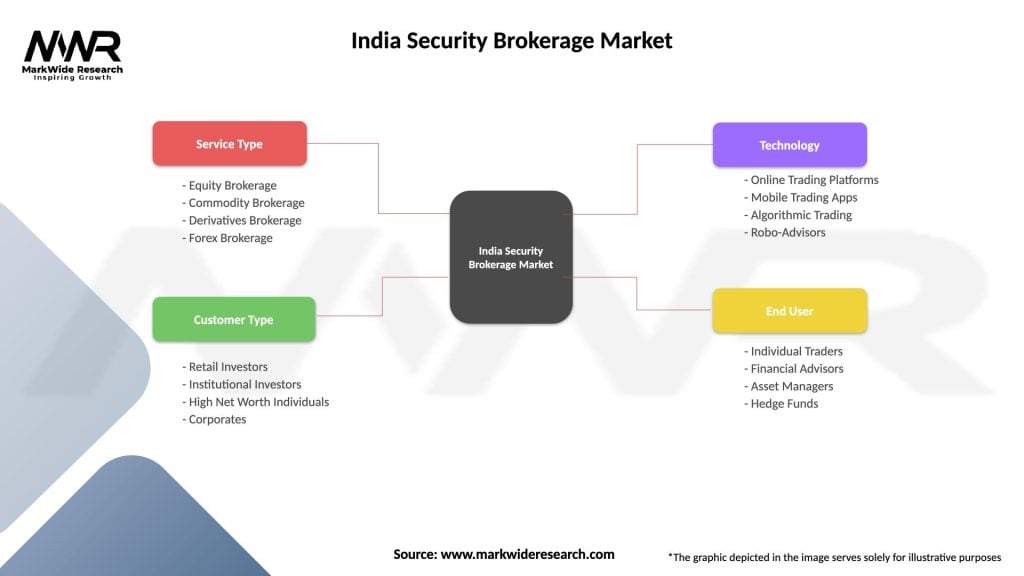

The India security brokerage market can be segmented across multiple dimensions to better understand customer needs, service offerings, and growth opportunities within different market categories.

By Service Type:

By Client Type:

By Product Category:

Each market segment within the India security brokerage market demonstrates unique characteristics, growth patterns, and competitive dynamics that require tailored strategies and service offerings.

Equity Trading Segment: Dominates overall market activity with approximately 70% revenue share, driven by increasing retail participation and favorable market conditions. The segment benefits from simplified trading procedures, reduced transaction costs, and improved market accessibility through mobile applications. Growth is particularly strong in derivatives trading as investors seek leveraged exposure and hedging opportunities.

Mutual Fund Distribution: Represents rapidly growing segment with significant cross-selling potential, as brokerages leverage existing customer relationships to offer systematic investment plans and goal-based investment solutions. The integration of mutual fund platforms with trading accounts creates comprehensive wealth management ecosystems that improve customer retention and lifetime value.

Commodity and Currency Trading: Shows steady growth driven by increased awareness of portfolio diversification benefits and hedging requirements among corporate clients. These segments offer higher margin opportunities compared to equity trading while serving specialized investor needs and risk management requirements.

Advisory and Wealth Management: Emerges as key differentiator for full-service brokers, with growing demand for personalized investment advice and comprehensive financial planning services. The integration of technology-enabled advisory tools with human expertise creates scalable solutions that serve diverse client segments effectively.

The evolving India security brokerage market creates substantial value propositions for various stakeholders including investors, service providers, technology companies, and regulatory authorities.

For Retail Investors:

For Brokerage Firms:

For Technology Providers:

Strengths:

Weaknesses:

Opportunities:

Threats:

Several transformative trends are reshaping the India security brokerage market, creating new opportunities and challenges for market participants across different segments.

Mobile-First Trading: The shift toward mobile-centric trading platforms continues to accelerate, with over 80% of trades now executed through smartphone applications. This trend drives demand for intuitive user interfaces, real-time notifications, and seamless transaction experiences that cater to on-the-go investors.

Artificial Intelligence Integration: Advanced AI and machine learning technologies are being deployed for personalized investment recommendations, risk assessment, fraud detection, and customer service automation. These capabilities enable brokerages to offer sophisticated services at scale while reducing operational costs.

Social Trading Platforms: The emergence of social trading features allows investors to follow successful traders, share investment strategies, and participate in community-driven investment decisions. This trend particularly appeals to younger investors seeking peer validation and learning opportunities.

Fractional Investing: The introduction of fractional share ownership and micro-investment capabilities enables small investors to participate in high-value stocks and diversified portfolios with minimal capital requirements. This democratization of investing expands market accessibility significantly.

Sustainable Investing: Growing awareness of environmental, social, and governance (ESG) factors drives demand for sustainable investment options and ESG-focused advisory services. Brokerages are responding by offering specialized ESG products and research capabilities.

Cryptocurrency Integration: Despite regulatory uncertainty, there is growing interest in cryptocurrency trading and blockchain-based investment products, prompting brokerages to explore digital asset offerings and related services.

Recent industry developments highlight the dynamic nature of the India security brokerage market and the continuous evolution of business models, technology adoption, and regulatory frameworks.

Technology Partnerships: Major brokerages are forming strategic alliances with technology companies to enhance their digital capabilities, improve customer experience, and develop innovative investment solutions. These partnerships enable faster innovation cycles and access to cutting-edge technologies.

Regulatory Reforms: SEBI has introduced several investor-friendly measures including instant account opening, enhanced disclosure requirements, and improved grievance redressal mechanisms. These reforms strengthen market integrity and boost investor confidence in the brokerage ecosystem.

Market Infrastructure Upgrades: Significant investments in trading infrastructure, settlement systems, and risk management frameworks have improved market efficiency and reduced systemic risks. The implementation of T+1 settlement cycles and enhanced surveillance systems demonstrates commitment to market development.

Product Launches: Brokerages continue to introduce innovative products including thematic investment options, goal-based planning tools, and algorithmic trading solutions. These launches cater to evolving investor preferences and create new revenue opportunities.

Acquisition Activity: The market has witnessed several strategic acquisitions and consolidation activities as larger players seek to expand their market presence, acquire technology capabilities, and achieve economies of scale. This trend is expected to continue as competition intensifies.

International Expansion: Some leading Indian brokerages are exploring international markets and cross-border investment opportunities, reflecting growing confidence and ambition within the domestic industry.

Based on comprehensive market analysis, several strategic recommendations emerge for different stakeholder groups to capitalize on market opportunities and navigate challenges effectively.

For Established Brokerages: Focus on technology modernization and digital transformation to compete with fintech disruptors while leveraging existing customer relationships for cross-selling opportunities. Invest in artificial intelligence and data analytics capabilities to provide personalized services and improve operational efficiency. Consider strategic partnerships or acquisitions to acquire technology capabilities and expand market reach.

For New Market Entrants: Identify underserved market segments and geographic regions where established players have limited presence. Develop differentiated value propositions through innovative technology, specialized services, or unique customer experience approaches. Build scalable technology infrastructure from the ground up to avoid legacy system constraints.

For Technology Providers: Develop comprehensive platform solutions that address multiple brokerage needs including trading, compliance, customer management, and analytics. Focus on cloud-based, scalable solutions that can serve brokerages of different sizes and complexity levels. Invest in emerging technologies such as blockchain, artificial intelligence, and advanced security solutions.

For Investors: Evaluate brokerage partners based on technology capabilities, service quality, cost structure, and regulatory compliance rather than solely on pricing. Consider the long-term value proposition including research quality, customer support, and additional financial services availability. Diversify across multiple platforms to reduce concentration risk and access different service capabilities.

For Regulators: Continue promoting financial inclusion and investor education while maintaining market integrity and investor protection standards. Support innovation through regulatory sandboxes and flexible frameworks that enable new business models while managing systemic risks. Enhance market infrastructure and surveillance capabilities to support growing market activity.

The future trajectory of the India security brokerage market appears highly promising, with multiple growth drivers and technological innovations positioned to drive sustained expansion and transformation over the coming years.

Market expansion is expected to accelerate significantly, with MWR projecting continued growth momentum driven by increasing financial literacy, rising disposable incomes, and expanding internet connectivity across Tier-2 and Tier-3 cities. The market is likely to witness sustained growth rates of 15-18% annually as new investor segments enter the market and existing participants increase their trading activity.

Technology evolution will continue to reshape service delivery models, with artificial intelligence, machine learning, and blockchain technologies enabling more sophisticated investment solutions and operational efficiencies. The integration of voice-based trading, augmented reality interfaces, and predictive analytics will further enhance customer experience and market accessibility.

Product innovation is expected to accelerate with the introduction of new investment instruments, alternative investment platforms, and comprehensive wealth management solutions that cater to diverse investor needs and risk profiles. The emergence of thematic investing, ESG-focused products, and international market access will create additional growth opportunities.

Regulatory evolution will likely support continued market development through investor-friendly policies, enhanced market infrastructure, and frameworks that promote innovation while maintaining market integrity. The potential introduction of new asset classes and investment vehicles could further expand market opportunities.

Competitive dynamics will intensify as technology giants, fintech startups, and international players enter the market, driving innovation and potentially reshaping the competitive landscape. Successful players will be those that effectively combine technology capabilities with customer-centric service delivery and regulatory compliance.

The India security brokerage market stands at an inflection point, characterized by unprecedented growth opportunities, technological transformation, and evolving customer expectations that are fundamentally reshaping the industry landscape. The convergence of favorable demographics, supportive regulatory environment, and rapid digitalization creates a compelling growth story that positions the market for sustained expansion over the coming decade.

Market participants who successfully navigate the challenges of intense competition, regulatory compliance, and technology evolution while capitalizing on opportunities in underserved segments and emerging technologies will be best positioned for long-term success. The emphasis on customer experience, innovative product offerings, and operational efficiency will determine competitive advantage in this dynamic market environment.

The transformation from traditional brokerage models to technology-enabled, customer-centric platforms represents more than just a business evolution—it signifies the democratization of financial markets and the empowerment of millions of Indians to participate in wealth creation opportunities. As the market continues to mature and expand, it will play an increasingly important role in India’s economic development and financial inclusion objectives, creating value for all stakeholders in the ecosystem.

What is Security Brokerage?

Security brokerage refers to the services provided by firms that facilitate the buying and selling of securities, such as stocks and bonds, on behalf of clients. These firms act as intermediaries between buyers and sellers in the financial markets.

What are the key players in the India Security Brokerage Market?

Key players in the India Security Brokerage Market include companies like Zerodha, ICICI Direct, and HDFC Securities. These firms offer a range of services including online trading, investment advisory, and portfolio management, among others.

What are the growth factors driving the India Security Brokerage Market?

The growth of the India Security Brokerage Market is driven by increasing retail participation in the stock market, advancements in technology facilitating online trading, and a growing awareness of investment opportunities among the population.

What challenges does the India Security Brokerage Market face?

The India Security Brokerage Market faces challenges such as regulatory compliance issues, intense competition among brokerage firms, and market volatility that can affect investor confidence and trading volumes.

What opportunities exist in the India Security Brokerage Market?

Opportunities in the India Security Brokerage Market include the expansion of financial literacy programs, the rise of fintech solutions offering innovative trading platforms, and the potential for increased foreign investment in Indian securities.

What trends are shaping the India Security Brokerage Market?

Trends shaping the India Security Brokerage Market include the growing popularity of mobile trading applications, the integration of artificial intelligence for personalized investment advice, and the shift towards sustainable investing practices.

India Security Brokerage Market

| Segmentation Details | Description |

|---|---|

| Service Type | Equity Brokerage, Commodity Brokerage, Derivatives Brokerage, Forex Brokerage |

| Customer Type | Retail Investors, Institutional Investors, High Net Worth Individuals, Corporates |

| Technology | Online Trading Platforms, Mobile Trading Apps, Algorithmic Trading, Robo-Advisors |

| End User | Individual Traders, Financial Advisors, Asset Managers, Hedge Funds |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the India Security Brokerage Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at