444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The North America building automation systems market represents a dynamic and rapidly evolving sector that encompasses intelligent technologies designed to control and monitor building operations. This comprehensive market includes heating, ventilation, air conditioning (HVAC) systems, lighting controls, security systems, fire safety equipment, and energy management solutions integrated through sophisticated digital platforms. Building automation systems have become essential infrastructure components across commercial, residential, and industrial facilities throughout the United States, Canada, and Mexico.

Market growth in North America is driven by increasing emphasis on energy efficiency, sustainability initiatives, and the growing adoption of Internet of Things (IoT) technologies. The region’s mature construction industry, coupled with stringent energy regulations and environmental standards, has created substantial demand for advanced automation solutions. Smart building technologies are experiencing accelerated adoption rates, with commercial buildings leading the transformation toward intelligent infrastructure management.

Regional dynamics indicate that the United States dominates the market landscape, accounting for approximately 78% of regional market share, followed by Canada with 16% market presence, and Mexico contributing 6% of the total market. The integration of artificial intelligence, machine learning, and cloud-based platforms is reshaping traditional building management approaches, creating new opportunities for system optimization and operational efficiency improvements.

The North America building automation systems market refers to the comprehensive ecosystem of interconnected technologies, software platforms, and control systems designed to automate, monitor, and optimize building operations across residential, commercial, and industrial facilities. These sophisticated systems integrate multiple building functions including climate control, lighting management, security monitoring, fire safety, energy distribution, and facility maintenance through centralized digital platforms and intelligent sensors.

Building automation systems encompass hardware components such as sensors, actuators, controllers, and communication networks, combined with software applications that enable real-time monitoring, data analytics, and automated decision-making. The systems utilize various communication protocols including BACnet, LonWorks, Modbus, and emerging wireless technologies to create seamless integration between different building subsystems and enable comprehensive facility management capabilities.

Market expansion in the North American building automation systems sector is characterized by robust growth driven by increasing demand for energy-efficient solutions, regulatory compliance requirements, and the proliferation of smart building technologies. The market demonstrates strong momentum across multiple segments, with commercial applications leading adoption rates and residential sectors showing accelerating growth patterns.

Key market drivers include rising energy costs, environmental sustainability mandates, and the growing emphasis on occupant comfort and safety. The integration of IoT technologies, artificial intelligence, and cloud computing platforms is transforming traditional building management approaches, enabling predictive maintenance, optimized energy consumption, and enhanced operational efficiency. Energy savings of up to 30-40% are achievable through comprehensive automation system implementations.

Technological advancement continues to reshape market dynamics, with wireless communication protocols, edge computing capabilities, and advanced analytics driving innovation. The market benefits from strong infrastructure development, favorable regulatory frameworks, and increasing awareness of building automation benefits among facility managers and property owners across the region.

Strategic market insights reveal several critical trends shaping the North American building automation systems landscape:

Energy efficiency mandates serve as primary catalysts for building automation system adoption across North America. Government regulations, utility incentive programs, and corporate sustainability initiatives create compelling business cases for intelligent building management solutions. Energy cost reduction potential of 25-35% through automated controls motivates facility owners to invest in comprehensive automation platforms.

Regulatory compliance requirements, including ASHRAE standards, LEED certification criteria, and local building codes, drive systematic adoption of automation technologies. These regulations establish minimum efficiency standards and encourage the implementation of advanced control systems that optimize energy consumption while maintaining occupant comfort and safety standards.

Technological convergence between traditional building systems and modern digital platforms creates new possibilities for integrated facility management. The proliferation of IoT devices, wireless communication protocols, and cloud computing infrastructure enables cost-effective deployment of sophisticated automation solutions across diverse building types and sizes.

Labor cost optimization represents another significant driver, as automated systems reduce the need for manual monitoring and maintenance activities. Facility management teams can focus on strategic activities while automation systems handle routine operational tasks, improving overall productivity and reducing operational expenses.

High initial investment requirements present significant barriers to building automation system adoption, particularly for smaller commercial facilities and residential applications. The comprehensive nature of modern automation systems, including hardware, software, installation, and commissioning costs, can create substantial upfront financial commitments that may deter potential adopters.

Technical complexity associated with system integration, configuration, and ongoing maintenance creates challenges for facility management teams lacking specialized expertise. The need for skilled technicians, system integrators, and ongoing training programs adds to the total cost of ownership and may limit adoption rates in certain market segments.

Cybersecurity concerns regarding connected building systems and data privacy issues create hesitation among some facility owners. The increasing connectivity of building automation systems to corporate networks and cloud platforms raises questions about vulnerability to cyber threats and the need for robust security measures.

Legacy system compatibility challenges complicate retrofit projects and system upgrades in existing buildings. Integration difficulties between new automation technologies and older building infrastructure can increase project complexity, costs, and implementation timelines, potentially limiting market growth in the retrofit segment.

Smart city initiatives across North American municipalities create substantial opportunities for building automation system deployment. Government investments in intelligent infrastructure, sustainable development projects, and urban modernization programs drive demand for integrated building management solutions that contribute to broader smart city objectives.

Retrofit market expansion represents significant growth potential, as millions of existing commercial and residential buildings require modernization to meet current efficiency standards. The aging building stock across North America presents opportunities for comprehensive automation system upgrades that improve performance, reduce costs, and enhance occupant experiences.

Emerging technologies including artificial intelligence, machine learning, and advanced analytics create new possibilities for predictive building management and autonomous system optimization. These technologies enable more sophisticated automation capabilities that can adapt to changing conditions, predict maintenance needs, and optimize performance in real-time.

Residential market growth driven by smart home technology adoption and increasing consumer awareness of automation benefits presents expanding opportunities. The integration of building automation features into residential construction and renovation projects creates new market segments and revenue streams for system providers.

Market dynamics in the North American building automation systems sector reflect the interplay between technological advancement, regulatory requirements, and evolving customer expectations. The convergence of traditional building controls with modern digital technologies creates a dynamic environment where innovation drives competitive advantage and market differentiation.

Supply chain evolution demonstrates increasing collaboration between technology providers, system integrators, and facility management companies. Strategic partnerships and vertical integration initiatives enable comprehensive solution delivery while reducing implementation complexity and improving customer experiences. Integration efficiency improvements of 40-50% are achievable through streamlined delivery models.

Customer demand patterns show growing preference for scalable, flexible automation solutions that can adapt to changing building requirements and accommodate future technology upgrades. The shift toward service-based business models and subscription-based software platforms reflects changing customer preferences for operational expense structures rather than large capital investments.

Competitive landscape dynamics feature increasing consolidation among system providers, technology acquisitions, and the emergence of new market entrants offering specialized solutions. The market rewards companies that can deliver comprehensive, integrated solutions while maintaining competitive pricing and superior customer support capabilities.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable market insights. Primary research activities include extensive interviews with industry executives, facility managers, system integrators, and technology providers across the North American region. These discussions provide firsthand insights into market trends, customer requirements, and competitive dynamics.

Secondary research encompasses analysis of industry reports, regulatory documents, company financial statements, and technology publications to validate primary findings and identify broader market patterns. Government databases, industry associations, and academic research contribute to comprehensive market understanding and trend identification.

Data validation processes include cross-referencing multiple sources, statistical analysis of market trends, and expert review of findings to ensure accuracy and reliability. Quantitative analysis techniques help identify growth patterns, market share distributions, and regional variations in adoption rates and technology preferences.

Market modeling utilizes advanced analytical techniques to project future growth scenarios, assess market potential, and evaluate the impact of various factors on market development. These models incorporate economic indicators, regulatory changes, and technological advancement timelines to provide comprehensive market forecasts.

United States market dominance reflects the country’s advanced commercial real estate sector, stringent energy efficiency regulations, and high technology adoption rates. Major metropolitan areas including New York, Los Angeles, Chicago, and Houston drive significant demand for sophisticated building automation solutions. The presence of leading technology companies and system integrators supports market development and innovation.

Canadian market growth benefits from government sustainability initiatives, energy efficiency programs, and increasing awareness of building automation benefits. Provincial regulations and utility incentive programs encourage automation system adoption across commercial and institutional facilities. The harsh climate conditions in many Canadian regions create strong demand for efficient HVAC control systems.

Mexican market expansion demonstrates accelerating growth driven by industrial development, commercial construction activity, and increasing foreign investment. Manufacturing facilities, commercial complexes, and hospitality projects drive demand for building automation solutions. Market growth rates in Mexico exceed 12% annually as infrastructure development accelerates.

Regional variations in technology adoption, regulatory requirements, and market maturity create diverse opportunities across different geographic areas. Coastal regions typically show higher adoption rates due to environmental regulations, while industrial regions focus on energy cost reduction and operational efficiency improvements.

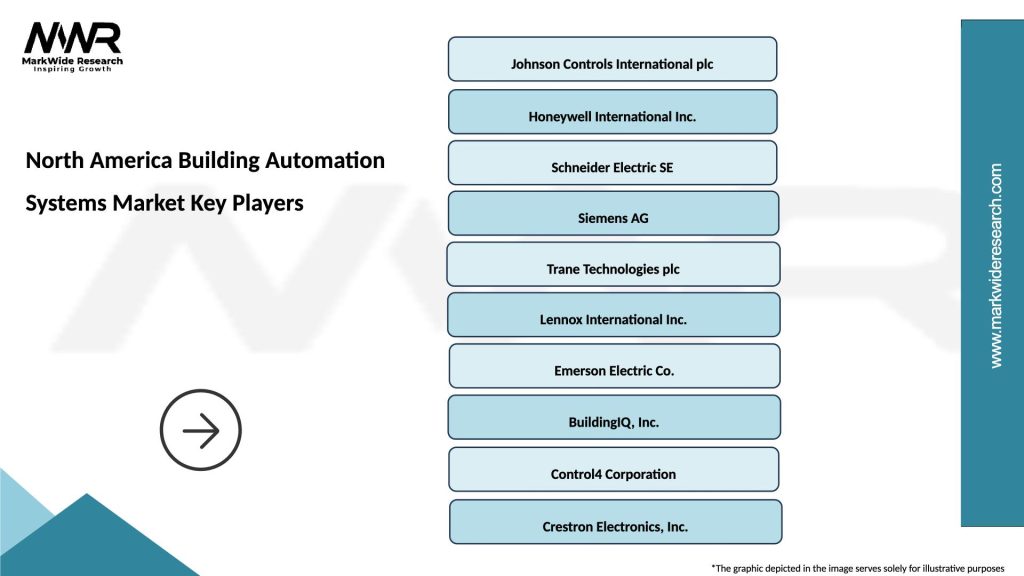

Market leadership in the North American building automation systems sector is characterized by a mix of established multinational corporations, specialized technology providers, and emerging innovative companies. The competitive environment rewards companies that can deliver comprehensive solutions, maintain strong customer relationships, and adapt to evolving technology requirements.

Leading market participants include:

Competitive strategies focus on technology innovation, strategic acquisitions, and comprehensive service offerings. Companies invest heavily in research and development to maintain technological leadership while expanding their solution portfolios through partnerships and acquisitions.

Technology-based segmentation reveals diverse automation approaches serving different market requirements:

Application-based segmentation demonstrates varied market opportunities:

End-user segmentation shows distinct market characteristics:

HVAC automation systems dominate the market landscape, representing approximately 45% of total system deployments across North American facilities. These systems provide comprehensive climate control, energy optimization, and indoor air quality management capabilities. Advanced HVAC automation incorporates variable air volume controls, demand-based ventilation, and predictive maintenance features that significantly reduce energy consumption while maintaining optimal comfort conditions.

Lighting control systems demonstrate rapid growth driven by LED technology adoption and daylight harvesting capabilities. Intelligent lighting solutions integrate occupancy sensors, daylight sensors, and scheduling controls to optimize energy usage while enhancing occupant productivity and comfort. Energy savings of 20-30% are typical through comprehensive lighting automation implementations.

Security and access control integration represents a growing segment as building owners seek comprehensive facility management solutions. Modern security automation systems incorporate video surveillance, access control, intrusion detection, and visitor management capabilities through unified platforms that enhance safety while reducing operational complexity.

Energy management platforms gain prominence as organizations focus on sustainability goals and cost reduction objectives. These systems provide real-time monitoring, demand response capabilities, and detailed analytics that enable facility managers to optimize energy consumption patterns and identify improvement opportunities.

Building owners and operators realize substantial benefits through building automation system implementation, including reduced operational costs, improved energy efficiency, and enhanced asset value. Operational cost reductions of 15-25% are achievable through automated system optimization and predictive maintenance capabilities. Property values increase through improved efficiency ratings and tenant satisfaction levels.

Facility managers benefit from centralized control capabilities, automated reporting, and predictive maintenance alerts that streamline operations and reduce manual workload. Advanced analytics provide insights into system performance, energy consumption patterns, and optimization opportunities that support data-driven decision-making and continuous improvement initiatives.

Occupants and tenants experience improved comfort, productivity, and safety through intelligent environmental controls and responsive building systems. Automated systems maintain optimal temperature, lighting, and air quality conditions while providing convenient access control and security features that enhance the overall building experience.

System integrators and service providers benefit from growing market demand, recurring service revenue opportunities, and technology advancement that creates new business models. The complexity of modern automation systems creates opportunities for specialized expertise and comprehensive service offerings that generate long-term customer relationships.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence integration emerges as a transformative trend, enabling building automation systems to learn from operational patterns, predict equipment failures, and optimize performance autonomously. AI-powered systems demonstrate 15-20% improvement in energy efficiency compared to traditional automation approaches through intelligent adaptation to changing conditions and occupancy patterns.

Edge computing adoption accelerates as building owners seek reduced latency, improved reliability, and enhanced data security for automation systems. Edge devices process data locally, reducing dependence on cloud connectivity while enabling real-time decision-making and faster system response times.

Sustainability-focused automation gains prominence as organizations pursue carbon neutrality goals and environmental certifications. Building automation systems increasingly incorporate renewable energy integration, carbon footprint monitoring, and sustainability reporting capabilities that support corporate environmental objectives.

Mobile and remote management capabilities become standard features as facility managers require flexible access to building systems from any location. Cloud-based platforms and mobile applications enable comprehensive system monitoring, control, and maintenance management through smartphones and tablets.

Interoperability standards development addresses compatibility challenges between different automation systems and devices. Industry initiatives promote open protocols and standardized communication interfaces that simplify system integration and reduce vendor lock-in concerns.

Strategic acquisitions reshape the competitive landscape as major automation companies expand their technology portfolios and market reach. Recent consolidation activities focus on acquiring specialized software capabilities, IoT platforms, and artificial intelligence technologies that enhance comprehensive solution offerings.

Partnership initiatives between automation providers and technology companies accelerate innovation and market development. Collaborations with cloud platform providers, semiconductor manufacturers, and software developers create integrated solutions that address evolving customer requirements and market opportunities.

Regulatory developments including updated energy codes, cybersecurity requirements, and environmental standards influence market dynamics and technology adoption patterns. New regulations create compliance requirements that drive automation system upgrades and modernization projects across existing building inventories.

Technology standardization efforts promote interoperability and reduce integration complexity through industry-wide protocol development and certification programs. Standards organizations work with manufacturers to establish common communication protocols and data formats that simplify system deployment and maintenance.

MarkWide Research analysis indicates that market participants should prioritize investment in artificial intelligence and machine learning capabilities to maintain competitive advantage in the evolving automation landscape. Companies that successfully integrate AI technologies into their automation platforms will capture significant market share as customers seek more intelligent and autonomous building management solutions.

Strategic focus on cybersecurity capabilities becomes critical as connected building systems face increasing security threats. Automation providers should invest in robust security frameworks, encryption technologies, and continuous monitoring capabilities to address customer concerns and regulatory requirements regarding data protection and system vulnerability.

Service-based business models present opportunities for recurring revenue generation and stronger customer relationships. Companies should develop comprehensive service offerings including system monitoring, predictive maintenance, and performance optimization services that provide ongoing value to customers while creating stable revenue streams.

Market expansion strategies should target the growing retrofit segment through cost-effective upgrade solutions and flexible financing options. Simplified installation processes, modular system designs, and phased implementation approaches can make automation systems more accessible to smaller commercial facilities and residential applications.

Market growth projections indicate continued expansion driven by increasing energy costs, regulatory requirements, and technology advancement. MWR forecasts suggest the North American building automation systems market will experience robust growth with compound annual growth rates exceeding 8% through the next decade as adoption accelerates across all building segments.

Technology evolution will focus on autonomous building management capabilities, enhanced occupant experiences, and seamless integration with smart city infrastructure. Future automation systems will incorporate advanced sensors, predictive analytics, and self-optimizing algorithms that minimize human intervention while maximizing performance and efficiency.

Market maturation will drive consolidation among system providers, standardization of communication protocols, and the emergence of platform-based business models. The industry will evolve toward comprehensive ecosystem approaches that integrate multiple building functions under unified management platforms with extensive third-party integration capabilities.

Sustainability integration will become increasingly important as building automation systems play central roles in achieving carbon neutrality goals and environmental compliance requirements. Future systems will incorporate renewable energy management, carbon tracking, and environmental impact optimization as core functionalities rather than optional features.

The North America building automation systems market represents a dynamic and rapidly evolving sector positioned for sustained growth driven by energy efficiency requirements, technological advancement, and changing customer expectations. The convergence of traditional building controls with modern digital technologies creates unprecedented opportunities for intelligent facility management and operational optimization.

Market fundamentals remain strong with supportive regulatory frameworks, increasing energy costs, and growing awareness of automation benefits driving adoption across commercial, residential, and industrial segments. The integration of artificial intelligence, IoT technologies, and cloud platforms transforms traditional building management approaches while creating new possibilities for autonomous system operation and predictive maintenance.

Future success in this market will depend on companies’ ability to deliver comprehensive, integrated solutions that address evolving customer requirements while maintaining competitive pricing and superior service capabilities. Organizations that invest in advanced technologies, cybersecurity capabilities, and service-based business models will be best positioned to capture market opportunities and achieve sustainable growth in the expanding North American building automation systems market.

What is Building Automation Systems?

Building Automation Systems refer to centralized control systems that manage a building’s mechanical, electrical, and electromechanical services. These systems enhance operational efficiency, improve energy management, and provide comfort to occupants through automation of lighting, HVAC, security, and other systems.

What are the key players in the North America Building Automation Systems Market?

Key players in the North America Building Automation Systems Market include Honeywell International Inc., Johnson Controls International plc, Siemens AG, and Schneider Electric SE, among others.

What are the main drivers of growth in the North America Building Automation Systems Market?

The main drivers of growth in the North America Building Automation Systems Market include the increasing demand for energy-efficient solutions, the rise in smart building initiatives, and advancements in IoT technology that enhance system integration and functionality.

What challenges does the North America Building Automation Systems Market face?

Challenges in the North America Building Automation Systems Market include high initial installation costs, the complexity of system integration, and the need for skilled personnel to manage and maintain these advanced systems.

What opportunities exist in the North America Building Automation Systems Market?

Opportunities in the North America Building Automation Systems Market include the growing trend of retrofitting existing buildings with automation technologies, the expansion of smart city projects, and the increasing focus on sustainability and energy conservation.

What trends are shaping the North America Building Automation Systems Market?

Trends shaping the North America Building Automation Systems Market include the integration of artificial intelligence for predictive maintenance, the use of cloud-based solutions for remote monitoring, and the increasing adoption of wireless communication technologies for enhanced connectivity.

North America Building Automation Systems Market

| Segmentation Details | Description |

|---|---|

| Product Type | Lighting Control, HVAC Control, Security Systems, Energy Management |

| Technology | Wireless, Wired, Cloud-Based, IoT-Enabled |

| End User | Commercial Buildings, Industrial Facilities, Educational Institutions, Healthcare Facilities |

| Installation | New Construction, Retrofit, Upgrades, Maintenance |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the North America Building Automation Systems Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at