444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Asia-Pacific organic fertilizer market represents one of the most dynamic and rapidly expanding segments within the global agricultural industry. This region, encompassing diverse economies from developed nations like Japan and Australia to emerging agricultural powerhouses such as India and China, demonstrates remarkable growth potential driven by increasing environmental consciousness and sustainable farming practices. The market encompasses various organic fertilizer types including compost, manure-based fertilizers, bone meal, and bio-fertilizers, each serving distinct agricultural applications across different crop categories.

Regional dynamics indicate that the Asia-Pacific organic fertilizer market is experiencing unprecedented growth, with adoption rates increasing by approximately 12-15% annually across major agricultural economies. Countries like India and China, which collectively represent over 60% of regional agricultural land, are leading this transformation through government initiatives promoting organic farming practices. The market’s expansion is particularly notable in rice, wheat, and vegetable cultivation, where farmers are increasingly recognizing the long-term soil health benefits of organic fertilization methods.

Market penetration varies significantly across the region, with developed markets like Japan and South Korea showing higher adoption rates of premium organic fertilizer products, while emerging economies focus on cost-effective organic solutions. The integration of traditional composting methods with modern bio-fertilizer technologies creates unique opportunities for market participants to develop region-specific products that cater to local agricultural practices and economic conditions.

The Asia-Pacific organic fertilizer market refers to the comprehensive ecosystem of naturally-derived soil enhancement products designed to improve crop yields while maintaining environmental sustainability across the Asia-Pacific region. This market encompasses all organic fertilizer types, from traditional compost and animal manure to advanced bio-fertilizers containing beneficial microorganisms, specifically formulated to meet the diverse agricultural needs of Asian and Pacific nations.

Organic fertilizers in this context are defined as nutrient sources derived from plant, animal, or microbial origins that enhance soil fertility without synthetic chemical additives. These products work by improving soil structure, increasing water retention capacity, and promoting beneficial microbial activity that supports long-term agricultural productivity. The market includes various product categories such as solid organic fertilizers, liquid bio-fertilizers, and specialized organic blends designed for specific crop types prevalent in the region.

Market scope extends beyond simple fertilizer products to include integrated organic farming solutions, soil conditioning agents, and sustainable agriculture consulting services. The definition encompasses both commercial organic fertilizer production and the growing trend of on-farm organic fertilizer generation through composting and vermiculture practices that are increasingly popular among small-scale farmers across the region.

Strategic analysis reveals that the Asia-Pacific organic fertilizer market stands at a critical juncture where traditional agricultural practices converge with modern sustainable farming technologies. The market demonstrates robust growth momentum driven by increasing consumer demand for organic food products, government support for sustainable agriculture, and growing awareness of soil health importance among farming communities. Regional agricultural policies increasingly favor organic farming practices, creating favorable conditions for market expansion.

Key growth drivers include rising environmental concerns, soil degradation issues, and the need for sustainable agricultural solutions that can support the region’s growing population. Countries like India have implemented national organic farming policies that directly support organic fertilizer adoption, while China’s focus on reducing chemical fertilizer dependency creates substantial market opportunities. The market benefits from approximately 8-10% annual growth in organic food consumption, which directly correlates with increased demand for organic fertilizers.

Market challenges primarily revolve around higher initial costs compared to synthetic alternatives, limited awareness among traditional farmers, and supply chain complexities in rural areas. However, these challenges are being addressed through government subsidies, farmer education programs, and innovative distribution models that make organic fertilizers more accessible to small-scale agricultural operations throughout the region.

Market intelligence indicates several critical insights that shape the Asia-Pacific organic fertilizer landscape. The following key insights provide strategic direction for market participants and stakeholders:

Environmental sustainability serves as the primary driver propelling the Asia-Pacific organic fertilizer market forward. Growing concerns about soil degradation, water pollution from chemical runoff, and long-term agricultural sustainability motivate farmers and policymakers to embrace organic fertilization methods. The region faces significant environmental challenges, with many agricultural areas experiencing soil fertility decline due to intensive chemical fertilizer use over decades.

Government initiatives across the region provide substantial support for organic fertilizer adoption through subsidies, training programs, and policy frameworks that favor sustainable agriculture. Countries like India have launched national missions promoting organic farming, while China implements policies to reduce chemical fertilizer dependency. These government programs often include financial incentives that make organic fertilizers more economically attractive to farmers, particularly small-scale operations.

Consumer demand for organic food products continues to drive market growth, with urban populations increasingly willing to pay premium prices for organically grown produce. This consumer preference creates market pull that encourages farmers to adopt organic fertilization practices to access higher-value market segments. The organic food market in the region grows at approximately 15-20% annually, directly supporting organic fertilizer demand.

Soil health awareness among farmers has increased significantly, with many recognizing that organic fertilizers provide long-term benefits including improved soil structure, enhanced water retention, and increased beneficial microbial activity. Educational programs and demonstration projects showcase the cumulative benefits of organic fertilization, leading to gradual but steady adoption among traditional farming communities.

Cost considerations represent the most significant restraint limiting widespread organic fertilizer adoption across the Asia-Pacific region. Organic fertilizers typically cost 20-40% more than synthetic alternatives, creating financial barriers for small-scale farmers operating on tight margins. The higher upfront costs, combined with slower initial results compared to chemical fertilizers, make adoption challenging for farmers seeking immediate yield improvements.

Supply chain limitations pose substantial challenges, particularly in remote rural areas where organic fertilizer availability remains inconsistent. Many regions lack adequate distribution networks for organic products, forcing farmers to rely on locally available but potentially inconsistent organic materials. Transportation costs for bulky organic fertilizers add to the overall expense, making them less competitive in price-sensitive markets.

Knowledge gaps among traditional farmers create adoption barriers, as many lack understanding of proper organic fertilizer application methods, timing, and expected results. The transition from chemical to organic fertilization requires different management approaches and patience for soil health improvements that may take multiple growing seasons to fully manifest. Limited extension services and technical support compound these knowledge challenges.

Quality inconsistency in organic fertilizer products creates market uncertainty, with varying nutrient content and quality standards across different suppliers. Lack of standardized testing and certification processes in some regional markets makes it difficult for farmers to assess product quality and effectiveness, leading to hesitation in adoption and potential disappointment with inconsistent results.

Technology integration presents significant opportunities for market expansion through the development of advanced bio-fertilizer products that combine traditional organic materials with beneficial microorganisms. These enhanced organic fertilizers can provide faster results and improved nutrient availability, addressing farmer concerns about slower organic fertilizer performance while maintaining environmental benefits.

E-commerce platforms offer new distribution channels that can overcome traditional supply chain limitations, particularly in rural areas. Online marketplaces and direct-to-farmer delivery services can improve organic fertilizer accessibility while reducing distribution costs. Digital platforms also enable better farmer education and technical support, addressing knowledge gaps that currently limit adoption.

Contract farming arrangements between organic fertilizer companies and agricultural cooperatives create opportunities for guaranteed market access and technical support. These partnerships can provide farmers with financing options, technical guidance, and assured markets for organic produce, making the transition to organic fertilization more economically viable and less risky.

Urban agriculture and vertical farming trends in major Asia-Pacific cities create new market segments for specialized organic fertilizer products. As urban food production expands, demand grows for clean, odorless organic fertilizers suitable for indoor and controlled environment agriculture applications, representing a high-value market opportunity.

Supply-demand dynamics in the Asia-Pacific organic fertilizer market reflect the complex interplay between growing demand and evolving supply capabilities. Demand continues to outpace supply in many regional markets, creating opportunities for new entrants and capacity expansion by existing players. The market experiences seasonal demand fluctuations aligned with regional planting cycles, requiring suppliers to manage inventory and production scheduling effectively.

Competitive dynamics show increasing market fragmentation as new players enter the market alongside established agricultural input companies expanding their organic product portfolios. Local and regional companies often maintain advantages in understanding specific crop requirements and farmer preferences, while multinational corporations bring advanced technology and broader distribution capabilities to the market.

Price dynamics reflect the ongoing tension between organic fertilizer production costs and farmer price sensitivity. Market prices show gradual decline as production scales increase and supply chains optimize, making organic fertilizers more accessible to price-conscious farmers. Government subsidies in key markets help bridge price gaps and accelerate adoption among small-scale farmers.

Innovation dynamics drive continuous product development, with companies investing in research to improve organic fertilizer effectiveness, reduce production costs, and develop application-specific formulations. MarkWide Research indicates that innovation investments in the organic fertilizer sector have increased by approximately 25% annually as companies seek competitive advantages through superior product performance.

Primary research methodologies employed in analyzing the Asia-Pacific organic fertilizer market include comprehensive surveys of farmers, distributors, and industry stakeholders across major agricultural regions. Field interviews with organic fertilizer users provide insights into adoption patterns, usage preferences, and perceived benefits or challenges. Industry expert consultations offer strategic perspectives on market trends, regulatory developments, and future growth prospects.

Secondary research encompasses analysis of government agricultural statistics, industry reports, trade publications, and academic research on organic farming practices across the region. Market data compilation includes production statistics, import-export figures, and pricing information from multiple regional sources to ensure comprehensive market coverage and accuracy.

Data validation processes involve cross-referencing information from multiple sources, conducting follow-up interviews to verify key findings, and employing statistical analysis to identify trends and patterns. Market sizing and growth projections utilize multiple analytical approaches to ensure reliability and account for regional variations in market development stages.

Analytical frameworks include Porter’s Five Forces analysis for competitive assessment, SWOT analysis for strategic evaluation, and trend analysis for future market projections. Regional market segmentation analysis provides detailed insights into country-specific opportunities and challenges, enabling targeted strategic recommendations for different market segments.

China dominates the regional organic fertilizer market, representing approximately 40% of total Asia-Pacific consumption. The Chinese market benefits from strong government support for sustainable agriculture, large-scale organic farming initiatives, and growing domestic demand for organic food products. Major agricultural provinces like Shandong, Henan, and Jiangsu lead in organic fertilizer adoption, driven by intensive vegetable and grain production systems.

India constitutes the second-largest regional market, accounting for roughly 25% of regional organic fertilizer usage. The Indian market shows rapid growth driven by the National Mission for Sustainable Agriculture and increasing awareness of soil health importance among farmers. States like Punjab, Haryana, and Uttar Pradesh demonstrate high adoption rates, particularly in rice and wheat cultivation systems.

Japan represents a mature market with high-value organic fertilizer products and advanced application technologies. Despite smaller agricultural land area, Japan shows strong demand for premium organic fertilizers, particularly in vegetable and fruit production. The market emphasizes quality and effectiveness, with farmers willing to pay premium prices for proven organic fertilizer solutions.

Southeast Asian markets including Thailand, Vietnam, and Indonesia show emerging growth potential, with increasing government support for sustainable agriculture and growing export-oriented organic farming sectors. These markets demonstrate strong growth in rice cultivation applications and expanding vegetable production for both domestic and export markets.

Market leaders in the Asia-Pacific organic fertilizer market include both multinational corporations and regional specialists that have established strong market positions through product innovation, distribution networks, and farmer relationships. The competitive landscape shows increasing consolidation as larger companies acquire regional players to expand market reach and product portfolios.

Competitive strategies focus on product differentiation, farmer education, and distribution network expansion. Companies invest heavily in research and development to create more effective organic fertilizer formulations while building relationships with agricultural cooperatives and extension services to reach small-scale farmers effectively.

By Product Type:

By Application:

By Form:

Compost-based fertilizers maintain market leadership due to their widespread availability, lower costs, and farmer familiarity with traditional composting methods. This category benefits from government programs promoting on-farm composting and municipal waste recycling initiatives that create readily available raw materials. Market growth in this segment averages 8-10% annually across major regional markets.

Bio-fertilizer products demonstrate the fastest growth rates, expanding at approximately 15-18% annually as farmers recognize the enhanced effectiveness of microbial-enhanced organic fertilizers. This category attracts significant research investment and product innovation, with companies developing crop-specific microbial formulations that provide targeted benefits for different agricultural applications.

Liquid organic fertilizers show strong growth in intensive agriculture systems and greenhouse operations where precise nutrient management is critical. This category benefits from modern irrigation systems and fertigation technologies that enable efficient liquid fertilizer application, particularly in high-value crop production systems.

Specialty organic fertilizers including seaweed-based and amino acid-enhanced products cater to premium market segments where farmers seek maximum effectiveness and are willing to pay higher prices for superior results. These products often target export-oriented agriculture and organic certification programs that require specific input standards.

Farmers benefit from improved soil health, enhanced crop quality, and access to premium organic food markets that command higher prices. Long-term soil fertility improvements reduce dependency on external inputs while building sustainable agricultural systems. Organic fertilizer use often qualifies farmers for organic certification programs and government incentive schemes that provide additional economic benefits.

Manufacturers gain access to growing market segments with higher profit margins compared to commodity chemical fertilizers. The organic fertilizer market offers opportunities for product differentiation, brand building, and direct farmer relationships that create competitive advantages. Companies can leverage sustainability positioning to attract environmentally conscious consumers and investors.

Distributors and retailers benefit from expanding product portfolios that cater to growing demand for sustainable agricultural inputs. Organic fertilizers often provide better margins than commodity products while building customer loyalty through technical support and advisory services. The market growth creates opportunities for specialized distribution channels and value-added services.

Government agencies achieve environmental and agricultural sustainability objectives through organic fertilizer promotion, supporting soil conservation, water quality protection, and rural economic development. Organic agriculture development contributes to food security goals while reducing environmental impacts of intensive farming systems.

Strengths:

Weaknesses:

Opportunities:

Threats:

Precision agriculture integration represents a major trend where organic fertilizers are being incorporated into data-driven farming systems that optimize application rates and timing based on soil testing and crop requirements. This trend combines traditional organic farming principles with modern technology to maximize effectiveness while minimizing waste and costs.

Microbial enhancement continues as a dominant trend, with manufacturers developing increasingly sophisticated bio-fertilizer products that combine organic nutrients with beneficial microorganisms. These enhanced products provide faster nutrient availability and improved soil biology, addressing traditional concerns about organic fertilizer performance compared to synthetic alternatives.

Customization and specialization trends show companies developing crop-specific and region-specific organic fertilizer formulations that address particular agricultural challenges and requirements. This trend moves beyond generic organic fertilizers toward targeted solutions that provide optimal results for specific applications and growing conditions.

Circular economy principles drive increasing focus on waste-to-fertilizer conversion, with companies developing systems to convert agricultural waste, food processing byproducts, and municipal organic waste into high-quality organic fertilizers. This trend addresses waste management challenges while creating sustainable fertilizer supply chains.

Digital marketing and distribution trends include the growth of e-commerce platforms, mobile applications for farmer education, and digital payment systems that make organic fertilizers more accessible to small-scale farmers. MarkWide Research data indicates that digital channel adoption in agricultural inputs has increased by approximately 30% annually across the region.

Strategic partnerships between organic fertilizer manufacturers and agricultural cooperatives have expanded significantly, creating integrated supply chains that provide farmers with financing, technical support, and guaranteed markets for organic produce. These partnerships address multiple adoption barriers simultaneously while building long-term customer relationships.

Research and development investments in organic fertilizer technology have intensified, with companies and research institutions collaborating on advanced microbial formulations, slow-release organic fertilizer technologies, and application optimization systems. Government research grants and private sector investments support innovation in sustainable agriculture technologies.

Regulatory developments include the establishment of organic fertilizer quality standards, certification programs, and subsidy schemes that support market growth while ensuring product quality and effectiveness. Countries like India and China have implemented comprehensive organic agriculture policies that directly impact fertilizer market development.

Manufacturing capacity expansion across the region reflects growing market confidence, with both domestic and international companies investing in new production facilities and distribution networks. These investments focus particularly on bio-fertilizer production capabilities and rural market penetration strategies.

Technology adoption includes the integration of IoT sensors, soil testing technologies, and mobile applications that help farmers optimize organic fertilizer application and monitor soil health improvements over time. These technological developments address knowledge gaps and provide data-driven support for organic farming decisions.

Market entry strategies should focus on building strong relationships with agricultural cooperatives and extension services that can provide credible endorsements and technical support to farmers. New entrants should consider partnerships with established agricultural input distributors rather than attempting to build distribution networks from scratch, particularly in rural markets where relationships and trust are crucial.

Product development priorities should emphasize effectiveness demonstration and cost optimization to address the two primary adoption barriers facing organic fertilizers. Companies should invest in field trials and demonstration projects that provide clear evidence of return on investment for farmers, while simultaneously working to reduce production costs through scale and process improvements.

Geographic expansion should prioritize markets with strong government support for organic agriculture and growing organic food demand. Secondary cities and peri-urban agricultural areas often provide better opportunities than remote rural regions due to better infrastructure, higher farmer education levels, and proximity to organic food markets.

Technology integration recommendations include developing mobile applications and digital platforms that provide farmers with application guidance, soil health monitoring, and connection to technical support services. These digital tools can differentiate products while addressing knowledge gaps that limit organic fertilizer adoption.

Partnership strategies should focus on vertical integration opportunities that connect organic fertilizer supply with organic food marketing and certification services. MWR analysis suggests that integrated value chain approaches provide stronger competitive positions and better farmer value propositions than standalone fertilizer supply.

Market growth projections indicate continued strong expansion across the Asia-Pacific organic fertilizer market, with growth rates expected to maintain 10-12% annually over the next five years. This growth will be driven by increasing environmental regulations, expanding organic food markets, and continued government support for sustainable agriculture practices across major regional economies.

Technology evolution will likely focus on enhanced bio-fertilizer formulations that provide faster results and improved nutrient efficiency, addressing current performance gaps compared to synthetic alternatives. Advanced microbial technologies, nanotechnology applications, and precision delivery systems will create new product categories that combine organic principles with superior effectiveness.

Market consolidation trends suggest that larger agricultural input companies will continue acquiring specialized organic fertilizer manufacturers to build comprehensive sustainable agriculture portfolios. This consolidation will likely improve distribution reach and technical support capabilities while potentially reducing product diversity and innovation in some market segments.

Regional market development will see emerging economies like Vietnam, Indonesia, and Bangladesh becoming increasingly important growth markets as their agricultural sectors modernize and government policies increasingly favor sustainable farming practices. These markets will likely follow development patterns similar to current leaders like India and China.

Sustainability integration will become increasingly important, with organic fertilizer companies expected to demonstrate comprehensive environmental benefits including carbon sequestration, biodiversity enhancement, and circular economy contributions. These broader sustainability metrics will become key differentiators in premium market segments and government procurement programs.

The Asia-Pacific organic fertilizer market stands at a transformative juncture where traditional agricultural practices converge with modern sustainability imperatives and technological innovation. The market demonstrates robust growth potential driven by environmental consciousness, government policy support, and increasing demand for organic food products across the region’s diverse economies. While challenges including higher costs and supply chain limitations persist, ongoing technological advances and supportive policy frameworks continue to address these barriers.

Strategic opportunities abound for companies that can effectively combine product innovation with farmer education and accessible distribution models. The market rewards participants who understand local agricultural practices, build trust-based relationships with farming communities, and provide comprehensive solutions rather than standalone products. Success requires balancing traditional organic farming principles with modern agricultural technologies and business models.

Future market development will likely emphasize enhanced effectiveness, cost optimization, and integrated value chain approaches that connect sustainable fertilizer supply with organic food marketing and certification services. Companies that can demonstrate clear return on investment for farmers while supporting broader sustainability objectives will capture the greatest market opportunities in this dynamic and rapidly evolving sector.

What is Organic Fertilizer?

Organic fertilizer refers to natural substances derived from plant or animal matter that are used to enhance soil fertility and promote plant growth. These fertilizers improve soil structure, provide essential nutrients, and support sustainable agricultural practices.

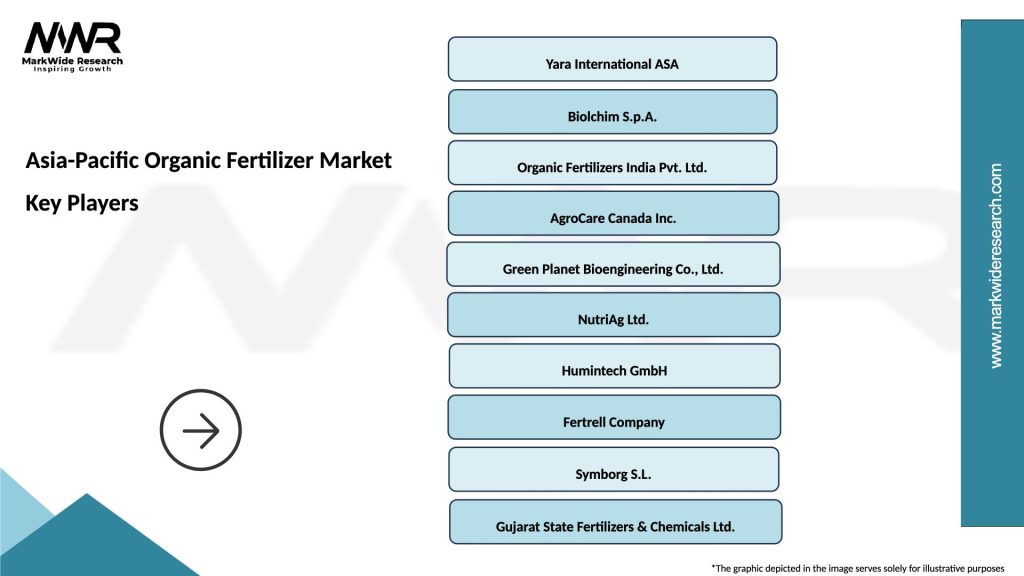

What are the key players in the Asia-Pacific Organic Fertilizer Market?

Key players in the Asia-Pacific Organic Fertilizer Market include companies like Biolchim S.p.A, Organic Fertilizers, and AgroCare among others. These companies are involved in the production and distribution of various organic fertilizers tailored for different agricultural needs.

What are the growth factors driving the Asia-Pacific Organic Fertilizer Market?

The Asia-Pacific Organic Fertilizer Market is driven by increasing demand for sustainable agriculture, rising awareness of soil health, and the growing trend of organic farming. Additionally, government initiatives promoting organic farming practices contribute to market growth.

What challenges does the Asia-Pacific Organic Fertilizer Market face?

Challenges in the Asia-Pacific Organic Fertilizer Market include the high cost of organic fertilizers compared to synthetic options and limited availability of raw materials. Additionally, inconsistent quality and regulatory hurdles can hinder market growth.

What opportunities exist in the Asia-Pacific Organic Fertilizer Market?

Opportunities in the Asia-Pacific Organic Fertilizer Market include the expansion of organic farming practices and increasing consumer demand for organic produce. Innovations in product formulations and distribution channels also present growth potential.

What trends are shaping the Asia-Pacific Organic Fertilizer Market?

Trends in the Asia-Pacific Organic Fertilizer Market include the rising adoption of bio-based fertilizers and the integration of technology in fertilizer production. Additionally, there is a growing focus on sustainable practices and eco-friendly products among consumers.

Asia-Pacific Organic Fertilizer Market

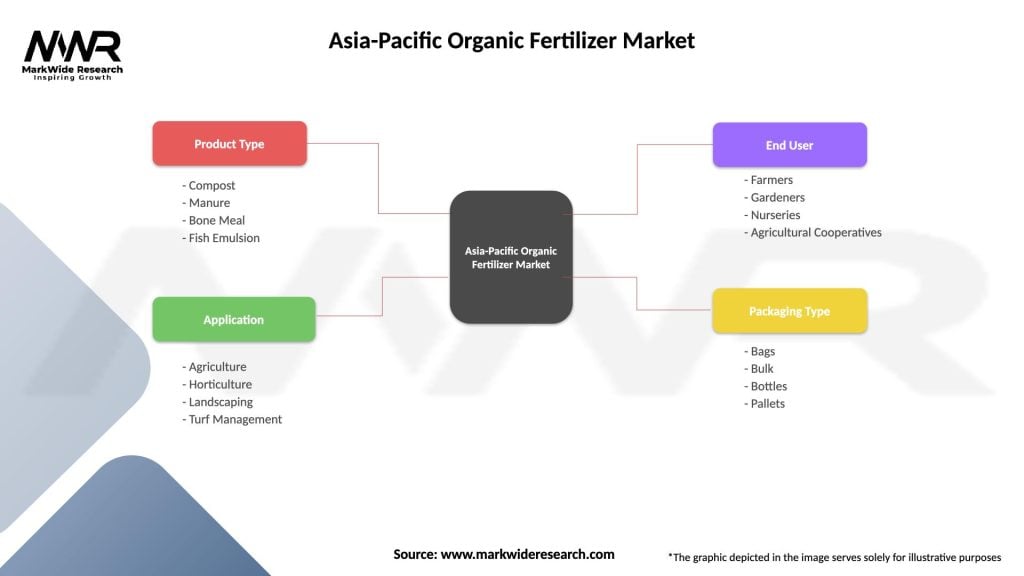

| Segmentation Details | Description |

|---|---|

| Product Type | Compost, Manure, Bone Meal, Fish Emulsion |

| Application | Agriculture, Horticulture, Landscaping, Turf Management |

| End User | Farmers, Gardeners, Nurseries, Agricultural Cooperatives |

| Packaging Type | Bags, Bulk, Bottles, Pallets |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Asia-Pacific Organic Fertilizer Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at