444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Middle East & Africa oral care market represents a dynamic and rapidly evolving sector within the broader personal care industry. This region encompasses diverse economies ranging from oil-rich Gulf states to emerging African markets, each presenting unique opportunities and challenges for oral care manufacturers and retailers. The market demonstrates robust growth potential driven by increasing health consciousness, urbanization, and rising disposable incomes across key demographics.

Regional diversity characterizes this market significantly, with the Middle East showing higher penetration rates of premium oral care products, while African markets present substantial opportunities for basic oral hygiene products. The market experiences steady expansion with growth rates averaging 6.2% annually, reflecting the region’s economic development and changing consumer preferences toward preventive healthcare.

Consumer behavior patterns vary considerably across the region, influenced by cultural practices, religious considerations, and economic factors. Urban centers in countries like UAE, Saudi Arabia, and South Africa drive demand for advanced oral care solutions, while rural areas focus primarily on essential products. The market benefits from increasing awareness of oral health importance and its connection to overall wellness, supported by government health initiatives and educational campaigns.

The Middle East & Africa oral care market refers to the comprehensive ecosystem of products, services, and technologies designed to maintain and improve oral hygiene across the diverse geographical regions of the Middle East and Africa. This market encompasses traditional oral care products such as toothpastes, toothbrushes, and mouthwashes, alongside emerging categories including whitening products, specialized therapeutic formulations, and innovative oral care devices.

Market scope extends beyond basic hygiene products to include professional dental care services, preventive treatments, and educational initiatives that promote oral health awareness. The definition encompasses both consumer-driven retail markets and professional dental care segments, reflecting the integrated nature of oral health maintenance in modern healthcare systems.

Geographic coverage includes major economies such as Saudi Arabia, UAE, Egypt, Nigeria, South Africa, and Kenya, each contributing distinct market characteristics and growth drivers. The market definition also incorporates cultural and religious considerations that influence product formulations, marketing approaches, and consumer acceptance patterns across different communities within the region.

Market dynamics in the Middle East & Africa oral care sector reflect a compelling growth story driven by demographic shifts, economic development, and evolving consumer preferences. The region demonstrates significant potential for market expansion, with urbanization rates reaching 68% in Middle Eastern countries and steadily increasing across African markets, creating favorable conditions for oral care product adoption.

Key growth drivers include rising health consciousness, increasing disposable incomes, and expanding retail infrastructure across major urban centers. The market benefits from strong demographic trends, with approximately 60% of the population under 30 years of age, representing a tech-savvy consumer base that values health and wellness products. Government initiatives promoting preventive healthcare further support market growth through public health campaigns and healthcare infrastructure development.

Competitive landscape features a mix of international brands and regional players, with multinational companies leveraging their global expertise while local manufacturers capitalize on cultural understanding and cost advantages. The market shows increasing premiumization in developed markets like UAE and Saudi Arabia, while price-sensitive segments dominate in emerging African markets, creating diverse opportunities for different market positioning strategies.

Consumer preferences across the Middle East & Africa oral care market reveal several critical insights that shape industry strategies and product development initiatives:

Demographic transformation serves as a primary catalyst for oral care market growth across the Middle East & Africa region. The predominantly young population structure, combined with increasing urbanization rates, creates favorable conditions for oral care product adoption and market expansion. Rising disposable incomes in oil-rich Middle Eastern countries and emerging African economies enable consumers to invest in premium oral care solutions and preventive health measures.

Health consciousness trends significantly influence market dynamics, with consumers increasingly recognizing the connection between oral health and overall wellness. Educational initiatives by healthcare organizations and government health departments raise awareness about the importance of proper oral hygiene, driving demand for comprehensive oral care solutions. Social media influence and digital health platforms further amplify health awareness messages, particularly among younger demographics.

Infrastructure development across the region supports market growth through expanding retail networks, improved distribution channels, and enhanced healthcare facilities. The proliferation of modern retail formats, including hypermarkets, pharmacies, and e-commerce platforms, increases product accessibility and consumer convenience. Government healthcare initiatives promoting preventive care and oral health education create supportive policy environments for market development.

Cultural factors also drive market growth, with increasing emphasis on personal grooming and appearance in both professional and social contexts. The influence of Western lifestyle trends, combined with traditional cultural values emphasizing cleanliness and health, creates unique market opportunities for oral care manufacturers to develop culturally appropriate products and marketing strategies.

Economic volatility presents significant challenges for the Middle East & Africa oral care market, particularly in oil-dependent economies where commodity price fluctuations impact consumer spending patterns. Currency devaluation in several African countries affects import costs for international brands, leading to price increases that may limit market accessibility for price-sensitive consumers.

Infrastructure limitations in rural and remote areas restrict market penetration and product distribution efficiency. Limited retail networks, inadequate cold chain facilities, and poor transportation infrastructure create barriers to reaching underserved populations. Healthcare access disparities between urban and rural areas limit awareness and education about oral health importance, constraining market growth potential in significant population segments.

Cultural and religious considerations may restrict certain product formulations or marketing approaches, requiring careful navigation of local sensitivities and preferences. Regulatory compliance requirements vary significantly across different countries, creating complexity for manufacturers seeking regional market expansion. Political instability in certain regions disrupts business operations and investment flows, creating uncertainty for long-term market development strategies.

Competition from traditional practices and home remedies remains strong in many communities, where conventional oral care methods compete with modern commercial products. Limited dental care infrastructure and high treatment costs may discourage preventive oral care adoption, as consumers prioritize immediate needs over long-term health investments.

Digital transformation creates unprecedented opportunities for oral care market expansion through e-commerce platforms, digital marketing, and telemedicine applications. The rapid adoption of smartphones and internet connectivity across the region enables direct-to-consumer marketing strategies and online retail channels that bypass traditional distribution limitations. Social media engagement provides cost-effective platforms for brand building and consumer education, particularly effective for reaching younger demographics.

Product innovation opportunities abound in developing culturally appropriate formulations that combine traditional ingredients with modern oral care technology. The growing demand for natural and organic products creates space for premium positioning and differentiated product offerings. Specialized segments such as children’s oral care, senior care products, and therapeutic formulations present untapped growth potential across diverse consumer groups.

Partnership opportunities with healthcare providers, educational institutions, and government health agencies can accelerate market penetration through professional endorsements and public health initiatives. Collaboration with local manufacturers enables cost-effective production and distribution while ensuring cultural sensitivity and regulatory compliance. Corporate social responsibility programs focusing on oral health education and community outreach can build brand loyalty while addressing social needs.

Emerging market segments in smaller African countries present significant growth opportunities as economic development and urbanization accelerate. The expansion of middle-class populations across the region creates new consumer segments with increasing purchasing power and health consciousness, driving demand for premium oral care solutions and innovative product categories.

Supply chain evolution significantly impacts market dynamics across the Middle East & Africa oral care sector. Manufacturers increasingly focus on regional production facilities and local sourcing strategies to reduce costs and improve supply chain resilience. Distribution network optimization becomes critical as companies seek to balance urban market penetration with rural area accessibility, often requiring hybrid distribution models combining traditional retail and digital channels.

Consumer behavior shifts drive dynamic changes in product demand patterns and marketing strategies. The influence of social media and digital platforms creates rapid trend adoption cycles, requiring agile product development and marketing responses. Price sensitivity variations across different market segments necessitate diverse pricing strategies and product portfolio management approaches to capture various consumer groups effectively.

Regulatory landscape changes influence market dynamics through evolving product standards, labeling requirements, and import regulations. Companies must navigate complex regulatory environments while maintaining product quality and compliance across multiple jurisdictions. Competitive intensity increases as both international and local players vie for market share, leading to innovation acceleration and marketing investment increases.

Technology integration transforms market dynamics through smart oral care devices, mobile health applications, and personalized oral care solutions. According to MarkWide Research analysis, technology adoption in oral care shows 23% annual growth in tech-forward markets like UAE and Saudi Arabia, indicating significant potential for digital health integration and connected oral care ecosystems.

Comprehensive research approach employed for analyzing the Middle East & Africa oral care market combines quantitative and qualitative methodologies to ensure accurate market assessment and strategic insights. Primary research involves extensive consumer surveys, industry expert interviews, and retail channel analysis across key markets including Saudi Arabia, UAE, Egypt, Nigeria, South Africa, and Kenya.

Data collection methods encompass multiple sources including consumer behavior studies, retail sales analysis, import/export statistics, and regulatory database reviews. Focus group discussions and in-depth interviews with industry stakeholders provide qualitative insights into market trends, consumer preferences, and competitive dynamics. Market sizing methodologies utilize bottom-up and top-down approaches to ensure accuracy and reliability of market assessments.

Secondary research incorporates analysis of industry reports, government statistics, trade association data, and company financial disclosures to validate primary research findings. Cross-referencing multiple data sources ensures comprehensive market understanding and reduces potential bias in analysis and conclusions. Regional expertise from local research partners provides cultural context and market nuances essential for accurate interpretation of consumer behavior patterns.

Analytical frameworks include SWOT analysis, Porter’s Five Forces assessment, and competitive benchmarking to provide strategic insights for market participants. Trend analysis and forecasting models incorporate economic indicators, demographic projections, and industry development patterns to project future market evolution and growth opportunities.

Gulf Cooperation Council (GCC) countries represent the most mature and affluent segment of the Middle East & Africa oral care market. Saudi Arabia and UAE lead regional consumption with premium product penetration rates exceeding 40%, driven by high disposable incomes and strong health consciousness. These markets demonstrate sophisticated consumer preferences for advanced oral care technologies, whitening products, and luxury brand positioning.

North African markets including Egypt, Morocco, and Algeria show strong growth potential with large population bases and increasing urbanization rates. Egypt emerges as a key market with growing middle-class segments and expanding retail infrastructure supporting oral care product accessibility. Local manufacturing capabilities in these countries provide cost advantages and cultural product adaptation opportunities.

Sub-Saharan Africa presents diverse market characteristics with South Africa leading in market maturity and consumer sophistication. Nigeria represents the largest population market with significant growth potential, while Kenya and Ghana demonstrate rapid economic development supporting oral care market expansion. Rural market penetration remains limited but offers substantial long-term growth opportunities as infrastructure development continues.

Regional market share distribution shows GCC countries accounting for approximately 35% of regional consumption, despite representing a smaller population base, reflecting higher per-capita consumption and premium product preferences. Sub-Saharan Africa represents the largest growth opportunity with expanding market access and increasing health awareness driving demand for basic and intermediate oral care products.

Market leadership in the Middle East & Africa oral care sector features a competitive mix of multinational corporations and regional players, each leveraging distinct advantages to capture market share and consumer loyalty:

Competitive strategies focus on brand differentiation, cultural adaptation, and distribution network expansion. International brands leverage global research and development capabilities while investing in local manufacturing and marketing customization. Regional players capitalize on cultural understanding, cost advantages, and traditional ingredient preferences to compete effectively against multinational corporations.

Product category segmentation reveals diverse market opportunities across the Middle East & Africa oral care landscape:

By Product Type:

By Price Segment:

By Distribution Channel:

Toothpaste category dominates the Middle East & Africa oral care market with comprehensive consumer adoption across all demographic segments. Fluoride-based formulations lead market share, while herbal and natural variants show accelerating growth rates of 8.5% annually in response to consumer preferences for traditional ingredients. Whitening toothpastes represent the fastest-growing subcategory, particularly popular among urban professionals and younger consumers seeking cosmetic benefits.

Toothbrush segment experiences significant transformation with electric toothbrush adoption increasing rapidly in affluent markets. Manual toothbrushes maintain dominant market share due to affordability and accessibility, but premium manual brushes with specialized bristle designs gain popularity. Children’s toothbrushes represent a growing niche with colorful designs and character licensing driving parental purchase decisions.

Mouthwash category shows strong growth potential with therapeutic formulations addressing specific oral health concerns gaining consumer acceptance. Alcohol-free variants perform well in Muslim-majority markets, while antibacterial and whitening mouthwashes appeal to health-conscious consumers. Portable mouthwash formats cater to busy lifestyles and travel convenience requirements.

Specialized products including dental floss, interdental brushes, and tongue cleaners represent emerging categories with significant growth opportunities. Consumer education about comprehensive oral care routines drives adoption of these supplementary products, particularly in markets with established dental care awareness and professional recommendations.

Manufacturers benefit from the Middle East & Africa oral care market through diverse growth opportunities spanning multiple price segments and consumer demographics. The region’s economic development and increasing health consciousness create expanding addressable markets for both basic and premium oral care products. Local manufacturing opportunities provide cost advantages, regulatory compliance benefits, and cultural product adaptation capabilities.

Retailers gain from growing consumer demand and expanding product categories that drive store traffic and basket size increases. The oral care category offers attractive margins and consistent repeat purchase patterns, supporting sustainable revenue growth. E-commerce platforms benefit from the category’s suitability for online sales and subscription-based delivery models.

Healthcare providers leverage oral care market growth to promote preventive health initiatives and patient education programs. Professional recommendations significantly influence consumer product choices, creating partnership opportunities with manufacturers for educational campaigns and product endorsements. Dental professionals benefit from increased consumer awareness and preventive care adoption.

Consumers receive improved oral health outcomes through access to advanced oral care technologies and comprehensive product options. Market competition drives innovation and affordability, making quality oral care products accessible to broader population segments. Health education initiatives supported by industry participants improve overall oral health awareness and practices across communities.

Strengths:

Weaknesses:

Opportunities:

Threats:

Natural and organic formulations represent the most significant trend shaping the Middle East & Africa oral care market. Consumer preference for products containing traditional ingredients like miswak, neem, and other herbal extracts drives product innovation and marketing strategies. Clean label trends emphasize transparency in ingredient sourcing and formulation, appealing to health-conscious consumers seeking chemical-free alternatives.

Premiumization trends emerge strongly in affluent markets, with consumers willing to invest in advanced oral care technologies and luxury brand experiences. Electric toothbrushes, professional-grade whitening products, and specialized therapeutic formulations gain market traction among discerning consumers. Personalization trends drive demand for customized oral care solutions addressing individual needs and preferences.

Sustainability initiatives influence product packaging, manufacturing processes, and brand positioning strategies. Eco-friendly packaging materials, refillable product formats, and sustainable sourcing practices resonate with environmentally conscious consumers. Digital health integration creates opportunities for smart oral care devices and mobile health applications that monitor and improve oral hygiene practices.

Cultural fusion trends combine traditional oral care wisdom with modern scientific formulations, creating unique product propositions that appeal to diverse consumer segments. MWR research indicates that products successfully integrating cultural elements show 15% higher consumer acceptance rates compared to purely Western-oriented formulations, highlighting the importance of cultural sensitivity in product development.

Manufacturing expansion initiatives by major oral care companies demonstrate confidence in regional market growth potential. Several multinational corporations establish local production facilities to serve regional markets more efficiently while reducing costs and improving supply chain resilience. Technology transfer programs enhance local manufacturing capabilities and product quality standards.

Strategic partnerships between international brands and local distributors accelerate market penetration and cultural adaptation efforts. These collaborations combine global expertise with local market knowledge to develop effective go-to-market strategies. Healthcare sector partnerships with dental associations and medical institutions strengthen professional endorsements and consumer education initiatives.

Digital transformation investments by industry participants focus on e-commerce platform development, digital marketing capabilities, and consumer engagement technologies. Mobile applications for oral health monitoring and personalized care recommendations represent emerging areas of innovation and investment. Supply chain digitization improves distribution efficiency and inventory management across diverse regional markets.

Regulatory harmonization efforts across regional trade blocs facilitate market access and reduce compliance complexity for manufacturers. Standardization of product testing requirements and labeling standards streamlines market entry processes and reduces operational costs for companies operating across multiple countries.

Market entry strategies should prioritize cultural sensitivity and local market adaptation to achieve sustainable success in the Middle East & Africa oral care market. Companies must invest in understanding regional consumer preferences, religious considerations, and traditional practices that influence product acceptance. Partnership approaches with local distributors and healthcare providers can accelerate market penetration while ensuring cultural appropriateness.

Product portfolio optimization requires balancing global brand consistency with local market customization. Successful companies develop tiered product strategies serving different price segments while maintaining brand integrity and quality standards. Innovation focus should emphasize natural ingredients, therapeutic benefits, and convenience features that address specific regional consumer needs and preferences.

Distribution strategy development must address infrastructure limitations and diverse retail landscapes across the region. Multi-channel approaches combining traditional retail, modern trade, and digital platforms ensure comprehensive market coverage. Rural market strategies require innovative distribution models and affordable product formulations to capture underserved population segments.

Investment priorities should focus on local manufacturing capabilities, digital marketing infrastructure, and consumer education programs. Building regional supply chains reduces costs and improves market responsiveness while supporting long-term competitive positioning. Sustainability initiatives increasingly influence consumer choices and regulatory requirements, making environmental responsibility a strategic imperative for market success.

Market growth trajectory for the Middle East & Africa oral care sector remains positive, supported by favorable demographic trends, economic development, and increasing health consciousness. The region’s young population structure and urbanization patterns create sustainable demand drivers for oral care products across all categories. Economic diversification efforts in oil-dependent economies support consumer spending stability and market resilience.

Technology integration will accelerate market evolution through smart oral care devices, personalized health solutions, and digital health platforms. The convergence of oral care with broader health and wellness trends creates opportunities for innovative product categories and service offerings. Artificial intelligence applications in oral health monitoring and personalized care recommendations represent emerging growth areas.

Market consolidation trends may emerge as companies seek scale advantages and regional market leadership positions. Strategic acquisitions and partnerships will likely increase as international brands pursue comprehensive regional coverage and local companies seek growth capital and global expertise. Regulatory evolution toward harmonized standards will facilitate cross-border trade and market integration.

Sustainability imperatives will increasingly influence product development, packaging design, and manufacturing processes. Consumer demand for environmentally responsible products and corporate social responsibility initiatives will drive industry transformation toward more sustainable practices. According to MarkWide Research projections, sustainable oral care products could capture 25% market share by 2030, reflecting growing environmental consciousness among regional consumers.

The Middle East & Africa oral care market presents compelling opportunities for industry participants willing to navigate its diverse challenges and cultural complexities. Strong demographic fundamentals, including young populations and increasing urbanization, create sustainable growth drivers that support long-term market expansion. Economic development across key regional markets enhances consumer purchasing power and drives demand for both basic and premium oral care solutions.

Success factors in this dynamic market include cultural sensitivity, local market adaptation, and strategic partnership development. Companies that effectively balance global expertise with regional customization achieve superior market performance and consumer acceptance. The integration of traditional practices with modern oral care technologies creates unique value propositions that resonate with diverse consumer segments across the region.

Future market evolution will be shaped by technology integration, sustainability initiatives, and continued economic development. Digital transformation creates new opportunities for consumer engagement and personalized oral care solutions, while environmental consciousness drives demand for sustainable products and practices. The region’s strategic importance as a bridge between global markets ensures continued investment and innovation in the oral care sector, positioning it for sustained growth and development in the years ahead.

What is Oral Care?

Oral care refers to the practices and products used to maintain oral hygiene and health, including brushing, flossing, and the use of mouthwash. It encompasses a variety of products such as toothpaste, toothbrushes, and dental treatments.

What are the key players in the Middle East & Africa Oral Care Market?

Key players in the Middle East & Africa Oral Care Market include Colgate-Palmolive, Procter & Gamble, Unilever, and GlaxoSmithKline, among others. These companies offer a range of oral care products catering to diverse consumer needs.

What are the growth factors driving the Middle East & Africa Oral Care Market?

The growth of the Middle East & Africa Oral Care Market is driven by increasing awareness of oral hygiene, rising disposable incomes, and the growing prevalence of dental diseases. Additionally, the expansion of retail channels and innovative product offerings contribute to market growth.

What challenges does the Middle East & Africa Oral Care Market face?

The Middle East & Africa Oral Care Market faces challenges such as limited access to dental care in rural areas, cultural differences in oral hygiene practices, and competition from local brands. These factors can hinder market penetration and growth.

What opportunities exist in the Middle East & Africa Oral Care Market?

Opportunities in the Middle East & Africa Oral Care Market include the introduction of natural and organic oral care products, the rise of e-commerce platforms for product distribution, and increasing investments in dental health awareness campaigns. These trends can enhance market potential.

What trends are shaping the Middle East & Africa Oral Care Market?

Trends shaping the Middle East & Africa Oral Care Market include the growing demand for eco-friendly packaging, the rise of personalized oral care solutions, and advancements in dental technology. These trends reflect changing consumer preferences and innovations in the industry.

Middle East & Africa Oral Care Market

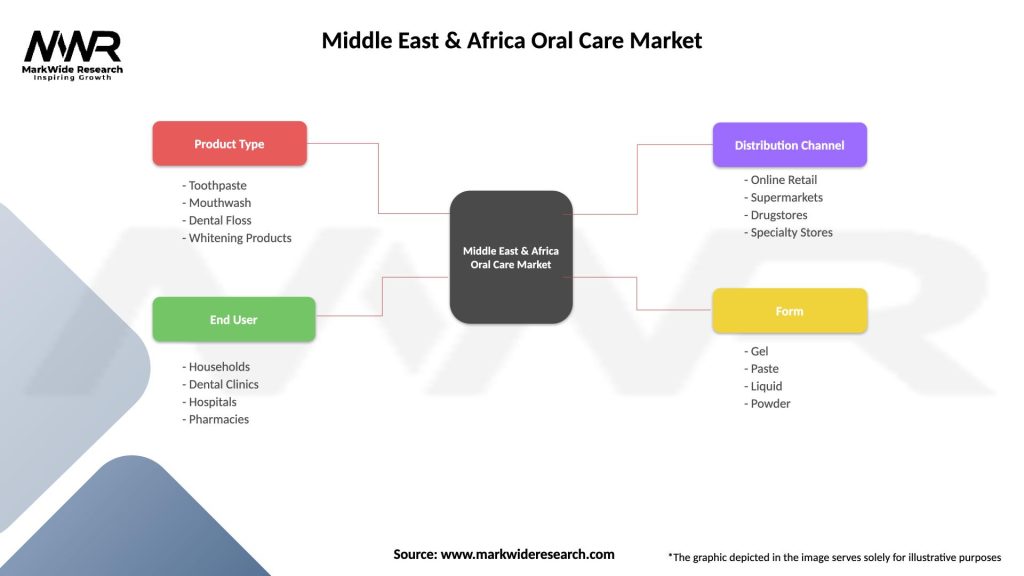

| Segmentation Details | Description |

|---|---|

| Product Type | Toothpaste, Mouthwash, Dental Floss, Whitening Products |

| End User | Households, Dental Clinics, Hospitals, Pharmacies |

| Distribution Channel | Online Retail, Supermarkets, Drugstores, Specialty Stores |

| Form | Gel, Paste, Liquid, Powder |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Middle East & Africa Oral Care Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at