444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The APAC aviation market represents one of the most dynamic and rapidly expanding aviation sectors globally, encompassing commercial aviation, cargo operations, general aviation, and military aircraft services across the Asia-Pacific region. Market dynamics in this region are characterized by unprecedented growth in air passenger traffic, increasing urbanization, and rising disposable incomes across emerging economies. The region’s aviation infrastructure has experienced remarkable transformation, with new airports, expanded flight networks, and modernized fleet operations driving substantial market expansion.

Regional growth patterns indicate that the APAC aviation market is experiencing robust expansion at a compound annual growth rate (CAGR) of 6.8%, significantly outpacing global aviation market averages. Countries such as China, India, Indonesia, and Vietnam are leading this growth trajectory, with domestic and international passenger traffic showing remarkable resilience and expansion potential. The market encompasses diverse segments including passenger airlines, cargo carriers, aircraft manufacturing, maintenance repair and overhaul (MRO) services, and aviation support infrastructure.

Infrastructure development across the region has been substantial, with governments investing heavily in airport expansion projects, air traffic management systems, and regulatory frameworks to support aviation growth. The emergence of low-cost carriers has democratized air travel, making aviation accessible to broader population segments and contributing to market expansion. Additionally, the region’s strategic geographic position as a global trade hub has strengthened cargo aviation operations, supporting international commerce and supply chain connectivity.

The APAC aviation market refers to the comprehensive ecosystem of aviation-related activities, services, and infrastructure spanning the Asia-Pacific region, including aircraft operations, airport services, maintenance facilities, and supporting technologies. This market encompasses all aspects of civil aviation, from passenger and cargo transportation to aircraft manufacturing, leasing, and maintenance services across countries including China, India, Japan, South Korea, Australia, Southeast Asian nations, and Pacific island territories.

Market scope extends beyond traditional airline operations to include aircraft manufacturing facilities, pilot training academies, aviation fuel supply chains, ground handling services, and digital aviation technologies. The definition encompasses both domestic and international aviation activities originating from or serving APAC destinations, reflecting the region’s role as a critical global aviation hub connecting East and West through major transit points and destination airports.

Strategic market positioning reveals that the APAC aviation market has emerged as the world’s fastest-growing aviation region, driven by economic development, population growth, and increasing connectivity demands. The market demonstrates exceptional resilience and recovery capabilities, with passenger traffic showing strong rebound patterns and cargo operations maintaining consistent growth trajectories. Key performance indicators suggest that the region accounts for approximately 35% of global aviation activity, with this percentage expected to increase significantly over the forecast period.

Market composition includes established aviation markets such as Japan and Australia alongside rapidly emerging markets including India, Vietnam, and Indonesia. The diversity of market maturity levels creates unique opportunities for different aviation business models, from premium full-service carriers to ultra-low-cost operators. Technological adoption rates in the region are accelerating, with digital transformation initiatives, sustainable aviation fuel programs, and next-generation aircraft technologies gaining momentum across multiple markets.

Investment flows into the APAC aviation sector have intensified, with both domestic and international investors recognizing the long-term growth potential. Government support through infrastructure development, regulatory modernization, and aviation industry promotion has created favorable conditions for market expansion and innovation.

Fundamental market insights reveal several critical trends shaping the APAC aviation landscape:

Economic prosperity across APAC nations serves as the primary driver of aviation market expansion, with rising middle-class populations gaining access to air travel for business and leisure purposes. GDP growth rates in key markets such as India, Vietnam, and Indonesia are translating directly into increased aviation demand, as economic development creates both business travel requirements and discretionary spending capacity for leisure travel.

Urbanization trends are creating concentrated population centers that generate significant aviation demand, particularly for domestic connectivity between major cities. The development of secondary cities and regional economic hubs is driving demand for improved air connectivity, creating opportunities for both full-service and low-cost carriers to expand route networks and increase flight frequencies.

Tourism industry growth represents another significant market driver, with APAC destinations attracting increasing numbers of international visitors while domestic tourism markets expand rapidly. Countries such as Thailand, Indonesia, and the Philippines are experiencing tourism booms that directly translate into aviation demand, supported by government initiatives to promote tourism and improve destination accessibility.

Trade and commerce expansion throughout the region is driving cargo aviation growth, with e-commerce development creating new demand patterns for air freight services. The region’s role as a global manufacturing hub requires efficient air cargo connectivity to support supply chains and time-sensitive shipments, particularly in technology and pharmaceutical sectors.

Infrastructure limitations in several APAC markets continue to constrain aviation growth potential, with airport capacity constraints, air traffic management limitations, and inadequate ground transportation connectivity creating bottlenecks. Many airports across the region are operating near or at capacity, limiting the ability to accommodate additional flights and passengers during peak periods.

Regulatory complexities and varying aviation standards across different countries create operational challenges for airlines seeking to expand regional networks. Differences in safety regulations, pilot licensing requirements, and operational procedures can increase costs and complexity for carriers operating across multiple APAC jurisdictions.

Economic volatility in certain markets can impact aviation demand, with currency fluctuations, political instability, and economic downturns affecting both passenger and cargo traffic patterns. The aviation industry’s sensitivity to economic cycles means that regional economic challenges can quickly translate into reduced demand and operational difficulties for airlines.

Environmental concerns and increasing regulatory pressure regarding carbon emissions are creating compliance costs and operational constraints for aviation operators. Growing awareness of aviation’s environmental impact is leading to stricter regulations and requirements for sustainable operations, which can increase operational costs and limit growth in environmentally sensitive markets.

Emerging market penetration presents substantial opportunities for aviation expansion, particularly in countries with large populations and developing economies where aviation penetration rates remain relatively low. Markets such as India, Indonesia, and the Philippines offer significant growth potential as economic development increases air travel accessibility and demand.

Technology integration opportunities are creating new revenue streams and operational efficiencies for aviation companies willing to invest in digital transformation. Advanced booking systems, predictive maintenance technologies, and artificial intelligence applications can improve operational efficiency while enhancing customer experience and reducing costs.

Sustainable aviation initiatives are opening new market segments and competitive advantages for early adopters of environmental technologies. Airlines and airports investing in sustainable aviation fuels, electric aircraft technologies, and carbon offset programs can differentiate themselves while meeting evolving regulatory requirements and customer expectations.

Regional connectivity expansion offers opportunities to develop new route networks connecting secondary cities and underserved markets. The development of regional aviation hubs and point-to-point connectivity can create new market opportunities while reducing dependence on traditional hub-and-spoke models.

Competitive dynamics within the APAC aviation market are intensifying as established carriers face increasing competition from low-cost operators and new market entrants. Traditional full-service airlines are adapting their business models to compete more effectively with budget carriers while maintaining premium service offerings for business travelers and high-yield routes.

Supply chain dynamics are evolving as aircraft manufacturers increase production capacity to meet regional demand, while MRO service providers expand operations to support growing fleet sizes. The development of regional aircraft manufacturing capabilities is reducing dependence on Western manufacturers while creating new competitive dynamics in aircraft procurement and support services.

Regulatory dynamics continue to evolve as governments balance aviation growth promotion with safety, security, and environmental concerns. MarkWide Research analysis indicates that regulatory harmonization efforts are progressing, with regional aviation authorities working toward standardized approaches that facilitate cross-border operations while maintaining safety standards.

Technology dynamics are accelerating transformation across all aspects of aviation operations, from aircraft design and manufacturing to passenger services and operational management. Digital technologies are enabling new business models and operational efficiencies while creating opportunities for innovation and competitive differentiation.

Comprehensive research approach employed for analyzing the APAC aviation market combines quantitative data analysis with qualitative insights from industry stakeholders, regulatory authorities, and market participants. Primary research methodologies include structured interviews with airline executives, airport operators, aircraft manufacturers, and aviation service providers across multiple APAC markets.

Data collection processes encompass analysis of publicly available aviation statistics, government transportation data, airline financial reports, and airport operational metrics. Secondary research sources include aviation industry publications, regulatory filings, and market intelligence reports from recognized aviation research organizations and consulting firms.

Market sizing methodologies utilize bottom-up analysis approaches, examining passenger traffic data, aircraft utilization rates, route network development, and capacity deployment patterns across different market segments. Cross-validation techniques ensure data accuracy and reliability through multiple independent data sources and analytical approaches.

Forecasting models incorporate economic indicators, demographic trends, infrastructure development plans, and regulatory changes to project future market development scenarios. Sensitivity analysis techniques account for various risk factors and market variables that could influence aviation market growth trajectories.

China aviation market represents the largest segment within APAC, accounting for approximately 28% of regional aviation activity. The Chinese market demonstrates exceptional domestic growth potential, with tier-two and tier-three cities driving significant traffic expansion. Government infrastructure investment and supportive aviation policies continue to fuel market development, while Chinese airlines expand international route networks.

India aviation sector shows remarkable growth momentum, with domestic passenger traffic expanding rapidly as economic development increases air travel accessibility. The Indian market benefits from a large population base, growing middle class, and government initiatives to improve regional connectivity. Low-cost carriers have achieved significant market penetration, making air travel accessible to broader population segments.

Southeast Asian markets including Indonesia, Thailand, Vietnam, and the Philippines demonstrate strong growth potential driven by tourism development, economic expansion, and increasing regional connectivity. These markets benefit from strategic geographic positions, growing economies, and supportive government policies promoting aviation development.

Developed APAC markets such as Japan, South Korea, and Australia maintain stable aviation operations while focusing on service quality, operational efficiency, and international connectivity. These markets serve as important hubs for regional and international traffic while demonstrating leadership in aviation technology adoption and sustainable operations.

Market leadership in the APAC aviation sector is distributed among several categories of operators, each serving different market segments and geographic regions:

Competitive strategies vary significantly across different market segments, with low-cost carriers focusing on operational efficiency and cost reduction while full-service airlines emphasize service quality, network connectivity, and premium offerings. Regional carriers are developing niche strategies targeting underserved routes and specialized market segments.

By Service Type:

By Aircraft Type:

By Business Model:

Passenger aviation segment dominates the APAC market, with domestic traffic showing particularly strong growth rates across emerging economies. The segment benefits from increasing urbanization, rising disposable incomes, and improved airport infrastructure. Low-cost carriers have achieved significant market penetration rates of 42% in several key markets, transforming travel patterns and accessibility.

Cargo aviation category demonstrates consistent growth driven by e-commerce expansion, international trade, and supply chain requirements. The APAC region’s role as a global manufacturing hub creates substantial demand for air freight services, particularly for time-sensitive and high-value shipments. Express delivery services are experiencing rapid expansion as online shopping continues to grow.

General aviation segment shows increasing activity as business aviation demand grows alongside economic development. Corporate flight departments and charter services are expanding to serve business travel requirements, while private aviation is growing in markets with high-net-worth individuals. Helicopter services are developing for urban transportation and specialized applications.

MRO services category is expanding rapidly to support growing fleet sizes across the region. Local MRO capabilities are developing to reduce dependence on overseas maintenance facilities while creating employment opportunities and technical expertise. Digital maintenance technologies are being adopted to improve efficiency and reduce aircraft downtime.

Airlines benefit from expanding market opportunities, with growing passenger demand creating revenue growth potential across multiple route segments. Operational efficiencies achieved through modern aircraft, digital technologies, and improved infrastructure reduce costs while enhancing service quality. Strategic partnerships and alliance memberships provide network expansion opportunities without significant capital investment.

Airport operators experience increased passenger and cargo volumes, generating revenue growth through aeronautical and non-aeronautical services. Infrastructure development projects create opportunities for capacity expansion and service enhancement, while retail and commercial activities benefit from growing passenger traffic. Digital technologies enable improved operational efficiency and customer experience.

Aircraft manufacturers benefit from strong demand for new aircraft across all categories, with airlines modernizing fleets and expanding capacity. Regional manufacturing partnerships create local market opportunities while reducing production costs. Aftermarket services and support contracts provide long-term revenue streams beyond initial aircraft sales.

Service providers including ground handling, catering, and technical services experience growth opportunities as aviation activity expands. Specialized services such as pilot training, aircraft leasing, and aviation consulting benefit from market development and increasing sophistication of aviation operations.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation trends are reshaping aviation operations across the APAC region, with airlines investing in mobile applications, artificial intelligence, and data analytics to improve customer experience and operational efficiency. Contactless technologies and biometric systems are becoming standard at major airports, enhancing security and passenger processing capabilities.

Sustainability initiatives are gaining momentum as environmental awareness increases and regulatory requirements evolve. Airlines are investing in fuel-efficient aircraft, sustainable aviation fuels, and carbon offset programs. Airport operators are implementing renewable energy systems and waste reduction programs to minimize environmental impact.

Low-cost carrier expansion continues to transform market dynamics, with budget airlines expanding into new markets and route segments. Hybrid business models are emerging as carriers seek to capture both cost-conscious and service-oriented passengers through flexible service offerings and pricing strategies.

Regional connectivity development is creating new opportunities for secondary cities and underserved markets. Point-to-point operations are reducing dependence on traditional hub systems while improving accessibility for smaller communities and regional destinations.

Infrastructure expansion projects across the region are creating significant capacity increases, with new airports under construction and existing facilities undergoing major expansion programs. Beijing Daxing International Airport, Mumbai’s new terminal, and various Southeast Asian airport projects represent substantial investments in aviation infrastructure.

Fleet modernization initiatives are accelerating as airlines replace older aircraft with fuel-efficient models. Major aircraft orders from APAC carriers demonstrate confidence in long-term market growth while supporting operational efficiency and environmental objectives. MWR analysis indicates that fleet renewal rates are exceeding 6.5% annually across major APAC carriers.

Regulatory harmonization efforts are progressing through regional aviation organizations and bilateral agreements. Safety standards alignment and operational procedure standardization are facilitating cross-border operations while maintaining high safety levels.

Technology partnerships between aviation companies and technology providers are creating innovative solutions for operational challenges. Artificial intelligence applications, predictive maintenance systems, and advanced booking platforms are being deployed across multiple market segments.

Strategic positioning recommendations for aviation companies operating in APAC markets emphasize the importance of local market understanding and flexible business models. Companies should develop region-specific strategies that account for cultural differences, regulatory requirements, and competitive dynamics while maintaining operational efficiency and service quality standards.

Investment priorities should focus on technology adoption, sustainability initiatives, and market expansion opportunities in underserved segments. Digital transformation investments can provide competitive advantages while improving operational efficiency and customer satisfaction. Sustainability investments are becoming essential for regulatory compliance and market positioning.

Partnership strategies can provide market access and operational efficiencies through code-sharing agreements, joint ventures, and strategic alliances. Local partnerships are particularly important for understanding market dynamics and navigating regulatory requirements in different countries.

Risk management approaches should address economic volatility, regulatory changes, and operational disruptions through diversified market exposure and flexible operational capabilities. Scenario planning and contingency strategies can help companies navigate market uncertainties and maintain operational continuity.

Long-term growth projections for the APAC aviation market remain highly positive, with passenger traffic expected to continue expanding at rates significantly above global averages. MarkWide Research forecasts suggest that the region will account for more than 50% of global aviation growth over the next decade, driven by economic development, urbanization, and increasing connectivity requirements.

Technology evolution will continue transforming aviation operations, with artificial intelligence, automation, and sustainable technologies becoming increasingly important for competitive positioning. Electric and hybrid aircraft technologies may begin commercial deployment in regional aviation segments, while sustainable aviation fuels become more widely available.

Market maturation patterns will vary across different countries, with emerging markets continuing rapid expansion while developed markets focus on efficiency improvements and service enhancement. Regional connectivity will improve as secondary cities develop aviation infrastructure and demand reaches sustainable levels for regular service.

Regulatory evolution will likely emphasize safety, security, and environmental standards while facilitating market access and operational efficiency. Regional harmonization efforts will continue progressing, creating more seamless operational environments for airlines and service providers operating across multiple markets.

The APAC aviation market represents a compelling growth opportunity characterized by strong fundamentals, supportive demographics, and favorable long-term trends. Economic development across the region continues driving aviation demand, while infrastructure investments and regulatory improvements create enabling conditions for market expansion. The diversity of market maturity levels provides opportunities for different business models and strategic approaches.

Competitive dynamics will continue evolving as low-cost carriers expand market presence while full-service airlines adapt their strategies to maintain competitiveness. Technology adoption and sustainability initiatives are becoming essential for long-term success, requiring significant investments but offering substantial competitive advantages for early adopters.

Strategic success in the APAC aviation market will require deep understanding of local market conditions, flexible business models, and strong operational capabilities. Companies that can effectively navigate regulatory complexities while delivering efficient, high-quality services will be best positioned to capitalize on the region’s exceptional growth potential and establish sustainable competitive advantages in this dynamic market environment.

What is Aviation?

Aviation refers to the design, development, production, and operation of aircraft. It encompasses various segments including commercial, military, and general aviation, as well as the associated infrastructure and services.

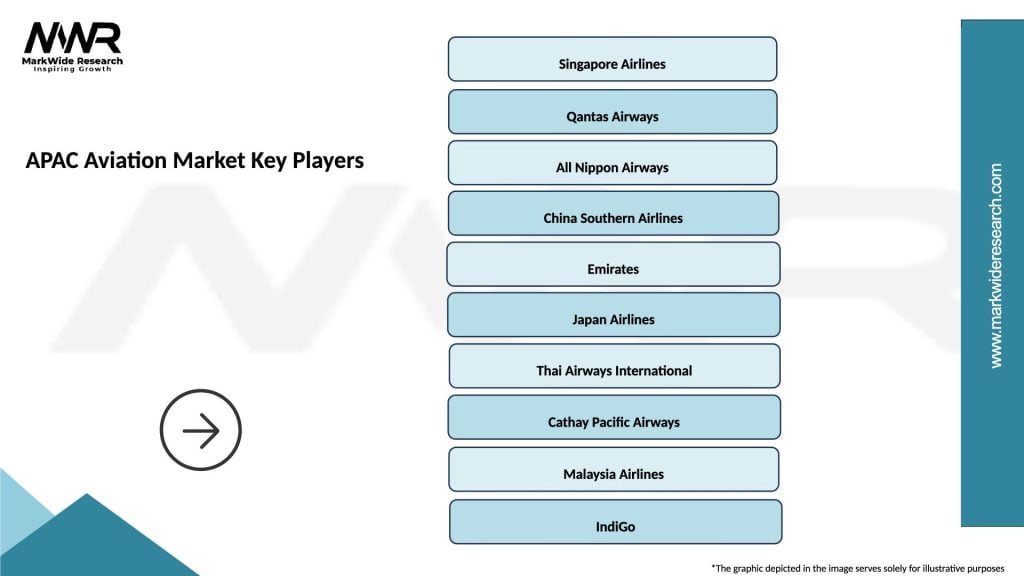

What are the key players in the APAC Aviation Market?

Key players in the APAC Aviation Market include Singapore Airlines, Cathay Pacific, and Qantas Airways, among others. These companies are involved in passenger and cargo transport, contributing significantly to the region’s aviation landscape.

What are the main drivers of growth in the APAC Aviation Market?

The main drivers of growth in the APAC Aviation Market include increasing air travel demand, rising disposable incomes, and expanding tourism sectors. Additionally, government investments in airport infrastructure are enhancing connectivity.

What challenges does the APAC Aviation Market face?

The APAC Aviation Market faces challenges such as regulatory hurdles, environmental concerns, and fluctuating fuel prices. These factors can impact operational costs and sustainability efforts within the industry.

What opportunities exist in the APAC Aviation Market?

Opportunities in the APAC Aviation Market include the growth of low-cost carriers, advancements in aviation technology, and increased focus on sustainable aviation practices. These trends are shaping the future of air travel in the region.

What trends are shaping the APAC Aviation Market?

Trends shaping the APAC Aviation Market include the rise of digital transformation in operations, the adoption of eco-friendly aircraft, and the expansion of air travel routes. These innovations are enhancing efficiency and customer experience.

APAC Aviation Market

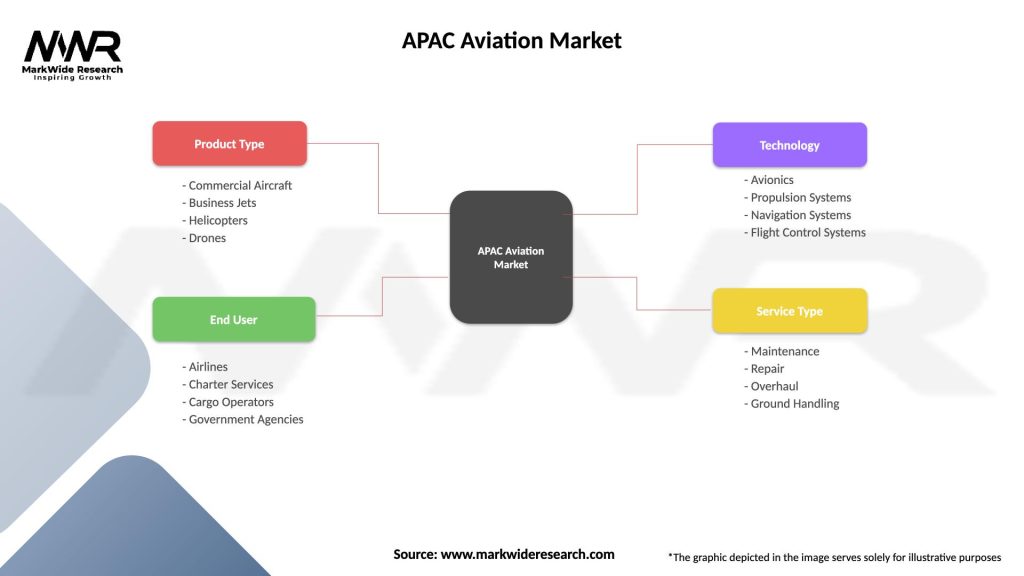

| Segmentation Details | Description |

|---|---|

| Product Type | Commercial Aircraft, Business Jets, Helicopters, Drones |

| End User | Airlines, Charter Services, Cargo Operators, Government Agencies |

| Technology | Avionics, Propulsion Systems, Navigation Systems, Flight Control Systems |

| Service Type | Maintenance, Repair, Overhaul, Ground Handling |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the APAC Aviation Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at