444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Europe ultrasound device market represents a dynamic and rapidly evolving healthcare technology sector that has experienced substantial growth across the continent. This comprehensive medical imaging market encompasses a diverse range of ultrasound equipment, from portable diagnostic devices to sophisticated imaging systems used in hospitals, clinics, and specialized medical facilities throughout European nations.

Market dynamics indicate that the European ultrasound device sector is experiencing robust expansion, driven by technological advancements, aging demographics, and increasing healthcare investments. The market demonstrates significant regional variations, with countries like Germany, France, and the United Kingdom leading in terms of adoption rates and technological innovation. Growth projections suggest the market will continue expanding at a compound annual growth rate (CAGR) of 6.2% through the forecast period.

Healthcare infrastructure across Europe has been increasingly adopting advanced ultrasound technologies, with particular emphasis on point-of-care ultrasound devices and artificial intelligence-integrated systems. The market benefits from strong regulatory frameworks, well-established healthcare systems, and significant research and development investments from both public and private sectors.

Regional distribution shows that Western European countries account for approximately 68% of the market share, while Eastern European nations are experiencing accelerated growth rates as healthcare modernization initiatives gain momentum. The market’s resilience has been demonstrated through consistent performance even during challenging economic periods.

The Europe ultrasound device market refers to the comprehensive ecosystem of medical imaging equipment, technologies, and services that utilize high-frequency sound waves to create real-time images of internal body structures across European healthcare systems. This market encompasses diagnostic ultrasound systems, therapeutic ultrasound devices, and associated software solutions used for medical examination, diagnosis, and treatment monitoring.

Ultrasound technology represents a non-invasive medical imaging modality that has become indispensable in modern healthcare delivery. The European market specifically includes all ultrasound-related medical devices manufactured, distributed, and utilized within the European Economic Area, covering both traditional imaging systems and emerging portable technologies.

Market scope extends beyond hardware to include software applications, maintenance services, training programs, and technological upgrades that support ultrasound device functionality. The definition encompasses various ultrasound applications including obstetrics, cardiology, radiology, emergency medicine, and specialized therapeutic procedures.

Strategic analysis of the Europe ultrasound device market reveals a mature yet innovative sector characterized by continuous technological advancement and expanding clinical applications. The market demonstrates strong fundamentals with consistent growth patterns driven by demographic trends, healthcare digitization, and increasing demand for non-invasive diagnostic procedures.

Key market drivers include the aging European population, rising prevalence of chronic diseases, and growing emphasis on early disease detection. Technological innovations such as artificial intelligence integration, 3D/4D imaging capabilities, and portable ultrasound devices are reshaping market dynamics and creating new opportunities for healthcare providers.

Market segmentation reveals diverse applications across multiple medical specialties, with obstetrics and gynecology representing the largest application segment, followed by cardiology and general imaging. The competitive landscape features established multinational corporations alongside innovative technology startups, creating a dynamic ecosystem of market participants.

Regional performance indicates that Germany leads the European market with approximately 22% market share, followed by France and the United Kingdom. Eastern European countries are experiencing rapid growth as healthcare infrastructure modernization accelerates across the region.

Market intelligence reveals several critical insights that define the current state and future trajectory of the Europe ultrasound device market:

Demographic transformation across Europe serves as a primary market driver, with the aging population requiring increased medical imaging services. The proportion of Europeans aged 65 and older continues to grow, creating sustained demand for diagnostic ultrasound procedures across various medical specialties.

Technological advancement represents another significant driver, with innovations in image quality, processing speed, and device portability expanding the clinical utility of ultrasound systems. Advanced features such as elastography, contrast-enhanced ultrasound, and automated measurement tools are enhancing diagnostic capabilities and attracting healthcare provider investment.

Healthcare policy initiatives across European Union member states are promoting early disease detection and preventive care, directly benefiting the ultrasound device market. Government healthcare programs and insurance coverage for ultrasound procedures are supporting market growth and accessibility.

Clinical evidence supporting ultrasound effectiveness in various medical applications continues to drive adoption. The non-invasive nature of ultrasound imaging, combined with real-time visualization capabilities, makes it an attractive alternative to radiation-based imaging modalities for many clinical scenarios.

Economic factors also contribute to market growth, as ultrasound technology offers cost-effective diagnostic solutions compared to MRI and CT imaging. Healthcare systems facing budget constraints are increasingly turning to ultrasound as a primary diagnostic tool for appropriate clinical indications.

Regulatory complexity presents significant challenges for ultrasound device manufacturers operating in the European market. The implementation of the Medical Device Regulation (MDR) has increased compliance requirements and costs, potentially limiting market entry for smaller manufacturers and delaying product launches.

Skilled operator shortage represents a critical market restraint, as effective ultrasound imaging requires specialized training and expertise. The limited availability of qualified sonographers and physicians trained in ultrasound techniques can constrain market growth and limit device utilization rates.

Budget constraints within European healthcare systems can limit capital equipment purchases, particularly for advanced ultrasound systems with higher price points. Economic pressures and competing healthcare priorities may delay equipment upgrades and new system acquisitions.

Technology limitations in certain clinical applications continue to restrict market expansion. While ultrasound technology has advanced significantly, limitations in imaging depth, resolution for certain anatomical structures, and operator dependency remain challenges that may favor alternative imaging modalities.

Market saturation in mature European markets may limit growth opportunities for traditional ultrasound applications. Established healthcare facilities may have adequate ultrasound coverage, requiring manufacturers to focus on replacement cycles and technological upgrades rather than new installations.

Artificial intelligence integration presents substantial opportunities for market expansion and differentiation. AI-powered ultrasound systems that can provide automated measurements, diagnostic assistance, and workflow optimization are attracting significant interest from healthcare providers seeking to improve efficiency and diagnostic accuracy.

Point-of-care applications represent a rapidly growing opportunity segment, particularly in emergency medicine, intensive care, and primary care settings. Portable ultrasound devices that can be used at the patient bedside or in remote locations are expanding the market beyond traditional radiology departments.

Emerging markets within Eastern Europe offer significant growth potential as healthcare infrastructure modernization continues. Countries investing in healthcare system upgrades present opportunities for ultrasound device manufacturers to establish market presence and build long-term partnerships.

Telemedicine integration creates new opportunities for remote ultrasound consultation and diagnosis. The development of ultrasound systems compatible with telemedicine platforms enables expert consultation and expands access to specialized care in underserved regions.

Specialized applications in areas such as interventional procedures, musculoskeletal imaging, and veterinary medicine are creating niche market opportunities. These specialized segments often command premium pricing and offer opportunities for focused product development and market positioning.

Competitive dynamics in the Europe ultrasound device market are characterized by intense competition among established multinational corporations and innovative technology companies. Market leaders are investing heavily in research and development to maintain technological advantages and expand their product portfolios.

Innovation cycles are accelerating as manufacturers compete to introduce advanced features and capabilities. The integration of artificial intelligence, cloud connectivity, and mobile compatibility is driving rapid product evolution and creating differentiation opportunities.

Partnership strategies are becoming increasingly important as companies seek to expand their market reach and technological capabilities. Collaborations between ultrasound manufacturers, software developers, and healthcare providers are creating integrated solutions that address specific clinical needs.

Pricing pressures continue to influence market dynamics as healthcare providers seek cost-effective solutions. Manufacturers are responding by developing tiered product offerings that balance advanced features with affordability, particularly for emerging market segments.

Regulatory evolution is shaping market dynamics as European authorities adapt to technological advances and safety requirements. Companies that can navigate regulatory requirements effectively while maintaining innovation momentum are positioned for market success.

Comprehensive market analysis was conducted using a multi-faceted research approach that combines primary and secondary research methodologies to provide accurate and reliable market insights. The research framework encompasses quantitative and qualitative data collection techniques to ensure comprehensive market coverage.

Primary research involved extensive interviews with key industry stakeholders including ultrasound device manufacturers, healthcare providers, regulatory experts, and clinical specialists across major European markets. Survey data was collected from hospital administrators, radiology departments, and medical equipment procurement professionals to understand purchasing patterns and technology preferences.

Secondary research utilized authoritative industry publications, regulatory databases, clinical studies, and market intelligence reports to validate findings and provide historical context. Analysis of patent filings, regulatory approvals, and clinical trial data provided insights into technological trends and innovation patterns.

Market modeling techniques were employed to project future market trends and growth patterns based on historical data, demographic projections, and healthcare spending forecasts. Statistical analysis methods ensured data accuracy and reliability throughout the research process.

Data validation procedures included cross-referencing multiple sources, expert review panels, and statistical verification to ensure research quality and accuracy. The methodology ensures comprehensive coverage of market segments, geographic regions, and technology categories within the European ultrasound device market.

Western Europe dominates the regional market landscape, with Germany, France, and the United Kingdom representing the largest individual markets. Germany leads with approximately 22% of the European market share, driven by advanced healthcare infrastructure, strong medical device manufacturing capabilities, and high healthcare spending levels.

France represents the second-largest market with robust demand across public and private healthcare sectors. The French market benefits from comprehensive healthcare coverage and significant investment in medical technology, particularly in hospital settings and specialized imaging centers.

United Kingdom maintains a strong market position despite Brexit-related uncertainties. The NHS represents a significant customer base, while private healthcare growth is creating additional market opportunities for advanced ultrasound technologies.

Italy and Spain demonstrate steady market growth with increasing adoption of portable ultrasound devices and point-of-care applications. These markets are experiencing modernization of healthcare infrastructure and growing demand for cost-effective diagnostic solutions.

Eastern Europe is experiencing the fastest growth rates, with countries like Poland, Czech Republic, and Hungary investing heavily in healthcare modernization. These markets present significant opportunities for ultrasound device manufacturers, with growth rates exceeding 9% annually in several countries.

Nordic countries including Sweden, Norway, and Denmark represent mature markets with high technology adoption rates and emphasis on innovative healthcare solutions. These markets often serve as early adopters for new ultrasound technologies and applications.

Market leadership is characterized by several multinational corporations that have established strong positions through technological innovation, comprehensive product portfolios, and extensive distribution networks across Europe.

Competitive strategies include continuous product innovation, strategic partnerships with healthcare providers, and expansion into emerging market segments. Companies are investing heavily in artificial intelligence capabilities and portable ultrasound technologies to maintain competitive advantages.

By Technology:

By Device Type:

By Application:

By End User:

Obstetrics and Gynecology represents the dominant application category, accounting for approximately 35% of total market demand. This segment benefits from routine pregnancy monitoring requirements, women’s health initiatives, and advanced 3D/4D imaging capabilities that enhance patient experience and diagnostic accuracy.

Cardiology applications are experiencing rapid growth driven by increasing cardiovascular disease prevalence and advanced echocardiography capabilities. Portable cardiac ultrasound devices are particularly popular for bedside assessments and emergency department applications.

Point-of-care ultrasound represents the fastest-growing category with applications expanding across emergency medicine, intensive care, and primary care settings. The convenience and immediate diagnostic capabilities of portable devices are driving adoption among non-radiologist physicians.

Interventional ultrasound is emerging as a specialized category with applications in guided procedures, biopsies, and therapeutic interventions. This segment commands premium pricing and requires specialized training and equipment capabilities.

Artificial intelligence-enhanced ultrasound systems are creating a new category focused on automated measurements, diagnostic assistance, and workflow optimization. These systems are attracting significant interest from healthcare providers seeking to improve efficiency and standardize imaging protocols.

Healthcare Providers benefit from improved diagnostic capabilities, cost-effective imaging solutions, and enhanced patient care delivery. Ultrasound technology offers real-time imaging without radiation exposure, making it suitable for routine monitoring and emergency applications.

Patients experience non-invasive diagnostic procedures, reduced waiting times, and improved access to medical imaging services. Point-of-care ultrasound enables immediate diagnosis and treatment decisions, enhancing overall healthcare experience.

Medical Professionals gain access to advanced imaging tools that support clinical decision-making and improve diagnostic confidence. Training opportunities and technological advancement create professional development possibilities and career enhancement.

Healthcare Systems achieve cost savings through efficient diagnostic workflows, reduced need for more expensive imaging modalities, and improved resource utilization. Ultrasound technology supports healthcare accessibility and quality improvement initiatives.

Technology Companies benefit from growing market demand, innovation opportunities, and partnership possibilities with healthcare providers. The expanding market creates revenue growth potential and competitive differentiation opportunities.

Research Institutions gain access to advanced imaging technologies for clinical research and medical education. Ultrasound technology supports research initiatives and contributes to medical knowledge advancement.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial Intelligence Integration represents the most significant trend shaping the European ultrasound device market. AI-powered systems are providing automated measurements, diagnostic assistance, and workflow optimization, with adoption rates reaching 45% among new system installations.

Portable Device Proliferation continues to transform market dynamics as point-of-care ultrasound becomes mainstream across medical specialties. Emergency departments and intensive care units are leading adoption, with portable device sales growing at 8.5% annually.

Cloud Connectivity is becoming standard in modern ultrasound systems, enabling remote access, data sharing, and telemedicine applications. Cloud-enabled devices facilitate expert consultation and improve healthcare accessibility in remote regions.

Sustainability Focus is influencing purchasing decisions as healthcare providers prioritize environmentally responsible medical equipment. Manufacturers are developing energy-efficient systems and sustainable manufacturing processes to meet market demands.

Workflow Integration with electronic health records and hospital information systems is becoming essential for modern ultrasound devices. Seamless data integration improves efficiency and supports comprehensive patient care documentation.

Specialized Applications are expanding beyond traditional imaging to include therapeutic ultrasound, interventional guidance, and research applications. These specialized segments often command premium pricing and create differentiation opportunities.

Regulatory Evolution has significantly impacted the European ultrasound device market with the implementation of the Medical Device Regulation (MDR). This regulatory framework has strengthened quality standards while creating opportunities for innovative manufacturers to differentiate their products.

Technology Partnerships between ultrasound manufacturers and artificial intelligence companies are accelerating innovation and creating advanced diagnostic capabilities. These collaborations are producing systems with enhanced automation and diagnostic accuracy.

Market Consolidation activities have reshaped the competitive landscape as larger companies acquire specialized technology firms and expand their product portfolios. Strategic acquisitions are enabling companies to offer comprehensive ultrasound solutions.

Clinical Evidence Development continues to support market expansion as research demonstrates ultrasound effectiveness in new applications. Clinical studies are validating point-of-care ultrasound benefits and expanding adoption across medical specialties.

Training Initiative Expansion by manufacturers and medical organizations is addressing the skilled operator shortage. Comprehensive training programs are improving ultrasound utilization and supporting market growth across Europe.

Sustainability Initiatives are gaining momentum as manufacturers develop environmentally responsible products and manufacturing processes. These initiatives align with European environmental regulations and healthcare provider sustainability goals.

MarkWide Research analysis suggests that companies should prioritize artificial intelligence integration and point-of-care applications to capitalize on the fastest-growing market segments. Investment in AI capabilities and portable device development will be critical for maintaining competitive positioning.

Strategic recommendations include focusing on Eastern European market expansion where healthcare modernization is creating significant growth opportunities. Companies should establish local partnerships and distribution networks to effectively serve these emerging markets.

Product development should emphasize user-friendly interfaces, automated features, and workflow integration to address the skilled operator shortage. Systems that can be effectively used by non-specialist physicians will have significant market advantages.

Partnership strategies with healthcare providers, technology companies, and research institutions will be essential for innovation and market expansion. Collaborative approaches can accelerate product development and create comprehensive solutions.

Regulatory compliance must remain a priority as European regulations continue to evolve. Companies should invest in regulatory expertise and quality systems to ensure market access and competitive advantage.

Sustainability initiatives should be integrated into product development and manufacturing processes to meet growing environmental expectations from healthcare providers and regulatory authorities.

Market projections indicate continued robust growth for the Europe ultrasound device market, with expansion expected across all major segments and geographic regions. The market is positioned for sustained growth driven by demographic trends, technological innovation, and expanding clinical applications.

Technology evolution will continue to shape market dynamics as artificial intelligence, cloud connectivity, and advanced imaging capabilities become standard features. MarkWide Research projects that AI-integrated systems will represent over 60% of new installations by the end of the forecast period.

Geographic expansion opportunities remain significant, particularly in Eastern European markets where healthcare infrastructure investments are accelerating. These regions are expected to contribute increasingly to overall market growth and present attractive opportunities for market participants.

Application diversification will create new market segments as ultrasound technology finds applications in emerging medical specialties and therapeutic procedures. Point-of-care applications are expected to achieve market penetration rates exceeding 75% in emergency departments across major European countries.

Competitive dynamics will intensify as technology companies compete for market share in high-growth segments. Innovation capabilities, regulatory compliance, and customer relationships will be key differentiating factors for market success.

Regulatory environment will continue to evolve, potentially creating both challenges and opportunities for market participants. Companies that can effectively navigate regulatory requirements while maintaining innovation momentum will be best positioned for long-term success.

The Europe ultrasound device market represents a dynamic and growing healthcare technology sector with substantial opportunities for continued expansion and innovation. Market fundamentals remain strong, supported by demographic trends, technological advancement, and expanding clinical applications across diverse medical specialties.

Key success factors for market participants include embracing artificial intelligence integration, developing portable point-of-care solutions, and establishing strong positions in emerging Eastern European markets. Companies that can effectively combine technological innovation with regulatory compliance and customer-focused solutions will be best positioned for market leadership.

Future growth prospects remain positive as healthcare systems across Europe continue to invest in advanced medical imaging technologies. The market’s evolution toward AI-enhanced, portable, and integrated ultrasound solutions creates opportunities for both established players and innovative new entrants to contribute to improved healthcare delivery across the continent.

What is Ultrasound Device?

Ultrasound devices are medical imaging equipment that use high-frequency sound waves to create images of organs and structures inside the body. They are commonly used in various applications, including obstetrics, cardiology, and musculoskeletal imaging.

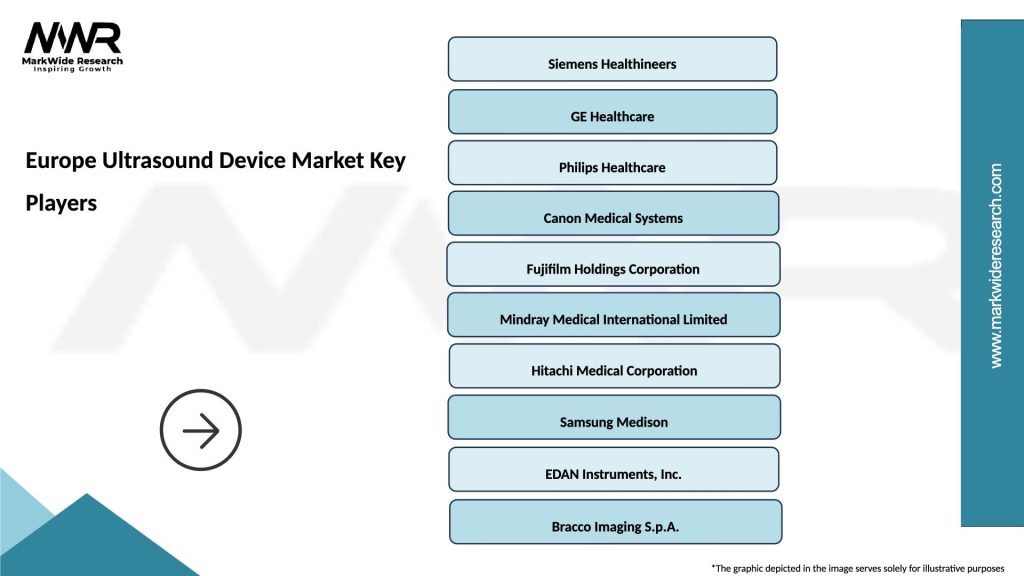

What are the key players in the Europe Ultrasound Device Market?

Key players in the Europe Ultrasound Device Market include Siemens Healthineers, GE Healthcare, Philips Healthcare, and Canon Medical Systems, among others.

What are the main drivers of growth in the Europe Ultrasound Device Market?

The growth of the Europe Ultrasound Device Market is driven by factors such as the increasing prevalence of chronic diseases, advancements in ultrasound technology, and the rising demand for non-invasive diagnostic procedures.

What challenges does the Europe Ultrasound Device Market face?

Challenges in the Europe Ultrasound Device Market include stringent regulatory requirements, high costs associated with advanced ultrasound systems, and the need for skilled professionals to operate these devices.

What opportunities exist in the Europe Ultrasound Device Market?

Opportunities in the Europe Ultrasound Device Market include the development of portable ultrasound devices, integration of artificial intelligence in imaging, and expanding applications in telemedicine and point-of-care settings.

What trends are shaping the Europe Ultrasound Device Market?

Trends in the Europe Ultrasound Device Market include the increasing adoption of 3D and 4D imaging technologies, the rise of handheld ultrasound devices, and a growing focus on patient-centric care and remote monitoring.

Europe Ultrasound Device Market

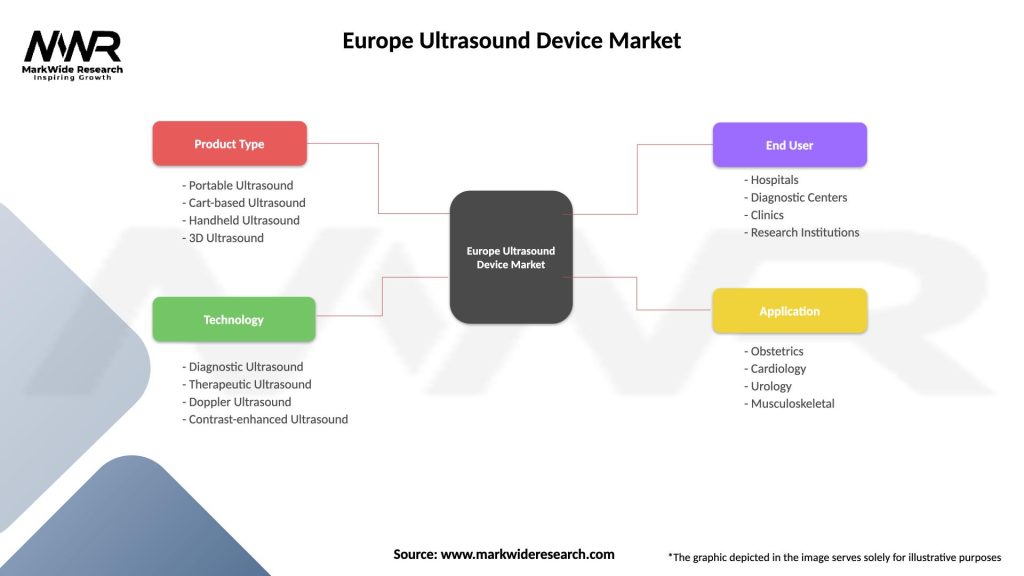

| Segmentation Details | Description |

|---|---|

| Product Type | Portable Ultrasound, Cart-based Ultrasound, Handheld Ultrasound, 3D Ultrasound |

| Technology | Diagnostic Ultrasound, Therapeutic Ultrasound, Doppler Ultrasound, Contrast-enhanced Ultrasound |

| End User | Hospitals, Diagnostic Centers, Clinics, Research Institutions |

| Application | Obstetrics, Cardiology, Urology, Musculoskeletal |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Europe Ultrasound Device Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at