444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Asia Pacific pharmaceutical packaging market represents one of the most dynamic and rapidly evolving sectors in the global healthcare industry. This comprehensive market encompasses a diverse range of packaging solutions designed specifically for pharmaceutical products, including primary packaging such as bottles, vials, and blister packs, as well as secondary packaging like cartons and labels. The region’s pharmaceutical packaging landscape is characterized by robust growth driven by increasing healthcare expenditure, expanding pharmaceutical manufacturing capabilities, and stringent regulatory requirements for drug safety and efficacy.

Market dynamics in the Asia Pacific region reflect the unique challenges and opportunities presented by diverse regulatory environments, varying economic development levels, and distinct healthcare infrastructure across different countries. The market is experiencing significant transformation as pharmaceutical companies increasingly focus on patient safety, product integrity, and supply chain efficiency. Growth projections indicate the market is expanding at a compound annual growth rate (CAGR) of 8.2%, driven primarily by rising demand for innovative packaging solutions and increasing pharmaceutical production volumes across key markets including China, India, Japan, and South Korea.

Regional characteristics demonstrate substantial variation in packaging requirements, with developed markets like Japan and Australia emphasizing advanced packaging technologies and sustainability initiatives, while emerging economies focus on cost-effective solutions and capacity expansion. The market’s evolution is further influenced by demographic trends, including aging populations, increasing chronic disease prevalence, and growing awareness of healthcare quality standards.

The Asia Pacific pharmaceutical packaging market refers to the comprehensive ecosystem of packaging materials, technologies, and services specifically designed for pharmaceutical products within the Asia Pacific region. This market encompasses all forms of packaging used to protect, preserve, and deliver pharmaceutical products from manufacturing facilities to end consumers, ensuring product integrity, safety, and compliance with regulatory standards throughout the supply chain.

Pharmaceutical packaging serves multiple critical functions beyond basic containment, including protection from environmental factors such as moisture, light, and oxygen, tamper evidence to ensure product security, and information communication through labeling and coding systems. The market includes various packaging formats such as primary packaging that directly contacts the pharmaceutical product, secondary packaging for additional protection and branding, and tertiary packaging for distribution and logistics purposes.

Market scope extends across diverse pharmaceutical categories including prescription medications, over-the-counter drugs, biologics, vaccines, and medical devices. The packaging solutions must meet stringent quality standards, regulatory compliance requirements, and specific performance criteria related to barrier properties, compatibility, and shelf-life extension to ensure pharmaceutical products maintain their therapeutic efficacy and safety profiles.

Strategic analysis of the Asia Pacific pharmaceutical packaging market reveals a sector experiencing unprecedented growth and transformation, driven by expanding pharmaceutical manufacturing capabilities and increasing healthcare demands across the region. The market demonstrates remarkable resilience and adaptability, with packaging manufacturers continuously innovating to meet evolving regulatory requirements and consumer expectations for safety, convenience, and sustainability.

Key market drivers include the region’s position as a global pharmaceutical manufacturing hub, with approximately 42% of global pharmaceutical production now occurring within Asia Pacific countries. This manufacturing concentration has created substantial demand for high-quality packaging solutions that can support both domestic consumption and international export requirements. Additionally, the growing prevalence of chronic diseases and aging demographics across the region has increased pharmaceutical consumption, directly impacting packaging demand.

Technological advancement represents a crucial market differentiator, with smart packaging technologies, serialization systems, and sustainable materials gaining significant traction. The integration of digital technologies into packaging solutions is enabling enhanced supply chain visibility, improved patient compliance, and better product authentication capabilities. Market participants are increasingly investing in research and development to create innovative packaging solutions that address specific regional challenges while meeting global quality standards.

Market intelligence reveals several critical insights that define the current landscape and future trajectory of the Asia Pacific pharmaceutical packaging market. These insights provide valuable perspective on market dynamics, competitive positioning, and emerging opportunities for industry stakeholders.

Primary growth drivers propelling the Asia Pacific pharmaceutical packaging market forward encompass a complex interplay of demographic, economic, and technological factors that create sustained demand for innovative packaging solutions. These drivers represent fundamental market forces that continue to shape industry development and investment priorities.

Demographic transformation across the Asia Pacific region serves as a fundamental market driver, with rapidly aging populations in developed markets like Japan, South Korea, and Singapore creating increased demand for pharmaceutical products and specialized packaging solutions. The growing prevalence of chronic diseases such as diabetes, cardiovascular conditions, and cancer requires sophisticated packaging that ensures medication stability and patient compliance. Healthcare expenditure increases across the region, driven by rising disposable incomes and government healthcare initiatives, directly translate into higher pharmaceutical consumption and packaging demand.

Manufacturing expansion represents another critical driver, as Asia Pacific countries continue to strengthen their position as global pharmaceutical production centers. Government initiatives promoting pharmaceutical manufacturing, including tax incentives and infrastructure development, have attracted significant foreign investment and technology transfer. The establishment of pharmaceutical special economic zones and manufacturing clusters has created economies of scale that benefit packaging suppliers and drive market growth.

Regulatory evolution continues to drive market development as countries implement more stringent packaging requirements aligned with international standards. Enhanced focus on drug safety, supply chain integrity, and patient protection has created demand for advanced packaging technologies including tamper-evident systems, child-resistant closures, and serialization capabilities.

Market challenges facing the Asia Pacific pharmaceutical packaging industry present significant obstacles that require strategic navigation and innovative solutions. These restraints impact market growth potential and influence competitive dynamics across the region.

Regulatory complexity represents a primary market restraint, as pharmaceutical packaging companies must navigate diverse and often conflicting regulatory requirements across different Asia Pacific countries. The lack of harmonized standards creates compliance challenges and increases operational costs for manufacturers serving multiple markets. Regulatory changes often require significant investment in new technologies and processes, creating barriers for smaller packaging companies and potentially limiting market competition.

Cost pressures from pharmaceutical companies seeking to reduce packaging expenses while maintaining quality standards create ongoing challenges for packaging manufacturers. The commoditization of basic packaging solutions has compressed profit margins and forced companies to invest heavily in value-added services and innovative technologies to maintain competitiveness. Raw material volatility, particularly for petroleum-based packaging materials, creates pricing uncertainty and impacts long-term contract negotiations.

Technical barriers include the complexity of developing packaging solutions that meet specific pharmaceutical requirements while remaining cost-effective and scalable. The need for extensive testing and validation processes for new packaging materials and designs creates lengthy development cycles and high research and development costs. Supply chain disruptions, as demonstrated during recent global events, highlight the vulnerability of complex packaging supply networks and the challenges of maintaining consistent quality and delivery performance.

Emerging opportunities within the Asia Pacific pharmaceutical packaging market present substantial potential for growth and innovation, driven by evolving healthcare needs, technological advancement, and changing market dynamics. These opportunities represent areas where forward-thinking companies can establish competitive advantages and capture market share.

Biologics packaging represents one of the most significant growth opportunities, as the increasing development and commercialization of biological pharmaceuticals requires specialized packaging solutions. The unique stability and handling requirements of biologics create demand for advanced packaging technologies including temperature-controlled systems, specialized barrier materials, and innovative delivery mechanisms. Market expansion in biologics is expected to drive substantial packaging innovation and investment opportunities.

Smart packaging technologies offer transformative opportunities for pharmaceutical packaging companies willing to invest in digital integration and connectivity solutions. The development of packaging systems that can monitor medication adherence, provide dosing reminders, and track product authenticity creates new value propositions for pharmaceutical companies and patients. Internet of Things (IoT) integration enables real-time monitoring of packaging conditions and supply chain visibility, addressing critical pharmaceutical industry needs.

Sustainable packaging solutions present significant opportunities as environmental consciousness increases among consumers, healthcare providers, and regulatory authorities. The development of biodegradable packaging materials, recyclable designs, and reduced packaging waste initiatives align with corporate sustainability goals and regulatory trends. Circular economy principles applied to pharmaceutical packaging create opportunities for innovative business models and partnerships throughout the value chain.

Market dynamics in the Asia Pacific pharmaceutical packaging sector reflect the complex interplay of supply and demand factors, competitive pressures, and technological evolution that continuously reshape the industry landscape. Understanding these dynamics is essential for stakeholders seeking to navigate market challenges and capitalize on emerging opportunities.

Supply chain evolution demonstrates increasing sophistication as pharmaceutical packaging manufacturers develop more integrated and responsive supply networks. The adoption of lean manufacturing principles and just-in-time delivery systems has improved efficiency while reducing inventory costs. Digital transformation initiatives are enabling better demand forecasting, production planning, and quality control throughout the supply chain, resulting in improved operational efficiency of approximately 15% across leading manufacturers.

Competitive intensity continues to increase as both domestic and international packaging companies compete for market share in the rapidly growing Asia Pacific pharmaceutical market. The entry of global packaging leaders into regional markets has elevated quality standards and technological capabilities while intensifying price competition. Strategic partnerships between packaging manufacturers and pharmaceutical companies are becoming more common, creating collaborative relationships that drive innovation and market development.

Technology adoption patterns reveal accelerating integration of advanced manufacturing technologies, including automation, artificial intelligence, and advanced materials science. These technological advances are enabling pharmaceutical packaging companies to improve product quality, reduce production costs, and develop innovative solutions that address specific market needs. Investment in technology has increased manufacturing productivity by approximately 18% among leading regional packaging companies.

Research approach for analyzing the Asia Pacific pharmaceutical packaging market employs comprehensive methodological frameworks that ensure accuracy, reliability, and actionable insights for industry stakeholders. The methodology combines quantitative analysis with qualitative research to provide a holistic understanding of market dynamics and future trends.

Primary research components include extensive interviews with industry executives, packaging manufacturers, pharmaceutical companies, and regulatory authorities across key Asia Pacific markets. These interviews provide firsthand insights into market challenges, opportunities, and strategic priorities that shape industry development. Survey methodologies capture quantitative data on market trends, technology adoption rates, and competitive positioning from a representative sample of market participants.

Secondary research encompasses comprehensive analysis of industry reports, regulatory documents, company financial statements, and trade publications to establish market context and validate primary research findings. Data triangulation techniques ensure research accuracy by cross-referencing multiple information sources and identifying potential discrepancies or biases in the data collection process.

Analytical frameworks include market sizing methodologies, competitive analysis models, and trend identification systems that provide structured approaches to understanding complex market dynamics. MarkWide Research employs proprietary analytical tools and databases to ensure comprehensive market coverage and reliable forecasting capabilities that support strategic decision-making for industry participants.

Regional market analysis reveals significant variation in pharmaceutical packaging market characteristics across different Asia Pacific countries, reflecting diverse economic development levels, regulatory environments, and healthcare infrastructure capabilities. This regional diversity creates both challenges and opportunities for pharmaceutical packaging companies operating across multiple markets.

China dominates the regional pharmaceutical packaging market, accounting for approximately 35% of total market share, driven by its position as the world’s largest pharmaceutical manufacturing hub and rapidly expanding domestic healthcare market. The country’s pharmaceutical packaging industry benefits from substantial government support, advanced manufacturing capabilities, and increasing focus on quality standards alignment with international requirements. Innovation initiatives in China are driving development of advanced packaging technologies and sustainable solutions.

India represents the second-largest regional market with approximately 22% market share, characterized by strong generic pharmaceutical manufacturing capabilities and growing domestic healthcare demand. The country’s pharmaceutical packaging industry is experiencing rapid modernization as companies invest in advanced technologies and quality systems to meet international export requirements. Government initiatives promoting pharmaceutical manufacturing and healthcare access are creating substantial growth opportunities for packaging suppliers.

Japan maintains its position as a technology leader in pharmaceutical packaging, with approximately 18% regional market share, despite its mature pharmaceutical market characteristics. The country’s focus on innovation, quality, and sustainability drives demand for advanced packaging solutions and creates opportunities for premium product segments. Aging demographics in Japan are creating specific packaging requirements related to patient compliance and ease of use.

South Korea, Australia, and Southeast Asian markets collectively represent approximately 25% of regional market share, with each market demonstrating unique characteristics and growth drivers. These markets are experiencing increasing pharmaceutical manufacturing investment and healthcare infrastructure development that supports packaging market growth.

Competitive dynamics in the Asia Pacific pharmaceutical packaging market reflect a complex ecosystem of global multinational corporations, regional leaders, and specialized niche players competing across different market segments and geographic regions. The competitive landscape is characterized by ongoing consolidation, technological innovation, and strategic partnerships that reshape market positioning.

Market leadership is distributed among several key players who have established strong positions through strategic investments, technological capabilities, and customer relationships. These leading companies compete on multiple dimensions including product quality, innovation capabilities, manufacturing scale, and service excellence.

Competitive strategies focus on technological differentiation, geographic expansion, and vertical integration to create sustainable competitive advantages. Companies are investing heavily in research and development, manufacturing capacity expansion, and strategic acquisitions to strengthen market positions and capture growth opportunities.

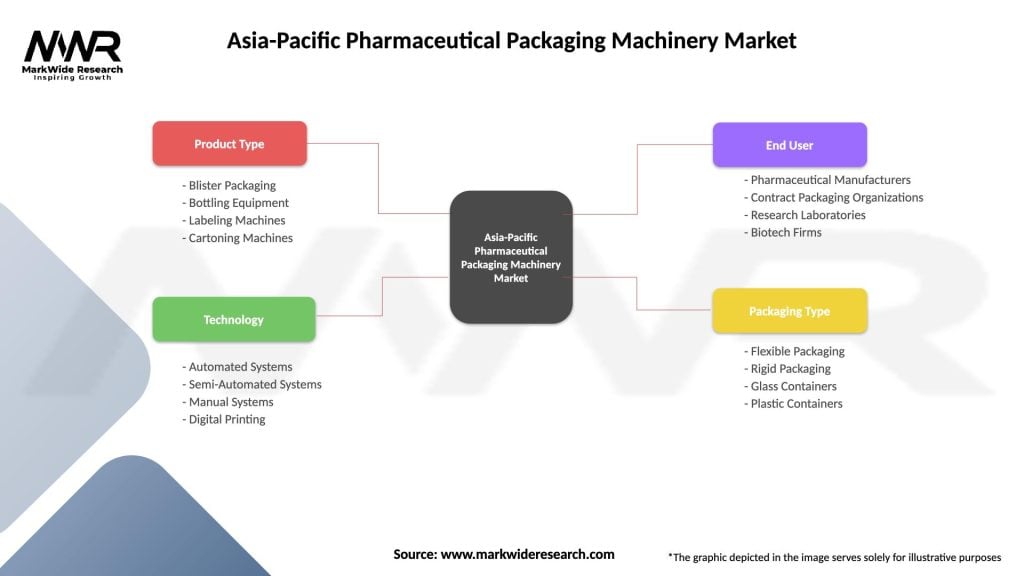

Market segmentation analysis provides detailed insights into the diverse components of the Asia Pacific pharmaceutical packaging market, revealing distinct characteristics, growth patterns, and competitive dynamics across different product categories, applications, and end-user segments.

By Product Type:

By Material Type:

By Drug Type:

Category analysis reveals distinct market characteristics and growth patterns across different pharmaceutical packaging segments, providing valuable insights for strategic planning and investment decisions. Each category demonstrates unique requirements, competitive dynamics, and development opportunities.

Primary Packaging Segment represents the largest market category, driven by direct pharmaceutical product contact requirements and stringent quality standards. This segment includes bottles, vials, blister packs, and prefilled syringes that must meet specific barrier properties, chemical compatibility, and regulatory compliance requirements. Innovation focus in primary packaging emphasizes patient safety, ease of use, and product protection throughout the shelf life. The segment is experiencing growth rates of approximately 9.1% annually, driven by increasing pharmaceutical production and quality standard improvements.

Glass Packaging Category maintains premium positioning due to excellent chemical inertness and barrier properties essential for sensitive pharmaceutical products. This category is particularly important for biologics, vaccines, and injectable medications that require maximum product protection. Technological advancement in glass packaging includes development of specialized coatings, improved break resistance, and innovative closure systems that enhance product safety and user convenience.

Flexible Packaging Segment demonstrates rapid growth driven by cost-effectiveness, versatility, and sustainability advantages. This category includes pouches, sachets, and flexible films that offer reduced material usage and improved supply chain efficiency. Market adoption of flexible packaging is increasing particularly for solid dosage forms and over-the-counter medications where traditional rigid packaging may be over-engineered for the application requirements.

Smart Packaging Category represents the fastest-growing segment with annual growth rates exceeding 15%, driven by increasing demand for supply chain visibility, patient compliance monitoring, and product authentication capabilities. This emerging category includes packaging systems with integrated sensors, RFID technology, and digital connectivity features that provide real-time information about product conditions and usage patterns.

Strategic advantages available to pharmaceutical packaging industry participants encompass multiple dimensions of value creation, competitive positioning, and market development opportunities. These benefits provide compelling reasons for continued investment and engagement in the Asia Pacific pharmaceutical packaging market.

For Packaging Manufacturers:

For Pharmaceutical Companies:

For Healthcare Providers:

For Patients:

Strategic analysis of the Asia Pacific pharmaceutical packaging market through SWOT framework reveals critical internal and external factors that influence market development and competitive positioning. This analysis provides valuable insights for strategic planning and risk management.

Strengths:

Weaknesses:

Opportunities:

Threats:

Emerging trends shaping the Asia Pacific pharmaceutical packaging market reflect evolving industry requirements, technological capabilities, and consumer expectations that drive innovation and market development. These trends provide insights into future market direction and investment priorities.

Sustainability Integration represents a fundamental trend transforming pharmaceutical packaging design and material selection. Companies are increasingly adopting circular economy principles, developing biodegradable packaging materials, and implementing recycling programs to address environmental concerns. Sustainable packaging adoption has reached approximately 68% among leading pharmaceutical companies in the region, driven by regulatory pressure and corporate responsibility initiatives.

Smart Packaging Evolution continues accelerating with integration of digital technologies, sensors, and connectivity features that provide real-time information about product conditions and usage patterns. These technologies enable supply chain visibility, patient compliance monitoring, and product authentication capabilities that address critical pharmaceutical industry needs. Digital packaging solutions are experiencing rapid adoption with implementation rates increasing by 25% annually across major regional markets.

Personalized Medicine Packaging emerges as pharmaceutical companies develop more targeted therapies requiring specialized packaging solutions. This trend includes development of smaller batch packaging capabilities, customized labeling systems, and flexible packaging formats that can accommodate diverse product requirements. Personalization capabilities are becoming increasingly important for pharmaceutical packaging manufacturers seeking to differentiate their offerings.

Regulatory Harmonization continues progressing as regional authorities work toward alignment with international standards and best practices. This trend simplifies compliance requirements for companies operating across multiple markets and facilitates trade and technology transfer. Standards alignment has improved significantly with over 80% of major markets now implementing ICH-compatible packaging guidelines.

Recent developments in the Asia Pacific pharmaceutical packaging industry demonstrate the dynamic nature of market evolution and the continuous innovation efforts by industry participants. These developments provide insights into strategic priorities and emerging market opportunities.

Technology Investments by leading packaging companies include substantial commitments to automation, artificial intelligence, and advanced materials research. Major manufacturers are establishing regional research and development centers to develop packaging solutions specifically designed for Asia Pacific market requirements. Investment levels in packaging technology have increased significantly, with companies allocating approximately 6-8% of revenues to research and development activities.

Strategic Partnerships between pharmaceutical companies and packaging manufacturers are becoming more sophisticated, involving collaborative product development, technology sharing, and long-term supply agreements. These partnerships enable packaging companies to better understand pharmaceutical industry requirements while providing pharmaceutical companies with access to specialized packaging expertise and innovation capabilities.

Manufacturing Expansion continues across the region as both domestic and international packaging companies invest in new production facilities and capacity upgrades. Recent facility announcements include advanced glass packaging plants, flexible packaging manufacturing centers, and specialized biologics packaging facilities designed to serve growing market demand.

Regulatory Approvals for innovative packaging materials and technologies are accelerating as regulatory authorities develop more efficient approval processes and embrace technological advancement. MarkWide Research analysis indicates that approval timelines for new packaging technologies have decreased by approximately 20% over the past three years, facilitating faster market introduction of innovative solutions.

Strategic recommendations for pharmaceutical packaging industry participants focus on positioning for sustained growth while navigating market challenges and capitalizing on emerging opportunities. These suggestions reflect comprehensive market analysis and industry expertise.

Technology Investment Priorities should emphasize smart packaging capabilities, sustainable materials development, and manufacturing automation to create competitive advantages and meet evolving market requirements. Companies should prioritize investments that provide both immediate operational benefits and long-term strategic positioning. Innovation focus should address specific regional needs including tropical climate stability, cost-effective solutions, and regulatory compliance automation.

Geographic Strategy Development requires careful consideration of market characteristics, regulatory requirements, and competitive dynamics across different Asia Pacific countries. Companies should develop market-specific strategies that leverage local advantages while maintaining operational efficiency and quality standards. Market entry strategies should consider partnership opportunities, regulatory pathways, and customer relationship development approaches that align with local business practices.

Partnership Strategy Enhancement should focus on developing deeper collaborative relationships with pharmaceutical companies, technology providers, and regulatory authorities. These partnerships can provide access to market intelligence, technology development resources, and customer insights that support strategic decision-making and innovation efforts. Collaboration models should emphasize mutual value creation and long-term relationship sustainability.

Sustainability Integration should become a core component of business strategy, encompassing material selection, manufacturing processes, and end-of-life considerations. Companies should develop comprehensive sustainability programs that address environmental concerns while maintaining product performance and cost competitiveness. Environmental initiatives should align with regulatory trends and customer expectations for responsible packaging solutions.

Market projections for the Asia Pacific pharmaceutical packaging market indicate continued robust growth driven by fundamental demographic, economic, and technological trends that support sustained demand for innovative packaging solutions. The future landscape will be characterized by increasing sophistication, technological integration, and sustainability focus.

Growth trajectory analysis suggests the market will maintain strong momentum with projected compound annual growth rates of 8.5-9.2% over the next five years, driven by expanding pharmaceutical production, increasing healthcare access, and growing demand for advanced packaging technologies. This growth will be supported by continued investment in manufacturing capabilities, technology development, and market expansion initiatives across the region.

Technology evolution will accelerate with widespread adoption of smart packaging solutions, advanced materials, and digital integration capabilities. The convergence of packaging and digital technologies will create new value propositions for pharmaceutical companies and patients, including real-time monitoring, enhanced safety features, and improved supply chain visibility. Digital transformation is expected to reach mainstream adoption levels of 75-80% within major pharmaceutical packaging applications by 2028.

Regulatory development will continue toward greater harmonization and standardization across Asia Pacific markets, facilitating trade and reducing compliance complexity for packaging manufacturers. Enhanced regulatory frameworks will support innovation while maintaining high safety and quality standards essential for pharmaceutical applications. MWR analysis indicates that regulatory alignment initiatives will reduce compliance costs by approximately 15-20% for companies operating across multiple regional markets.

Sustainability transformation will become increasingly important as environmental regulations strengthen and corporate responsibility initiatives expand. The development of circular economy approaches to pharmaceutical packaging will create new business models and competitive advantages for companies that successfully integrate sustainability into their operations and product offerings.

The Asia Pacific pharmaceutical packaging market represents a rapidly expanding sector driven by increasing healthcare demands, aging populations, and robust pharmaceutical manufacturing growth across the region. Market dynamics across key markets including China, India, Japan, South Korea, and Australia demonstrate exceptional growth potential supported by rising drug production, regulatory modernization, and expanding healthcare infrastructure. Innovation in smart packaging technologies and sustainable materials continues transforming industry standards throughout the Asia Pacific region.

Strategic success in this diverse market requires understanding unique regulatory requirements across different countries and adapting packaging solutions to meet specific local compliance standards. Companies that prioritize advanced barrier technologies, tamper-evident solutions, and serialization capabilities will be best positioned to capture opportunities in this growing market. Digital integration and track-and-trace technologies have become essential for maintaining supply chain integrity and meeting evolving regulatory requirements across Asian markets.

Manufacturing excellence and cost-effective production capabilities position the region as a global hub for pharmaceutical packaging solutions. Sustainability initiatives focusing on recyclable materials and reduced environmental impact align with increasing corporate responsibility mandates. Emerging opportunities in biologics packaging, cold-chain solutions, and patient-centric designs present new avenues for growth as the pharmaceutical landscape continues evolving toward personalized medicine and specialty treatments.

The competitive environment will continue intensifying as both established global players and innovative regional manufacturers compete for market leadership. Long-term success will require ongoing investment in automation technologies, quality systems, and regulatory expertise to meet increasingly stringent safety and efficacy standards. Customer-focused approaches emphasizing supply chain reliability, technical support, and collaborative innovation partnerships will become increasingly critical differentiators in this dynamic and rapidly growing Asia Pacific pharmaceutical packaging market.

What is Pharmaceutical Packaging?

Pharmaceutical packaging refers to the process of enclosing and protecting pharmaceutical products, including medications and medical devices, to ensure their safety, efficacy, and quality. This includes various materials and technologies used to package drugs for distribution and use in healthcare settings.

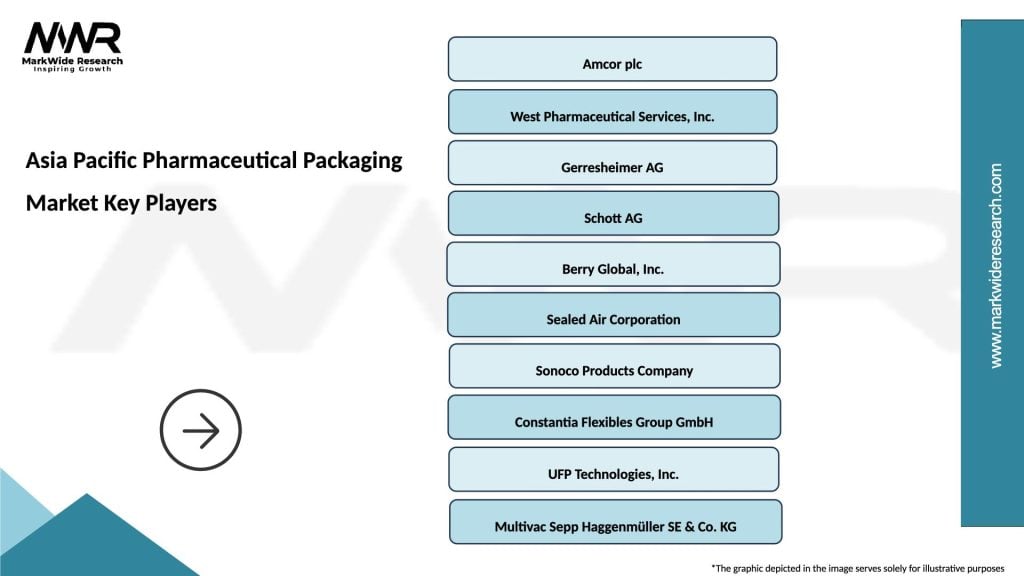

What are the key players in the Asia Pacific Pharmaceutical Packaging Market?

Key players in the Asia Pacific Pharmaceutical Packaging Market include companies like Amcor, West Pharmaceutical Services, and Schott AG, which provide innovative packaging solutions for pharmaceuticals. These companies focus on enhancing product safety and compliance with regulatory standards, among others.

What are the growth factors driving the Asia Pacific Pharmaceutical Packaging Market?

The growth of the Asia Pacific Pharmaceutical Packaging Market is driven by increasing demand for advanced packaging solutions, rising healthcare expenditures, and the growing prevalence of chronic diseases. Additionally, the expansion of the pharmaceutical industry in emerging economies contributes to market growth.

What challenges does the Asia Pacific Pharmaceutical Packaging Market face?

The Asia Pacific Pharmaceutical Packaging Market faces challenges such as stringent regulatory requirements, high production costs, and the need for sustainable packaging solutions. These factors can hinder innovation and increase operational complexities for manufacturers.

What opportunities exist in the Asia Pacific Pharmaceutical Packaging Market?

Opportunities in the Asia Pacific Pharmaceutical Packaging Market include the development of smart packaging technologies and eco-friendly materials. As consumer awareness of sustainability grows, companies are exploring biodegradable and recyclable packaging options to meet market demands.

What trends are shaping the Asia Pacific Pharmaceutical Packaging Market?

Trends in the Asia Pacific Pharmaceutical Packaging Market include the increasing adoption of child-resistant packaging, the use of tamper-evident features, and the integration of digital technologies for tracking and authentication. These trends aim to enhance safety and improve patient compliance.

Asia Pacific Pharmaceutical Packaging Market

| Segmentation Details | Description |

|---|---|

| Packaging Type | Blister Packs, Bottles, Vials, Pouches |

| Material | Glass, Plastic, Aluminum, Paper |

| End User | Pharmaceutical Companies, Contract Manufacturers, Hospitals, Retail Pharmacies |

| Technology | Cold Forming, Injection Molding, Extrusion, Laminating |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Asia Pacific Pharmaceutical Packaging Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at