444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2150

The India adhesive market represents one of the most dynamic and rapidly expanding segments within the country’s chemical industry landscape. Market dynamics indicate substantial growth driven by increasing industrialization, infrastructure development, and rising consumer demand across multiple sectors. The adhesive industry in India encompasses a diverse range of products including structural adhesives, pressure-sensitive adhesives, hot-melt adhesives, and specialty formulations designed for specific applications.

Industrial expansion across automotive, construction, packaging, and electronics sectors has created unprecedented demand for high-performance adhesive solutions. The market demonstrates robust growth potential with increasing adoption of advanced bonding technologies replacing traditional mechanical fastening methods. Regional distribution shows concentrated activity in major industrial hubs including Maharashtra, Gujarat, Tamil Nadu, and Karnataka, which collectively account for approximately 60% of total market consumption.

Technology advancement plays a crucial role in market evolution, with manufacturers investing heavily in research and development to create innovative formulations. The shift toward eco-friendly adhesives and sustainable manufacturing practices has gained significant momentum, driven by stringent environmental regulations and growing corporate sustainability initiatives. Market penetration continues to expand into rural and semi-urban areas, supported by improving distribution networks and increasing awareness of adhesive applications.

The India adhesive market refers to the comprehensive ecosystem of adhesive products, technologies, and services operating within the Indian subcontinent, encompassing manufacturing, distribution, and consumption of bonding solutions across diverse industrial and consumer applications. This market includes various adhesive categories such as water-based, solvent-based, reactive, and hot-melt formulations designed to meet specific performance requirements across different substrates and operating conditions.

Adhesive solutions in the Indian context serve critical functions in industries ranging from automotive assembly and construction to packaging and electronics manufacturing. The market encompasses both industrial-grade adhesives used in manufacturing processes and consumer adhesives available through retail channels for household and small-scale applications. Market definition extends beyond product sales to include technical services, application support, and customized formulation development.

Strategic analysis reveals the India adhesive market as a high-growth sector experiencing robust expansion across multiple application segments. Market leadership is characterized by a mix of multinational corporations and domestic manufacturers, creating a competitive landscape that drives innovation and cost optimization. The market benefits from India’s position as a major manufacturing hub and the government’s focus on infrastructure development through initiatives like Make in India and Smart Cities Mission.

Growth trajectory remains strong with the market experiencing consistent expansion at a CAGR of approximately 8.5% over recent years. Key growth drivers include increasing automotive production, expanding packaging industry, growing construction activities, and rising electronics manufacturing. The market demonstrates resilience and adaptability, with manufacturers successfully navigating challenges related to raw material price volatility and regulatory changes.

Investment patterns show significant capital allocation toward capacity expansion, technology upgrades, and product development initiatives. Market consolidation trends indicate strategic partnerships and acquisitions as companies seek to strengthen their market position and expand their product portfolios. The sector’s contribution to India’s chemical industry continues to grow, reflecting its strategic importance in supporting manufacturing competitiveness.

Market intelligence reveals several critical insights that define the current state and future direction of India’s adhesive industry. MarkWide Research analysis indicates strong correlation between industrial growth and adhesive consumption patterns, with manufacturing-intensive states showing higher per-capita adhesive usage.

Industrial expansion serves as the primary catalyst driving adhesive market growth across India. The country’s emergence as a global manufacturing destination has created substantial demand for high-performance bonding solutions across diverse sectors. Automotive manufacturing continues to be a major growth driver, with increasing vehicle production and the shift toward lightweight materials requiring advanced adhesive technologies.

Infrastructure development initiatives under government programs like Bharatmala and Sagarmala have significantly boosted demand for construction adhesives. Urbanization trends and growing middle-class population drive residential construction activities, creating sustained demand for architectural adhesives and sealants. The packaging industry experiences robust growth driven by e-commerce expansion, food processing growth, and changing consumer preferences toward convenient packaging formats.

Technology advancement in manufacturing processes has increased adoption of adhesive bonding over traditional mechanical fastening methods. Cost efficiency and performance benefits of modern adhesive solutions make them attractive alternatives for manufacturers seeking to optimize production processes. Electronics manufacturing growth, supported by government initiatives like Production Linked Incentive schemes, creates new opportunities for specialty adhesive applications.

Raw material volatility represents a significant challenge for adhesive manufacturers, with petroleum-based feedstock prices experiencing frequent fluctuations that impact production costs and profit margins. Supply chain disruptions and dependency on imported raw materials create operational challenges, particularly for specialty chemical components required in high-performance formulations.

Regulatory compliance requirements related to environmental standards and worker safety create additional operational costs and complexity for manufacturers. Technical expertise shortage in application engineering and product development limits the industry’s ability to develop customized solutions for emerging applications. Price sensitivity in certain market segments, particularly in cost-conscious industries, constrains premium product adoption.

Competition from alternatives such as mechanical fasteners and welding technologies in specific applications limits market expansion opportunities. Quality consistency challenges in maintaining product performance across different climatic conditions and application environments affect customer confidence. Infrastructure limitations in certain regions impact distribution efficiency and market penetration in rural areas.

Emerging applications in renewable energy sectors, particularly solar panel assembly and wind turbine manufacturing, present significant growth opportunities for specialty adhesive formulations. Electric vehicle adoption creates demand for advanced bonding solutions for battery assembly, thermal management, and lightweight construction applications.

Smart manufacturing initiatives and Industry 4.0 adoption create opportunities for intelligent adhesive systems with monitoring capabilities and predictive maintenance features. Export potential to neighboring countries and emerging markets offers growth avenues for Indian manufacturers with competitive cost structures and improving quality standards.

Sustainable formulations development aligns with global environmental trends and creates differentiation opportunities for manufacturers investing in green chemistry. Rural market penetration through improved distribution networks and product awareness campaigns can unlock substantial untapped demand. Customization services and technical support offerings provide value-added revenue streams and strengthen customer relationships.

Competitive intensity in the India adhesive market continues to increase as both domestic and international players expand their presence and capabilities. Market consolidation trends show strategic acquisitions and partnerships aimed at strengthening product portfolios and expanding geographic reach. Innovation cycles have accelerated with manufacturers investing heavily in research and development to create differentiated products.

Customer expectations have evolved toward demanding higher performance, environmental compliance, and technical support services. Supply chain optimization has become critical for maintaining competitiveness, with companies investing in backward integration and strategic supplier partnerships. Digital transformation initiatives are reshaping customer engagement, order processing, and technical service delivery models.

Regulatory landscape continues to evolve with increasing focus on environmental standards, worker safety, and product quality requirements. Technology transfer and collaboration with international partners accelerate innovation and help Indian manufacturers access advanced formulation technologies. Market segmentation has become more sophisticated with specialized products for niche applications gaining importance.

Comprehensive analysis of the India adhesive market employs multiple research methodologies to ensure accuracy and reliability of insights. Primary research involves extensive interviews with industry executives, technical experts, distributors, and end-users across different application segments and geographic regions. Secondary research encompasses analysis of company annual reports, industry publications, government statistics, and trade association data.

Market sizing methodology combines top-down and bottom-up approaches, utilizing production data, import-export statistics, and consumption patterns across different sectors. Trend analysis incorporates historical data spanning multiple years to identify growth patterns and market evolution trajectories. Competitive intelligence gathering involves monitoring company strategies, product launches, capacity expansions, and market positioning activities.

Data validation processes include cross-referencing multiple sources, expert interviews for verification, and statistical analysis to ensure consistency and accuracy. Regional analysis methodology involves state-wise consumption pattern analysis and industrial activity correlation studies. Technology assessment includes evaluation of patent filings, research publications, and innovation trends in adhesive formulations.

Western India dominates the adhesive market with Maharashtra and Gujarat accounting for approximately 40% of total consumption. This region benefits from concentrated automotive manufacturing, chemical industry presence, and well-developed industrial infrastructure. Mumbai and Pune serve as major consumption centers with strong demand from automotive, packaging, and consumer goods industries.

Southern India represents the second-largest market with Tamil Nadu, Karnataka, and Andhra Pradesh contributing 30% of market demand. The region’s strength in automotive manufacturing, electronics production, and aerospace industries drives adhesive consumption. Bangalore and Chennai emerge as key growth centers with expanding manufacturing activities and technology adoption.

Northern India shows steady growth with Delhi NCR, Punjab, and Haryana representing 20% of market share. The region benefits from proximity to major consumer markets, growing automotive production, and expanding packaging industry. Eastern India accounts for the remaining 10% market share but shows promising growth potential driven by infrastructure development and industrial expansion initiatives.

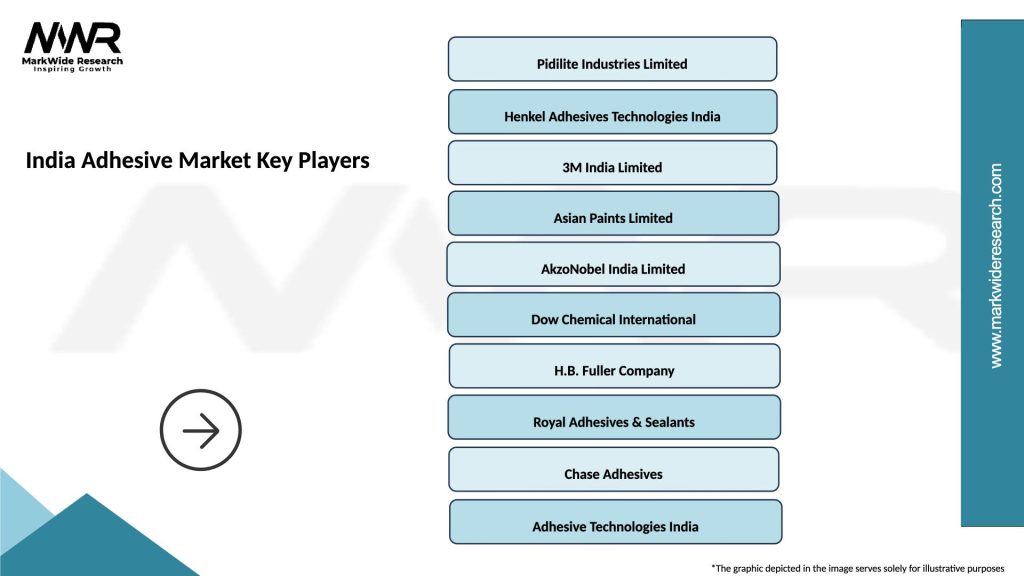

Market leadership in India’s adhesive industry is characterized by a diverse mix of multinational corporations and domestic manufacturers, each bringing unique strengths and market positioning strategies. Competitive dynamics reflect intense rivalry across different product segments and application areas.

Technology-based segmentation reveals distinct market characteristics and growth patterns across different adhesive categories. Water-based adhesives dominate the market due to environmental compliance and cost-effectiveness, particularly in packaging and construction applications. Solvent-based formulations maintain strong presence in industrial applications requiring high performance and durability.

By Technology:

By Application:

Structural adhesives represent the highest value segment within the India adhesive market, commanding premium pricing due to their critical performance requirements and specialized applications. Automotive applications drive demand for structural bonding solutions that provide strength, durability, and weight reduction benefits. Aerospace and defense sectors create niche opportunities for ultra-high-performance formulations.

Pressure-sensitive adhesives show robust growth driven by labeling, packaging, and medical applications. Tape manufacturing represents a significant consumption category with diverse industrial and consumer applications. Medical adhesives emerge as a specialized growth segment with stringent regulatory requirements and high-value applications.

Construction adhesives benefit from infrastructure development initiatives and growing preference for modern building techniques. Flooring applications represent a stable demand source with consistent replacement and new installation requirements. Sealants and caulks complement adhesive offerings in construction and automotive applications, providing comprehensive bonding solutions.

Manufacturers benefit from India’s growing industrial base and expanding application opportunities across diverse sectors. Cost advantages from local production, competitive labor costs, and improving infrastructure support profitability and market competitiveness. Technology partnerships with international companies provide access to advanced formulations and application expertise.

End-users gain from increasing product availability, competitive pricing, and improving technical support services. Performance improvements in adhesive formulations enable better product quality, reduced assembly costs, and enhanced manufacturing efficiency. Customization capabilities allow for tailored solutions meeting specific application requirements.

Distributors and retailers benefit from expanding market demand, diverse product portfolios, and growing customer base. Technical training and support programs enhance their ability to serve customers effectively. Supply chain partners including raw material suppliers and logistics providers participate in the industry’s growth trajectory through increased business volumes and strategic partnerships.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability transformation emerges as the most significant trend shaping the India adhesive market, with manufacturers investing heavily in developing bio-based formulations and reducing environmental impact. Green chemistry principles guide new product development, focusing on renewable raw materials and reduced volatile organic compound emissions. Circular economy concepts influence packaging design and product lifecycle management.

Digital integration revolutionizes customer engagement and technical service delivery through online platforms, virtual technical support, and digital product selection tools. Smart adhesives with monitoring capabilities and responsive properties represent emerging technology trends. Automation in application processes drives demand for adhesives compatible with robotic dispensing systems.

Customization demand increases as manufacturers seek tailored solutions for specific applications and performance requirements. MWR analysis indicates growing preference for technical partnerships over transactional relationships. Regional manufacturing strategies gain importance as companies establish production facilities closer to major consumption centers to reduce logistics costs and improve service levels.

Capacity expansion initiatives dominate recent industry developments, with major manufacturers investing in new production facilities and technology upgrades. Pidilite Industries announced significant capacity additions across multiple locations to meet growing demand. International collaborations have increased, with several technology transfer agreements and joint venture formations.

Product innovations focus on developing formulations for emerging applications such as electric vehicle batteries, renewable energy components, and advanced packaging solutions. Research partnerships between industry and academic institutions have strengthened, leading to breakthrough developments in adhesive chemistry. Sustainability initiatives include investments in bio-based raw materials and recycling technologies.

Market consolidation activities include strategic acquisitions and partnerships aimed at strengthening market position and expanding product portfolios. Digital transformation projects encompass customer relationship management systems, supply chain optimization platforms, and predictive maintenance solutions. Quality certifications and compliance initiatives demonstrate commitment to international standards and customer requirements.

Strategic recommendations for market participants emphasize the importance of investing in sustainable product development and advanced manufacturing technologies. Market positioning should focus on technical expertise and customer service excellence to differentiate from price-based competition. Geographic expansion into underserved regions presents significant growth opportunities for established players.

Innovation investment in specialty formulations for emerging applications such as electric vehicles and renewable energy systems will drive future growth. Partnership strategies with end-users and technology providers can accelerate product development and market penetration. Supply chain resilience building through backward integration and strategic supplier relationships will mitigate raw material risks.

Digital capabilities development in customer engagement, technical support, and supply chain management will enhance competitive positioning. Sustainability leadership through eco-friendly product development and circular economy practices will create long-term value. Talent development in technical and application engineering capabilities will support growth and innovation objectives.

Growth trajectory for the India adhesive market remains robust with sustained expansion expected across all major application segments. Technology evolution will drive market sophistication with increasing adoption of high-performance and specialty formulations. Market maturation in developed regions will be balanced by growth opportunities in emerging applications and geographic markets.

Industry consolidation is expected to continue with strategic mergers and acquisitions reshaping the competitive landscape. Innovation acceleration will focus on sustainable formulations, smart adhesive technologies, and application-specific solutions. Export growth potential positions Indian manufacturers to capture opportunities in regional and global markets with competitive offerings.

Regulatory evolution toward stricter environmental standards will drive product reformulation and manufacturing process improvements. MarkWide Research projections indicate sustained growth momentum with the market expected to maintain its expansion trajectory over the forecast period. Investment opportunities remain attractive across the value chain, from raw material production to specialized application development and technical services.

Market assessment reveals the India adhesive market as a dynamic and rapidly evolving sector with substantial growth potential across diverse application segments. Industrial expansion, infrastructure development, and technological advancement continue to drive demand for innovative bonding solutions. The market demonstrates resilience and adaptability, successfully navigating challenges while capitalizing on emerging opportunities.

Competitive dynamics reflect a healthy mix of international expertise and domestic market knowledge, creating an environment conducive to innovation and customer service excellence. Sustainability trends and digital transformation initiatives position the industry for long-term success and alignment with global best practices. Strategic positioning of Indian manufacturers in cost-competitive segments while building capabilities in high-value applications creates a balanced growth approach.

Future prospects remain highly positive with multiple growth drivers supporting sustained market expansion. The India adhesive market is well-positioned to benefit from the country’s manufacturing growth, infrastructure development, and increasing integration with global supply chains, making it an attractive sector for continued investment and development.

What is Adhesive?

Adhesive refers to substances used for bonding materials together, which can include a variety of applications such as construction, automotive, and packaging. In the context of the India Adhesive Market, these products are essential for both industrial and consumer uses.

What are the key players in the India Adhesive Market?

Key players in the India Adhesive Market include companies like Pidilite Industries, Henkel AG, and Sika AG, which are known for their diverse adhesive solutions. These companies compete in various segments such as construction adhesives, automotive adhesives, and specialty adhesives, among others.

What are the growth factors driving the India Adhesive Market?

The India Adhesive Market is driven by factors such as the rapid growth of the construction industry, increasing demand for automotive adhesives, and the rise in packaging applications. Additionally, the trend towards lightweight materials in manufacturing is also contributing to market expansion.

What challenges does the India Adhesive Market face?

Challenges in the India Adhesive Market include fluctuating raw material prices, stringent environmental regulations, and competition from alternative bonding technologies. These factors can impact production costs and market dynamics.

What opportunities exist in the India Adhesive Market?

Opportunities in the India Adhesive Market include the growing demand for eco-friendly adhesives and innovations in adhesive technology. The expansion of e-commerce and packaging solutions also presents new avenues for growth.

What trends are shaping the India Adhesive Market?

Trends in the India Adhesive Market include the increasing use of smart adhesives, advancements in bio-based adhesives, and a shift towards sustainable practices. These trends are influencing product development and consumer preferences.

India Adhesive Market

| Segmentation Details | Description |

|---|---|

| Product Type | Polyurethane, Epoxy, Acrylic, Silicone |

| Application | Construction, Automotive, Packaging, Woodworking |

| End User | Manufacturers, Contractors, Retailers, Distributors |

| Packaging Type | Drums, Tubs, Sachets, Cartridges |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the India Adhesive Market

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at