444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2150

The India sugar market represents one of the most significant agricultural commodity sectors in the country, establishing India as the world’s second-largest sugar producer and consumer. Market dynamics indicate robust growth driven by increasing domestic consumption, expanding industrial applications, and government policy initiatives supporting the sugar industry. The sector demonstrates remarkable resilience with annual production growth consistently maintaining upward momentum despite seasonal variations and climatic challenges.

Production capacity across India’s sugar mills has expanded substantially, with modern manufacturing facilities incorporating advanced processing technologies. The market encompasses traditional sugar production alongside emerging segments including ethanol blending, bagasse-based power generation, and specialty sugar products. Regional distribution shows concentrated production in key states including Uttar Pradesh, Maharashtra, Karnataka, and Tamil Nadu, which collectively account for approximately 75% of national production.

Consumer demand patterns reflect India’s growing population and rising disposable incomes, driving consistent market expansion. The sector benefits from strong domestic consumption coupled with strategic export opportunities, positioning India as a major player in global sugar trade. Technological advancement in sugar processing, coupled with sustainable practices and diversification into co-products, continues to enhance market competitiveness and profitability across the industry.

The India sugar market refers to the comprehensive ecosystem encompassing sugar cane cultivation, processing, manufacturing, distribution, and consumption of sugar and related products within the Indian subcontinent. This market includes traditional white sugar production, raw sugar processing, specialty sugar variants, and co-products such as molasses, bagasse, and ethanol derived from sugar cane processing operations.

Market scope extends beyond basic sugar production to include integrated operations involving power generation from bagasse, ethanol production for fuel blending programs, and various industrial applications of sugar-derived products. The sector encompasses both organized sugar mills and cooperative societies, creating a complex supply chain network that supports millions of farmers and industrial workers across rural and semi-urban regions.

Economic significance of the India sugar market extends to rural employment generation, foreign exchange earnings through exports, and contribution to the country’s energy security through ethanol blending initiatives. The market operates within a regulatory framework that includes minimum support prices, export incentives, and environmental compliance requirements, making it a strategically important sector for India’s agricultural and industrial economy.

Market performance in India’s sugar sector demonstrates consistent growth trajectory supported by favorable government policies, technological modernization, and expanding application areas. The industry has successfully navigated challenges including cyclical price fluctuations, weather dependencies, and international trade dynamics while maintaining its position as a global sugar production leader.

Key growth drivers include increasing domestic consumption driven by population growth and urbanization, government mandates for ethanol blending reaching 10% by volume in petrol, and expanding industrial applications of sugar in food processing, pharmaceuticals, and chemical industries. The sector benefits from integrated business models that maximize value extraction from sugar cane through co-product development and renewable energy generation.

Strategic initiatives by industry players focus on capacity expansion, technological upgrades, and diversification into high-value segments. The market shows strong potential for continued growth with emerging opportunities in organic sugar, specialty sweeteners, and bio-based chemicals derived from sugar cane processing. Export competitiveness remains strong with India maintaining significant market share in global sugar trade, particularly in Asian and Middle Eastern markets.

Production efficiency improvements across India’s sugar mills have resulted in enhanced recovery rates and reduced processing costs. The following insights highlight critical market developments:

Population growth and urbanization trends continue to drive fundamental demand for sugar across India, with per capita consumption showing steady increases in urban and semi-urban areas. Demographic shifts toward younger populations with higher disposable incomes support premium sugar product segments and processed food consumption patterns that require substantial sugar inputs.

Government policy support through ethanol blending mandates creates significant demand for sugar-derived ethanol, providing mills with alternative revenue streams and reducing dependence on traditional sugar sales. Renewable energy initiatives promote bagasse-based power generation, enabling sugar mills to become energy self-sufficient while contributing excess power to grid networks.

Industrial expansion in food processing, beverages, confectionery, and pharmaceutical sectors drives consistent demand for various sugar grades and specialty products. Export opportunities in regional markets provide additional demand channels, particularly during periods of domestic surplus production. The growing health consciousness has also spurred demand for organic and specialty sugar variants, creating premium market segments with higher profit margins.

Technological advancement in sugar processing enables higher recovery rates, improved product quality, and enhanced operational efficiency. Financial support through government schemes and institutional lending facilitates modernization and capacity expansion across the industry, supporting long-term growth objectives and competitiveness enhancement.

Weather dependency remains a significant constraint for the India sugar market, with monsoon patterns and climatic conditions directly impacting sugar cane yields and quality. Cyclical price volatility creates challenges for both producers and consumers, with international commodity price fluctuations affecting domestic market stability and profitability margins.

High capital requirements for establishing and modernizing sugar mills pose barriers to entry and expansion, particularly for smaller players and cooperative societies with limited financial resources. Environmental regulations regarding water usage, effluent treatment, and emissions control require substantial investments in compliance infrastructure and ongoing operational costs.

Transportation costs and logistics challenges affect market efficiency, particularly in regions with inadequate infrastructure connecting production areas to consumption centers. Labor availability during peak harvesting and processing seasons creates operational constraints and cost pressures for sugar mills across major producing regions.

International trade policies and tariff structures impact export competitiveness and market access, while domestic policy changes regarding pricing and subsidies create uncertainty for long-term planning. Competition from alternative sweeteners and artificial substitutes poses challenges to traditional sugar demand growth, particularly in health-conscious consumer segments and industrial applications seeking cost-effective alternatives.

Ethanol blending expansion presents substantial growth opportunities as government mandates increase blending ratios and create consistent demand for sugar-derived ethanol. Bio-based chemicals derived from sugar cane processing offer high-value diversification opportunities in pharmaceutical, cosmetic, and industrial chemical applications with premium pricing potential.

Organic sugar production represents a rapidly growing segment driven by health-conscious consumers and premium food manufacturers seeking certified organic ingredients. Export market expansion in African and Southeast Asian countries provides opportunities for Indian sugar producers to establish long-term supply relationships and capture market share in developing economies.

Integrated business models combining sugar production with power generation, ethanol manufacturing, and specialty chemical production offer enhanced profitability and risk diversification. Technology partnerships with international equipment manufacturers and research institutions enable access to advanced processing technologies and efficiency improvements.

Value-added product development including specialty sugars, liquid sugars, and customized industrial grades creates opportunities for premium pricing and customer loyalty. Sustainable production practices and environmental certifications open access to environmentally conscious markets and customers willing to pay premium prices for responsibly produced sugar products.

Supply-demand balance in the India sugar market demonstrates complex interactions between production cycles, consumption patterns, and policy interventions. Seasonal variations in sugar cane harvesting and processing create predictable supply patterns, while demand remains relatively stable throughout the year with peak consumption during festival seasons and summer months.

Price mechanisms reflect both domestic market conditions and international commodity trends, with government interventions through minimum support prices and export incentives helping stabilize market dynamics. Inventory management across the supply chain requires careful coordination between mills, traders, and distributors to maintain adequate stock levels while minimizing carrying costs and quality deterioration.

Competitive dynamics involve both large integrated sugar companies and smaller cooperative mills, creating a diverse market structure with varying cost structures and operational capabilities. Technological adoption rates differ significantly across market participants, with larger players investing in advanced processing equipment while smaller mills focus on incremental efficiency improvements.

Regulatory environment continues to evolve with policies supporting ethanol production, environmental compliance, and farmer welfare programs. Market integration with global sugar markets exposes domestic prices to international volatility while providing opportunities for arbitrage and export earnings during favorable market conditions.

Primary research for analyzing the India sugar market involved comprehensive data collection through structured interviews with sugar mill executives, industry associations, government officials, and key stakeholders across the value chain. Field surveys conducted in major sugar-producing states provided insights into production practices, technological adoption, and operational challenges faced by different categories of market participants.

Secondary research encompassed analysis of government publications, industry reports, trade statistics, and regulatory documents to establish market size, growth trends, and policy impacts. Data validation processes included cross-referencing multiple sources and conducting expert interviews to ensure accuracy and reliability of market intelligence gathered through various research channels.

Quantitative analysis utilized statistical modeling techniques to project market trends, identify growth patterns, and assess the impact of various market drivers and restraints. Qualitative assessment involved thematic analysis of stakeholder interviews and industry expert opinions to understand market dynamics, competitive positioning, and strategic implications for different market segments.

Market segmentation analysis employed clustering techniques to identify distinct market segments based on production capacity, technology adoption, geographic location, and product specialization. Trend analysis incorporated time-series data spanning multiple production cycles to identify long-term patterns and cyclical variations in market performance and growth trajectories.

Uttar Pradesh dominates India’s sugar production landscape, accounting for approximately 45% of national sugar output with over 120 operational sugar mills. The state benefits from extensive sugar cane cultivation areas, favorable agro-climatic conditions, and well-established processing infrastructure supporting both traditional and modern sugar manufacturing facilities.

Maharashtra represents the second-largest sugar-producing state with significant market share and advanced cooperative sugar mill networks. The region demonstrates high productivity levels, integrated business models combining sugar and ethanol production, and strong export orientation serving international markets through efficient port connectivity and logistics infrastructure.

Karnataka shows rapid growth in sugar production capacity with modern mills incorporating advanced processing technologies and sustainable practices. Tamil Nadu maintains consistent production levels with focus on quality improvement and specialty sugar products serving South Indian markets and export destinations in Southeast Asia and Middle East regions.

Regional variations in production costs, recovery rates, and market access create distinct competitive advantages and challenges across different geographic areas. Northern states benefit from proximity to major consumption centers, while southern and western regions demonstrate advantages in export logistics and integrated co-product development. Emerging regions including Bihar, Haryana, and Punjab show potential for capacity expansion and market share growth through supportive state policies and infrastructure development initiatives.

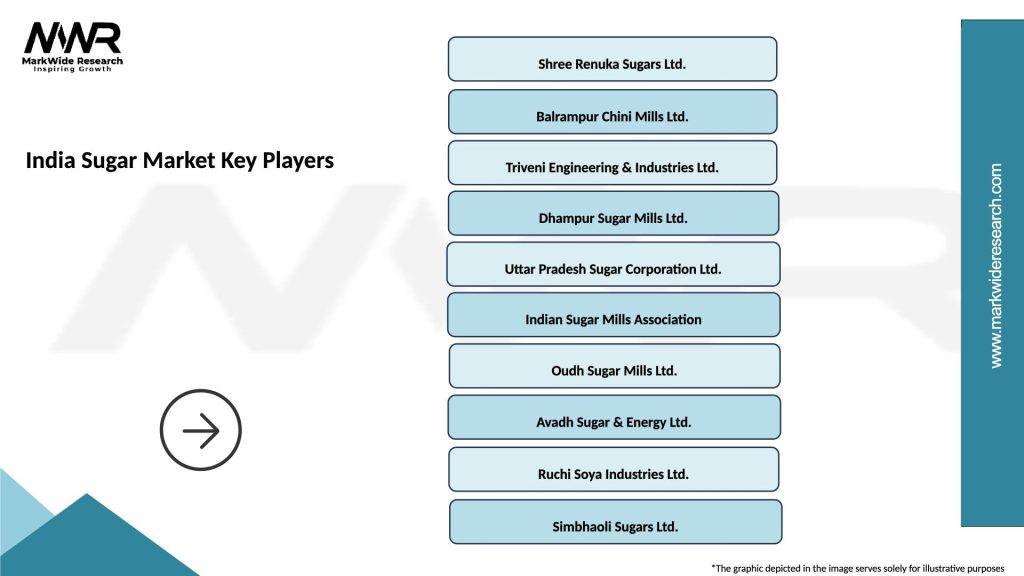

Market leadership in India’s sugar sector involves both large private companies and cooperative societies, creating a diverse competitive environment with varying business models and strategic approaches. The following companies represent key market participants:

Competitive strategies focus on operational efficiency, technological upgrades, product diversification, and vertical integration to enhance profitability and market positioning. Cooperative sugar mills maintain significant market presence, particularly in Maharashtra and Karnataka, competing through farmer ownership models and community-based operations.

By Product Type:

By Application:

By Distribution Channel:

White Sugar Category dominates market volume with consistent demand from both household consumers and industrial users. Quality standards have improved significantly with modern mills producing sugar meeting international specifications and food safety requirements. Packaging innovations including consumer-friendly sizes and bulk industrial packaging serve diverse market segments effectively.

Organic Sugar Segment shows rapid growth with premium pricing reflecting increasing health consciousness and demand for certified organic products. Production challenges include maintaining organic certification standards and managing higher production costs while building sustainable supply chains from certified organic sugar cane cultivation.

Industrial Sugar Applications demonstrate steady growth driven by expanding food processing and beverage industries. Customization requirements for specific industrial applications create opportunities for value-added products and long-term customer relationships with premium pricing structures.

Export-oriented Production focuses on meeting international quality standards and competitive pricing for global markets. Raw sugar exports serve refining industries in deficit countries while refined sugar exports target consumer markets in neighboring countries and regions with established trade relationships.

Sugar Mill Operators benefit from diversified revenue streams through integrated operations combining sugar production with ethanol manufacturing and power generation. Operational efficiency improvements through modern technology adoption result in higher recovery rates, reduced processing costs, and improved product quality standards meeting market requirements.

Farmers and Suppliers gain from stable income sources through long-term supply contracts and minimum support price mechanisms. Agricultural extension services provided by sugar mills improve farming practices, increase yields, and enhance sugar cane quality, resulting in better prices and reduced production risks for farming communities.

Industrial Customers benefit from reliable supply chains, consistent product quality, and competitive pricing structures. Customization capabilities enable manufacturers to obtain specialized sugar products meeting specific technical requirements for food processing, pharmaceutical, and chemical applications.

Government and Economy benefit from rural employment generation, foreign exchange earnings through exports, and contribution to renewable energy goals through ethanol blending programs. Tax revenues from sugar industry operations support public finances while rural development initiatives funded by industry contribute to social and economic progress in agricultural regions.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability Focus drives adoption of environmentally friendly production practices, waste reduction initiatives, and renewable energy integration across sugar mills. Circular economy principles promote maximum utilization of sugar cane through co-product development, bagasse utilization, and waste-to-energy conversion programs.

Digital Transformation encompasses implementation of IoT sensors, data analytics, and automation systems for process optimization and quality control. Precision agriculture techniques support sugar cane cultivation with GPS-guided farming, soil monitoring, and yield optimization technologies improving productivity and resource efficiency.

Health and Wellness Trends influence product development toward organic sugar, low-glycemic alternatives, and specialty sugar products catering to health-conscious consumers. Clean Label Movement drives demand for natural, minimally processed sugar products with transparent sourcing and production methods.

Export Market Diversification involves exploring new geographic markets and developing long-term trade relationships beyond traditional export destinations. Value Chain Integration trends toward vertical integration and strategic partnerships across the sugar supply chain from farming to final product distribution, according to MarkWide Research analysis of industry developments.

Capacity Expansion Projects across major sugar-producing states involve establishment of new mills and modernization of existing facilities with advanced processing equipment. Ethanol Production Scaling includes significant investments in distillery capacity to meet government blending mandates and capture growing biofuel market opportunities.

Technology Partnerships between Indian sugar companies and international equipment manufacturers facilitate access to cutting-edge processing technologies and operational best practices. Research and Development initiatives focus on improving sugar recovery rates, developing specialty products, and enhancing co-product utilization efficiency.

Sustainability Certifications adoption includes implementation of environmental management systems, water conservation programs, and carbon footprint reduction initiatives. Quality Upgrades involve installation of advanced laboratory equipment and quality control systems to meet international food safety standards and customer specifications.

Strategic Acquisitions and consolidation activities reshape market structure with larger players acquiring smaller mills to achieve economies of scale and operational synergies. Export Infrastructure Development includes investments in port facilities, storage capacity, and logistics networks to enhance export competitiveness and market access capabilities.

Diversification Strategy recommendations emphasize developing integrated business models that maximize value extraction from sugar cane through ethanol production, power generation, and specialty chemical manufacturing. Technology Investment priorities should focus on automation, process optimization, and quality enhancement systems that improve operational efficiency and product competitiveness.

Market Positioning strategies should leverage India’s cost advantages and production scale to capture increased market share in regional export markets while developing premium product segments for domestic consumption. Sustainability Initiatives require immediate attention to meet evolving environmental regulations and customer expectations for responsible production practices.

Risk Management approaches should include weather hedging mechanisms, price risk mitigation strategies, and supply chain diversification to reduce vulnerability to external shocks. Partnership Development with technology providers, research institutions, and international trading companies can accelerate innovation adoption and market expansion capabilities.

Capacity Optimization recommendations include focusing on operational excellence, maintenance efficiency, and production planning systems that maximize asset utilization and minimize production costs. Market Intelligence systems should be enhanced to provide real-time insights into price trends, demand patterns, and competitive dynamics for informed decision-making, as suggested by MWR industry analysis.

Growth Trajectory for India’s sugar market indicates continued expansion driven by domestic consumption growth, ethanol demand increases, and export market opportunities. Production capacity is expected to grow steadily with new mill establishments and existing facility expansions supporting increased output levels and market supply capabilities.

Technology Integration will accelerate with widespread adoption of digital systems, automation technologies, and advanced processing equipment improving operational efficiency and product quality. Sustainability Standards will become increasingly important with environmental compliance, carbon neutrality goals, and sustainable production practices becoming competitive differentiators.

Market Consolidation trends suggest continued industry restructuring with larger, more efficient players gaining market share through acquisitions and strategic partnerships. Product Innovation will focus on specialty sugars, organic products, and value-added co-products serving evolving consumer preferences and industrial requirements.

Export Competitiveness is projected to strengthen with infrastructure improvements, quality upgrades, and cost optimization initiatives supporting India’s position in global sugar trade. Policy Environment evolution toward market-oriented mechanisms and reduced government intervention will create more dynamic and competitive market conditions, with MarkWide Research projecting sustained growth momentum across key market segments over the forecast period.

India’s sugar market demonstrates remarkable resilience and growth potential, supported by strong domestic demand, expanding industrial applications, and strategic government initiatives promoting sector development. The industry’s evolution toward integrated business models combining traditional sugar production with ethanol manufacturing and renewable energy generation creates sustainable competitive advantages and enhanced profitability prospects.

Market fundamentals remain robust with consistent domestic consumption growth, favorable demographic trends, and expanding export opportunities in regional markets. Technological advancement and operational efficiency improvements across the industry support long-term competitiveness while sustainability initiatives address environmental concerns and regulatory requirements.

Strategic positioning of India as a global sugar production leader, combined with cost competitiveness and quality improvements, provides strong foundation for continued market expansion and international trade growth. The India sugar market represents a dynamic and evolving sector with significant opportunities for stakeholders committed to innovation, sustainability, and operational excellence in meeting diverse market demands and consumer preferences.

What is Sugar?

Sugar is a sweet, soluble carbohydrate that is widely used as a sweetener in food and beverages. It is derived from various plants, primarily sugarcane and sugar beet, and plays a crucial role in the food industry, including confectionery and baking applications.

What are the key players in the India Sugar Market?

Key players in the India Sugar Market include companies like Bajaj Hindusthan Sugar, Shree Renuka Sugars, and Dwarikesh Sugar Industries. These companies are involved in sugar production, refining, and distribution, contributing significantly to the market landscape.

What are the growth factors driving the India Sugar Market?

The India Sugar Market is driven by increasing demand for sugar in food and beverage applications, rising population, and growing awareness of sugar’s role in various culinary practices. Additionally, the expansion of the confectionery industry is further fueling market growth.

What challenges does the India Sugar Market face?

The India Sugar Market faces challenges such as fluctuating raw material prices, regulatory changes, and competition from alternative sweeteners. These factors can impact profitability and market stability for sugar producers.

What opportunities exist in the India Sugar Market?

Opportunities in the India Sugar Market include the growing trend of organic and natural sweeteners, innovations in sugar processing technologies, and the potential for export growth. These factors can enhance market prospects for sugar manufacturers.

What trends are shaping the India Sugar Market?

Trends in the India Sugar Market include a shift towards healthier sugar alternatives, increased focus on sustainability in sugar production, and advancements in processing techniques. These trends are influencing consumer preferences and industry practices.

India Sugar Market

| Segmentation Details | Description |

|---|---|

| Product Type | White Sugar, Brown Sugar, Liquid Sugar, Raw Sugar |

| End User | Food & Beverage, Confectionery, Bakery, Pharmaceuticals |

| Distribution Channel | Online Retail, Supermarkets, Wholesale, Convenience Stores |

| Packaging Type | Bags, Bulk Containers, Sachets, Jars |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the India Sugar Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at