444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The European home appliance market represents one of the most mature and technologically advanced regions globally, characterized by sophisticated consumer preferences and stringent environmental regulations. Market dynamics in Europe reflect a strong emphasis on energy efficiency, smart connectivity, and premium design aesthetics that align with evolving lifestyle patterns across diverse European nations.

Consumer behavior across European markets demonstrates increasing demand for intelligent home solutions, with smart appliances experiencing remarkable growth rates of 12.5% annually. The market encompasses traditional white goods including refrigerators, washing machines, dishwashers, and cooking appliances, alongside emerging categories such as robotic vacuum cleaners and connected kitchen devices.

Regional variations within Europe create distinct market segments, with Western European countries like Germany, France, and the United Kingdom driving premium appliance adoption, while Eastern European markets show accelerating growth in mid-range segments. The market benefits from established distribution networks, strong retail infrastructure, and sophisticated consumer financing options that facilitate appliance replacement cycles.

Technological innovation serves as a primary differentiator, with European manufacturers leading global development in energy-efficient technologies and sustainable manufacturing processes. The integration of Internet of Things (IoT) capabilities and artificial intelligence features has transformed traditional appliances into connected ecosystem components, creating new value propositions for European consumers seeking convenience and efficiency.

The European home appliance market refers to the comprehensive ecosystem of household electrical and electronic devices designed to perform domestic tasks, enhance living comfort, and improve household efficiency across European Union member states and associated territories. This market encompasses both traditional appliances and innovative smart home solutions that integrate advanced technologies.

Market scope includes major appliance categories such as refrigeration systems, laundry equipment, cooking appliances, dishwashers, and small domestic appliances including coffee makers, vacuum cleaners, and food processors. The European market distinguishes itself through stringent energy efficiency standards, environmental compliance requirements, and sophisticated consumer expectations for design and functionality.

Geographic coverage spans diverse economic environments from highly developed Western European markets to rapidly growing Eastern European economies, each presenting unique consumer preferences, purchasing power levels, and regulatory frameworks. The market operates within the broader context of European Union regulations governing product safety, energy consumption, and environmental impact.

Market performance in the European home appliance sector demonstrates resilient growth despite economic uncertainties, driven by replacement demand, technological advancement, and changing consumer lifestyles. Smart appliance adoption has accelerated significantly, with connected devices representing 28% of total appliance sales in major European markets.

Key growth drivers include increasing urbanization, rising disposable incomes in Eastern European markets, and growing environmental consciousness leading to energy-efficient appliance adoption. The market benefits from established manufacturing capabilities, strong brand presence, and sophisticated retail distribution networks that support consistent market expansion.

Competitive dynamics feature both established European manufacturers and international brands competing across multiple price segments. Premium positioning strategies have proven successful, with high-end appliances capturing 35% market share in Western European countries, reflecting consumer willingness to invest in quality and advanced features.

Future prospects remain positive, supported by ongoing technological innovation, sustainable product development, and expanding market opportunities in emerging European economies. The integration of artificial intelligence, enhanced connectivity features, and sustainable manufacturing processes positions the market for continued evolution and growth.

Consumer preferences across European markets reveal distinct patterns that shape appliance development and marketing strategies:

Market segmentation reveals significant opportunities across various appliance categories, with cooking appliances and refrigeration systems maintaining dominant positions while emerging categories like robotic cleaning devices show exceptional growth potential of 18% annually.

Technological advancement serves as the primary catalyst driving European home appliance market expansion. The integration of smart technologies, artificial intelligence, and IoT connectivity creates compelling value propositions that encourage consumer upgrades and new purchases. Smart home ecosystem development particularly influences purchasing decisions as consumers seek integrated solutions.

Environmental regulations and sustainability initiatives across European Union member states drive demand for energy-efficient appliances. Government incentives, energy labeling requirements, and environmental consciousness among European consumers create strong market momentum for eco-friendly appliance solutions that reduce energy consumption and environmental impact.

Demographic trends including urbanization, changing household compositions, and evolving lifestyle patterns contribute to market growth. Smaller household sizes increase demand for compact appliances, while busy lifestyles drive adoption of time-saving automated solutions. Aging populations in many European countries create opportunities for user-friendly appliances with enhanced accessibility features.

Economic recovery and increasing disposable incomes, particularly in Eastern European markets, support appliance market expansion. Consumer confidence improvements and favorable financing options enable households to invest in premium appliances and smart home technologies that enhance living standards and convenience.

Replacement cycles for existing appliances provide consistent market demand, with European households typically replacing major appliances every 10-15 years. Technological obsolescence and energy efficiency improvements accelerate replacement decisions, creating steady market opportunities for manufacturers and retailers.

Economic uncertainties and inflation pressures across European markets create challenges for appliance manufacturers and consumers. Rising material costs, supply chain disruptions, and energy price volatility impact both production costs and consumer purchasing power, potentially delaying appliance replacement decisions and affecting market growth rates.

Intense competition from both established European brands and international manufacturers creates pricing pressures that limit profit margins. The market’s maturity in Western European countries results in slower growth rates compared to emerging markets, requiring companies to focus on innovation and premium positioning strategies.

Regulatory complexity across different European Union member states creates compliance challenges for manufacturers. Varying safety standards, energy efficiency requirements, and environmental regulations increase development costs and complicate market entry strategies for both domestic and international appliance companies.

Consumer durability expectations in European markets mean longer replacement cycles compared to other regions. High-quality European appliances often exceed 15-year operational lifespans, reducing the frequency of replacement purchases and limiting market growth potential in mature segments.

Supply chain vulnerabilities exposed during recent global disruptions continue to impact appliance availability and pricing. Semiconductor shortages, raw material constraints, and logistics challenges create production delays and inventory management difficulties that affect market stability and growth consistency.

Smart home integration presents substantial growth opportunities as European consumers increasingly adopt connected home technologies. The convergence of appliances with home automation systems, voice assistants, and mobile applications creates new revenue streams and enhances customer engagement through ongoing software updates and premium service offerings.

Sustainability focus opens opportunities for innovative eco-friendly appliances that exceed current energy efficiency standards. European consumers’ environmental consciousness and government sustainability initiatives create demand for appliances featuring renewable energy integration, reduced water consumption, and recyclable materials throughout the product lifecycle.

Eastern European expansion offers significant growth potential as these markets experience economic development and rising living standards. Countries like Poland, Czech Republic, and Romania show accelerating appliance adoption rates of 8-10% annually, providing opportunities for both premium and mid-range appliance positioning strategies.

Aging population services create niche opportunities for specialized appliances designed for elderly users. Features such as enhanced accessibility, simplified controls, safety monitoring, and health integration capabilities address the needs of Europe’s growing senior demographic while creating differentiated market segments.

Rental and subscription models emerge as alternative business approaches that align with changing European consumer preferences for flexibility and sustainability. Appliance-as-a-Service offerings provide ongoing revenue opportunities while reducing consumer upfront costs and environmental impact through improved product lifecycle management.

Supply and demand dynamics in the European home appliance market reflect complex interactions between consumer preferences, technological capabilities, and economic conditions. Demand patterns show seasonal variations with peak sales occurring during spring renovation periods and holiday seasons, while supply chains adapt to accommodate these fluctuations through strategic inventory management.

Price dynamics demonstrate ongoing pressure from multiple factors including raw material costs, energy prices, and competitive positioning. Premium appliances maintain strong margins through advanced features and brand positioning, while mid-range segments experience intensifying competition that drives innovation and value enhancement strategies.

Innovation cycles accelerate as manufacturers compete to introduce cutting-edge technologies and features. The typical product development cycle has shortened from 3-4 years to 18-24 months, driven by rapid technological advancement and consumer expectations for continuous improvement in functionality and efficiency.

Distribution evolution reflects changing consumer shopping behaviors with online sales channels gaining significant market share of 42% across European markets. Traditional retail partnerships remain important, but omnichannel strategies become essential for reaching diverse consumer segments and providing comprehensive customer experiences.

Regulatory influence continues shaping market dynamics through evolving energy efficiency standards, safety requirements, and environmental regulations. Manufacturers must balance compliance costs with innovation investments while maintaining competitive pricing and market accessibility across diverse European regulatory environments.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into European home appliance market trends and dynamics. Primary research includes extensive consumer surveys, industry expert interviews, and manufacturer consultations across major European markets to gather firsthand insights into market conditions and future expectations.

Secondary research incorporates analysis of industry reports, government statistics, trade association data, and company financial statements to validate primary findings and provide comprehensive market context. Data triangulation methods ensure accuracy and reliability of market insights through cross-verification of multiple information sources.

Market segmentation analysis utilizes both quantitative and qualitative research approaches to identify distinct consumer segments, regional variations, and product category opportunities. Statistical analysis of sales data, consumer behavior patterns, and demographic trends provides foundation for market projections and strategic recommendations.

Competitive intelligence gathering involves systematic analysis of major market participants, their strategies, product portfolios, and market positioning approaches. This research component includes evaluation of pricing strategies, distribution networks, and innovation capabilities that influence competitive dynamics.

Trend analysis incorporates forward-looking research methodologies including technology assessment, regulatory impact analysis, and consumer preference evolution studies. These approaches enable identification of emerging opportunities and potential market disruptions that may influence future market development.

Western European markets including Germany, France, United Kingdom, and Italy represent the most mature and sophisticated segments of the European home appliance market. These countries demonstrate strong preference for premium appliances with advanced features, energy efficiency, and design aesthetics. Germany leads in engineering innovation and manufacturing excellence, while France emphasizes culinary appliances and design sophistication.

Nordic countries including Sweden, Norway, Denmark, and Finland show exceptional adoption rates for sustainable and energy-efficient appliances. These markets prioritize environmental responsibility and are early adopters of smart home technologies, with smart appliance penetration reaching 45% in urban households. The region’s high disposable incomes support premium appliance positioning strategies.

Eastern European markets present dynamic growth opportunities with countries like Poland, Czech Republic, Hungary, and Romania experiencing rapid economic development. These markets show accelerating appliance adoption rates as living standards improve and consumer preferences evolve toward modern convenience solutions. Price sensitivity remains higher than Western European markets, creating opportunities for value-oriented positioning.

Southern European countries including Spain, Portugal, and Greece demonstrate recovery from economic challenges with renewed appliance market growth. These markets emphasize cooking appliances and kitchen solutions that align with Mediterranean lifestyle preferences. Energy efficiency priorities drive replacement decisions as utility costs remain significant household expenses.

Benelux region comprising Netherlands, Belgium, and Luxembourg shows strong market performance with high appliance penetration rates and sophisticated consumer preferences. These compact markets demonstrate willingness to invest in premium appliances and smart home technologies, with connected appliance adoption exceeding 38% in major urban centers.

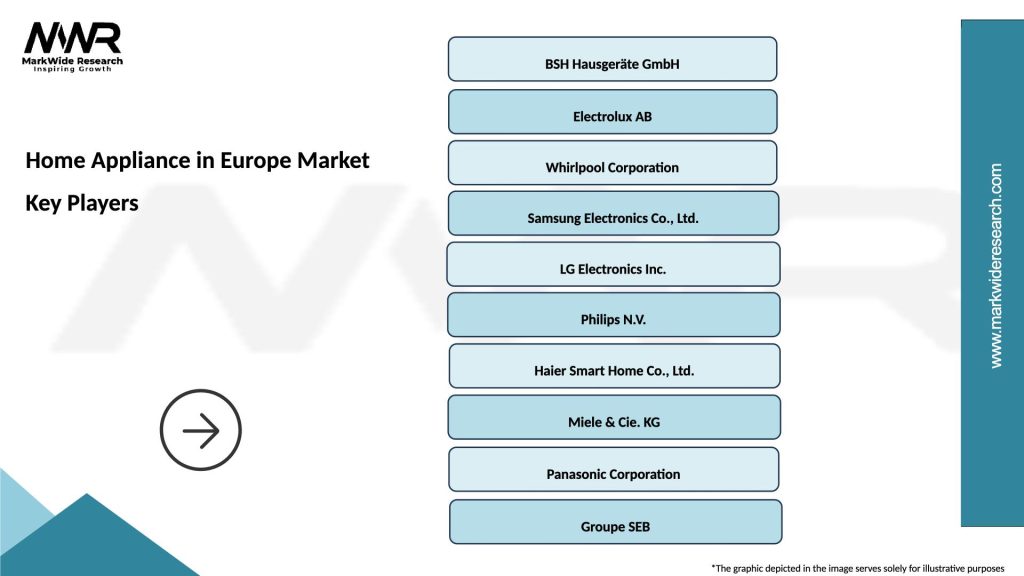

Market leadership in the European home appliance sector features a combination of established European manufacturers and international brands competing across multiple segments and price points. The competitive environment emphasizes innovation, brand strength, and distribution capabilities as key differentiating factors.

Major market participants include:

Competitive strategies focus on technological differentiation, brand building, and market-specific adaptation. Companies invest heavily in research and development to introduce innovative features while maintaining competitive pricing and expanding distribution networks across diverse European markets.

Market consolidation trends continue as companies seek scale advantages and expanded geographic coverage. Strategic acquisitions and partnerships enable market participants to strengthen their competitive positions and access new customer segments while optimizing operational efficiencies.

Product category segmentation reveals distinct market dynamics across major appliance types:

By Product Type:

By Technology:

By Price Segment:

By Distribution Channel:

Refrigeration appliances maintain the largest market share within European home appliances, driven by essential household functionality and ongoing innovation in energy efficiency and smart features. French door refrigerators and side-by-side models gain popularity in larger European homes, while compact designs serve urban markets with space constraints.

Laundry appliances demonstrate strong growth through technological advancement including steam cleaning, allergen removal, and smart connectivity features. European consumers prioritize water and energy efficiency, driving demand for high-efficiency washing machines and heat pump dryers that reduce environmental impact and operating costs.

Cooking appliances reflect diverse European culinary traditions with regional preferences for specific cooking methods and appliance configurations. Induction cooktops gain market share due to energy efficiency and precise temperature control, while combination ovens and steam cooking features appeal to health-conscious consumers seeking versatile cooking options.

Dishwashers show consistent growth as European households increasingly value convenience and time-saving solutions. Integrated dishwashers dominate in kitchen renovation projects, while compact models serve smaller households and urban apartments. Water efficiency improvements and quiet operation features drive replacement decisions.

Small appliances represent the fastest-growing category with exceptional innovation rates and frequent product introductions. Coffee machines, robotic vacuum cleaners, and food preparation appliances benefit from changing lifestyle patterns and increased focus on home convenience and automation solutions.

Manufacturers benefit from the European market’s sophisticated consumer base that values quality, innovation, and advanced features. The region’s willingness to pay premium prices for superior products enables healthy profit margins and supports substantial research and development investments. Brand loyalty in European markets provides competitive advantages for established manufacturers with strong reputations.

Retailers gain from consistent replacement demand and growing interest in smart home technologies that require expert consultation and installation services. The European market’s emphasis on after-sales service creates ongoing revenue opportunities through maintenance contracts and extended warranties. Omnichannel strategies enable retailers to serve diverse consumer preferences effectively.

Consumers benefit from extensive product choices, competitive pricing, and advanced technologies that enhance household efficiency and convenience. European regulatory standards ensure high product quality and safety while energy efficiency requirements reduce long-term operating costs. Smart appliance features provide enhanced control and monitoring capabilities that improve user experiences.

Technology providers find opportunities in the growing demand for smart connectivity, artificial intelligence, and automation features. The European market’s early adoption of new technologies creates testing grounds for innovative solutions that can be scaled globally. Partnership opportunities with appliance manufacturers enable technology integration and market access.

Service providers benefit from increasing complexity of modern appliances that require specialized installation, maintenance, and repair services. The European market’s emphasis on product longevity creates ongoing service demand throughout extended appliance lifecycles. Smart appliances enable remote monitoring and predictive maintenance services that add value for consumers and service providers.

Strengths:

Weaknesses:

Opportunities:

Threats:

Smart connectivity integration dominates current market trends as European consumers increasingly adopt connected home ecosystems. Appliances featuring Wi-Fi connectivity, mobile app control, and voice assistant compatibility become standard expectations rather than premium features. Artificial intelligence integration enables predictive maintenance, energy optimization, and personalized user experiences that enhance appliance value propositions.

Sustainability emphasis drives product development toward eco-friendly materials, energy-efficient operation, and circular economy principles. European manufacturers invest in recyclable components, reduced packaging, and take-back programs that align with environmental regulations and consumer values. Water conservation features and renewable energy integration become key differentiating factors.

Minimalist design aesthetics influence appliance styling with clean lines, integrated controls, and seamless kitchen integration. European consumers prefer appliances that complement modern interior design trends while maintaining functionality and user-friendliness. Customization options allow consumers to match appliances with specific design preferences and kitchen configurations.

Health and wellness focus creates demand for appliances that support healthy lifestyle choices. Steam cooking, air frying, and food preservation technologies that maintain nutritional value gain popularity. Air quality monitoring and allergen reduction features in appliances address growing health consciousness among European consumers.

Compact and multi-functional designs respond to urbanization trends and smaller living spaces across European cities. Appliances that combine multiple functions while maintaining performance standards appeal to space-conscious consumers. Modular appliance systems enable flexible configurations that adapt to changing household needs and space constraints.

Technological breakthroughs in appliance manufacturing include advanced sensor integration, machine learning algorithms, and improved energy storage systems. European manufacturers lead development of heat pump technologies for dryers and water heaters that significantly reduce energy consumption while maintaining performance standards.

Strategic partnerships between appliance manufacturers and technology companies accelerate smart home integration and software development capabilities. Collaborations with telecommunications providers and home automation specialists create comprehensive connected home solutions that enhance consumer experiences and market differentiation.

Manufacturing innovations focus on sustainable production processes, automated assembly systems, and quality control improvements. European facilities invest in Industry 4.0 technologies that optimize production efficiency while reducing environmental impact and maintaining high quality standards that European consumers expect.

Regulatory developments including updated energy labeling requirements and environmental standards drive product innovation and market evolution. New regulations promoting repairability and component recycling influence product design and create opportunities for service-oriented business models that extend appliance lifecycles.

Market consolidation continues through strategic acquisitions and partnerships that strengthen competitive positions and expand geographic coverage. MarkWide Research analysis indicates that consolidation trends enable companies to achieve scale advantages while maintaining innovation capabilities and market responsiveness.

Innovation investment remains critical for maintaining competitive advantage in the European home appliance market. Companies should prioritize smart technology integration, energy efficiency improvements, and user experience enhancements that align with evolving consumer expectations and regulatory requirements.

Market diversification strategies should focus on expanding presence in Eastern European markets while maintaining strong positions in Western European countries. Localized product development and pricing strategies can capture growth opportunities in emerging markets while serving sophisticated consumer preferences in mature markets.

Sustainability initiatives should become integral to product development and marketing strategies. Companies that lead in environmental responsibility and circular economy principles will benefit from regulatory compliance advantages and consumer preference alignment. Life cycle assessment and eco-design principles should guide product development decisions.

Digital transformation investments in e-commerce capabilities, customer data analytics, and direct-to-consumer channels will become increasingly important. Omnichannel strategies that integrate online and offline customer experiences provide competitive advantages in reaching diverse European consumer segments effectively.

Service expansion opportunities in installation, maintenance, and smart home integration services create additional revenue streams and customer engagement touchpoints. Companies should develop comprehensive service offerings that support the entire appliance lifecycle and enhance customer satisfaction and loyalty.

Market evolution in the European home appliance sector will be shaped by continued technological advancement, changing consumer lifestyles, and environmental considerations. Smart appliance adoption is projected to reach 65% penetration rates in major European markets within the next five years, driven by improved connectivity infrastructure and consumer familiarity with smart home technologies.

Growth prospects remain positive across European markets, with Eastern European countries expected to drive above-average growth rates as economic development continues. Western European markets will focus on premium appliance segments and replacement demand driven by technological advancement and energy efficiency improvements.

Technology integration will accelerate with artificial intelligence, machine learning, and advanced sensors becoming standard features across appliance categories. Predictive maintenance capabilities and energy optimization algorithms will enhance appliance value propositions while reducing operating costs and environmental impact.

Sustainability requirements will intensify through evolving European Union regulations and consumer expectations. Appliances featuring circular economy principles, renewable energy integration, and minimal environmental impact will gain competitive advantages in environmentally conscious European markets.

Market dynamics will continue evolving through digitalization, changing retail landscapes, and new business models. MWR projections indicate that subscription-based appliance services and direct-to-consumer sales channels will capture increasing market share while traditional retail partnerships adapt to omnichannel consumer preferences.

The European home appliance market represents a dynamic and sophisticated ecosystem characterized by technological innovation, environmental consciousness, and diverse consumer preferences across multiple regional markets. Market fundamentals remain strong, supported by consistent replacement demand, growing smart home adoption, and expanding opportunities in Eastern European economies.

Competitive advantages in this market require continuous innovation, brand strength, and adaptability to evolving consumer expectations and regulatory requirements. Companies that successfully balance premium positioning with accessibility, sustainability with performance, and tradition with innovation will capture the greatest opportunities in this mature yet evolving market.

Future success will depend on embracing digital transformation, sustainable manufacturing practices, and comprehensive customer service approaches that extend beyond traditional appliance sales. The European market’s emphasis on quality, durability, and environmental responsibility creates opportunities for companies that align their strategies with these fundamental values while delivering cutting-edge technology and exceptional user experiences.

What is Home Appliance?

Home appliances refer to electrical or mechanical devices used in households for various tasks, such as cooking, cleaning, and food preservation. Common examples include refrigerators, washing machines, and microwaves.

What are the key companies in the Home Appliance in Europe Market?

Key companies in the Home Appliance in Europe Market include Bosch, Electrolux, and Whirlpool, which are known for their innovative products and strong market presence. These companies focus on energy efficiency and smart technology integration, among others.

What are the growth factors driving the Home Appliance in Europe Market?

The Home Appliance in Europe Market is driven by factors such as increasing consumer demand for energy-efficient products, advancements in smart home technology, and a growing trend towards automation in households. Additionally, rising disposable incomes contribute to higher spending on home appliances.

What challenges does the Home Appliance in Europe Market face?

The Home Appliance in Europe Market faces challenges such as intense competition among manufacturers, fluctuating raw material prices, and regulatory compliance related to energy efficiency standards. These factors can impact profitability and market dynamics.

What opportunities exist in the Home Appliance in Europe Market?

Opportunities in the Home Appliance in Europe Market include the growing demand for smart appliances, increased focus on sustainability, and the potential for expansion in emerging markets. Companies can leverage these trends to innovate and capture new customer segments.

What trends are shaping the Home Appliance in Europe Market?

Trends shaping the Home Appliance in Europe Market include the rise of connected devices, the integration of artificial intelligence for enhanced user experience, and a shift towards eco-friendly materials. These trends reflect changing consumer preferences and technological advancements.

Home Appliance in Europe Market

| Segmentation Details | Description |

|---|---|

| Product Type | Refrigerators, Washing Machines, Ovens, Dishwashers |

| Technology | Smart Appliances, Energy-Efficient, IoT-Enabled, Traditional |

| End User | Households, Commercial, Hospitality, Institutions |

| Distribution Channel | Online Retail, Specialty Stores, Hypermarkets, Direct Sales |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Home Appliance in Europe Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at